Key Insights

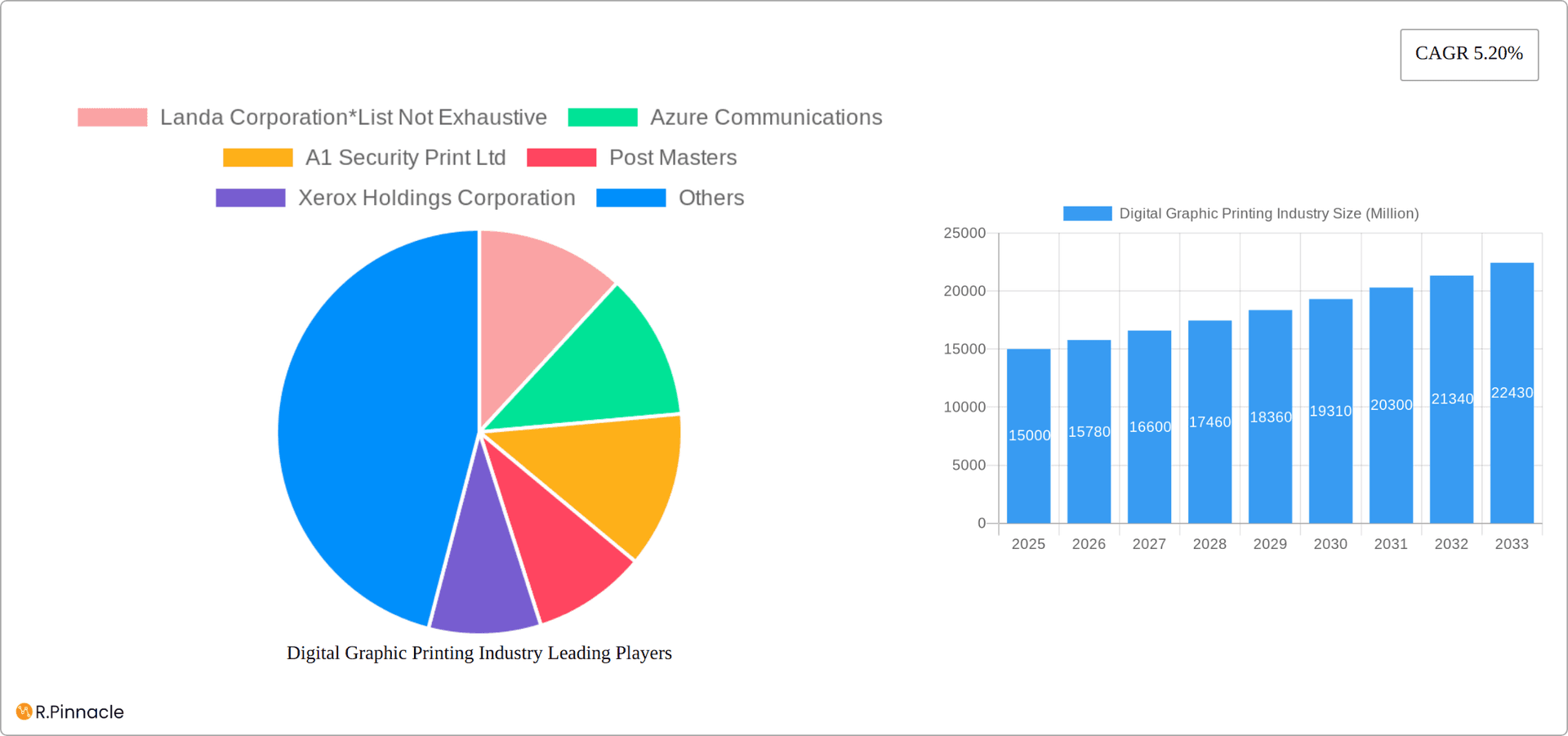

The digital graphic printing market is poised for substantial growth, projected to reach $14.9 billion by 2025, with a CAGR of 1.7%. Key drivers include the expanding e-commerce landscape and the demand for personalized marketing, significantly boosting the advertising print segment with a need for high-quality, on-demand solutions. Transactional printing, essential for business processes, and security printing, driven by increasing security concerns, remain vital segments. While general commercial printing continues to contribute, technological advancements in inkjet and electrophotography are enhancing print quality, speed, and cost-efficiency, further propelling market expansion.

Digital Graphic Printing Industry Market Size (In Billion)

North America and Europe currently lead in market share due to established infrastructure and high adoption. However, the Asia-Pacific region presents the most rapid expansion opportunities, fueled by economic growth and a rising middle class in China and India. Despite challenges like fluctuating raw material costs and competition, the market outlook is positive. Leading companies are investing in R&D for innovative solutions. The market segmentation by printing process (inkjet, electrophotography) and application (advertising, transactional, security, general commercial) offers diverse opportunities. The forecast period of 2025-2033 indicates continued significant market expansion across all segments and regions.

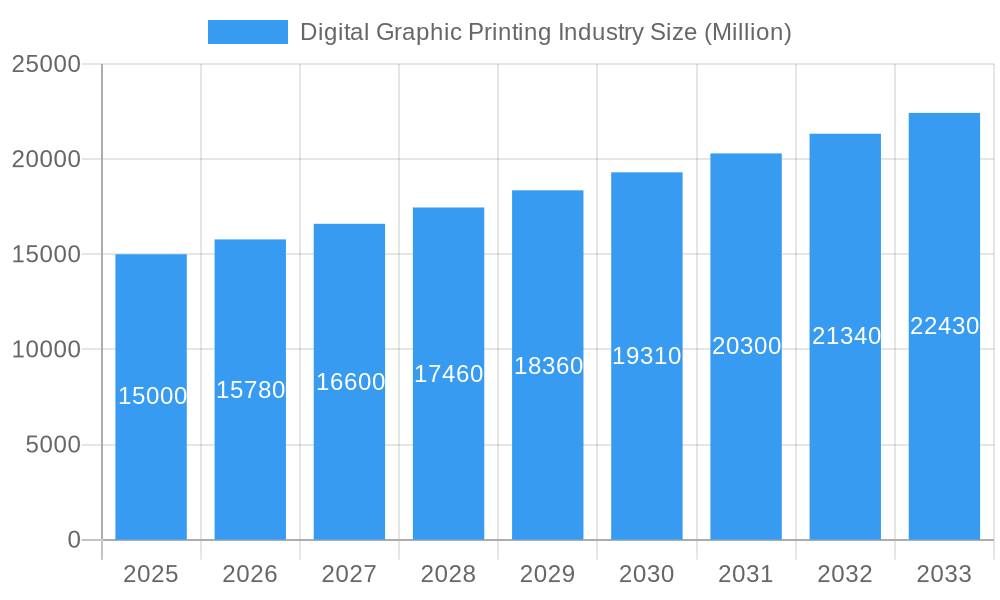

Digital Graphic Printing Industry Company Market Share

Digital Graphic Printing Industry Report: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Digital Graphic Printing industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Digital Graphic Printing Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Digital Graphic Printing industry, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. The industry exhibits a moderately concentrated structure, with key players holding significant market share. For instance, Xerox Holdings Corporation and Landa Corporation hold an estimated xx% and xx% market share, respectively, as of 2025 (estimated).

- Market Concentration: Moderate, with key players holding significant share.

- Innovation Drivers: Advancements in inkjet and electrophotography technologies, demand for personalized print, and increasing security printing needs.

- Regulatory Frameworks: Vary by region, impacting material sourcing and environmental regulations.

- Product Substitutes: Digital signage, online advertising, and other digital communication channels.

- End-User Demographics: Businesses across diverse sectors, including advertising, transactional, and security printing.

- M&A Activities: Significant M&A activity observed in the historical period (2019-2024), with deal values totaling an estimated xx Million. Examples include [insert specific examples of M&A deals if available, otherwise use "strategic acquisitions by major players to expand market reach and technological capabilities"].

Digital Graphic Printing Industry Market Dynamics & Trends

This section delves into the market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Digital Graphic Printing industry. The market is driven by factors such as increasing demand for personalized marketing materials, the growth of e-commerce necessitating improved transactional printing, and the rise of sophisticated security features for sensitive documents. Technological disruptions, such as the advancement of inkjet printing technology and the increasing adoption of automation, are reshaping the industry. Consumer preferences are shifting towards faster turnaround times, greater customization options, and sustainable printing solutions. Competitive dynamics are marked by intense competition among established players and the emergence of new entrants offering innovative solutions.

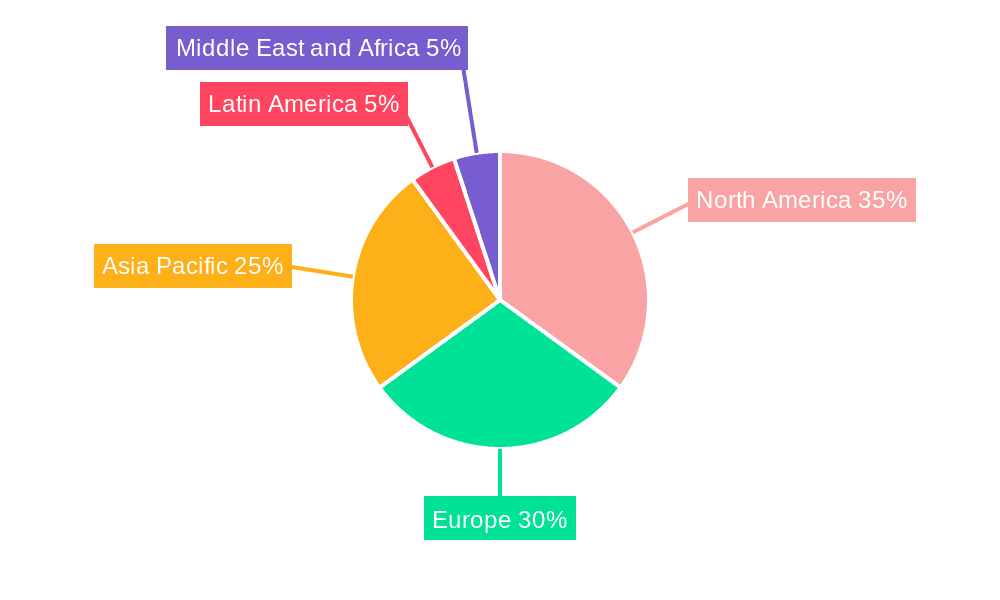

Dominant Regions & Segments in Digital Graphic Printing Industry

The digital graphic printing market is a dynamic landscape shaped by geographical variations and specialized applications. North America currently holds the largest market share, fueled by high disposable income, advanced infrastructure, and a well-established printing industry. However, the Asia-Pacific region is poised for the most rapid growth, driven by factors such as rapid urbanization, burgeoning economies, and a rising demand for personalized marketing and transactional materials. This disparity highlights the diverse opportunities and challenges present across different regions.

- Leading Region (2025 Estimate): North America, benefiting from its mature market and technological advancements.

- Fastest-Growing Region (Projected): Asia-Pacific, experiencing explosive growth due to economic expansion and increased consumer demand.

- Dominant Printing Process: Inkjet technology continues its ascent, prized for its versatility, high-quality output, and ability to handle diverse substrates. Electrophotography remains significant, particularly in high-volume transactional printing.

- Leading Applications: Transactional printing (invoices, statements, etc.) maintains a substantial share due to consistently high volume. However, growth is also seen in personalized marketing materials, packaging, and security printing, reflecting evolving market needs.

- Key Drivers in North America: Established infrastructure, strong regulatory support, high technological adoption rates, and a sophisticated consumer base.

- Key Drivers in Asia-Pacific: Rapid economic growth, increasing urbanization leading to higher marketing spend, and a burgeoning middle class driving demand for personalized products and services.

Digital Graphic Printing Industry Product Innovations

Recent product innovations include high-speed, high-resolution inkjet printers offering improved color accuracy and reduced printing costs. The development of eco-friendly inks and substrates is also gaining traction, catering to increasing environmental concerns. These innovations are providing competitive advantages through enhanced print quality, speed, and cost-effectiveness, ultimately increasing market penetration.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the digital graphic printing market, analyzing key trends across printing processes and applications. The market is segmented by:

Printing Process:

- Inkjet Printing: The inkjet segment is experiencing robust growth fueled by advancements in print head technology, improved ink formulations, and the increasing demand for high-quality, personalized outputs. The market size is projected to reach [Insert Projected Market Size] by 2033. Key players include [List Key Players and Briefly Describe their Market Position]. Competitive pressures are intense, focusing on print speed, image quality, and cost-effectiveness.

- Electrophotography: This segment remains vital, especially for high-volume transactional printing where speed and reliability are paramount. While facing competition from inkjet, electrophotography retains a strong position due to its established infrastructure and cost-efficiency in large-scale operations. Market size projections indicate [Insert Projected Market Size] by 2033, with key competitors being [List Key Players and Briefly Describe their Market Position].

Application:

- Transactional Printing: This segment continues to be a major revenue driver, although growth may moderate slightly as digitalization progresses. However, increased security needs and personalized communication are creating new opportunities within this sector. Market size is projected to be [Insert Projected Market Size] by 2033.

- Advertising Print: This segment is experiencing a shift towards more targeted and personalized campaigns, with growth linked to the effectiveness of digital marketing strategies. [Insert Projected Market Size] by 2033.

- Security Printing: This is a high-growth niche driven by heightened security concerns across various industries. Advancements in anti-counterfeiting technologies are creating new avenues for innovation. [Insert Projected Market Size] by 2033.

- General Commercial Print: This encompasses a broad range of applications, experiencing growth in line with overall economic activity. [Insert Projected Market Size] by 2033.

Key Drivers of Digital Graphic Printing Industry Growth

Growth is primarily fueled by technological advancements in printing technology, increasing demand for customized printing solutions, and the rise of e-commerce and digital marketing. Economic growth and favorable government regulations further stimulate market expansion.

Challenges in the Digital Graphic Printing Industry Sector

Challenges include high initial investment costs associated with new technologies, intense competition from established players, fluctuations in raw material prices, and environmental regulations impacting sustainable practices. These factors can affect market expansion and profitability.

Emerging Opportunities in Digital Graphic Printing Industry

The digital graphic printing industry is ripe with opportunities driven by technological advancements and evolving market demands. The integration of 3D printing technologies opens doors to new applications and customized products. The increasing focus on sustainability is creating demand for eco-friendly inks, substrates, and printing processes. Furthermore, the rise of personalized packaging and on-demand printing is reshaping the industry, offering opportunities for agile and responsive businesses.

Leading Players in the Digital Graphic Printing Industry Market

- Xerox Holdings Corporation - A major player with a broad portfolio and established market presence.

- Landa Corporation - Known for its innovative nanographic printing technology.

- Azure Communications - [Add brief description of company and its market position]

- A1 Security Print Ltd - [Add brief description of company and its market position]

- Post Masters - [Add brief description of company and its market position]

- Giesecke+Devrient Currency Technology GmbH - [Add brief description of company and its market position]

- Madras Security Printers Pvt Ltd - [Add brief description of company and its market position]

- Swiss Post Solutions - [Add brief description of company and its market position]

Key Developments in Digital Graphic Printing Industry

- 2022 Q3: Landa Corporation launched its new Nanographic Printing Presses, significantly improving printing speed and quality, enhancing its competitive edge.

- 2023 Q1: Xerox Holdings Corporation announced a strategic partnership to expand its reach in the Asia-Pacific market, capitalizing on the region's growth potential.

- [Add more bullet points with specific development information, including dates, companies involved, and a brief description of the impact.] For example: "Q2 2023: Introduction of a new eco-friendly ink by [Company Name], reducing environmental impact and attracting environmentally conscious clients."

Future Outlook for Digital Graphic Printing Industry Market

The Digital Graphic Printing market is poised for continued growth, driven by technological innovations, increasing demand for personalized and high-quality prints, and the expanding adoption of digital marketing strategies. Strategic investments in R&D and expansion into new markets will be crucial for players to maintain a competitive edge and capitalize on future opportunities.

Digital Graphic Printing Industry Segmentation

-

1. Printing Process

- 1.1. Inkjet

- 1.2. Electrophotography

-

2. Application

- 2.1. Advertising Print

- 2.2. Transactional Printing

- 2.3. Security Printing

- 2.4. General Commercial Print

Digital Graphic Printing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Poland

- 2.7. Netherlands

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Digital Graphic Printing Industry Regional Market Share

Geographic Coverage of Digital Graphic Printing Industry

Digital Graphic Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Glass containers for food and beverages are 100% recyclable and hence can be recycled endlessly without loss in quality or purity - something few food and beverage packaging options can claim. Manufacturers benefit from recycling in several ways

- 3.3. Market Restrains

- 3.3.1 However

- 3.3.2 container glass is manufactured by a process called annealing in which different air polluting compounds such as nitrogen oxides

- 3.3.3 sulfur dioxides

- 3.3.4 and other harmful particulates are released. Exposure to these harmful compounds at high concentrations can cause severe respiratory diseases such as asthma

- 3.3.5 chronic bronchitis

- 3.3.6 mucus secretion

- 3.3.7 and lung cancer.

- 3.4. Market Trends

- 3.4.1. Inkjet Printing Process is Expected to Hold a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 5.1.1. Inkjet

- 5.1.2. Electrophotography

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Advertising Print

- 5.2.2. Transactional Printing

- 5.2.3. Security Printing

- 5.2.4. General Commercial Print

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 6. North America Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 6.1.1. Inkjet

- 6.1.2. Electrophotography

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Advertising Print

- 6.2.2. Transactional Printing

- 6.2.3. Security Printing

- 6.2.4. General Commercial Print

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 7. Europe Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 7.1.1. Inkjet

- 7.1.2. Electrophotography

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Advertising Print

- 7.2.2. Transactional Printing

- 7.2.3. Security Printing

- 7.2.4. General Commercial Print

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 8. Asia Pacific Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 8.1.1. Inkjet

- 8.1.2. Electrophotography

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Advertising Print

- 8.2.2. Transactional Printing

- 8.2.3. Security Printing

- 8.2.4. General Commercial Print

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 9. Latin America Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 9.1.1. Inkjet

- 9.1.2. Electrophotography

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Advertising Print

- 9.2.2. Transactional Printing

- 9.2.3. Security Printing

- 9.2.4. General Commercial Print

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 10. Middle East and Africa Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 10.1.1. Inkjet

- 10.1.2. Electrophotography

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Advertising Print

- 10.2.2. Transactional Printing

- 10.2.3. Security Printing

- 10.2.4. General Commercial Print

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Landa Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Azure Communications

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A1 Security Print Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Post Masters

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xerox Holdings Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Giesecke+Devrient Currency Technology GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Madras Security Printers Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Swiss Post Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Landa Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Digital Graphic Printing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 3: North America Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 4: North America Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 9: Europe Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 10: Europe Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 15: Asia Pacific Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 16: Asia Pacific Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 21: Latin America Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 22: Latin America Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 27: Middle East and Africa Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 28: Middle East and Africa Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 2: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Digital Graphic Printing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 5: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 10: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United kingdom Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Poland Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 21: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 28: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 31: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Graphic Printing Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the Digital Graphic Printing Industry?

Key companies in the market include Landa Corporation*List Not Exhaustive, Azure Communications, A1 Security Print Ltd, Post Masters, Xerox Holdings Corporation, Giesecke+Devrient Currency Technology GmbH, Madras Security Printers Pvt Ltd, Swiss Post Solutions.

3. What are the main segments of the Digital Graphic Printing Industry?

The market segments include Printing Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Glass containers for food and beverages are 100% recyclable and hence can be recycled endlessly without loss in quality or purity - something few food and beverage packaging options can claim. Manufacturers benefit from recycling in several ways: Recycled glass reduces emissions and consumption of raw materials. extends the life of plant equipment. such as furnaces. and saves energy.; The growth in population in the country in the recent years has led to a rise in the building & construction sector where soda-lime-silica-based glass is used in windowpanes. owing to their hardness and ease of workability..

6. What are the notable trends driving market growth?

Inkjet Printing Process is Expected to Hold a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

However. container glass is manufactured by a process called annealing in which different air polluting compounds such as nitrogen oxides. sulfur dioxides. and other harmful particulates are released. Exposure to these harmful compounds at high concentrations can cause severe respiratory diseases such as asthma. chronic bronchitis. mucus secretion. and lung cancer..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Graphic Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Graphic Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Graphic Printing Industry?

To stay informed about further developments, trends, and reports in the Digital Graphic Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence