Key Insights

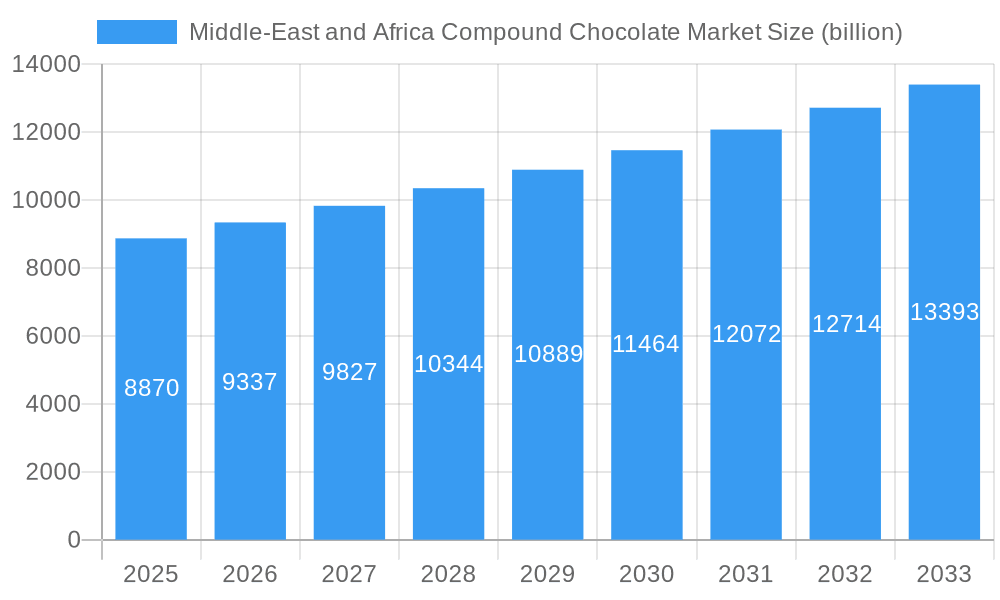

The Middle East and Africa Compound Chocolate Market is experiencing robust growth, projected to reach USD 8.87 billion in 2025 with a Compound Annual Growth Rate (CAGR) of 5.4% through 2033. This expansion is fueled by a rising demand for convenient and affordable chocolate products across the region, driven by increasing disposable incomes and a growing population. Key market drivers include the escalating popularity of confectionery and bakery products, where compound chocolate serves as a versatile and cost-effective ingredient. Furthermore, the expanding food processing industry, particularly in emerging economies within the Middle East and Africa, is significantly contributing to market expansion. The convenience and adaptability of compound chocolate in various applications, from coatings and fillings to inclusions, make it an attractive option for manufacturers looking to innovate and meet evolving consumer preferences.

Middle-East and Africa Compound Chocolate Market Market Size (In Billion)

Trends such as the growing interest in healthier and more indulgent chocolate options, alongside the rise of private label brands, are shaping the market landscape. While the market presents significant opportunities, certain restraints, including fluctuating raw material prices and intense competition, pose challenges. The market is segmented by flavor, with Milk, White, and Dark varieties all showing strong demand. In terms of form, Chocolate Chips/Drops/Chunks and Chocolate Slab remain dominant, catering to diverse manufacturing needs. Applications span across Bakery, Confectionery, Frozen Desserts and Ice Cream, and Beverages, highlighting the broad utility of compound chocolate. Geographically, the United Arab Emirates, Saudi Arabia, and South Africa are pivotal markets within the Middle East & Africa region, showcasing substantial growth potential. Major players like Puratos, Cargill Incorporated, and Barry Callebaut are actively investing in research and development to capture market share and introduce innovative product offerings.

Middle-East and Africa Compound Chocolate Market Company Market Share

Middle-East and Africa Compound Chocolate Market: Unlocking Growth in a Dynamic Landscape (2019-2033)

This comprehensive report delivers an in-depth analysis of the Middle-East and Africa (MEA) compound chocolate market, projected to reach $XX billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from 2025. Spanning the study period of 2019–2033, with 2025 as the base and estimated year, this report offers critical insights for industry professionals seeking to capitalize on the region's burgeoning demand for versatile and cost-effective chocolate solutions. We dissect market dynamics, explore dominant segments, highlight product innovations, and identify key growth drivers and challenges, providing a strategic roadmap for market players.

Middle-East and Africa Compound Chocolate Market Market Structure & Innovation Trends

The MEA compound chocolate market exhibits a moderate to high concentration, with key players like Cargill Incorporated, Barry Callebaut, and Puratos dominating the landscape. Innovation is primarily driven by the demand for specialized functionalities, cost-effectiveness, and evolving consumer preferences for healthier and plant-based alternatives. Regulatory frameworks are evolving, with increasing attention to food safety standards and labeling requirements across the region. Product substitutes, such as other confectionery coatings and flavorings, exist but struggle to match the cost-effectiveness and versatility of compound chocolates in many applications. End-user demographics reveal a growing middle class with increasing disposable income, fueling demand across all application segments, particularly bakery and confectionery. Mergers and acquisitions (M&A) activities, while not extensively detailed in public records for this specific niche, are anticipated to play a role in market consolidation and expansion, with potential deal values reaching into the hundreds of millions of dollars as companies seek to enhance their regional footprint and product portfolios.

Middle-East and Africa Compound Chocolate Market Market Dynamics & Trends

The MEA compound chocolate market is poised for significant expansion, driven by a confluence of potent factors. A primary growth driver is the escalating demand from the bakery and confectionery industries, where compound chocolate's cost-effectiveness, ease of use, and versatility make it an indispensable ingredient for a wide array of products, from cakes and pastries to candies and chocolates. The growing middle-class population across the Middle East and Africa, coupled with rising disposable incomes, is further fueling consumer spending on indulgence products, directly benefiting the compound chocolate sector.

Technological disruptions are playing a crucial role, with advancements in manufacturing processes leading to improved product quality, enhanced texture, and wider flavor profiles for compound chocolates. Manufacturers are increasingly investing in research and development to create specialized compounds tailored to specific applications, such as high-temperature stable coatings for baked goods or dairy-free options to cater to a growing vegan and lactose-intolerant consumer base.

Consumer preferences are undergoing a noticeable shift. While traditional chocolate flavors remain popular, there is a burgeoning demand for healthier options, including reduced sugar and plant-based alternatives. This trend is driving innovation in compound chocolate formulations, with companies exploring the use of alternative sweeteners and plant-derived ingredients. Furthermore, the convenience factor associated with compound chocolate, which often requires less tempering than traditional chocolate, appeals to busy consumers and smaller food businesses.

Competitive dynamics are characterized by the presence of both large multinational corporations and regional players. Companies are vying for market share through product innovation, strategic partnerships, and competitive pricing. The focus is shifting from merely supplying a commodity to offering value-added solutions that address specific customer needs and market trends. The market penetration of compound chocolate is steadily increasing as more food manufacturers recognize its economic and functional advantages. The estimated market penetration is projected to reach XX% by 2025, with significant potential for further growth. The overall market size for compound chocolate in the MEA region is projected to reach $XX billion by 2033, with a projected CAGR of XX% between 2025 and 2033.

Dominant Regions & Segments in Middle-East and Africa Compound Chocolate Market

The Middle-East and Africa Compound Chocolate Market is characterized by vibrant growth across its diverse segments, with particular dominance observed in key geographical areas and specific applications.

Dominant Geography: United Arab Emirates & Saudi Arabia

- Economic Policies and Investment: The United Arab Emirates (UAE) and Saudi Arabia stand out as leading economic powerhouses within the MEA region, characterized by strong government initiatives to foster industrial growth and attract foreign investment. Their robust economies, coupled with a high disposable income among their populations, create a fertile ground for the expansion of the food and beverage sector, consequently driving the demand for compound chocolates.

- Consumer Demand for Confectionery: These nations exhibit a significant and growing consumer appetite for confectionery products, including chocolates, biscuits, and ice cream. The presence of a large expatriate population also contributes to a diverse palate and a higher propensity for consuming a wide range of food items.

- Food Processing Infrastructure: Both the UAE and Saudi Arabia have invested heavily in developing advanced food processing infrastructure, making them attractive hubs for manufacturers of compound chocolate and its downstream applications. This includes modern manufacturing facilities, efficient logistics networks, and a skilled workforce.

Dominant Segments:

Flavor: Milk Compound Chocolate

- Consumer Preference: Milk compound chocolate remains the most popular flavor profile due to its universally appealing sweet taste and smooth texture, making it a staple in a wide range of confectionery and bakery products.

- Cost-Effectiveness: Its formulation often allows for a more cost-effective production compared to dark or white chocolate, making it a preferred choice for mass-produced consumer goods.

- Versatile Application: Milk compound chocolate is extensively used in applications such as chocolate bars, fillings for pastries, coatings for biscuits, and as a key ingredient in ice cream and beverage mixes.

Form: Chocolate Chips/Drops/Chunks

- Ease of Use in Baking: The ready-to-use nature of chips, drops, and chunks significantly enhances convenience for home bakers and industrial food producers, simplifying the incorporation of chocolate into various recipes.

- Textural Appeal: These forms provide distinct textural elements in baked goods, candies, and frozen desserts, adding visual appeal and satisfying mouthfeel.

- Wide Applicability: They are integral to cookies, muffins, brownies, ice cream toppings, and cereal coatings, contributing to their dominant market share.

Application: Confectionery

- Largest Consumer Base: The confectionery industry is the single largest consumer of compound chocolate, encompassing a vast array of products including chocolate bars, candies, truffles, and enrobed snacks.

- Growth Driven by Innovation: Continuous innovation in confectionery product development, driven by new flavor combinations and product formats, directly fuels the demand for specialized compound chocolates.

- Affordability and Accessibility: Compound chocolate's affordability makes it the go-to ingredient for a wide range of mass-market confectionery items, ensuring its sustained dominance.

Application: Bakery

- Expanding Market: The bakery sector, including artisanal bakeries and large-scale commercial operations, represents a significant and rapidly growing application for compound chocolate.

- Ingredient Versatility: Compound chocolate's ability to withstand higher baking temperatures without burning or losing its properties makes it ideal for use in cakes, cookies, pastries, bread, and various fillings and glazes.

- Consumer Demand for Indulgence: Consumers consistently seek indulgent baked goods, and chocolate remains a perennial favorite, bolstering the demand for compound chocolate in this segment.

Middle-East and Africa Compound Chocolate Market Product Innovations

Product innovations in the MEA compound chocolate market are predominantly focused on enhancing functionality, catering to specific dietary needs, and improving cost-effectiveness. Manufacturers are developing specialized compound chocolates with improved melt profiles, enhanced gloss, and superior heat stability for demanding applications in bakery and confectionery. A notable trend is the development of dairy-free and plant-based compound chocolate options, responding to the growing demand for vegan and lactose-free products. These innovations often leverage alternative fats and emulsifiers to achieve desired textures and tastes without traditional dairy ingredients. Furthermore, efforts are being made to develop compound chocolates with cleaner labels, reducing artificial additives and focusing on more natural ingredients. These advancements are crucial for gaining competitive advantages, meeting evolving consumer preferences, and expanding market reach across the diverse MEA region.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Middle-East and Africa Compound Chocolate Market, encompassing key segmentation across Flavor (Milk, White, Dark), Form (Chocolate Chips/Drops/Chunks, Chocolate Slab, Chocolate Coatings), Application (Bakery, Confectionery, Frozen Desserts and Ice Cream, Beverages, Cereals, Other Applications), and Geography (United Arab Emirates, Saudi Arabia, South Africa, Rest of Middle East & Africa). Each segment is analyzed for its market size, growth projections, and competitive dynamics. The Confectionery and Bakery application segments are expected to exhibit the highest growth rates, driven by increasing consumer demand and the versatility of compound chocolates. Geographically, the United Arab Emirates and Saudi Arabia are anticipated to lead market expansion due to their robust economies and significant consumer spending power. The Milk flavor segment and Chocolate Chips/Drops/Chunks form are projected to maintain their dominance due to widespread consumer preference and ease of application.

Key Drivers of Middle-East and Africa Compound Chocolate Market Growth

The growth of the Middle-East and Africa Compound Chocolate Market is propelled by several key factors. Economically, a rising disposable income and a growing middle-class population across the region significantly boost demand for confectionery and baked goods, where compound chocolate is a staple ingredient. Technologically, advancements in processing and formulation allow for the creation of more versatile, cost-effective, and functional compound chocolates tailored to specific applications and consumer preferences, including healthier alternatives. Regulatory bodies in some countries are increasingly focusing on food safety and quality standards, pushing manufacturers towards higher-quality ingredients and processes. Furthermore, the inherent cost-effectiveness and ease of use of compound chocolate compared to couverture chocolate make it an attractive option for a wide range of food manufacturers, from small businesses to large enterprises, fueling its widespread adoption.

Challenges in the Middle-East and Africa Compound Chocolate Market Sector

Despite its growth potential, the Middle-East and Africa Compound Chocolate Market faces several challenges. Fluctuations in the price and availability of raw materials, particularly cocoa beans and vegetable oils, can impact production costs and profitability, leading to price volatility. Stringent and varying import/export regulations across different MEA countries can create logistical hurdles and increase compliance costs for manufacturers and distributors. Intense competition from both domestic and international players, coupled with the presence of product substitutes, puts pressure on profit margins and necessitates continuous innovation and strategic pricing. Furthermore, supply chain disruptions, exacerbated by regional instability or global events, can affect the timely delivery of raw materials and finished products, posing a significant challenge to market players. Consumer awareness regarding the differences between compound chocolate and true chocolate, and potential preferences for the latter, can also be a restraint in certain premium market segments.

Emerging Opportunities in Middle-East and Africa Compound Chocolate Market

Emerging opportunities in the Middle-East and Africa Compound Chocolate Market lie in several key areas. The rapidly growing demand for plant-based and vegan food products presents a significant opportunity for manufacturers to develop and market specialized dairy-free compound chocolates. The convenience food sector continues to expand, creating demand for compound chocolate in ready-to-eat meals, snacks, and pre-packaged desserts. Emerging markets within Africa, with their growing populations and developing economies, offer untapped potential for market expansion. Furthermore, increasing consumer interest in novel flavors and functional ingredients provides avenues for product differentiation and the development of premium compound chocolate offerings. Collaborations with local food manufacturers and ingredient suppliers can also unlock new market niches and distribution channels.

Leading Players in the Middle-East and Africa Compound Chocolate Market Market

- Puratos

- Cargill Incorporated

- Barry Callebaut

- Tiger Brands Limited

- Ferrero International SA

- Mars Incorporated

- Kerry Group

- Cocoa Processing Company Limited

- IFFCO Group

- Kees Beyers Chocolate CC

Key Developments in Middle-East and Africa Compound Chocolate Market Industry

- May 2022: Blommer Chocolate Co. announced a partnership with Israel-based company DouxMatok for inaugurating chocolate coatings with Incredo sugar, along with its range of food applications, enrobing, panning, and molding. This development signals a trend towards innovative ingredient integration to enhance product performance and appeal.

- November 2021: Barry Callebaut declared the launch of the dairy-free chocolate compound product portfolio, which is 100% plant-based. The products under this portfolio include Compound Soft Shaped Chunks, Compound Chip/Chunk, Compound Soft Chunk, dairy-free EZ melt compound, and Bulk Liquid for different applications. This significant launch caters to the burgeoning demand for plant-based alternatives and showcases the company's commitment to sustainable and inclusive product development.

Future Outlook for Middle-East and Africa Compound Chocolate Market Market

The future outlook for the Middle-East and Africa Compound Chocolate Market is exceptionally promising, driven by sustained economic growth, evolving consumer preferences, and continuous innovation. The increasing disposable income and a growing young population in many MEA countries will continue to fuel demand for confectionery and baked goods. The trend towards healthier and plant-based eating habits will create significant opportunities for the development and adoption of specialized compound chocolates. Furthermore, ongoing investments in food processing infrastructure across the region will streamline production and distribution, enhancing market accessibility. Strategic partnerships, focused product development addressing regional tastes, and a commitment to quality and sustainability will be crucial for players looking to capitalize on the abundant growth accelerators and secure a strong market position in the coming years. The market is expected to witness further consolidation and expansion, presenting lucrative prospects for both established players and new entrants.

Middle-East and Africa Compound Chocolate Market Segmentation

-

1. Flavor

- 1.1. Milk

- 1.2. White

- 1.3. Dark

-

2. Form

- 2.1. Chocolate Chips/Drops/Chunks

- 2.2. Chocolate Slab

- 2.3. Chocolate Coatings

-

3. Application

- 3.1. Bakery

- 3.2. Confectionery

- 3.3. Frozen Desserts and Ice Cream

- 3.4. Beverages

- 3.5. Cereals

- 3.6. Other Applications

-

4. Geography

-

4.1. Middle East & Africa

- 4.1.1. United Arab Emirates

- 4.1.2. Saudi Arabia

- 4.1.3. South Africa

- 4.1.4. Rest of Middle East & Africa

-

4.1. Middle East & Africa

Middle-East and Africa Compound Chocolate Market Segmentation By Geography

- 1. Middle East

-

2. United Arab Emirates

- 2.1. Saudi Arabia

- 2.2. South Africa

- 2.3. Rest of Middle East

Middle-East and Africa Compound Chocolate Market Regional Market Share

Geographic Coverage of Middle-East and Africa Compound Chocolate Market

Middle-East and Africa Compound Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. High Preference of Chocolate-based Products Accelerates the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Flavor

- 5.1.1. Milk

- 5.1.2. White

- 5.1.3. Dark

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Chocolate Chips/Drops/Chunks

- 5.2.2. Chocolate Slab

- 5.2.3. Chocolate Coatings

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Confectionery

- 5.3.3. Frozen Desserts and Ice Cream

- 5.3.4. Beverages

- 5.3.5. Cereals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Middle East & Africa

- 5.4.1.1. United Arab Emirates

- 5.4.1.2. Saudi Arabia

- 5.4.1.3. South Africa

- 5.4.1.4. Rest of Middle East & Africa

- 5.4.1. Middle East & Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.5.2. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Flavor

- 6. Middle East Middle-East and Africa Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Flavor

- 6.1.1. Milk

- 6.1.2. White

- 6.1.3. Dark

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Chocolate Chips/Drops/Chunks

- 6.2.2. Chocolate Slab

- 6.2.3. Chocolate Coatings

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery

- 6.3.2. Confectionery

- 6.3.3. Frozen Desserts and Ice Cream

- 6.3.4. Beverages

- 6.3.5. Cereals

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Middle East & Africa

- 6.4.1.1. United Arab Emirates

- 6.4.1.2. Saudi Arabia

- 6.4.1.3. South Africa

- 6.4.1.4. Rest of Middle East & Africa

- 6.4.1. Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Flavor

- 7. United Arab Emirates Middle-East and Africa Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Flavor

- 7.1.1. Milk

- 7.1.2. White

- 7.1.3. Dark

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Chocolate Chips/Drops/Chunks

- 7.2.2. Chocolate Slab

- 7.2.3. Chocolate Coatings

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery

- 7.3.2. Confectionery

- 7.3.3. Frozen Desserts and Ice Cream

- 7.3.4. Beverages

- 7.3.5. Cereals

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Middle East & Africa

- 7.4.1.1. United Arab Emirates

- 7.4.1.2. Saudi Arabia

- 7.4.1.3. South Africa

- 7.4.1.4. Rest of Middle East & Africa

- 7.4.1. Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Flavor

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Puratos

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Cargill Incorporated

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Barry Callebaut

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Tiger Brands Limited*List Not Exhaustive

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Ferrero International SA

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Mars Incorporated

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Kerry Group

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Cocoa Processing Company Limited

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 IFFCO Group

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Kees Beyers Chocolate CC

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Puratos

List of Figures

- Figure 1: Middle-East and Africa Compound Chocolate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Compound Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 2: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Form 2020 & 2033

- Table 3: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 7: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 12: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Form 2020 & 2033

- Table 13: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Middle-East and Africa Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Middle-East and Africa Compound Chocolate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: South Africa Middle-East and Africa Compound Chocolate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Middle East Middle-East and Africa Compound Chocolate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Compound Chocolate Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Middle-East and Africa Compound Chocolate Market?

Key companies in the market include Puratos, Cargill Incorporated, Barry Callebaut, Tiger Brands Limited*List Not Exhaustive, Ferrero International SA, Mars Incorporated, Kerry Group, Cocoa Processing Company Limited, IFFCO Group, Kees Beyers Chocolate CC.

3. What are the main segments of the Middle-East and Africa Compound Chocolate Market?

The market segments include Flavor, Form, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

High Preference of Chocolate-based Products Accelerates the Growth.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, Blommer Chocolate Co. announced a partnership with Israel-based company DouxMatok for inaugurating chocolate coatings with Incredo sugar, along with its range of food applications, enrobing, panning, and molding.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Compound Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Compound Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Compound Chocolate Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Compound Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence