Key Insights

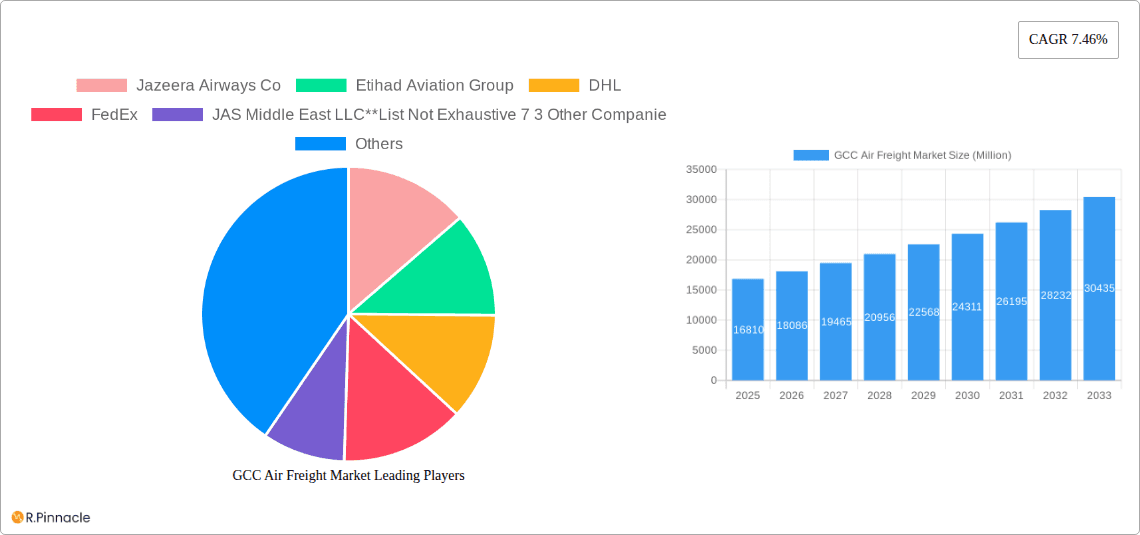

The GCC air freight market, valued at $16.81 billion in 2025, is projected to experience robust growth, driven by the region's expanding e-commerce sector, increasing cross-border trade, and the flourishing tourism industry. The 7.46% CAGR forecast for the period 2025-2033 indicates a significant market expansion, exceeding $30 billion by 2033. Key growth drivers include the strategic location of the GCC as a crucial transit point for global trade, government initiatives to enhance logistics infrastructure, and the rising demand for faster and more reliable air freight services across diverse sectors like pharmaceuticals, perishables, and high-value manufactured goods. The market is segmented by service type (forwarding, airlines, mail, other services), destination (domestic, international), and country (Saudi Arabia, UAE, Qatar, Rest of GCC). While Saudi Arabia and the UAE dominate the market due to their larger economies and extensive airport infrastructure, Qatar and the rest of the GCC countries contribute significantly to the overall growth. The presence of major players like DHL, FedEx, and various national carriers signifies the market's maturity and competitiveness.

GCC Air Freight Market Market Size (In Billion)

Competition within the GCC air freight market is intense, with both international and regional players vying for market share. However, the market presents significant opportunities for specialized services catering to niche sectors. The increasing focus on sustainability and technological advancements, such as the adoption of blockchain technology for improved supply chain transparency, will further shape the market landscape. Challenges remain, including fluctuating fuel prices, geopolitical uncertainties, and the need for continuous investment in infrastructure to handle the projected growth. Nevertheless, the long-term outlook remains positive, fueled by the GCC's economic diversification strategies and its continued integration into the global economy. The strong growth trajectory is expected to attract further investment and innovation, driving efficiency and enhancing the overall competitiveness of the GCC air freight sector.

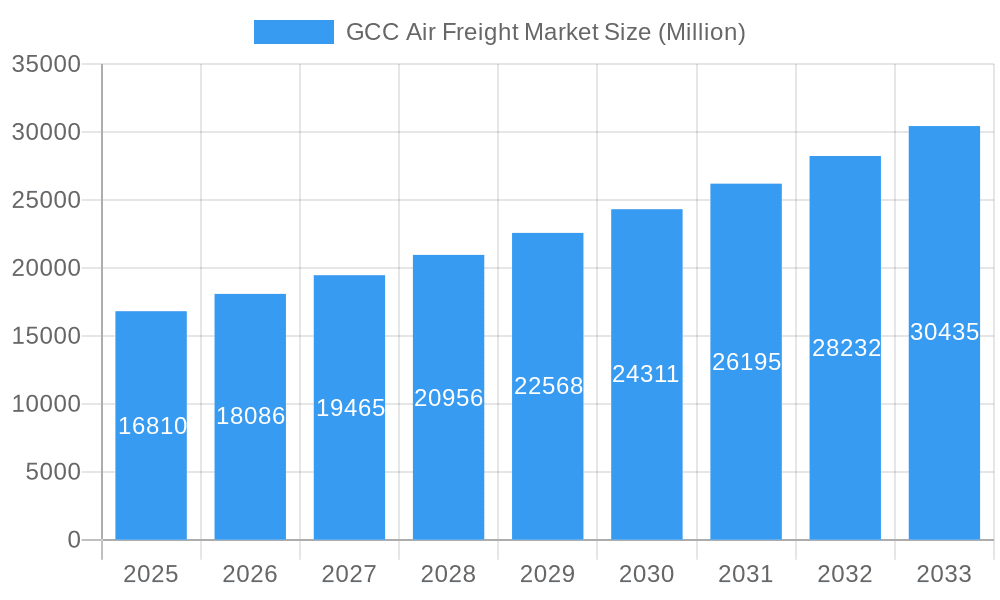

GCC Air Freight Market Company Market Share

GCC Air Freight Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the GCC air freight market, covering the period from 2019 to 2033. It offers crucial insights into market dynamics, key players, emerging trends, and future growth potential, empowering industry professionals to make informed strategic decisions. The report meticulously examines market segmentation by services (Forwarding, Airlines, Mail, Other Services), destination (Domestic, International), and country (Saudi Arabia, United Arab Emirates, Qatar, Rest of GCC). With a base year of 2025 and an estimated year of 2025, the report projects market growth from 2025 to 2033, offering valuable forecasting data to support long-term planning. The estimated market size in 2025 is XX Million.

GCC Air Freight Market Structure & Innovation Trends

This section delves into the competitive landscape of the GCC air freight market, analyzing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report examines the market share held by key players, including Jazeera Airways Co, Etihad Aviation Group, DHL, FedEx, JAS Middle East LLC, and 7-3 other companies (Air Charter Service, Qatar Airways Group, Maximus Air, Qatar Aviation Services, Saudi Airlines Cargo Company Limited amongst others).

- Market Concentration: The report quantifies market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) and assesses the degree of competition. For example, the market share of DHL in the UAE is estimated to be xx% in 2025.

- Innovation Drivers: The analysis explores technological advancements driving innovation, such as the adoption of blockchain technology for enhanced supply chain transparency and the use of AI for predictive maintenance.

- Regulatory Frameworks: The report examines the impact of government regulations and policies on market growth, including those related to air safety, customs procedures, and environmental regulations.

- Product Substitutes: The report evaluates potential substitutes for air freight, such as sea freight and rail transport, and their impact on market dynamics.

- End-User Demographics: Analysis of end-user industries and their freight transportation needs is provided.

- M&A Activities: The report details significant mergers and acquisitions (M&A) in the GCC air freight sector, including deal values and their impact on market structure. For instance, the recent UPS acquisition of MNX and DHL's acquisition of Danzas AEI Emirates are analyzed in detail to determine their impact on market concentration and competitive dynamics. The total value of M&A deals in the historical period (2019-2024) is estimated to be XX Million.

GCC Air Freight Market Market Dynamics & Trends

This section analyzes the growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the GCC air freight market. Key performance indicators (KPIs) such as the Compound Annual Growth Rate (CAGR) and market penetration are used to provide a detailed overview of the market's evolution. The projected CAGR for the forecast period (2025-2033) is xx%. Factors driving market growth include increased e-commerce activity, rising cross-border trade, and improvements in air freight infrastructure. Technological disruptions, such as the rise of drone delivery and autonomous vehicles, are also evaluated for their potential impact on the market. Furthermore, shifting consumer preferences towards faster and more reliable delivery services are examined. The analysis also includes a detailed study of competitive dynamics, focusing on pricing strategies, service differentiation, and market share gains. Market penetration of air freight within the broader logistics sector is projected to reach xx% by 2033.

Dominant Regions & Segments in GCC Air Freight Market

This section identifies the leading regions, countries, and segments within the GCC air freight market. The analysis focuses on the key drivers of dominance in each segment, using both detailed paragraphs and bullet points for clarity.

By Country: The UAE is projected to remain the dominant market due to its strategic location, robust infrastructure, and thriving economy. Saudi Arabia also shows strong growth potential with planned infrastructure development initiatives.

- Key Drivers for UAE:

- Advanced airport infrastructure.

- Strong e-commerce sector.

- Supportive government policies.

- Key Drivers for Saudi Arabia:

- Vision 2030 initiatives.

- Growing logistics sector.

- Increased investments in infrastructure.

- Key Drivers for UAE:

By Services: The forwarding segment is expected to maintain its dominance due to the growing demand for specialized logistics services.

- Key Drivers for Forwarding:

- Increasing complexity of global supply chains.

- Demand for specialized services like customs brokerage.

- Growth of e-commerce and related logistics needs.

- Key Drivers for Forwarding:

By Destination: The international segment is expected to drive overall market growth, fueled by increasing global trade and cross-border e-commerce.

GCC Air Freight Market Product Innovations

Recent product innovations in the GCC air freight market focus on enhancing speed, efficiency, and security. Technological advancements such as real-time tracking and monitoring systems, improved temperature-controlled shipping containers, and automated warehousing systems are gaining traction. These innovations are driven by the need to meet the demands of time-sensitive deliveries and enhance supply chain visibility. The integration of data analytics and artificial intelligence is also transforming route optimization, resource allocation, and predictive maintenance of aircraft. This improves operational efficiency and reduces overall transportation costs.

Report Scope & Segmentation Analysis

The report segments the GCC air freight market along three key axes: services, destination, and country. Each segment is analyzed in detail, providing insights into growth projections, market size, and competitive dynamics.

- By Services: The market is segmented into forwarding, airlines, mail, and other services. The forwarding segment shows the highest growth, driven by complex supply chains. The airline segment is also significant, with key players like Etihad and Qatar Airways playing critical roles.

- By Destination: The market is divided into domestic and international segments. The international segment is larger, driven by significant cross-border trade within the GCC and beyond.

- By Country: The market is broken down by country, with the UAE, Saudi Arabia, Qatar, and the rest of the GCC analyzed separately. The UAE and Saudi Arabia are the largest markets due to their developed economies and infrastructure.

Key Drivers of GCC Air Freight Market Growth

The GCC air freight market's growth is driven by several factors. The expansion of e-commerce, particularly cross-border transactions, significantly boosts demand for faster delivery options. Government initiatives aimed at diversifying economies and fostering logistics infrastructure development, like Saudi Vision 2030, fuel further expansion. Furthermore, the rise of specialized logistics services, catering to niche industries like pharmaceuticals and high-value goods, drives market growth.

Challenges in the GCC Air Freight Market Sector

The GCC air freight market faces certain challenges. Stringent regulatory compliance requirements and customs procedures can increase operational complexities and costs. Fluctuations in fuel prices directly impact operational expenses. Intense competition among established players and new entrants necessitates continuous innovation and efficiency enhancements to maintain a competitive edge. Finally, geopolitical uncertainties in the region can affect overall market stability and growth.

Emerging Opportunities in GCC Air Freight Market

Emerging opportunities lie in the growing adoption of cutting-edge technologies, including automation, AI, and blockchain. Expansion of cold chain logistics to meet increasing demand for temperature-sensitive goods presents significant potential. The rise of specialized services like last-mile delivery and same-day air freight offers further avenues for growth. Finally, tapping into the growth of e-commerce and cross-border trade across diverse sectors remains a lucrative prospect.

Leading Players in the GCC Air Freight Market Market

- Jazeera Airways Co

- Etihad Aviation Group

- DHL

- FedEx

- JAS Middle East LLC

- Air Charter Service

- Qatar Airways Group

- Maximus Air

- Qatar Aviation Services

- Saudi Airlines Cargo Company Limited

Key Developments in GCC Air Freight Market Industry

- November 2023: United Parcel Service (UPS) finalized its acquisition of MNX, enhancing its time-sensitive logistics capabilities.

- October 2023: DHL acquired full control of Danzas AEI Emirates, strengthening its position in the UAE and GCC.

Future Outlook for GCC Air Freight Market Market

The GCC air freight market shows considerable potential for continued growth. The ongoing expansion of e-commerce, coupled with investments in infrastructure and technological advancements, will fuel further expansion. Strategic partnerships and collaborations among industry players will play a crucial role in shaping the market's future trajectory. A focus on enhancing operational efficiency, embracing sustainable practices, and meeting evolving customer demands will be essential for success.

GCC Air Freight Market Segmentation

-

1. Services

- 1.1. Forwarding

- 1.2. Airlines

- 1.3. Mail

- 1.4. Other Services

-

2. Destination

- 2.1. Domestic

- 2.2. International

GCC Air Freight Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

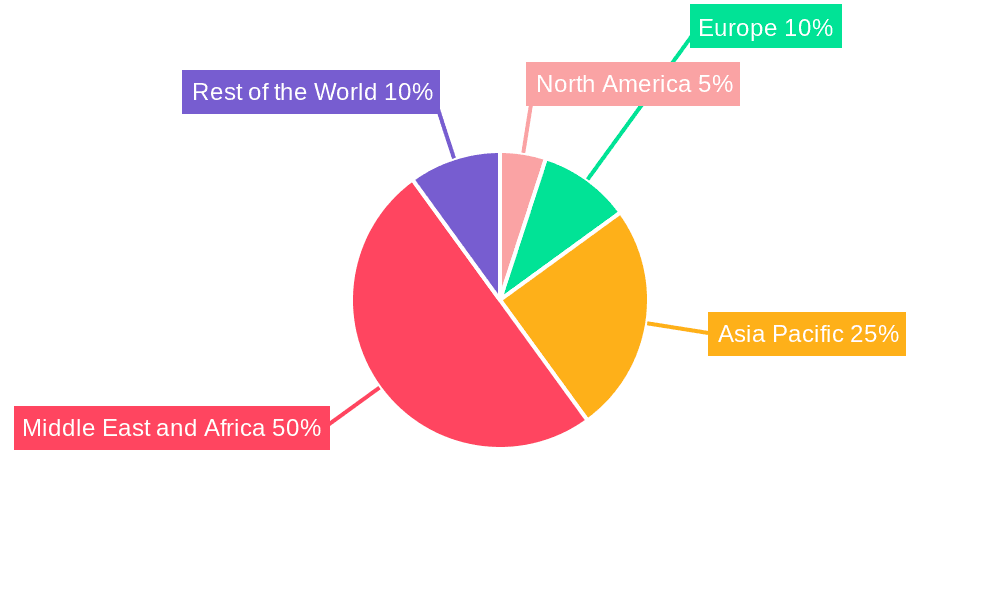

GCC Air Freight Market Regional Market Share

Geographic Coverage of GCC Air Freight Market

GCC Air Freight Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic expansion; Trade liberalization

- 3.3. Market Restrains

- 3.3.1. Regulatory barriers; Security concerns

- 3.4. Market Trends

- 3.4.1. Booming international segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Air Freight Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Forwarding

- 5.1.2. Airlines

- 5.1.3. Mail

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America GCC Air Freight Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Forwarding

- 6.1.2. Airlines

- 6.1.3. Mail

- 6.1.4. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America GCC Air Freight Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Forwarding

- 7.1.2. Airlines

- 7.1.3. Mail

- 7.1.4. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe GCC Air Freight Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Forwarding

- 8.1.2. Airlines

- 8.1.3. Mail

- 8.1.4. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa GCC Air Freight Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Forwarding

- 9.1.2. Airlines

- 9.1.3. Mail

- 9.1.4. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific GCC Air Freight Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Forwarding

- 10.1.2. Airlines

- 10.1.3. Mail

- 10.1.4. Other Services

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jazeera Airways Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Etihad Aviation Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FedEx

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JAS Middle East LLC**List Not Exhaustive 7 3 Other Companie

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Air Charter Service

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qatar Airways Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maximus Air

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qatar Aviation Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saudi Airlines Cargo Company Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jazeera Airways Co

List of Figures

- Figure 1: Global GCC Air Freight Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Air Freight Market Revenue (Million), by Services 2025 & 2033

- Figure 3: North America GCC Air Freight Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America GCC Air Freight Market Revenue (Million), by Destination 2025 & 2033

- Figure 5: North America GCC Air Freight Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America GCC Air Freight Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GCC Air Freight Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Air Freight Market Revenue (Million), by Services 2025 & 2033

- Figure 9: South America GCC Air Freight Market Revenue Share (%), by Services 2025 & 2033

- Figure 10: South America GCC Air Freight Market Revenue (Million), by Destination 2025 & 2033

- Figure 11: South America GCC Air Freight Market Revenue Share (%), by Destination 2025 & 2033

- Figure 12: South America GCC Air Freight Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America GCC Air Freight Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Air Freight Market Revenue (Million), by Services 2025 & 2033

- Figure 15: Europe GCC Air Freight Market Revenue Share (%), by Services 2025 & 2033

- Figure 16: Europe GCC Air Freight Market Revenue (Million), by Destination 2025 & 2033

- Figure 17: Europe GCC Air Freight Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: Europe GCC Air Freight Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe GCC Air Freight Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Air Freight Market Revenue (Million), by Services 2025 & 2033

- Figure 21: Middle East & Africa GCC Air Freight Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Middle East & Africa GCC Air Freight Market Revenue (Million), by Destination 2025 & 2033

- Figure 23: Middle East & Africa GCC Air Freight Market Revenue Share (%), by Destination 2025 & 2033

- Figure 24: Middle East & Africa GCC Air Freight Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Air Freight Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Air Freight Market Revenue (Million), by Services 2025 & 2033

- Figure 27: Asia Pacific GCC Air Freight Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Asia Pacific GCC Air Freight Market Revenue (Million), by Destination 2025 & 2033

- Figure 29: Asia Pacific GCC Air Freight Market Revenue Share (%), by Destination 2025 & 2033

- Figure 30: Asia Pacific GCC Air Freight Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Air Freight Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Air Freight Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global GCC Air Freight Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 3: Global GCC Air Freight Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GCC Air Freight Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Global GCC Air Freight Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 6: Global GCC Air Freight Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Air Freight Market Revenue Million Forecast, by Services 2020 & 2033

- Table 11: Global GCC Air Freight Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 12: Global GCC Air Freight Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Air Freight Market Revenue Million Forecast, by Services 2020 & 2033

- Table 17: Global GCC Air Freight Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 18: Global GCC Air Freight Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Air Freight Market Revenue Million Forecast, by Services 2020 & 2033

- Table 29: Global GCC Air Freight Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 30: Global GCC Air Freight Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Air Freight Market Revenue Million Forecast, by Services 2020 & 2033

- Table 38: Global GCC Air Freight Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 39: Global GCC Air Freight Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Air Freight Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Air Freight Market?

The projected CAGR is approximately 7.46%.

2. Which companies are prominent players in the GCC Air Freight Market?

Key companies in the market include Jazeera Airways Co, Etihad Aviation Group, DHL, FedEx, JAS Middle East LLC**List Not Exhaustive 7 3 Other Companie, Air Charter Service, Qatar Airways Group, Maximus Air, Qatar Aviation Services, Saudi Airlines Cargo Company Limited.

3. What are the main segments of the GCC Air Freight Market?

The market segments include Services, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic expansion; Trade liberalization.

6. What are the notable trends driving market growth?

Booming international segment.

7. Are there any restraints impacting market growth?

Regulatory barriers; Security concerns.

8. Can you provide examples of recent developments in the market?

November 2023: United Parcel Service (UPS) finalized its acquisition of Minnesota-based MNX, a global provider of time-sensitive logistics solutions. This acquisition strengthens UPS's capabilities in time-sensitive logistics, particularly benefiting healthcare clients in the United States, Europe, and Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Air Freight Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Air Freight Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Air Freight Market?

To stay informed about further developments, trends, and reports in the GCC Air Freight Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence