Key Insights

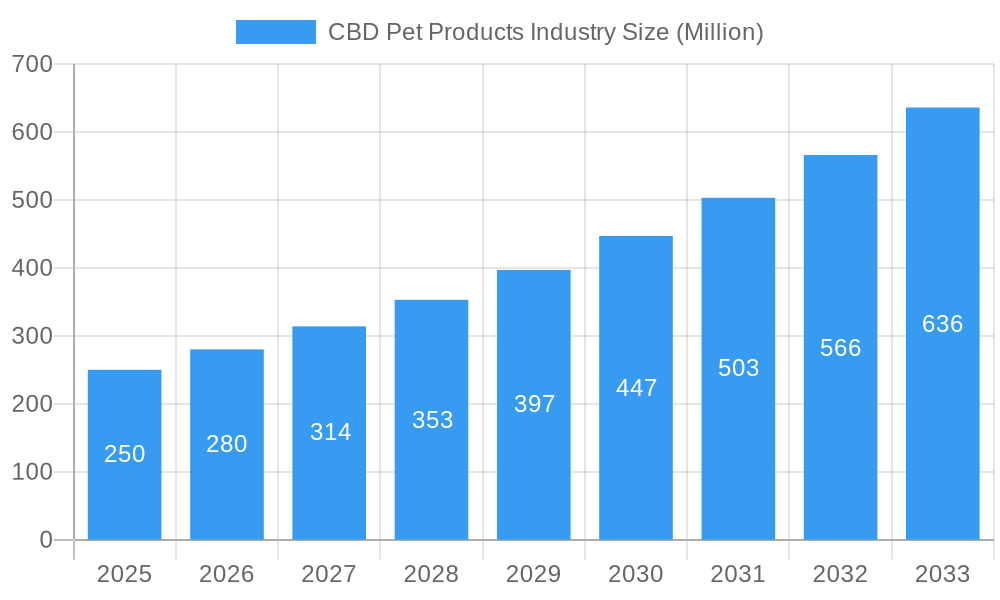

The CBD pet products market is experiencing robust growth, fueled by increasing pet owner awareness of CBD's potential therapeutic benefits for animals and a rising humanization of pets. The market, estimated at $XX million in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033. This growth is driven by several factors, including the increasing prevalence of pet anxiety, arthritis, and other age-related ailments in companion animals. The rising availability of high-quality, veterinarian-approved CBD products through diverse distribution channels—online retail, veterinary clinics, and retail pharmacies—further contributes to market expansion. The Food-grade segment currently holds a larger market share than Therapeutic-grade, reflecting the widespread use of CBD for general wellness in pets. However, the Therapeutic-grade segment is poised for significant growth driven by increasing research highlighting CBD's effectiveness in treating specific health conditions. Key players like Joy Organics, Canna-Pet, and others are contributing to market development through product innovation and strategic marketing efforts. Geographic expansion, particularly in regions with burgeoning pet ownership and increasing disposable incomes like North America and Europe, is also driving market growth. While regulatory hurdles and concerns regarding product purity pose challenges, the overall market outlook remains positive, with continued expansion anticipated throughout the forecast period.

CBD Pet Products Industry Market Size (In Million)

The market segmentation reveals distinct opportunities. Online retail channels currently dominate distribution, reflecting the convenience and accessibility of e-commerce. However, retail pharmacies and veterinary clinics are emerging as important avenues, leveraging professional recommendations and trusted brand associations. The ongoing research into the efficacy of CBD for specific pet ailments is expected to fuel demand in the Therapeutic-grade segment, potentially leading to a shift in market share. Furthermore, the increasing acceptance of CBD as a complementary treatment option within the veterinary community is fostering consumer confidence and driving adoption. Regional variations in regulatory landscapes and consumer awareness will influence market penetration, with North America and Europe expected to remain key markets due to higher pet ownership rates and advanced regulatory frameworks. Nevertheless, emerging markets in Asia Pacific and South America also present significant growth potential as awareness and acceptance of CBD pet products increase.

CBD Pet Products Industry Company Market Share

CBD Pet Products Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning CBD pet products market, offering invaluable insights for industry professionals, investors, and stakeholders. With a detailed examination of market structure, dynamics, and future trends, this report forecasts robust growth, projecting a market size of XX Million by 2033. The study period covers 2019-2033, with 2025 as the base and estimated year. The historical period analyzed is 2019-2024, and the forecast period spans 2025-2033.

CBD Pet Products Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the CBD pet products market. The market is characterized by a mix of established players and emerging brands, leading to a moderately fragmented structure. Key players include Joy Organics, Canna-Pet, Wet Nose, HempMy Pet, Holista Pet, NaturVet, Honest Paws, and Fomo Bones. Market share data for these companies reveals a relatively even distribution, with no single dominant player holding more than xx%. Innovation is driven by the ongoing research into the therapeutic benefits of CBD for pets, leading to the development of new product formulations and delivery methods. Regulatory frameworks vary across different geographies, impacting market growth and product availability. Product substitutes include traditional pet supplements and pharmaceuticals, while M&A activity remains relatively low, with an estimated total deal value of xx Million in the past five years.

- Market Concentration: Moderately Fragmented

- Key Players: Joy Organics, Canna-Pet, Wet Nose, HempMy Pet, Holista Pet, NaturVet, Honest Paws, Fomo Bones

- M&A Activity (2019-2024): Total Deal Value: xx Million

- Innovation Drivers: Therapeutic research, new formulations, improved delivery systems

CBD Pet Products Industry Market Dynamics & Trends

The CBD pet products market is experiencing significant growth, driven by increasing pet ownership, rising consumer awareness of CBD's potential health benefits for animals, and the increasing acceptance of CBD as a complementary therapy. Technological advancements in CBD extraction and formulation are contributing to the development of higher-quality, more effective products. Consumer preferences are shifting towards natural and holistic pet care solutions, further fueling market growth. Competitive dynamics are characterized by intense competition among numerous players vying for market share, leading to innovative product launches and strategic partnerships. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033.

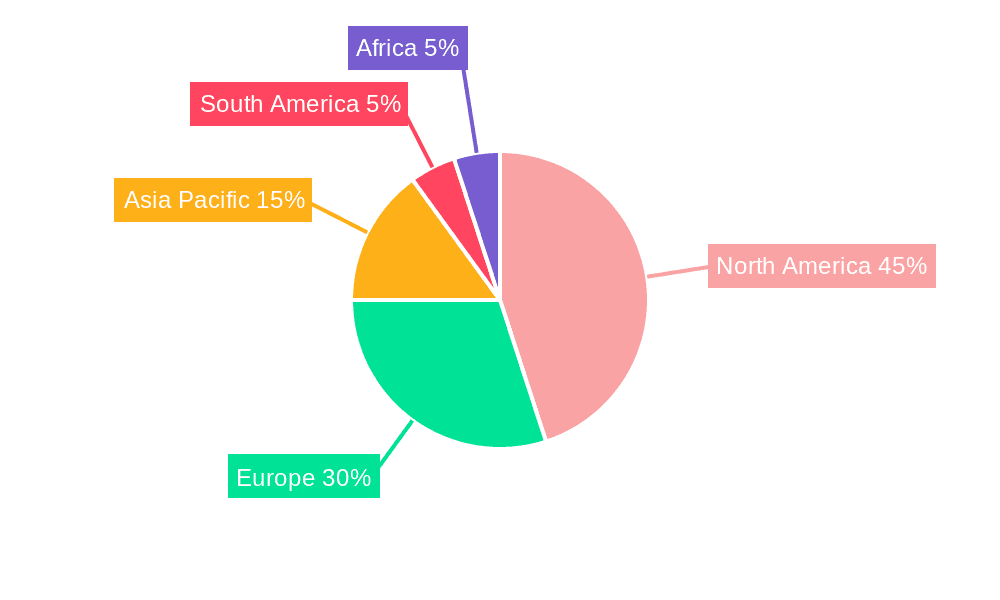

Dominant Regions & Segments in CBD Pet Products Industry

The North American market currently dominates the global CBD pet products industry, driven by high pet ownership rates, increasing consumer awareness, and relatively favorable regulatory environments. Within this region, the United States holds the largest market share.

- Leading Region: North America (United States)

- Key Drivers (North America): High pet ownership, consumer awareness, favorable regulatory landscape (in certain states).

Segment Dominance:

- Type: Therapeutic-grade CBD products are expected to experience faster growth than food-grade products due to their perceived higher efficacy in addressing specific health concerns.

- Distribution Channel: Online retail channels currently dominate, offering convenience and broad reach. However, growth is expected in retail pharmacies and veterinary clinics as consumer trust and professional endorsements increase.

CBD Pet Products Industry Product Innovations

Recent product innovations focus on enhanced bioavailability, targeted formulations for specific pet health issues (joint pain, anxiety, skin conditions), and convenient delivery methods (e.g., treats, topical creams). Technological advancements in extraction and purification methods are leading to higher-quality CBD products with improved efficacy and safety. The market is seeing a trend towards customized formulations, catering to specific pet breeds and health needs.

Report Scope & Segmentation Analysis

This report segments the CBD pet products market based on product type (food-grade, therapeutic-grade) and distribution channel (online retail, retail pharmacies, veterinary clinics, other). Each segment’s growth trajectory, market size, and competitive dynamics are thoroughly analyzed. Food-grade products comprise a larger market share currently but therapeutic-grade products show higher growth potential. Online retail channels currently dominate, followed by retail pharmacies and veterinary clinics. Growth projections for each segment are included, with detailed competitive landscapes presented within each.

Key Drivers of CBD Pet Products Industry Growth

Several factors contribute to the market's growth. Increasing pet ownership globally, especially in developed countries, is a major driver. Growing consumer awareness of CBD’s potential health benefits for pets and a shift toward natural pet care products further fuel market expansion. Favorable regulatory environments in some regions facilitate market growth. Advances in CBD extraction and formulation technology lead to more efficient and effective products.

Challenges in the CBD Pet Products Industry Sector

The industry faces challenges including regulatory uncertainty in many jurisdictions, inconsistent product quality, and potential supply chain disruptions. Consumer skepticism regarding the efficacy and safety of CBD products also poses a challenge. Competitive pressures from numerous established and emerging brands create a dynamic and challenging market environment. The lack of standardized testing and labeling further complicates things, impacting consumer trust.

Emerging Opportunities in CBD Pet Products Industry

Emerging opportunities lie in expanding into new geographic markets, particularly in developing economies. The development of innovative product formulations, such as targeted therapies for specific conditions and personalized CBD pet products, also presents significant opportunities. Increased collaboration with veterinarians and pet care professionals can enhance product credibility and market penetration. Educating consumers about the benefits and proper use of CBD products is crucial to expand market reach.

Leading Players in the CBD Pet Products Industry Market

- Joy Organics

- Canna-Pet

- Wet Nose

- HempMy Pet

- Holista Pet

- NaturVet

- Honest Paws

- Fomo Bones

Key Developments in CBD Pet Products Industry

- March 2022: Healthy TOKYO launched its first CBD pet line in Japan.

- August 2022: Pet Releaf launched a line of CBD grooming products for dogs.

- November 2022: Sky Wellness relaunched its D Oh Gee brand CBD dog products.

Future Outlook for CBD Pet Products Industry Market

The future of the CBD pet products market appears bright. Continued research into the therapeutic benefits of CBD for animals, coupled with increasing consumer demand for natural pet care solutions, will drive market growth. Strategic partnerships between CBD companies and veterinary professionals will enhance market penetration and credibility. Innovative product development and expansion into new global markets will further fuel the market's expansion. The market is poised for substantial growth, with opportunities for both established and emerging players.

CBD Pet Products Industry Segmentation

-

1. Type

- 1.1. Food-grade

- 1.2. Therapeutic-grade

-

2. Distribution Channel

- 2.1. Online Retail Channel

- 2.2. Retail Pharmacies

- 2.3. Veterinary Clinics

- 2.4. Other Distribution Channels

CBD Pet Products Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

CBD Pet Products Industry Regional Market Share

Geographic Coverage of CBD Pet Products Industry

CBD Pet Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Pet Owners and Increased Spending on Pets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CBD Pet Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food-grade

- 5.1.2. Therapeutic-grade

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail Channel

- 5.2.2. Retail Pharmacies

- 5.2.3. Veterinary Clinics

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America CBD Pet Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Food-grade

- 6.1.2. Therapeutic-grade

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail Channel

- 6.2.2. Retail Pharmacies

- 6.2.3. Veterinary Clinics

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe CBD Pet Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Food-grade

- 7.1.2. Therapeutic-grade

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail Channel

- 7.2.2. Retail Pharmacies

- 7.2.3. Veterinary Clinics

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific CBD Pet Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Food-grade

- 8.1.2. Therapeutic-grade

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail Channel

- 8.2.2. Retail Pharmacies

- 8.2.3. Veterinary Clinics

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America CBD Pet Products Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Food-grade

- 9.1.2. Therapeutic-grade

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail Channel

- 9.2.2. Retail Pharmacies

- 9.2.3. Veterinary Clinics

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa CBD Pet Products Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Food-grade

- 10.1.2. Therapeutic-grade

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail Channel

- 10.2.2. Retail Pharmacies

- 10.2.3. Veterinary Clinics

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Joy Organics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Canna-Pet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wet Nose

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HempMy Pet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Holista Pet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NaturVet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honest Paws

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fomo Bones

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Joy Organics

List of Figures

- Figure 1: Global CBD Pet Products Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America CBD Pet Products Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America CBD Pet Products Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America CBD Pet Products Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America CBD Pet Products Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America CBD Pet Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe CBD Pet Products Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe CBD Pet Products Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe CBD Pet Products Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe CBD Pet Products Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe CBD Pet Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific CBD Pet Products Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific CBD Pet Products Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific CBD Pet Products Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America CBD Pet Products Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America CBD Pet Products Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America CBD Pet Products Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America CBD Pet Products Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America CBD Pet Products Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Africa CBD Pet Products Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Africa CBD Pet Products Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Africa CBD Pet Products Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Africa CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Africa CBD Pet Products Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Africa CBD Pet Products Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global CBD Pet Products Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global CBD Pet Products Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global CBD Pet Products Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global CBD Pet Products Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global CBD Pet Products Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global CBD Pet Products Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global CBD Pet Products Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global CBD Pet Products Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global CBD Pet Products Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Germany CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: France CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global CBD Pet Products Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global CBD Pet Products Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global CBD Pet Products Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global CBD Pet Products Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global CBD Pet Products Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global CBD Pet Products Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global CBD Pet Products Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global CBD Pet Products Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global CBD Pet Products Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: South Africa CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Africa CBD Pet Products Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CBD Pet Products Industry?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the CBD Pet Products Industry?

Key companies in the market include Joy Organics, Canna-Pet, Wet Nose, HempMy Pet, Holista Pet, NaturVet, Honest Paws, Fomo Bones.

3. What are the main segments of the CBD Pet Products Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Increase in the Number of Pet Owners and Increased Spending on Pets.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

November 2022: Sky Wellness, a company providing people and animals with CBD, relaunched its CBD wellness collection for dogs under its D Oh Gee brand. The collection includes three broad-spectrum, THC-free CBD products formulated to support joint health and mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CBD Pet Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CBD Pet Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CBD Pet Products Industry?

To stay informed about further developments, trends, and reports in the CBD Pet Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence