Key Insights

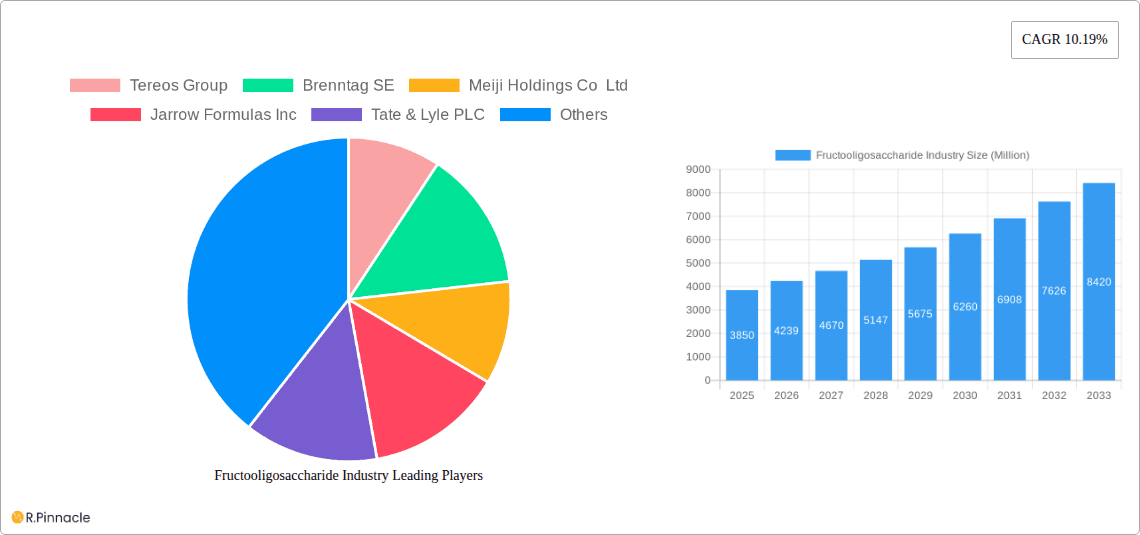

The global Fructooligosaccharide (FOS) market is poised for significant expansion, projected to reach an estimated USD 3.85 billion in 2025. This robust growth is propelled by a compelling Compound Annual Growth Rate (CAGR) of 10.19%, indicating a dynamic and expanding industry. The primary drivers fueling this surge include increasing consumer awareness and demand for natural, health-promoting ingredients. FOS, recognized for its prebiotic properties, is gaining traction in functional foods and beverages, dietary supplements, and infant nutrition as consumers actively seek products that support gut health and overall well-being. The pharmaceutical sector also presents a growing application, leveraging FOS for its therapeutic benefits. Furthermore, the escalating demand for animal feed additives that enhance livestock health and productivity is contributing to market expansion.

Fructooligosaccharide Industry Market Size (In Billion)

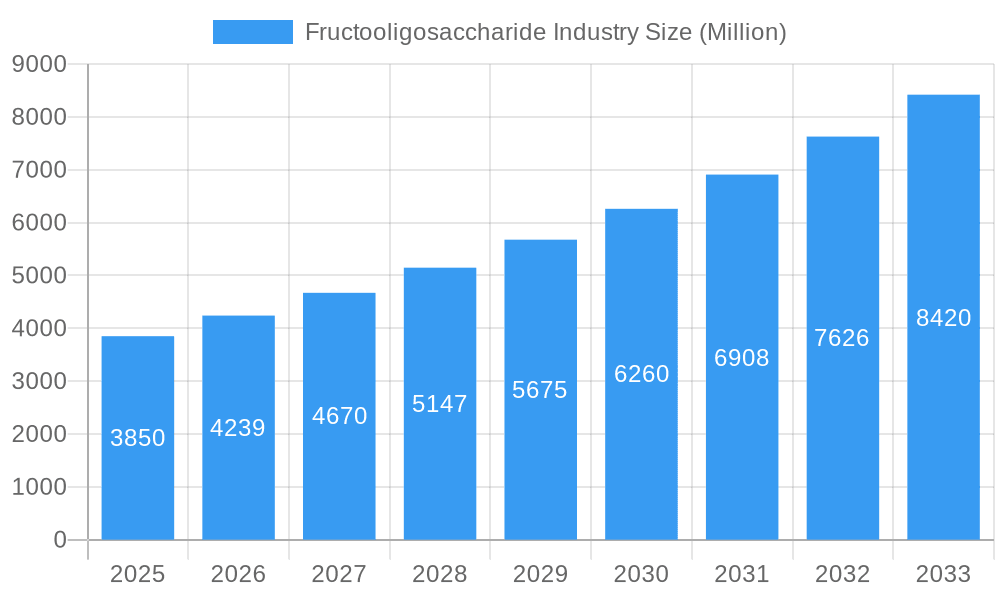

The market is characterized by a vibrant competitive landscape, featuring key players such as Cargill Inc., Ingredion Incorporated, and Royal Friesland Campina NV, alongside specialized manufacturers like Tereos Group and Südzucker AG (BENEO). These companies are actively engaged in innovation, product development, and strategic partnerships to capture market share. Emerging trends point towards the development of novel FOS formulations with improved functionalities and broader applications. While growth prospects are strong, the market faces certain restraints, including the fluctuating costs of raw materials and the complex regulatory landscape surrounding novel food ingredients in some regions. Nevertheless, the overarching trend of health and wellness, coupled with the proven benefits of prebiotics, ensures a promising future for the Fructooligosaccharide market.

Fructooligosaccharide Industry Company Market Share

Unlock the potential of the burgeoning Fructooligosaccharide (FOS) market with this comprehensive industry analysis. This in-depth report provides actionable insights into market dynamics, innovation trends, and strategic opportunities within the FOS sector from 2019 to 2033, with a base and estimated year of 2025. Leveraging high-ranking keywords such as "fructooligosaccharide market," "prebiotic ingredients," "gut health," and "functional foods," this report is meticulously crafted for industry professionals seeking to navigate and capitalize on this rapidly expanding global market. Discover key growth drivers, prevailing challenges, dominant regional players, and cutting-edge product innovations that are shaping the future of FOS applications in infant formula, fortified foods, dietary supplements, animal feed, and pharmaceuticals.

Fructooligosaccharide Industry Market Structure & Innovation Trends

The Fructooligosaccharide (FOS) industry exhibits a moderately concentrated market structure, with a mix of large multinational corporations and specialized ingredient manufacturers. Innovation is a critical driver, fueled by extensive research into gut microbiome health, the growing demand for natural and functional ingredients, and advancements in extraction and purification technologies. Regulatory frameworks, while evolving, are largely supportive of FOS as a safe and beneficial food additive and dietary supplement ingredient. Product substitutes, such as other prebiotics like inulin and galactooligosaccharides (GOS), present a competitive landscape. End-user demographics are increasingly health-conscious, particularly millennials and Gen Z, who actively seek out products that offer tangible health benefits. Mergers and acquisitions (M&A) are significant strategic activities, enabling companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, Tate & Lyle PLC's acquisition of Quantum Hi-Tech Biological Co. Ltd in March 2022 for USD 237 million underscores this trend, enhancing their prebiotic fiber business in China. The market share of leading players, coupled with the aggregate value of M&A deals, indicates a dynamic and consolidating industry poised for substantial growth.

Fructooligosaccharide Industry Market Dynamics & Trends

The Fructooligosaccharide (FOS) market is experiencing robust growth, projected to expand significantly between 2025 and 2033. This expansion is primarily propelled by escalating consumer awareness and demand for health-promoting ingredients. The undeniable scientific evidence linking prebiotic consumption to improved gut health, enhanced immunity, and better nutrient absorption is a cornerstone of this trend. This has led to an increased integration of FOS into a wide array of consumer products, transforming dietary habits and product formulations. Technological disruptions are playing a crucial role, with continuous innovations in production processes leading to higher purity, improved functionality, and cost-effectiveness of FOS. These advancements are crucial for meeting the increasing global demand and ensuring competitive pricing. Consumer preferences are shifting towards natural, clean-label ingredients, and FOS, derived from natural sources like chicory root and sugarcane, perfectly aligns with this demand. The functional food and beverage segment, in particular, is witnessing a surge in FOS incorporation as manufacturers seek to enhance the health benefits of their offerings. The competitive dynamics within the industry are characterized by a strategic focus on product differentiation, R&D investment, and market penetration. Key players are actively engaged in expanding their production capacities and forging strategic partnerships to secure raw material supply and distribution networks. The compound annual growth rate (CAGR) of the FOS market is estimated to be robust, reflecting its increasing market penetration across various application segments. The global market penetration of FOS is still relatively nascent in some regions, presenting significant untapped potential for future growth. The increasing prevalence of lifestyle-related diseases and a proactive approach to wellness among consumers globally are further reinforcing the demand for FOS.

Dominant Regions & Segments in Fructooligosaccharide Industry

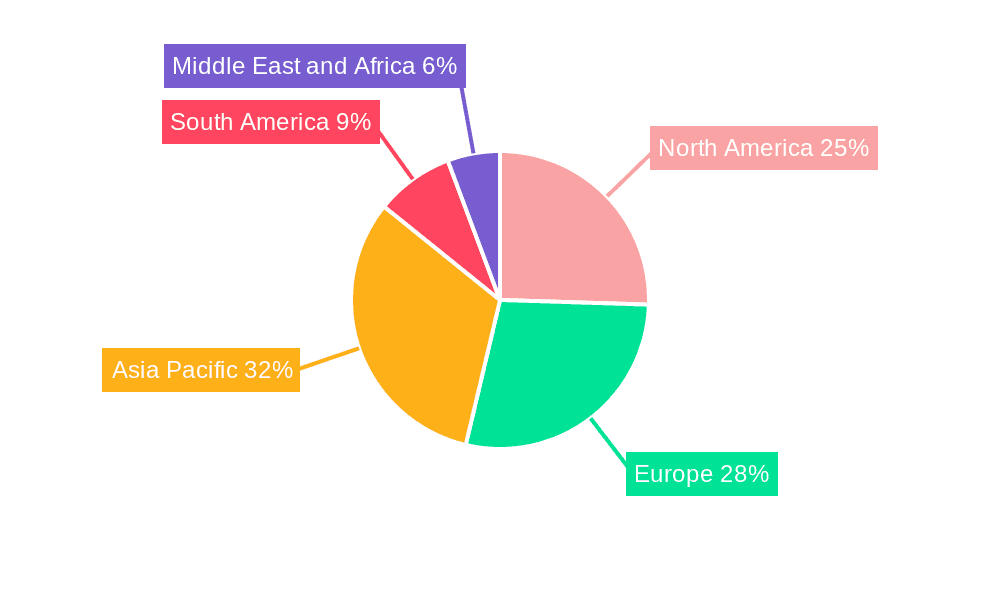

The global Fructooligosaccharide (FOS) market is experiencing significant growth and strategic evolution, with specific regions and application segments leading the charge. Asia Pacific, particularly China, is emerging as a dominant region due to its large population, increasing disposable income, and growing health consciousness. This region's robust manufacturing capabilities and proactive government policies supporting the food ingredient sector contribute significantly to market expansion. North America and Europe remain strong markets, driven by a well-established consumer base for health supplements and functional foods, coupled with stringent regulatory approvals that favor scientifically backed ingredients.

Infant Formula: This segment is a cornerstone of FOS market dominance. Increasing awareness among parents regarding the importance of gut health for infant development, coupled with the similarity of FOS to human milk oligosaccharides (HMOs), drives demand. Key drivers include the rising birth rates in developing economies and the premiumization of infant nutrition products. Manufacturers are focusing on FOS formulations that mimic natural breast milk components for optimal infant health.

Fortified Food and Beverage: This is another high-growth segment, benefiting from the broad applicability of FOS across various food categories.

- Consumer Preference: Growing demand for healthier snack options, beverages, and convenience foods.

- Taste and Texture: FOS acts as a sugar replacer and contributes to desirable mouthfeel, making it attractive for product reformulation.

- Functional Labeling: Companies are leveraging FOS to market products with "gut health" or "digestive wellness" claims, appealing to health-conscious consumers.

Dietary Supplements: The FOS market in dietary supplements is robust, driven by the global trend of preventative healthcare and the increasing self-medication trend.

- Digestive Health Focus: A primary driver is the consumer search for solutions to common digestive issues like constipation and bloating.

- Immune System Support: Emerging research highlighting the role of the gut microbiome in immune function further bolsters demand.

- Natural Ingredient Appeal: FOS's natural origin resonates with consumers seeking alternatives to synthetic additives.

Animal Feed: The animal nutrition sector is witnessing a significant uptake of FOS.

- Gut Health in Livestock: Improving gut health in farm animals leads to better nutrient absorption, reduced reliance on antibiotics, and enhanced overall animal welfare.

- Sustainable Agriculture: FOS contributes to more efficient and sustainable animal farming practices.

- Pet Food Innovation: Growing demand for premium pet food with added health benefits, including digestive support.

Pharmaceuticals: While a smaller segment currently, FOS shows promise in pharmaceutical applications.

- Excipient Use: Its prebiotic properties and stability make it suitable as an excipient in drug formulations.

- Therapeutic Potential: Ongoing research into FOS's role in managing specific health conditions, such as inflammatory bowel disease, could unlock future pharmaceutical applications.

Fructooligosaccharide Industry Product Innovations

Fructooligosaccharide (FOS) product innovation is characterized by enhanced purity, tailored functionalities, and novel delivery systems. Companies are developing FOS with specific chain lengths and degrees of polymerization to optimize prebiotic efficacy for distinct applications. Innovations also focus on improving FOS solubility, stability in various food matrices, and taste profiles to overcome limitations and expand its use in mainstream products. The competitive advantage lies in offering FOS solutions that address specific health needs, such as targeted gut microbiome modulation or enhanced mineral absorption, backed by robust scientific research.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Fructooligosaccharide (FOS) market across key segments. The Infant Formula segment is a significant revenue contributor, driven by the demand for gut health-supporting ingredients for early childhood development. Projections indicate sustained strong growth within this segment. The Fortified Food and Beverage segment offers expansive growth opportunities due to the broad applicability of FOS in enhancing the health profile of everyday consumables. Market size and competitive dynamics are rapidly evolving as food manufacturers innovate. The Dietary Supplements segment continues to be a robust market, fueled by consumer focus on proactive health management and digestive wellness. Growth projections remain strong, with high competitive intensity. The Animal Feed segment is experiencing increasing adoption, driven by the need for antibiotic alternatives and improved animal health. Market expansion is anticipated as the livestock and pet food industries prioritize functional ingredients. The Pharmaceuticals segment, while nascent, presents emerging opportunities, with ongoing research exploring FOS's therapeutic potential and its utility as an excipient. Future growth is contingent on clinical validation and regulatory approvals.

Key Drivers of Fructooligosaccharide Industry Growth

The Fructooligosaccharide (FOS) industry's growth is propelled by several interconnected factors. The escalating global consumer awareness regarding the critical role of gut health in overall well-being is a primary driver. This is bolstered by increasing scientific validation of FOS's prebiotic benefits, leading to greater consumer trust and demand. Technological advancements in FOS production, yielding higher purity and more cost-effective manufacturing, also contribute significantly. Furthermore, the expanding functional food and beverage sector, coupled with the growing demand for dietary supplements, provides a fertile ground for FOS incorporation. Supportive regulatory environments in key markets further facilitate market penetration.

Challenges in the Fructooligosaccharide Industry Sector

Despite its promising growth trajectory, the Fructooligosaccharide (FOS) industry faces several challenges. Fluctuations in raw material prices, particularly for chicory root and sugarcane, can impact production costs and profit margins. Stringent and varying regulatory landscapes across different countries can pose hurdles for market entry and product approval, especially for novel applications. The presence of alternative prebiotic ingredients, such as inulin and galactooligosaccharides (GOS), creates competitive pressure. Consumer education remains an ongoing challenge, with a need to clearly communicate the benefits and differentiation of FOS. Supply chain complexities and the need for consistent quality control across a global manufacturing base also present operational challenges.

Emerging Opportunities in Fructooligosaccharide Industry

The Fructooligosaccharide (FOS) market is ripe with emerging opportunities. The increasing demand for plant-based and natural ingredients presents a significant avenue for growth, as FOS is derived from natural sources. Innovations in targeted prebiotic formulations for specific health conditions, such as immune support or weight management, are expected to drive market expansion. The growing pet food industry's focus on pet health and wellness offers a substantial opportunity for FOS incorporation. Furthermore, the exploration of FOS in functional medical foods and as an excipient in pharmaceutical formulations opens up new, high-value market segments. Expansion into underserved geographical markets with a growing middle class and increasing health awareness also presents significant potential.

Leading Players in the Fructooligosaccharide Industry Market

- Tereos Group

- Brenntag SE

- Meiji Holdings Co Ltd

- Jarrow Formulas Inc

- Tate & Lyle PLC

- Galam Group

- Baolingbao Biological Co Ltd

- Cargill Inc

- Ingredion Incorporated

- Royal Friesland Campina NV

- Südzucker AG (BENEO)

Key Developments in Fructooligosaccharide Industry Industry

- March 2022: Tate & Lyle PLC (Tate & Lyle) announced the signing of an agreement to acquire Quantum Hi-Tech Biological Co. Ltd (Quantum), a leading prebiotic dietary fiber business in China specializing in fructooligosaccharides (FOS) and galactooligosaccharides (GOS), from ChemPartner Pharmatech Co. Ltd (ChemPartner) for a total consideration of USD 237 million. This acquisition significantly strengthens Tate & Lyle's position in the growing Chinese FOS market.

- January 2022: Galam, a global manufacturer of specialty ingredients, announced its plan to launch a production plant for its prebiotic GOFOS, a short-chain fructooligosaccharide (sc-FOS). Scientific evidence suggests daily consumption of GOFOS offers various health benefits for humans and animals, stimulating the growth and maintenance of beneficial gut bacteria.

- June 2020: Global nutrition ingredients manufacturer Galam invested USD 20 million in the launch of two new fructooligosaccharides (FOS) production plants. These plants are designed to manufacture thousands of tons of FOS, catering to the increasing global demand for this gut health-benefiting prebiotic fiber.

Future Outlook for Fructooligosaccharide Industry Market

The future outlook for the Fructooligosaccharide (FOS) market is exceptionally bright, characterized by sustained growth and expanding applications. The increasing understanding of the gut-brain axis and the microbiome's influence on overall health will continue to fuel demand for FOS. Strategic opportunities lie in the development of synergistic blends of FOS with other prebiotics and probiotics for enhanced health outcomes. The expansion of FOS into emerging economies, driven by rising disposable incomes and a growing middle class embracing healthier lifestyles, will be a key growth accelerator. Continuous innovation in product development, focusing on specialized functionalities and improved delivery systems, will further solidify FOS's market position. The market is poised for significant growth through 2033, driven by a confluence of consumer demand, scientific advancement, and industry investment.

Fructooligosaccharide Industry Segmentation

-

1. Application

- 1.1. Infant Formula

- 1.2. Fortified Food and Beverage

- 1.3. Dietary Supplements

- 1.4. Animal Feed

- 1.5. Pharmaceuticals

Fructooligosaccharide Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Australia

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Fructooligosaccharide Industry Regional Market Share

Geographic Coverage of Fructooligosaccharide Industry

Fructooligosaccharide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness Of Health Benefits Of Oleoresins; Rise Of Clean Label Products

- 3.3. Market Restrains

- 3.3.1. Supply Chain Volatility and Availability Of Other Flavor Ingredients

- 3.4. Market Trends

- 3.4.1. Rising Demand for Low-calorie Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fructooligosaccharide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Infant Formula

- 5.1.2. Fortified Food and Beverage

- 5.1.3. Dietary Supplements

- 5.1.4. Animal Feed

- 5.1.5. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fructooligosaccharide Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Infant Formula

- 6.1.2. Fortified Food and Beverage

- 6.1.3. Dietary Supplements

- 6.1.4. Animal Feed

- 6.1.5. Pharmaceuticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Fructooligosaccharide Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Infant Formula

- 7.1.2. Fortified Food and Beverage

- 7.1.3. Dietary Supplements

- 7.1.4. Animal Feed

- 7.1.5. Pharmaceuticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Fructooligosaccharide Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Infant Formula

- 8.1.2. Fortified Food and Beverage

- 8.1.3. Dietary Supplements

- 8.1.4. Animal Feed

- 8.1.5. Pharmaceuticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Fructooligosaccharide Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Infant Formula

- 9.1.2. Fortified Food and Beverage

- 9.1.3. Dietary Supplements

- 9.1.4. Animal Feed

- 9.1.5. Pharmaceuticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Fructooligosaccharide Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Infant Formula

- 10.1.2. Fortified Food and Beverage

- 10.1.3. Dietary Supplements

- 10.1.4. Animal Feed

- 10.1.5. Pharmaceuticals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tereos Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Brenntag SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meiji Holdings Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jarrow Formulas Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tate & Lyle PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Galam Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baolingbao Biological Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cargill Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ingredion Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Friesland Campina NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Südzucker AG (BENEO)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Tereos Group

List of Figures

- Figure 1: Global Fructooligosaccharide Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fructooligosaccharide Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Fructooligosaccharide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Fructooligosaccharide Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Fructooligosaccharide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Fructooligosaccharide Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Fructooligosaccharide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Fructooligosaccharide Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Fructooligosaccharide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Fructooligosaccharide Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Fructooligosaccharide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Fructooligosaccharide Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Fructooligosaccharide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Fructooligosaccharide Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Fructooligosaccharide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Fructooligosaccharide Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Fructooligosaccharide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Fructooligosaccharide Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Fructooligosaccharide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Fructooligosaccharide Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Fructooligosaccharide Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fructooligosaccharide Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Fructooligosaccharide Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Fructooligosaccharide Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Fructooligosaccharide Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Fructooligosaccharide Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Fructooligosaccharide Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Fructooligosaccharide Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Fructooligosaccharide Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Fructooligosaccharide Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Fructooligosaccharide Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Fructooligosaccharide Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Fructooligosaccharide Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South Africa Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Fructooligosaccharide Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fructooligosaccharide Industry?

The projected CAGR is approximately 10.19%.

2. Which companies are prominent players in the Fructooligosaccharide Industry?

Key companies in the market include Tereos Group, Brenntag SE, Meiji Holdings Co Ltd, Jarrow Formulas Inc, Tate & Lyle PLC, Galam Group, Baolingbao Biological Co Ltd, Cargill Inc, Ingredion Incorporated, Royal Friesland Campina NV, Südzucker AG (BENEO).

3. What are the main segments of the Fructooligosaccharide Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness Of Health Benefits Of Oleoresins; Rise Of Clean Label Products.

6. What are the notable trends driving market growth?

Rising Demand for Low-calorie Foods.

7. Are there any restraints impacting market growth?

Supply Chain Volatility and Availability Of Other Flavor Ingredients.

8. Can you provide examples of recent developments in the market?

In March 2022, Tate & Lyle PLC (Tate & Lyle), a leading global provider of food and beverage ingredients and solutions, announced the signing of an agreement to acquire Quantum Hi-Tech Biological Co. Ltd (Quantum), engaged in the research, development, production, and sale of fructooligosaccharides (FOS) and galactooligosaccharides (GOS) and a leading prebiotic dietary fiber business in China, from ChemPartner Pharmatech Co. Ltd (ChemPartner) for a total consideration of USD 237 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fructooligosaccharide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fructooligosaccharide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fructooligosaccharide Industry?

To stay informed about further developments, trends, and reports in the Fructooligosaccharide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence