Key Insights

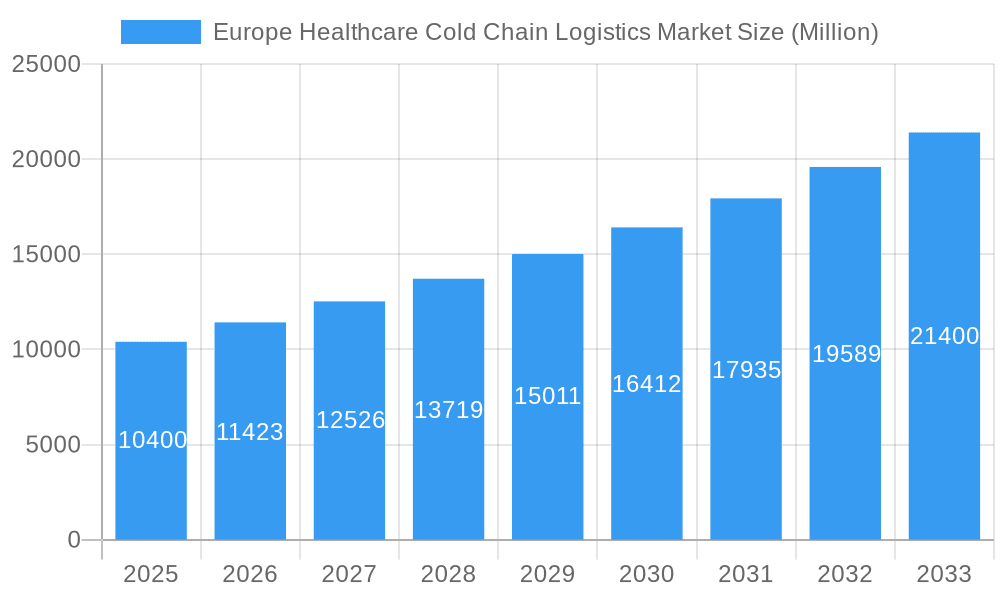

The European healthcare cold chain logistics market, valued at €10.40 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.69% from 2025 to 2033. This significant growth is driven by several key factors. The increasing prevalence of chronic diseases necessitates the efficient and reliable transportation of temperature-sensitive pharmaceuticals, including biopharmaceuticals and vaccines. Stringent regulatory requirements concerning product integrity and safety further fuel demand for specialized cold chain solutions. Advancements in cold chain technologies, such as temperature-controlled containers and real-time monitoring systems, enhance efficiency and reduce the risk of spoilage, contributing to market expansion. Furthermore, the growing adoption of personalized medicine and the rise of biologics are creating additional demand for specialized logistics services. The market is segmented by country (Germany, France, Spain, and the rest of Europe), product (biopharmaceuticals, vaccines, clinical trial materials), services (transportation, storage, value-added services like packaging and labeling), and end-user (hospitals, clinics, pharmaceutical, biopharmaceutical, and biotechnology companies). Germany, France, and Spain represent the largest national markets within Europe, reflecting their established healthcare infrastructure and higher healthcare spending.

Europe Healthcare Cold Chain Logistics Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational logistics providers and specialized cold chain logistics companies. Key players like DB Schenker, DHL, Marken Ltd, and Kuehne + Nagel are leveraging their extensive networks and technological capabilities to cater to the growing market demand. Smaller, specialized firms focus on niche segments, such as the transportation of highly sensitive biological samples. However, challenges remain. The fluctuating cost of fuel and the complexities of complying with international regulations pose potential obstacles to market growth. Despite these challenges, the long-term outlook for the European healthcare cold chain logistics market remains positive, driven by the underlying trends mentioned above and continued investment in infrastructure and technology. The market's future trajectory is likely to be influenced by the increasing adoption of digital technologies for enhanced visibility and control within the cold chain.

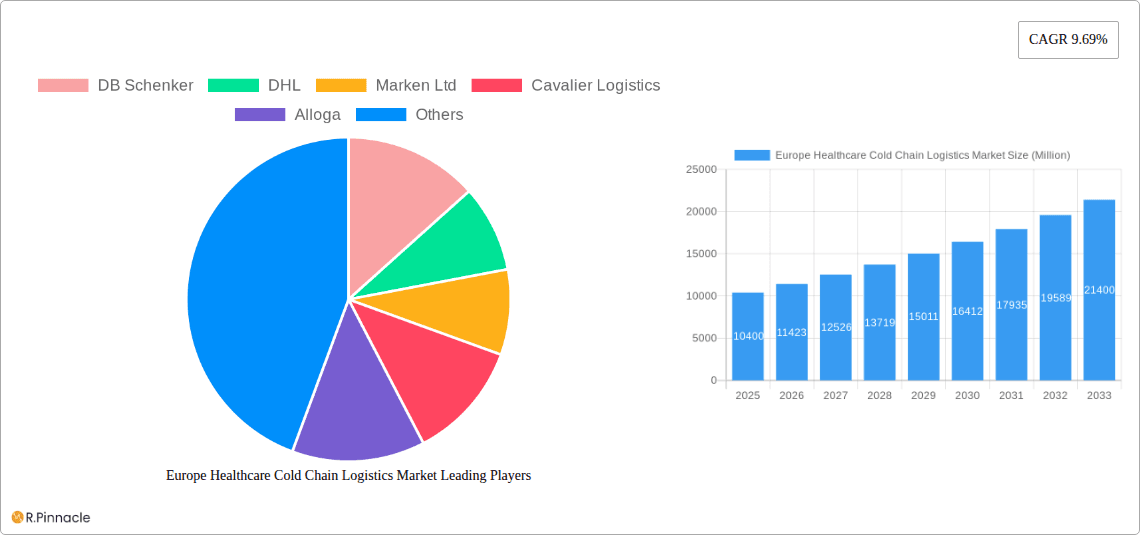

Europe Healthcare Cold Chain Logistics Market Company Market Share

Europe Healthcare Cold Chain Logistics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Healthcare Cold Chain Logistics Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market is segmented by country (Germany, France, Spain, Rest of Europe), product (biopharmaceuticals, vaccines, clinical trial materials), services (transportation, storage, value-added services), and end-user (hospitals, clinics, pharmaceuticals, biopharmaceutical, biotechnology companies). The total market size in 2025 is estimated at xx Million.

Europe Healthcare Cold Chain Logistics Market Structure & Innovation Trends

The European healthcare cold chain logistics market exhibits a moderately consolidated structure, with key players such as DB Schenker, DHL, Marken Ltd, Kuehne + Nagel, and others holding significant market share. However, the presence of numerous smaller, specialized providers indicates a competitive landscape. Market share data for 2025 estimates DB Schenker at xx%, DHL at xx%, Marken Ltd at xx%, and Kuehne + Nagel at xx%. The remaining share is distributed among other players, including Cavalier Logistics, Alloga, Envirotainer, Carrier Transicold, Primafrio, and Biocair, along with several smaller companies. Innovation is driven by the increasing demand for temperature-sensitive pharmaceuticals, stricter regulatory compliance, and advancements in technology such as IoT-enabled monitoring and AI-powered route optimization. Recent M&A activity in the sector, totaling approximately xx Million in 2024, reflects consolidation efforts and expansion strategies. Regulatory frameworks, such as GDP (Good Distribution Practice) guidelines, significantly influence market operations. Product substitutes are limited, as maintaining the integrity of temperature-sensitive products is paramount. The end-user demographics are shifting towards specialized healthcare providers and biotechnology companies driving demand for sophisticated logistics solutions.

Europe Healthcare Cold Chain Logistics Market Dynamics & Trends

The European healthcare cold chain logistics market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the increasing prevalence of chronic diseases leading to higher demand for pharmaceuticals, the rise of biologics and other temperature-sensitive medications, technological advancements improving cold chain efficiency and monitoring capabilities (such as real-time tracking and predictive analytics), and stringent regulatory requirements enforcing higher standards for transportation and storage. Market penetration of advanced cold chain technologies is increasing steadily, with adoption rates projected to reach xx% by 2033. Consumer preferences, especially among pharmaceutical companies, are shifting towards integrated logistics solutions that provide end-to-end visibility and traceability. Competitive dynamics are characterized by both consolidation and differentiation. Larger companies are expanding their service offerings, while smaller players are focusing on niche segments and specialized solutions.

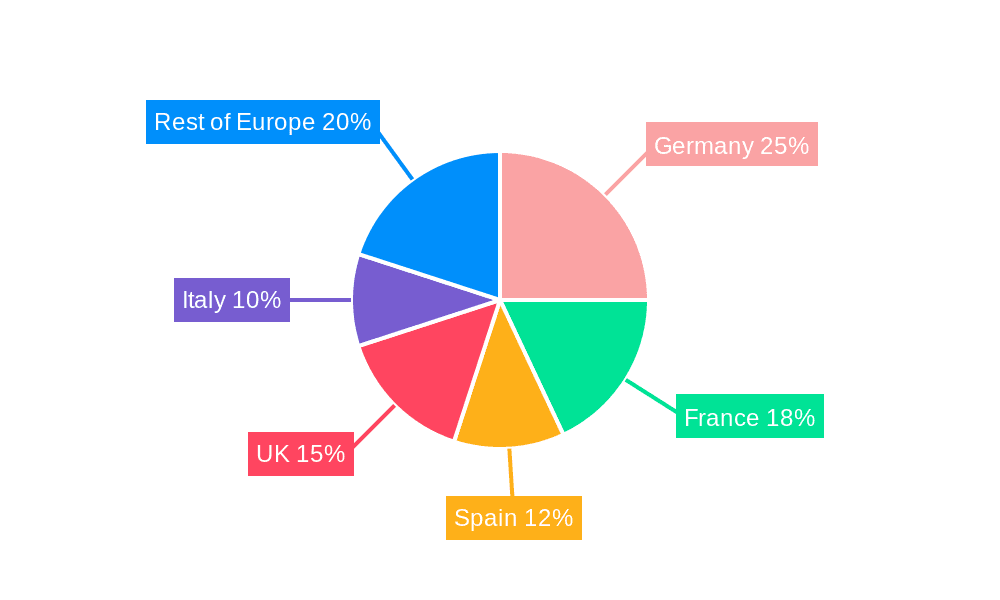

Dominant Regions & Segments in Europe Healthcare Cold Chain Logistics Market

- By Country: Germany currently holds the largest market share, driven by a robust pharmaceutical industry and advanced infrastructure. France and Spain follow, with significant growth potential in the rest of Europe. Key drivers for Germany's dominance include its strong economic performance, well-developed transportation networks, and the concentration of major pharmaceutical companies. France benefits from its large population and robust healthcare system, while Spain showcases a rapidly expanding pharmaceutical sector.

- By Product: Biopharmaceuticals constitute the largest segment, followed by vaccines and clinical trial materials. This dominance is due to the escalating demand for biologics and the rising investment in clinical trials across Europe.

- By Services: Transportation currently holds the largest share, although value-added services like packaging and labeling are showing faster growth. This is attributed to the increasing need for specialized packaging and regulatory compliance in this industry.

- By End User: Pharmaceutical companies and biotechnology firms are the primary end-users, with hospitals and clinics contributing significantly to the market. This segment is characterized by complex supply chains and demanding quality and regulatory compliance requirements.

Europe Healthcare Cold Chain Logistics Market Product Innovations

Recent innovations focus on enhancing temperature control precision, utilizing advanced tracking and monitoring technologies (including IoT sensors and blockchain), and improving packaging materials to provide superior insulation and protection. These advancements aim to mitigate risks associated with temperature excursions, enhance supply chain visibility, and ensure product integrity, thus leading to increased efficiency and reduced waste. The market is moving towards more integrated and automated solutions, improving overall cold chain management.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the European healthcare cold chain logistics market, segmented by country (Germany, France, Spain, and Rest of Europe), product type (biopharmaceuticals, vaccines, and clinical trial materials), services offered (transportation, storage, and value-added services), and end-user (hospitals, clinics, pharmaceutical, biopharmaceutical, and biotechnology companies). Each segment’s growth projections, market size, and competitive dynamics are analyzed in detail.

Key Drivers of Europe Healthcare Cold Chain Logistics Market Growth

The market’s growth is driven by several factors: increased demand for temperature-sensitive pharmaceutical products, technological advancements in cold chain management, stringent regulatory compliance requirements, and a growing focus on patient safety. Advancements such as real-time temperature monitoring and predictive analytics are enhancing efficiency and reducing waste. Increased investment in research and development of biologics fuels this market significantly.

Challenges in the Europe Healthcare Cold Chain Logistics Market Sector

Key challenges include maintaining consistent temperature control throughout the supply chain, navigating complex regulatory landscapes, managing risks associated with product spoilage or damage, and ensuring cost-effectiveness. Supply chain disruptions due to geopolitical events and natural disasters pose further challenges. The high cost of specialized equipment and maintaining stringent quality standards is an additional hurdle.

Emerging Opportunities in Europe Healthcare Cold Chain Logistics Market

Emerging opportunities lie in the adoption of advanced technologies such as AI, machine learning, and blockchain for improved efficiency, transparency, and security. The growing demand for personalized medicine and the increasing prevalence of chronic diseases present growth opportunities. The development of sustainable cold chain solutions addressing environmental concerns offers additional market potential.

Leading Players in the Europe Healthcare Cold Chain Logistics Market Market

- DB Schenker

- DHL

- Marken Ltd

- Cavalier Logistics

- Alloga

- Kuehne + Nagel

- Envirotainer

- 7 3 Other Companies

- Carrier Transicold

- Primafrio

- Biocair

Key Developments in Europe Healthcare Cold Chain Logistics Market Industry

- January 2023: DHL announced a significant expansion of its cold chain infrastructure in Germany.

- May 2024: Marken Ltd launched a new temperature-controlled packaging solution.

- October 2024: A merger between two smaller cold chain logistics companies resulted in xx Million deal.

Future Outlook for Europe Healthcare Cold Chain Logistics Market Market

The European healthcare cold chain logistics market is poised for continued growth, driven by innovation, increased demand for temperature-sensitive pharmaceuticals, and ongoing technological advancements. Strategic partnerships and investments in advanced technologies will be key to success. The market offers significant opportunities for companies that can provide reliable, efficient, and cost-effective solutions that meet the increasing demands of the healthcare industry.

Europe Healthcare Cold Chain Logistics Market Segmentation

-

1. Product

- 1.1. Biopharmaceuticals

- 1.2. Vaccines

- 1.3. Clinical Trial Materials

-

2. Services

- 2.1. Transportation

- 2.2. Storage

- 2.3. Value Added Services (Packaging and Labeling)

-

3. End User

- 3.1. Hospitals, Clinics and Pharmaceuticals

- 3.2. Biopharmaceutical

- 3.3. Biotechnology

Europe Healthcare Cold Chain Logistics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Healthcare Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Europe Healthcare Cold Chain Logistics Market

Europe Healthcare Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Investment; Risk of Temperature Excursions

- 3.4. Market Trends

- 3.4.1. The OTC Pharmaceuticals Consumption is Projected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Healthcare Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biopharmaceuticals

- 5.1.2. Vaccines

- 5.1.3. Clinical Trial Materials

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Transportation

- 5.2.2. Storage

- 5.2.3. Value Added Services (Packaging and Labeling)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals, Clinics and Pharmaceuticals

- 5.3.2. Biopharmaceutical

- 5.3.3. Biotechnology

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marken Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cavalier Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alloga

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Envirotainer**List Not Exhaustive 7 3 Other Companie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carrier Transicold

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Primafrio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Biocair

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Healthcare Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Healthcare Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 3: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 7: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Healthcare Cold Chain Logistics Market?

The projected CAGR is approximately 9.69%.

2. Which companies are prominent players in the Europe Healthcare Cold Chain Logistics Market?

Key companies in the market include DB Schenker, DHL, Marken Ltd, Cavalier Logistics, Alloga, Kuehne + Nagel, Envirotainer**List Not Exhaustive 7 3 Other Companie, Carrier Transicold, Primafrio, Biocair.

3. What are the main segments of the Europe Healthcare Cold Chain Logistics Market?

The market segments include Product, Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries.

6. What are the notable trends driving market growth?

The OTC Pharmaceuticals Consumption is Projected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Initial Capital Investment; Risk of Temperature Excursions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Healthcare Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Healthcare Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Healthcare Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Healthcare Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence