Key Insights

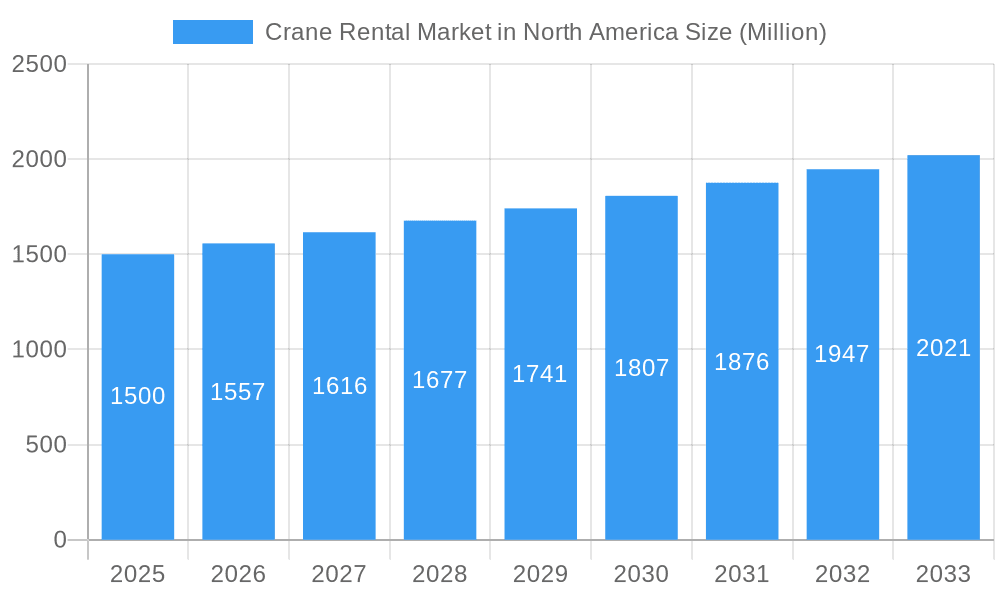

The North American crane rental market, projected to reach 50.54 billion by 2025, is anticipated to grow at a robust CAGR of 6.1% through 2033. This expansion is primarily driven by significant investments in infrastructure development and commercial projects across the United States and Canada. The increasing complexity of modern construction mandates the use of specialized cranes, escalating demand for diverse equipment including mobile, truck-mounted, and application-specific cranes for mining and offshore operations. Government initiatives supporting infrastructure spending further bolster market growth. While factors like fluctuating fuel prices and construction cycle volatility present potential challenges, the strong outlook for infrastructure and industrial activity in North America is expected to mitigate these risks. The market is segmented by crane type (e.g., wheel-mounted, truck-mounted), application (construction, mining, marine, industrial), and geography (United States, Canada). Key industry players, including Maxim Crane Works, Lampson International, and United Rentals, are actively influencing market trends through service enhancements, fleet expansion, and technological innovations. Growth is expected to be most pronounced in the United States, attributed to its extensive infrastructure projects and construction volume, with Canada showing consistent growth fueled by ongoing investments in infrastructure and resource extraction.

Crane Rental Market in North America Market Size (In Billion)

The competitive environment features both established enterprises and regional specialists, characterized by intense rivalry in pricing, service quality, equipment availability, and geographic reach. Strategic acquisitions, fleet modernization, and technological integration are central to companies' efforts to expand market share. The adoption of advanced technologies, such as telematics and remote monitoring, is enhancing operational efficiency and safety, contributing to overall market expansion. Sustained infrastructure investment, advancements in crane rental technology, and the overall health of the construction and industrial sectors will shape future growth trajectories. A thorough understanding of these dynamics is essential for businesses to capitalize on emerging opportunities and navigate market challenges effectively.

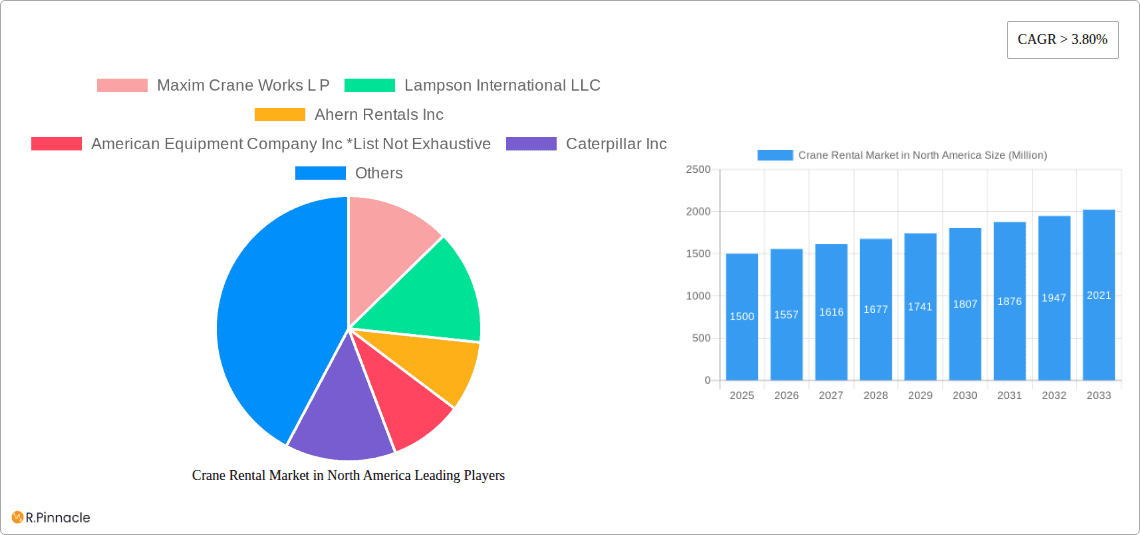

Crane Rental Market in North America Company Market Share

North American Crane Rental Market Analysis: Forecast 2019-2033

This comprehensive report delivers in-depth analysis of the North American crane rental market, providing crucial insights for industry professionals, investors, and strategic stakeholders. The study encompasses the period from 2019 to 2033, with 2025 serving as the base year and the forecast extending to 2033. Leveraging rigorous data analysis and expert perspectives, this report offers a clear overview of market dynamics, growth drivers, challenges, and future prospects. The market size is projected to reach significant value by 2033.

Crane Rental Market in North America Market Structure & Innovation Trends

This section delves into the structural elements and innovative forces shaping the North American crane rental market. We analyze market concentration, identifying key players and their respective market shares. The report also explores innovation drivers, including technological advancements and evolving customer needs, alongside regulatory frameworks and their impact. A detailed examination of product substitutes and their competitive threat is also included, coupled with an in-depth look at end-user demographics and their rental preferences. Finally, the report analyzes significant mergers and acquisitions (M&A) activities, quantifying deal values and assessing their influence on market consolidation. Key players such as Maxim Crane Works LP, Lampson International LLC, Ahern Rentals Inc, and United Rentals Inc. are examined for their market share and strategic moves.

- Market Concentration: The North American crane rental market exhibits a moderately concentrated structure, with a few major players holding significant market share. Precise figures for market share are detailed within the full report.

- M&A Activity: Recent years have witnessed considerable M&A activity, with deals such as the February 2022 acquisition of Capital City Group, Inc. by Bay Crane Companies, Inc., significantly altering the competitive landscape. The report quantifies the value of significant M&A deals and analyzes their impact on market dynamics. For example, the xx Million acquisition of Capital City Group by Bay Crane illustrates a trend toward consolidation.

Crane Rental Market in North America Market Dynamics & Trends

This section provides a detailed analysis of the market's dynamic evolution. We explore key growth drivers, such as infrastructure development and industrial expansion, analyzing their impact on market expansion. The report further examines technological disruptions, including the adoption of advanced crane technologies and digitalization within the industry. Consumer preferences and their shift towards specialized rental services are also addressed. Furthermore, the report delves into competitive dynamics, including pricing strategies, service offerings, and geographic expansion initiatives. The compound annual growth rate (CAGR) and market penetration rates are provided with detailed analysis.

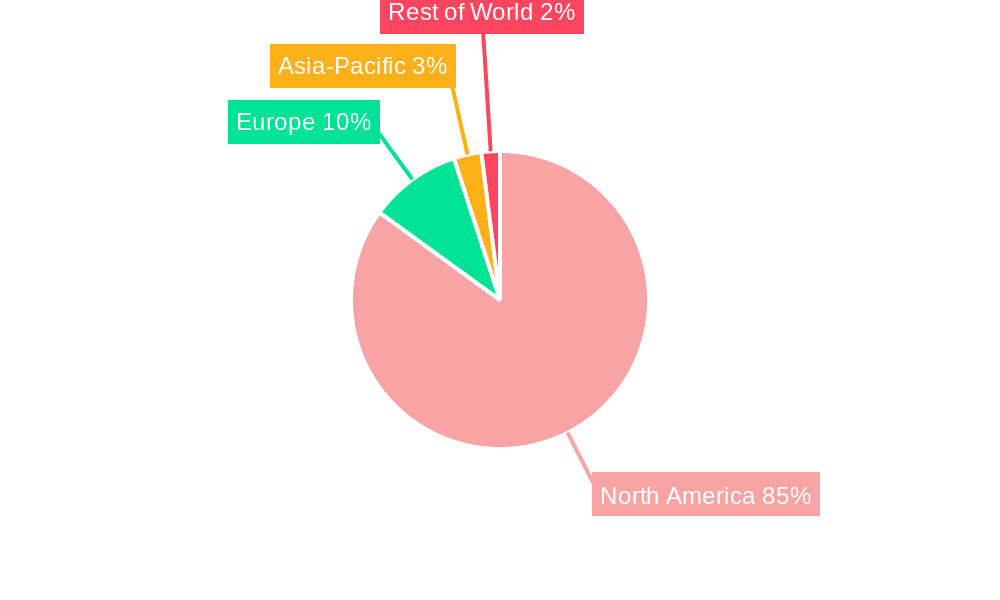

Dominant Regions & Segments in Crane Rental Market in North America

This section identifies the leading regions and segments within the North American crane rental market.

By Country: The United States dominates the market due to its large construction and infrastructure projects. Canada follows as a significant market, while the "Rest of North America" segment represents a smaller but growing market.

By Crane Type: Wheel-mounted mobile cranes command the largest share of the market due to their versatility and applicability across diverse projects. The demand for commercial truck-mounted cranes is also significant, driven by smaller-scale construction and maintenance work.

By Application Type: The construction sector is the primary driver of demand for crane rental services, followed by mining & excavation, marine & offshore, and industrial applications. The report provides detailed breakdown and analysis of the market share of each segment. Key drivers, such as government infrastructure spending, economic growth, and mining activities, are analyzed for their impact on each segment.

The dominance of each region and segment is meticulously analyzed in the full report, considering economic policies, infrastructure development, and other relevant factors.

Crane Rental Market in North America Product Innovations

The crane rental market witnesses continuous product innovation, driven by the need for enhanced safety, efficiency, and precision. Technological advancements such as advanced control systems, remote operation capabilities, and improved load-handling technologies are reshaping the industry. These innovations enhance operational efficiency, reduce downtime, and improve safety measures, which directly increases their market fit and competitive advantage.

Report Scope & Segmentation Analysis

The report provides a granular segmentation of the North American crane rental market across three key dimensions: country (United States, Canada, Rest of North America), crane type (wheel-mounted mobile crane, commercial truck-mounted crane, side boom, straddle crane, railroad crane, others), and application type (construction, mining & excavation, marine & offshore, industrial applications). Each segment's growth projections, market size, and competitive dynamics are detailed. The report projects significant growth for the wheel-mounted mobile crane segment, driven by the increase in infrastructure projects, while the construction application type segment remains dominant due to persistent high demand.

Key Drivers of Crane Rental Market in North America Growth

Several factors propel the growth of the North American crane rental market. These include robust infrastructure development initiatives, increasing construction activity across various sectors, growing demand for heavy lifting equipment in industrial and energy sectors, and favorable government policies promoting infrastructure investment. Technological advancements in crane design and operation further enhance efficiency and safety, fueling market growth.

Challenges in the Crane Rental Market in North America Sector

The crane rental market faces challenges including stringent safety regulations, fluctuating fuel prices impacting operational costs, intense competition among rental providers, and potential supply chain disruptions affecting equipment availability. These factors can impact profitability and market expansion.

Emerging Opportunities in Crane Rental Market in North America

Emerging opportunities lie in the adoption of advanced technologies like automation and remote operations, expansion into niche markets such as renewable energy and specialized construction projects, and the increasing demand for sustainable and environmentally friendly crane solutions.

Leading Players in the Crane Rental Market in North America Market

- Maxim Crane Works L P

- Lampson International LLC

- Ahern Rentals Inc

- American Equipment Company Inc

- Caterpillar Inc

- All Erection & Crane Rental Corp

- Buckner HeavyLift Cranes

- United Rentals Inc

Key Developments in Crane Rental Market in North America Industry

- July 2021: Maxim Crane purchased 51 Grove mobile cranes, strengthening its fleet and expanding its market reach.

- February 2022: Capital City Group, Inc. was acquired by Bay Crane Companies, Inc., consolidating market share in the northeastern United States.

Future Outlook for Crane Rental Market in North America Market

The future of the North American crane rental market appears promising, driven by sustained infrastructure development, industrial growth, and technological innovations. Strategic partnerships, expansion into new markets, and the adoption of advanced technologies will be key to success. The market is poised for continued growth, presenting significant opportunities for both established players and new entrants.

Crane Rental Market in North America Segmentation

-

1. Crane Type

- 1.1. Wheel-mounted Mobile Crane

- 1.2. Commercial Truck-mounted Crane

- 1.3. Side Boom

- 1.4. Straddle Crane

- 1.5. Railroad Crane

- 1.6. Others

-

2. Application Type

- 2.1. Construction

- 2.2. Mining & Excavation

- 2.3. Marine & Offshore

- 2.4. Industrial Applications

Crane Rental Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Crane Rental Market in North America Regional Market Share

Geographic Coverage of Crane Rental Market in North America

Crane Rental Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. Construction Activities to Elevate Crane Rental Services in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crane Type

- 5.1.1. Wheel-mounted Mobile Crane

- 5.1.2. Commercial Truck-mounted Crane

- 5.1.3. Side Boom

- 5.1.4. Straddle Crane

- 5.1.5. Railroad Crane

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Construction

- 5.2.2. Mining & Excavation

- 5.2.3. Marine & Offshore

- 5.2.4. Industrial Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Crane Type

- 6. North America Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Crane Type

- 6.1.1. Wheel-mounted Mobile Crane

- 6.1.2. Commercial Truck-mounted Crane

- 6.1.3. Side Boom

- 6.1.4. Straddle Crane

- 6.1.5. Railroad Crane

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Construction

- 6.2.2. Mining & Excavation

- 6.2.3. Marine & Offshore

- 6.2.4. Industrial Applications

- 6.1. Market Analysis, Insights and Forecast - by Crane Type

- 7. South America Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Crane Type

- 7.1.1. Wheel-mounted Mobile Crane

- 7.1.2. Commercial Truck-mounted Crane

- 7.1.3. Side Boom

- 7.1.4. Straddle Crane

- 7.1.5. Railroad Crane

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Construction

- 7.2.2. Mining & Excavation

- 7.2.3. Marine & Offshore

- 7.2.4. Industrial Applications

- 7.1. Market Analysis, Insights and Forecast - by Crane Type

- 8. Europe Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Crane Type

- 8.1.1. Wheel-mounted Mobile Crane

- 8.1.2. Commercial Truck-mounted Crane

- 8.1.3. Side Boom

- 8.1.4. Straddle Crane

- 8.1.5. Railroad Crane

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Construction

- 8.2.2. Mining & Excavation

- 8.2.3. Marine & Offshore

- 8.2.4. Industrial Applications

- 8.1. Market Analysis, Insights and Forecast - by Crane Type

- 9. Middle East & Africa Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Crane Type

- 9.1.1. Wheel-mounted Mobile Crane

- 9.1.2. Commercial Truck-mounted Crane

- 9.1.3. Side Boom

- 9.1.4. Straddle Crane

- 9.1.5. Railroad Crane

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Construction

- 9.2.2. Mining & Excavation

- 9.2.3. Marine & Offshore

- 9.2.4. Industrial Applications

- 9.1. Market Analysis, Insights and Forecast - by Crane Type

- 10. Asia Pacific Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Crane Type

- 10.1.1. Wheel-mounted Mobile Crane

- 10.1.2. Commercial Truck-mounted Crane

- 10.1.3. Side Boom

- 10.1.4. Straddle Crane

- 10.1.5. Railroad Crane

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Construction

- 10.2.2. Mining & Excavation

- 10.2.3. Marine & Offshore

- 10.2.4. Industrial Applications

- 10.1. Market Analysis, Insights and Forecast - by Crane Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Maxim Crane Works L P

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lampson International LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ahern Rentals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Equipment Company Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Caterpillar Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 All Erection & Crane Rental Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Buckner HeavyLift Cranes

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 United Rentals Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Maxim Crane Works L P

List of Figures

- Figure 1: Global Crane Rental Market in North America Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 3: North America Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 4: North America Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 5: North America Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 9: South America Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 10: South America Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 11: South America Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 15: Europe Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 16: Europe Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 17: Europe Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 21: Middle East & Africa Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 22: Middle East & Africa Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 27: Asia Pacific Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 28: Asia Pacific Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Asia Pacific Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 2: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Global Crane Rental Market in North America Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 5: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 11: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 17: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 29: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 30: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 38: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 39: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crane Rental Market in North America?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Crane Rental Market in North America?

Key companies in the market include Maxim Crane Works L P, Lampson International LLC, Ahern Rentals Inc, American Equipment Company Inc *List Not Exhaustive, Caterpillar Inc, All Erection & Crane Rental Corp, Buckner HeavyLift Cranes, United Rentals Inc.

3. What are the main segments of the Crane Rental Market in North America?

The market segments include Crane Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

Construction Activities to Elevate Crane Rental Services in North America.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

In February 2022, Capital City Group, Inc. has been acquired by The Bay Crane Companies, Inc., the leading specialist crane and rigging equipment service and rental provider in the northeastern United States. As a result of the deal, Bay Crane now has 15 full-service facilities and is among the top 10 crane service providers in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crane Rental Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crane Rental Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crane Rental Market in North America?

To stay informed about further developments, trends, and reports in the Crane Rental Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence