Key Insights

The European alcoholic beverages packaging market, estimated at $82.46 billion in 2025, is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033. This growth trajectory is propelled by several key market dynamics. The increasing popularity of ready-to-drink (RTD) cocktails and premium alcoholic beverages is fostering demand for innovative and visually appealing packaging. Concurrently, a strong emphasis on sustainability is driving the adoption of eco-friendly materials, including recycled glass and paper-based cartons. Evolving consumer preferences for convenient and portable packaging formats are also influencing market trends, with pouches and lightweight plastic bottles gaining prominence. However, market expansion may be tempered by fluctuating raw material costs and stringent regulations pertaining to packaging waste.

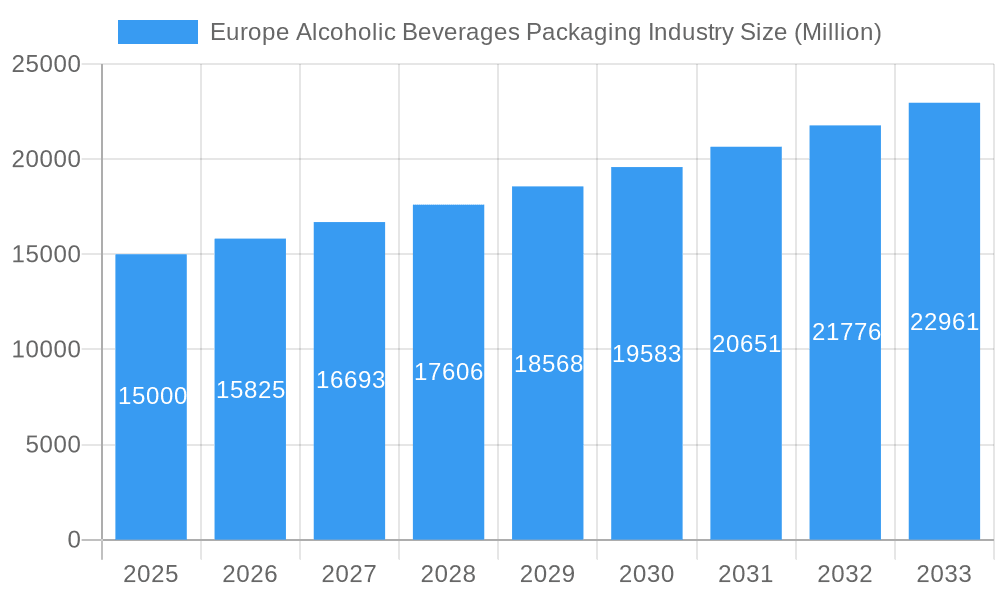

Europe Alcoholic Beverages Packaging Industry Market Size (In Billion)

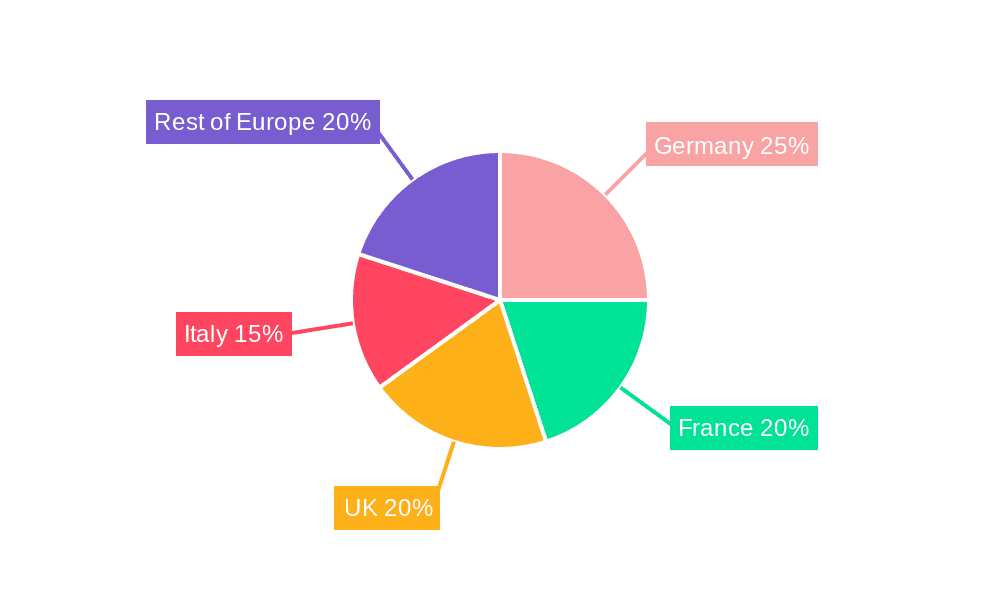

The market segmentation includes primary materials (plastic, paper, metal, glass), alcoholic product types (wine, spirits, beer, RTDs, others), product formats (bottles, cans, cartons, pouches), and key geographic regions (UK, France, Germany, Italy, and the rest of Europe). Germany, France, and the UK represent the largest national markets, underpinned by high per capita alcohol consumption and well-established beverage industries. Leading market participants such as Amcor, Ball Corporation, and Owens-Illinois are consistently innovating to address evolving consumer needs and regulatory compliances.

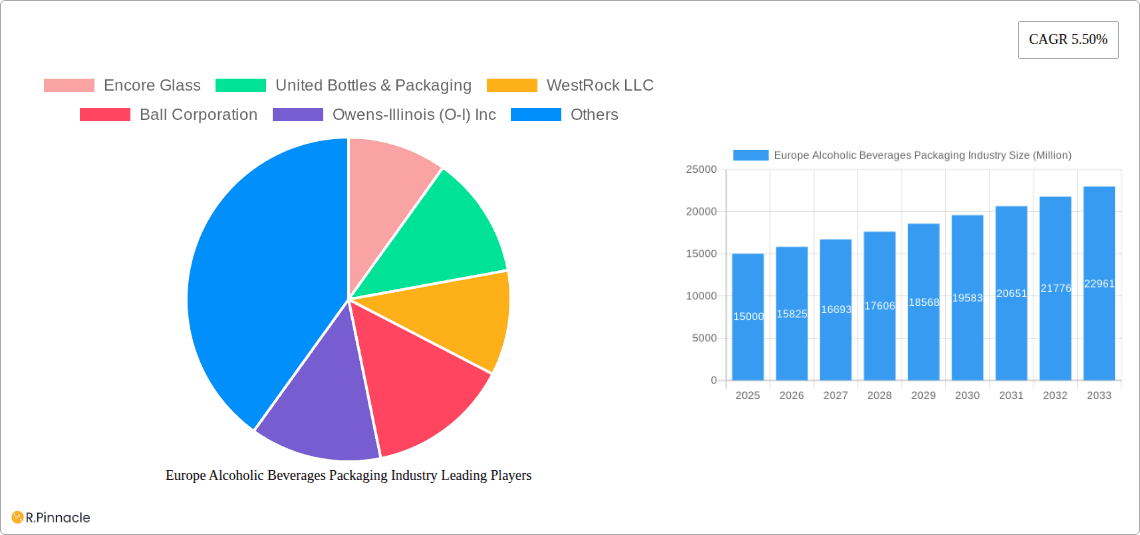

Europe Alcoholic Beverages Packaging Industry Company Market Share

Competitive intensity is anticipated to remain robust, with companies intensifying investments in research and development to deliver sustainable and cost-effective packaging solutions. The increasing implementation of lightweighting technologies in packaging design and a focused effort on enhancing supply chain efficiency are contributing to overall market growth. The RTD segment, in particular, is demonstrating notable growth, and strategic collaborations between packaging manufacturers and beverage brands are expected to accelerate innovation within this dynamic sector. Despite existing challenges, the market's positive outlook is attributed to sustained demand for alcoholic beverages, coupled with heightened awareness of sustainable packaging alternatives among both consumers and producers. The European alcoholic beverages packaging market forecast indicates continued growth, driven by a convergence of consumer demand, technological advancements, and environmentally conscious initiatives.

Europe Alcoholic Beverages Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe alcoholic beverages packaging industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a complete picture of current market dynamics and future growth projections. The market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Alcoholic Beverages Packaging Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the European alcoholic beverages packaging market. We examine market concentration, identifying key players and their market share. The report also delves into the impact of mergers and acquisitions (M&A) activities, providing analysis of deal values and their strategic implications. Innovation is explored through the lens of material science advancements, sustainability initiatives, and evolving consumer preferences. Regulatory frameworks impacting packaging materials, labeling, and sustainability are also thoroughly assessed. Finally, the report analyzes substitute products, exploring their impact on market share and future growth.

- Market Concentration: The European alcoholic beverages packaging market exhibits a moderately concentrated structure, with key players like Amcor, Owens-Illinois, and Ball Corporation holding significant market share. However, smaller regional players contribute significantly to the overall market.

- M&A Activity: Recent years have witnessed notable M&A activity, including Amcor's acquisition of a flexible packaging facility in the Czech Republic (August 2022) and Berlin Packaging's purchase of Panvetri (April 2022). These deals have a combined estimated value of xx Million and are projected to further shape market dynamics.

- Innovation Drivers: Sustainability concerns are driving innovation, with a focus on lightweighting, recycled content, and biodegradable materials. Technological advancements in printing and labeling also contribute to product differentiation.

- Regulatory Frameworks: EU regulations on packaging waste and recyclability are significantly impacting material selection and packaging design.

Europe Alcoholic Beverages Packaging Industry Market Dynamics & Trends

This section examines the market's growth drivers, technological advancements, evolving consumer preferences, and the competitive dynamics that will shape its future. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates for key segments. Key growth drivers include the increasing demand for alcoholic beverages, evolving consumer preferences toward premiumization and sustainability, and ongoing innovation in packaging technologies. Technological disruptions are assessed through the adoption of automation in production, lightweighting technologies, and innovative material solutions. Competitive dynamics are explored through pricing strategies, product differentiation, and brand positioning.

The market is witnessing significant growth driven by rising disposable incomes, changing lifestyles, and a growing preference for premium alcoholic beverages. The CAGR for the forecast period is estimated to be xx%, driven by increased demand for convenient packaging formats and sustainable options. Market penetration of innovative packaging materials, such as lightweight plastics and biodegradable alternatives, is also on the rise.

Dominant Regions & Segments in Europe Alcoholic Beverages Packaging Industry

This section identifies the leading regions, countries, and segments within the European alcoholic beverages packaging market based on primary material (plastic, paper, metal, glass), alcoholic product type (wine, spirits, beer, RTD, other), product type (bottles, cans, cartons, pouches), and country (UK, France, Italy, Germany, Rest of Europe). Key drivers for each dominant segment are analyzed.

By Primary Material: Glass remains a dominant material, particularly for premium wines and spirits, due to its perceived quality and aesthetic appeal. Plastic continues to dominate for RTD beverages, due to its cost-effectiveness and convenience.

By Alcoholic Product: Wine packaging holds the largest market share, driven by strong consumption in major European countries.

By Product Type: Glass bottles continue to dominate, followed by metal cans for beer.

By Country: The United Kingdom, France, and Germany are the largest markets due to high alcoholic beverage consumption and established packaging industries.

Key Drivers: Strong domestic alcoholic beverage consumption, robust infrastructure, and favorable economic policies all contribute to the dominance of these regions and segments.

Europe Alcoholic Beverages Packaging Industry Product Innovations

Recent innovations include the increased use of lightweighting techniques across various packaging formats to reduce environmental impact and costs. Sustainable packaging materials such as recycled PET and bio-based plastics are also gaining traction. Advances in printing and labeling technologies are creating opportunities for enhanced brand visibility and consumer engagement. These innovations enhance product appeal and meet the growing demand for environmentally conscious packaging solutions.

Report Scope & Segmentation Analysis

This report segments the European alcoholic beverages packaging market by primary material (plastic, paper, metal, glass), alcoholic product (wine, spirits, beer, RTD, others), product type (bottles, cans, cartons, pouches, others), and country (UK, France, Italy, Germany, Rest of Europe). Each segment's growth projections, market size (xx Million for each major segment in 2025, projections for 2033), and competitive dynamics are analyzed, providing a detailed understanding of market opportunities.

Example: The plastic bottle segment is expected to witness significant growth due to its cost-effectiveness and suitability for various alcoholic beverages. However, increasing environmental concerns may limit its future growth. The glass bottle segment, while larger in 2025, may see slower growth due to higher production costs.

Key Drivers of Europe Alcoholic Beverages Packaging Industry Growth

The European alcoholic beverages packaging market is fueled by several key drivers. Rising consumer demand for alcoholic beverages, especially premium products, is a significant factor. The trend towards sustainability is driving the adoption of eco-friendly packaging materials. Furthermore, technological advancements in packaging design and production are enhancing efficiency and creating new opportunities. Stringent regulations on packaging waste are also pushing innovation in recyclable and reusable packaging solutions.

Challenges in the Europe Alcoholic Beverages Packaging Industry Sector

The European alcoholic beverages packaging industry faces several challenges. Fluctuating raw material prices impact production costs and profitability. Meeting stringent environmental regulations is costly and complex. Intense competition from both domestic and international players creates pricing pressure. Supply chain disruptions can impact production and delivery, impacting market stability. These factors present significant hurdles to consistent market growth.

Emerging Opportunities in Europe Alcoholic Beverages Packaging Industry

The European alcoholic beverages packaging industry presents numerous opportunities. The growing demand for sustainable packaging offers potential for manufacturers to develop and market eco-friendly solutions. Innovations in lightweighting and other production efficiency strategies create potential for cost savings and enhanced competitiveness. Moreover, the expansion of e-commerce creates opportunities for specialized packaging solutions suitable for online delivery. These factors represent promising future avenues for growth.

Leading Players in the Europe Alcoholic Beverages Packaging Industry Market

- Encore Glass

- United Bottles & Packaging

- WestRock LLC

- Ball Corporation

- Owens-Illinois (O-I) Inc (Owens-Illinois)

- Ardagh Group SA (Ardagh Group)

- Crown Holdings Incorporated (Crown Holdings)

- Berry Global Inc (Berry Global)

- IntraPac International LL

- Brick Packaging LLC

- Amcor Ltd (Amcor)

Key Developments in Europe Alcoholic Beverages Packaging Industry

- August 2022: Amcor acquires a flexible packaging facility in the Czech Republic, boosting its European capacity and organic growth.

- April 2022: Berlin Packaging acquires Panvetri, expanding its glass and metal packaging portfolio for the wine and olive oil sectors.

Future Outlook for Europe Alcoholic Beverages Packaging Industry Market

The future of the European alcoholic beverages packaging market is promising. Continued growth in alcoholic beverage consumption, coupled with increasing demand for sustainable and innovative packaging solutions, will drive market expansion. Opportunities exist for companies to capitalize on consumer preferences for premiumization, convenience, and environmentally responsible packaging. Strategic investments in research and development, sustainable materials, and efficient production processes will be crucial for maintaining a competitive edge in this dynamic market.

Europe Alcoholic Beverages Packaging Industry Segmentation

-

1. Primary Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Alcoholic Products

- 2.1. Wine

- 2.2. Spirits

- 2.3. Beer

- 2.4. Ready-to-drink (RTD)

- 2.5. Other Types of Alcoholic Beverages

-

3. Product Type

- 3.1. Plastic Bottles

- 3.2. Glass Bottles

- 3.3. Metal Cans

- 3.4. Cartons

- 3.5. Pouches

- 3.6. Other Product Types

Europe Alcoholic Beverages Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Alcoholic Beverages Packaging Industry Regional Market Share

Geographic Coverage of Europe Alcoholic Beverages Packaging Industry

Europe Alcoholic Beverages Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Purchasing Power of Consumers; Increasing Consumption of Alcoholic Drinks

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Regarding Environmental Safety; Lack Of Improvement In Technology To Hinder The Growth

- 3.4. Market Trends

- 3.4.1. Glass Packaging is Expected to have a Major Share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Alcoholic Products

- 5.2.1. Wine

- 5.2.2. Spirits

- 5.2.3. Beer

- 5.2.4. Ready-to-drink (RTD)

- 5.2.5. Other Types of Alcoholic Beverages

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Plastic Bottles

- 5.3.2. Glass Bottles

- 5.3.3. Metal Cans

- 5.3.4. Cartons

- 5.3.5. Pouches

- 5.3.6. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Encore Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Bottles & Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WestRock LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ball Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Owens-Illinois (O-I) Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardagh Group SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crown Holdings Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IntraPac International LL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brick Packaging LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amcor Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Encore Glass

List of Figures

- Figure 1: Europe Alcoholic Beverages Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Alcoholic Beverages Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Alcoholic Products 2020 & 2033

- Table 3: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Alcoholic Products 2020 & 2033

- Table 7: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Alcoholic Beverages Packaging Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Alcoholic Beverages Packaging Industry?

Key companies in the market include Encore Glass, United Bottles & Packaging, WestRock LLC, Ball Corporation, Owens-Illinois (O-I) Inc, Ardagh Group SA, Crown Holdings Incorporated, Berry Global Inc, IntraPac International LL, Brick Packaging LLC, Amcor Ltd.

3. What are the main segments of the Europe Alcoholic Beverages Packaging Industry?

The market segments include Primary Material, Alcoholic Products, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.46 billion as of 2022.

5. What are some drivers contributing to market growth?

High Purchasing Power of Consumers; Increasing Consumption of Alcoholic Drinks.

6. What are the notable trends driving market growth?

Glass Packaging is Expected to have a Major Share in the market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Regarding Environmental Safety; Lack Of Improvement In Technology To Hinder The Growth.

8. Can you provide examples of recent developments in the market?

August 2022 - Amcor, a responsible packaging solutions development and production pioneer, announced that it had acquired a top-tier flexible packaging facility in the Czech Republic. The site's advantageous location instantly improves Amcor's capacity to meet rising customer demand across its flexible packaging network in Europe. With this acquisition, the company is investing in quickening its flexible business' organic growth in Europe's lucrative categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Alcoholic Beverages Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Alcoholic Beverages Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Alcoholic Beverages Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Alcoholic Beverages Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence