Key Insights

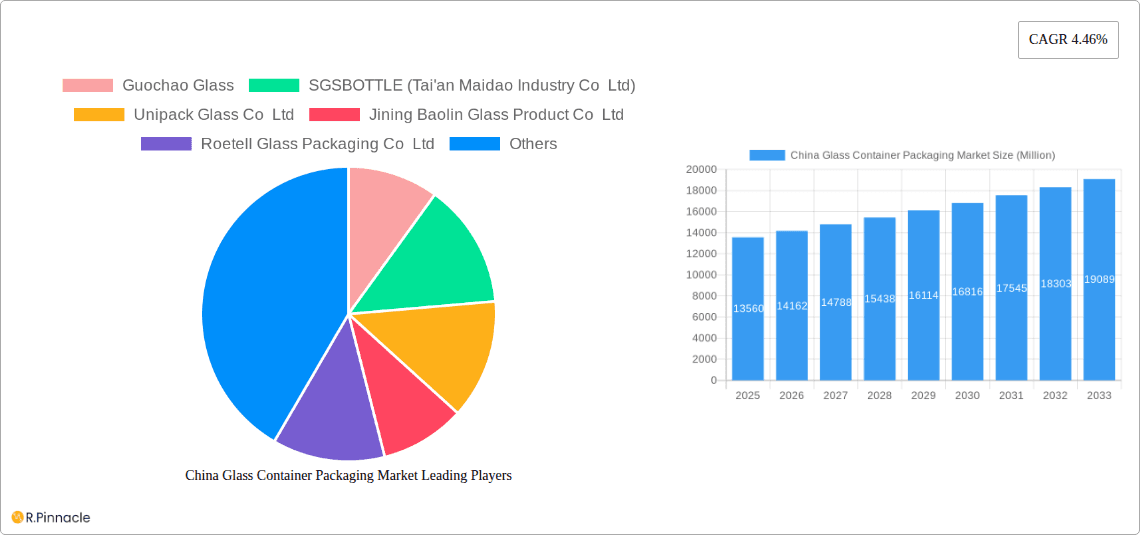

The China glass container packaging market, valued at $13.56 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.46% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage industry in China, with its increasing demand for aesthetically pleasing and functional packaging, is a primary driver. Furthermore, the growing pharmaceutical and cosmetics sectors contribute significantly to market growth, as glass offers superior barrier properties, protecting sensitive products from contamination and degradation. The preference for sustainable and recyclable packaging materials, aligning with China's environmental initiatives, also boosts market demand. While potential restraints exist, such as fluctuating raw material prices and competition from alternative packaging materials like plastics, the overall market outlook remains positive. The segmentation within the market reveals a strong presence across various end-user verticals, with Food & Beverage likely holding the largest market share, followed by Pharmaceuticals and Cosmetics. Leading players like Guochao Glass, SGSBOTTLE, and Unipack Glass are well-positioned to capitalize on these growth opportunities, leveraging their established manufacturing capabilities and distribution networks. The continuous innovation in glass packaging design and manufacturing technologies further enhances the market's prospects, creating a favorable environment for growth throughout the forecast period.

China Glass Container Packaging Market Market Size (In Billion)

The historical period (2019-2024) likely saw similar growth trends, albeit possibly impacted by short-term economic fluctuations or specific government regulations. The forecast period (2025-2033) anticipates continued expansion, driven by sustained consumer demand, evolving packaging preferences, and investments in the glass manufacturing sector. While regional variations within China might exist, the overall market dynamics point towards a consistent upward trajectory. Strategic partnerships, mergers and acquisitions, and technological advancements are expected to further shape the competitive landscape, leading to increased market consolidation and specialization in specific niche segments.

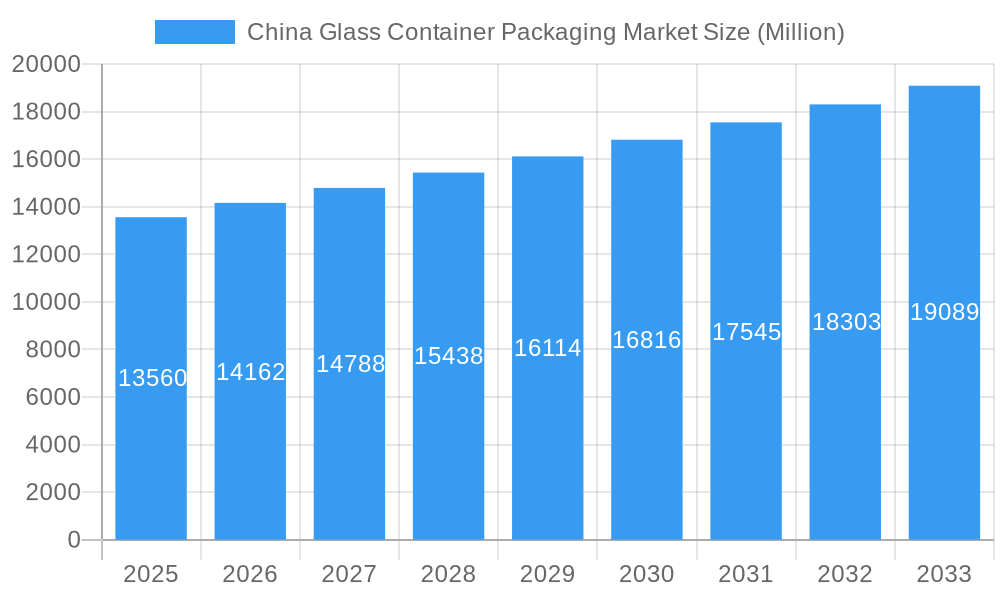

China Glass Container Packaging Market Company Market Share

China Glass Container Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China glass container packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to paint a clear picture of current market dynamics and future growth trajectories. The report covers key market segments, leading players, and emerging trends, providing actionable intelligence to navigate this dynamic market.

China Glass Container Packaging Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the China glass container packaging market, examining market concentration, innovation drivers, regulatory influences, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. The market is characterized by a moderately consolidated structure, with key players such as Guochao Glass and Unipack Glass Co Ltd holding significant market share. However, the presence of numerous smaller regional players contributes to a competitive environment. Innovation is driven by increasing demand for lightweight, sustainable, and aesthetically appealing packaging solutions. Regulatory frameworks focusing on environmental protection and food safety are shaping product development and manufacturing processes. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focused on consolidating market share and expanding product portfolios.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share (Estimated).

- Innovation Drivers: Sustainability, lightweighting, design innovation, improved barrier properties.

- Regulatory Framework: Stringent food safety regulations and environmental protection policies.

- Product Substitutes: Plastic and metal containers, although glass retains advantages in terms of barrier properties and recyclability.

- End-User Demographics: Growing middle class driving demand for premium packaging in food and beverage segments.

- M&A Activity: Moderate activity, with a focus on consolidating market share and expanding geographical reach.

China Glass Container Packaging Market Market Dynamics & Trends

The China glass container packaging market is experiencing robust growth, fueled by several key factors. Rising consumer disposable incomes and changing lifestyles are driving demand for packaged food and beverages. Technological advancements in glass manufacturing processes, such as the adoption of advanced automation and lightweighting techniques, are improving efficiency and reducing costs. The increasing adoption of sustainable packaging practices is further propelling market growth. However, the market also faces challenges such as fluctuating raw material prices and intense competition. The market is estimated to register a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to increase significantly in the food and beverage segments. Consumer preferences are shifting towards premium and sustainable packaging, creating opportunities for innovative product development. Competitive dynamics are intense, with companies focusing on product differentiation, cost optimization, and supply chain efficiency.

Dominant Regions & Segments in China Glass Container Packaging Market

The coastal regions of China, particularly those encompassing major manufacturing hubs and densely populated urban centers, dominate the glass container packaging market. This dominance is attributed to several key factors:

- Economic Policies: Favorable government policies supporting industrial development and infrastructure investment.

- Infrastructure: Well-developed transportation networks and manufacturing infrastructure facilitate efficient production and distribution.

- Proximity to Markets: Strategic locations ensure timely delivery to large consumer bases.

The food and beverage segment commands the largest share of the market, driven by the expanding food processing and beverage industries. The pharmaceutical segment is also experiencing significant growth, driven by increased demand for high-quality packaging solutions for pharmaceuticals and other healthcare products. The cosmetics segment shows consistent growth, mirroring the expansion of the beauty and personal care market in China. While the ‘Other End User Verticals’ segment contributes a smaller share, it demonstrates potential for future growth.

China Glass Container Packaging Market Product Innovations

Recent innovations in the China glass container packaging market focus on lightweighting, enhanced barrier properties, and improved aesthetics. Manufacturers are investing in advanced technologies to reduce glass thickness while maintaining structural integrity and increasing the use of recycled glass content. New designs incorporating decorative elements are appealing to the premium segment. The market is also seeing the introduction of innovative closures and packaging formats to improve convenience and product protection. These innovations cater to evolving consumer preferences and stringent regulatory requirements.

Report Scope & Segmentation Analysis

This report segments the China glass container packaging market based on End-user Verticals:

Food: This segment is experiencing robust growth due to the increasing demand for packaged food products. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. Competition is intense, with players focusing on cost optimization and product differentiation.

Beverages: Similar to the food segment, the beverage segment is characterized by high growth, fueled by expanding consumption of packaged beverages. The market size is estimated at xx Million in 2025, with projected growth mirroring the food segment.

Pharmaceuticals: Driven by stricter regulations and increasing healthcare spending, this segment is experiencing significant growth, with a market size of xx Million in 2025 and a CAGR of xx%.

Cosmetics: The cosmetics segment benefits from the expanding beauty and personal care industry. Market size is estimated at xx Million in 2025 with a steady CAGR.

Other End User Verticals: This segment includes various applications and shows moderate growth potential.

Key Drivers of China Glass Container Packaging Market Growth

Several key factors are driving the growth of the China glass container packaging market. These include the rising disposable incomes of Chinese consumers, leading to increased spending on packaged goods; robust growth in the food and beverage sectors; the growing demand for sustainable and eco-friendly packaging solutions; and government initiatives promoting the development of the packaging industry. Technological advancements in manufacturing processes, improving efficiency and reducing costs are also contributing factors.

Challenges in the China Glass Container Packaging Market Sector

The China glass container packaging market faces several challenges. Fluctuating raw material prices (especially energy costs) impact production costs. Intense competition among numerous players puts downward pressure on margins. Environmental regulations, though beneficial in the long term, necessitate investment in cleaner production technologies. Supply chain disruptions can affect timely delivery of products.

Emerging Opportunities in China Glass Container Packaging Market

Emerging opportunities exist in the development of lightweight and sustainable packaging solutions. The increasing demand for premium and customized packaging creates opportunities for innovation in design and functionality. Growth in the e-commerce sector presents opportunities for specialized packaging solutions for online deliveries. Expansion into new and underserved markets within China will also open up avenues for growth.

Leading Players in the China Glass Container Packaging Market Market

- Guochao Glass

- SGSBOTTLE (Tai'an Maidao Industry Co Ltd)

- Unipack Glass Co Ltd

- Jining Baolin Glass Product Co Ltd

- Roetell Glass Packaging Co Ltd

- East Asia Glass Limited

- Hualian Glass Manufacturers Co Ltd

- Shanghai Misa Glass Co Ltd

- Shanghai Vista Packaging Co Ltd

- Xuzhou Huihe International Trade Co Ltd

- Huaxing Glas

Key Developments in China Glass Container Packaging Market Industry

March 2020: Shanghai Fosun Pharmaceutical Group Co. collaborated with BioNTech to develop and market the mRNA shot in China, significantly boosting demand for pharmaceutical glass packaging. USD 300 Million was invested in initial doses.

January 2020: Itron, Inc.'s collaboration with Innowatts highlights the potential integration of smart technologies in the supply chain of glass packaging, enhancing efficiency.

Future Outlook for China Glass Container Packaging Market Market

The future of the China glass container packaging market looks promising. Continued growth in the food and beverage sectors, rising consumer spending, and the increasing adoption of sustainable packaging practices will drive market expansion. Technological innovations, focusing on lightweighting and improved performance, will shape the market. Strategic partnerships and investments in research and development will position key players for success in this evolving landscape.

China Glass Container Packaging Market Segmentation

-

1. End-user Vertical

- 1.1. Food

- 1.2. Beverages

- 1.3. Pharmaceuticals

- 1.4. Cosmetics

- 1.5. Other End User Verticals

China Glass Container Packaging Market Segmentation By Geography

- 1. China

China Glass Container Packaging Market Regional Market Share

Geographic Coverage of China Glass Container Packaging Market

China Glass Container Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Disposable Income and Integration in Premium Packaging; Improved Technology Offering Better Solutions

- 3.3. Market Restrains

- 3.3.1. High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions

- 3.4. Market Trends

- 3.4.1. Higher Disposable Income and Integration in Premium Packaging to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Glass Container Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Food

- 5.1.2. Beverages

- 5.1.3. Pharmaceuticals

- 5.1.4. Cosmetics

- 5.1.5. Other End User Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Guochao Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SGSBOTTLE (Tai'an Maidao Industry Co Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unipack Glass Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jining Baolin Glass Product Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roetell Glass Packaging Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 East Asia Glass Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hualian Glass Manufacturers Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Misa Glass Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shanghai Vista Packaging Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xuzhou Huihe International Trade Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huaxing Glas

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Guochao Glass

List of Figures

- Figure 1: China Glass Container Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Glass Container Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: China Glass Container Packaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 2: China Glass Container Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Glass Container Packaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: China Glass Container Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Glass Container Packaging Market?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the China Glass Container Packaging Market?

Key companies in the market include Guochao Glass, SGSBOTTLE (Tai'an Maidao Industry Co Ltd), Unipack Glass Co Ltd, Jining Baolin Glass Product Co Ltd, Roetell Glass Packaging Co Ltd, East Asia Glass Limited, Hualian Glass Manufacturers Co Ltd, Shanghai Misa Glass Co Ltd, Shanghai Vista Packaging Co Ltd, Xuzhou Huihe International Trade Co Ltd, Huaxing Glas.

3. What are the main segments of the China Glass Container Packaging Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Disposable Income and Integration in Premium Packaging; Improved Technology Offering Better Solutions.

6. What are the notable trends driving market growth?

Higher Disposable Income and Integration in Premium Packaging to Drive the Market.

7. Are there any restraints impacting market growth?

High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions.

8. Can you provide examples of recent developments in the market?

March 2020 - Shanghai Fosun Pharmaceutical Group Co. collaborated with BioNTech to develop and market the mRNA shot in China and made an advance payment of EUR 250 million (USD 300 million) for an initial 50 million doses. The German vaccine maker would supply no fewer than 100 million doses for China by the end of 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Glass Container Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Glass Container Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Glass Container Packaging Market?

To stay informed about further developments, trends, and reports in the China Glass Container Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence