Key Insights

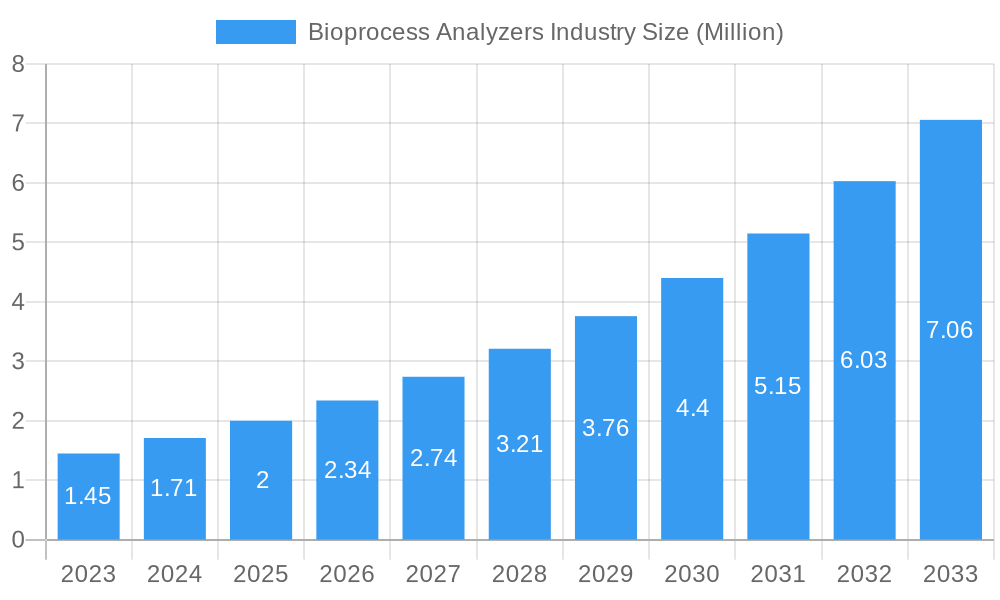

The global Bioprocess Analyzers Industry is poised for remarkable expansion, projected to reach a substantial 2.00 Million Value Unit by 2025. This robust growth is driven by a CAGR of 15.80%, indicating a dynamic and rapidly evolving market. Key catalysts fueling this surge include the escalating demand for advanced biopharmaceuticals, a heightened focus on ensuring product quality and safety in biomanufacturing, and significant investments in research and development for novel therapies. The increasing complexity of bioprocesses necessitates sophisticated analytical solutions to monitor and control critical parameters, thereby optimizing yields and reducing operational costs. Furthermore, the growing prevalence of chronic diseases and an aging global population are intensifying the need for biotherapeutics, directly translating into greater adoption of bioprocess analyzers. Emerging economies are also contributing to market expansion as they invest in biotechnology infrastructure and expand their biopharmaceutical manufacturing capabilities, creating new avenues for growth.

Bioprocess Analyzers Industry Market Size (In Million)

The Bioprocess Analyzers Industry encompasses a diverse range of products, applications, and analytical types, catering to the intricate needs of biopharmaceutical production. The market is segmented into Instruments and Consumables, with both categories experiencing consistent demand. Applications span crucial areas such as Antibiotics, Recombinant Proteins, Biosimilars, and Other Applications, reflecting the broad utility of these analyzers across the biopharmaceutical landscape. The analytical techniques themselves are categorized into Substrate Analysis, Metabolite Analysis, and Concentration Detection, highlighting the precision and depth of insights these systems provide. Major industry players like Thermo Fisher Scientific, Agilent Technologies, and F. Hoffmann-La Roche AG are at the forefront, driving innovation and catering to the diverse needs of the global market, which includes significant contributions from North America, Europe, and the Asia Pacific region.

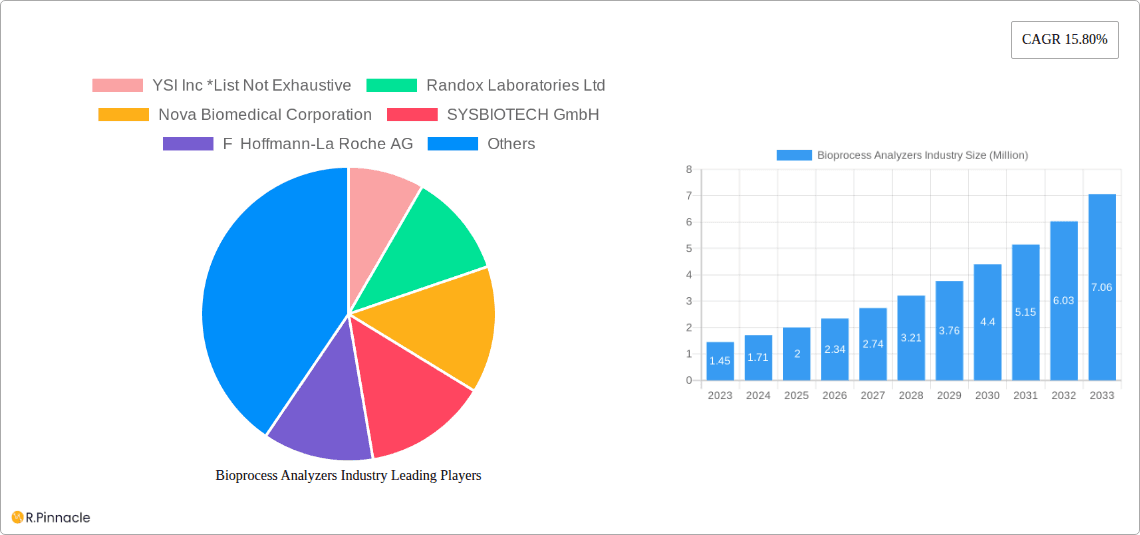

Bioprocess Analyzers Industry Company Market Share

Gain unparalleled insights into the Bioprocess Analyzers Industry, a critical sector for pharmaceutical and biotechnology advancements. This comprehensive report provides an in-depth analysis of market dynamics, innovation trends, regional dominance, and future opportunities. With meticulous research covering the Study Period: 2019–2033, Base Year: 2025, and Forecast Period: 2025–2033, this report equips industry professionals with actionable intelligence to navigate this rapidly evolving landscape. Explore key segments including Instruments, Consumables, and applications such as Antibiotics, Recombinant Proteins, and Biosimilars, alongside analysis of Substrate Analysis, Metabolite Analysis, and Concentration Detection.

Bioprocess Analyzers Industry Market Structure & Innovation Trends

The bioprocess analyzers market exhibits a moderately concentrated structure, with leading players like Thermo Fisher Scientific, Agilent Technologies, and Sartorius AG holding significant market shares, estimated to be around 20-25% in the base year 2025. Innovation is a paramount driver, fueled by the increasing demand for high-throughput, real-time monitoring solutions in biopharmaceutical manufacturing. Key innovation areas include the development of advanced sensor technologies, AI-driven data analytics for process optimization, and integrated systems for seamless workflow automation. Regulatory frameworks, particularly stringent quality control standards from bodies like the FDA and EMA, are influencing product development and market entry strategies. Product substitutes, such as traditional offline testing methods, are gradually being phased out by the superior efficiency and accuracy of online bioprocess analyzers. End-user demographics are increasingly dominated by large pharmaceutical corporations, contract development and manufacturing organizations (CDMOs), and academic research institutions. Merger and acquisition (M&A) activities are expected to remain active, with estimated deal values in the range of 50 Million to 200 Million, as companies seek to expand their product portfolios and geographical reach.

Bioprocess Analyzers Industry Market Dynamics & Trends

The global bioprocess analyzers market is poised for substantial growth, driven by an escalating demand for biologics, a surge in research and development activities within the pharmaceutical and biotechnology sectors, and the imperative for improved process efficiency and quality control in biomanufacturing. The market penetration of advanced bioprocess analytical technologies is expected to rise significantly, projected to reach over 60% by the end of the forecast period. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) and machine learning (ML) revolutionizing data interpretation and predictive analytics. This enables real-time process monitoring and optimization, leading to enhanced yields and reduced production costs. Consumer preferences are shifting towards solutions offering automation, miniaturization, and enhanced sensitivity, aligning with the industry's pursuit of Industry 4.0 principles. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on developing comprehensive solutions that cater to the entire bioprocessing workflow. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% to 9.5% from 2025 to 2033. Emerging trends like continuous manufacturing and single-use technologies are further augmenting the demand for sophisticated bioprocess monitoring tools. The growing prevalence of chronic diseases and the subsequent need for novel therapeutics are also significant contributors to market expansion. Furthermore, the increasing outsourcing of biopharmaceutical manufacturing to CDMOs is creating new avenues for market growth, as these organizations invest in advanced analytical instrumentation to serve a diverse client base. The rising emphasis on personalized medicine and the development of complex biotherapeutics also necessitate highly precise and versatile analytical solutions.

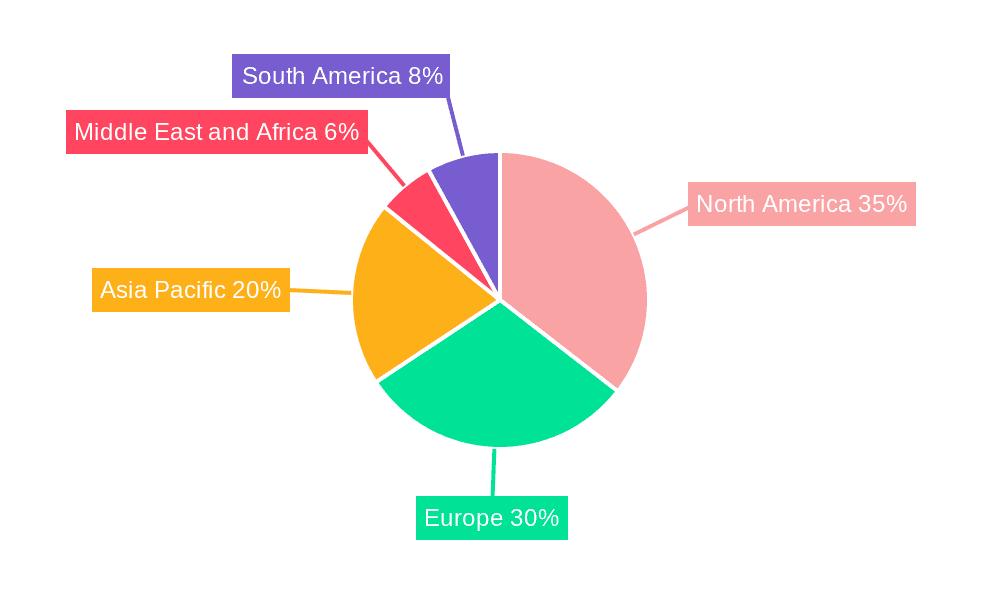

Dominant Regions & Segments in Bioprocess Analyzers Industry

North America, particularly the United States, is projected to maintain its dominance in the global bioprocess analyzers market throughout the forecast period. This leadership is underpinned by a robust pharmaceutical and biotechnology industry, substantial investments in life sciences research and development, and the presence of leading biopharmaceutical companies. Economic policies that favor innovation and a well-established regulatory framework further bolster market growth in the region.

Dominant Segments:

Product:

- Instruments: This segment is expected to hold the largest market share, driven by the continuous development of sophisticated analytical instruments such as spectrometers, chromatographs, and cell analyzers. The increasing adoption of Process Analytical Technology (PAT) is a significant catalyst.

- Consumables: While smaller in market share compared to instruments, the consumables segment is crucial for the recurrent revenue generation of bioprocess analyzer manufacturers. This includes reagents, disposable sensors, and sample preparation kits.

Application:

- Recombinant Proteins: The burgeoning market for recombinant proteins, used in therapeutic and diagnostic applications, is a primary driver for bioprocess analyzers. Demand is fueled by advancements in protein engineering and the development of novel protein-based drugs.

- Biosimilars: The growing pipeline of biosimilars, aimed at providing more affordable alternatives to blockbuster biologics, is creating substantial demand for precise and cost-effective bioprocess analytical solutions to ensure comparability with reference products.

- Antibiotics: While a more established application, the continuous need for effective antibiotics and the challenge of antibiotic resistance ensure a steady demand for bioprocess analyzers in their production.

- Other Applications: This broad category encompasses a range of emerging applications, including the development of vaccines, cell and gene therapies, and advanced diagnostics, all of which contribute to market growth.

Type:

- Concentration Detection: Accurately quantifying the concentration of target molecules is fundamental in bioprocessing. Technologies enabling precise and real-time concentration detection are highly sought after.

- Metabolite Analysis: Understanding metabolic pathways and monitoring metabolite profiles are critical for optimizing cell culture performance and product quality. Advances in metabolomics are driving growth in this area.

- Substrate Analysis: Monitoring substrate levels ensures optimal nutrient availability for cell growth and product formation. This remains a core function of bioprocess analysis.

Infrastructure development, including advanced manufacturing facilities and research laboratories, further supports the dominance of leading regions. Government initiatives promoting biotechnology and pharmaceutical innovation also play a pivotal role in shaping regional market trends.

Bioprocess Analyzers Industry Product Innovations

Product innovation in the bioprocess analyzers industry is sharply focused on enhancing real-time monitoring capabilities, improving data accuracy, and enabling greater automation. Developments include miniaturized, integrated sensor systems for inline and online measurements, reducing the need for manual sampling. AI-powered software solutions are being integrated to provide predictive analytics and optimize bioprocess parameters, leading to increased yields and consistent product quality. Competitive advantages are derived from superior sensitivity, speed, and the ability to perform multi-analyte detection simultaneously. The market is witnessing the emergence of user-friendly interfaces and cloud-based data management systems, simplifying data accessibility and collaboration.

Report Scope & Segmentation Analysis

This report meticulously segments the Bioprocess Analyzers Industry to provide granular insights. The Product segmentation includes Instruments and Consumables, crucial for understanding both capital expenditure and recurring operational costs. The Application segment is detailed, covering Antibiotics, Recombinant Proteins, Biosimilars, and Other Applications, reflecting the diverse end-use industries driving demand. Furthermore, the Type segmentation delves into Substrate Analysis, Metabolite Analysis, and Concentration Detection, highlighting the specific analytical functions paramount to bioprocessing. Each segment is analyzed for its market size, projected growth trajectory, and the competitive landscape that shapes its dynamics, offering a holistic view of market opportunities.

Key Drivers of Bioprocess Analyzers Industry Growth

Several pivotal factors are propelling the growth of the bioprocess analyzers industry. The escalating global demand for biologics, including vaccines and therapeutic proteins, necessitates sophisticated analytical tools for efficient and quality-controlled production. Advancements in biotechnology and the increasing focus on personalized medicine are driving the development of complex biotherapeutics that require precise monitoring. Technological innovations, such as the integration of AI and machine learning into analytical platforms, are enhancing process understanding and optimization, leading to improved yields and reduced costs. Furthermore, the growing trend of outsourcing biopharmaceutical manufacturing to Contract Development and Manufacturing Organizations (CDMOs) is spurring investments in advanced analytical instrumentation. Favorable government initiatives and increasing R&D spending in the life sciences sector also contribute significantly to market expansion.

Challenges in the Bioprocess Analyzers Industry Sector

Despite robust growth, the bioprocess analyzers industry faces several significant challenges. Stringent regulatory hurdles and the need for extensive validation of analytical methods can prolong product development timelines and increase costs. High initial investment costs for advanced analytical instrumentation can be a barrier for smaller companies and academic institutions. The complexity of bioprocesses requires highly skilled personnel to operate and interpret data from sophisticated analytical systems, leading to a talent gap. Supply chain disruptions, particularly for specialized components and raw materials, can impact manufacturing and delivery timelines. Furthermore, the competitive pressure to offer innovative and cost-effective solutions necessitates continuous investment in R&D, impacting profit margins.

Emerging Opportunities in Bioprocess Analyzers Industry

The bioprocess analyzers industry is ripe with emerging opportunities driven by technological advancements and evolving market demands. The rapidly expanding market for cell and gene therapies presents a significant avenue for growth, requiring novel analytical approaches for quality control. The increasing adoption of continuous manufacturing processes in biopharmaceutical production creates a demand for real-time, inline monitoring solutions. The integration of digital technologies, such as IoT and cloud computing, offers opportunities for developing smart, connected analytical platforms that enhance data management and collaboration. Expansion into emerging economies with a growing biopharmaceutical manufacturing base also presents substantial untapped potential. Furthermore, the development of portable and point-of-care bioprocess analysis devices could open up new application areas.

Leading Players in the Bioprocess Analyzers Industry Market

- YSI Inc

- Randox Laboratories Ltd

- Nova Biomedical Corporation

- SYSBIOTECH GmbH

- F Hoffmann-La Roche AG

- 4BioCell GmbH & Co KG

- Sartorius AG

- Kaiser Optical Systems Inc

- Groton Biosystems

- Thermo Fisher Scientific

- Agilent Technologies

Key Developments in Bioprocess Analyzers Industry Industry

- August 2022: Beckman Coulter Life Sciences entered into a partnership with Flownamics to create an automated, online solution for bioprocess culture monitoring and control. The agreement unites the company's Vi-CELL BLU Cell Viability Analyzer with the Seg-Flow S3 Automated On-Line Sampling System from Flownamics.

- February 2022: Dow collaborated with Sartorius and Südpack Medica to manufacture bioprocessing bags, which are essential components for the safe production and transportation of the COVID-19 vaccines globally.

Future Outlook for Bioprocess Analyzers Industry Market

The future outlook for the bioprocess analyzers industry remains exceptionally positive, driven by a confluence of factors. The sustained growth in the biologics market, coupled with the increasing complexity of therapeutic molecules, will continue to fuel demand for advanced analytical solutions. The ongoing digital transformation of biomanufacturing, characterized by the integration of AI, ML, and IoT, will accelerate the adoption of smart and automated analytical platforms. The expansion of personalized medicine and the growing pipeline of cell and gene therapies present significant opportunities for specialized analytical technologies. Furthermore, the increasing focus on process intensification and continuous manufacturing will necessitate highly integrated and real-time monitoring capabilities. Strategic collaborations, M&A activities, and a commitment to innovation will be crucial for companies to maintain a competitive edge and capitalize on the burgeoning market potential. The global bioprocess analyzers market is projected to witness sustained expansion and technological evolution in the coming years.

Bioprocess Analyzers Industry Segmentation

-

1. Product

- 1.1. Instruments

- 1.2. Consumables

-

2. Application

- 2.1. Antibiotics

- 2.2. Recombinant Proteins

- 2.3. Biosimilars

- 2.4. Other Applications

-

3. Type

- 3.1. Substrate Analysis

- 3.2. Metabolite Analysis

- 3.3. Concentration Detection

Bioprocess Analyzers Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Bioprocess Analyzers Industry Regional Market Share

Geographic Coverage of Bioprocess Analyzers Industry

Bioprocess Analyzers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Interest in the Development of Advanced Medicines and Vaccines; Increasing Demand for Biologics

- 3.3. Market Restrains

- 3.3.1. Complexity of Upstream and Downstream Processing and Strict Regulations; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Recombinant Protein Segment is Expected to Hold a Significant Market Share over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bioprocess Analyzers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Instruments

- 5.1.2. Consumables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Antibiotics

- 5.2.2. Recombinant Proteins

- 5.2.3. Biosimilars

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Substrate Analysis

- 5.3.2. Metabolite Analysis

- 5.3.3. Concentration Detection

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Bioprocess Analyzers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Instruments

- 6.1.2. Consumables

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Antibiotics

- 6.2.2. Recombinant Proteins

- 6.2.3. Biosimilars

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Substrate Analysis

- 6.3.2. Metabolite Analysis

- 6.3.3. Concentration Detection

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Bioprocess Analyzers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Instruments

- 7.1.2. Consumables

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Antibiotics

- 7.2.2. Recombinant Proteins

- 7.2.3. Biosimilars

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Substrate Analysis

- 7.3.2. Metabolite Analysis

- 7.3.3. Concentration Detection

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Bioprocess Analyzers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Instruments

- 8.1.2. Consumables

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Antibiotics

- 8.2.2. Recombinant Proteins

- 8.2.3. Biosimilars

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Substrate Analysis

- 8.3.2. Metabolite Analysis

- 8.3.3. Concentration Detection

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Bioprocess Analyzers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Instruments

- 9.1.2. Consumables

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Antibiotics

- 9.2.2. Recombinant Proteins

- 9.2.3. Biosimilars

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Substrate Analysis

- 9.3.2. Metabolite Analysis

- 9.3.3. Concentration Detection

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Bioprocess Analyzers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Instruments

- 10.1.2. Consumables

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Antibiotics

- 10.2.2. Recombinant Proteins

- 10.2.3. Biosimilars

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Substrate Analysis

- 10.3.2. Metabolite Analysis

- 10.3.3. Concentration Detection

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 YSI Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Randox Laboratories Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nova Biomedical Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SYSBIOTECH GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F Hoffmann-La Roche AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 4BioCell GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sartorious AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kaiser Optical Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Groton Biosystems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thermo Fisher Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Agilent Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 YSI Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Bioprocess Analyzers Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bioprocess Analyzers Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Bioprocess Analyzers Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Bioprocess Analyzers Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Bioprocess Analyzers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Bioprocess Analyzers Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: North America Bioprocess Analyzers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Bioprocess Analyzers Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Bioprocess Analyzers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bioprocess Analyzers Industry Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Bioprocess Analyzers Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Bioprocess Analyzers Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Bioprocess Analyzers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Bioprocess Analyzers Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Bioprocess Analyzers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Bioprocess Analyzers Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Bioprocess Analyzers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Bioprocess Analyzers Industry Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Bioprocess Analyzers Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Bioprocess Analyzers Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Bioprocess Analyzers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Bioprocess Analyzers Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Pacific Bioprocess Analyzers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Bioprocess Analyzers Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Bioprocess Analyzers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bioprocess Analyzers Industry Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Bioprocess Analyzers Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Bioprocess Analyzers Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Bioprocess Analyzers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Bioprocess Analyzers Industry Revenue (Million), by Type 2025 & 2033

- Figure 31: Middle East and Africa Bioprocess Analyzers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 32: Middle East and Africa Bioprocess Analyzers Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Bioprocess Analyzers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Bioprocess Analyzers Industry Revenue (Million), by Product 2025 & 2033

- Figure 35: South America Bioprocess Analyzers Industry Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Bioprocess Analyzers Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Bioprocess Analyzers Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Bioprocess Analyzers Industry Revenue (Million), by Type 2025 & 2033

- Figure 39: South America Bioprocess Analyzers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 40: South America Bioprocess Analyzers Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Bioprocess Analyzers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Bioprocess Analyzers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Bioprocess Analyzers Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bioprocess Analyzers Industry?

The projected CAGR is approximately 15.80%.

2. Which companies are prominent players in the Bioprocess Analyzers Industry?

Key companies in the market include YSI Inc *List Not Exhaustive, Randox Laboratories Ltd, Nova Biomedical Corporation, SYSBIOTECH GmbH, F Hoffmann-La Roche AG, 4BioCell GmbH & Co KG, Sartorious AG, Kaiser Optical Systems Inc, Groton Biosystems, Thermo Fisher Scientific, Agilent Technologies.

3. What are the main segments of the Bioprocess Analyzers Industry?

The market segments include Product, Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Interest in the Development of Advanced Medicines and Vaccines; Increasing Demand for Biologics.

6. What are the notable trends driving market growth?

Recombinant Protein Segment is Expected to Hold a Significant Market Share over the Forecast Period.

7. Are there any restraints impacting market growth?

Complexity of Upstream and Downstream Processing and Strict Regulations; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2022: Beckman Coulter Life Sciences entered into a partnership with Flownamics to create an automated, online solution for bioprocess culture monitoring and control. The agreement unites the company's Vi-CELL BLU Cell Viability Analyzer with the Seg-Flow S3 Automated On-Line Sampling System from Flownamics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bioprocess Analyzers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bioprocess Analyzers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bioprocess Analyzers Industry?

To stay informed about further developments, trends, and reports in the Bioprocess Analyzers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence