Key Insights

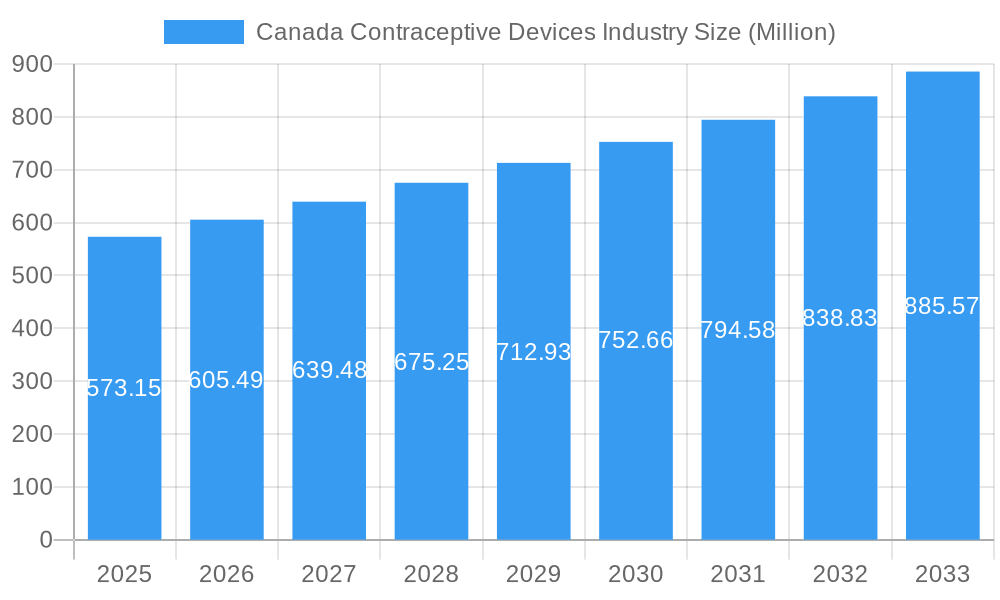

The Canadian contraceptive devices market is poised for significant expansion, projected to reach a market size of $573.15 million by 2025, with a robust CAGR of 5.70% expected to drive sustained growth through 2033. This upward trajectory is fueled by a confluence of factors, including increasing awareness and accessibility of a diverse range of contraceptive methods, a growing emphasis on reproductive health and family planning initiatives across the nation, and a rising prevalence of sexually transmitted infections (STIs) necessitating the use of barrier methods. Technological advancements in product development, leading to more effective, user-friendly, and discreet contraceptive solutions, are also playing a crucial role. Furthermore, supportive government policies and healthcare programs aimed at promoting reproductive autonomy and reducing unintended pregnancies are creating a favorable market environment. The market's segmentation reveals a strong demand across various product types, with condoms and Intrauterine Devices (IUDs) likely to remain dominant segments due to their efficacy and widespread adoption.

Canada Contraceptive Devices Industry Market Size (In Million)

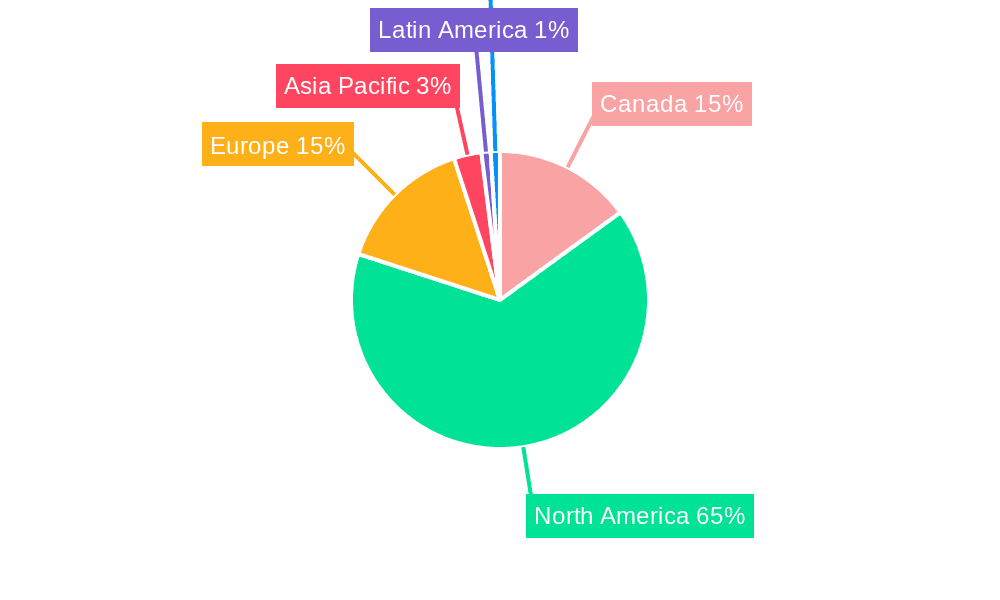

Despite the promising growth, certain challenges temper the market's full potential. These include, but are not limited to, varying levels of insurance coverage for contraceptive devices across different provinces, potential social stigmas associated with certain methods, and the ongoing need for comprehensive sexual health education to address misinformation and promote informed choices. The competitive landscape is dynamic, with key players such as Bayer Healthcare, Reckitt Benckiser, and Cooper Surgical Inc. actively engaged in product innovation and strategic partnerships to capture market share. Geographically, while the provided data focuses on Canada, the broader North American market for contraceptive devices is substantial, with Canada representing a significant contributor driven by its developed healthcare infrastructure and progressive social attitudes towards reproductive health. The market's future will likely be shaped by innovations in long-acting reversible contraceptives (LARCs) and a continued push for greater equity in access to a full spectrum of contraceptive options.

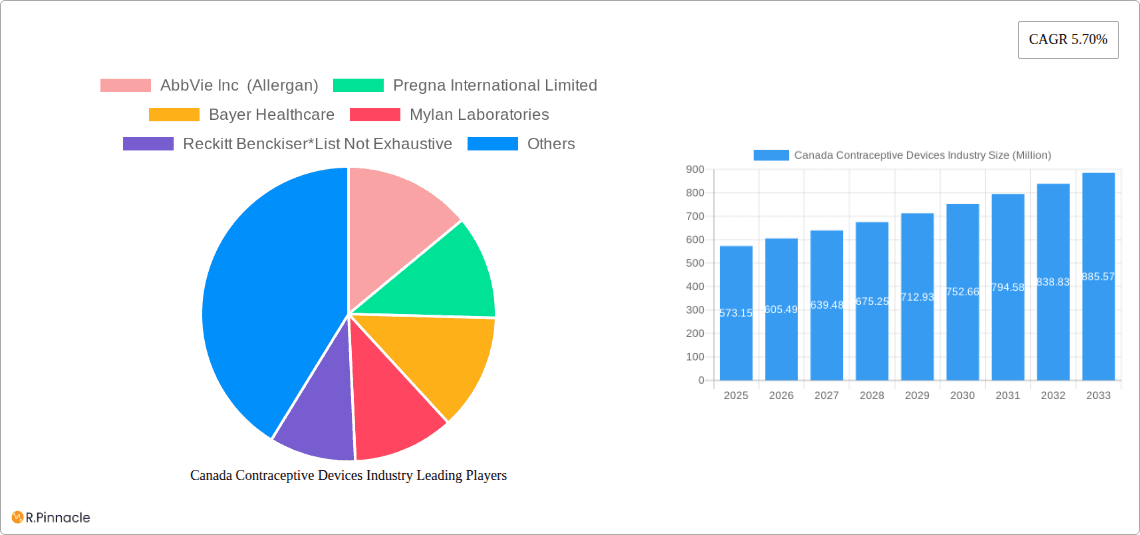

Canada Contraceptive Devices Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Canadian Contraceptive Devices Industry, providing critical insights into market structure, dynamics, segmentation, key players, and future outlook. Leveraging high-ranking keywords like "contraceptive devices Canada," "IUD market Canada," "condom market trends," and "female contraception," this report is designed to empower industry professionals, investors, and stakeholders with actionable intelligence for strategic decision-making. Our analysis covers the historical period (2019-2024), base year (2025), and extends to a robust forecast period (2025-2033), with a particular focus on estimated figures for 2025.

Canada Contraceptive Devices Industry Market Structure & Innovation Trends

The Canadian contraceptive devices market exhibits a moderate to high degree of concentration, with a few key players holding substantial market share. AbbVie Inc (Allergan), Bayer Healthcare, and Reckitt Benckiser are prominent entities driving innovation and market expansion. Innovation in this sector is primarily fueled by advancements in material science, product design for enhanced user experience and efficacy, and the development of more discreet and long-acting contraceptive solutions. Regulatory frameworks, overseen by Health Canada, play a crucial role in ensuring product safety and efficacy, influencing product approval timelines and market entry strategies. While product substitutes exist, such as hormonal contraceptives and natural family planning methods, the demand for reliable and accessible contraceptive devices in Canada remains strong. End-user demographics reveal a growing awareness and demand for diverse contraceptive options across all age groups, with a particular emphasis on female contraceptive devices and male condoms. Merger and acquisition (M&A) activities, while not extensively prevalent, are strategic moves aimed at consolidating market presence and expanding product portfolios. For instance, the acquisition of Allergan by AbbVie has significantly bolstered its presence in the women's health sector. The estimated market share of the top three players is projected to be around 65% in the base year of 2025, with M&A deal values in the past five years averaging in the tens of millions of dollars.

Canada Contraceptive Devices Industry Market Dynamics & Trends

The Canadian contraceptive devices market is poised for significant growth, driven by a confluence of factors including increasing awareness of sexual health, a growing emphasis on reproductive autonomy, and advancements in product technology. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This growth is underpinned by heightened consumer preferences for user-friendly, effective, and discreet contraceptive methods. Technological disruptions are continuously shaping the landscape, with a rising demand for long-acting reversible contraceptives (LARCs) like Intrauterine Devices (IUDs) and hormonal implants. These innovations offer convenience and efficacy, addressing the evolving needs of Canadian consumers. The competitive dynamics are characterized by a blend of established global players and emerging local manufacturers, all vying for market share through product innovation, strategic partnerships, and targeted marketing campaigns. Market penetration of advanced contraceptive methods, particularly among younger demographics, is steadily increasing, reflecting a shift towards more proactive family planning. Furthermore, government initiatives promoting sexual health education and access to contraception contribute to market expansion. The rising disposable income and a greater focus on personal health and well-being are also significant growth catalysts. The IUD market in Canada is anticipated to witness a CAGR of over 5% during the forecast period, driven by its high efficacy and extended duration of use.

Dominant Regions & Segments in Canada Contraceptive Devices Industry

The Dominant Regions in the Canadian Contraceptive Devices Industry are primarily driven by population density, healthcare infrastructure, and socioeconomic factors. Ontario consistently emerges as the leading region due to its large population base, advanced healthcare systems, and higher disposable incomes, leading to greater accessibility and adoption of a wide range of contraceptive devices. British Columbia and Quebec follow closely, with significant market penetration across various segments.

Within the Segments by Type:

- Intra Uterine Device (IUDs): This segment exhibits robust growth, driven by increasing physician recommendations and patient preference for long-acting, reversible, and highly effective contraception. Factors contributing to its dominance include reduced user error and the convenience of not requiring daily or frequent user action. The projected market size for IUDs is expected to reach $150 Million by 2025, with continued strong growth.

- Condoms: As the most widely accessible and affordable form of contraception, condoms continue to hold a significant market share. Their dominance is bolstered by their dual role in preventing both pregnancy and sexually transmitted infections (STIs). Ongoing innovation in materials and designs caters to a broad consumer base. The condom market trends indicate a stable yet significant contribution to the overall industry, projected at $120 Million in 2025.

- Vaginal Rings: The increasing acceptance and availability of innovative vaginal ring technologies, such as the recently launched Haloette, are fueling growth in this segment. Their ease of use and hormonal delivery mechanism make them an attractive option for many women.

- Other Types (Diaphragms, Cervical Caps, Sponges): While these methods represent a smaller market share, they cater to specific user needs and preferences, often for women seeking non-hormonal or barrier methods.

Within the Segments by Gender:

- Female Contraception: This segment overwhelmingly dominates the market due to the biological nature of reproduction and the wider array of available contraceptive methods for women. This includes IUDs, vaginal rings, hormonal pills, and implants. The demand for female contraceptive devices remains the primary growth engine.

- Male Contraception: The male segment is primarily driven by the sales of condoms. While research into novel male contraceptive methods is ongoing, their market impact remains limited in the current landscape.

Key drivers for dominance in specific regions include government health policies promoting access to contraception, robust distribution networks for pharmaceutical and medical devices, and targeted public health campaigns. Economic policies that support healthcare affordability also play a pivotal role in segment growth.

Canada Contraceptive Devices Industry Product Innovations

Product innovations in the Canadian contraceptive devices industry are significantly enhancing user experience and efficacy. The introduction of vegan condoms by Dubbed Jems addresses a growing consumer demand for ethically produced and hypoallergenic products. Furthermore, the launch of Mithra's vaginal contraceptive ring, Myring (marketed as Haloette), represents a significant advancement in long-acting, reversible contraception, offering convenience and sustained hormonal release. These innovations are driven by advancements in material science for comfort and safety, smart device integration for usage tracking, and the development of more discreet and user-friendly designs. Competitive advantages are being gained through superior product performance, reduced side effects, and targeted marketing to specific consumer demographics seeking personalized reproductive health solutions. The focus is on providing options that seamlessly integrate into users' lifestyles.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Canada Contraceptive Devices Industry, segmented by Type and Gender. The Type segmentation includes: Condoms, Diaphragms, Cervical Caps, Sponges, Vaginal Rings, Intra Uterine Device (IUDs), and Other Types. The Gender segmentation covers Male and Female users.

- Condoms: Expected to maintain a strong market presence with steady growth, driven by accessibility and dual protection benefits.

- IUDs: Projected to be a key growth driver, with increasing adoption due to high efficacy and long-term convenience.

- Vaginal Rings: Poised for significant expansion, fueled by product innovation and increasing consumer acceptance of LARC methods.

- Female Contraception: This segment will continue to dominate the market, benefiting from a broad range of available and evolving product offerings, including hormonal and non-hormonal solutions.

- Male Contraception: Primarily driven by condom sales, with limited diversification in product offerings.

The analysis encompasses market sizes, growth projections, and competitive dynamics within each segment throughout the study period.

Key Drivers of Canada Contraceptive Devices Industry Growth

The growth of the Canada Contraceptive Devices Industry is propelled by several critical drivers. Technological advancements in developing safer, more effective, and user-friendly contraceptive methods, particularly long-acting reversible contraceptives (LARCs) like IUDs and implants, are paramount. Increasing awareness and education regarding sexual health and reproductive rights among the Canadian population, fostered by public health initiatives and improved access to information, significantly boosts demand. Furthermore, favorable government policies and healthcare reforms that prioritize accessible and affordable contraception play a crucial role. Economic factors such as rising disposable incomes and a greater emphasis on preventative healthcare contribute to increased spending on reproductive health products. The sustained focus on women's health and empowerment also translates into higher demand for diverse contraceptive choices.

Challenges in the Canada Contraceptive Devices Industry Sector

Despite robust growth, the Canada Contraceptive Devices Industry faces several challenges. Regulatory hurdles and lengthy approval processes for new medical devices can impede market entry for innovative products, potentially delaying their availability to consumers. Supply chain disruptions, exacerbated by global events, can affect product availability and pricing, impacting market stability. Competitive pressures from both established and emerging players necessitate continuous innovation and cost-effective strategies. Societal stigma and misinformation surrounding certain contraceptive methods can also act as barriers to widespread adoption. Furthermore, cost of advanced contraceptive devices can be a concern for some segments of the population, despite healthcare coverage initiatives. The limited development and market penetration of novel male contraceptive options also represent a long-standing challenge in achieving equitable contraceptive responsibilities.

Emerging Opportunities in Canada Contraceptive Devices Industry

The Canada Contraceptive Devices Industry is ripe with emerging opportunities. The growing demand for personalized and on-demand contraception is fostering innovation in smart contraceptive devices and applications that offer tailored user experiences. The increasing preference for non-hormonal and natural contraceptive methods presents an opportunity for manufacturers to develop and market a wider range of such options. Expansion into underserved rural and remote areas, with targeted distribution and education programs, can unlock new market potential. The rising interest in sustainable and eco-friendly contraceptive products, such as biodegradable condoms, aligns with evolving consumer values. Furthermore, strategic partnerships with healthcare providers and educational institutions can enhance product awareness and facilitate wider adoption of advanced contraceptive technologies. The continued global focus on women's reproductive health also presents opportunities for Canadian manufacturers to expand their export markets.

Leading Players in the Canada Contraceptive Devices Industry Market

- AbbVie Inc (Allergan)

- Pregna International Limited

- Bayer Healthcare

- Mylan Laboratories

- Reckitt Benckiser

- Teva Pharmaceutical Industries Ltd

- Cooper Surgical Inc

- DKT International

- Pfizer Inc

Key Developments in Canada Contraceptive Devices Industry Industry

- May 2022: Dubbed Jems launched Vegan Condoms for safer intercourse, renouncing toxicity in all forms. This development caters to a growing niche market demanding ethically sourced and environmentally conscious products.

- February 2022: Mitra and Searchlight Pharma commercially launched Mithra's vaginal contraceptive ring, Myring, under the brand Haloette in Canada. This launch signifies an advancement in long-acting reversible contraception options, enhancing user convenience and efficacy.

Future Outlook for Canada Contraceptive Devices Industry Market

The future outlook for the Canada Contraceptive Devices Industry is exceptionally bright, characterized by sustained growth and continuous innovation. The market is expected to be driven by the increasing adoption of long-acting reversible contraceptives (LARCs), which offer superior efficacy and convenience. Technological advancements, including the integration of digital health solutions and the development of novel materials, will further enhance product offerings. A growing emphasis on comprehensive sexual health education and increased access to a diverse range of contraceptive options will empower individuals to make informed choices, boosting market penetration across all demographics. Strategic collaborations between manufacturers, healthcare providers, and governmental bodies will be crucial in addressing existing challenges and capitalizing on emerging opportunities. The market is poised to witness significant expansion, driven by a proactive approach to reproductive health and a commitment to user well-being.

Canada Contraceptive Devices Industry Segmentation

-

1. Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Cervical Caps

- 1.4. Sponges

- 1.5. Vaginal Rings

- 1.6. Intra Uterine Device (IUDs)

- 1.7. Other Types

-

2. Gender

- 2.1. Male

- 2.2. Female

Canada Contraceptive Devices Industry Segmentation By Geography

- 1. Canada

Canada Contraceptive Devices Industry Regional Market Share

Geographic Coverage of Canada Contraceptive Devices Industry

Canada Contraceptive Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About Sexually Transmitted Diseases (STDs); Rising Rate of Unintended Pregnancies and Rise in Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated with the Use of Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Condoms are Expected to Dominate the Canada Contraceptive Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Contraceptive Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Cervical Caps

- 5.1.4. Sponges

- 5.1.5. Vaginal Rings

- 5.1.6. Intra Uterine Device (IUDs)

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AbbVie Inc (Allergan)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pregna International Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mylan Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reckitt Benckiser*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teva Pharmaceutical Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cooper Surgical Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DKT International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pfizer Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 AbbVie Inc (Allergan)

List of Figures

- Figure 1: Canada Contraceptive Devices Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Contraceptive Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Contraceptive Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Contraceptive Devices Industry Revenue Million Forecast, by Gender 2020 & 2033

- Table 3: Canada Contraceptive Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Contraceptive Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Contraceptive Devices Industry Revenue Million Forecast, by Gender 2020 & 2033

- Table 6: Canada Contraceptive Devices Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Contraceptive Devices Industry?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Canada Contraceptive Devices Industry?

Key companies in the market include AbbVie Inc (Allergan), Pregna International Limited, Bayer Healthcare, Mylan Laboratories, Reckitt Benckiser*List Not Exhaustive, Teva Pharmaceutical Industries Ltd, Cooper Surgical Inc, DKT International, Pfizer Inc.

3. What are the main segments of the Canada Contraceptive Devices Industry?

The market segments include Type, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 573.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About Sexually Transmitted Diseases (STDs); Rising Rate of Unintended Pregnancies and Rise in Government Initiatives.

6. What are the notable trends driving market growth?

Condoms are Expected to Dominate the Canada Contraceptive Devices Market.

7. Are there any restraints impacting market growth?

Side Effects Associated with the Use of Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

May 2022: Dubbed Jems launched Vegan Condoms for safer intercourse, renouncing toxicity in all forms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Contraceptive Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Contraceptive Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Contraceptive Devices Industry?

To stay informed about further developments, trends, and reports in the Canada Contraceptive Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence