Key Insights

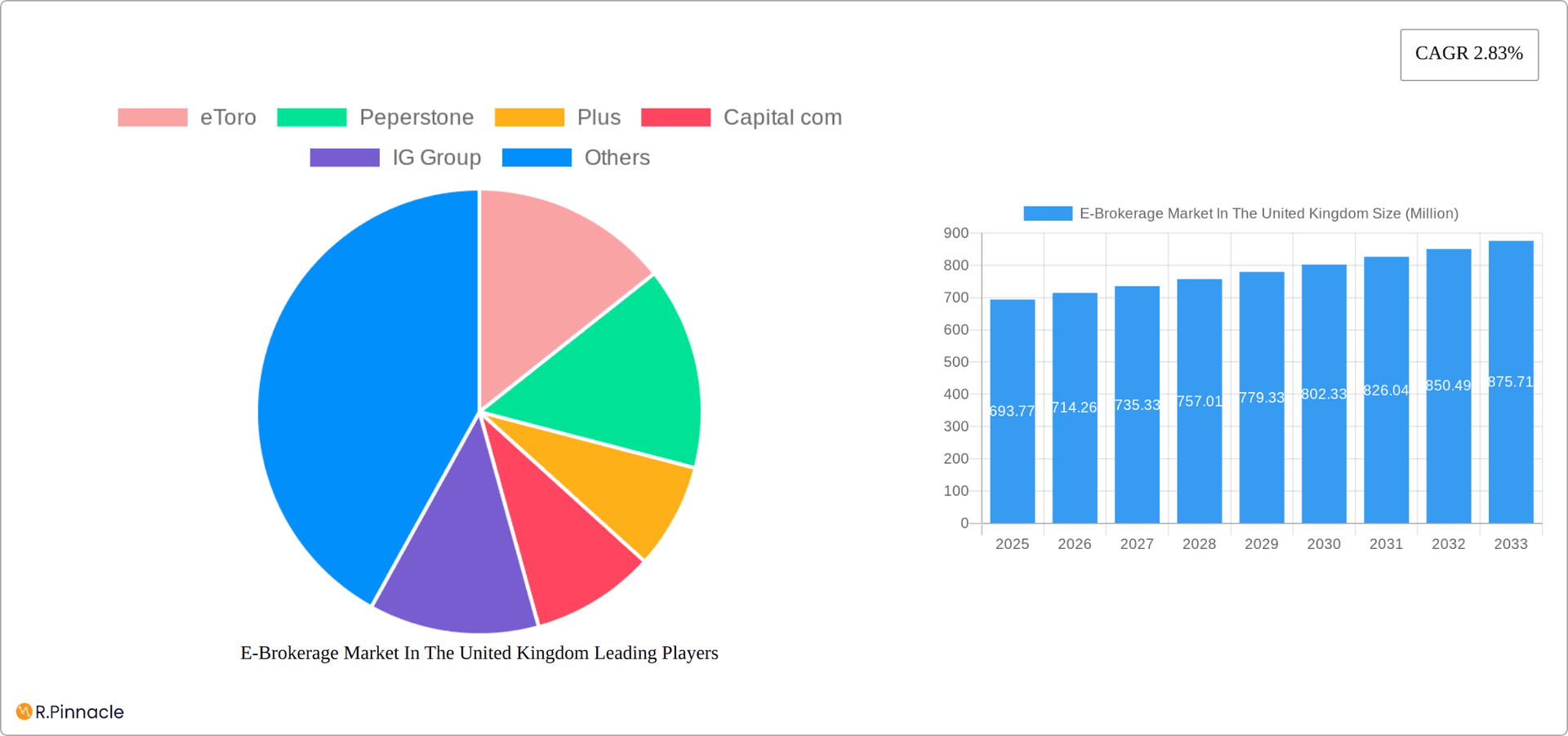

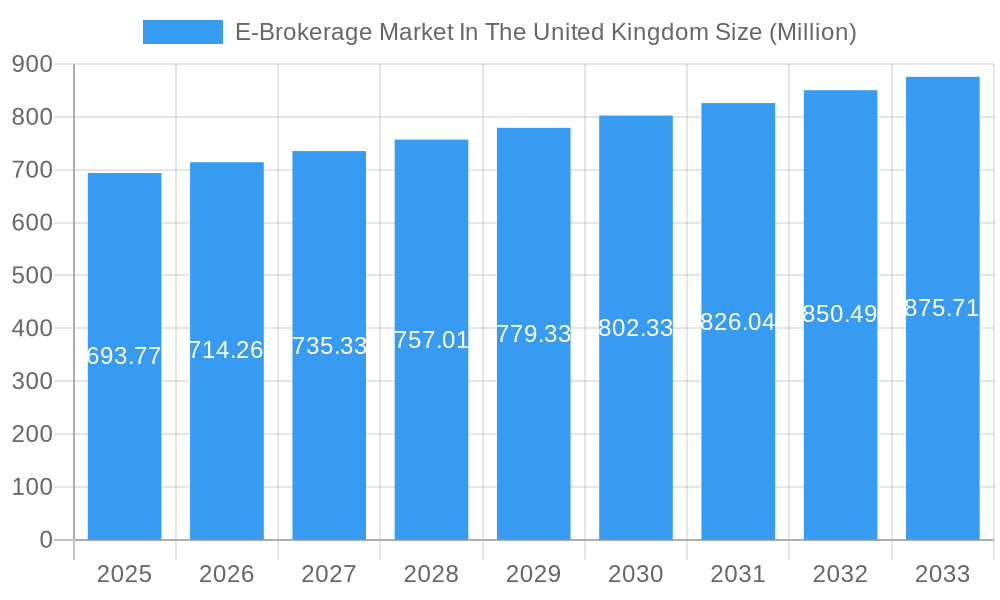

The UK e-brokerage market, valued at £693.77 million in 2025, exhibits a steady growth trajectory, projected at a CAGR of 2.83% from 2025 to 2033. This growth is fueled by several key drivers. Increased smartphone penetration and readily available high-speed internet access have significantly broadened the reach of online trading platforms, attracting a younger, digitally savvy demographic. Furthermore, the simplification of trading processes through user-friendly interfaces and the proliferation of educational resources have democratized access to investment opportunities. The rise of mobile-first trading apps and the integration of innovative technologies like AI-powered investment advice further enhance convenience and attract a wider investor base. However, regulatory scrutiny and concerns regarding cybersecurity remain key restraints. Competition among established players like eToro, Peperstone, Plus500, Capital.com, IG Group, City Index, Robinhood, AvaTrade, Monesta Markets, and Stocktrade is fierce, pushing firms to continuously innovate and enhance their offerings to maintain a competitive edge. Market segmentation is likely driven by investor type (e.g., retail, institutional), asset class preference (e.g., stocks, forex, cryptocurrencies), and service offerings (e.g., basic brokerage, advanced analytics, portfolio management). The historical period (2019-2024) likely saw fluctuating growth depending on global economic conditions and regulatory changes, providing a strong foundation for the projected future expansion.

E-Brokerage Market In The United Kingdom Market Size (In Million)

The forecast period (2025-2033) will likely witness a gradual increase in market size, influenced by macroeconomic factors and evolving investor behaviour. Technological advancements will continue to shape the landscape, with the integration of blockchain technology and decentralized finance (DeFi) potentially impacting future growth. Regulatory changes and evolving investor preferences will also play a significant role in shaping the market's trajectory. The continued expansion of the UK's fintech sector, coupled with increased financial literacy, should contribute to sustained market growth. However, potential economic downturns or changes in investor sentiment could create temporary disruptions. Monitoring these factors will be crucial in accurately assessing the long-term prospects of the UK e-brokerage market.

E-Brokerage Market In The United Kingdom Company Market Share

E-Brokerage Market in the United Kingdom: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK e-brokerage market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and future growth potential. The analysis includes detailed segmentation, key player profiles, and an assessment of emerging opportunities and challenges. Expect detailed data, including market size projections in Millions, CAGR calculations, and in-depth examination of key players like eToro, Peperstone, Plus500, Capital.com, IG Group, City Index, Robinhood, AvaTrade, Monesta Markets, and Stocktrade.

E-Brokerage Market In The United Kingdom Market Structure & Innovation Trends

The UK e-brokerage market is a dynamic landscape shaped by a complex interplay of market concentration, innovation, regulation, and competitive pressures. This section provides a detailed analysis of these key factors, offering insights into market share dynamics, significant M&A activity, and the forces driving future growth.

Market Concentration and Competitive Landscape: While a few major players dominate the UK e-brokerage market, creating a moderately concentrated structure, the market also features a diverse range of smaller firms and emerging fintech companies. Precise market share data for individual companies is often proprietary and subject to change, but our analysis indicates a competitive environment with significant room for disruption. We are currently refining our market share projections for a more accurate representation.

Innovation Drivers: Technological advancements are reshaping the UK e-brokerage landscape. The rapid adoption of mobile trading platforms, coupled with the integration of artificial intelligence (AI) and machine learning (ML) into investment tools, is enhancing the user experience and driving greater efficiency. Regulatory changes, aimed at fostering competition and protecting investors, also act as catalysts for innovation.

Regulatory Frameworks and Compliance: The Financial Conduct Authority (FCA) plays a vital role in overseeing and regulating the UK e-brokerage market, setting standards for operational conduct, cybersecurity, and investor protection. Adherence to FCA regulations is paramount for market participants, impacting both market structure and individual firm strategies.

Product Substitutes and Competitive Pressures: E-brokerage firms face competition from various sources, including traditional brokerage services, direct investing platforms, and robo-advisors. The increasing sophistication of these alternatives necessitates continuous innovation and adaptation from e-brokers to maintain a competitive edge.

End-User Demographics and Investor Behavior: The UK e-brokerage market serves a diverse client base, ranging from retail investors to sophisticated institutional clients. Our ongoing research focuses on understanding the evolving demographic and behavioral trends within this user base, including investment preferences, risk tolerance, and technological proficiency. More detailed demographic specifics will be included in our upcoming report.

M&A Activities and Market Consolidation: Recent mergers and acquisitions, such as the significant partnership between Cenkos and FinnCap in March 2023, creating a 50/50 shareholding in FinnCap, highlight the ongoing consolidation within the sector. While the exact financial details of many such deals remain undisclosed, these activities often signal a shift in market power and reshape the competitive dynamics. We are currently updating our projections for the value of this and other significant transactions.

E-Brokerage Market In The United Kingdom Market Dynamics & Trends

The UK e-brokerage market has experienced robust growth in recent years, driven by factors such as increased internet and smartphone penetration, a rising retail investor base, and the introduction of innovative trading platforms. This section delves into the historical and projected growth rates, market penetration, and key factors influencing the market's trajectory. Our analysis covers the period from 2019 to 2033, with 2025 serving as the base year.

The historical period (2019-2024) witnessed a Compound Annual Growth Rate (CAGR) estimated at xx%. We project a CAGR of xx% for the forecast period (2025-2033), indicating sustained growth. Market penetration is anticipated to reach xx% by 2033. However, this projection is subject to several influencing factors, including regulatory changes, macroeconomic conditions, shifts in investor behavior, and the competitive intensity introduced by new market entrants such as Public, which launched in July 2023. The competitive landscape and its impact on growth rates are areas of ongoing analysis.

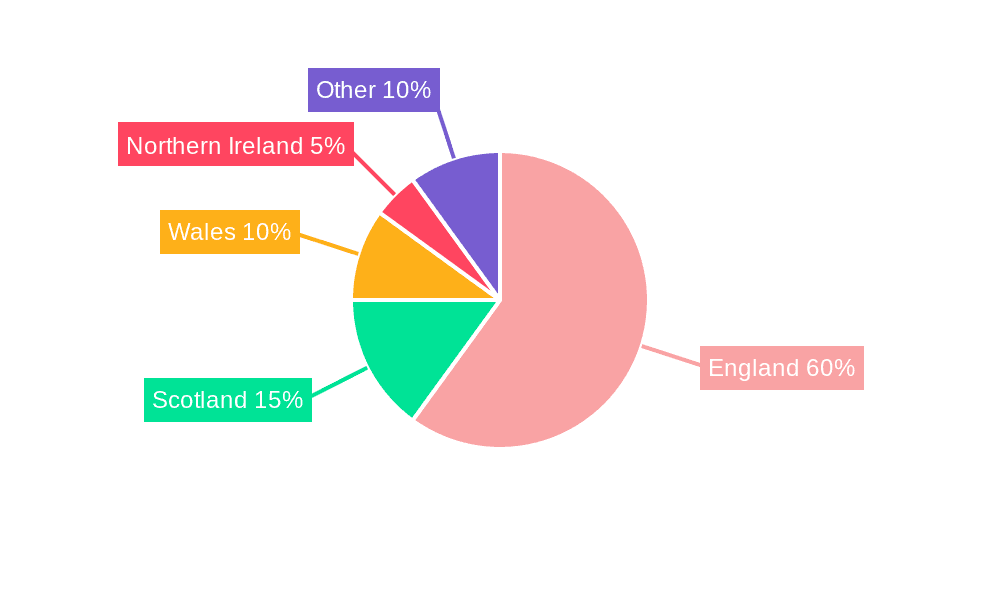

Dominant Regions & Segments in E-Brokerage Market In The United Kingdom

This section identifies the leading regions and segments within the UK e-brokerage market. Analysis will incorporate key drivers, including economic policies and infrastructure, to explain regional dominance. Due to a lack of sufficient data to segment by region currently, analysis will be primarily focused on the national market.

- Key Drivers of National Market Dominance:

- High internet and smartphone penetration.

- Increasing financial literacy amongst the population.

- A relatively favorable regulatory environment for online brokerage services (although subject to change).

- A growing number of retail investors seeking alternative investment options.

The UK e-brokerage market is currently dominated by the national market, with no significant regional disparities identified at this time. Future analysis may reveal more granular regional differences.

E-Brokerage Market In The United Kingdom Product Innovations

The UK e-brokerage market is witnessing significant product innovation, driven by technological advancements. Platforms are incorporating AI-powered trading tools, enhanced mobile interfaces, and personalized investment solutions. The competitive landscape necessitates continuous innovation to retain and attract clients. These innovations are enhancing the user experience and expanding access to diverse financial instruments.

Report Scope & Segmentation Analysis

This report segments the UK e-brokerage market based on several factors. This segmentation may include but not limited to investor type (retail vs. institutional), trading platform type (web-based vs. mobile), and asset class (stocks, forex, etc.). Detailed projections on market size and growth for each segment will be provided within the complete report. Competitive dynamics will be analyzed based on individual segment analysis.

Key Drivers of E-Brokerage Market In The United Kingdom Growth

Several key factors are driving the growth of the UK e-brokerage market. These include:

Technological Advancements: Mobile trading apps, AI-driven trading tools, and enhanced online platforms provide convenient and user-friendly access to investment opportunities.

Economic Factors: Favorable economic conditions can increase investor confidence and participation in the market.

Regulatory Environment: A well-defined regulatory framework fosters investor trust and market stability.

Challenges in the E-Brokerage Market In The United Kingdom Sector

Despite its growth potential, the UK e-brokerage market faces several significant challenges that require careful navigation by market participants:

Regulatory Scrutiny and Compliance Costs: The stringent regulatory environment overseen by the FCA necessitates significant compliance investments from e-brokerage firms, impacting operational efficiency and profitability.

Cybersecurity Threats and Data Protection: The digital nature of e-brokerage operations makes the sector particularly vulnerable to cyberattacks. Protecting investor funds and sensitive data requires significant investment in robust security measures and ongoing vigilance.

Intense Competition and Market Disruption: The market's competitive landscape is characterized by both established players and disruptive new entrants, leading to price wars and a constant need for innovation to retain market share.

Economic Volatility and Investor Sentiment: Market fluctuations and broader economic conditions directly influence investor behavior and trading activity, impacting the overall performance of the e-brokerage sector.

Emerging Opportunities in E-Brokerage Market In The United Kingdom

Despite the challenges, several promising opportunities exist for growth and innovation within the UK e-brokerage market:

Fintech Integration and Enhanced Trading Solutions: The integration of innovative fintech solutions promises to improve the efficiency, security, and overall user experience of trading platforms. This includes advancements in AI-driven investment tools and personalized financial management.

Expansion of Mobile Trading and Accessibility: The continued rise of mobile trading is expanding the reach and accessibility of online brokerage services, particularly among younger demographics.

Demand for Personalized Investment Solutions and Advice: There is a growing demand for personalized investment advice and tailored financial solutions, creating opportunities for firms offering sophisticated wealth management services.

Focus on ESG Investing and Sustainable Finance: The increasing focus on Environmental, Social, and Governance (ESG) factors is creating a new area of opportunity, with investors actively seeking platforms that facilitate sustainable and responsible investments.

Leading Players in the E-Brokerage Market In The United Kingdom Market

- eToro

- Peperstone

- Plus500

- Capital.com

- IG Group

- City Index

- Robinhood

- AvaTrade

- Monesta Markets

- Stocktrade

Key Developments in E-Brokerage Market In The United Kingdom Industry

- March 2023: Cenkos and FinnCap merge, creating a strengthened entity with increased client base.

- July 2023: Public, an American brokerage firm, launches in the UK, offering commission-free trading on US stocks.

Future Outlook for E-Brokerage Market In The United Kingdom Market

The future of the UK e-brokerage market appears promising, with continued growth driven by technological advancements, increased investor participation, and the expansion of financial products. Success will depend on navigating the evolving regulatory landscape, mitigating cybersecurity risks, and adapting to the changing needs of increasingly sophisticated investors. Strategic partnerships, product diversification, a relentless focus on customer experience, and a commitment to innovation will be crucial factors in determining market leadership in the years to come.

E-Brokerage Market In The United Kingdom Segmentation

-

1. Investor

- 1.1. Retail

- 1.2. Institutional

-

2. Operation

- 2.1. Domestic

- 2.2. Foreign

E-Brokerage Market In The United Kingdom Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-Brokerage Market In The United Kingdom Regional Market Share

Geographic Coverage of E-Brokerage Market In The United Kingdom

E-Brokerage Market In The United Kingdom REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience and Cost-Effectiveness; Real Time Analysis of Market Available In E-Brokerage Platforms

- 3.3. Market Restrains

- 3.3.1. Convenience and Cost-Effectiveness; Real Time Analysis of Market Available In E-Brokerage Platforms

- 3.4. Market Trends

- 3.4.1. Rising Digital Innovation & Adoption of Artificial Intelligence (AI) and Machine Learning (ML)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Brokerage Market In The United Kingdom Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Domestic

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 6. North America E-Brokerage Market In The United Kingdom Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Operation

- 6.2.1. Domestic

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 7. South America E-Brokerage Market In The United Kingdom Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Operation

- 7.2.1. Domestic

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 8. Europe E-Brokerage Market In The United Kingdom Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Operation

- 8.2.1. Domestic

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 9. Middle East & Africa E-Brokerage Market In The United Kingdom Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Operation

- 9.2.1. Domestic

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 10. Asia Pacific E-Brokerage Market In The United Kingdom Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Operation

- 10.2.1. Domestic

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 eToro

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Peperstone

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Plus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Capital com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IG Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 City Index

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robinhood

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AvaTrade

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Monesta Markets

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stocktrade

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 eToro

List of Figures

- Figure 1: Global E-Brokerage Market In The United Kingdom Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global E-Brokerage Market In The United Kingdom Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America E-Brokerage Market In The United Kingdom Revenue (Million), by Investor 2025 & 2033

- Figure 4: North America E-Brokerage Market In The United Kingdom Volume (Million), by Investor 2025 & 2033

- Figure 5: North America E-Brokerage Market In The United Kingdom Revenue Share (%), by Investor 2025 & 2033

- Figure 6: North America E-Brokerage Market In The United Kingdom Volume Share (%), by Investor 2025 & 2033

- Figure 7: North America E-Brokerage Market In The United Kingdom Revenue (Million), by Operation 2025 & 2033

- Figure 8: North America E-Brokerage Market In The United Kingdom Volume (Million), by Operation 2025 & 2033

- Figure 9: North America E-Brokerage Market In The United Kingdom Revenue Share (%), by Operation 2025 & 2033

- Figure 10: North America E-Brokerage Market In The United Kingdom Volume Share (%), by Operation 2025 & 2033

- Figure 11: North America E-Brokerage Market In The United Kingdom Revenue (Million), by Country 2025 & 2033

- Figure 12: North America E-Brokerage Market In The United Kingdom Volume (Million), by Country 2025 & 2033

- Figure 13: North America E-Brokerage Market In The United Kingdom Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America E-Brokerage Market In The United Kingdom Volume Share (%), by Country 2025 & 2033

- Figure 15: South America E-Brokerage Market In The United Kingdom Revenue (Million), by Investor 2025 & 2033

- Figure 16: South America E-Brokerage Market In The United Kingdom Volume (Million), by Investor 2025 & 2033

- Figure 17: South America E-Brokerage Market In The United Kingdom Revenue Share (%), by Investor 2025 & 2033

- Figure 18: South America E-Brokerage Market In The United Kingdom Volume Share (%), by Investor 2025 & 2033

- Figure 19: South America E-Brokerage Market In The United Kingdom Revenue (Million), by Operation 2025 & 2033

- Figure 20: South America E-Brokerage Market In The United Kingdom Volume (Million), by Operation 2025 & 2033

- Figure 21: South America E-Brokerage Market In The United Kingdom Revenue Share (%), by Operation 2025 & 2033

- Figure 22: South America E-Brokerage Market In The United Kingdom Volume Share (%), by Operation 2025 & 2033

- Figure 23: South America E-Brokerage Market In The United Kingdom Revenue (Million), by Country 2025 & 2033

- Figure 24: South America E-Brokerage Market In The United Kingdom Volume (Million), by Country 2025 & 2033

- Figure 25: South America E-Brokerage Market In The United Kingdom Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America E-Brokerage Market In The United Kingdom Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe E-Brokerage Market In The United Kingdom Revenue (Million), by Investor 2025 & 2033

- Figure 28: Europe E-Brokerage Market In The United Kingdom Volume (Million), by Investor 2025 & 2033

- Figure 29: Europe E-Brokerage Market In The United Kingdom Revenue Share (%), by Investor 2025 & 2033

- Figure 30: Europe E-Brokerage Market In The United Kingdom Volume Share (%), by Investor 2025 & 2033

- Figure 31: Europe E-Brokerage Market In The United Kingdom Revenue (Million), by Operation 2025 & 2033

- Figure 32: Europe E-Brokerage Market In The United Kingdom Volume (Million), by Operation 2025 & 2033

- Figure 33: Europe E-Brokerage Market In The United Kingdom Revenue Share (%), by Operation 2025 & 2033

- Figure 34: Europe E-Brokerage Market In The United Kingdom Volume Share (%), by Operation 2025 & 2033

- Figure 35: Europe E-Brokerage Market In The United Kingdom Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe E-Brokerage Market In The United Kingdom Volume (Million), by Country 2025 & 2033

- Figure 37: Europe E-Brokerage Market In The United Kingdom Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe E-Brokerage Market In The United Kingdom Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa E-Brokerage Market In The United Kingdom Revenue (Million), by Investor 2025 & 2033

- Figure 40: Middle East & Africa E-Brokerage Market In The United Kingdom Volume (Million), by Investor 2025 & 2033

- Figure 41: Middle East & Africa E-Brokerage Market In The United Kingdom Revenue Share (%), by Investor 2025 & 2033

- Figure 42: Middle East & Africa E-Brokerage Market In The United Kingdom Volume Share (%), by Investor 2025 & 2033

- Figure 43: Middle East & Africa E-Brokerage Market In The United Kingdom Revenue (Million), by Operation 2025 & 2033

- Figure 44: Middle East & Africa E-Brokerage Market In The United Kingdom Volume (Million), by Operation 2025 & 2033

- Figure 45: Middle East & Africa E-Brokerage Market In The United Kingdom Revenue Share (%), by Operation 2025 & 2033

- Figure 46: Middle East & Africa E-Brokerage Market In The United Kingdom Volume Share (%), by Operation 2025 & 2033

- Figure 47: Middle East & Africa E-Brokerage Market In The United Kingdom Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa E-Brokerage Market In The United Kingdom Volume (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa E-Brokerage Market In The United Kingdom Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa E-Brokerage Market In The United Kingdom Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific E-Brokerage Market In The United Kingdom Revenue (Million), by Investor 2025 & 2033

- Figure 52: Asia Pacific E-Brokerage Market In The United Kingdom Volume (Million), by Investor 2025 & 2033

- Figure 53: Asia Pacific E-Brokerage Market In The United Kingdom Revenue Share (%), by Investor 2025 & 2033

- Figure 54: Asia Pacific E-Brokerage Market In The United Kingdom Volume Share (%), by Investor 2025 & 2033

- Figure 55: Asia Pacific E-Brokerage Market In The United Kingdom Revenue (Million), by Operation 2025 & 2033

- Figure 56: Asia Pacific E-Brokerage Market In The United Kingdom Volume (Million), by Operation 2025 & 2033

- Figure 57: Asia Pacific E-Brokerage Market In The United Kingdom Revenue Share (%), by Operation 2025 & 2033

- Figure 58: Asia Pacific E-Brokerage Market In The United Kingdom Volume Share (%), by Operation 2025 & 2033

- Figure 59: Asia Pacific E-Brokerage Market In The United Kingdom Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific E-Brokerage Market In The United Kingdom Volume (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific E-Brokerage Market In The United Kingdom Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific E-Brokerage Market In The United Kingdom Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Investor 2020 & 2033

- Table 2: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Investor 2020 & 2033

- Table 3: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Operation 2020 & 2033

- Table 4: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Operation 2020 & 2033

- Table 5: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Investor 2020 & 2033

- Table 8: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Investor 2020 & 2033

- Table 9: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Operation 2020 & 2033

- Table 10: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Operation 2020 & 2033

- Table 11: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Country 2020 & 2033

- Table 13: United States E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: Canada E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Investor 2020 & 2033

- Table 20: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Investor 2020 & 2033

- Table 21: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Operation 2020 & 2033

- Table 22: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Operation 2020 & 2033

- Table 23: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Country 2020 & 2033

- Table 25: Brazil E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Argentina E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Investor 2020 & 2033

- Table 32: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Investor 2020 & 2033

- Table 33: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Operation 2020 & 2033

- Table 34: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Operation 2020 & 2033

- Table 35: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Country 2020 & 2033

- Table 37: United Kingdom E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 39: Germany E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: France E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: Italy E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Spain E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Russia E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Benelux E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: Nordics E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Investor 2020 & 2033

- Table 56: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Investor 2020 & 2033

- Table 57: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Operation 2020 & 2033

- Table 58: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Operation 2020 & 2033

- Table 59: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Country 2020 & 2033

- Table 61: Turkey E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Israel E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 65: GCC E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 67: North Africa E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 69: South Africa E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Investor 2020 & 2033

- Table 74: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Investor 2020 & 2033

- Table 75: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Operation 2020 & 2033

- Table 76: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Operation 2020 & 2033

- Table 77: Global E-Brokerage Market In The United Kingdom Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global E-Brokerage Market In The United Kingdom Volume Million Forecast, by Country 2020 & 2033

- Table 79: China E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: India E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 83: Japan E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 85: South Korea E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 87: ASEAN E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 89: Oceania E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific E-Brokerage Market In The United Kingdom Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific E-Brokerage Market In The United Kingdom Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Brokerage Market In The United Kingdom?

The projected CAGR is approximately 2.83%.

2. Which companies are prominent players in the E-Brokerage Market In The United Kingdom?

Key companies in the market include eToro, Peperstone, Plus, Capital com, IG Group, City Index, Robinhood, AvaTrade, Monesta Markets, Stocktrade.

3. What are the main segments of the E-Brokerage Market In The United Kingdom?

The market segments include Investor, Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 693.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Convenience and Cost-Effectiveness; Real Time Analysis of Market Available In E-Brokerage Platforms.

6. What are the notable trends driving market growth?

Rising Digital Innovation & Adoption of Artificial Intelligence (AI) and Machine Learning (ML).

7. Are there any restraints impacting market growth?

Convenience and Cost-Effectiveness; Real Time Analysis of Market Available In E-Brokerage Platforms.

8. Can you provide examples of recent developments in the market?

In March 2023, the United Kingdom broking firm Cenkos merged with FinnCap. Post merger both companies own a 50% share of the new firm with the company being named FinnCap. The merger will strengthen the position of both firms with an increase in clients and new customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Brokerage Market In The United Kingdom," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Brokerage Market In The United Kingdom report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Brokerage Market In The United Kingdom?

To stay informed about further developments, trends, and reports in the E-Brokerage Market In The United Kingdom, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence