Key Insights

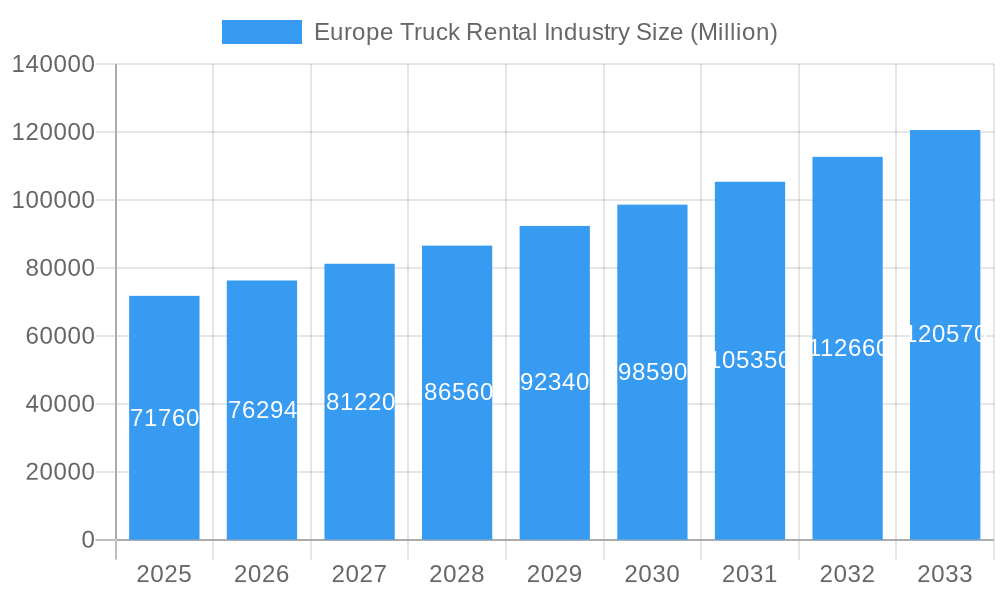

The European truck rental market, valued at €71.76 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key factors. The rise of e-commerce and last-mile delivery services necessitates efficient and flexible transportation solutions, significantly boosting demand for short-term truck rentals. Furthermore, increasing construction activity across major European economies like Germany, France, and the UK contributes to the growth of long-term leasing contracts. Stringent emission regulations are also influencing the market, pushing rental companies to invest in modern, fuel-efficient trucks, impacting both rental costs and overall market dynamics. The preference for flexible rental options over outright truck ownership, particularly among small and medium-sized enterprises (SMEs), continues to drive market expansion. Competition among established players like Volvo, Daimler, and Ryder, alongside the emergence of specialized niche players, ensures a dynamic and innovative market landscape.

Europe Truck Rental Industry Market Size (In Billion)

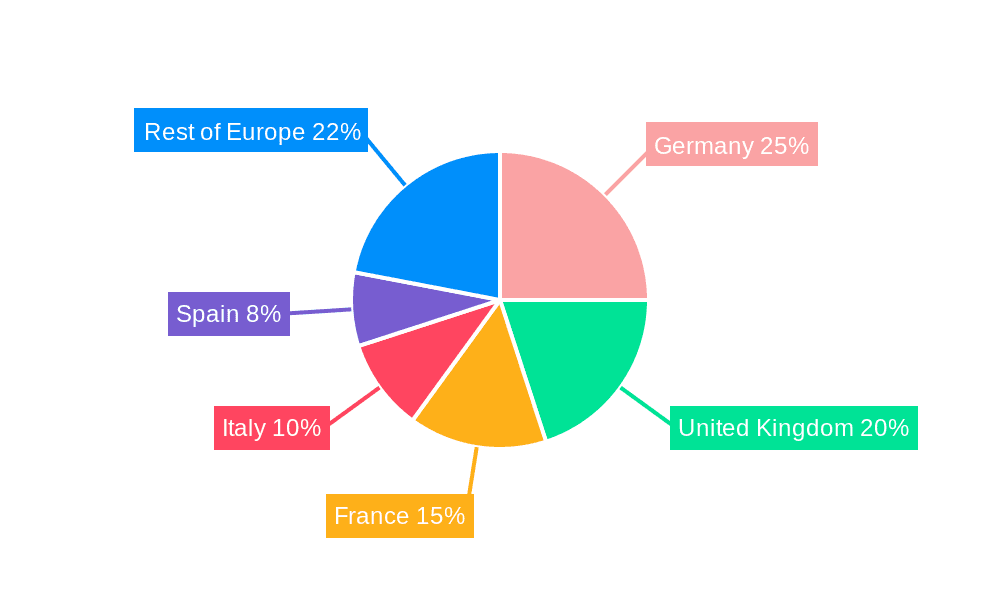

Geographical distribution reflects the economic strength of specific European nations. Germany, the UK, and France represent the largest markets within the region, due to their advanced logistics infrastructure and robust economies. However, growth opportunities exist in other European countries as their economies develop and logistics needs expand. The online booking segment is witnessing substantial growth, driven by technological advancements and user preference for convenience and transparency. This segment is anticipated to continue outpacing offline bookings in the coming years. While economic downturns or fuel price volatility could pose challenges, the overall trend suggests a continuously expanding European truck rental market with significant opportunities for both established and emerging players. Further market segmentation based on truck type (e.g., heavy-duty, light-duty) could yield even more granular insights into specific market niches and growth projections.

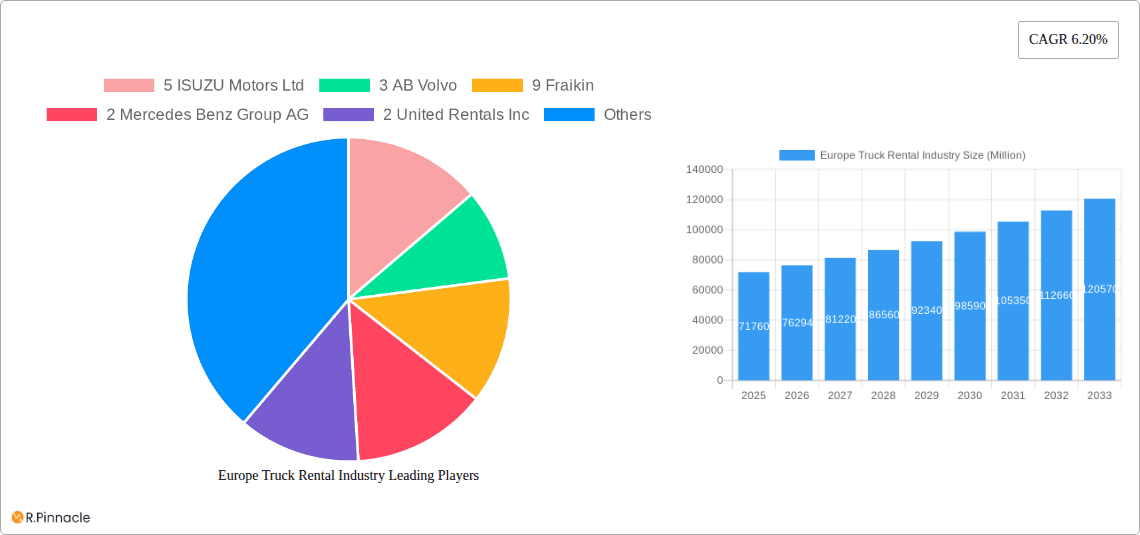

Europe Truck Rental Industry Company Market Share

Europe Truck Rental Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe truck rental industry, encompassing market size, segmentation, key players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive data analysis and expert insights to offer actionable intelligence for industry professionals, investors, and strategic decision-makers. This report is crucial for understanding the dynamic landscape of the European truck rental market and navigating its evolving trends. The total market size is estimated at xx Million in 2025.

Europe Truck Rental Industry Market Structure & Innovation Trends

This section delves into the competitive landscape of the European truck rental market, analyzing market concentration, innovation drivers, regulatory frameworks, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of large multinational corporations and smaller regional players. The top players, including Ryder Group, Fraikin, and Penske Truck Leasing, hold significant market share, but the market also features a number of smaller, specialized rental firms.

Market Concentration: While a few large players dominate, the market isn't hyper-concentrated, with opportunities for niche players. Market share data reveals that the top 5 players collectively hold approximately xx% of the market, leaving a significant portion for smaller players and new entrants.

Innovation Drivers: The industry is driven by technological advancements, including the introduction of electric and hydrogen-powered trucks, telematics, and digital booking platforms. These innovations enhance efficiency, sustainability, and customer experience.

Regulatory Framework: Stringent environmental regulations and emission standards are shaping the industry, driving the adoption of cleaner vehicles and sustainable practices. This includes incentives for electric truck adoption and stricter emission norms for existing fleets.

Product Substitutes: While direct substitutes are limited, alternative transportation solutions (like rail freight) can compete for certain types of goods and distances.

End-User Demographics: The demand for truck rental services stems from diverse sectors, including logistics, construction, and manufacturing, with variations across geographic regions and economic conditions.

M&A Activities: The industry has witnessed significant M&A activity, driven by consolidation efforts and expansion strategies. Recent deals have involved xx Million in total value. Examples include (though not limited to): consolidation within specific geographical regions to create larger, more efficient operational networks.

Europe Truck Rental Industry Market Dynamics & Trends

This section explores the key market dynamics and trends influencing the growth of the European truck rental industry. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by a combination of factors.

Growth Drivers: Rising e-commerce activity, increasing industrial output, and the need for efficient logistics solutions are key growth drivers. Expansion into emerging markets within Europe, and the growing preference for short-term rentals for flexibility are also notable factors. The market penetration of online booking platforms is also growing rapidly.

Technological Disruptions: The adoption of electric and alternative fuel vehicles, along with advancements in telematics and data analytics, is disrupting the industry, demanding increased investments in technology and fleet modernization.

Consumer Preferences: The demand for flexible rental options, including short-term and long-term leasing, is rising. Clients prefer customizable contracts and integrated value-added services like maintenance and insurance.

Competitive Dynamics: The market exhibits both cooperation and competition. Major players are expanding their service offerings and geographical reach, while smaller players are focusing on niche segments and specialized services.

Dominant Regions & Segments in Europe Truck Rental Industry

This section identifies the leading regions and segments within the European truck rental market. Germany, the United Kingdom, and France collectively account for the largest market share, owing to their robust economies, extensive transportation networks, and high levels of industrial activity. The short-term leasing segment is also presently dominant, but the long-term leasing segment is gaining traction due to its cost-effectiveness.

Key Drivers:

- Germany: Strong manufacturing sector, advanced infrastructure, and favorable economic conditions.

- United Kingdom: Significant logistics sector and a large volume of goods transport.

- France: Extensive road network and high demand from various industries.

- Short-Term Leasing: Flexibility and cost-effectiveness for short-term projects and seasonal demands.

- Long-Term Leasing: Cost predictability and long-term cost savings for companies with consistent needs.

The online booking segment continues to grow significantly faster than offline bookings. Italy and Spain show promising growth potential, driven by their expanding economies and infrastructure developments.

Europe Truck Rental Industry Product Innovations

Recent innovations in the truck rental industry include the emergence of all-inclusive rental models for electric trucks, incorporating maintenance and support. This is driven by the adoption of sustainable and environmentally friendly solutions by major players and a strong push towards a reduced carbon footprint. Moreover, the integration of telematics and advanced data analytics improves fleet management and enhances operational efficiency.

Report Scope & Segmentation Analysis

By Booking Type: The report segments the market into offline and online bookings, analyzing growth projections and competitive dynamics for each. Online bookings show higher growth due to convenience and efficiency.

By Rental Type: The market is divided into short-term and long-term leasing, outlining specific market sizes and growth trajectories. Long-term leasing gains traction with businesses seeking predictable costs.

By Country: The report covers major European countries including Germany, the United Kingdom, France, Spain, Italy, and the Rest of Europe, providing a detailed regional analysis. Germany maintains its leading position, with other regions showcasing diverse growth patterns.

Key Drivers of Europe Truck Rental Industry Growth

Several factors fuel the growth of the European truck rental market. Firstly, the continued expansion of e-commerce and the corresponding rise in demand for efficient last-mile delivery solutions significantly impact the need for rental trucks. Secondly, government incentives and regulations promoting the adoption of eco-friendly vehicles propel investment in electric and alternative fuel truck rentals. Finally, fluctuations in fuel prices and vehicle ownership costs affect the demand for rental services.

Challenges in the Europe Truck Rental Industry Sector

The industry faces several challenges. Firstly, the high initial investment required for electric vehicle fleets poses a barrier. Secondly, the impact of supply chain disruptions and the availability of new vehicles have affected rental availability and prices. Lastly, intense competition from established players and emerging competitors creates pricing pressures.

Emerging Opportunities in Europe Truck Rental Industry

Several emerging opportunities exist within the European truck rental market. The growing demand for sustainable transportation solutions and the development of alternative fuel infrastructure present significant potential for growth in specialized rental services. In addition, the expanding application of telematics and data analytics optimizes fleet management and opens new revenue streams through service packages.

Leading Players in the Europe Truck Rental Industry Market

- ISUZU Motors Ltd

- AB Volvo (Volvo Group)

- Fraikin (Fraikin)

- Mercedes Benz Group AG (Mercedes-Benz Group AG)

- United Rentals Inc (United Rentals)

- Traton SE (Traton SE)

- Tip Trailer Services Germany GmbH

- Heisterkamp Truck Rental

- PACCAR Inc (PACCAR)

- Easy Rent Truck and Trailer GmbH

- Paccar Leasing Gmbh (paccar Inc )

- Ryder Group (Ryder)

- Man Financial Services/Euro-leasing

- Penske Truck Leasing (Penske Truck Leasing)

- IVECO SpA (IVECO)

*List Not Exhaustive

Key Developments in Europe Truck Rental Industry Industry

Sept 2022: Iveco Group announced GATE Green and Advanced Transport Ecosystem, an all-inclusive rental model for electric trucks and vans, signifying a shift towards sustainable transportation solutions.

Apr 2022: Hylane GmbH's launch as a provider of climate-friendly mobility, offering hydrogen truck rentals, marks a significant step towards reducing carbon emissions in the industry. The agreement with Hyzon Motors for fuel cell electric trucks further underscores this commitment.

Future Outlook for Europe Truck Rental Industry Market

The European truck rental market is poised for substantial growth, driven by e-commerce expansion, favorable economic conditions in several key regions, and the increasing adoption of sustainable and technologically advanced vehicles. Strategic partnerships and investments in innovative technologies will be crucial for navigating the competitive landscape and securing market share within the industry.

Europe Truck Rental Industry Segmentation

-

1. Booking Type

- 1.1. Offline Booking

- 1.2. Online Booking

-

2. Rental Type

- 2.1. Short-term Leasing

- 2.2. Long-term Leasing

Europe Truck Rental Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Truck Rental Industry Regional Market Share

Geographic Coverage of Europe Truck Rental Industry

Europe Truck Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting Consumer Preference toward Eco-friendly Medium of Transportation

- 3.3. Market Restrains

- 3.3.1. Growing Incidents of Bike Damage and Theft

- 3.4. Market Trends

- 3.4.1. Rising Emission Standards in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Truck Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline Booking

- 5.1.2. Online Booking

- 5.2. Market Analysis, Insights and Forecast - by Rental Type

- 5.2.1. Short-term Leasing

- 5.2.2. Long-term Leasing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 5 ISUZU Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 AB Volvo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 9 Fraikin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Mercedes Benz Group AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 2 United Rentals Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 Traton SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 1 Tip Trailer Services Germany GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Truck Manufacturers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 5 Heisterkamp Truck Rental

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 PACCAR Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Truck Rental Firms

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 6 Easy Rent Truck and Trailer GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 4 Paccar Leasing Gmbh (paccar Inc )

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 8 Ryder Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 7 Man Financial Services/Euro-leasing

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 3 Penske Truck Leasing

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 6 IVECO SpA*List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 5 ISUZU Motors Ltd

List of Figures

- Figure 1: Europe Truck Rental Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Truck Rental Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Truck Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Europe Truck Rental Industry Revenue Million Forecast, by Rental Type 2020 & 2033

- Table 3: Europe Truck Rental Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Truck Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 5: Europe Truck Rental Industry Revenue Million Forecast, by Rental Type 2020 & 2033

- Table 6: Europe Truck Rental Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Truck Rental Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe Truck Rental Industry?

Key companies in the market include 5 ISUZU Motors Ltd, 3 AB Volvo, 9 Fraikin, 2 Mercedes Benz Group AG, 2 United Rentals Inc, 4 Traton SE, 1 Tip Trailer Services Germany GmbH, Truck Manufacturers, 5 Heisterkamp Truck Rental, 1 PACCAR Inc, Truck Rental Firms, 6 Easy Rent Truck and Trailer GmbH, 4 Paccar Leasing Gmbh (paccar Inc ), 8 Ryder Group, 7 Man Financial Services/Euro-leasing, 3 Penske Truck Leasing, 6 IVECO SpA*List Not Exhaustive.

3. What are the main segments of the Europe Truck Rental Industry?

The market segments include Booking Type, Rental Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Shifting Consumer Preference toward Eco-friendly Medium of Transportation.

6. What are the notable trends driving market growth?

Rising Emission Standards in Europe.

7. Are there any restraints impacting market growth?

Growing Incidents of Bike Damage and Theft.

8. Can you provide examples of recent developments in the market?

Sept 2022: GATE Green and Advanced Transport Ecosystem, a long-term, an all-inclusive rental model for electric trucks and vans, was announced by Iveco Group. The new entity will provide a comprehensive service based on a pay-per-use model, giving customers access to tomorrow's propulsion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Truck Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Truck Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Truck Rental Industry?

To stay informed about further developments, trends, and reports in the Europe Truck Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence