Key Insights

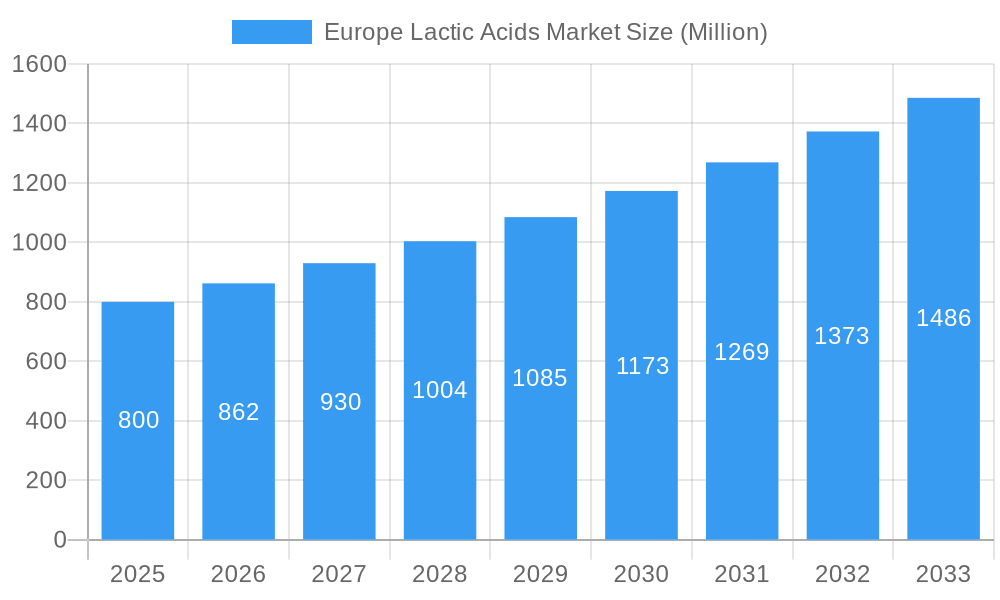

The European lactic acid market, valued at €0.45 million in 2024, is forecast for substantial growth. Driven by escalating demand in diverse food and beverage sectors, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.7%. This robust expansion is expected to elevate the market size to over €1.5 billion by 2033. Key growth drivers include a rising consumer preference for natural and clean-label ingredients, particularly in bakery, confectionery, dairy, and meat products. The burgeoning functional food and beverage industry, with its emphasis on health and wellness, also significantly contributes to market expansion. Furthermore, lactic acid's established role as a preservative and acidity regulator in various food applications bolsters market growth. While potential supply chain vulnerabilities and raw material price volatility present challenges, the market outlook remains highly positive, with Germany, France, and the UK leading consumption.

Europe Lactic Acids Market Market Size (In Million)

Market segmentation highlights a strong preference for naturally sourced lactic acid over synthetic alternatives, aligning with consumer demand for sustainable and natural ingredients. The food and beverage industry remains the dominant application segment, with bakery and confectionery experiencing the most pronounced growth. Leading industry players, including Gremount International, Galactic, Vigon International, DuPont, Corbion, and DECHEMA, are actively investing in research and development to enhance product quality and diversify portfolios, catering to evolving market requirements. Innovations focus on optimizing production processes for improved efficiency and reduced environmental impact. The competitive landscape indicates a strategic emphasis on partnerships, mergers, and acquisitions to secure market share and broaden geographical presence. The European lactic acid market offers significant growth opportunities, especially for enterprises prioritizing sustainable, high-quality products that meet contemporary consumer expectations.

Europe Lactic Acids Market Company Market Share

Europe Lactic Acids Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Lactic Acids Market, offering valuable insights for industry professionals, investors, and stakeholders. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report segments the market by application (Bakery, Confectionery, Dairy, Beverages, Meat, Poultry and Fish, Fruits and Vegetables) and source (Natural, Synthetic), providing a granular understanding of market dynamics and growth potential. Key players like Gremount International Company Limited, Galactic, Vigon International Inc, DuPont de Nemours Inc, Corbion N V, and DECACHIMIE S A are analyzed to understand competitive landscapes and market share.

Europe Lactic Acids Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Europe Lactic Acids market, including market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025. Innovation is driven by the increasing demand for natural and sustainable ingredients across various food and beverage applications. Stringent regulatory frameworks regarding food safety and labeling influence product development and market entry. Substitutes like citric acid and malic acid pose competitive challenges. The end-user demographics are primarily food and beverage manufacturers, with a growing emphasis on health-conscious consumers. M&A activities have been moderate, with a total deal value of approximately xx Million in the last 5 years.

- Market Concentration: Moderately concentrated, top 5 players holding xx% market share (2025).

- Innovation Drivers: Demand for natural ingredients, sustainability concerns.

- Regulatory Framework: Stringent food safety and labeling regulations.

- Product Substitutes: Citric acid, malic acid.

- End-User Demographics: Food and beverage manufacturers, health-conscious consumers.

- M&A Activities: Moderate activity, total deal value of approximately xx Million (2019-2024).

Europe Lactic Acids Market Market Dynamics & Trends

The Europe Lactic Acids market is experiencing robust growth, driven by several factors. The rising demand for clean-label products and the increasing preference for natural food ingredients are key drivers. Technological advancements in fermentation processes have led to more efficient and cost-effective lactic acid production. Consumer preferences towards healthier and functional foods are fueling market growth. Competitive dynamics are shaped by pricing strategies, product innovation, and brand recognition. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with significant market penetration in the dairy and bakery segments. Market penetration in the confectionery segment is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions & Segments in Europe Lactic Acids Market

Germany is the leading region in the Europe Lactic Acids market, driven by a robust food processing industry and high consumer demand for food additives. Other key regions include France, the UK, and Italy. Within applications, the Dairy segment holds the largest market share, followed by the Bakery and Confectionery segments. The Natural source segment shows higher growth compared to the Synthetic segment, reflecting consumer preference for naturally derived ingredients.

- Germany: Leading region due to strong food processing industry and high consumer demand.

- Dairy Segment: Largest market share among applications.

- Natural Source Segment: Higher growth compared to Synthetic segment due to consumer preference.

- Key Drivers (Germany): Strong food processing infrastructure, high disposable income, consumer preference for natural ingredients.

Europe Lactic Acids Market Product Innovations

Recent innovations in the Europe Lactic Acids market focus on developing high-purity lactic acid with enhanced functionality. Manufacturers are investing in eco-friendly production processes to reduce environmental impact. New applications are being explored in areas like pharmaceuticals and cosmetics, expanding market opportunities beyond traditional food and beverage uses. These innovations are enhancing the competitive advantages of leading players through differentiation and improved market fit.

Report Scope & Segmentation Analysis

This report comprehensively segments the Europe Lactic Acids market by application (Bakery, Confectionery, Dairy, Beverages, Meat, Poultry and Fish, Fruits and Vegetables) and source (Natural, Synthetic). Each segment's growth projections, market size, and competitive dynamics are analyzed, providing a detailed understanding of the market landscape. The Dairy application is projected to witness significant growth, driven by its use in yogurt and cheese production. The Natural source segment is experiencing robust growth, owing to the rising demand for naturally derived ingredients.

Key Drivers of Europe Lactic Acids Market Growth

The Europe Lactic Acids market's growth is driven by increasing demand for natural food preservatives, the growing popularity of fermented foods and beverages, and stringent regulations promoting the use of natural ingredients in food products. Technological advancements in fermentation and purification processes also contribute to increased efficiency and lower costs, driving market expansion. The rising health-conscious consumer base further fuels this market growth.

Challenges in the Europe Lactic Acids Market Sector

Challenges faced by the Europe Lactic Acids market include fluctuations in raw material prices, stringent regulatory compliance requirements, and intense competition among manufacturers. Supply chain disruptions and environmental concerns related to production processes also pose significant challenges. These factors can impact profitability and market expansion.

Emerging Opportunities in Europe Lactic Acids Market

Emerging opportunities lie in the development of novel lactic acid derivatives with specialized functionalities. Expanding into new applications like pharmaceuticals and cosmetics presents substantial growth potential. The increasing demand for sustainable and eco-friendly production methods offers opportunities for innovative companies to gain a competitive edge.

Leading Players in the Europe Lactic Acids Market Market

Key Developments in Europe Lactic Acids Market Industry

- October 2022: Corbion N V launched a new range of sustainable lactic acid solutions for the food and beverage industry.

- March 2023: DuPont de Nemours Inc. announced a strategic partnership to expand its lactic acid production capacity in Europe.

- Further key developments will be added in the complete report.

Future Outlook for Europe Lactic Acids Market Market

The Europe Lactic Acids market is poised for significant growth, fueled by increasing consumer demand for clean-label products and the rising popularity of plant-based foods. Strategic investments in research and development, coupled with the adoption of sustainable production practices, will further drive market expansion. The market holds significant potential for players who can effectively address consumer preferences and meet the demands of the evolving food and beverage industry.

Europe Lactic Acids Market Segmentation

-

1. Source

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy

- 2.4. Beverages

- 2.5. Meat, Poultry and Fish

- 2.6. Fruits and Vegetables

Europe Lactic Acids Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Russia

- 1.6. Spain

- 1.7. Rest of Europe

Europe Lactic Acids Market Regional Market Share

Geographic Coverage of Europe Lactic Acids Market

Europe Lactic Acids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Inclination Towards Health

- 3.2.2 Personal Care and Anti-Aging Supplements; Increasing Consumption of Functional Beverages

- 3.3. Market Restrains

- 3.3.1. High Price of the Final Product

- 3.4. Market Trends

- 3.4.1. Growing Demand For Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Lactic Acids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy

- 5.2.4. Beverages

- 5.2.5. Meat, Poultry and Fish

- 5.2.6. Fruits and Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gremount International Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Galactic*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vigon International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DuPont de Nemours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corbion N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DECACHIMIE S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Gremount International Company Limited

List of Figures

- Figure 1: Europe Lactic Acids Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Lactic Acids Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Lactic Acids Market Revenue million Forecast, by Source 2020 & 2033

- Table 2: Europe Lactic Acids Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Lactic Acids Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Lactic Acids Market Revenue million Forecast, by Source 2020 & 2033

- Table 5: Europe Lactic Acids Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Lactic Acids Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: France Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Germany Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Russia Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Spain Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Lactic Acids Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Lactic Acids Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Europe Lactic Acids Market?

Key companies in the market include Gremount International Company Limited, Galactic*List Not Exhaustive, Vigon International Inc, DuPont de Nemours Inc, Corbion N V, DECACHIMIE S A.

3. What are the main segments of the Europe Lactic Acids Market?

The market segments include Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.45 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Health. Personal Care and Anti-Aging Supplements; Increasing Consumption of Functional Beverages.

6. What are the notable trends driving market growth?

Growing Demand For Processed Food.

7. Are there any restraints impacting market growth?

High Price of the Final Product.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Lactic Acids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Lactic Acids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Lactic Acids Market?

To stay informed about further developments, trends, and reports in the Europe Lactic Acids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence