Key Insights

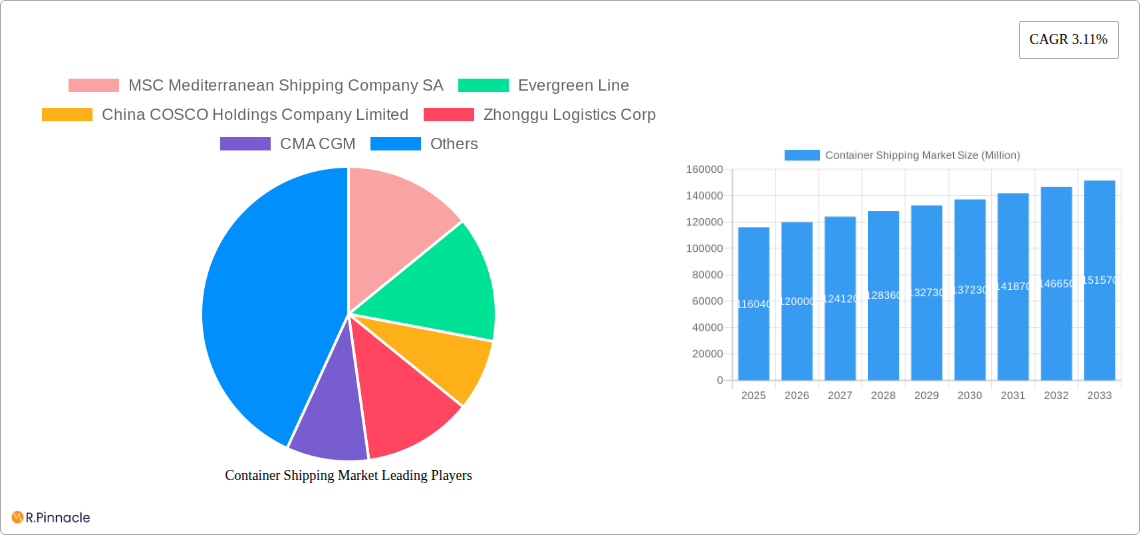

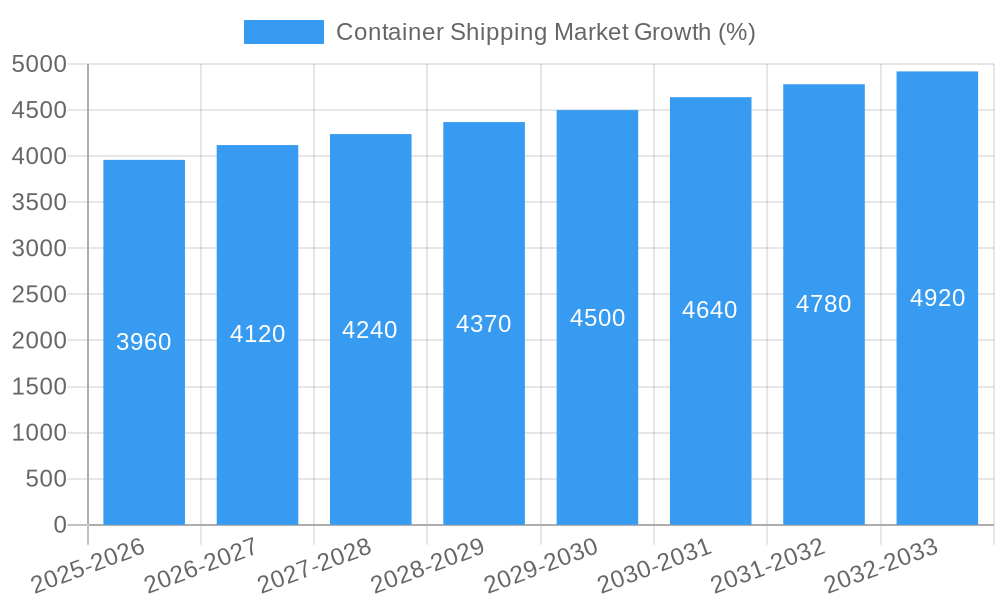

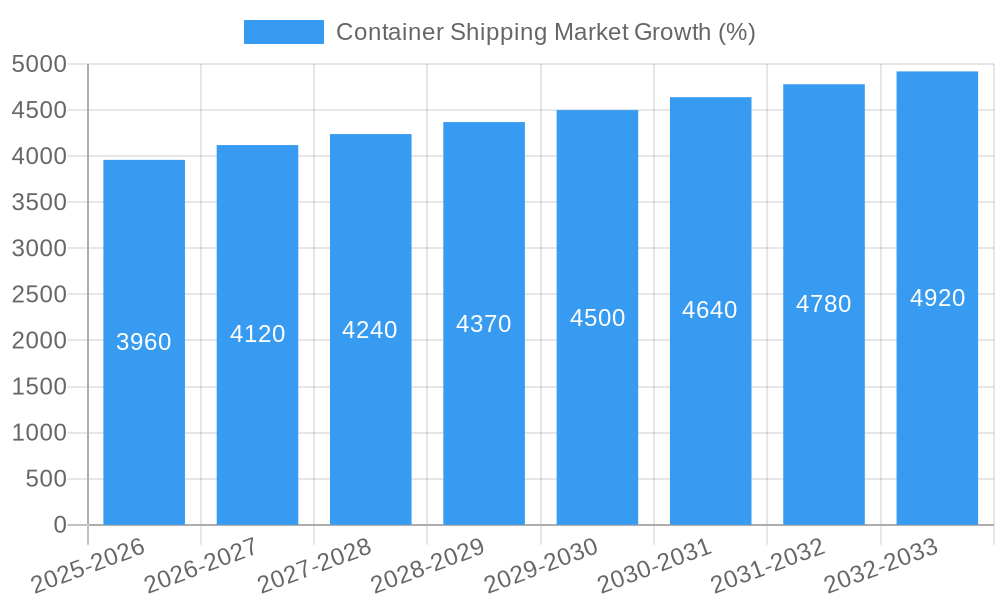

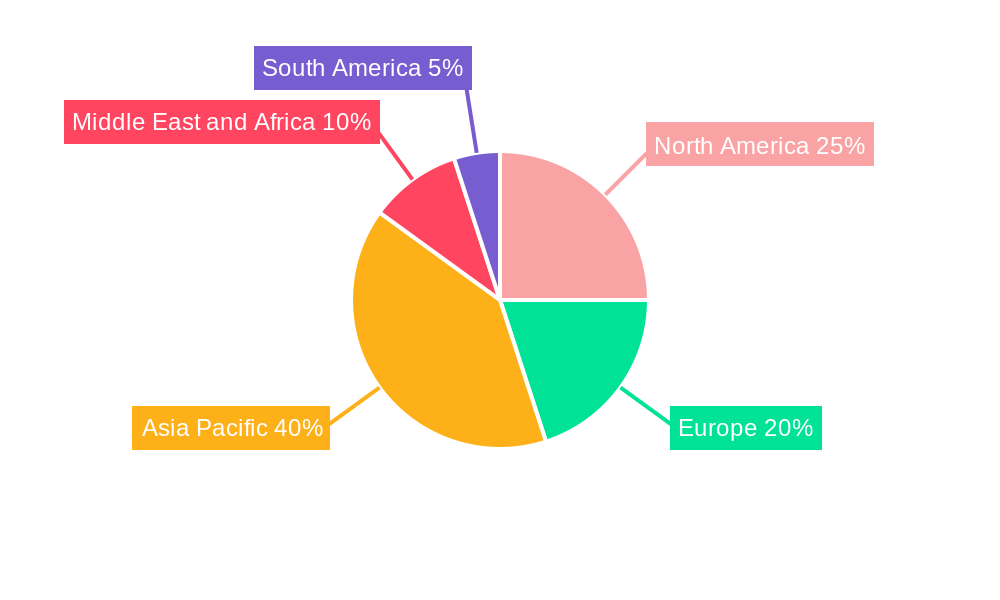

The global container shipping market, valued at $116.04 billion in 2025, is projected to experience steady growth, driven by increasing global trade, the expansion of e-commerce, and the rising demand for efficient logistics solutions. The 3.11% CAGR indicates a consistent upward trajectory throughout the forecast period (2025-2033). Market segmentation reveals significant contributions from both large and high-cube containers, reflecting the need for optimized cargo capacity. Reefer container shipping, catering to perishable goods, is also a key segment experiencing substantial growth fueled by the global demand for fresh produce and temperature-sensitive pharmaceuticals. Major players like Maersk, MSC, and COSCO dominate the market, leveraging their extensive vessel fleets and global network reach. Regional variations are anticipated, with Asia-Pacific, particularly China, expected to maintain a significant market share due to its role as a manufacturing and export hub. North America and Europe are also crucial markets, experiencing substantial growth driven by strong import and export activities. However, challenges such as fluctuating fuel prices, geopolitical instability, and port congestion present potential restraints to market growth. The industry is actively adapting to these challenges through technological advancements, such as improved vessel tracking and optimized port operations, aiming to enhance efficiency and reliability.

The competitive landscape is intensely competitive, with established players continually vying for market dominance. Strategic partnerships, mergers, and acquisitions are likely to shape the market further. Companies are investing heavily in infrastructure development and fleet modernization to meet the growing demand and maintain their competitive edge. The focus on sustainability is also emerging as a key factor, with increased pressure on shipping companies to reduce their carbon footprint and adopt environmentally friendly practices. The market is expected to witness further consolidation as smaller players struggle to compete with the large, integrated logistics providers. The ongoing expansion of global supply chains and increasing trade volumes will continue to drive growth in the container shipping market over the forecast period.

Container Shipping Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global container shipping market, covering market structure, dynamics, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and anyone seeking a detailed understanding of this vital sector of global trade.

Container Shipping Market Structure & Innovation Trends

The container shipping market is characterized by high concentration, with a few major players dominating the landscape. Market share data reveals that AP Moller-Maersk AS, MSC Mediterranean Shipping Company SA, CMA CGM, and COSCO SHIPPING Holdings Co., Ltd. hold a significant portion of the global market. However, smaller players like Wan Hai Lines, ZIM, and ONE (Ocean Network Express) also contribute significantly. Innovation is driven by the need for improved efficiency, sustainability, and digitalization. Regulatory frameworks, such as IMO 2020, are impacting operational strategies and investment decisions. The market witnesses consistent mergers and acquisitions (M&A) activity, aiming to enhance market share and operational efficiencies. Recent deals have involved hundreds of Millions in transaction values, though precise figures are often confidential. Product substitutes, while limited, include alternative transportation methods like air freight and rail, although these often cater to different market segments. The end-user demographic is diverse, encompassing manufacturers, retailers, and importers globally.

- Market Concentration: High, with top 5 players controlling xx% of market share.

- Innovation Drivers: Efficiency gains, sustainability concerns, digitalization.

- Regulatory Frameworks: IMO 2020 and other environmental regulations.

- M&A Activity: Significant, with deals valued in the hundreds of Millions.

- Product Substitutes: Limited, primarily air freight and rail.

- End-User Demographics: Diverse, including manufacturers, retailers, and importers.

Container Shipping Market Dynamics & Trends

The container shipping market exhibits a dynamic interplay of growth drivers, technological disruptions, evolving consumer preferences, and intense competition. The global trade landscape plays a significant role, with fluctuating demand and trade wars having a major impact. Technological advancements, such as autonomous vessels and digitalized supply chain management, are disrupting established processes and fostering new business models. Consumer preferences for faster delivery times and increased transparency are pushing the industry to adopt innovative solutions. The competitive landscape is fierce, characterized by price wars, capacity fluctuations, and alliances. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%, with market penetration rates varying across regions and segments.

Dominant Regions & Segments in Container Shipping Market

Asia, particularly China and East Asia, remain the dominant region for container shipping, driven by robust manufacturing and exports. This dominance is further fueled by extensive port infrastructure and a large consumer base. Other regions such as Europe and North America also contribute significantly.

- By Size: Large containers dominate the market due to cost-efficiency.

- By Type: General container shipping holds the largest market share, though reefer container shipping is experiencing significant growth due to increased demand for perishable goods.

Key Drivers for Dominant Regions:

- Asia (East Asia): Strong manufacturing base, extensive port infrastructure, high export volumes.

- Europe: Developed economies, significant import/export activities, well-established logistics networks.

- North America: Large consumer base, significant imports from Asia.

Dominance Analysis:

Asia's dominance is primarily due to its role as a manufacturing and export hub, driving high demand for container shipping services. The region's extensive port infrastructure and well-established logistics networks further contribute to its leading position. Europe and North America hold significant positions due to substantial import and export activities, but their market shares are comparatively smaller than Asia's.

Container Shipping Market Product Innovations

Recent product innovations focus on enhancing efficiency, sustainability, and security. This includes the development of larger, more efficient container vessels, improved tracking and monitoring technologies, and environmentally friendly fuels and technologies. These advancements aim to optimize logistics, reduce costs, and minimize environmental impact. The successful market fit for these innovations hinges upon their ability to meet evolving industry requirements for efficiency, sustainability, and reliability.

Report Scope & Segmentation Analysis

This report analyzes the container shipping market across various segments:

By Size:

- Small Containers: This segment caters to specific niche markets and exhibits modest growth.

- Large Containers: This segment dominates due to cost efficiency and is expected to grow at xx%.

- High Cube Containers: This segment is growing at a faster rate, catering to the need for increased cargo capacity.

By Type:

- General Container Shipping: This is the largest segment, characterized by high volume and moderate growth.

- Reefer Container Shipping: This segment shows higher growth due to increased demand for perishable goods.

Key Drivers of Container Shipping Market Growth

Growth in the container shipping market is driven by several factors including:

- Global Trade Growth: Increasing globalization fuels demand for efficient freight transport.

- E-commerce Boom: The rise of e-commerce significantly increases demand for faster shipping solutions.

- Technological Advancements: Innovation in ship design, automation, and digitalization improve efficiency and reduce costs.

- Infrastructure Development: Investment in ports and logistics infrastructure supports market expansion.

Challenges in the Container Shipping Market Sector

Several challenges hinder the growth of the container shipping market:

- Geopolitical Instability: Trade wars and regional conflicts disrupt supply chains and reduce trade volumes.

- Fuel Prices: Fluctuations in fuel prices significantly impact operational costs and profitability.

- Port Congestion: Inefficient port operations lead to delays and increased costs.

- Environmental Regulations: Stricter environmental regulations necessitate costly investments in greener technologies.

Emerging Opportunities in Container Shipping Market

Emerging opportunities within the container shipping sector include:

- Digitalization: Implementing advanced technologies to optimize operations, improve efficiency, and enhance transparency.

- Sustainable Shipping: Investing in green technologies and alternative fuels to reduce environmental impact.

- Expansion into New Markets: Serving emerging economies and tapping into new trade routes.

- Specialized Container Services: Catering to specific niche markets with specialized container types and logistics solutions.

Leading Players in the Container Shipping Market Market

- MSC Mediterranean Shipping Company SA

- Evergreen Line

- China COSCO Holdings Company Limited

- Zhonggu Logistics Corp

- CMA CGM

- ONE (Ocean Network Express)

- Zim

- Wan Hai Lines

- SITC

- Antong Holdings (QASC)

- 6 3 Other Companies

- AP Moller-Maersk AS

- Hapag-Lloyd

Key Developments in Container Shipping Market Industry

- January 2024: SITC and Xiamen Port Holdings Group signed a framework agreement to enhance logistics cooperation.

- May 2023: Mazagon Dock Shipbuilders entered the container manufacturing business, receiving an order for 2,500 containers.

- January 2023: AP Moller-Maersk completed its acquisition of Martin Bencher Group, strengthening its project logistics capabilities.

Future Outlook for Container Shipping Market Market

The future of the container shipping market is promising, driven by ongoing globalization, e-commerce growth, and technological innovation. Strategic investments in infrastructure, sustainable solutions, and digitalization will be crucial for success. The market is expected to continue its growth trajectory, presenting significant opportunities for established players and new entrants alike. However, navigating geopolitical uncertainties and environmental regulations will remain critical challenges.

Container Shipping Market Segmentation

-

1. Size

- 1.1. Small Containers

- 1.2. Large Containers

- 1.3. High Cube Containers

-

2. Type

- 2.1. General Container Shipping

- 2.2. Reefer Container Shipping

Container Shipping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Egypt

- 4.2. Qatar

- 4.3. Saudi Arabia

- 4.4. United Arab Emirates

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Colombia

- 5.3. Rest of South America

Container Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. Increasing high cube containers segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Small Containers

- 5.1.2. Large Containers

- 5.1.3. High Cube Containers

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. General Container Shipping

- 5.2.2. Reefer Container Shipping

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Small Containers

- 6.1.2. Large Containers

- 6.1.3. High Cube Containers

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. General Container Shipping

- 6.2.2. Reefer Container Shipping

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Small Containers

- 7.1.2. Large Containers

- 7.1.3. High Cube Containers

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. General Container Shipping

- 7.2.2. Reefer Container Shipping

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Small Containers

- 8.1.2. Large Containers

- 8.1.3. High Cube Containers

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. General Container Shipping

- 8.2.2. Reefer Container Shipping

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Middle East and Africa Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Small Containers

- 9.1.2. Large Containers

- 9.1.3. High Cube Containers

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. General Container Shipping

- 9.2.2. Reefer Container Shipping

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. South America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Small Containers

- 10.1.2. Large Containers

- 10.1.3. High Cube Containers

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. General Container Shipping

- 10.2.2. Reefer Container Shipping

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. North America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 France

- 12.1.3 United Kingdom

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Australia

- 13.1.4 India

- 13.1.5 Singapore

- 13.1.6 Malaysia

- 13.1.7 Indonesia

- 13.1.8 Thailand

- 13.1.9 Rest of Asia Pacific

- 14. Middle East and Africa Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Egypt

- 14.1.2 Qatar

- 14.1.3 Saudi Arabia

- 14.1.4 United Arab Emirates

- 14.1.5 South Africa

- 14.1.6 Rest of Middle East and Africa

- 15. South America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Colombia

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MSC Mediterranean Shipping Company SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Evergreen Line

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 China COSCO Holdings Company Limited

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Zhonggu Logistics Corp

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 CMA CGM

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 ONE (Ocean Network Express)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Zim

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Wan Hai Lines

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SITC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Antong Holdings (QASC)**List Not Exhaustive 6 3 Other Companie

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 AP Moller-Maersk AS

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Hapag-Lloyd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 MSC Mediterranean Shipping Company SA

List of Figures

- Figure 1: Global Container Shipping Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 13: North America Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 14: North America Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 19: Europe Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 20: Europe Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 25: Asia Pacific Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 26: Asia Pacific Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 31: Middle East and Africa Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 32: Middle East and Africa Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East and Africa Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East and Africa Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 37: South America Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 38: South America Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 39: South America Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: South America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Container Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 3: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Container Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Malaysia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Indonesia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Thailand Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Egypt Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Qatar Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Arab Emirates Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Colombia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of South America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 38: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of North America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 45: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Germany Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: United Kingdom Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 53: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: China Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Australia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Singapore Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Malaysia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Indonesia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Thailand Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 65: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Egypt Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Qatar Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Saudi Arabia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: United Arab Emirates Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: South Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of Middle East and Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 74: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 75: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Colombia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Shipping Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the Container Shipping Market?

Key companies in the market include MSC Mediterranean Shipping Company SA, Evergreen Line, China COSCO Holdings Company Limited, Zhonggu Logistics Corp, CMA CGM, ONE (Ocean Network Express), Zim, Wan Hai Lines, SITC, Antong Holdings (QASC)**List Not Exhaustive 6 3 Other Companie, AP Moller-Maersk AS, Hapag-Lloyd.

3. What are the main segments of the Container Shipping Market?

The market segments include Size, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

Increasing high cube containers segment.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

January 2024: SITC signed a framework agreement with Xiamen Port Holdings Group on January 2024, aiming to boost logistics jointly. Headquartered in Hong Kong, SITC is an intra-Asia shipping logistics company. The new agreement will see the two parties focus their cooperation on route network layout, international transit, complete logistics service chain, cross-border e-commerce, hinterland cargo source expansion, port intelligence, and digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Container Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Container Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Container Shipping Market?

To stay informed about further developments, trends, and reports in the Container Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence