Key Insights

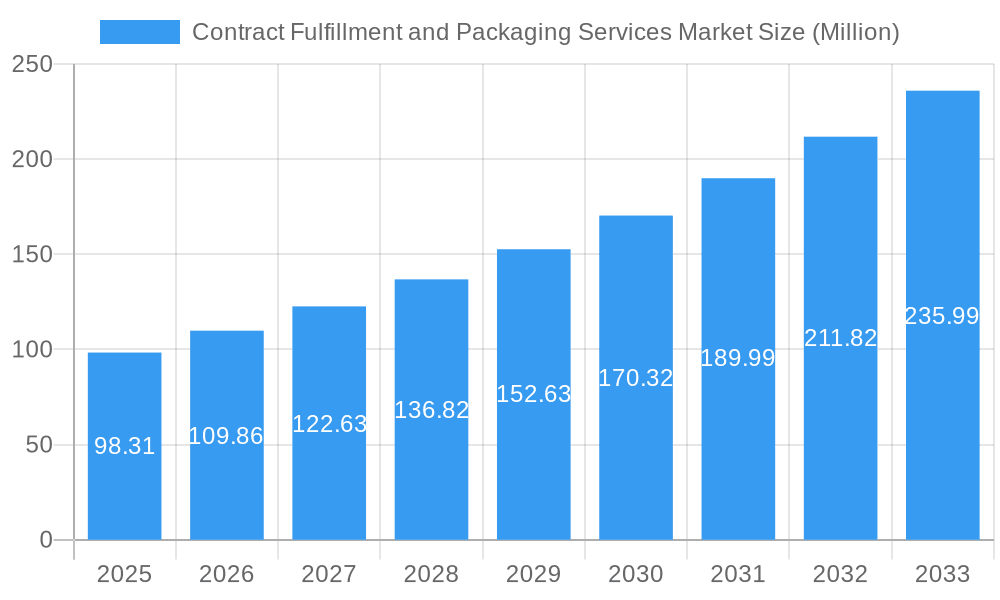

The Contract Fulfillment and Packaging Services market is experiencing robust growth, projected to reach a market size of $98.31 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 11.43%. This growth is fueled by several key factors. The increasing demand for e-commerce and the rise of direct-to-consumer (DTC) brands necessitate efficient and reliable fulfillment and packaging solutions. Consumers expect fast and damage-free deliveries, driving the need for sophisticated warehousing, inventory management, and packaging technologies. Furthermore, the pharmaceutical and food and beverage sectors, with their stringent regulatory requirements and complex supply chains, are major contributors to market growth, relying heavily on specialized contract packaging services to ensure product quality and safety. The diverse service offerings, including packaging design and prototyping, contract packing (encompassing bottling, filling, labeling, and wrapping), package testing, and warehousing and fulfillment, cater to a wide range of industry needs, further propelling market expansion.

Contract Fulfillment and Packaging Services Market Market Size (In Million)

Significant market trends include the growing adoption of automation and robotics in fulfillment centers to improve efficiency and reduce operational costs. Sustainable packaging solutions are gaining traction, driven by increasing environmental concerns and consumer demand for eco-friendly products. The rise of omnichannel retail strategies also necessitates flexible and scalable fulfillment solutions that can adapt to changing consumer expectations and distribution channels. However, challenges remain, including fluctuations in raw material costs, labor shortages, and the complexities of managing global supply chains. Nevertheless, the overall outlook for the Contract Fulfillment and Packaging Services market remains positive, with continued growth expected throughout the forecast period (2025-2033), driven by the ongoing expansion of e-commerce, the increasing demand for specialized packaging solutions, and the continuous evolution of logistics and supply chain management practices.

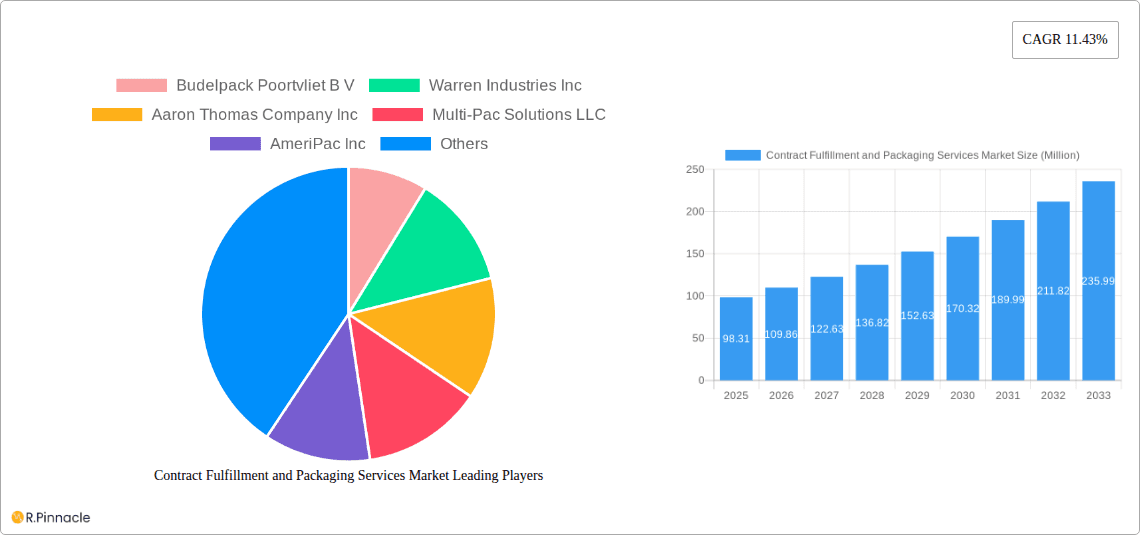

Contract Fulfillment and Packaging Services Market Company Market Share

Contract Fulfillment and Packaging Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Contract Fulfillment and Packaging Services market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers actionable intelligence on market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive research and data analysis to paint a clear picture of this evolving market landscape. With a projected market value reaching xx Million by 2033, understanding the intricacies of this sector is critical for sustained success.

Contract Fulfillment and Packaging Services Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Contract Fulfillment and Packaging Services market. The market exhibits a moderately fragmented structure with several key players holding significant but not dominant market shares. Market concentration is assessed using the Herfindahl-Hirschman Index (HHI), revealing a score of xx, indicating a moderately competitive market.

Key Aspects Analyzed:

- Market Share Analysis: Leading players like Budelpack Poortvliet B.V., Warren Industries Inc., and Sonoco Products Company hold significant but not dominant shares, with xx% combined market share in 2025.

- Innovation Drivers: Technological advancements in automation, packaging materials, and supply chain management are driving innovation, with a focus on sustainable and efficient solutions.

- Regulatory Frameworks: Compliance with food safety regulations (e.g., FDA, EU regulations) and environmental standards (e.g., reducing plastic waste) significantly influence market dynamics.

- Product Substitutes: The emergence of alternative packaging solutions and e-commerce fulfillment models creates competitive pressures.

- End-User Demographics: Growing demand from the food and beverage, pharmaceutical, and household & personal care sectors fuels market expansion. These sectors are analyzed in detail in subsequent sections.

- M&A Activities: The report includes an analysis of recent mergers and acquisitions, highlighting deal values and their impact on market consolidation. In 2024, the total value of M&A deals in this sector was estimated at xx Million.

Contract Fulfillment and Packaging Services Market Dynamics & Trends

The Contract Fulfillment and Packaging Services market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%, indicating a significant expansion. This growth is fueled by several factors:

- E-commerce Boom: The surge in online shopping necessitates efficient fulfillment and packaging solutions, boosting market demand.

- Supply Chain Optimization: Companies are increasingly outsourcing fulfillment and packaging to streamline operations and reduce costs.

- Technological Advancements: Automation and advanced technologies are improving efficiency and reducing operational costs. Market penetration of automation in contract packaging is estimated at xx% in 2025.

- Growing Demand for Customized Packaging: Consumers increasingly expect personalized and sustainable packaging, driving demand for innovative solutions.

- Competitive Dynamics: Intense competition among providers is leading to innovation, price optimization, and improved service offerings.

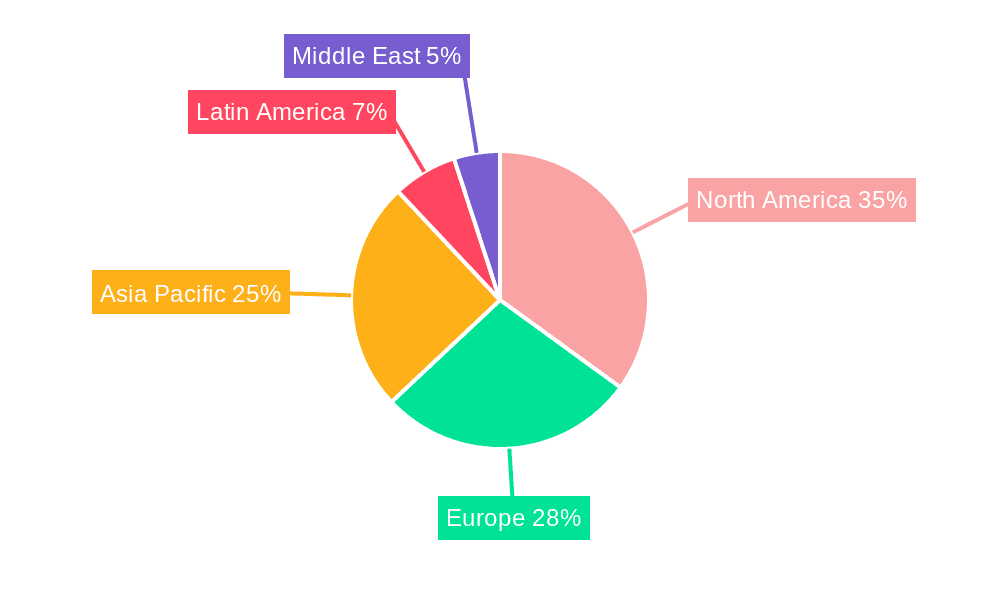

Dominant Regions & Segments in Contract Fulfillment and Packaging Services Market

North America currently holds the largest market share, driven by robust e-commerce growth and established logistics infrastructure. However, the Asia-Pacific region is anticipated to exhibit significant growth over the forecast period due to rapid economic development and increasing consumer spending.

Leading Segments:

- Service Type: Contract packing (bottling/filling, packaging, labeling, wrapping, etc.) dominates the market due to high demand from various industries.

- End-user Type: The pharmaceutical and food & beverage sectors are the largest consumers of contract fulfillment and packaging services, driven by stringent quality and regulatory requirements.

Key Drivers:

- North America: Strong e-commerce growth, established logistics infrastructure, and high disposable incomes.

- Europe: Stringent regulatory frameworks and a focus on sustainability drive innovation and market growth.

- Asia-Pacific: Rapid economic expansion, rising consumer spending, and increasing manufacturing activity.

Contract Fulfillment and Packaging Services Market Product Innovations

Recent innovations focus on sustainable packaging materials (e.g., biodegradable plastics, recycled content), automated packaging lines, and intelligent packaging solutions (e.g., RFID tagging for improved traceability). These advancements enhance efficiency, reduce costs, and improve sustainability, aligning with the evolving preferences of both businesses and consumers.

Report Scope & Segmentation Analysis

This report segments the market by service type (Packaging Design & Prototyping, Contract Packing, Package Testing, Warehousing and Fulfillment, Other Service Types) and end-user type (Food, Beverage, Pharmaceutical, Household & Personal Care, Other End-user Segments). Each segment's market size, growth projections, and competitive dynamics are analyzed. For example, the Contract Packing segment is expected to witness a CAGR of xx% during the forecast period, driven by its high demand across industries. Similarly, the Pharmaceutical end-user segment displays strong growth due to stringent regulatory compliance and the need for specialized packaging.

Key Drivers of Contract Fulfillment and Packaging Services Market Growth

Growth is primarily driven by the expansion of e-commerce, the rising demand for customized packaging, advancements in automation technologies, and the increasing need for efficient supply chain management. Government regulations promoting sustainable packaging practices also play a significant role.

Challenges in the Contract Fulfillment and Packaging Services Market Sector

Key challenges include fluctuating raw material prices, stringent regulatory compliance requirements, intense competition, and the need to manage complex supply chains. These factors can impact profitability and operational efficiency. Supply chain disruptions caused a xx% decrease in market growth in 2022, according to our analysis.

Emerging Opportunities in Contract Fulfillment and Packaging Services Market

Opportunities lie in developing sustainable packaging solutions, integrating advanced automation technologies, expanding into emerging markets, and providing customized fulfillment solutions tailored to specific end-user needs. The rising demand for personalized and sustainable packaging presents significant potential for growth.

Leading Players in the Contract Fulfillment and Packaging Services Market Market

- Budelpack Poortvliet B V

- Warren Industries Inc

- Aaron Thomas Company Inc

- Multi-Pac Solutions LLC

- AmeriPac Inc

- FW Logistics

- Assemblies Unlimited Inc

- ActionPak Inc

- Boughey Distribution Ltd

- Kane Logistics

- Sharp (UDG Healthcare plc)

- PAC Worldwide Inc

- Sonoco Products Company

- Wasdell Packaging Group

- Swan Packaging Fulfillment Inc

Key Developments in Contract Fulfillment and Packaging Services Market Industry

- January 2023: Sonoco Products Company launched a new line of sustainable packaging solutions.

- June 2022: A major merger between two contract packing companies resulted in a significant increase in market share for the combined entity. (Further details are provided in the full report.)

(Additional key developments will be included in the complete report.)

Future Outlook for Contract Fulfillment and Packaging Services Market Market

The Contract Fulfillment and Packaging Services market is poised for continued growth, driven by several factors. Technological advancements, the rise of e-commerce, and growing demand for sustainable packaging solutions will significantly shape future market dynamics. Companies that effectively adapt to these trends and offer innovative solutions will capture a larger share of the market. The market is expected to reach xx Million by 2033, presenting considerable opportunities for both established players and new entrants.

Contract Fulfillment and Packaging Services Market Segmentation

-

1. Service Type

- 1.1. Packaging Design & Prototyping

- 1.2. Contract

- 1.3. Package Testing

- 1.4. Warehousing and Fulfilment

- 1.5. Other Service Types

-

2. End-user Type

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Household & Personal Care

- 2.5. Other End-user Segments

Contract Fulfillment and Packaging Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Contract Fulfillment and Packaging Services Market Regional Market Share

Geographic Coverage of Contract Fulfillment and Packaging Services Market

Contract Fulfillment and Packaging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Steady Demand from Key Verticals

- 3.2.2 such as the Food and Beverage Sector; Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation

- 3.3. Market Restrains

- 3.3.1. ; Stringent Government Regulations; Competition from In-house Packaging

- 3.4. Market Trends

- 3.4.1. Contract Packing is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Packaging Design & Prototyping

- 5.1.2. Contract

- 5.1.3. Package Testing

- 5.1.4. Warehousing and Fulfilment

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Household & Personal Care

- 5.2.5. Other End-user Segments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Packaging Design & Prototyping

- 6.1.2. Contract

- 6.1.3. Package Testing

- 6.1.4. Warehousing and Fulfilment

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Type

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Household & Personal Care

- 6.2.5. Other End-user Segments

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Packaging Design & Prototyping

- 7.1.2. Contract

- 7.1.3. Package Testing

- 7.1.4. Warehousing and Fulfilment

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Type

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Household & Personal Care

- 7.2.5. Other End-user Segments

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Packaging Design & Prototyping

- 8.1.2. Contract

- 8.1.3. Package Testing

- 8.1.4. Warehousing and Fulfilment

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Type

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Household & Personal Care

- 8.2.5. Other End-user Segments

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Packaging Design & Prototyping

- 9.1.2. Contract

- 9.1.3. Package Testing

- 9.1.4. Warehousing and Fulfilment

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Type

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Household & Personal Care

- 9.2.5. Other End-user Segments

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Packaging Design & Prototyping

- 10.1.2. Contract

- 10.1.3. Package Testing

- 10.1.4. Warehousing and Fulfilment

- 10.1.5. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Type

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Household & Personal Care

- 10.2.5. Other End-user Segments

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Budelpack Poortvliet B V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Warren Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aaron Thomas Company Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Multi-Pac Solutions LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AmeriPac Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FW Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Assemblies Unlimited Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ActionPak Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boughey Distribution Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kane Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sharp (UDG Healthcare plc)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PAC Worldwide Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sonoco Products Company*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wasdell Packaging Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Swan Packaging Fulfillment Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Budelpack Poortvliet B V

List of Figures

- Figure 1: Global Contract Fulfillment and Packaging Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 5: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 6: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 11: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 12: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 17: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 18: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 29: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 30: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 3: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 9: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 15: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 18: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Fulfillment and Packaging Services Market?

The projected CAGR is approximately 11.43%.

2. Which companies are prominent players in the Contract Fulfillment and Packaging Services Market?

Key companies in the market include Budelpack Poortvliet B V, Warren Industries Inc, Aaron Thomas Company Inc, Multi-Pac Solutions LLC, AmeriPac Inc, FW Logistics, Assemblies Unlimited Inc, ActionPak Inc, Boughey Distribution Ltd, Kane Logistics, Sharp (UDG Healthcare plc), PAC Worldwide Inc, Sonoco Products Company*List Not Exhaustive, Wasdell Packaging Group, Swan Packaging Fulfillment Inc.

3. What are the main segments of the Contract Fulfillment and Packaging Services Market?

The market segments include Service Type , End-user Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 98.31 Million as of 2022.

5. What are some drivers contributing to market growth?

; Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Steady Demand from Key Verticals. such as the Food and Beverage Sector; Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation.

6. What are the notable trends driving market growth?

Contract Packing is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Stringent Government Regulations; Competition from In-house Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Fulfillment and Packaging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Fulfillment and Packaging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Fulfillment and Packaging Services Market?

To stay informed about further developments, trends, and reports in the Contract Fulfillment and Packaging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence