Key Insights

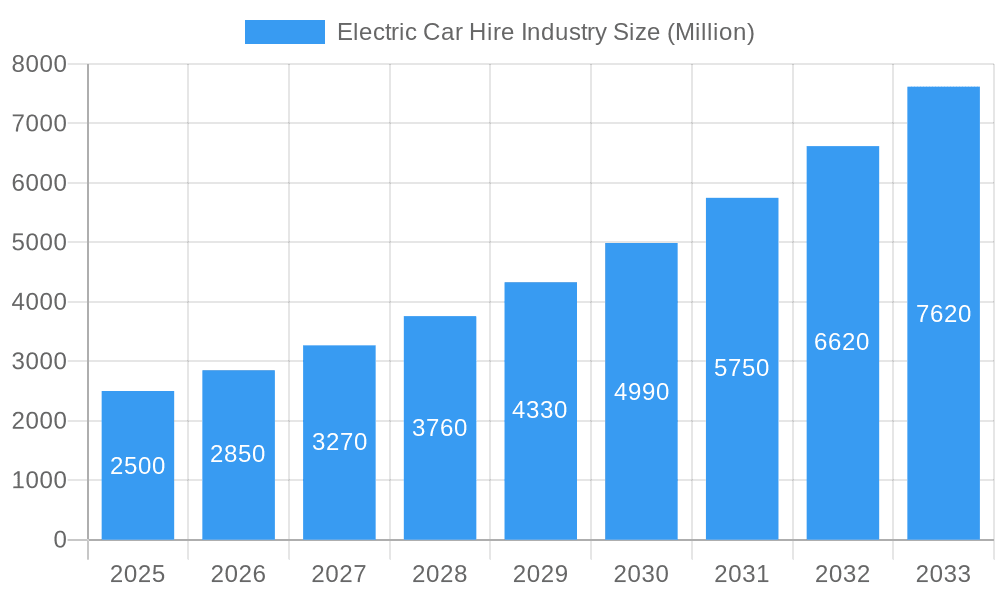

The electric car hire market is experiencing significant expansion, propelled by heightened environmental awareness, supportive government initiatives for EV adoption, and a growing charging infrastructure network. With a projected Compound Annual Growth Rate (CAGR) of 15.3%, the market is set to reach $13.06 billion by 2025. This growth is driven by escalating demand for sustainable urban transportation solutions. The market's diverse segmentation, covering battery, hybrid, and plug-in hybrid electric vehicles, across various body styles, pricing tiers, booking methods, and end-use applications, offers substantial opportunities for specialization. Leading companies are strategically investing in electric fleets to capture this evolving market. Key regions for growth include North America, Europe, and Asia Pacific, influenced by policy, consumer preference, and infrastructure development. Technological advancements in battery technology and increasing consumer acceptance are expected to further accelerate market expansion.

Electric Car Hire Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, with notable contributions from the Asia Pacific region, driven by urbanization and rising disposable incomes. Decreasing EV costs and advancements in battery technology, leading to extended ranges and faster charging, are primary growth catalysts. However, challenges such as the initial high cost of EVs impacting rental prices, inconsistent charging infrastructure, and potential range anxiety persist. Overcoming these hurdles through public-private infrastructure initiatives and innovative pricing strategies is vital for sustained growth. Increased competition among established players and new entrants will foster service innovation and enhanced customer value propositions.

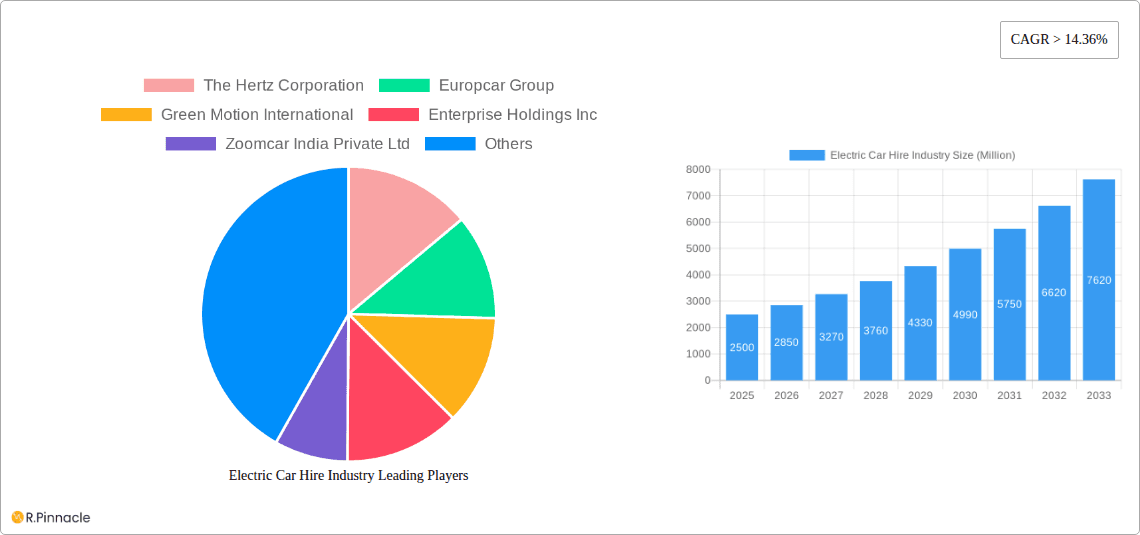

Electric Car Hire Industry Company Market Share

Electric Car Hire Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global electric car hire industry, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to project a market size exceeding $XX Million by 2033.

Electric Car Hire Industry Market Structure & Innovation Trends

The electric car hire market is characterized by a moderately concentrated structure, with key players like The Hertz Corporation, Europcar Group, Enterprise Holdings Inc., and Avis Rent a Car Ltd. holding significant market share. However, the emergence of numerous smaller, specialized firms, such as UFODrive and Zoomcar, signifies increasing competition. Market share dynamics are significantly influenced by innovation in battery technology, charging infrastructure development, and the introduction of diverse vehicle models. Regulatory frameworks, particularly those related to emissions standards and government incentives, play a crucial role in shaping market growth. The rising preference for sustainable transportation and the increasing availability of affordable electric vehicles are major drivers of market expansion. Furthermore, strategic mergers and acquisitions (M&A) are reshaping the competitive landscape. For instance, while specific deal values are unavailable, the number of M&A activities in this sector is predicted to reach xx in 2025.

- Market Concentration: Moderately concentrated, with several major players dominating.

- Innovation Drivers: Battery technology advancements, charging infrastructure development, vehicle model diversification.

- Regulatory Frameworks: Government incentives and emissions regulations significantly impact growth.

- Product Substitutes: Traditional gasoline-powered rental cars.

- End-User Demographics: Increasingly diverse, encompassing both individual and business travelers.

- M&A Activities: Significant activity predicted, reshaping the competitive landscape.

Electric Car Hire Industry Market Dynamics & Trends

The electric car hire market is experiencing robust growth, driven by several key factors. The increasing awareness of environmental concerns, coupled with stricter emission regulations in many regions, fuels the demand for eco-friendly transportation options. Technological advancements, particularly in battery technology and charging infrastructure, are lowering the barriers to entry for electric vehicle adoption. Consumer preferences are shifting towards electric vehicles, boosted by government incentives and lower running costs. The competitive landscape is dynamic, with both established players and new entrants vying for market share through innovative business models and technological advancements. The Compound Annual Growth Rate (CAGR) for the industry is projected to be xx% during the forecast period. Market penetration is expected to surpass xx% by 2033.

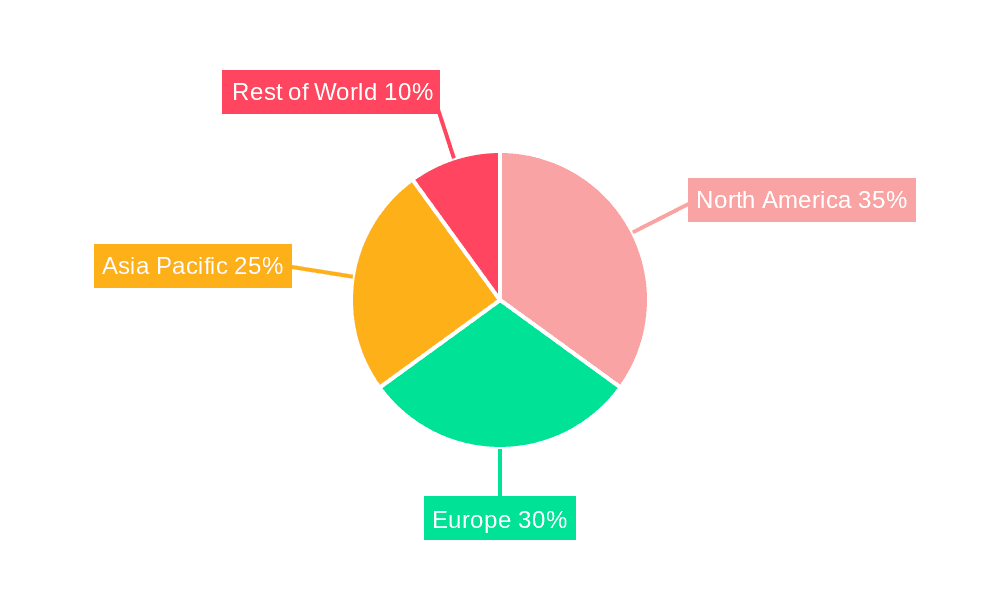

Dominant Regions & Segments in Electric Car Hire Industry

The North American and European markets currently dominate the electric car hire industry, driven by robust infrastructure development and supportive government policies. However, the Asia-Pacific region is expected to experience substantial growth in the coming years.

Key Drivers by Region:

- North America: Strong government incentives, well-developed charging infrastructure, high consumer adoption rates.

- Europe: Stringent emission regulations, expanding charging networks, increasing environmental awareness.

- Asia-Pacific: Rapid economic growth, increasing urbanization, rising disposable incomes.

Dominant Segments:

- By Vehicle Type: Battery Electric Vehicles (BEVs) are projected to become the dominant segment due to their improved range and performance.

- By Body Style: SUVs and hatchbacks are expected to hold the largest market share owing to their versatility and practicality.

- By Type: The budget/economy segment holds significant potential for growth due to increasing affordability.

- By Booking Type: Online bookings are projected to dominate due to convenience and accessibility.

- By End-Use: Airport transport and local usage are the most significant segments.

Electric Car Hire Industry Product Innovations

Recent product innovations focus on enhancing battery range, improving charging speeds, and integrating advanced technologies like autonomous driving features. The market is also seeing the introduction of diverse vehicle models catering to different customer needs and preferences. This includes the expansion of vehicle types beyond sedans to incorporate SUVs, MUVs, and luxury options, all aiming to optimize market fit and achieve a competitive advantage.

Report Scope & Segmentation Analysis

This report segments the electric car hire market across various parameters, including vehicle type (Battery Electric, Hybrid Electric, Plug-in Hybrid Electric), body style (Hatchback, Sedan, SUV, MUV), vehicle type (Luxury, Budget/Economy), booking type (Online, Offline), and end-use (Local Usage, Airport Transport, Outstation). Each segment's growth projection, market size, and competitive dynamics are thoroughly analyzed, providing a comprehensive understanding of the market landscape.

Key Drivers of Electric Car Hire Industry Growth

Several key factors contribute to the growth of the electric car hire industry. Technological advancements in battery technology and charging infrastructure are crucial, alongside supportive government policies such as tax incentives and subsidies for electric vehicles. Increasing environmental awareness and consumer preference for sustainable transportation are also significant driving forces.

Challenges in the Electric Car Hire Industry Sector

The industry faces challenges including the high initial cost of electric vehicles, limited charging infrastructure in certain regions, and the dependence on battery technology which is still subject to ongoing improvements and constraints. Supply chain disruptions and the intense competition from both established players and new entrants represent further challenges impacting profitability and growth projections.

Emerging Opportunities in Electric Car Hire Industry

Emerging opportunities lie in expanding into underserved markets, integrating innovative technologies such as telematics and connected car services, and catering to specific consumer segments with tailored offerings. The development of more efficient charging infrastructure and the potential integration of autonomous driving technologies also presents significant opportunities for growth.

Leading Players in the Electric Car Hire Industry Market

- The Hertz Corporation

- Europcar Group

- Green Motion International

- Enterprise Holdings Inc

- Zoomcar India Private Ltd

- Zipcar Inc

- Avis Rent a Car Ltd

- DriveElectric

- BlueIndy

- Sixt SE

Key Developments in Electric Car Hire Industry Industry

- August 2022: UFODrive expands into the US market, launching in San Francisco.

Future Outlook for Electric Car Hire Industry Market

The future outlook for the electric car hire industry is positive, driven by continued technological advancements, supportive government policies, and growing consumer demand for sustainable transportation. The market is poised for significant growth, presenting considerable opportunities for both established players and new entrants. Strategic partnerships, expansion into new markets, and the development of innovative business models will be crucial for success in this evolving industry.

Electric Car Hire Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric

- 1.2. Hybrid Electric

- 1.3. Plug-in Hybrid Electric

-

2. Body Style

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. Sports Utility Vehicles (SUVs)

- 2.4. Multi-utility Vehicle (MUV)

-

3. Type

- 3.1. Luxury

- 3.2. Budget/Economy

-

4. Booking Type

- 4.1. Online

- 4.2. Offline

-

5. End-Use

- 5.1. Local Usage

- 5.2. Airport Transport

- 5.3. Outstation

Electric Car Hire Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Car Hire Industry Regional Market Share

Geographic Coverage of Electric Car Hire Industry

Electric Car Hire Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Online Booking Type Is Expected To Have High Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Car Hire Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric

- 5.1.2. Hybrid Electric

- 5.1.3. Plug-in Hybrid Electric

- 5.2. Market Analysis, Insights and Forecast - by Body Style

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. Sports Utility Vehicles (SUVs)

- 5.2.4. Multi-utility Vehicle (MUV)

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Luxury

- 5.3.2. Budget/Economy

- 5.4. Market Analysis, Insights and Forecast - by Booking Type

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by End-Use

- 5.5.1. Local Usage

- 5.5.2. Airport Transport

- 5.5.3. Outstation

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Car Hire Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Battery Electric

- 6.1.2. Hybrid Electric

- 6.1.3. Plug-in Hybrid Electric

- 6.2. Market Analysis, Insights and Forecast - by Body Style

- 6.2.1. Hatchback

- 6.2.2. Sedan

- 6.2.3. Sports Utility Vehicles (SUVs)

- 6.2.4. Multi-utility Vehicle (MUV)

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Luxury

- 6.3.2. Budget/Economy

- 6.4. Market Analysis, Insights and Forecast - by Booking Type

- 6.4.1. Online

- 6.4.2. Offline

- 6.5. Market Analysis, Insights and Forecast - by End-Use

- 6.5.1. Local Usage

- 6.5.2. Airport Transport

- 6.5.3. Outstation

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Car Hire Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Battery Electric

- 7.1.2. Hybrid Electric

- 7.1.3. Plug-in Hybrid Electric

- 7.2. Market Analysis, Insights and Forecast - by Body Style

- 7.2.1. Hatchback

- 7.2.2. Sedan

- 7.2.3. Sports Utility Vehicles (SUVs)

- 7.2.4. Multi-utility Vehicle (MUV)

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Luxury

- 7.3.2. Budget/Economy

- 7.4. Market Analysis, Insights and Forecast - by Booking Type

- 7.4.1. Online

- 7.4.2. Offline

- 7.5. Market Analysis, Insights and Forecast - by End-Use

- 7.5.1. Local Usage

- 7.5.2. Airport Transport

- 7.5.3. Outstation

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Car Hire Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Battery Electric

- 8.1.2. Hybrid Electric

- 8.1.3. Plug-in Hybrid Electric

- 8.2. Market Analysis, Insights and Forecast - by Body Style

- 8.2.1. Hatchback

- 8.2.2. Sedan

- 8.2.3. Sports Utility Vehicles (SUVs)

- 8.2.4. Multi-utility Vehicle (MUV)

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Luxury

- 8.3.2. Budget/Economy

- 8.4. Market Analysis, Insights and Forecast - by Booking Type

- 8.4.1. Online

- 8.4.2. Offline

- 8.5. Market Analysis, Insights and Forecast - by End-Use

- 8.5.1. Local Usage

- 8.5.2. Airport Transport

- 8.5.3. Outstation

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of World Electric Car Hire Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Battery Electric

- 9.1.2. Hybrid Electric

- 9.1.3. Plug-in Hybrid Electric

- 9.2. Market Analysis, Insights and Forecast - by Body Style

- 9.2.1. Hatchback

- 9.2.2. Sedan

- 9.2.3. Sports Utility Vehicles (SUVs)

- 9.2.4. Multi-utility Vehicle (MUV)

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Luxury

- 9.3.2. Budget/Economy

- 9.4. Market Analysis, Insights and Forecast - by Booking Type

- 9.4.1. Online

- 9.4.2. Offline

- 9.5. Market Analysis, Insights and Forecast - by End-Use

- 9.5.1. Local Usage

- 9.5.2. Airport Transport

- 9.5.3. Outstation

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Hertz Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Europcar Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Green Motion International

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Enterprise Holdings Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Zoomcar India Private Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Zipcar Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Avis Rent a Car Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DriveElectric

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 BlueIndy*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sixt SE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global Electric Car Hire Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Electric Car Hire Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Car Hire Industry Revenue (billion), by Body Style 2025 & 2033

- Figure 5: North America Electric Car Hire Industry Revenue Share (%), by Body Style 2025 & 2033

- Figure 6: North America Electric Car Hire Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: North America Electric Car Hire Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Electric Car Hire Industry Revenue (billion), by Booking Type 2025 & 2033

- Figure 9: North America Electric Car Hire Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 10: North America Electric Car Hire Industry Revenue (billion), by End-Use 2025 & 2033

- Figure 11: North America Electric Car Hire Industry Revenue Share (%), by End-Use 2025 & 2033

- Figure 12: North America Electric Car Hire Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Electric Car Hire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Electric Car Hire Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Electric Car Hire Industry Revenue (billion), by Body Style 2025 & 2033

- Figure 17: Europe Electric Car Hire Industry Revenue Share (%), by Body Style 2025 & 2033

- Figure 18: Europe Electric Car Hire Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe Electric Car Hire Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Electric Car Hire Industry Revenue (billion), by Booking Type 2025 & 2033

- Figure 21: Europe Electric Car Hire Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 22: Europe Electric Car Hire Industry Revenue (billion), by End-Use 2025 & 2033

- Figure 23: Europe Electric Car Hire Industry Revenue Share (%), by End-Use 2025 & 2033

- Figure 24: Europe Electric Car Hire Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Electric Car Hire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Electric Car Hire Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific Electric Car Hire Industry Revenue (billion), by Body Style 2025 & 2033

- Figure 29: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Body Style 2025 & 2033

- Figure 30: Asia Pacific Electric Car Hire Industry Revenue (billion), by Type 2025 & 2033

- Figure 31: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Type 2025 & 2033

- Figure 32: Asia Pacific Electric Car Hire Industry Revenue (billion), by Booking Type 2025 & 2033

- Figure 33: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 34: Asia Pacific Electric Car Hire Industry Revenue (billion), by End-Use 2025 & 2033

- Figure 35: Asia Pacific Electric Car Hire Industry Revenue Share (%), by End-Use 2025 & 2033

- Figure 36: Asia Pacific Electric Car Hire Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of World Electric Car Hire Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 39: Rest of World Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Rest of World Electric Car Hire Industry Revenue (billion), by Body Style 2025 & 2033

- Figure 41: Rest of World Electric Car Hire Industry Revenue Share (%), by Body Style 2025 & 2033

- Figure 42: Rest of World Electric Car Hire Industry Revenue (billion), by Type 2025 & 2033

- Figure 43: Rest of World Electric Car Hire Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Rest of World Electric Car Hire Industry Revenue (billion), by Booking Type 2025 & 2033

- Figure 45: Rest of World Electric Car Hire Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 46: Rest of World Electric Car Hire Industry Revenue (billion), by End-Use 2025 & 2033

- Figure 47: Rest of World Electric Car Hire Industry Revenue Share (%), by End-Use 2025 & 2033

- Figure 48: Rest of World Electric Car Hire Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of World Electric Car Hire Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Car Hire Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Car Hire Industry Revenue billion Forecast, by Body Style 2020 & 2033

- Table 3: Global Electric Car Hire Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Electric Car Hire Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 5: Global Electric Car Hire Industry Revenue billion Forecast, by End-Use 2020 & 2033

- Table 6: Global Electric Car Hire Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Electric Car Hire Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Electric Car Hire Industry Revenue billion Forecast, by Body Style 2020 & 2033

- Table 9: Global Electric Car Hire Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Electric Car Hire Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 11: Global Electric Car Hire Industry Revenue billion Forecast, by End-Use 2020 & 2033

- Table 12: Global Electric Car Hire Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: US Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Car Hire Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Electric Car Hire Industry Revenue billion Forecast, by Body Style 2020 & 2033

- Table 18: Global Electric Car Hire Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Electric Car Hire Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 20: Global Electric Car Hire Industry Revenue billion Forecast, by End-Use 2020 & 2033

- Table 21: Global Electric Car Hire Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: UK Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Spain Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Electric Car Hire Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Electric Car Hire Industry Revenue billion Forecast, by Body Style 2020 & 2033

- Table 30: Global Electric Car Hire Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Electric Car Hire Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 32: Global Electric Car Hire Industry Revenue billion Forecast, by End-Use 2020 & 2033

- Table 33: Global Electric Car Hire Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: India Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: China Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Asia Pacific Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Electric Car Hire Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 40: Global Electric Car Hire Industry Revenue billion Forecast, by Body Style 2020 & 2033

- Table 41: Global Electric Car Hire Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Electric Car Hire Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 43: Global Electric Car Hire Industry Revenue billion Forecast, by End-Use 2020 & 2033

- Table 44: Global Electric Car Hire Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 45: South America Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Middle East and Africa Electric Car Hire Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Car Hire Industry?

The projected CAGR is approximately 15.3%.

2. Which companies are prominent players in the Electric Car Hire Industry?

Key companies in the market include The Hertz Corporation, Europcar Group, Green Motion International, Enterprise Holdings Inc, Zoomcar India Private Ltd, Zipcar Inc, Avis Rent a Car Ltd, DriveElectric, BlueIndy*List Not Exhaustive, Sixt SE.

3. What are the main segments of the Electric Car Hire Industry?

The market segments include Vehicle Type, Body Style, Type, Booking Type, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.06 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Online Booking Type Is Expected To Have High Market Share.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

In August 2022, UFODrive, an electric vehicle rental firm based in Europe, arrived in San Francisco on Thursday, marking the startup's first foray into the United States. Since its inception in 2018, UFODrive has expanded rapidly in 16 cities across Europe, including London, Paris, Berlin, Amsterdam, and Dublin. In addition, the business plans separate launches in New York and Austin in October.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Car Hire Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Car Hire Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Car Hire Industry?

To stay informed about further developments, trends, and reports in the Electric Car Hire Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence