Key Insights

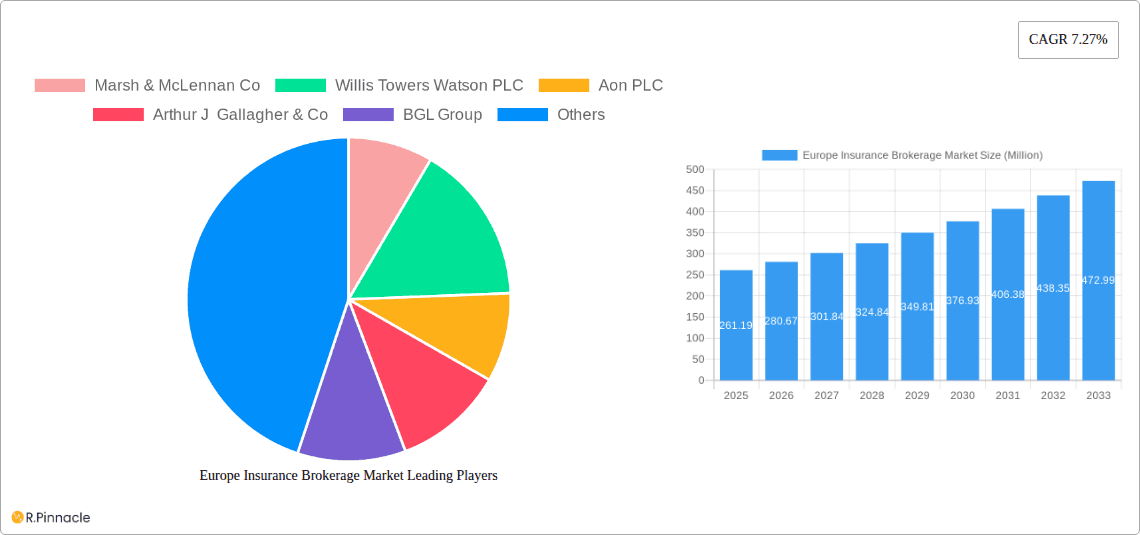

The European insurance brokerage market, valued at €261.19 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.27% from 2025 to 2033. This expansion is fueled by several key factors. Increasing demand for specialized insurance products and risk management solutions across diverse sectors, including but not limited to financial services, healthcare, and manufacturing, is a significant driver. Furthermore, the growing complexity of insurance regulations and the need for expert advice are pushing businesses to rely more heavily on the services offered by insurance brokers. Technological advancements, such as the adoption of Insurtech solutions and data analytics, are also contributing to market growth by improving efficiency, automating processes, and enhancing client engagement. The competitive landscape is characterized by a mix of large multinational corporations like Marsh & McLennan, Willis Towers Watson, and Aon, alongside regional players and niche brokers. This dynamic environment fosters innovation and drives competition, ultimately benefiting clients.

Europe Insurance Brokerage Market Market Size (In Million)

The market's trajectory is influenced by several trends. A shift towards digital platforms and online brokerage services is reshaping client interactions. The rising adoption of data-driven risk assessment methodologies is enhancing the accuracy and effectiveness of risk mitigation strategies. Consolidation within the industry, through mergers and acquisitions, is also expected to continue, leading to a more concentrated market structure. However, challenges such as economic volatility and increasing competition from Insurtech disruptors could pose potential restraints on market growth. Nevertheless, the long-term outlook remains positive, driven by the sustained demand for professional insurance brokerage services and the ongoing evolution of the insurance landscape. The market segmentation, though not explicitly provided, likely reflects variations in insurance lines (e.g., property & casualty, life & health), client size (e.g., SMEs, large corporations), and geographical distribution within Europe.

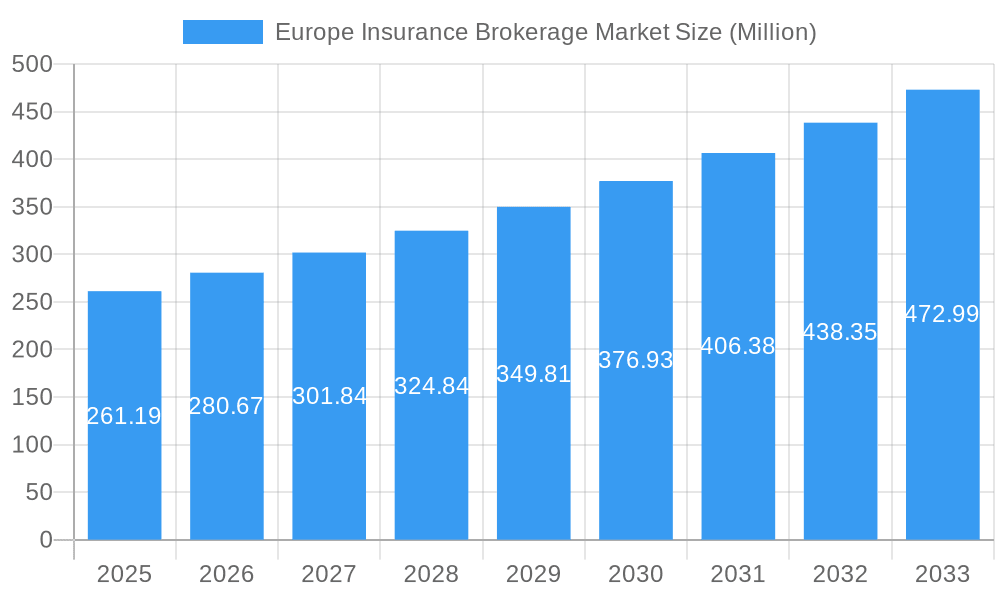

Europe Insurance Brokerage Market Company Market Share

Europe Insurance Brokerage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Insurance Brokerage Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The report leverages extensive data analysis and expert insights to provide a clear understanding of the market landscape, encompassing key trends, challenges, and opportunities.

Europe Insurance Brokerage Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European insurance brokerage market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report quantifies market share held by major players such as Marsh & McLennan Co, Willis Towers Watson PLC, Aon PLC, Arthur J Gallagher & Co, BGL Group, AmWINS Group Inc, Assured Partners Inc, NFP Corp, Lockton Companies, and HUB International Ltd (list not exhaustive). We delve into the impact of mergers and acquisitions (M&A), analyzing deal values and their influence on market dynamics. The analysis also considers the role of regulatory frameworks and their effects on market competition, innovation, and growth. Innovation drivers are examined, alongside an assessment of substitute products and the evolving demographics of end-users.

Europe Insurance Brokerage Market Market Dynamics & Trends

This section explores the key factors driving market growth, including technological advancements, shifting consumer preferences, and competitive dynamics. The report presents a detailed analysis of the Compound Annual Growth Rate (CAGR) and market penetration rates across different segments. We examine the impact of technological disruptions, such as the adoption of Insurtech solutions, on market structure and competitive dynamics. The analysis considers macroeconomic factors influencing the market, including economic growth, inflation, and interest rates. Further insights are provided on the evolution of consumer preferences, including demand for personalized insurance products and digital channels.

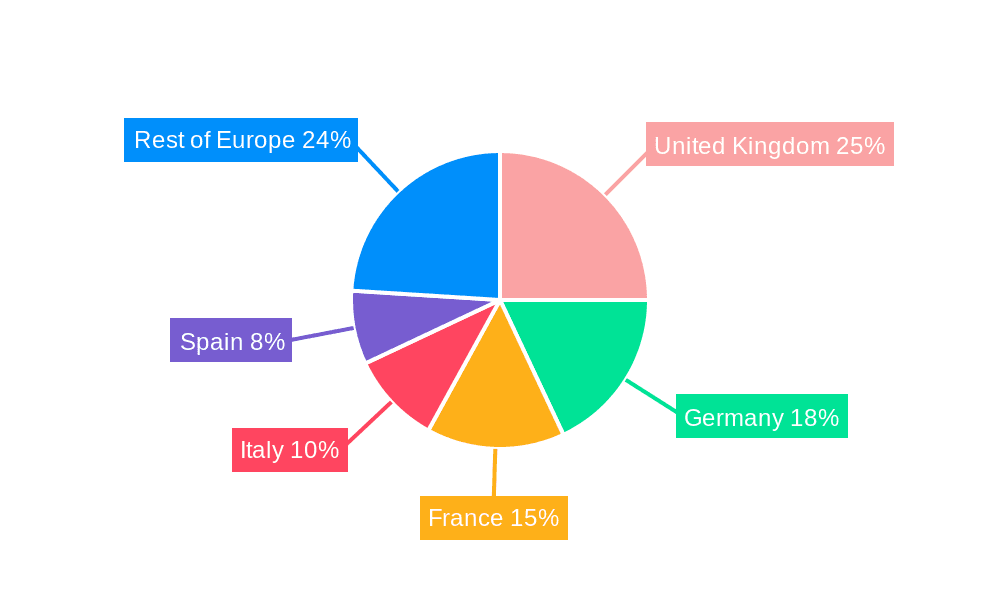

Dominant Regions & Segments in Europe Insurance Brokerage Market

This section identifies the leading regions and segments within the European insurance brokerage market. Key drivers of dominance are analyzed using a detailed breakdown by country and segment, emphasizing contributing factors such as economic policies, infrastructure development, and regulatory environment. The analysis leverages a combination of qualitative and quantitative data to identify areas of strength and potential for growth within specific geographical locations and market segments.

- Key Drivers (examples):

- Favorable economic policies stimulating investment in insurance.

- Robust infrastructure supporting efficient insurance operations.

- Supportive regulatory frameworks encouraging market participation.

Europe Insurance Brokerage Market Product Innovations

This section summarizes recent product developments, their applications, and competitive advantages. The analysis focuses on technological advancements and their impact on market fit, highlighting the role of Insurtech and its influence on product differentiation and customer experience.

Report Scope & Segmentation Analysis

The report provides a detailed segmentation analysis of the Europe Insurance Brokerage Market. This includes a breakdown by [Insert Segmentation details here - e.g., type of insurance, customer size, distribution channel etc.]. Each segment's growth projections, market size, and competitive dynamics are presented. We will estimate the market size for each segment and offer projections for future growth.

Key Drivers of Europe Insurance Brokerage Market Growth

This section identifies and analyzes the key factors driving growth in the Europe Insurance Brokerage Market. These include technological advancements (e.g., AI-driven risk assessment, digital distribution platforms), economic factors (e.g., GDP growth, insurance penetration rates), and regulatory changes (e.g., new compliance requirements, insurance reforms).

Challenges in the Europe Insurance Brokerage Market Sector

This section identifies and analyzes the challenges faced by the Europe Insurance Brokerage Market. These may include regulatory hurdles (e.g., compliance costs, licensing requirements), supply chain issues (e.g., data security breaches, cyberattacks), and intense competitive pressures (e.g., price wars, market consolidation). The impact of these challenges on market growth is quantified where possible.

Emerging Opportunities in Europe Insurance Brokerage Market

This section highlights emerging opportunities in the Europe Insurance Brokerage Market. This will cover new markets (e.g., untapped customer segments, expansion into new geographies), emerging technologies (e.g., blockchain, IoT-enabled insurance), and evolving consumer preferences (e.g., increasing demand for personalized insurance, digital insurance offerings).

Leading Players in the Europe Insurance Brokerage Market Market

- Marsh & McLennan Co

- Willis Towers Watson PLC

- Aon PLC

- Arthur J Gallagher & Co

- BGL Group

- AmWINS Group Inc

- Assured Partners Inc

- NFP Corp

- Lockton Companies

- HUB International Ltd

Key Developments in Europe Insurance Brokerage Market Industry

- March 2022: Marsh & McLennan, the world's largest insurance broker, planned to exit all of its businesses in Russia.

- March 2022: Aon PLC acquired the actuarial software platform Tyche, significantly expanding its capabilities in the re/insurance sector.

Future Outlook for Europe Insurance Brokerage Market Market

This section summarizes the growth accelerators and provides an outlook for the future of the Europe Insurance Brokerage Market. It highlights strategic opportunities for market participants and discusses the potential for continued growth, considering evolving market dynamics and emerging trends. The forecast incorporates expert opinions and qualitative assessments to provide a holistic view of the market's future trajectory. The report projects a market value of XX Million by 2033.

Europe Insurance Brokerage Market Segmentation

-

1. Type of Insurance

- 1.1. Life Insurance

- 1.2. Non-life Insurance

Europe Insurance Brokerage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Insurance Brokerage Market Regional Market Share

Geographic Coverage of Europe Insurance Brokerage Market

Europe Insurance Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Demand for Insurance Policies Driving the Insurance Brokerage Market in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insurance Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marsh & McLennan Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Willis Towers Watson PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aon PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arthur J Gallagher & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BGL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AmWINS Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Assured Partners Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NFP Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lockton Companies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HUB International Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Marsh & McLennan Co

List of Figures

- Figure 1: Europe Insurance Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Insurance Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Insurance Brokerage Market Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 2: Europe Insurance Brokerage Market Volume Billion Forecast, by Type of Insurance 2020 & 2033

- Table 3: Europe Insurance Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Insurance Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Europe Insurance Brokerage Market Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 6: Europe Insurance Brokerage Market Volume Billion Forecast, by Type of Insurance 2020 & 2033

- Table 7: Europe Insurance Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Insurance Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insurance Brokerage Market?

The projected CAGR is approximately 7.27%.

2. Which companies are prominent players in the Europe Insurance Brokerage Market?

Key companies in the market include Marsh & McLennan Co, Willis Towers Watson PLC, Aon PLC, Arthur J Gallagher & Co, BGL Group, AmWINS Group Inc, Assured Partners Inc, NFP Corp, Lockton Companies, HUB International Ltd**List Not Exhaustive.

3. What are the main segments of the Europe Insurance Brokerage Market?

The market segments include Type of Insurance.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.19 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Demand for Insurance Policies Driving the Insurance Brokerage Market in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: Marsh & McLennan, the world's largest insurance broker, was planning to exit all of its businesses in Russia, while its rival Aon suspended operations in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insurance Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insurance Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insurance Brokerage Market?

To stay informed about further developments, trends, and reports in the Europe Insurance Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence