Key Insights

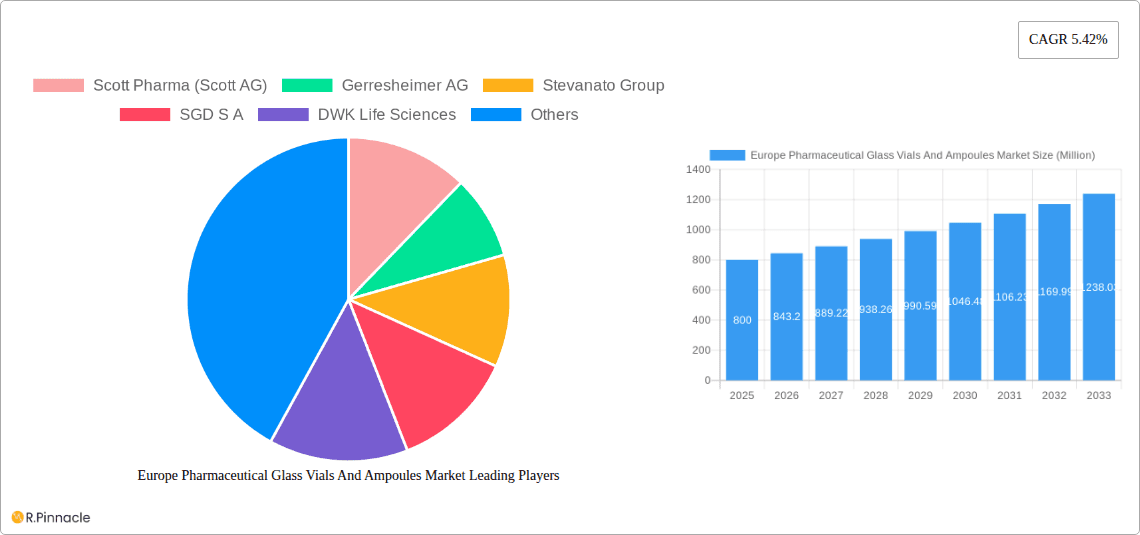

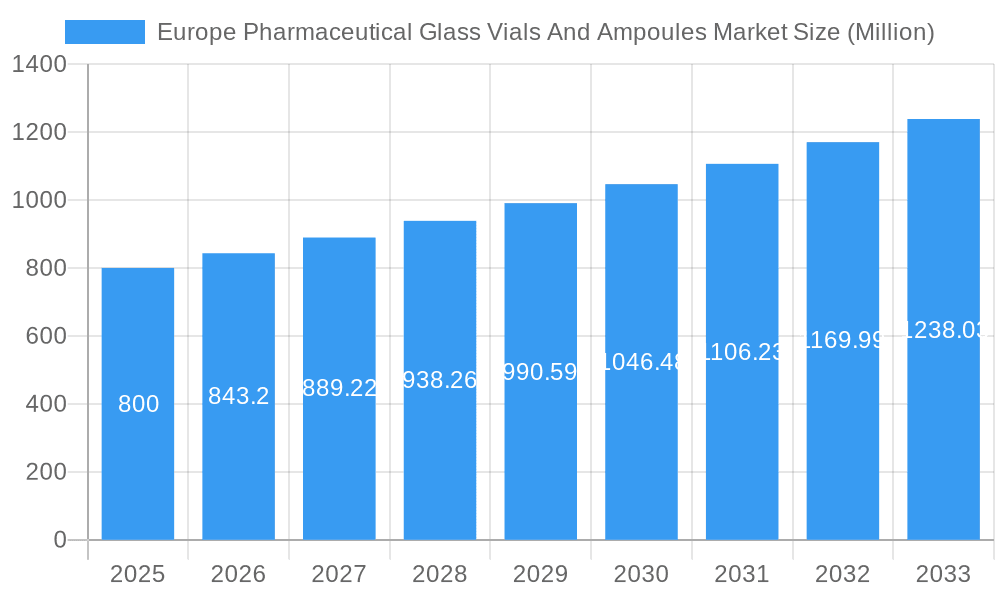

The European pharmaceutical glass vials and ampoules market, valued at approximately $800 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.42% from 2025 to 2033. This expansion is fueled by several key factors. The rising prevalence of chronic diseases necessitates increased pharmaceutical production, creating significant demand for primary packaging like glass vials and ampoules. Furthermore, the stringent regulatory environment in Europe emphasizes the use of high-quality, inert packaging materials to ensure drug efficacy and patient safety, bolstering the market for pharmaceutical-grade glass. Technological advancements in glass manufacturing, leading to improved durability, sterility, and ease of handling, are also contributing to market growth. Increasing investments in research and development for new drug formulations further underpin this positive outlook. While challenges such as fluctuations in raw material prices and competition from alternative packaging materials exist, the overall market trajectory remains upward due to the aforementioned drivers.

Europe Pharmaceutical Glass Vials And Ampoules Market Market Size (In Million)

The market segmentation reveals a diverse landscape of players, including established multinational corporations like Schott Pharma and Gerresheimer AG, alongside specialized regional manufacturers. These companies are actively engaged in capacity expansions, product diversification, and strategic partnerships to capitalize on the market opportunities. Geographic variations in market growth are expected, with potentially faster growth in regions experiencing increased pharmaceutical manufacturing activity or experiencing a higher incidence of chronic diseases. The ongoing focus on sustainability within the pharmaceutical industry is also influencing market trends, with companies increasingly adopting eco-friendly manufacturing practices and exploring sustainable packaging options. This emphasis on sustainability is likely to become an even more significant driver in the coming years, further shaping the competitive dynamics of the European pharmaceutical glass vials and ampoules market.

Europe Pharmaceutical Glass Vials And Ampoules Market Company Market Share

Europe Pharmaceutical Glass Vials and Ampoules Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Pharmaceutical Glass Vials and Ampoules Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report utilizes a robust methodology, incorporating market sizing, segmentation, competitive analysis, and future projections. Key players such as Gerresheimer AG, Stevanato Group, and SGD SA are analyzed, along with emerging trends and challenges shaping the market landscape.

Europe Pharmaceutical Glass Vials And Ampoules Market Market Structure & Innovation Trends

The European pharmaceutical glass vials and ampoules market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is driven by continuous innovation in glass manufacturing techniques, focusing on enhanced durability, sterility, and compatibility with various pharmaceutical formulations. Stringent regulatory frameworks, including those related to drug safety and environmental compliance, influence market dynamics. The market witnesses continuous mergers and acquisitions (M&A) activities, as evidenced by the recent EUR 800 million (USD 883.24 million) acquisition of Bormioli Pharma by Gerresheimer AG in May 2024. This transaction highlights the consolidation trend and the strategic importance of securing a robust supply chain within the sector. Substitute materials, such as plastic containers, exist but glass vials and ampoules maintain dominance due to their inherent properties related to drug stability and barrier protection.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Innovation Drivers: Improved barrier properties, enhanced sterility assurance, reduced breakage rates, and sustainable manufacturing practices.

- Regulatory Framework: Stringent quality control standards and compliance requirements influence production and distribution.

- Product Substitutes: Plastic containers pose limited competition due to glass's superior properties for drug stability and protection.

- End-User Demographics: Pharmaceutical companies, contract manufacturers, and hospitals are major end-users.

- M&A Activities: Significant M&A activity observed in recent years, with deals valued at xx Million (2019-2024). Examples include the Gerresheimer AG acquisition of Bormioli Pharma.

Europe Pharmaceutical Glass Vials And Ampoules Market Market Dynamics & Trends

The Europe Pharmaceutical Glass Vials and Ampoules Market demonstrates steady growth, driven by increasing pharmaceutical production, rising demand for injectable drugs, and technological advancements in glass manufacturing. The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of innovative vial and ampoule designs, incorporating features such as enhanced barrier properties and improved breakage resistance, is steadily increasing. Consumer preferences, influenced by factors such as safety, efficacy, and convenience, strongly favor glass packaging for injectable drugs. Competitive dynamics are characterized by ongoing innovation, capacity expansion, and strategic acquisitions among key market players.

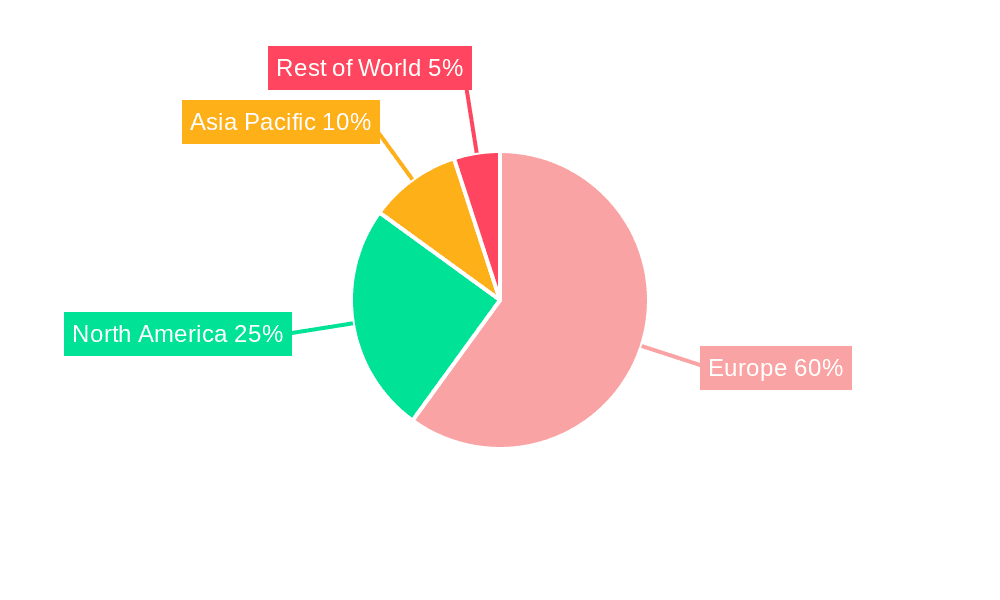

Dominant Regions & Segments in Europe Pharmaceutical Glass Vials And Ampoules Market

Germany and Italy are the dominant regions in the European pharmaceutical glass vials and ampoules market, owing to their established pharmaceutical industry presence and advanced manufacturing capabilities. Further expansion into Eastern European markets is observed, driven by growth in the healthcare sector and increased investment in pharmaceutical infrastructure.

- Key Drivers for Germany and Italy:

- Strong pharmaceutical industry presence with a high concentration of manufacturing facilities.

- Advanced manufacturing infrastructure and skilled labor.

- Supportive government policies promoting domestic pharmaceutical production.

- Established supply chains and distribution networks.

- High demand for injectable medications.

The analysis demonstrates that the xx segment holds the largest market share, driven by the increasing prevalence of xx diseases and the growing demand for xx medications.

Europe Pharmaceutical Glass Vials And Ampoules Market Product Innovations

Recent product innovations focus on improving vial and ampoule design, manufacturing processes, and surface treatment to enhance drug stability, reduce breakage, and improve sterility. Companies are increasingly adopting advanced technologies such as automated production lines and sophisticated quality control systems. This helps enhance productivity and reduces the risk of defects. New materials and surface coatings are being developed to provide even better barrier properties and improve compatibility with a wider range of drugs. These innovations cater to the demand for improved drug efficacy, safety, and patient convenience.

Report Scope & Segmentation Analysis

This report segments the Europe Pharmaceutical Glass Vials and Ampoules Market by product type (vials, ampoules), capacity (ml), material (Type I, Type II glass), application (parenteral drugs, injectables, etc.), and end-user (pharmaceutical companies, hospitals, etc.). The report provides detailed market size, growth projections, and competitive dynamics for each segment. Each segment's growth is impacted by various factors, such as specific regulatory landscapes, drug innovation, and specific user requirements. For instance, the market segment of Type I glass vials is experiencing a higher growth rate than that of Type II glass vials, attributed to the superior chemical resistance and durability.

Key Drivers of Europe Pharmaceutical Glass Vials And Ampoules Market Growth

The Europe Pharmaceutical Glass Vials and Ampoules Market is primarily propelled by factors such as rising demand for injectable drugs, escalating investment in healthcare infrastructure, technological advancements in glass manufacturing, and the burgeoning biopharmaceutical industry. Government initiatives promoting pharmaceutical innovation and stringent quality standards further fuel market growth. The increasing prevalence of chronic diseases globally contributes significantly to the growing demand for injectable medications, necessitating a robust supply chain of high-quality glass vials and ampoules. The adoption of automated production lines and optimized manufacturing techniques further enhances the market's growth potential.

Challenges in the Europe Pharmaceutical Glass Vials And Ampoules Market Sector

The European pharmaceutical glass vials and ampoules market faces challenges such as stringent regulatory compliance requirements, potential supply chain disruptions, and intense competition among established players. These factors can influence production costs and market access. The increasing demand for sustainable and environmentally friendly packaging solutions also presents an ongoing challenge for manufacturers. Meeting the stringent quality and safety standards while navigating volatile raw material prices adds complexity to the market.

Emerging Opportunities in Europe Pharmaceutical Glass Vials And Ampoules Market

Emerging opportunities in the market include the development of specialized vials for advanced drug delivery systems, the increased adoption of sustainable packaging solutions, and the exploration of new markets in Eastern Europe. Furthermore, the growing demand for pre-filled syringes and cartridges presents significant expansion potential for manufacturers. Companies that can innovate in sustainable materials and drug delivery technologies will be well-positioned for future growth.

Leading Players in the Europe Pharmaceutical Glass Vials And Ampoules Market Market

- Scott Pharma (Scott AG)

- Gerresheimer AG

- Stevanato Group

- SGD S A

- DWK Life Sciences

- Bormioli Pharma S p A

- NAFVSM B V

- Soffieria Bertolini S p A

- SFAM Group

- Origin Pharma Packaging

- Alphial S r l

*List Not Exhaustive

Key Developments in Europe Pharmaceutical Glass Vials And Ampoules Market Industry

- May 2024: Gerresheimer AG acquired Bormioli Pharma for approximately USD 883.24 Million, significantly expanding its market presence in Europe.

- January 2024: SGD Pharma increased its siliconized glass vial production capacity with a new line at its Saint-Quentin Lamotte facility, enhancing its supply chain capabilities.

Future Outlook for Europe Pharmaceutical Glass Vials And Ampoules Market Market

The Europe Pharmaceutical Glass Vials and Ampoules Market is poised for continued growth, driven by several factors including the expanding biopharmaceutical sector, increasing demand for injectable drugs, and technological advancements in glass manufacturing. Strategic partnerships, mergers and acquisitions, and the development of innovative product offerings will play a pivotal role in shaping the market’s future. Companies focusing on sustainability and advanced drug delivery systems are expected to capture significant market share in the coming years.

Europe Pharmaceutical Glass Vials And Ampoules Market Segmentation

-

1. Product Type

- 1.1. Vials

- 1.2. Ampoules

-

2. Geography***

- 2.1. Germany

- 2.2. Italy

- 2.3. France

- 2.4. United Kingdom

- 2.5. Spain

Europe Pharmaceutical Glass Vials And Ampoules Market Segmentation By Geography

- 1. Germany

- 2. Italy

- 3. France

- 4. United Kingdom

- 5. Spain

Europe Pharmaceutical Glass Vials And Ampoules Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Glass Vials And Ampoules Market

Europe Pharmaceutical Glass Vials And Ampoules Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investments in Pharmaceutical Industry in the Region; The rising Trend of Sustainable Packaging Significant Growth Opportunities

- 3.3. Market Restrains

- 3.3.1. Investments in Pharmaceutical Industry in the Region; The rising Trend of Sustainable Packaging Significant Growth Opportunities

- 3.4. Market Trends

- 3.4.1. Ampoules Are Set To Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Glass Vials And Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vials

- 5.1.2. Ampoules

- 5.2. Market Analysis, Insights and Forecast - by Geography***

- 5.2.1. Germany

- 5.2.2. Italy

- 5.2.3. France

- 5.2.4. United Kingdom

- 5.2.5. Spain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Italy

- 5.3.3. France

- 5.3.4. United Kingdom

- 5.3.5. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Pharmaceutical Glass Vials And Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vials

- 6.1.2. Ampoules

- 6.2. Market Analysis, Insights and Forecast - by Geography***

- 6.2.1. Germany

- 6.2.2. Italy

- 6.2.3. France

- 6.2.4. United Kingdom

- 6.2.5. Spain

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Italy Europe Pharmaceutical Glass Vials And Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vials

- 7.1.2. Ampoules

- 7.2. Market Analysis, Insights and Forecast - by Geography***

- 7.2.1. Germany

- 7.2.2. Italy

- 7.2.3. France

- 7.2.4. United Kingdom

- 7.2.5. Spain

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Pharmaceutical Glass Vials And Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vials

- 8.1.2. Ampoules

- 8.2. Market Analysis, Insights and Forecast - by Geography***

- 8.2.1. Germany

- 8.2.2. Italy

- 8.2.3. France

- 8.2.4. United Kingdom

- 8.2.5. Spain

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. United Kingdom Europe Pharmaceutical Glass Vials And Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vials

- 9.1.2. Ampoules

- 9.2. Market Analysis, Insights and Forecast - by Geography***

- 9.2.1. Germany

- 9.2.2. Italy

- 9.2.3. France

- 9.2.4. United Kingdom

- 9.2.5. Spain

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Pharmaceutical Glass Vials And Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Vials

- 10.1.2. Ampoules

- 10.2. Market Analysis, Insights and Forecast - by Geography***

- 10.2.1. Germany

- 10.2.2. Italy

- 10.2.3. France

- 10.2.4. United Kingdom

- 10.2.5. Spain

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Scott Pharma (Scott AG)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gerresheimer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stevanato Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGD S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DWK Life Sciences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bormioli Pharma S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NAFVSM B V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Soffieria Bertolini S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SFAM Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Origin Pharma Packaging

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Alphial S r l *List Not Exhaustive 7 2 Heat Map Analysi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Scott Pharma (Scott AG)

List of Figures

- Figure 1: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Glass Vials And Ampoules Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Geography*** 2020 & 2033

- Table 4: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Geography*** 2020 & 2033

- Table 5: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Geography*** 2020 & 2033

- Table 10: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Geography*** 2020 & 2033

- Table 11: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Geography*** 2020 & 2033

- Table 16: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Geography*** 2020 & 2033

- Table 17: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 21: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Geography*** 2020 & 2033

- Table 22: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Geography*** 2020 & 2033

- Table 23: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 27: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Geography*** 2020 & 2033

- Table 28: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Geography*** 2020 & 2033

- Table 29: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 33: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Geography*** 2020 & 2033

- Table 34: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Geography*** 2020 & 2033

- Table 35: Europe Pharmaceutical Glass Vials And Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Pharmaceutical Glass Vials And Ampoules Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Glass Vials And Ampoules Market?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the Europe Pharmaceutical Glass Vials And Ampoules Market?

Key companies in the market include Scott Pharma (Scott AG), Gerresheimer AG, Stevanato Group, SGD S A, DWK Life Sciences, Bormioli Pharma S p A, NAFVSM B V, Soffieria Bertolini S p A, SFAM Group, Origin Pharma Packaging, Alphial S r l *List Not Exhaustive 7 2 Heat Map Analysi.

3. What are the main segments of the Europe Pharmaceutical Glass Vials And Ampoules Market?

The market segments include Product Type, Geography***.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.8 Million as of 2022.

5. What are some drivers contributing to market growth?

Investments in Pharmaceutical Industry in the Region; The rising Trend of Sustainable Packaging Significant Growth Opportunities.

6. What are the notable trends driving market growth?

Ampoules Are Set To Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Investments in Pharmaceutical Industry in the Region; The rising Trend of Sustainable Packaging Significant Growth Opportunities.

8. Can you provide examples of recent developments in the market?

May 2024: Gerresheimer Glas GmbH, an indirect subsidiary of Gerresheimer AG, inked a purchase agreement with funds advised by Triton ("Triton") to acquire Blitz LuxCo Sarl, the holding entity of the Bormioli Pharma Group ("Bormioli Pharma"). The agreed purchase price hinges on an enterprise value pegged at approximately EUR 800 million (USD 883.24 million). Bormioli Pharma's diverse portfolio encompasses pharmaceutical primary packaging crafted from both glass and plastic, alongside closure solutions, accessories, and dispensing systems. Through this acquisition, Gerresheimer bolsters its presence in Europe, particularly in Southern regions, and solidifies its stature as a premier full-service provider and global ally to the pharmaceutical and biotech sectors.January 2024: SGD Pharma boosted capacity for siliconized glass vials with a new line. The company inaugurated a new siliconisation operation at its Saint-Quentin Lamotte (SQLM) facility in France. By bringing glass silicification in-house, the company bolsters its already comprehensive suite of services, ensuring quicker responses, a secure supply chain, and greater flexibility in vial sizes. The newly established operation at SQLM can handle all glass types, accommodating vial sizes from 3 ml to 500 ml in both clear and amber variants, all while maintaining a high processing capacity. This treatment caters to diverse market needs, including applications in anti-infectives, parenteral nutrition, diagnostics, animal health, and oncology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Glass Vials And Ampoules Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Glass Vials And Ampoules Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Glass Vials And Ampoules Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Glass Vials And Ampoules Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence