Key Insights

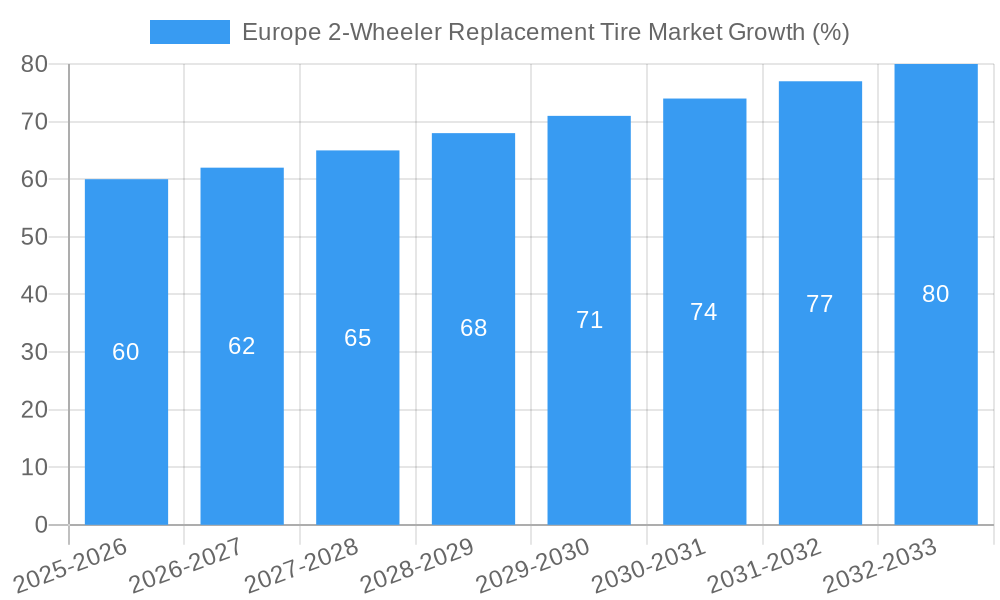

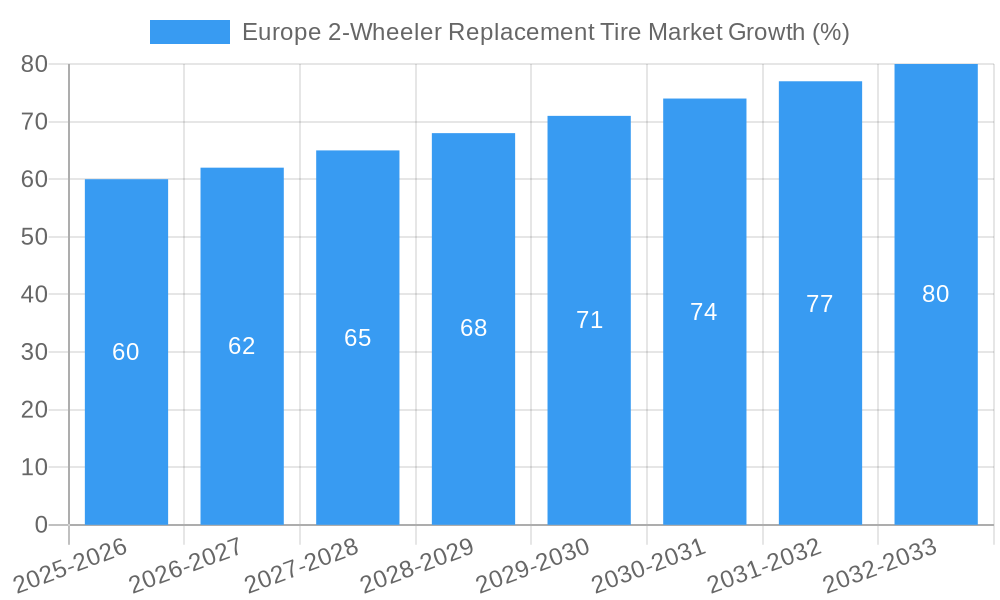

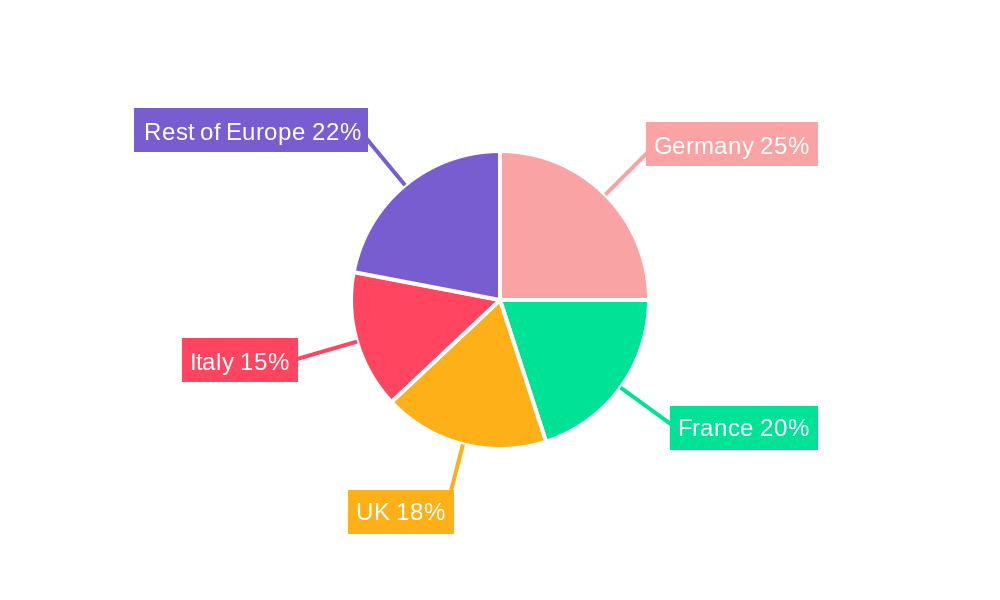

The European two-wheeler replacement tire market, encompassing motorcycles, scooters, and mopeds, is experiencing robust growth, driven by increasing two-wheeler ownership, particularly in urban areas, and a rising preference for electric vehicles. The market's compound annual growth rate (CAGR) exceeding 4% indicates a significant expansion trajectory over the forecast period (2025-2033). Key growth drivers include rising disposable incomes, increasing urbanization leading to higher commuting needs, and stringent emission regulations promoting electric two-wheeler adoption. The replacement tire segment holds considerable market share due to the naturally higher replacement frequency compared to OEM (original equipment manufacturer) tires. While the petrol-powered segment currently dominates, the electric vehicle segment is exhibiting exponential growth, presenting a promising avenue for tire manufacturers. Competition is fierce, with established global players like Michelin, Goodyear, and Apollo Tires, alongside other significant players, vying for market share through innovation in tire technology, sustainable manufacturing practices, and targeted marketing strategies. The regional breakdown reveals strong market performance across major European economies like Germany, France, and the UK, with potential for growth in other regions like the Netherlands and Sweden. The market's resilience is supported by factors such as increasing awareness of tire safety and the growing demand for high-performance tires offering enhanced grip, durability, and fuel efficiency.

However, challenges persist. Fluctuations in raw material prices, particularly rubber, represent a significant headwind. Furthermore, the market is vulnerable to economic downturns, impacting consumer spending on discretionary items like replacement tires. Government regulations regarding tire disposal and recycling also present challenges for manufacturers. To navigate these hurdles, tire companies are focusing on developing sustainable and eco-friendly tire materials, enhancing their distribution networks, and offering value-added services to improve customer loyalty. The market's future growth hinges on factors such as the continuing growth of electric two-wheelers, the adoption of advanced tire technologies, and successful strategies to navigate economic uncertainties and sustainability concerns. A focus on delivering superior performance, longevity and cost-effectiveness will be critical for success in this competitive and evolving landscape.

Europe 2-Wheeler Replacement Tire Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe 2-wheeler replacement tire market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unravels market dynamics, growth drivers, and future potential. The analysis incorporates data on key market segments, including vehicle type (motorcycle, scooter/moped), fuel type (petrol, electric), and demand category (OEM, replacement), alongside competitive landscape analysis of major players.

Europe 2-Wheeler Replacement Tire Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European 2-wheeler replacement tire market, examining market concentration, innovation drivers, regulatory influences, and market dynamics. We delve into the impact of product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities.

- Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant market share. The top five players account for approximately xx% of the total market revenue in 2025.

- Innovation Drivers: The push for improved fuel efficiency, enhanced tire durability, and advanced safety features drives innovation. The increasing adoption of electric two-wheelers is also stimulating the development of specialized tires.

- Regulatory Framework: EU regulations on tire labeling and emissions standards significantly influence market dynamics. Stringent environmental regulations are pushing manufacturers towards eco-friendly tire production.

- Product Substitutes: Limited direct substitutes exist for tires; however, the market faces indirect competition from alternative mobility solutions.

- End-User Demographics: The growing young population and increasing urbanization contribute to the demand for two-wheelers and replacement tires.

- M&A Activities: The past five years have witnessed xx M&A deals in the European 2-wheeler replacement tire market, with a total deal value of approximately €xx Million. These activities aim to enhance market share and expand product portfolios.

Europe 2-Wheeler Replacement Tire Market Market Dynamics & Trends

This section explores the key factors influencing the growth trajectory of the European 2-wheeler replacement tire market. We analyze market growth drivers, technological disruptions, consumer preferences, and the competitive landscape, providing insights into market size, CAGR, and penetration rates. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing two-wheeler ownership, rising disposable incomes, and technological advancements in tire manufacturing. The replacement segment is projected to dominate, accounting for approximately xx% of the total market. The market penetration rate of advanced tire technologies, such as run-flat tires and self-sealing tires, is expected to increase significantly in the coming years. The rising preference for electric two-wheelers is creating new opportunities for specialized tire manufacturers, while the increasing demand for high-performance tires is fuelling competition among established players.

Dominant Regions & Segments in Europe 2-Wheeler Replacement Tire Market

This section identifies the leading regions, countries, and segments within the European 2-wheeler replacement tire market.

- Leading Region: Germany is expected to be the largest market in Europe, driven by high two-wheeler ownership and robust economic growth.

- Leading Country: Within Germany, major cities like Berlin, Munich and Hamburg drive significant demand.

- Dominant Vehicle Type: Motorcycles constitute the largest segment, driven by a preference for high-performance bikes.

- Dominant Fuel Type: Petrol-powered two-wheelers currently dominate the market, although the electric segment is experiencing rapid growth.

- Dominant Demand Category: The replacement market is significantly larger than the OEM market, reflecting the ongoing need for tire replacements.

Key Drivers:

- Economic Growth: Strong economic performance in several European countries fuels consumer spending on two-wheelers and their maintenance.

- Infrastructure Development: Investment in road infrastructure enhances the convenience and safety of two-wheeler commuting.

- Government Policies: Incentives for purchasing electric two-wheelers are driving demand in this segment.

Europe 2-Wheeler Replacement Tire Market Product Innovations

Recent innovations focus on enhancing fuel efficiency, durability, grip, and safety. The incorporation of advanced materials and manufacturing techniques are driving the development of lighter, stronger, and more environmentally friendly tires. The market is witnessing a rise in smart tires with embedded sensors that monitor tire pressure and other vital parameters, enhancing rider safety and convenience. These innovations are improving overall market competitiveness and aligning with consumer demands for enhanced performance and safety features.

Report Scope & Segmentation Analysis

This report segments the Europe 2-wheeler replacement tire market across several key parameters:

Vehicle Type: Motorcycle and Scooter/Moped segments will be analysed separately, considering distinct tire requirements and market dynamics. The motorcycle segment is projected to exhibit higher growth due to its larger market size and increasing preference for performance-oriented tires. Scooter/Moped segment shows steady growth fueled by urban commute needs.

Fuel Type: The Petrol segment is currently dominant, but the Electric segment is experiencing substantial growth fueled by environmental concerns and government incentives. Growth projections for the electric segment are significantly higher than the petrol segment.

Demand Category: The Replacement market is far larger than the OEM market, reflecting the continuous need for tire replacements due to wear and tear. Both segments will be thoroughly assessed, considering differing market dynamics and customer profiles.

Key Drivers of Europe 2-Wheeler Replacement Tire Market Growth

The growth of the European 2-wheeler replacement tire market is driven by several factors, including increasing two-wheeler ownership, rising disposable incomes, improving road infrastructure, and government initiatives promoting sustainable transportation. Technological advancements in tire manufacturing, such as the development of fuel-efficient and long-lasting tires, further fuel market expansion. The growing adoption of electric two-wheelers is also creating new opportunities for specialized tire manufacturers.

Challenges in the Europe 2-Wheeler Replacement Tire Market Sector

The market faces challenges including fluctuating raw material prices, intense competition, stringent environmental regulations, and supply chain disruptions. Economic downturns can also impact consumer spending on replacement tires. These factors can influence the profitability and growth prospects of players in this market.

Emerging Opportunities in Europe 2-Wheeler Replacement Tire Market

The market presents growth opportunities in the electric two-wheeler segment, premium tire offerings, and technological advancements like smart tires. Expanding into new markets within Europe, and leveraging digital marketing strategies also present significant potential.

Leading Players in the Europe 2-Wheeler Replacement Tire Market Market

Key Developments in Europe 2-Wheeler Replacement Tire Market Industry

- 2022-Q4: Michelin launched a new range of eco-friendly tires for electric scooters.

- 2023-Q1: Goodyear announced a strategic partnership with an electric two-wheeler manufacturer.

- 2023-Q2: Apollo Tires acquired a smaller tire manufacturer to expand its European market reach. (Further details are xx due to confidential nature)

Future Outlook for Europe 2-Wheeler Replacement Tire Market Market

The future outlook for the European 2-wheeler replacement tire market is positive, driven by the growing popularity of two-wheelers, especially electric vehicles. Technological innovation and regulatory changes will continue to shape the market, creating opportunities for companies that can adapt to evolving consumer preferences and environmental concerns. The market is anticipated to see robust growth, particularly in the electric vehicle segment.

Europe 2-Wheeler Replacement Tire Market Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter/Moped

-

2. Fuel type

- 2.1. Petrol

- 2.2. Electric

-

3. Demand Category

- 3.1. OEM

- 3.2. Replacement

Europe 2-Wheeler Replacement Tire Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. Italy

- 1.4. France

- 1.5. Rest of Europe

Europe 2-Wheeler Replacement Tire Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness

- 3.3. Market Restrains

- 3.3.1. Competitiveness Of Alternative Materials

- 3.4. Market Trends

- 3.4.1. Retreading of The Tire Will Push The 2-Wheeler Market for Replacement Tire Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter/Moped

- 5.2. Market Analysis, Insights and Forecast - by Fuel type

- 5.2.1. Petrol

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Demand Category

- 5.3.1. OEM

- 5.3.2. Replacement

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Apollo Tires Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Michelin

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BFGoodrich

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Firestone

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cooper

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Goodyear

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Dunlop

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokoham

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 General

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Apollo Tires Ltd

List of Figures

- Figure 1: Europe 2-Wheeler Replacement Tire Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe 2-Wheeler Replacement Tire Market Share (%) by Company 2024

List of Tables

- Table 1: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Fuel type 2019 & 2032

- Table 4: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Demand Category 2019 & 2032

- Table 5: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Fuel type 2019 & 2032

- Table 16: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Demand Category 2019 & 2032

- Table 17: Europe 2-Wheeler Replacement Tire Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe 2-Wheeler Replacement Tire Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe 2-Wheeler Replacement Tire Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe 2-Wheeler Replacement Tire Market?

Key companies in the market include Apollo Tires Ltd, Michelin, BFGoodrich, Firestone, Cooper, Goodyear, Dunlop, Yokoham, General.

3. What are the main segments of the Europe 2-Wheeler Replacement Tire Market?

The market segments include Vehicle Type, Fuel type, Demand Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness.

6. What are the notable trends driving market growth?

Retreading of The Tire Will Push The 2-Wheeler Market for Replacement Tire Segment.

7. Are there any restraints impacting market growth?

Competitiveness Of Alternative Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe 2-Wheeler Replacement Tire Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe 2-Wheeler Replacement Tire Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe 2-Wheeler Replacement Tire Market?

To stay informed about further developments, trends, and reports in the Europe 2-Wheeler Replacement Tire Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence