Key Insights

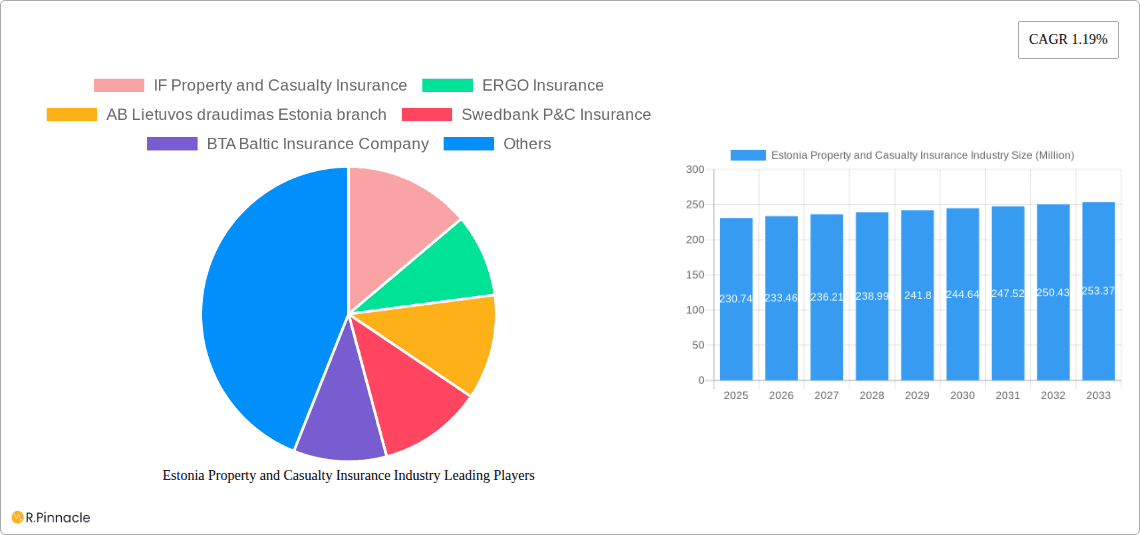

The Estonian property and casualty (P&C) insurance market, valued at €230.74 million in 2025, exhibits a modest yet steady growth trajectory, projected to increase at a Compound Annual Growth Rate (CAGR) of 1.19% from 2025 to 2033. This relatively low CAGR suggests a market characterized by maturity and stability, rather than explosive expansion. Several factors contribute to this moderate growth. The relatively small size of the Estonian economy limits overall insurance market potential. Furthermore, a robust regulatory environment and established insurance practices contribute to market stability, but may also stifle rapid expansion. Key drivers include increasing awareness of insurance products, particularly among younger demographics adopting digital platforms, and rising property values, necessitating higher coverage levels. However, factors like low economic growth and a cautious consumer sentiment may restrain market expansion. Competition among established players, including IF Property and Casualty Insurance, ERGO Insurance, and Swedbank P&C Insurance, is intense, leading to price competitiveness and a focus on niche market segments. The market likely shows a concentration amongst the largest players, with smaller insurers vying for market share. The forecast period of 2025-2033 suggests a continued trend of gradual market expansion rather than a period of rapid, unpredictable shifts.

Estonia Property and Casualty Insurance Industry Market Size (In Million)

The competitive landscape is shaped by both international and domestic players. International insurers leverage their global expertise and brand recognition to capture market share. Domestic players, however, possess an intimate understanding of the local market and regulatory environment, enabling them to tailor products and services to specific customer needs. The industry's performance is closely tied to the overall economic health of Estonia. Factors such as GDP growth, inflation rates, and employment levels influence consumer spending on insurance products. Future growth opportunities likely lie in developing innovative products, improving customer service through digital channels, and focusing on under-penetrated segments. The market's relatively mature nature suggests an emphasis on maintaining market share rather than aggressively pursuing large-scale expansion. Growth will likely be incremental and driven by small gains across various segments.

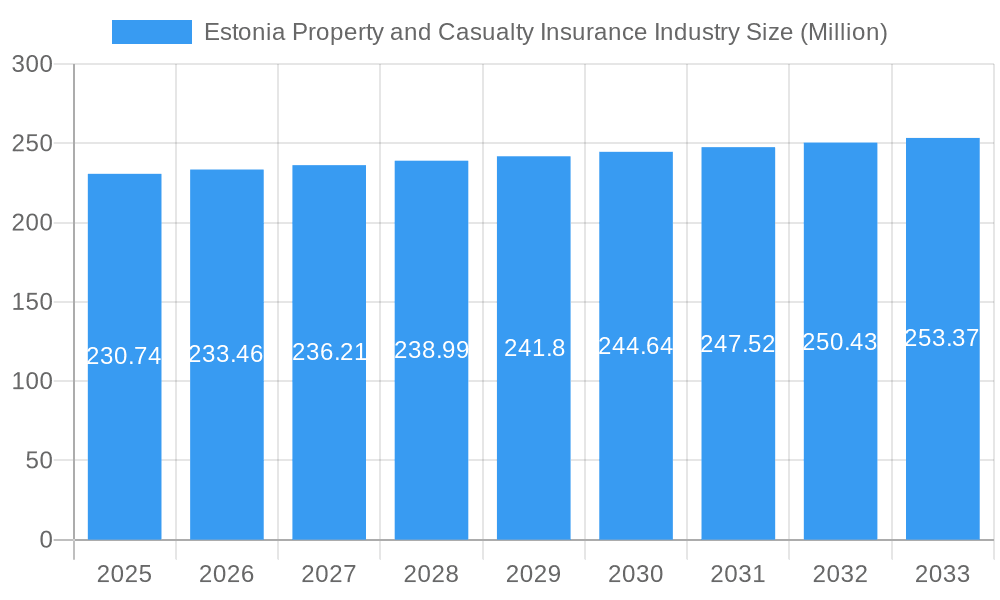

Estonia Property and Casualty Insurance Industry Company Market Share

Estonia Property and Casualty Insurance Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Estonian property and casualty insurance market, offering valuable insights for industry professionals, investors, and strategic planners. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033. We analyze market structure, dynamics, key players, and future growth opportunities, providing actionable intelligence to navigate this dynamic sector.

Estonia Property and Casualty Insurance Industry Market Structure & Innovation Trends

This section analyzes the Estonian property and casualty insurance market structure, highlighting key trends and drivers impacting growth. We examine market concentration, identifying leading players and their respective market shares. The report also explores innovation drivers, including technological advancements and regulatory changes. Furthermore, it delves into the competitive landscape, analyzing M&A activities and their impact on market dynamics. The study period covers 2019-2024, providing a robust historical perspective.

- Market Concentration: The Estonian market exhibits a [level of concentration - e.g., moderately concentrated] structure, with the top 5 players holding an estimated [xx]% market share in 2024.

- Innovation Drivers: Digitalization, AI-powered solutions (as exemplified by Swedbank's partnership with Akur8), and evolving customer expectations are key drivers.

- Regulatory Framework: The Estonian Financial Supervision Authority (EFSA) plays a crucial role in shaping the regulatory environment.

- M&A Activity: Recent acquisitions, such as Howden's acquisition of KindlustusEst and Smart Kindlustusmaakler in February 2024, illustrate the ongoing consolidation within the market. The total deal value for this acquisition was estimated at xx Million. Other M&A activities during the historical period (2019-2024) resulted in an estimated total deal value of xx Million.

- Product Substitutes: The emergence of Insurtech startups presents potential challenges through innovative product offerings.

- End-User Demographics: The report analyzes changing demographics and their impact on insurance demand, including factors such as age, income, and risk profiles.

Estonia Property and Casualty Insurance Industry Market Dynamics & Trends

This section dives deep into the market dynamics driving the Estonian property and casualty insurance sector. We explore market growth drivers, analyzing factors contributing to expansion and contraction. Technological disruptions, shifting consumer preferences, and competitive dynamics are thoroughly examined, supported by quantitative metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates. The analysis covers the historical period (2019-2024) and projects trends through 2033. The Estonian market is expected to experience a CAGR of [xx]% during the forecast period (2025-2033), driven by [mention specific factors, e.g., increasing insurance awareness, economic growth, government initiatives]. Market penetration is projected to reach [xx]% by 2033.

Dominant Regions & Segments in Estonia Property and Casualty Insurance Industry

This section identifies the leading regions and segments within the Estonian property and casualty insurance market. A detailed analysis of market dominance is provided, highlighting key drivers contributing to the success of specific regions or segments.

- Key Drivers for Dominant Regions/Segments:

- Economic Policies: Government initiatives promoting insurance penetration and economic stability.

- Infrastructure Development: Improved infrastructure leading to increased investment and economic activity.

- [Add other relevant drivers, e.g., demographic shifts, specific industry growth]

[Detailed dominance analysis focusing on the leading region/segment in paragraph form.]

Estonia Property and Casualty Insurance Industry Product Innovations

This section summarizes recent product developments, focusing on technological advancements and their impact on market competitiveness. The emphasis is on the market fit and competitive advantages offered by these innovations. The increasing adoption of digital platforms and AI-driven solutions is transforming the industry, improving efficiency, and enhancing customer experiences. The integration of telematics in motor insurance and the development of customized insurance solutions based on individual risk profiles are noteworthy examples of recent product innovations.

Report Scope & Segmentation Analysis

This report segments the Estonian property and casualty insurance market by [List segmentation criteria, e.g., product type (motor, home, commercial), distribution channel (direct, brokers), customer segment (individuals, businesses)]. Each segment's growth projections, market size, and competitive dynamics are detailed, providing a comprehensive overview of the market structure. [Paragraph for each segment, providing specifics on size, growth, and competitive dynamics.]

Key Drivers of Estonia Property and Casualty Insurance Industry Growth

The growth of the Estonian property and casualty insurance industry is driven by several key factors. Technological advancements, such as AI and data analytics, are significantly improving operational efficiency and customer experience. Furthermore, economic growth and rising disposable incomes contribute to increased demand for insurance products. Finally, supportive government policies and regulations further facilitate market expansion.

Challenges in the Estonia Property and Casualty Insurance Industry Sector

The Estonian property and casualty insurance sector faces several challenges. Increasing regulatory scrutiny necessitates compliance with stringent guidelines, impacting operational costs. Cybersecurity threats pose a significant risk to data security and operational stability. Furthermore, intense competition from both established players and new entrants necessitates constant innovation and efficiency improvements to maintain market share. These challenges have a quantifiable impact on profitability and growth, which the report will thoroughly assess.

Emerging Opportunities in Estonia Property and Casualty Insurance Industry

The Estonian property and casualty insurance market presents several emerging opportunities. The growing adoption of Insurtech solutions creates opportunities for innovative product offerings and improved customer experience. Expansion into niche markets and leveraging data analytics for risk assessment provide further avenues for growth. Finally, collaborating with Fintech companies offers synergies to expand into adjacent financial services.

Leading Players in the Estonia Property and Casualty Insurance Industry Market

- IF Property and Casualty Insurance

- ERGO Insurance

- AB Lietuvos draudimas Estonia branch

- Swedbank P&C Insurance

- BTA Baltic Insurance Company

- Salva Kindlustus

- Compensa Vienna Insurance Group ADB Estonia branch

- LHV Kindlustus

- VIG Group

- Lietuvos Draudimas

- Inges Kindlustus

List Not Exhaustive

Key Developments in Estonia Property and Casualty Insurance Industry

- February 2024: Howden acquired the business operations of KindlustusEst Kindlustusmaakler OÜ and AS Smart Kindlustusmaakler, expanding its presence in the Estonian insurance brokerage market.

- March 2024: Swedbank partnered with Akur8 to implement AI-powered insurance pricing solutions, aiming to enhance efficiency and customer experience.

Future Outlook for Estonia Property and Casualty Insurance Industry Market

The future of the Estonian property and casualty insurance market is promising, driven by sustained economic growth, technological innovation, and a growing awareness of insurance products. Strategic partnerships, investments in digital technologies, and the development of customized insurance solutions will play a crucial role in shaping the future landscape. The market is poised for further consolidation and the emergence of new players, presenting exciting opportunities for growth and expansion.

Estonia Property and Casualty Insurance Industry Segmentation

-

1. Product Type

- 1.1. Motor Insurance

- 1.2. Property Insurance

- 1.3. Civil Liability Insurance

- 1.4. Financial Loss Insurance

- 1.5. Others

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Brokers

- 2.4. Other Distribution Channel

Estonia Property and Casualty Insurance Industry Segmentation By Geography

- 1. Estonia

Estonia Property and Casualty Insurance Industry Regional Market Share

Geographic Coverage of Estonia Property and Casualty Insurance Industry

Estonia Property and Casualty Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance

- 3.3. Market Restrains

- 3.3.1. Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance

- 3.4. Market Trends

- 3.4.1. Direct Sales leading P&C Insurance market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Estonia Property and Casualty Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Insurance

- 5.1.2. Property Insurance

- 5.1.3. Civil Liability Insurance

- 5.1.4. Financial Loss Insurance

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Brokers

- 5.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Estonia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IF Property and Casualty Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ERGO Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AB Lietuvos draudimas Estonia branch

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Swedbank P&C Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BTA Baltic Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Salva Kindlustus

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compensa Vienna Insurance Group ADB Estonia branch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LHV Kindlustus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VIG Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lietuvos Draudimas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Inges Kindlustus**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IF Property and Casualty Insurance

List of Figures

- Figure 1: Estonia Property and Casualty Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Estonia Property and Casualty Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Estonia Property and Casualty Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Estonia Property and Casualty Insurance Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Estonia Property and Casualty Insurance Industry?

The projected CAGR is approximately 1.19%.

2. Which companies are prominent players in the Estonia Property and Casualty Insurance Industry?

Key companies in the market include IF Property and Casualty Insurance, ERGO Insurance, AB Lietuvos draudimas Estonia branch, Swedbank P&C Insurance, BTA Baltic Insurance Company, Salva Kindlustus, Compensa Vienna Insurance Group ADB Estonia branch, LHV Kindlustus, VIG Group, Lietuvos Draudimas, Inges Kindlustus**List Not Exhaustive.

3. What are the main segments of the Estonia Property and Casualty Insurance Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 230.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance.

6. What are the notable trends driving market growth?

Direct Sales leading P&C Insurance market.

7. Are there any restraints impacting market growth?

Self service insurance through Mobile apps increasing Non-life insurance penetration; Increase in Natural catastrophe driving new business opportunity for P&C insurance.

8. Can you provide examples of recent developments in the market?

In February 2024, Howden acquired the business operations of the corporate portfolio of KindlustusEst Kindlustusmaakler OÜ as well as AS Smart Kindlustusmaakler. Howden expands its footprint in the area by acquiring two prominent insurance agents in Estonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Estonia Property and Casualty Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Estonia Property and Casualty Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Estonia Property and Casualty Insurance Industry?

To stay informed about further developments, trends, and reports in the Estonia Property and Casualty Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence