Key Insights

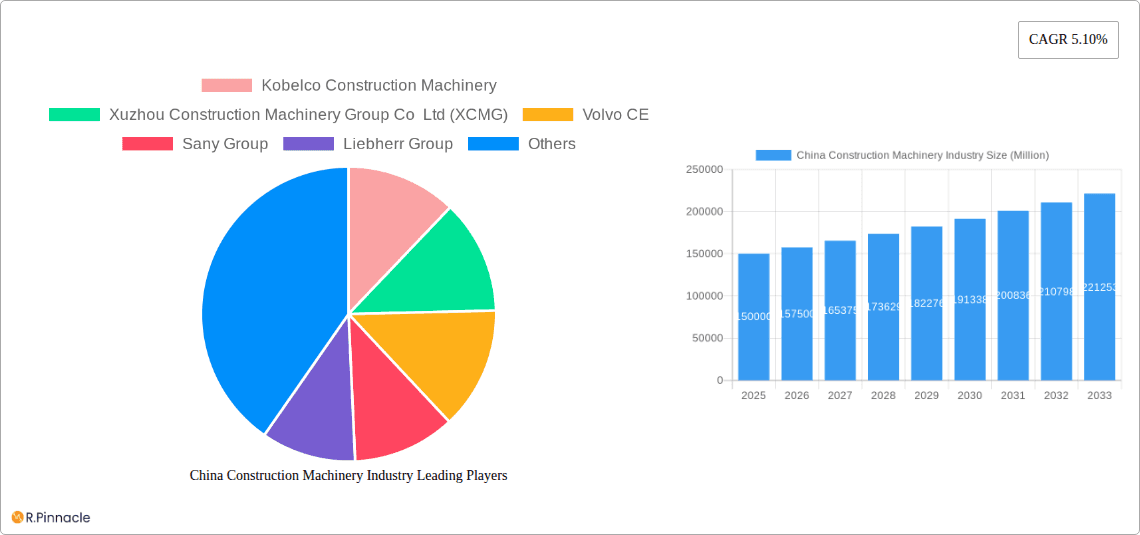

The China construction machinery market, currently experiencing robust growth, presents a significant opportunity for investors and industry players. With a Compound Annual Growth Rate (CAGR) of 5.10% from 2019 to 2024, the market is projected to continue its expansion through 2033. This growth is fueled by several key factors, including substantial government investments in infrastructure development as part of China's Belt and Road Initiative and ongoing urbanization efforts driving demand for construction equipment across various applications. The market segmentation reveals a dynamic landscape, with hybrid and electric drive types gaining traction amidst increasing environmental concerns and government regulations promoting sustainable construction practices. While the conventional drive type still dominates, the shift towards electrification signifies a crucial long-term trend. The OEM sales channel holds a significant share, indicating strong collaboration between manufacturers and construction companies. Application-wise, building and infrastructure projects are primary drivers, followed by energy and industrial sectors. Key players like Kobelco, XCMG, Volvo CE, Sany, Liebherr, and Caterpillar are fiercely competing, leading to technological advancements and innovative product offerings. However, potential restraints include fluctuations in raw material prices, global economic uncertainties, and potential trade policy shifts. Despite these challenges, the overall outlook for the China construction machinery market remains positive, driven by sustained infrastructure investments and technological advancements.

China Construction Machinery Industry Market Size (In Billion)

The continued expansion of China's economy, coupled with ambitious infrastructure projects and ongoing urbanization, will likely sustain the market's growth trajectory. The increasing adoption of advanced technologies, such as automation and digitalization, will further enhance efficiency and productivity within the construction sector, creating additional demand. Furthermore, the growing emphasis on sustainable construction practices is creating opportunities for manufacturers of environmentally friendly machinery, like electric and hybrid models. Competition amongst major players will remain intense, pushing innovation and potentially leading to price optimization and improved product quality. Analyzing specific market segments, such as telescopic handlers and excavators, reveals potentially higher growth rates within these niche applications, representing lucrative investment prospects for companies capable of catering to specialized needs. By carefully considering the macroeconomic landscape, technological advancements, and competitive dynamics, businesses can navigate the complexities of this market and capitalize on its significant growth potential.

China Construction Machinery Industry Company Market Share

China Construction Machinery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China construction machinery industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, technological advancements, and key players to provide a clear picture of the industry's future. The report leverages extensive data analysis to deliver actionable intelligence, helping you navigate the complexities of this rapidly evolving market.

China Construction Machinery Industry Market Structure & Innovation Trends

The Chinese construction machinery market is characterized by a dynamic interplay of established global giants and ambitious domestic players. Market concentration is moderate, with a few dominant players holding significant market share, but a substantial number of smaller and specialized companies contributing to the overall landscape. Key players include Kobelco Construction Machinery, Xuzhou Construction Machinery Group Co Ltd (XCMG), Volvo CE, Sany Group, Liebherr Group, China Communications Construction Company, Caterpillar Inc, Zoomlion Heavy Industry Science and Technology Co Ltd, and Tadano Ltd. This list is not exhaustive.

Innovation is driven by increasing demand for efficient, environmentally friendly, and technologically advanced machinery. Government regulations promoting sustainable construction practices further fuel innovation in areas like hybrid and electric drive systems. The market witnesses significant M&A activity, with deal values exceeding xx Million USD in recent years, aimed at expanding market reach, technological capabilities, and geographical presence. Several factors influence market structure:

- Market Share: XCMG and Sany Group hold substantial market share domestically.

- M&A Activity: Consolidation is a prominent trend, with larger players acquiring smaller firms to enhance their portfolios and technological capabilities. The average deal size is estimated at xx Million USD.

- Regulatory Framework: Government policies focused on infrastructure development and environmental protection directly influence market growth and technology adoption.

- Product Substitutes: While limited, the rise of alternative construction methods and automation could present subtle challenges to traditional machinery.

- End-User Demographics: The construction sector's diverse end-user base – from state-owned enterprises to private contractors – impacts market demand patterns.

China Construction Machinery Industry Market Dynamics & Trends

The Chinese construction machinery market exhibits robust growth, driven by sustained infrastructure investments, urbanization, and industrial expansion. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, and the market is projected to achieve a value of xx Million USD by 2033. Technological disruptions, particularly in automation, digitization, and alternative power systems, are reshaping the competitive landscape. Consumer preferences are shifting towards higher efficiency, lower emission, and technologically advanced machines. The market penetration of hybrid and electric drive systems is gradually increasing, driven by environmental regulations and cost-effectiveness in the long run. Competitive dynamics are characterized by fierce competition among both domestic and international players, leading to continuous innovation and price optimization. These dynamics are further influenced by:

- Government Spending: Continued investment in infrastructure projects significantly fuels demand.

- Technological Advancements: The adoption of advanced technologies like AI and IoT enhances efficiency and productivity.

- Environmental Regulations: Stricter emission norms are accelerating the development and adoption of cleaner technologies.

- Economic Growth: The overall health of the Chinese economy directly influences investment in construction projects.

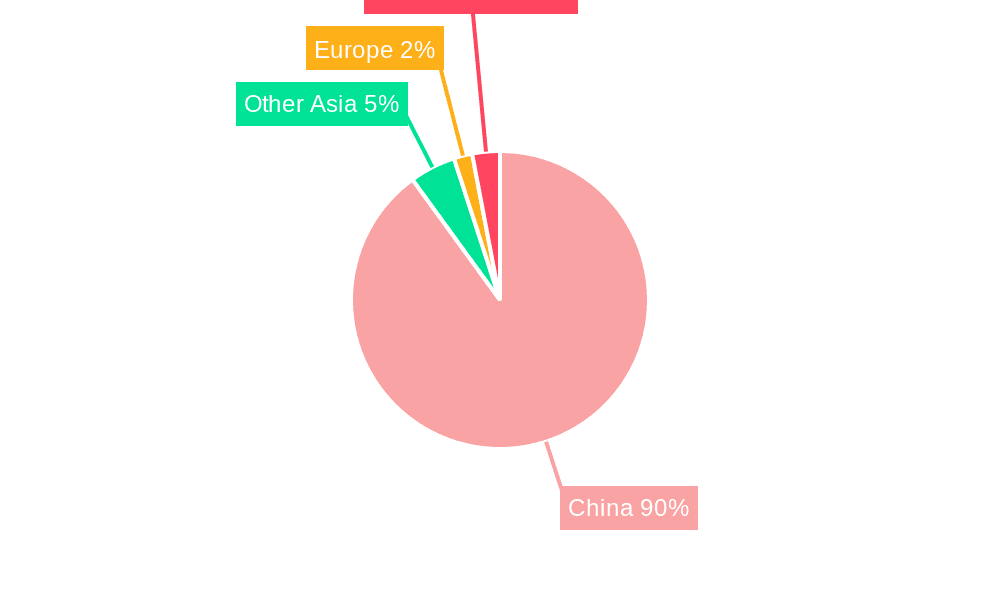

Dominant Regions & Segments in China Construction Machinery Industry

The eastern coastal regions of China, particularly provinces like Guangdong, Jiangsu, and Zhejiang, dominate the construction machinery market. These regions benefit from higher economic activity, extensive infrastructure development, and a concentration of construction projects. Within the market segments, excavators currently hold the largest share, followed by loaders and backhoe loaders. The infrastructure application segment is the most prominent, driven by government investments in transportation, energy, and water resource projects. Key drivers for dominance include:

- Eastern Coastal Regions: High economic activity, significant infrastructure investment, and a large pool of construction projects.

- Excavators Segment: High demand across various applications, coupled with continuous technological advancements.

- Infrastructure Application: Government initiatives emphasizing infrastructure development significantly boost demand in this sector.

Drive Type: Conventional drive systems still dominate, but hybrid and electric options are gaining traction due to environmental concerns and potential cost savings.

Sales Channel: OEM (Original Equipment Manufacturer) sales account for the major share, with aftermarket sales contributing significantly to revenue streams.

Application Type: Infrastructure is the leading application, followed by building and energy sectors.

Machinery Type: Excavators, loaders and backhoe loaders continue to dominate the market, while the demand for telescopic handlers and motor graders is growing steadily.

China Construction Machinery Industry Product Innovations

Recent innovations focus on enhanced efficiency, automation, and environmental sustainability. Manufacturers are introducing hybrid and electric models, advanced control systems, and autonomous features. This addresses the increasing demand for environmentally friendly and cost-effective solutions. Examples include XCMG's new XE7000 hydraulic excavator with enhanced features for mining applications and Allison transmission’s integration into XCMG's all-terrain cranes. The competitive advantage lies in offering technologically advanced, efficient, and environmentally responsible machinery that meets the evolving needs of the construction sector.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the China construction machinery market based on drive type (conventional, hybrid, electric), sales channel (OEM, aftermarket), application type (building, infrastructure, energy), and machinery type (cranes, telescopic handlers, excavators, loaders and backhoe loaders, motor graders). Growth projections for each segment are included, along with assessments of market size and competitive dynamics. Each segment exhibits unique growth trajectories influenced by technological advancements, regulatory policies, and consumer preferences.

Key Drivers of China Construction Machinery Industry Growth

The industry's growth is primarily driven by robust government investment in infrastructure development, ongoing urbanization, and the expansion of various industrial sectors. Technological advancements such as automation and electrification further propel growth, while supportive government policies related to infrastructure spending and environmental regulations contribute significantly to industry expansion. These drivers are intertwined and work synergistically to bolster market growth.

Challenges in the China Construction Machinery Industry Sector

The industry faces challenges including intensifying competition, fluctuations in raw material prices, supply chain disruptions, and environmental regulations. These factors can impact production costs, profitability, and market access. The impact of these challenges can vary from moderate to significant depending on the specific company and its strategies to mitigate these risks. Furthermore, stringent environmental regulations may increase production costs for certain types of machinery.

Emerging Opportunities in China Construction Machinery Industry

Emerging opportunities lie in the increasing adoption of advanced technologies like AI, IoT, and automation in construction machinery. Growth is also seen in the renewable energy sector, which demands specialized construction equipment. This, coupled with the growing focus on sustainable construction practices, provides scope for innovative and eco-friendly product development. The expansion of rural infrastructure presents additional opportunities for market penetration.

Leading Players in the China Construction Machinery Industry Market

- Kobelco Construction Machinery

- Xuzhou Construction Machinery Group Co Ltd (XCMG)

- Volvo CE

- Sany Group

- Liebherr Group

- China Communications Construction Company

- Caterpillar Inc

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Tadano Ltd

- List Not Exhaustive

Key Developments in China Construction Machinery Industry

- August 2022: XCMG announced the development of its second XE7000 hydraulic excavator, featuring enhanced bucket capacity and operating efficiency for mining applications.

- October 2022: Shantui delivered its first DL300G bulldozer to a Hong Kong customer for use in prestigious projects like the Hong Kong International Airport's third runway expansion.

- November 2022: XCMG signed USD 60 Million worth of contracts with Kawasaki Heavy Industries, Linde Hydraulics AG, Danfoss A/S, and Daimler SE to strengthen its global supply chain network.

- November 2022: XCMG selected Allison transmissions as its exclusive supplier for all-terrain cranes, featuring Allison's new 4970 SP transmission in the XCA400L8 model.

Future Outlook for China Construction Machinery Industry Market

The China construction machinery market is poised for continued growth, driven by sustained government investment, technological advancements, and the increasing demand for efficient and sustainable construction solutions. The market's long-term prospects are positive, with significant opportunities for players who can adapt to evolving technological trends and consumer preferences. Strategic partnerships, product innovation, and a focus on sustainability will be critical for success in this dynamic market.

China Construction Machinery Industry Segmentation

-

1. Machinery Type

- 1.1. Crane

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

-

2. Drive Type

- 2.1. Conventional

- 2.2. Hybrid and Electric

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

-

4. Application Type

- 4.1. Building

- 4.2. Infrastructure

- 4.3. Energy

China Construction Machinery Industry Segmentation By Geography

- 1. China

China Construction Machinery Industry Regional Market Share

Geographic Coverage of China Construction Machinery Industry

China Construction Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Excavators to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Conventional

- 5.2.2. Hybrid and Electric

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Building

- 5.4.2. Infrastructure

- 5.4.3. Energy

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xuzhou Construction Machinery Group Co Ltd (XCMG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo CE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sany Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Communications Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caterpillar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zoomlion Heavy Industry Science and Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tadano Ltd*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: China Construction Machinery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Construction Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 2: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 3: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 4: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: China Construction Machinery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 7: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 8: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 9: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 10: China Construction Machinery Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Construction Machinery Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the China Construction Machinery Industry?

Key companies in the market include Kobelco Construction Machinery, Xuzhou Construction Machinery Group Co Ltd (XCMG), Volvo CE, Sany Group, Liebherr Group, China Communications Construction Company, Caterpillar Inc, Zoomlion Heavy Industry Science and Technology Co Ltd, Tadano Ltd*List Not Exhaustive.

3. What are the main segments of the China Construction Machinery Industry?

The market segments include Machinery Type, Drive Type, Sales Channel, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Excavators to Drive the Market..

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: XCMG confirmed signed purchasing contracts worth USD 60 million with four major global suppliers, Kawasaki Heavy Industries, Linde Hydraulics AG, Danfoss A/S, and Daimler SE, to build a high-end global supply chain network and maintain resilience in the global construction equipment manufacturing industry. The contracts were signed at the ongoing China International Import Expo (CIIE) in Shanghai.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Construction Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Construction Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Construction Machinery Industry?

To stay informed about further developments, trends, and reports in the China Construction Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence