Key Insights

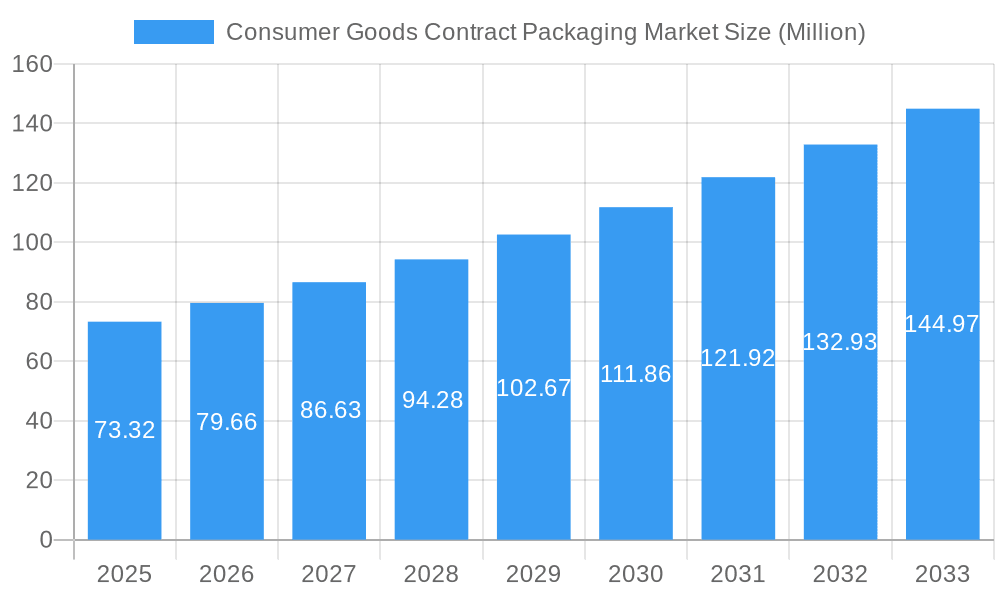

The Consumer Goods Contract Packaging Market, valued at $73.32 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.69% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for customized packaging solutions across various consumer goods sectors, including food, beverages, pharmaceuticals, and personal care, fuels the market's growth. Manufacturers are increasingly outsourcing packaging to specialized contract packagers to leverage their expertise, optimize efficiency, and reduce operational costs. Secondly, the rising adoption of sustainable and eco-friendly packaging materials, such as biodegradable and recyclable options, is creating new opportunities within the market. Consumers are increasingly environmentally conscious, leading brands to prioritize sustainable packaging to enhance their brand image and appeal to this growing segment. Finally, technological advancements in packaging automation and machinery are enhancing efficiency and reducing production costs, further propelling market growth. The market is segmented by end-user industry and packaging type, with primary, secondary, and tertiary packaging segments showing significant potential. Geographic expansion, particularly in emerging markets with burgeoning consumer goods industries, presents another significant growth avenue.

Consumer Goods Contract Packaging Market Market Size (In Million)

While the market demonstrates considerable potential, certain challenges exist. Competition among established players and new entrants necessitates continuous innovation and value-added service offerings. Fluctuations in raw material prices and geopolitical instability can also impact profitability. However, the overall outlook remains positive, with continued growth projected across various segments and regions. The market's future hinges on the ability of contract packaging companies to adapt to evolving consumer preferences, regulatory changes, and technological innovations, while maintaining a strong focus on sustainability and efficiency. Major players like Jones Healthcare Group, UNICEP Packaging LLC, and others are well-positioned to capitalize on this growth, leveraging their expertise and established market presence. The long-term forecast suggests significant market expansion, driven by consistent demand and industry innovation.

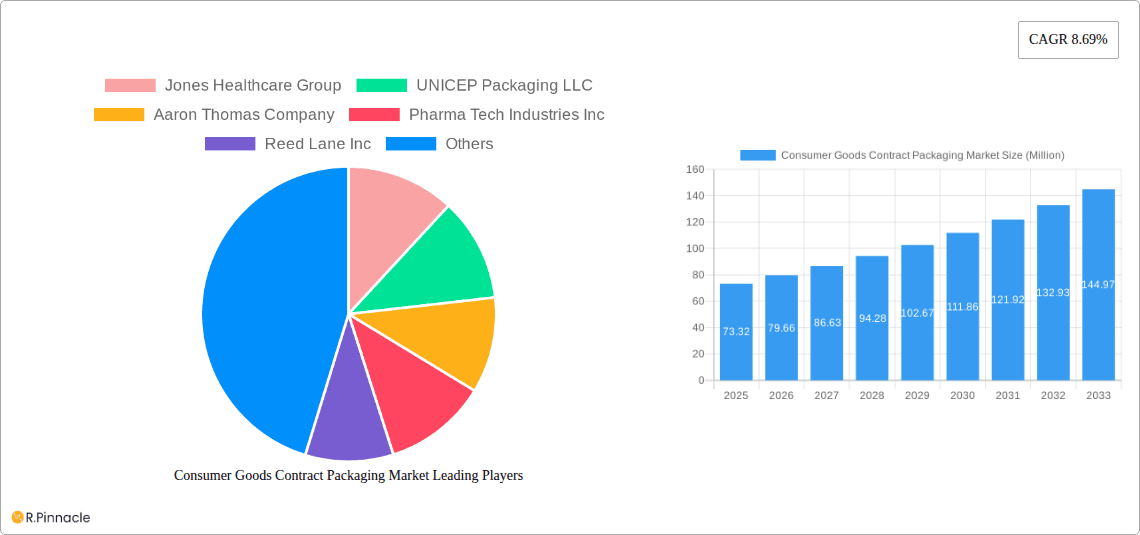

Consumer Goods Contract Packaging Market Company Market Share

Consumer Goods Contract Packaging Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Consumer Goods Contract Packaging Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers market size, growth drivers, challenges, opportunities, and key players, with a detailed forecast extending to 2033. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period is 2019-2024. This report is essential for understanding the current market landscape and navigating future trends in this dynamic sector.

Consumer Goods Contract Packaging Market Market Structure & Innovation Trends

The Consumer Goods Contract Packaging Market exhibits a moderately fragmented structure, with numerous players vying for market share. While no single entity dominates, several companies hold significant positions, driving competition and innovation. Key players include Jones Healthcare Group, UNICEP Packaging LLC, Aaron Thomas Company, Pharma Tech Industries Inc, Reed Lane Inc, Multipack Solutions LLC, Complete Co-Packing Services Ltd, Sharp Packaging Services, Budelpack Poortvliet BV, Stamar Packaging Inc, and Green Packaging Asia. This competitive landscape fosters continuous innovation in packaging materials, technologies, and services.

Market share for the leading companies ranges from 5% to 15% individually, with the remaining share distributed among smaller players. The report analyzes recent M&A activity, revealing a total deal value of approximately $xx Million over the past five years, indicating a trend toward consolidation. Regulatory frameworks, including food safety and environmental regulations, significantly influence packaging choices and drive innovation in sustainable packaging solutions. Furthermore, the increasing demand for customized packaging and e-commerce growth contributes to market expansion and innovative solutions. Product substitutes, such as reusable containers and eco-friendly alternatives, are gradually gaining traction, putting pressure on traditional packaging materials.

Consumer Goods Contract Packaging Market Market Dynamics & Trends

The Consumer Goods Contract Packaging Market is experiencing significant and sustained growth, a trend projected to continue robustly throughout the forecast period of 2025-2033, with an estimated Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR Here]%. This expansion is primarily fueled by the escalating global demand for a diverse range of packaged consumer goods, spanning sectors from food and beverages to personal care and pharmaceuticals. A pivotal force shaping this market is the rapid integration of technological advancements. Automation, including sophisticated robotics and AI-driven systems, is revolutionizing production lines, leading to enhanced efficiency, reduced labor costs, and improved quality control. Furthermore, the exploration and adoption of advanced materials, such as high-barrier films and intelligent packaging, are opening up new avenues for product protection, extended shelf life, and interactive consumer experiences.

Consumer preferences are also playing a crucial role in market evolution. The increasing emphasis on convenience, driven by busy lifestyles, is leading to demand for single-serve, ready-to-eat, and easy-to-open packaging formats. Simultaneously, a powerful wave of environmental consciousness is reshaping consumer choices, creating a surge in demand for sustainable packaging solutions. This includes a strong preference for recyclable, compostable, biodegradable, and packaging made from recycled content. Brands are responding by partnering with contract packagers capable of delivering innovative, eco-friendly, and aesthetically pleasing designs that resonate with environmentally aware consumers. While developed economies currently exhibit high market penetration due to established infrastructure and consumer spending power, emerging markets present substantial untapped potential for growth, driven by rising disposable incomes and an expanding middle class.

A deep understanding of these market dynamics is derived from rigorous analysis of key metrics such as CAGR, precise market penetration rates across various segments and regions, and in-depth consumer behavior data. The competitive landscape is characterized by intense rivalry among contract packaging providers, compelling them to continually invest in innovation, optimize their operational strategies for cost-efficiency, and forge strategic partnerships to expand their service offerings and market reach.

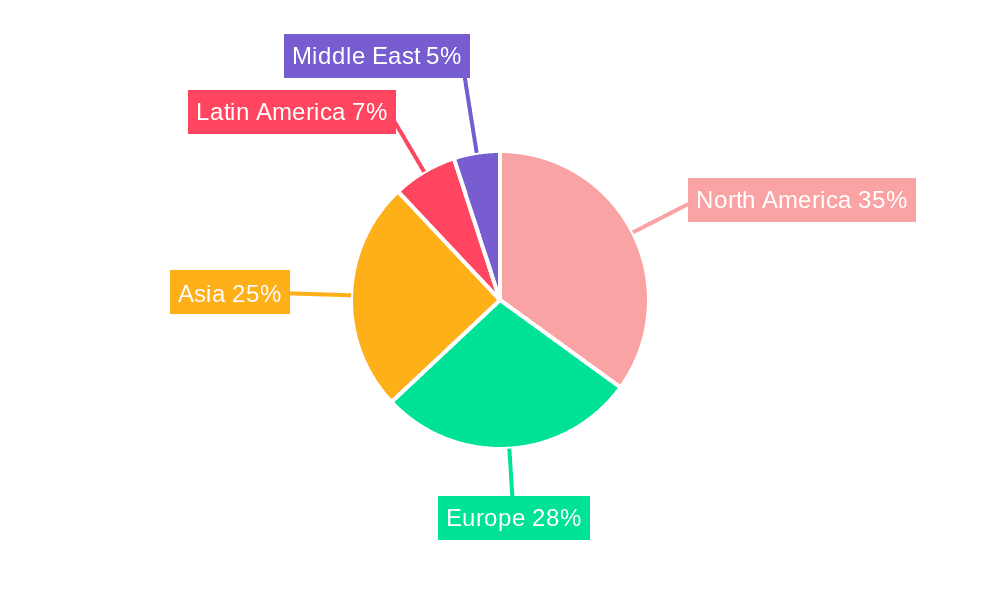

Dominant Regions & Segments in Consumer Goods Contract Packaging Market

The global Consumer Goods Contract Packaging Market is presently dominated by the North American region. This leadership is underpinned by a highly developed and dynamic food and beverage industry, robust logistical infrastructure, a strong regulatory framework that often mandates specific packaging standards, and a high propensity for consumer spending on packaged goods. However, the spotlight is increasingly turning towards the Asia-Pacific region, which is poised for the most rapid growth rate. This accelerated expansion is attributed to a burgeoning middle class with increasing purchasing power, significant economic growth across numerous countries, and a rapidly evolving consumer landscape that is showing a greater appetite for convenience and variety in packaged goods.

Key Drivers by Segment:

- Food & Beverage: This segment is propelled by the escalating demand for processed foods, ready-to-eat meals, convenience snacks, and an unwavering focus on enhancing food safety protocols and extending product shelf life through advanced packaging technologies.

- Pharmaceutical: The pharmaceutical segment is characterized by stringent regulatory compliance, the critical need for tamper-evident and child-resistant packaging, and the overall expansion of the global healthcare industry, including the rise of biologics and specialized drug delivery systems.

- Household & Personal Care: Driven by increasing consumer disposable income and a desire for premium and visually appealing products, this segment sees a growing preference for innovative, convenient, and aesthetically pleasing packaging that enhances the user experience and brand perception.

- Primary Packaging: The fundamental necessity for direct product containment ensures continuous and high-volume demand for primary packaging solutions across all consumer goods categories.

- Secondary Packaging: This layer of packaging is experiencing elevated demand for its role in product protection during transit, as well as its crucial function in branding and shelf appeal. There is a pronounced emphasis on developing novel designs and incorporating sustainable materials.

- Tertiary Packaging: The growth in tertiary packaging is intrinsically linked to the efficiency of global logistics networks and the increasing need for robust, secure, and cost-effective solutions for the safe transportation of goods in bulk.

Country-level analysis: Within their respective dominant regions, the United States, China, and India stand out as key contributors to the overall market growth. These nations play a pivotal role due to their large consumer bases, evolving industrial capacities, and significant market potential. The detailed dominance analysis incorporated within the report meticulously examines factors such as economic policies, infrastructure development initiatives, nuanced consumer behavior patterns, and the prevailing regulatory landscape to provide a comprehensive understanding of regional and country-specific market dynamics.

Consumer Goods Contract Packaging Market Product Innovations

The landscape of product innovations within the Consumer Goods Contract Packaging Market is dynamic and customer-centric. A paramount focus is placed on the development and utilization of sustainable packaging materials. This includes a significant push towards biodegradable plastics derived from renewable resources, compostable packaging solutions that break down naturally, and an increased incorporation of post-consumer recycled (PCR) content, directly addressing the growing environmental consciousness and demand for eco-friendly options among consumers. Brands are actively seeking partners who can offer these greener alternatives without compromising on performance or aesthetics.

Complementing material innovation are substantial advancements in technology and automation. Sophisticated automation systems, including high-speed filling, sealing, and palletizing equipment, are dramatically enhancing production efficiency, reducing lead times, and minimizing errors. Innovations in flexible packaging are also a key trend, offering lighter weight, reduced material usage, and improved product protection. The market is witnessing a surge in demand for packaging designs that not only offer superior product protection and extended shelf life but also contribute to an enhanced consumer experience. This includes features like easy-open mechanisms, resealability, portion control, and integrated functionalities. These innovations empower contract packaging providers to deliver differentiated services and create significant competitive advantages, enabling them to offer compelling value propositions that meet the evolving needs of their diverse clientele.

Report Scope & Segmentation Analysis

The report provides a comprehensive analysis of the Consumer Goods Contract Packaging Market segmented by end-user industry (Food, Beverage, Pharmaceutical, Household and Personal Care, Other End-user Industries) and packaging type (Primary, Secondary, Tertiary). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The Food & Beverage segment currently dominates the market, followed by the Pharmaceutical sector. The primary packaging segment enjoys the largest share due to basic necessity. Secondary and tertiary segments are growing at a faster rate driven by value additions and logistics improvements. Growth projections for each segment are provided for the forecast period (2025-2033).

Key Drivers of Consumer Goods Contract Packaging Market Growth

The Consumer Goods Contract Packaging Market is propelled by a confluence of powerful and interconnected drivers. A fundamental economic factor is the consistent rise in consumer disposable income across both developed and emerging economies, leading to increased purchasing power and a higher demand for a wider array of packaged consumer goods. This upward trend in spending directly translates to greater volumes for contract packagers.

Technological advancements are revolutionizing the sector. Innovations in novel packaging materials, such as those offering enhanced barrier properties, active and intelligent packaging functionalities, and sustainable alternatives, are improving product quality and consumer appeal. Simultaneously, the widespread adoption of automation in packaging processes is significantly boosting operational efficiency, reducing production costs, and enabling greater flexibility in handling diverse product types and packaging formats.

The increasing stringency of global regulations concerning food safety and product traceability is a significant catalyst. Manufacturers are compelled to invest in packaging solutions that ensure product integrity, prevent contamination, and provide clear tracking information, thereby driving demand for specialized contract packaging services. The explosive growth of the e-commerce landscape has also created a distinct need for robust and resilient packaging solutions. Contract packagers are essential in ensuring products are adequately protected during the complex shipping and handling processes inherent in online retail, as well as offering customized packaging for direct-to-consumer shipments.

Finally, the pervasive and growing consumer and regulatory focus on sustainability and eco-friendly practices is a major market influencer. The shift away from single-use plastics towards recyclable, biodegradable, and compostable packaging solutions is accelerating, creating substantial opportunities for contract packagers who can offer these environmentally responsible alternatives.

Challenges in the Consumer Goods Contract Packaging Market Sector

The Consumer Goods Contract Packaging Market faces several challenges. Fluctuating raw material prices directly impact production costs and profitability. Stringent environmental regulations and the need for sustainable packaging present significant hurdles. Intense competition among contract packaging providers necessitates continuous innovation and efficiency improvements. Supply chain disruptions due to geopolitical events or natural disasters can hinder operations and impact delivery timelines. The increasing cost of labor further complicates efficient production.

Emerging Opportunities in Consumer Goods Contract Packaging Market

The rise of e-commerce and the associated need for specialized packaging presents a significant growth opportunity. The growing demand for personalized and customized packaging solutions offers further expansion opportunities. The increasing focus on sustainable and eco-friendly packaging materials drives innovation and new market avenues. The development and adoption of advanced packaging technologies, such as smart packaging and active packaging, offer exciting future prospects.

Leading Players in the Consumer Goods Contract Packaging Market Market

- Jones Healthcare Group

- UNICEP Packaging LLC

- Aaron Thomas Company

- Pharma Tech Industries Inc

- Reed Lane Inc

- Multipack Solutions LLC

- Complete Co-Packing Services Ltd

- Sharp Packaging Services

- Budelpack Poortvliet BV

- Stamar Packaging Inc

- Green Packaging Asia

Key Developments in Consumer Goods Contract Packaging Market Industry

- 2023-Q2: Jones Healthcare Group, a prominent player in the pharmaceutical packaging sector, announced the launch of a new comprehensive line of sustainable packaging solutions designed to reduce environmental impact and meet growing consumer demand for eco-friendly products.

- 2022-Q4: UNICEP Packaging LLC, a diversified contract packaging provider, strategically expanded its market reach and service capabilities through the acquisition of a smaller, specialized contract packaging firm, enhancing its regional presence and client portfolio.

- 2021-Q3: Pharma Tech Industries Inc made a significant investment in state-of-the-art advanced automation technology, aimed at increasing production throughput, improving accuracy, and further enhancing operational efficiency within its pharmaceutical packaging operations.

(Further detailed analysis of key mergers, acquisitions, product launches, technological integrations, and strategic partnerships will be provided in the comprehensive market report.)

Future Outlook for Consumer Goods Contract Packaging Market Market

The Consumer Goods Contract Packaging Market is poised for continued growth, driven by factors such as rising consumer demand, technological advancements, and the increasing adoption of sustainable packaging solutions. Strategic partnerships, acquisitions, and product innovation will play a crucial role in shaping the market landscape. The focus on customization, personalization, and enhanced consumer experiences will further drive market expansion. The market will see increased adoption of digitalization and supply chain optimization techniques to ensure efficiency and competitiveness.

Consumer Goods Contract Packaging Market Segmentation

-

1. Packaging

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Household and Personal Care

- 2.5. Other End-user Industries

Consumer Goods Contract Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Netherlands

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Consumer Goods Contract Packaging Market Regional Market Share

Geographic Coverage of Consumer Goods Contract Packaging Market

Consumer Goods Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Increasing Demand from the E-commerce Industry; Increasing Need for Latest Technology and Innovative Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Competition from In-house Packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceuticals is Expected to Experience Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Household and Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 6. North America Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging

- 6.1.1. Primary

- 6.1.2. Secondary

- 6.1.3. Tertiary

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Household and Personal Care

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Packaging

- 7. Europe Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging

- 7.1.1. Primary

- 7.1.2. Secondary

- 7.1.3. Tertiary

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Household and Personal Care

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Packaging

- 8. Asia Pacific Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging

- 8.1.1. Primary

- 8.1.2. Secondary

- 8.1.3. Tertiary

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Household and Personal Care

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Packaging

- 9. Latin America Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging

- 9.1.1. Primary

- 9.1.2. Secondary

- 9.1.3. Tertiary

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Household and Personal Care

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Packaging

- 10. Middle East and Africa Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging

- 10.1.1. Primary

- 10.1.2. Secondary

- 10.1.3. Tertiary

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Household and Personal Care

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Packaging

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jones Healthcare Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UNICEP Packaging LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aaron Thomas Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pharma Tech Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Reed Lane Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Multipack Solutions LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Complete Co-Packing Services Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sharp Packaging Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Budelpack Poortvliet BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stamar Packaging Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Green Packaging Asia

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Jones Healthcare Group

List of Figures

- Figure 1: Global Consumer Goods Contract Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 3: North America Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 4: North America Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 9: Europe Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 10: Europe Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 15: Asia Pacific Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 16: Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 21: Latin America Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 22: Latin America Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 27: Middle East and Africa Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 28: Middle East and Africa Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 2: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 5: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 10: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Netherlands Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 20: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 27: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 30: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Goods Contract Packaging Market?

The projected CAGR is approximately 8.69%.

2. Which companies are prominent players in the Consumer Goods Contract Packaging Market?

Key companies in the market include Jones Healthcare Group, UNICEP Packaging LLC, Aaron Thomas Company, Pharma Tech Industries Inc, Reed Lane Inc, Multipack Solutions LLC, Complete Co-Packing Services Ltd*List Not Exhaustive, Sharp Packaging Services, Budelpack Poortvliet BV, Stamar Packaging Inc, Green Packaging Asia.

3. What are the main segments of the Consumer Goods Contract Packaging Market?

The market segments include Packaging, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Increasing Demand from the E-commerce Industry; Increasing Need for Latest Technology and Innovative Packaging.

6. What are the notable trends driving market growth?

Pharmaceuticals is Expected to Experience Significant Growth.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Competition from In-house Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Goods Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Goods Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Goods Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Consumer Goods Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence