Key Insights

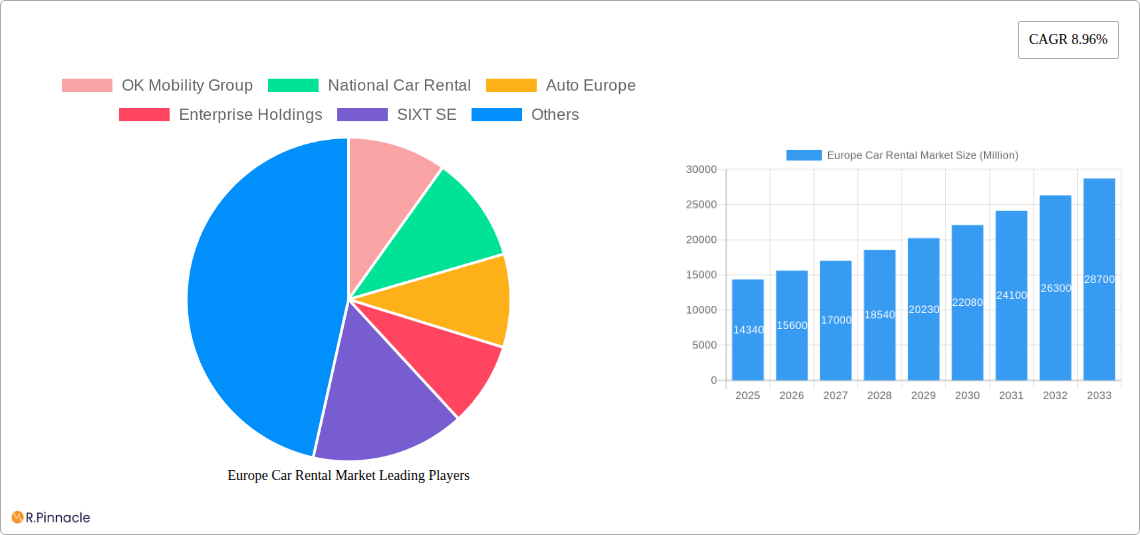

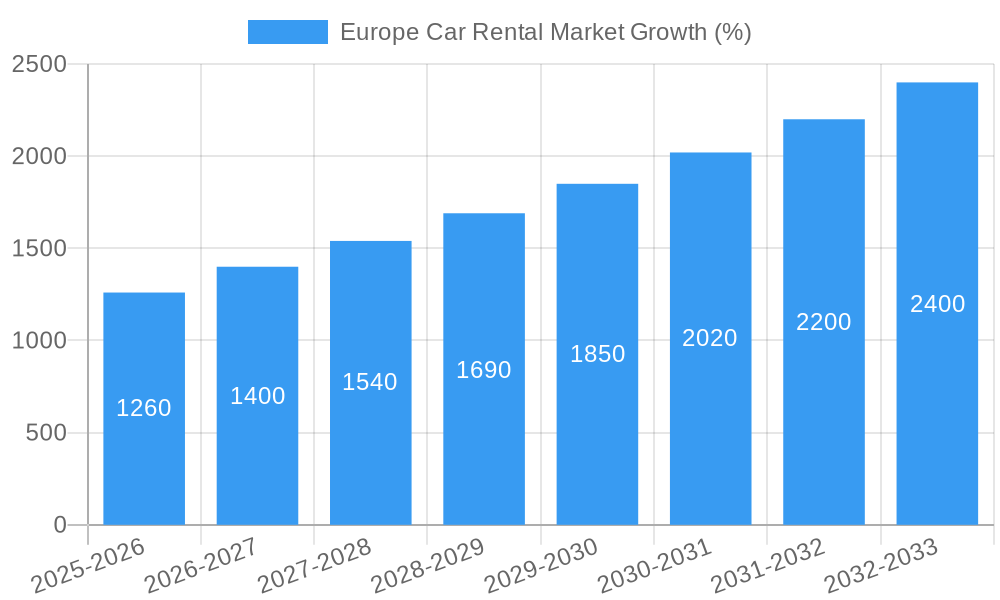

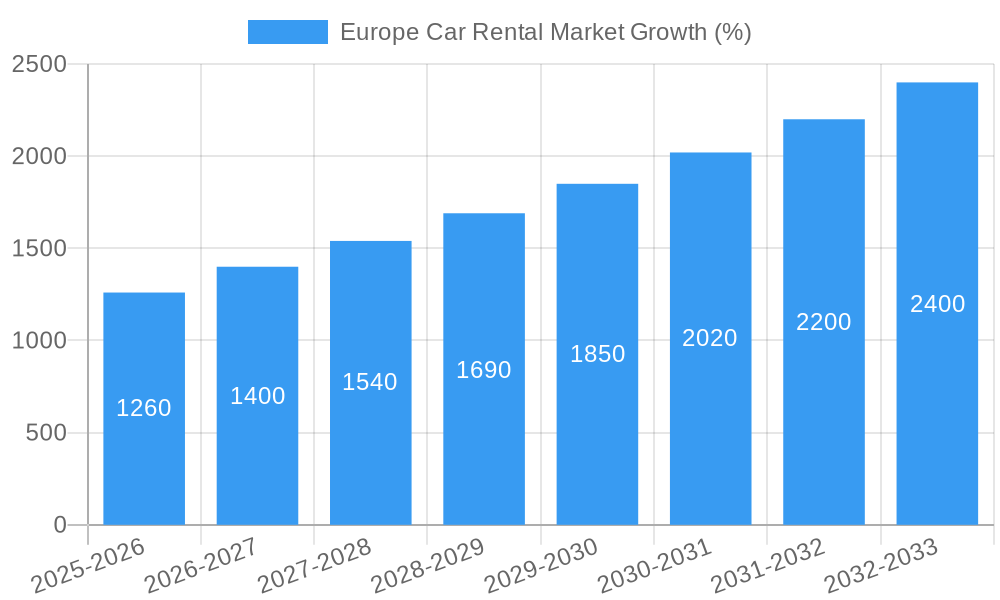

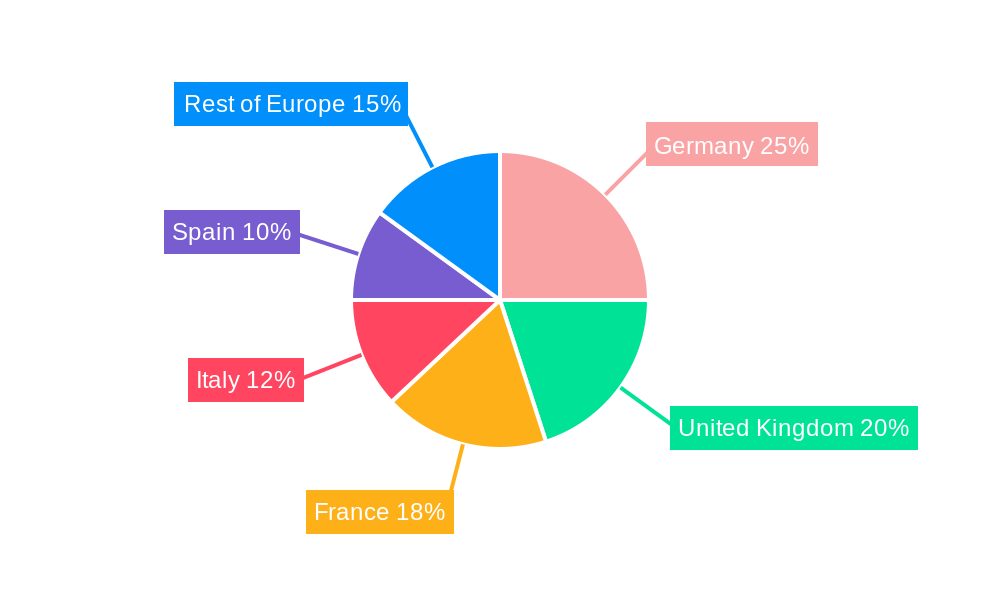

The European car rental market, valued at €14.34 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising popularity of leisure travel and business trips across Europe fuels demand for short-term rentals. The increasing adoption of online booking platforms simplifies the rental process, boosting convenience and accessibility for consumers. Furthermore, the expanding fleet of both economy and premium vehicles caters to diverse customer preferences and budgets. Growth is also spurred by the increasing preference for self-drive holidays, particularly among younger demographics, and the growing adoption of car-sharing services. However, challenges such as fluctuating fuel prices, stringent environmental regulations impacting vehicle emissions, and potential economic downturns pose restraints to market expansion. The market is segmented by booking type (offline vs. online), rental duration (short-term vs. long-term), application type (leisure/tourism vs. business), vehicle type (economy/budget vs. premium/luxury), and country (Germany, UK, France, Spain, Italy, and Rest of Europe). Germany, the UK, and France currently hold the largest market shares, reflecting their substantial tourism and business travel sectors.

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 8.96%, indicating significant market expansion. Competitive dynamics are shaped by a mix of large multinational corporations like Enterprise Holdings and Avis Budget Group, alongside regional players like OK Mobility Group and SIXT SE. Future market success hinges on companies' ability to adapt to evolving consumer preferences, leverage technology for enhanced booking and management systems, implement sustainable practices, and effectively navigate regulatory changes within each European nation. Strong online presence, flexible rental options, and an emphasis on customer service are vital for competitive advantage in this dynamic and growing market.

Europe Car Rental Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe car rental market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth drivers, competitive landscapes, and future projections. The analysis incorporates key segments, including booking type, rental duration, application type, vehicle type, and country-specific data for major European markets.

Europe Car Rental Market Structure & Innovation Trends

The Europe car rental market is characterized by a moderately concentrated landscape, with a few major players commanding significant market share. However, smaller, regional players also contribute to a dynamic and competitive environment. The market is driven by innovation in areas such as online booking platforms, mobile applications, and the integration of electric vehicles. Strict regulatory frameworks regarding safety, emissions, and data privacy influence operational strategies. Product substitutes, such as ride-sharing services and public transportation, exert competitive pressure. End-user demographics show a growing preference for convenience and personalized services, shaping product offerings. M&A activity has been significant, with deals valued at xx Million in the last five years, driving consolidation and market reshaping.

- Market Concentration: The top five players hold an estimated xx% market share.

- Innovation Drivers: Technological advancements, customer expectations, and sustainability initiatives.

- Regulatory Frameworks: EU regulations on data privacy, environmental standards, and consumer protection.

- M&A Activity: xx Million in deal value over the past five years, primarily driven by consolidation efforts.

Europe Car Rental Market Dynamics & Trends

The Europe car rental market exhibits robust growth, projected at a CAGR of xx% during 2025-2033. This growth is fueled by factors such as increasing tourism, business travel, and the rising popularity of road trips. Technological disruptions, such as the adoption of online booking systems and mobile apps, have significantly enhanced customer experience and convenience, boosting market penetration. Changing consumer preferences towards flexible rental options and premium services are reshaping the market. Intense competition among established players and new entrants drives innovation and efficiency improvements. Market penetration of online booking systems is estimated to reach xx% by 2033.

Dominant Regions & Segments in Europe Car Rental Market

The report identifies Germany, the United Kingdom, and France as the dominant markets, driven by robust tourism sectors, well-developed infrastructure, and high business travel activity. Short-term rentals constitute a significant portion of the market, followed by long-term rentals. The leisure/tourism segment is the largest application area, while the business segment also demonstrates substantial growth. Economy/budget cars dominate the vehicle type segment due to price sensitivity and convenience, with premium/luxury cars showing moderate growth.

- Germany: Strong economy, extensive infrastructure, high tourism rates.

- United Kingdom: Large population, diverse tourism, well-developed transportation network.

- France: Popular tourist destination, extensive highway network, high business travel volume.

- Short-Term Rentals: Dominated by leisure travelers and spontaneous bookings.

- Leisure/Tourism Segment: Driven by the growth of tourism and holiday travel.

Europe Car Rental Market Product Innovations

Recent product innovations focus on enhanced online platforms, mobile app functionalities, and improved customer service. The integration of technology like telematics, GPS tracking, and connected car features is becoming increasingly prevalent. The introduction of electric vehicles and sustainable transportation solutions is gaining traction, driven by environmental concerns and government regulations. These innovations are improving operational efficiency, enhancing customer experience, and aligning with broader sustainability goals within the market.

Report Scope & Segmentation Analysis

The report segments the Europe car rental market across various parameters:

- Booking Type: Offline and Online (Online bookings are growing rapidly).

- Rental Duration: Short-Term and Long-Term (Short-term dominates).

- Application Type: Leisure/Tourism and Business (Leisure tourism is the leading segment).

- Vehicle Type: Economy/Budget Cars and Premium/Luxury Cars (Economy cars are the most significant).

- Country: Germany, United Kingdom, France, Spain, Italy, and Rest of Europe (Germany, UK, and France are leading markets).

Each segment's growth projections, market size, and competitive dynamics are analyzed in detail within the report.

Key Drivers of Europe Car Rental Market Growth

Growth is driven by several factors, including:

- Rising Tourism and Business Travel: Increased travel contributes to demand for rental cars.

- Technological Advancements: Improved online platforms and mobile apps enhance booking and service.

- Favorable Economic Conditions: Positive economic growth stimulates travel and vehicle rentals.

Challenges in the Europe Car Rental Market Sector

The Europe car rental market faces several challenges, including:

- Intense Competition: Pressure from established players and new entrants.

- Regulatory Hurdles: Stringent regulations regarding emissions and data privacy.

- Supply Chain Disruptions: Challenges in vehicle availability and maintenance impact operations.

Emerging Opportunities in Europe Car Rental Market

Emerging opportunities exist in:

- Electric Vehicle Rentals: Growing demand for environmentally friendly transportation.

- Subscription Models: Long-term rental options provide flexibility and affordability.

- Expansion into Emerging Markets: Untapped potential in less developed European regions.

Leading Players in the Europe Car Rental Market Market

- OK Mobility Group

- National Car Rental

- Auto Europe

- Enterprise Holdings

- SIXT SE

- Budget Rent a Car System Inc

- Alamo Rent A Car

- ACE Rent A Car

- Hertz Global Holdings

- Europcar Mobility Group

- Avis Budget Group Inc

Key Developments in Europe Car Rental Market Industry

- December 2023: SIXT SE phases out Tesla electric rental cars due to reduced resale value.

- October 2023: Enterprise Holdings rebrands to Enterprise Mobility.

- June 2023: Europcar partners with BringOz logistics platform to optimize vehicle movement.

Future Outlook for Europe Car Rental Market Market

The Europe car rental market is poised for continued growth, driven by sustained tourism, technological advancements, and the expanding adoption of innovative rental models. Strategic investments in technology, sustainability initiatives, and expansion into new markets will be crucial for achieving sustainable growth and market leadership in the years to come.

Europe Car Rental Market Segmentation

-

1. Booking Type

- 1.1. Offline

- 1.2. Online

-

2. Rental Duration

- 2.1. Short Term

- 2.2. Long Term

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Economy/Budget Cars

- 4.2. Premium/Luxury Cars

Europe Car Rental Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inbound Tourism to Fuel Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Online Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short Term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Economy/Budget Cars

- 5.4.2. Premium/Luxury Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Germany Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 OK Mobility Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 National Car Rental

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Auto Europe

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Enterprise Holdings

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SIXT SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Budget Rent a Car System Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Alamo Rent a Car

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ACE Rent A Ca

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Hertz Global Holdings

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Europcar Mobility Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Avis Budget Group Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 OK Mobility Group

List of Figures

- Figure 1: Europe Car Rental Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Car Rental Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Car Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 3: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 4: Europe Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 5: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Europe Car Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 16: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 17: Europe Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 18: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Europe Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Belgium Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Denmark Europe Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Car Rental Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the Europe Car Rental Market?

Key companies in the market include OK Mobility Group, National Car Rental, Auto Europe, Enterprise Holdings, SIXT SE, Budget Rent a Car System Inc, Alamo Rent a Car, ACE Rent A Ca, Hertz Global Holdings, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Europe Car Rental Market?

The market segments include Booking Type, Rental Duration, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inbound Tourism to Fuel Market Growth.

6. What are the notable trends driving market growth?

Online Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: SIXT SE, a German-based car rental company, announced that it was phasing out Tesla electric rental cars from its fleets because of reduced resale costs. SIXT was the second company apart from Hertz to announce the replacement of its electric vehicle fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Car Rental Market?

To stay informed about further developments, trends, and reports in the Europe Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence