Key Insights

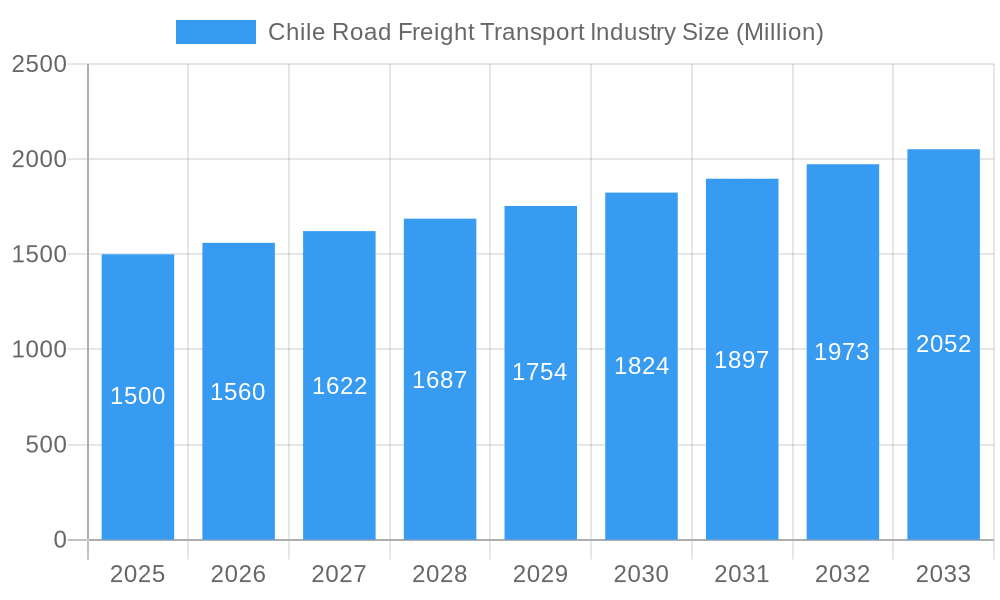

The Chilean road freight transport market, valued at approximately $1.14 billion in its base year of 2025, is projected for substantial expansion. The industry is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2033. Key growth drivers include the surge in e-commerce, demanding efficient last-mile delivery, and the robust performance of Chile's mining, agricultural, manufacturing, and automotive sectors. Significant infrastructure development aimed at improving road networks and logistics further supports this growth trajectory. Emerging challenges include fuel price volatility, driver shortages, and the imperative for enhanced safety and sustainability regulations. The market is segmented, with international transport experiencing particularly strong growth due to Chile's trade partnerships, while domestic transport remains vital for regional connectivity. Leading companies such as Transportes Nazar, Transportes CCU Limitada, and Agunsa are influencing market dynamics through fleet expansion and service diversification.

Chile Road Freight Transport Industry Market Size (In Billion)

The forecast period (2025-2033) indicates sustained growth, propelled by strategic investments in logistics infrastructure and the ongoing expansion of key economic sectors. The industry must proactively address evolving environmental regulations by adopting sustainable practices, including fuel-efficient vehicles and optimized routing, to reduce carbon emissions. Mitigating driver shortages through improved working conditions and comprehensive training programs will be critical for sustained development. Technological integrations, such as telematics and advanced route planning software, present a significant opportunity to boost efficiency and reduce operational expenses. The market is likely to witness consolidation, with larger entities acquiring smaller competitors, thereby reshaping the competitive environment. Diversification into specialized freight handling for sensitive goods and enhanced cold chain logistics are emerging as crucial trends.

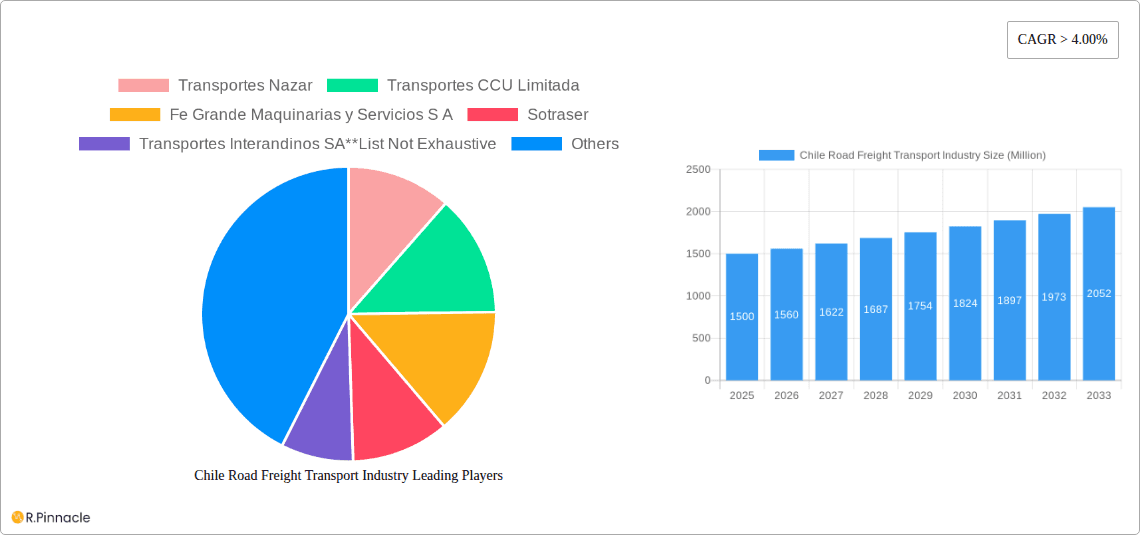

Chile Road Freight Transport Industry Company Market Share

Chile Road Freight Transport Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Chile road freight transport industry, offering crucial insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this study unveils market dynamics, competitive landscapes, and future growth projections. The report leverages extensive data and analysis to forecast market size and growth rates, identifying key opportunities and challenges within this dynamic sector.

Chile Road Freight Transport Industry Market Structure & Innovation Trends

This section analyzes the Chilean road freight transport market's structure, highlighting key trends impacting its evolution. The market displays a moderately concentrated structure, with several prominent players such as Agunsa, Transportes Nazar, and Transportes CCU Limitada holding significant market share, although the exact figures are proprietary to the full report. However, the fragmented nature of smaller operators also plays a significant role. Innovation is driven by advancements in logistics technology, including telematics, route optimization software, and supply chain management systems. Regulatory frameworks, including those related to environmental regulations and driver safety, are continuously evolving, shaping industry practices. Product substitutes, like rail and air freight, exert competitive pressure, while the end-user demographic is diverse, encompassing manufacturing, mining, and agriculture. The report also includes an overview of recent mergers and acquisitions (M&A) activities, analyzing their impact on market consolidation and deal values (estimated at xx Million USD in the last five years).

Chile Road Freight Transport Industry Market Dynamics & Trends

The Chilean road freight transport industry exhibits robust growth driven by a expanding economy, increased domestic and international trade, and a developing e-commerce sector. Technological disruptions, such as the adoption of digital freight platforms and autonomous vehicles, are reshaping the industry landscape. Shifts in consumer preferences towards faster and more reliable delivery services are further influencing market dynamics. Intense competition among established players and new entrants necessitates strategic adaptations and innovations. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, with market penetration of new technologies reaching xx% by 2033. These figures are detailed in the full report.

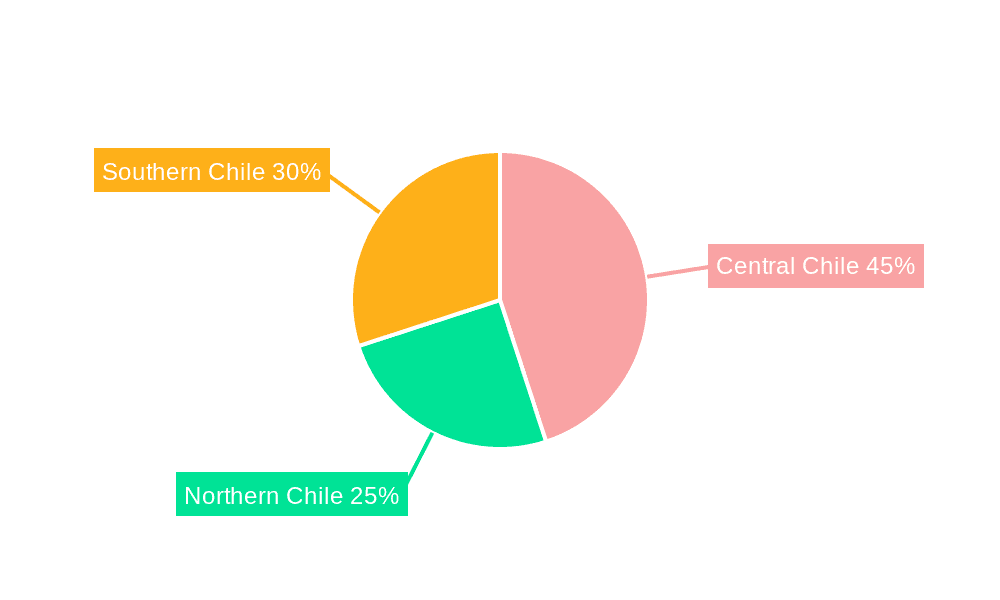

Dominant Regions & Segments in Chile Road Freight Transport Industry

The report identifies key regions and segments dominating the Chilean road freight transport market. While the precise market share attribution for each region and segment is detailed in the full report, the following insights are provided here:

- By Destination: Domestic transport currently holds the largest market share due to the robust internal trade within Chile. International transport is experiencing growth, fueled by increasing exports and imports.

- By End-User: The Mining and Quarrying sector is a dominant end-user, followed by the Manufacturing and Automotive sector. The growth of these sectors strongly influences the overall market demand.

Key drivers for regional dominance include factors such as proximity to major ports and industrial centers, the development of infrastructure (road networks), and the strength of economic activity in various regions. The detailed analysis of economic policies influencing regional distribution and infrastructure development can be found in the full report.

Chile Road Freight Transport Industry Product Innovations

Recent product innovations include the implementation of advanced telematics systems for real-time tracking and fleet management, the integration of route optimization software for enhanced efficiency, and the increasing adoption of digital freight platforms streamlining logistics processes. These innovations aim to improve operational efficiency, reduce costs, and enhance transparency within the supply chain, aligning with the market's demand for improved service levels and cost optimization.

Report Scope & Segmentation Analysis

This report segments the Chilean road freight transport market by destination (domestic and international) and end-user (Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, Pharmaceutical and Healthcare, Other End-Users). Each segment’s growth projections, market size, and competitive dynamics are provided in the full report. For example, the Mining and Quarrying segment is expected to exhibit robust growth due to ongoing mining activities within the country, while the e-commerce boom is stimulating growth in the Distributive Trade segment.

Key Drivers of Chile Road Freight Transport Industry Growth

Several factors drive the growth of the Chilean road freight transport industry. Economic expansion stimulates trade and industrial activities, increasing the demand for transport services. Government investments in infrastructure, including road improvements, enhance connectivity and transportation efficiency. Technological advancements, such as the adoption of telematics and digital platforms, optimize logistics and reduce operational costs. Furthermore, the rise of e-commerce is significantly bolstering demand for last-mile delivery services.

Challenges in the Chile Road Freight Transport Industry Sector

The industry faces challenges such as fluctuating fuel prices, impacting operational costs. Driver shortages and stringent regulatory requirements related to safety and environmental standards add operational complexities. Competition is intense, pressuring profit margins and demanding continuous operational efficiencies and innovation. Furthermore, the condition of road infrastructure in certain areas can hinder transportation efficiency and increase costs, resulting in an estimated xx Million USD loss annually.

Emerging Opportunities in Chile Road Freight Transport Industry

Emerging opportunities exist in the adoption of sustainable transport solutions, such as electric and hybrid vehicles, driven by growing environmental awareness. The increasing adoption of advanced technologies, such as AI-powered route optimization and predictive maintenance, presents substantial efficiency gains. Expansion into niche markets, including specialized transport services for perishable goods and hazardous materials, presents further avenues for growth.

Leading Players in the Chile Road Freight Transport Industry Market

- Transportes Nazar

- Transportes CCU Limitada

- Fe Grande Maquinarias y Servicios S A

- Sotraser

- Transportes Interandinos SA

- Andes Logistics de Chile S A

- Transportes Tamarugal Limitada

- Agunsa

- Transportes Casablanca

- Logistica Linsa S A

Key Developments in Chile Road Freight Transport Industry

- February 2023: Agunsa successfully shipped 400 electric buses in five bulk ships, demonstrating innovative solutions to overcome logistical challenges, specifically the lack of RoRo ship space.

- November 2022: Agunsa received a USD 70 Million loan from the IFC, highlighting the industry's increasing focus on sustainability and corporate social responsibility.

Future Outlook for Chile Road Freight Transport Industry Market

The Chilean road freight transport market is poised for continued growth, driven by sustained economic expansion, infrastructural developments, and technological advancements. Strategic investments in sustainable solutions, technological integrations, and specialized services will significantly shape the industry’s trajectory. The market is expected to witness increased consolidation through mergers and acquisitions, leading to a more concentrated yet innovative market landscape.

Chile Road Freight Transport Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End-User

- 2.1. Manufacturing and Automotive)

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Pharmaceutical and Healthcare

- 2.7. Other End-Users

Chile Road Freight Transport Industry Segmentation By Geography

- 1. Chile

Chile Road Freight Transport Industry Regional Market Share

Geographic Coverage of Chile Road Freight Transport Industry

Chile Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Growth in the E-commerce Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive)

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Pharmaceutical and Healthcare

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transportes CCU Limitada

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fe Grande Maquinarias y Servicios S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sotraser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transportes Interandinos SA**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Andes Logistics de Chile S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Transportes Tamarugal Limitada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agunsa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Transportes Casablanca

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logistica Linsa S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Road Freight Transport Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Chile Road Freight Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Chile Road Freight Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Chile Road Freight Transport Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Chile Road Freight Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Chile Road Freight Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 5: Chile Road Freight Transport Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Chile Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Road Freight Transport Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Chile Road Freight Transport Industry?

Key companies in the market include Transportes Nazar, Transportes CCU Limitada, Fe Grande Maquinarias y Servicios S A, Sotraser, Transportes Interandinos SA**List Not Exhaustive, Andes Logistics de Chile S A, Transportes Tamarugal Limitada, Agunsa, Transportes Casablanca, Logistica Linsa S A.

3. What are the main segments of the Chile Road Freight Transport Industry?

The market segments include Destination, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Growth in the E-commerce Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

February 2023: Due to the lack of available spaces for RoRo ships, Agunsa's chartering area in China and Chile accepted the challenge and developed a comprehensive solution to ship 400 electric buses in five bulk ships on time through their POS subsidiary. For AGUNSA, this project is highly relevant since, in addition to providing a comprehensive solution to the client, it allows them to contribute to the electromobility process of the public transport system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Chile Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence