Key Insights

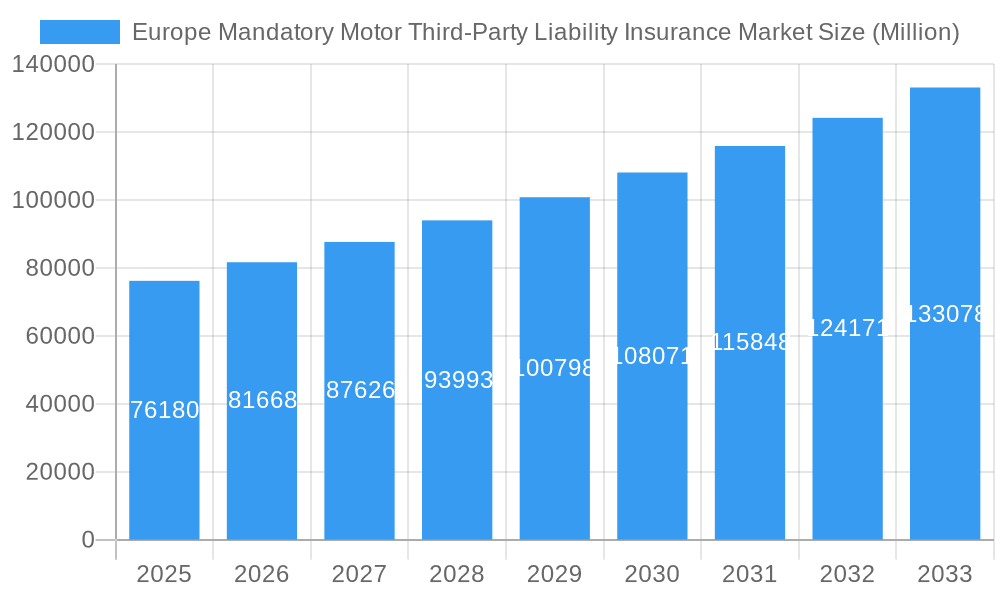

The European Mandatory Motor Third-Party Liability (MTPL) insurance market, valued at €76.18 billion in 2025, is projected to experience robust growth, driven by increasing vehicle ownership, stricter government regulations enforcing comprehensive insurance coverage, and a rising awareness of the financial implications of road accidents. The 7.24% Compound Annual Growth Rate (CAGR) from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Key growth drivers include expanding urban populations in several European countries, leading to increased vehicle density and consequently, a higher likelihood of accidents. Furthermore, evolving insurance technologies, such as telematics and AI-powered risk assessment, are streamlining processes and improving efficiency for insurers, enhancing customer experiences and lowering operational costs. The market also benefits from government initiatives promoting road safety and encouraging higher insurance penetration rates. However, economic downturns and fluctuating fuel prices could pose challenges, impacting consumer spending and potentially reducing insurance uptake. Competitive pressures among major players like Allianz, AXA, Aviva, Admiral Group, MAPFRE, Chubb Limited, Generali Group, Ergo Insurance, and SCOR will likely intensify, leading to innovative product offerings and price optimizations.

Europe Mandatory Motor Third-Party Liability Insurance Market Market Size (In Billion)

The segmentation of the European MTPL insurance market is likely diverse, incorporating factors such as vehicle type (cars, motorcycles, commercial vehicles), policy type (basic coverage, enhanced benefits), and distribution channels (online platforms, brokers, direct sales). Regional variations in insurance regulations, economic conditions, and road safety records will also contribute to market dynamics. The historical period (2019-2024) likely exhibited a similar growth trajectory, albeit possibly impacted by the economic uncertainties of the COVID-19 pandemic. The consistent CAGR over the forecast period suggests a sustained market expansion, underpinned by the fundamental drivers mentioned above. Understanding these trends and dynamics is crucial for insurers to strategize effectively and capitalize on growth opportunities within this significant market segment.

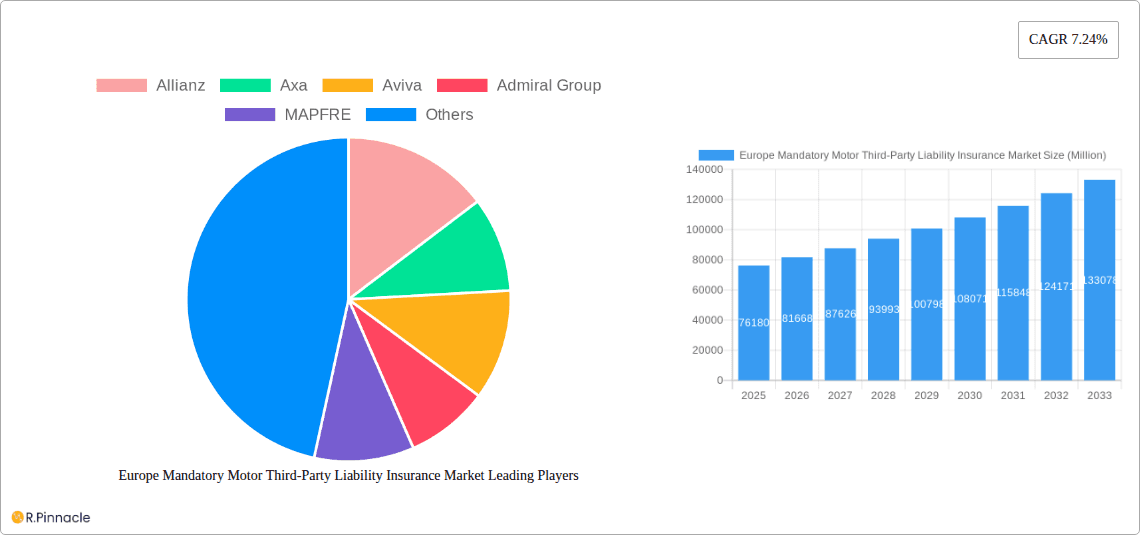

Europe Mandatory Motor Third-Party Liability Insurance Market Company Market Share

Europe Mandatory Motor Third-Party Liability Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Mandatory Motor Third-Party Liability Insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Key players like Allianz, AXA, Aviva, Admiral Group, MAPFRE, Chubb Limited, Generali Group, BaFin, Ergo Insurance, and SCOR (list not exhaustive) are analyzed, alongside market segments and significant industry developments. Expect detailed data on market size (in Millions), CAGR, and market penetration.

Europe Mandatory Motor Third-Party Liability Insurance Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European mandatory motor third-party liability insurance market. We delve into market concentration, identifying key players and their market share. Innovation drivers, including technological advancements and regulatory changes, are examined. The impact of regulatory frameworks, the availability of product substitutes, end-user demographics, and recent M&A activities (including deals like Allianz's acquisition of Tua Assicurazioni for EUR 280 Million and Aviva's acquisition of AIG Life UK for EUR 453 Million) are also discussed. The analysis includes:

- Market Concentration: Assessment of market share held by leading players. (e.g., Allianz holds xx%, AXA holds xx%, etc.)

- Innovation Drivers: Analysis of technological advancements impacting the market (e.g., telematics, AI-powered risk assessment).

- Regulatory Framework: Examination of existing regulations and their influence on market growth and competition.

- M&A Activities: Detailed review of recent mergers and acquisitions, their impact on market consolidation, and the associated deal values.

Europe Mandatory Motor Third-Party Liability Insurance Market Market Dynamics & Trends

This section explores the key market dynamics driving growth and shaping the future of the European mandatory motor third-party liability insurance market. We examine market growth drivers, including economic factors, increasing vehicle ownership, and evolving consumer preferences. The influence of technological disruptions, such as the rise of Insurtech companies and the adoption of digital platforms, is thoroughly analyzed. Competitive dynamics, including pricing strategies and product differentiation, are also discussed. Specific metrics like the Compound Annual Growth Rate (CAGR) and market penetration rates are provided.

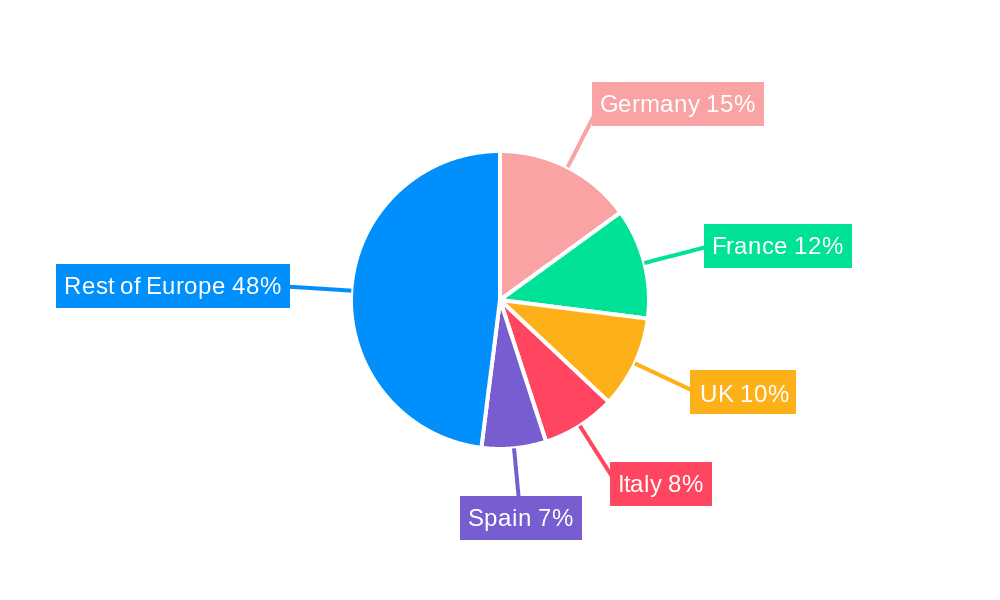

Dominant Regions & Segments in Europe Mandatory Motor Third-Party Liability Insurance Market

This section pinpoints the leading regions and segments within the European market. A detailed analysis of the dominant regions (e.g., Germany, UK, France) explores the factors contributing to their market leadership. We will identify key drivers using bullet points for each region and segment. These might include:

- Economic policies: Impact of government regulations and incentives on market growth.

- Infrastructure: Role of infrastructure development in driving market expansion.

- Consumer behavior: Analysis of consumer preferences and buying patterns.

Europe Mandatory Motor Third-Party Liability Insurance Market Product Innovations

This section summarizes recent product developments, focusing on technological advancements and their market fit. We analyze how new products are addressing evolving consumer needs and competitive pressures. The analysis will highlight innovative features and competitive advantages offered by leading players.

Report Scope & Segmentation Analysis

This section details the various market segmentations used in the report. These might include segmentation by vehicle type, insurance coverage level, distribution channel, and geographic region. Each segment’s growth projections, market size, and competitive dynamics will be explored individually.

Key Drivers of Europe Mandatory Motor Third-Party Liability Insurance Market Growth

This section outlines the key factors driving market growth. We will examine technological advancements, economic growth, and favorable regulatory environments, providing specific examples of their impact.

Challenges in the Europe Mandatory Motor Third-Party Liability Insurance Market Sector

This section discusses the challenges and restraints affecting market growth. This will cover regulatory hurdles, supply chain disruptions, and intense competition. We will quantify the impact of these challenges whenever possible.

Emerging Opportunities in Europe Mandatory Motor Third-Party Liability Insurance Market

This section highlights emerging opportunities and trends that hold significant potential for market expansion. This includes new market segments, technological innovations, and evolving consumer preferences.

Leading Players in the Europe Mandatory Motor Third-Party Liability Insurance Market Market

- Allianz

- AXA

- Aviva

- Admiral Group

- MAPFRE

- Chubb Limited

- Generali Group

- BaFin

- Ergo Insurance

- SCOR (List Not Exhaustive)

Key Developments in Europe Mandatory Motor Third-Party Liability Insurance Market Industry

- April 2024: Aviva PLC acquired AIG Life Limited for EUR 453 Million (USD 497.95 Million).

- March 2024: Allianz acquired Tua Assicurazioni in Italy for EUR 280 Million (USD 307.78 Million).

Future Outlook for Europe Mandatory Motor Third-Party Liability Insurance Market Market

This section summarizes the future growth potential of the European mandatory motor third-party liability insurance market. We will discuss strategic opportunities for market players and identify factors that will shape the market's trajectory in the coming years.

Europe Mandatory Motor Third-Party Liability Insurance Market Segmentation

-

1. Type

- 1.1. Bodily Injury Liability

- 1.2. Property Damage Liability

-

2. Distribution Channel

- 2.1. Independent Agents/Brokers

- 2.2. Direct Sales

- 2.3. Banks

-

3. Application

- 3.1. Personal

- 3.2. Commercial

Europe Mandatory Motor Third-Party Liability Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Mandatory Motor Third-Party Liability Insurance Market Regional Market Share

Geographic Coverage of Europe Mandatory Motor Third-Party Liability Insurance Market

Europe Mandatory Motor Third-Party Liability Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Ownership

- 3.3. Market Restrains

- 3.3.1. Increasing Vehicle Ownership

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles on the Road to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Mandatory Motor Third-Party Liability Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bodily Injury Liability

- 5.1.2. Property Damage Liability

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Independent Agents/Brokers

- 5.2.2. Direct Sales

- 5.2.3. Banks

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allianz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aviva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Admiral Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAPFRE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Generali Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BaFin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ergo Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SCOR**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Allianz

List of Figures

- Figure 1: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Mandatory Motor Third-Party Liability Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mandatory Motor Third-Party Liability Insurance Market?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Europe Mandatory Motor Third-Party Liability Insurance Market?

Key companies in the market include Allianz, Axa, Aviva, Admiral Group, MAPFRE, Chubb Limited, Generali Group, BaFin, Ergo Insurance, SCOR**List Not Exhaustive.

3. What are the main segments of the Europe Mandatory Motor Third-Party Liability Insurance Market?

The market segments include Type, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Ownership.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles on the Road to Drive Market Growth.

7. Are there any restraints impacting market growth?

Increasing Vehicle Ownership.

8. Can you provide examples of recent developments in the market?

April 2024: Aviva PLC ("Aviva") announced the acquisition of AIG Life Limited ("AIG Life UK") from Corebridge Financial Inc., a subsidiary of American International Group Inc. After receiving all requisite approvals, the acquisition was finalized for EUR 453 million (USD 497.95 million).March 2024: Allianz finalized its acquisition of Tua Assicurazioni in Italy. Allianz SpA confirmed the successful acquisition of Tua Assicurazioni SpA from Assicurazioni Generali SpA. The deal was sealed for EUR 280 million (USD 307.78 million). Tua Assicurazioni boasts a robust property and casualty (P/C) insurance portfolio, generating approximately EUR 280 million (USD 307.78 million) in gross written premiums in 2022. Notably, this was largely facilitated through its extensive network of nearly 500 agents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mandatory Motor Third-Party Liability Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mandatory Motor Third-Party Liability Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mandatory Motor Third-Party Liability Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Mandatory Motor Third-Party Liability Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence