Key Insights

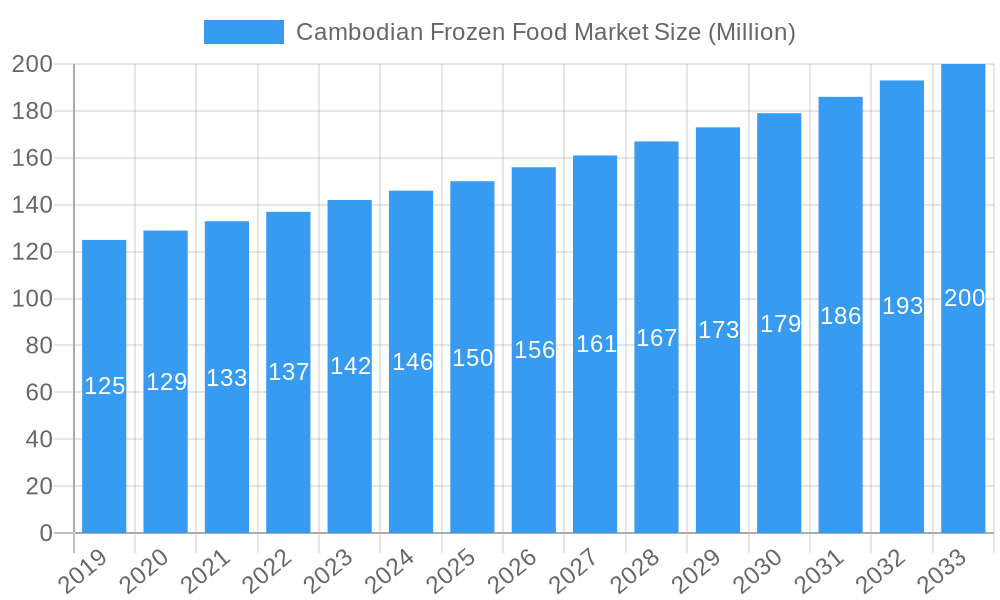

The Cambodian Frozen Food Market is projected for substantial expansion, driven by evolving consumer lifestyles and increasing urbanization. With a projected market size of $33.64 million in the base year of 2025, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.76% through 2033. This growth is underpinned by a rising middle class with increased disposable income, a growing demand for convenient food options, and broader product availability across retail channels. Key drivers include the penetration of modern retail formats and the burgeoning online food delivery sector, enhancing accessibility. Growing consumer acceptance of frozen food as a safe and nutritious alternative further supports market expansion.

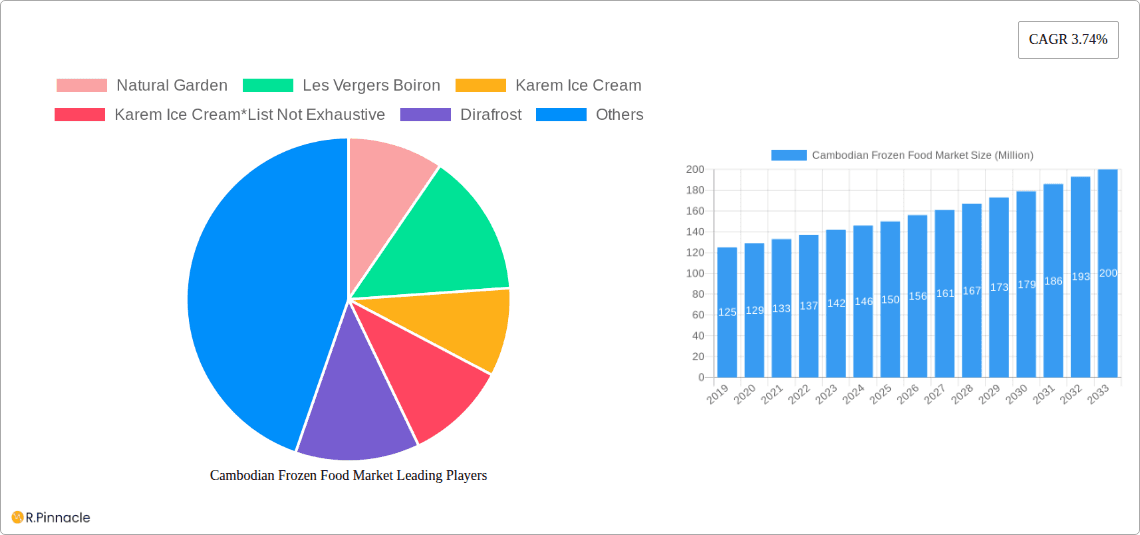

Cambodian Frozen Food Market Market Size (In Million)

Market dynamics are shaped by key segments and trends. The "Frozen Fruit and Vegetable" segment is anticipated to gain significant traction, aligning with health-conscious preferences. "Frozen Ready Meals" are increasingly popular for their convenience. While modern retail channels lead distribution, traditional grocery stores are adapting. Challenges include developing robust cold chain infrastructure and consumer education regarding frozen food quality and safety. Despite these, the Cambodian Frozen Food Market outlook remains positive, offering considerable opportunities for industry players.

Cambodian Frozen Food Market Company Market Share

Gain comprehensive insights into the Cambodian Frozen Food Market with this in-depth report. This resource details market structure, dynamics, leading regions, and emerging opportunities, providing essential information for industry professionals, investors, and stakeholders to navigate this rapidly evolving sector.

Cambodian Frozen Food Market Market Structure & Innovation Trends

The Cambodian frozen food market exhibits a moderate level of market concentration, with key players like Natural Garden and Karem Ice Cream holding significant, though not dominant, market share. Innovation is a key differentiator, driven by evolving consumer demand for convenience and healthier options. Regulatory frameworks, while developing, are increasingly supportive of food safety and quality standards, impacting product development and market entry. Potential product substitutes include fresh and chilled food alternatives, but the convenience and extended shelf-life of frozen products continue to drive demand. End-user demographics are shifting, with a growing middle class and urban population seeking convenient meal solutions. Mergers and acquisitions (M&A) activities, while currently limited, present strategic opportunities for market consolidation and expansion, with estimated deal values in the tens of millions of USD. The market share distribution among key players is estimated to be around 25% for Natural Garden and 18% for Karem Ice Cream, with other entities comprising the remainder.

Cambodian Frozen Food Market Market Dynamics & Trends

The Cambodian frozen food market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This robust expansion is primarily fueled by increasing disposable incomes, a burgeoning urban population with demanding lifestyles, and a growing awareness of the convenience and extended shelf-life offered by frozen food products. Technological advancements in freezing and packaging techniques are enhancing product quality and variety, making frozen options more appealing. Consumer preferences are rapidly shifting towards convenience-oriented solutions, with a rising demand for ready-to-eat and frozen meal options that cater to busy schedules. The competitive landscape is becoming more intense, with both domestic and international players vying for market share. The market penetration of frozen food products is still in its nascent stages, indicating substantial room for growth. Key trends include the demand for healthier frozen options, such as those with reduced sodium and natural ingredients, and a growing interest in ethnic and international frozen food varieties. The online channel for frozen food sales is also witnessing accelerated adoption, driven by e-commerce growth and improved cold chain logistics.

Dominant Regions & Segments in Cambodian Frozen Food Market

The Cambodian frozen food market is predominantly driven by urban centers, with Phnom Penh leading in consumption and distribution. Within the Type segmentation, Frozen Meat and Seafood currently holds the largest market share, driven by a growing demand for convenient protein sources and the increasing popularity of seafood in Cambodian cuisine. Frozen Dessert also represents a significant segment, fueled by rising disposable incomes and a preference for indulgent treats. The Frozen Fruit and Vegetable segment is gaining traction due to growing health consciousness and the availability of diverse tropical fruits. Frozen Ready Meal is an emerging segment with high growth potential as busy lifestyles become more prevalent.

In terms of Distribution Channel, Hypermarket/Supermarket remains the dominant channel, offering wider product availability and promotional activities. However, the Online Channel is experiencing rapid growth, driven by e-commerce platforms and the convenience it offers to consumers.

Key Drivers for Dominance:

- Phnom Penh's Economic Hub: High population density, higher disposable incomes, and a concentration of modern retail outlets in Phnom Penh foster greater consumption of frozen food products.

- Growing Middle Class: An expanding middle class with increased purchasing power is more likely to adopt frozen food for convenience and variety.

- Urbanization: The shift of population to urban areas leads to busier lifestyles, increasing the demand for quick and easy meal solutions.

- Investment in Cold Chain Infrastructure: Improvements in cold chain logistics are crucial for expanding the reach and availability of frozen foods across the country.

Cambodian Frozen Food Market Product Innovations

Product innovations in the Cambodian frozen food market are primarily focused on enhancing convenience, nutritional value, and catering to local taste preferences. Companies are increasingly developing ready-to-cook frozen meals featuring traditional Cambodian dishes, alongside a wider array of frozen fruits and vegetables sourced locally. Technological advancements in blast freezing and vacuum packaging are improving product freshness and extending shelf life, offering competitive advantages. Applications range from household consumption to food service industries, with a growing emphasis on traceable and ethically sourced ingredients.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Cambodian frozen food market across various critical segments.

Type: The market is segmented into Frozen Meat and Seafood, Frozen Dessert, Frozen Fruit and Vegetable, Frozen Ready Meal, and Other Types. Frozen Meat and Seafood is expected to maintain its leading position, with a projected market size of approximately $60 Million by 2033. Frozen Ready Meal is anticipated to witness the highest CAGR, driven by evolving consumer lifestyles.

Distribution Channel: Key distribution channels include Hypermarket/Supermarket, Traditional Grocery Store, Online Channel, and Other Distribution Channels. Hypermarkets/Supermarkets will continue to dominate, accounting for an estimated $75 Million market share by 2033. The Online Channel is projected to exhibit substantial growth, reflecting the increasing adoption of e-commerce.

Key Drivers of Cambodian Frozen Food Market Growth

The growth of the Cambodian frozen food market is propelled by several key factors. Rising disposable incomes and an expanding middle class are significantly boosting consumer purchasing power for convenient food options. The increasing urbanization rate leads to busier lifestyles, creating a higher demand for time-saving meal solutions. Technological advancements in freezing and storage, coupled with improved cold chain infrastructure, enhance product quality and accessibility. Furthermore, a growing health consciousness among consumers is driving demand for frozen fruits and vegetables, while a wider availability of imported and locally produced frozen goods is expanding product choices.

Challenges in the Cambodian Frozen Food Market Sector

Despite its growth potential, the Cambodian frozen food market faces several challenges. Inadequate cold chain infrastructure, particularly in rural areas, limits product reach and can lead to quality issues. High electricity costs and inconsistent power supply can also impact storage and transportation. Consumer perception regarding the quality and nutritional value of frozen foods remains a hurdle, requiring sustained marketing and education efforts. Intense price competition from both local and international players can squeeze profit margins. Additionally, complex import regulations and customs procedures can pose difficulties for international market participants.

Emerging Opportunities in Cambodian Frozen Food Market

The Cambodian frozen food market presents several exciting emerging opportunities. The increasing adoption of online retail platforms creates a significant avenue for direct-to-consumer sales. Growing consumer interest in healthier eating habits opens doors for innovative product development in frozen fruits, vegetables, and lean protein options. The expansion of the food service sector, including restaurants and hotels, offers substantial B2B opportunities for frozen food suppliers. Furthermore, the growing tourism industry can drive demand for a wider variety of international frozen food products. Strategic partnerships with local distributors can help overcome infrastructure challenges and expand market reach.

Leading Players in the Cambodian Frozen Food Market Market

- Natural Garden

- Les Vergers Boiron

- Karem Ice Cream

- Dirafrost

Key Developments in Cambodian Frozen Food Market Industry

- 2023: Launch of a new range of frozen fruit and vegetable blends by Natural Garden, focusing on convenience and health.

- 2023: Karem Ice Cream introduces new flavors of frozen desserts, catering to local taste preferences.

- 2022: Increased investment in cold chain logistics by major distributors to expand market reach across Cambodia.

- 2021: Rise in online sales of frozen foods, indicating a growing consumer preference for e-commerce convenience.

- 2020: Enhanced focus on product traceability and food safety standards in response to evolving regulatory landscapes.

Future Outlook for Cambodian Frozen Food Market Market

The future outlook for the Cambodian frozen food market is highly promising, driven by sustained economic growth and evolving consumer lifestyles. Increased disposable incomes, coupled with a growing demand for convenience, will continue to fuel market expansion. Investments in cold chain infrastructure and advancements in freezing technologies will enhance product quality and accessibility. Emerging trends like the demand for healthy frozen options and the growth of online sales channels present significant opportunities for innovation and market penetration. Strategic collaborations and a focus on local consumer preferences will be crucial for success in this dynamic and expanding market, with a projected market size exceeding $150 Million by 2033.

Cambodian Frozen Food Market Segmentation

-

1. Type

- 1.1. Frozen Meat and Seafood

- 1.2. Frozen Dessert

- 1.3. Frozen Fruit and Vegetable

- 1.4. Frozen Ready Meal

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Traditional Grocery Store

- 2.3. Online Channel

- 2.4. Other Distribution Channels

Cambodian Frozen Food Market Segmentation By Geography

- 1. Cambodia

Cambodian Frozen Food Market Regional Market Share

Geographic Coverage of Cambodian Frozen Food Market

Cambodian Frozen Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Heath Concerns are Boosting the Demand for Milk Protein; Growing Demand for Performance Nutrition and Beverages

- 3.3. Market Restrains

- 3.3.1. Rising Demand and Popularity of Plant-based Proteins

- 3.4. Market Trends

- 3.4.1. Influence of Westernization on Diet and Healthy Tourism

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodian Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Meat and Seafood

- 5.1.2. Frozen Dessert

- 5.1.3. Frozen Fruit and Vegetable

- 5.1.4. Frozen Ready Meal

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Traditional Grocery Store

- 5.2.3. Online Channel

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Natural Garden

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Les Vergers Boiron

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Karem Ice Cream

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Karem Ice Cream*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dirafrost

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Natural Garden

List of Figures

- Figure 1: Cambodian Frozen Food Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Cambodian Frozen Food Market Share (%) by Company 2025

List of Tables

- Table 1: Cambodian Frozen Food Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Cambodian Frozen Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Cambodian Frozen Food Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Cambodian Frozen Food Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Cambodian Frozen Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Cambodian Frozen Food Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodian Frozen Food Market?

The projected CAGR is approximately 5.76%.

2. Which companies are prominent players in the Cambodian Frozen Food Market?

Key companies in the market include Natural Garden, Les Vergers Boiron, Karem Ice Cream, Karem Ice Cream*List Not Exhaustive, Dirafrost.

3. What are the main segments of the Cambodian Frozen Food Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.64 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Heath Concerns are Boosting the Demand for Milk Protein; Growing Demand for Performance Nutrition and Beverages.

6. What are the notable trends driving market growth?

Influence of Westernization on Diet and Healthy Tourism.

7. Are there any restraints impacting market growth?

Rising Demand and Popularity of Plant-based Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodian Frozen Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodian Frozen Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodian Frozen Food Market?

To stay informed about further developments, trends, and reports in the Cambodian Frozen Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence