Key Insights

The Egypt Oil and Gas Upstream Market is projected for robust expansion, with an estimated Compound Annual Growth Rate (CAGR) of 4.6%. The market size was valued at $12.8 billion in the base year 2024. This growth is propelled by increasing domestic energy consumption, Egypt's strategic geographical positioning, and continuous exploration and development initiatives across onshore and offshore reserves. Key industry participants, including Shell, ExxonMobil, BP, and the Egyptian General Petroleum Corporation, underscore the market's established nature and potential. However, challenges such as global oil and gas price volatility, regulatory complexities, and environmental considerations require strategic navigation. Market segmentation into onshore and offshore segments, alongside product categories like crude oil and natural gas, offers avenues for diversified investment. The forecast period of 2025-2033 indicates significant growth potential, contingent on sustained investment, stable regulatory frameworks, and effective environmental management. Analysis of historical data (2019-2024) is vital for refining future projections, with a specific focus on factors influencing crude oil production, refining capacity, and natural gas exploration.

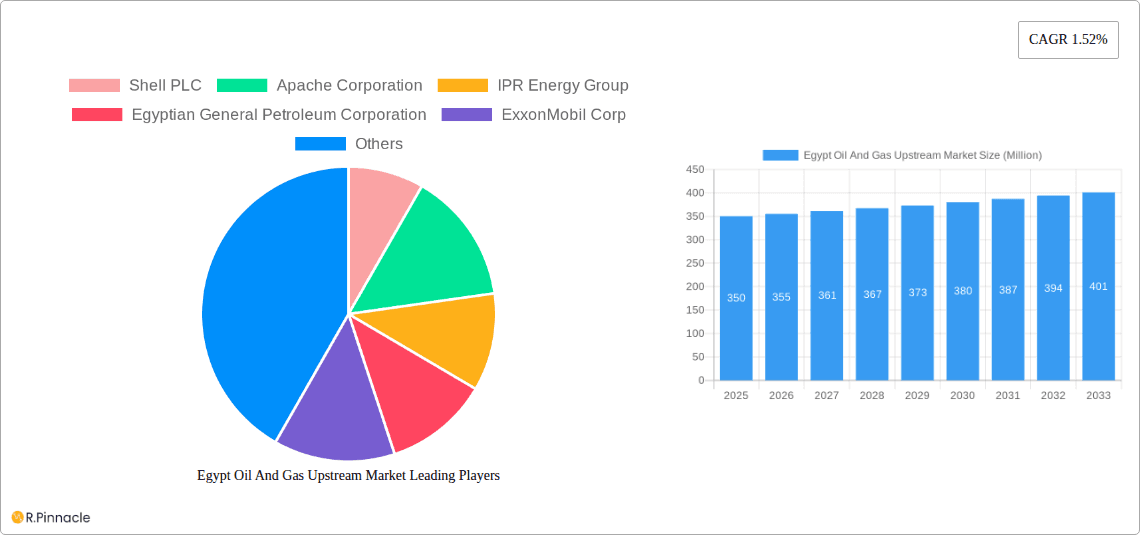

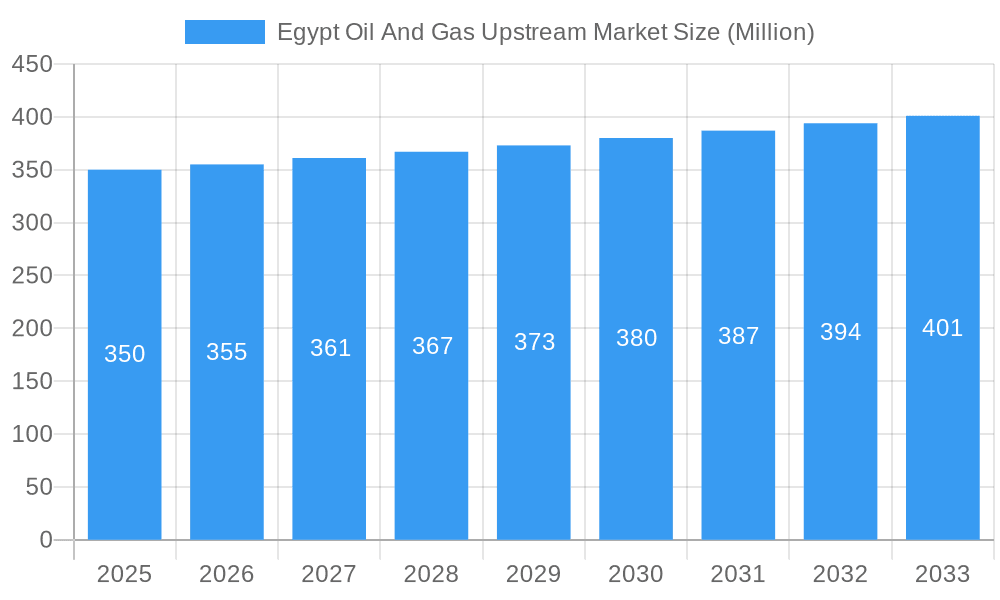

Egypt Oil And Gas Upstream Market Market Size (In Billion)

Government policies supporting energy security and investment incentives will significantly influence exploration and production rates. Technological advancements in enhanced oil recovery (EOR) and exploration methodologies are poised to boost operational efficiency and output. A comprehensive strategy must integrate geopolitical considerations impacting international energy markets, which can shape investor sentiment and decision-making. While dominated by major international and national oil companies, the competitive landscape also presents opportunities for smaller, specialized firms. Continuous monitoring of the global energy sector, regional political stability, and governmental regulations is crucial for accurate forecasting and effective risk-reward management within the Egypt Oil and Gas Upstream Market.

Egypt Oil And Gas Upstream Market Company Market Share

Egypt Oil & Gas Upstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Egypt Oil & Gas Upstream Market, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future outlook. The analysis encompasses key segments including onshore and offshore locations, as well as Crude Oil, Natural Gas, and Other Products. Leading players like Shell PLC, Apache Corporation, and BP PLC are profiled, alongside an evaluation of the competitive landscape and emerging opportunities.

Egypt Oil & Gas Upstream Market Market Structure & Innovation Trends

This section delves into the market's competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report examines the market share held by key players such as Shell PLC, Apache Corporation, ExxonMobil Corp, Chevron Corporation, BP PLC, TotalEnergies SE, Eni SpA, and Wintershall AG, among others. The Egyptian General Petroleum Corporation plays a significant role as a state-owned enterprise. The analysis includes:

- Market Concentration: A detailed breakdown of market share distribution among major players. The report will quantify market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) to assess the level of competition.

- Innovation Drivers: Exploration of technological advancements driving efficiency gains and cost reductions within the upstream sector. This includes assessing the impact of digitalization, enhanced oil recovery (EOR) techniques, and automation.

- Regulatory Framework: Assessment of the regulatory environment impacting exploration, production, and investment in the Egyptian upstream sector, including licensing procedures and environmental regulations.

- Product Substitutes: An analysis of potential substitutes for oil and gas, including renewable energy sources and their potential impact on market demand.

- End-User Demographics: An examination of the end-users of oil and gas produced in Egypt, including both domestic consumption and export markets.

- M&A Activities: A review of recent mergers and acquisitions (M&A) within the Egyptian upstream sector, including deal values and their strategic implications for the market. The report will quantify M&A activity using the total value of deals completed during the study period. For example, we anticipate xx Million USD worth of M&A deals in the analysed period.

Egypt Oil & Gas Upstream Market Market Dynamics & Trends

This section analyzes the market's growth trajectory, exploring key factors influencing its evolution. The analysis will include:

- Market Growth Drivers: Detailed examination of factors driving market growth, including rising energy demand, government policies encouraging exploration and production, and strategic investments by international oil companies. The report will quantify this growth using Compound Annual Growth Rate (CAGR) projections. We predict a CAGR of xx% during the forecast period (2025-2033).

- Technological Disruptions: Assessment of the impact of technological advancements on exploration and production techniques, including the use of artificial intelligence (AI) and big data analytics.

- Consumer Preferences: Examination of evolving consumer preferences toward environmentally friendly energy sources and their implications for the oil and gas market.

- Competitive Dynamics: An in-depth analysis of competitive strategies employed by major players, including market positioning, product differentiation, and pricing strategies. The report will incorporate analysis of market penetration rates for various product segments.

Dominant Regions & Segments in Egypt Oil & Gas Upstream Market

This section identifies the dominant regions and segments within the Egyptian upstream market.

Location: A comprehensive comparison of onshore and offshore exploration and production activities, detailing their respective strengths, challenges, and future growth prospects. The analysis will identify the dominant location based on production volume and investment. For example, we anticipate the offshore sector will account for xx% of total production by 2033.

Product: A detailed analysis of the market share held by Crude Oil, Natural Gas, and Other Products. Key drivers for each segment will be identified and explored. The analysis will include:

- Crude Oil: Drivers of crude oil production, including exploration success rates and government policies.

- Natural Gas: Drivers of natural gas production, focusing on its growing role in domestic consumption and export markets.

- Other Products: Examination of the market for other upstream products, such as liquefied petroleum gas (LPG) and natural gas liquids (NGLs).

Key drivers will be elaborated upon using bullet points for each segment, and paragraphs for a thorough analysis of dominance.

Egypt Oil & Gas Upstream Market Product Innovations

This section summarizes recent product developments, focusing on technological trends and market fit. It will highlight innovations in exploration techniques, production optimization, and environmental sustainability initiatives. Examples may include new drilling technologies, improved recovery methods, and carbon capture and storage (CCS) solutions.

Report Scope & Segmentation Analysis

This report segments the Egypt Oil & Gas Upstream Market by location (onshore and offshore) and product (crude oil, natural gas, and other products). Each segment will have its growth projections, market sizes, and competitive dynamics detailed.

Key Drivers of Egypt Oil & Gas Upstream Market Growth

Growth drivers include rising domestic energy demand, supportive government policies, increased investment from international oil companies, and advancements in exploration and production technologies. The government's focus on infrastructure development and attracting foreign investment will also be explored.

Challenges in the Egypt Oil & Gas Upstream Market Sector

Challenges include fluctuating global oil and gas prices, regulatory complexities, infrastructure limitations, security concerns, and the increasing need to balance energy production with environmental sustainability. The report quantifies these challenges through their impact on investment, production levels, and operational costs.

Emerging Opportunities in Egypt Oil & Gas Upstream Market

Emerging opportunities include the potential for deeper offshore exploration, the development of renewable energy resources alongside oil and gas, and the implementation of advanced technologies for enhanced oil recovery.

Leading Players in the Egypt Oil & Gas Upstream Market Market

- Shell PLC

- Apache Corporation

- IPR Energy Group

- Egyptian General Petroleum Corporation

- ExxonMobil Corp

- Chevron Corporation

- Wintershall AG

- TotalEnergies SE

- Eni SpA

- BP PLC

Key Developments in Egypt Oil & Gas Upstream Market Industry

- May 2023: Dana Gas plans to drill 11 new wells, adding up to 80 bcf of reserves and production, with a USD 100 Million investment.

- June 2022: BP awarded an offshore exploration block.

- January 2022: TransGlobe Energy and Pharos Energy awarded contracts worth at least USD 506 Million for oil exploration, with an additional USD 67 Million grant for drilling 12 wells.

Future Outlook for Egypt Oil & Gas Upstream Market Market

The future outlook is positive, driven by continued investment, technological advancements, and the government's commitment to developing the energy sector. However, challenges related to global energy transition and environmental concerns will need to be addressed for sustained growth. The report projects significant growth in the sector based on continued investments and exploration successes.

Egypt Oil And Gas Upstream Market Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

-

2. Product

- 2.1. Crude Oil

- 2.2. Natural Gas

- 2.3. Other Products

Egypt Oil And Gas Upstream Market Segmentation By Geography

- 1. Egypt

Egypt Oil And Gas Upstream Market Regional Market Share

Geographic Coverage of Egypt Oil And Gas Upstream Market

Egypt Oil And Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Oil and Gas Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Inclination Toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Natural Gas Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Oil And Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Crude Oil

- 5.2.2. Natural Gas

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apache Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IPR Energy Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Egyptian General Petroleum Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wintershall AG*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eni SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BP PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Egypt Oil And Gas Upstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Egypt Oil And Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Oil And Gas Upstream Market Revenue billion Forecast, by Location 2020 & 2033

- Table 2: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Location 2020 & 2033

- Table 3: Egypt Oil And Gas Upstream Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Product 2020 & 2033

- Table 5: Egypt Oil And Gas Upstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 7: Egypt Oil And Gas Upstream Market Revenue billion Forecast, by Location 2020 & 2033

- Table 8: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Location 2020 & 2033

- Table 9: Egypt Oil And Gas Upstream Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Product 2020 & 2033

- Table 11: Egypt Oil And Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Oil And Gas Upstream Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Egypt Oil And Gas Upstream Market?

Key companies in the market include Shell PLC, Apache Corporation, IPR Energy Group, Egyptian General Petroleum Corporation, ExxonMobil Corp, Chevron Corporation, Wintershall AG*List Not Exhaustive, TotalEnergies SE, Eni SpA, BP PLC.

3. What are the main segments of the Egypt Oil And Gas Upstream Market?

The market segments include Location, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Oil and Gas Sector.

6. What are the notable trends driving market growth?

Natural Gas Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Inclination Toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

May 2023: UAE-based energy firm - Dana Gas announced its plans to start the drilling of 11 new wells in Egypt by the end of this year and projects the wells to add up to 80 bcf of reserves and production. The company has allocated investments of approximately USD 100 million to drill these wells, indicating that the company has four concessions in Egypt and is seeking to include them in one concession within an agreement awaiting approval by the House of Representatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Oil And Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Oil And Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Oil And Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Egypt Oil And Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence