Key Insights

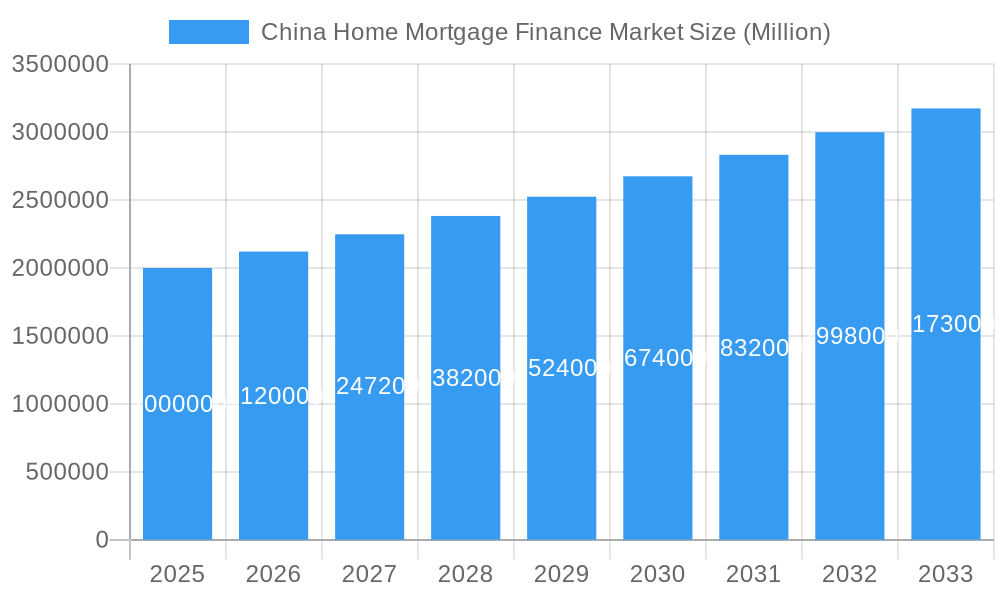

The China home mortgage finance market is poised for significant expansion, driven by sustained urbanization, a growing middle class, and supportive government policies promoting homeownership. While recent regulatory adjustments and property market moderation have introduced short-term fluctuations, the long-term outlook remains robust. The market size in 2025 is estimated at $1.6 trillion USD, encompassing both residential and commercial mortgages. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately 6% from 2025 to 2033. Key growth catalysts include ongoing infrastructure development, affordable housing initiatives, and advancements in financial technology that enhance lending efficiency and accessibility. Increased competition among financial institutions is expected to foster innovative product development and competitive pricing, particularly benefiting first-time homebuyers. However, market participants must remain cognizant of potential macroeconomic instability and evolving regulatory landscapes when assessing future trajectories.

China Home Mortgage Finance Market Market Size (In Billion)

The evolution of China's financial infrastructure, particularly in fintech and digital mortgage processing, will be instrumental in shaping market dynamics. This includes the development of sophisticated mortgage products and expanded credit access. Intensified competition among lenders will likely result in enhanced service offerings and more attractive interest rates. Despite these positive trends, a comprehensive analysis necessitates a careful consideration of regional housing market variations, demographic shifts, and the broader Chinese economic climate to accurately forecast market performance.

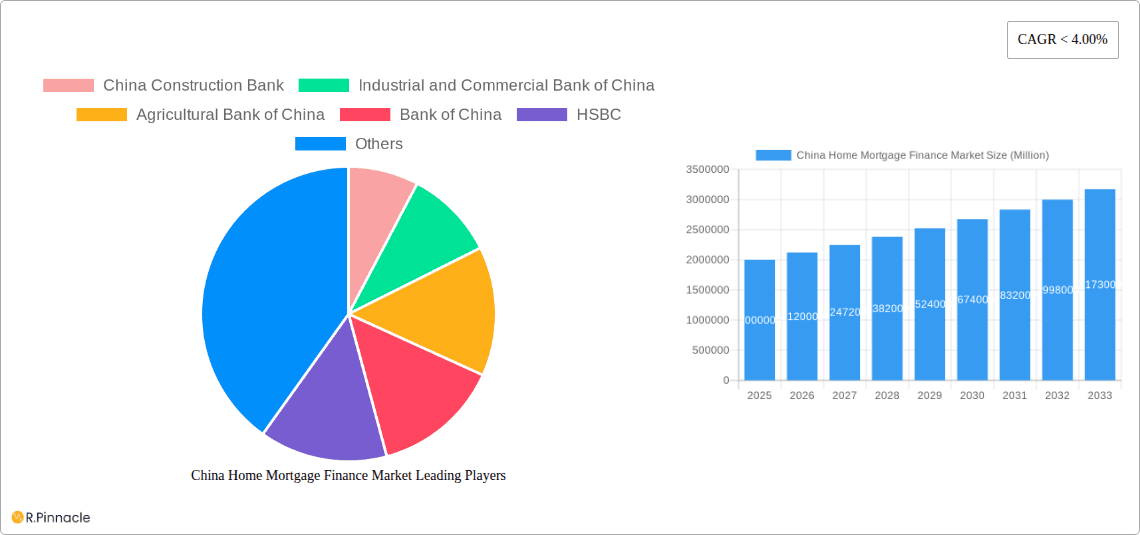

China Home Mortgage Finance Market Company Market Share

China Home Mortgage Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Home Mortgage Finance Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market structure, dynamics, and future trends, this report leverages data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market growth from 2025 to 2033. The study period covers 2019-2033.

China Home Mortgage Finance Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the China Home Mortgage Finance Market. We examine market concentration, identifying key players and their respective market shares. The analysis delves into the impact of mergers and acquisitions (M&A) activities, assessing deal values and their influence on market consolidation. Innovation trends are explored, including the adoption of fintech solutions and the development of new mortgage products. Furthermore, the report examines the evolving regulatory framework and its impact on market participants.

- Market Concentration: The market is highly concentrated, with major players like China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, and Bank of China holding significant market share (estimated at xx% collectively in 2025). Other key players include Bank of Communications, Postal Savings Bank of China, and HSBC. (Precise market share figures are detailed within the full report).

- M&A Activity: The report analyzes significant M&A deals in the period 2019-2024, including deal values and their implications for market structure. The total value of M&A deals during this period is estimated at xx Million USD.

- Innovation Drivers: Technological advancements such as AI-powered credit scoring and digital mortgage applications are key drivers of innovation. Regulatory changes also spur innovation by encouraging the development of new products and services.

- Regulatory Framework: The report analyzes the impact of existing and upcoming regulations on market dynamics.

China Home Mortgage Finance Market Market Dynamics & Trends

This section explores the key factors driving market growth, technological disruptions, evolving consumer preferences, and competitive dynamics within the China Home Mortgage Finance Market. The analysis incorporates a comprehensive review of market growth drivers, such as urbanization, rising disposable incomes, and government policies supporting homeownership. Technological disruptions, including the rise of fintech and digital lending platforms, are analyzed in detail. Consumer preferences are examined, including shifts towards specific mortgage products and the growing demand for personalized services. The report includes a detailed assessment of competitive dynamics, considering factors such as pricing strategies, product differentiation, and market share.

- CAGR: The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%.

- Market Penetration: The market penetration rate is expected to reach xx% by 2033.

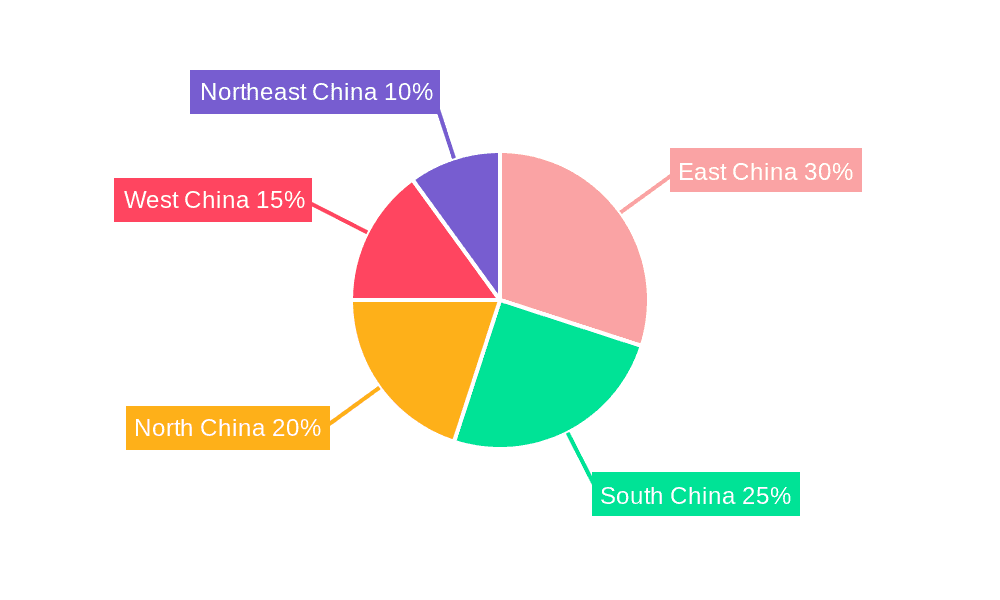

Dominant Regions & Segments in China Home Mortgage Finance Market

This section identifies the leading regions and segments within the China Home Mortgage Finance Market. It provides a detailed analysis of the factors contributing to the dominance of specific regions and segments, including economic policies, infrastructure development, and demographic trends.

- Key Drivers for Dominant Regions/Segments: (Specific details on leading regions/segments and their drivers will be included in the full report).

- Economic Policies: Government initiatives supporting homeownership and infrastructure development.

- Infrastructure Development: Availability of affordable housing and robust infrastructure.

- Demographic Trends: Population growth and changing demographics (e.g., urbanization).

China Home Mortgage Finance Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the China home mortgage finance market. The analysis emphasizes technological trends and the market fit of new offerings. Technological advances in mortgage origination, risk assessment, and customer service are highlighted, along with their impact on market competition and consumer experience.

Report Scope & Segmentation Analysis

This report segments the China Home Mortgage Finance Market by various factors, including mortgage type (e.g., fixed-rate, adjustable-rate), loan amount, borrower type (individual, corporate), and geographic location. Each segment's growth projections, market sizes, and competitive dynamics are detailed in the full report.

Key Drivers of China Home Mortgage Finance Market Growth

Key growth drivers for the China Home Mortgage Finance Market include:

- Government policies promoting homeownership.

- Rapid urbanization and increasing disposable incomes.

- Technological advancements in mortgage lending.

Challenges in the China Home Mortgage Finance Market Sector

Challenges facing the sector include:

- Regulatory hurdles and compliance requirements.

- Rising non-performing loans.

- Intense competition among lenders.

Emerging Opportunities in China Home Mortgage Finance Market

Emerging opportunities include:

- Growth in the rural mortgage market.

- Expansion of digital mortgage lending platforms.

- Development of innovative mortgage products tailored to specific needs.

Leading Players in the China Home Mortgage Finance Market Market

Key Developments in China Home Mortgage Finance Market Industry

- September 2022: China Construction Bank Corp. announces a 30-billion-yuan (USD 4.2 billion) fund to purchase properties from developers, aiming to alleviate the real estate crisis.

- October 2022: HSBC expands its private banking network in China, launching operations in two new cities, signifying increased investment and competition in the high-net-worth segment.

Future Outlook for China Home Mortgage Finance Market Market

The future outlook for the China Home Mortgage Finance Market is positive, driven by sustained economic growth, ongoing urbanization, and the continued development of innovative financial technologies. Strategic opportunities exist for lenders who can effectively adapt to changing market conditions, leverage technology, and cater to the evolving needs of borrowers. The market is projected to experience significant growth in the coming years, presenting substantial opportunities for investors and market participants.

China Home Mortgage Finance Market Segmentation

-

1. Types of Lenders

- 1.1. Banks

- 1.2. House Provident Fund (HPF)

-

2. Financing Options

- 2.1. Personal New Housing Loan

- 2.2. Personal Second-hand Housing Loan

- 2.3. Personal Housing Provident Fund (Portfolio) Loan

-

3. Types of Mortgage

- 3.1. Fixed

- 3.2. Variable

China Home Mortgage Finance Market Segmentation By Geography

- 1. China

China Home Mortgage Finance Market Regional Market Share

Geographic Coverage of China Home Mortgage Finance Market

China Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Favorable Mortgage Rates is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Home Mortgage Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 5.1.1. Banks

- 5.1.2. House Provident Fund (HPF)

- 5.2. Market Analysis, Insights and Forecast - by Financing Options

- 5.2.1. Personal New Housing Loan

- 5.2.2. Personal Second-hand Housing Loan

- 5.2.3. Personal Housing Provident Fund (Portfolio) Loan

- 5.3. Market Analysis, Insights and Forecast - by Types of Mortgage

- 5.3.1. Fixed

- 5.3.2. Variable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Construction Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Industrial and Commercial Bank of China

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agricultural Bank of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HSBC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank of Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Postal Savings Bank of China**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 China Construction Bank

List of Figures

- Figure 1: China Home Mortgage Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Home Mortgage Finance Market Share (%) by Company 2025

List of Tables

- Table 1: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Lenders 2020 & 2033

- Table 2: China Home Mortgage Finance Market Revenue billion Forecast, by Financing Options 2020 & 2033

- Table 3: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Mortgage 2020 & 2033

- Table 4: China Home Mortgage Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Lenders 2020 & 2033

- Table 6: China Home Mortgage Finance Market Revenue billion Forecast, by Financing Options 2020 & 2033

- Table 7: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Mortgage 2020 & 2033

- Table 8: China Home Mortgage Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Home Mortgage Finance Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the China Home Mortgage Finance Market?

Key companies in the market include China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, HSBC, Bank of Communications, Postal Savings Bank of China**List Not Exhaustive.

3. What are the main segments of the China Home Mortgage Finance Market?

The market segments include Types of Lenders, Financing Options, Types of Mortgage.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Favorable Mortgage Rates is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: HSBC expands China's private banking network and launches in two new cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the China Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence