Key Insights

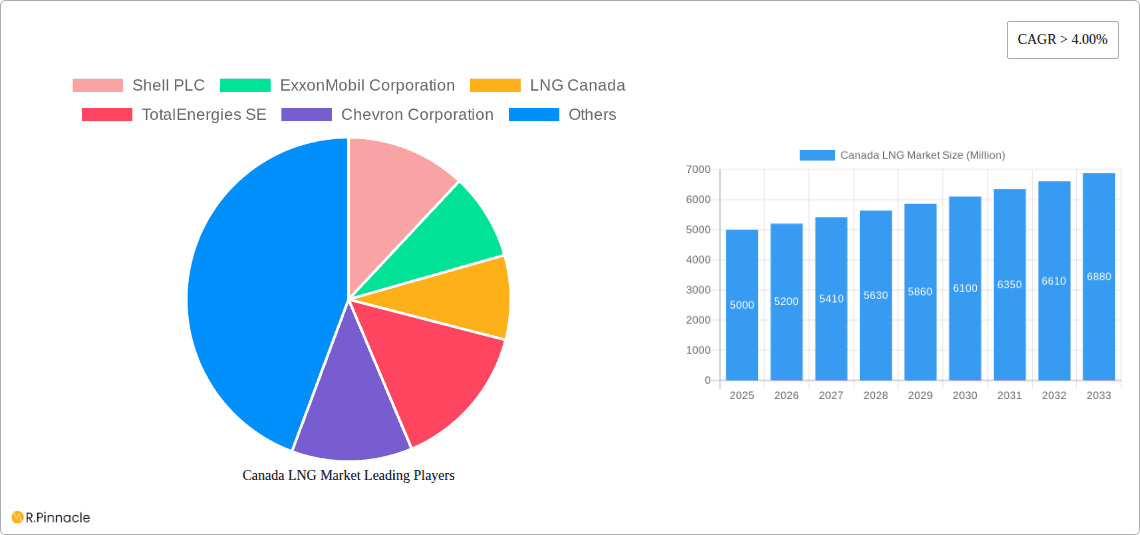

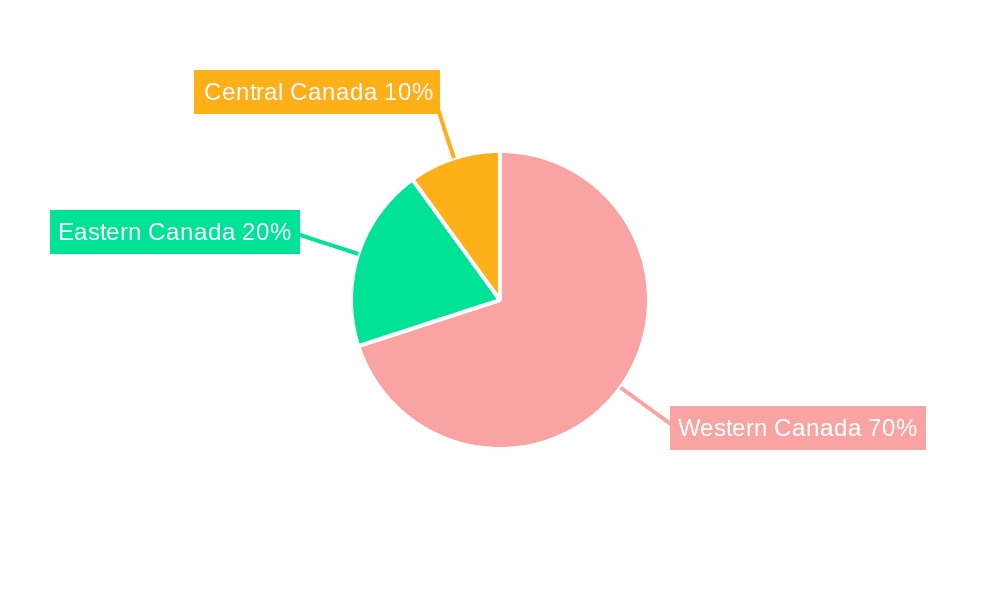

The Canadian LNG market, exhibiting a robust CAGR exceeding 4%, presents a significant growth opportunity. Driven by increasing global demand for cleaner energy sources and Canada's substantial natural gas reserves, the market is poised for expansion throughout the forecast period (2025-2033). Key drivers include the rising adoption of LNG as a transportation fuel, particularly in heavy-duty vehicles, and its increasing utilization in power generation, offering a cleaner alternative to traditional fossil fuels. Furthermore, government initiatives promoting energy diversification and environmental sustainability are providing a favorable regulatory landscape. While infrastructure development costs and potential environmental concerns represent challenges, ongoing technological advancements in liquefaction and regasification technologies are mitigating these restraints. The market is segmented by infrastructure (liquefaction plants, regasification facilities, and shipping) and application (transportation, power generation, and other industrial uses). Major players like Shell, ExxonMobil, and LNG Canada are actively investing in expanding their Canadian operations, leveraging the country's abundant resources and strategic geographical location for global LNG trade. Regional variations exist, with Western Canada anticipated to dominate the market due to its proximity to significant gas reserves and export facilities.

Canada LNG Market Market Size (In Billion)

The market size in 2025 is estimated at $5 billion (assuming a reasonable starting point based on global LNG market trends and Canada's resource potential). The consistent CAGR of over 4% will translate into substantial growth throughout the forecast period, likely reaching over $7 billion by 2033. This growth trajectory will be fueled by ongoing investments in new infrastructure, particularly liquefaction plants aimed at expanding export capacity. While challenges remain, including securing environmental permits and navigating regulatory processes, the overall outlook for the Canadian LNG market is optimistic, presenting substantial long-term growth prospects for both established players and new market entrants.

Canada LNG Market Company Market Share

Canada LNG Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Canada LNG market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth potential. Benefit from detailed segmentations, actionable data, and expert analysis to navigate the complexities of this dynamic market.

Canada LNG Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Canadian LNG market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The study period is 2019-2033, with 2025 as the base and estimated year.

- Market Concentration: The Canadian LNG market exhibits a moderately concentrated structure, with key players like Shell PLC, ExxonMobil Corporation, LNG Canada, TotalEnergies SE, and Chevron Corporation holding significant market share. Precise market share figures for 2025 are estimated at xx Million, with Shell PLC holding an estimated xx% market share.

- Innovation Drivers: Technological advancements in liquefaction and transportation, coupled with increasing demand for cleaner energy sources, are driving innovation. Government incentives and supportive regulatory frameworks are further fostering innovation.

- Regulatory Frameworks: Federal and provincial regulations related to environmental protection, safety, and resource management significantly shape the market. Changes in these regulations can impact investment decisions and project timelines.

- Product Substitutes: Natural gas and other renewable energy sources pose competitive pressure, while the development of carbon capture and storage technologies is an emerging trend.

- End-User Demographics: Key end-users include power generation companies, industrial users, and potentially, the transportation sector as LNG adoption for fuel increases.

- M&A Activities: The historical period (2019-2024) witnessed xx Million worth of M&A deals, with a predicted increase to xx Million in the forecast period (2025-2033). These activities are expected to reshape the market landscape and intensify competition. The majority of M&A activities were driven by integration strategies to secure supply chains.

Canada LNG Market Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The study period is 2019-2033, with 2025 as the base and estimated year.

The Canadian LNG market is experiencing significant growth, driven primarily by increasing global demand for LNG, coupled with Canada's substantial natural gas reserves. Technological advancements in liquefaction technologies are improving efficiency and reducing costs, further boosting market expansion. Government policies supporting LNG development, alongside evolving consumer preferences towards cleaner energy sources are major contributors to market growth. The competitive landscape is characterized by both established players and new entrants, creating a dynamic environment with intense competition and strategic alliances. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, with market penetration expected to reach xx% by 2033. The increasing focus on energy security is also adding to the market's growth trajectory.

Dominant Regions & Segments in Canada LNG Market

British Columbia is the dominant region in the Canadian LNG market, driven by existing infrastructure and significant natural gas resources. Key drivers include supportive government policies and a favourable regulatory environment.

Dominant Segments:

- LNG Infrastructure:

- Liquefaction Plants: High capital investment and long lead times characterize this segment, with the Kitimat terminal a major contributor to market growth.

- Regasification Facilities: Relatively limited in Canada, growth depends on import demand and strategic location.

- LNG Shipping: Growth tied to export volumes and the need for specialized LNG carriers.

- Application:

- Power Generation: A major driver of LNG demand in Canada, with projected growth as coal-fired plants are phased out.

- Transportation Fuel: A growing market segment, but faces challenges in terms of infrastructure and regulatory hurdles.

- Other Applications: Includes industrial uses, contributing to overall demand growth.

Canada LNG Market Product Innovations

Recent product innovations focus on improving the efficiency and reducing the environmental impact of LNG liquefaction and transportation. Technological advancements in liquefaction technologies have improved efficiency and reduced costs. This has led to better market fit, with innovations designed to meet environmental concerns and enhance the competitiveness of Canadian LNG.

Report Scope & Segmentation Analysis

This report segments the Canadian LNG market by infrastructure (liquefaction plants, regasification facilities, LNG shipping) and application (transportation fuel, power generation, other). Each segment's growth projections, market sizes (in Millions), and competitive dynamics are thoroughly analyzed for the forecast period (2025-2033). The detailed segmentation helps identify market opportunities and assess potential risks.

Key Drivers of Canada LNG Market Growth

Growth is driven by increasing global LNG demand, Canada's substantial natural gas reserves, technological advancements improving liquefaction efficiency, supportive government policies and incentives, and a shift towards cleaner energy. The Kitimat LNG project exemplifies this, with its substantial capacity expansion contributing significantly to market growth.

Challenges in the Canada LNG Market Sector

Challenges include high capital costs associated with LNG infrastructure development, potential regulatory hurdles related to environmental impact assessments and permitting processes, and competition from other energy sources. Supply chain disruptions and geopolitical uncertainties add further complexities. These challenges could impact project timelines and profitability.

Emerging Opportunities in Canada LNG Market

Emerging opportunities lie in expanding LNG export capacity, developing innovative technologies for carbon capture and storage, and exploring new markets for Canadian LNG. Furthermore, the integration of LNG into transportation fuels and the potential for small-scale LNG solutions offer further growth avenues.

Leading Players in the Canada LNG Market Market

- Shell PLC

- ExxonMobil Corporation

- LNG Canada

- TotalEnergies SE

- Chevron Corporation

- Fluor Corporation

- TechnipFMC PLC

Key Developments in Canada LNG Market Industry

- October 2022: LNG Canada accelerated construction of its Kitimat LNG terminal. The workforce is projected to reach 7,500 next year, signaling a significant boost in project activity and market impact. The 70% completion of Phase 1 and 75% completion of the Coastal GasLink pipeline are key milestones.

- February 2022: The Cedar LNG project submitted its Environmental Assessment Certificate (EAC) application, marking a crucial step towards its development and adding to the future supply potential of the Canadian LNG market.

Future Outlook for Canada LNG Market Market

The Canadian LNG market holds significant future potential, driven by increasing global demand, ongoing infrastructure development, and advancements in technology. Strategic partnerships and investments will play a crucial role in shaping the market's future trajectory. The focus on sustainability and environmentally friendly practices will drive future market growth and investment.

Canada LNG Market Segmentation

-

1. LNG Infrastructure

- 1.1. LNG Liquefaction Plants

- 1.2. LNG Regasification Facilities

- 1.3. LNG Shipping

-

2. Application

- 2.1. Transportation Fuel

- 2.2. Power Generation

- 2.3. Other Application Types

Canada LNG Market Segmentation By Geography

- 1. Canada

Canada LNG Market Regional Market Share

Geographic Coverage of Canada LNG Market

Canada LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Penetration of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Upcoming LNG Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada LNG Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 5.1.1. LNG Liquefaction Plants

- 5.1.2. LNG Regasification Facilities

- 5.1.3. LNG Shipping

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transportation Fuel

- 5.2.2. Power Generation

- 5.2.3. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LNG Canada

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fluor Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TechnipFMC PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Canada LNG Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada LNG Market Share (%) by Company 2025

List of Tables

- Table 1: Canada LNG Market Revenue Million Forecast, by LNG Infrastructure 2020 & 2033

- Table 2: Canada LNG Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada LNG Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada LNG Market Revenue Million Forecast, by LNG Infrastructure 2020 & 2033

- Table 5: Canada LNG Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Canada LNG Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada LNG Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Canada LNG Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, LNG Canada, TotalEnergies SE, Chevron Corporation, Fluor Corporation, TechnipFMC PLC.

3. What are the main segments of the Canada LNG Market?

The market segments include LNG Infrastructure, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Upcoming LNG Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Penetration of Renewable Energy.

8. Can you provide examples of recent developments in the market?

October 2022: LNG Canada ramped construction at its Kitimat liquefied natural gas (LNG) terminal. The workforce is expected to peak at 7,500 people next year. The first phase of the LNG project is 70% completed, and the Coastal GasLink (CGL) pipeline is 75% completed. Once complete, the terminal for the liquefaction, storage, and loading of liquefied natural gas will export LNG produced by the project's partners in the Montney Formation gas fields near Dawson Creek.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada LNG Market?

To stay informed about further developments, trends, and reports in the Canada LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence