Key Insights

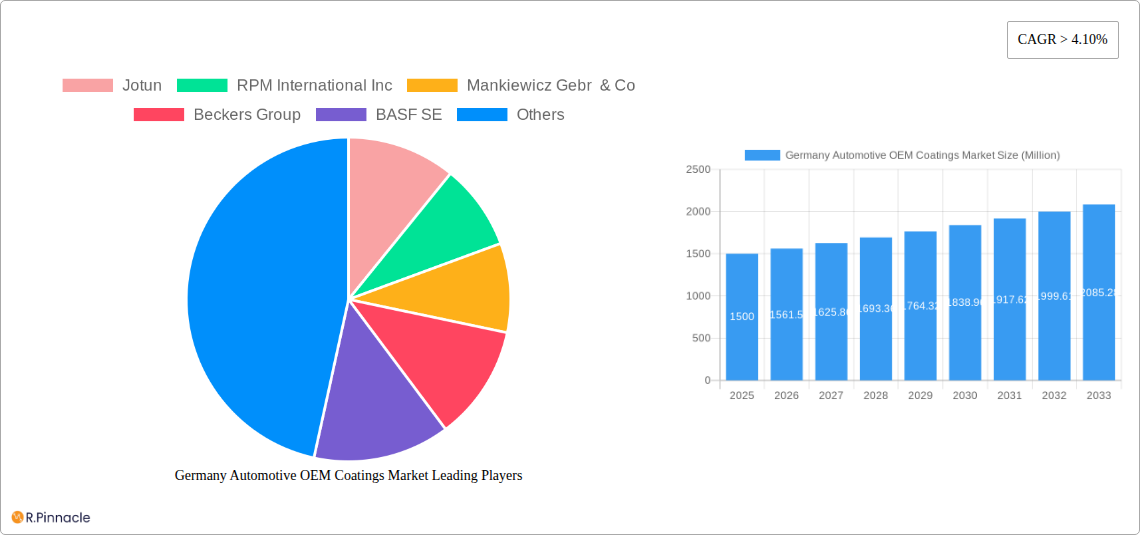

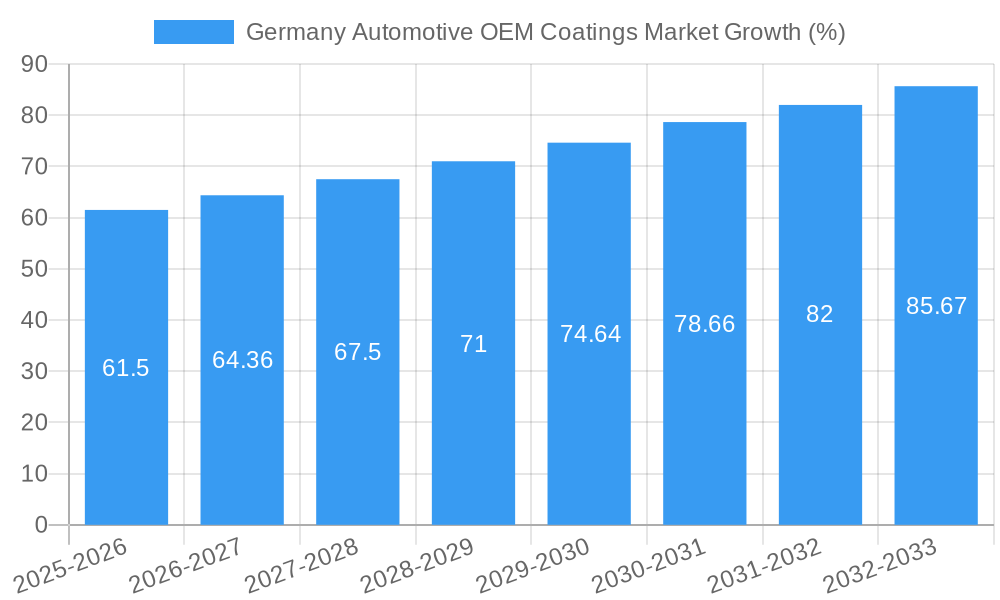

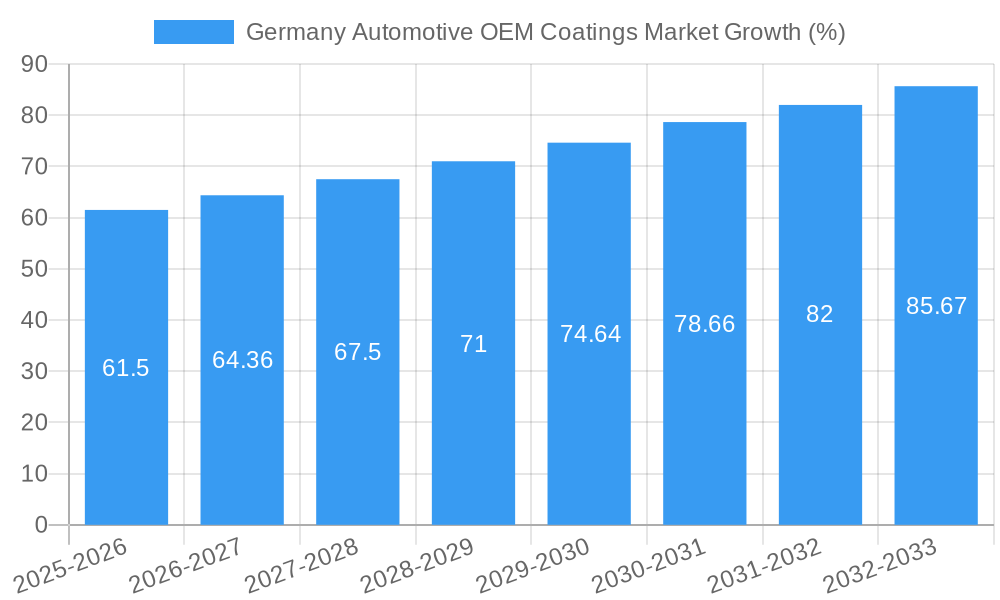

The German automotive OEM coatings market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 4.10% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for lightweight vehicles, fueled by stringent fuel efficiency regulations and the rising popularity of electric vehicles (EVs), is stimulating innovation in coating technologies. Lightweight materials often require specialized coatings to enhance durability and corrosion resistance, driving market growth. Secondly, the automotive industry's focus on sustainability is leading to increased adoption of eco-friendly waterborne and UV-cured coatings, reducing the environmental impact of manufacturing processes. Germany's strong automotive manufacturing base and its commitment to environmental regulations further bolster this trend. Finally, advancements in coating technology, such as the development of high-performance coatings with enhanced scratch and chip resistance, are contributing to increased market value. The market is segmented by application (passenger vehicles, commercial vehicles, ACE), technology (waterborne, solventborne, powder, UV-cured), resin type (acrylic, alkyd, epoxy, polyurethane, polyester), and layer (basecoat, clearcoat, electrocoat, primer).

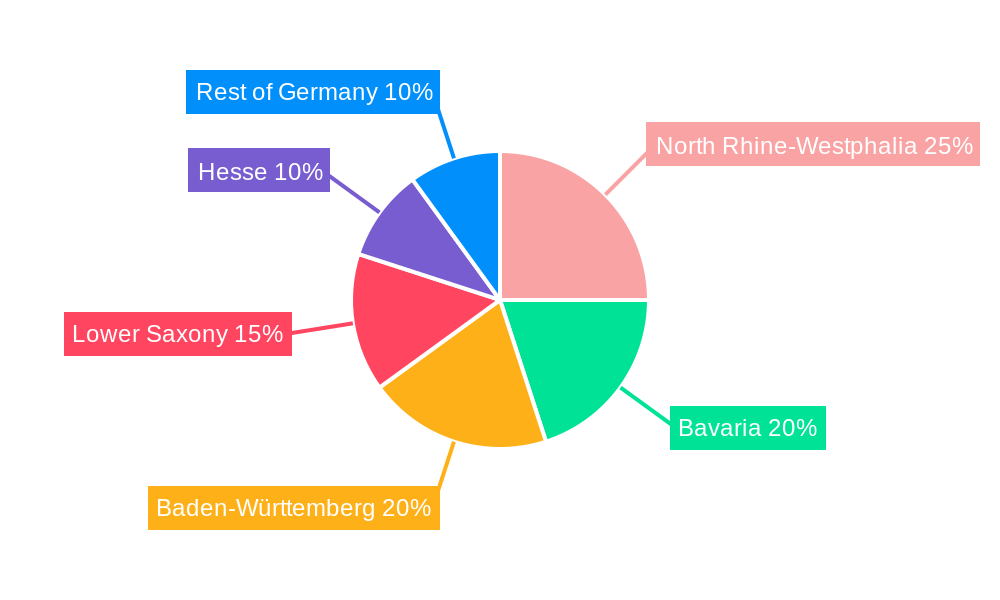

Major players such as BASF SE, Akzo Nobel N.V., PPG Industries, and others are strategically investing in research and development to offer innovative and sustainable coating solutions, catering to the evolving demands of the automotive industry. The regional concentration within Germany is notable, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse representing significant market hubs due to their established automotive manufacturing clusters. However, challenges such as fluctuating raw material prices and stringent environmental regulations may pose some restraints to market growth. Nonetheless, the overall outlook for the German automotive OEM coatings market remains positive, driven by sustained growth in vehicle production, technological innovation, and the increasing focus on sustainable manufacturing practices. The forecast period of 2025-2033 is expected to witness a substantial increase in market value due to the confluence of these factors.

Germany Automotive OEM Coatings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Automotive OEM Coatings Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report meticulously examines market structure, dynamics, dominant segments, product innovations, and future growth prospects, providing actionable intelligence to navigate the complexities of this dynamic market. The market size is valued at XX Million in 2025 and is projected to reach XX Million by 2033.

Germany Automotive OEM Coatings Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the German Automotive OEM Coatings Market. We delve into market concentration, examining the market share held by key players such as Jotun, RPM International Inc, Mankiewicz Gebr & Co, Beckers Group, BASF SE, Axalta Coating Systems, Akzo Nobel N V, PPG Industries, The Sherwin Williams Company, MIPA SE, and others. The report also investigates M&A activities, quantifying deal values where possible and analyzing their impact on market dynamics. Innovation is explored through an examination of technological advancements, such as the increasing adoption of waterborne and UV-cured coatings, and the influence of regulatory frameworks like stricter emission standards. Analysis of product substitutes and end-user demographics further enriches the understanding of market structure. The market share of the top 5 players in 2025 is estimated at xx%, reflecting a moderately concentrated market. M&A activity in the period 2019-2024 involved approximately xx Million in deal value, primarily driven by consolidation efforts.

- Market Concentration: Moderate, with top 5 players holding xx% market share (2025).

- Innovation Drivers: Stringent emission regulations, demand for lightweight vehicles, and aesthetic preferences.

- Regulatory Framework: EU REACH regulations, VOC emission limits, and other environmental directives.

- Product Substitutes: Limited, with existing alternatives mostly focusing on niche applications.

- End-User Demographics: Predominantly automotive OEMs, with varying demands based on vehicle type.

- M&A Activities: xx Million in deal value (2019-2024), driven by consolidation and expansion strategies.

Germany Automotive OEM Coatings Market Market Dynamics & Trends

This section delves into the factors driving market growth, technological advancements, and competitive forces shaping the market. The report analyzes the compound annual growth rate (CAGR) for the forecast period, exploring the market penetration of different coating technologies (waterborne, solventborne, powder, UV-cured). Key growth drivers include the increasing demand for passenger and commercial vehicles, the rising adoption of sustainable coating technologies, and the ongoing development of high-performance coatings with enhanced durability and aesthetics. The analysis also considers consumer preferences toward eco-friendly and high-quality finishes. Competitive dynamics are assessed through an examination of pricing strategies, product differentiation, and technological innovation among key players. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), driven primarily by the increasing demand for passenger vehicles and the growing adoption of advanced coating technologies. Waterborne coatings are projected to achieve xx% market penetration by 2033.

Dominant Regions & Segments in Germany Automotive OEM Coatings Market

This section identifies the leading regions and segments within the German Automotive OEM Coatings market. A detailed analysis will highlight the dominance of specific application areas (Passenger Vehicles, Commercial Vehicles, ACE), technologies (Waterborne, Solventborne, Powder, UV-Cured), resin types (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Other Resin Types), and layers (Basecoat, Clearcoat, Electrocoat, Primer). The analysis will incorporate both quantitative and qualitative data to provide a comprehensive picture of market segmentation.

- Key Drivers for Dominant Segments:

- Passenger Vehicles: High volume production, diverse aesthetic preferences, and stringent emission regulations.

- Waterborne Technology: Environmental regulations and demand for sustainable solutions.

- Polyurethane Resin Type: High performance characteristics, versatility, and durability.

- Clearcoat Layer: Aesthetic appeal and protection against environmental damage.

The passenger vehicle segment holds the largest market share, driven by high production volumes and diverse aesthetic requirements. The waterborne technology segment shows strong growth due to stringent environmental regulations and increasing demand for sustainable solutions. Polyurethane resins dominate due to their high performance and versatility. The clearcoat layer segment is pivotal due to its role in enhancing aesthetics and durability.

Germany Automotive OEM Coatings Market Product Innovations

Recent product innovations focus on eco-friendly, high-performance coatings, incorporating advanced technologies like UV curing and waterborne systems to meet stringent environmental regulations and demand for lightweight vehicles. These innovations offer enhanced durability, improved aesthetics, and reduced environmental impact, providing significant competitive advantages for manufacturers. The market is witnessing a shift towards customized coatings tailored to specific vehicle types and customer requirements.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis across Application (Passenger Vehicles, Commercial Vehicles, ACE), Technology (Waterborne, Solventborne, Powder, UV-Cured), Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Other Resin Types), and Layer (Basecoat, Clearcoat, Electrocoat, Primer). Each segment's market size, growth projections, and competitive dynamics are thoroughly examined. For instance, the passenger vehicle segment is projected to witness xx% growth, driven by increasing vehicle production. The waterborne technology segment is expected to show significant growth due to stringent environmental norms. Each resin type displays specific growth trajectories depending on application requirements and performance characteristics. The clearcoat layer is a crucial segment driving premium aesthetics.

Key Drivers of Germany Automotive OEM Coatings Market Growth

Growth in the German Automotive OEM Coatings Market is primarily driven by increasing vehicle production, stringent environmental regulations promoting the adoption of eco-friendly coatings, and the growing demand for high-performance coatings with enhanced durability and aesthetic appeal. Technological advancements in coating technologies, like UV curing and waterborne systems, further fuel market expansion. Government incentives for sustainable manufacturing practices also contribute to market growth.

Challenges in the Germany Automotive OEM Coatings Market Sector

The market faces challenges such as fluctuating raw material prices, stringent environmental regulations, increasing competition, and the need for continuous innovation to meet evolving customer demands and technological advancements. Supply chain disruptions and potential economic downturns also pose significant risks to market growth. These factors can lead to price volatility and impact profitability.

Emerging Opportunities in Germany Automotive OEM Coatings Market

Emerging opportunities lie in the development of lightweight coatings, specialized coatings for electric vehicles, and the growing adoption of digital technologies for improved efficiency and customized solutions. Focus on sustainability and compliance with stringent environmental regulations presents a significant growth avenue. The development of innovative coating solutions for next-generation vehicles opens up new market opportunities.

Leading Players in the Germany Automotive OEM Coatings Market Market

- Jotun

- RPM International Inc

- Mankiewicz Gebr & Co

- Beckers Group

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N V

- PPG Industries

- The Sherwin Williams Company

- MIPA SE

Key Developments in Germany Automotive OEM Coatings Market Industry

- 2022: BASF SE launched a new waterborne coating technology for improved sustainability.

- 2023: Axalta Coating Systems announced a strategic partnership to expand its market reach.

- 2024: Jotun invested in a new manufacturing facility to increase production capacity. (Further developments to be added)

Future Outlook for Germany Automotive OEM Coatings Market Market

The future of the German Automotive OEM Coatings market is bright, driven by increasing vehicle production, stringent environmental regulations, and the ongoing demand for high-performance coatings. The continued adoption of sustainable technologies, coupled with innovation in coating materials and application methods, will shape the market's future growth. The market presents significant opportunities for companies that can adapt to changing consumer preferences, technological advancements, and environmental regulations.

Germany Automotive OEM Coatings Market Segmentation

-

1. Application

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

- 1.3. ACE

-

2. Technology

- 2.1. Waterborne

- 2.2. Solventborne

- 2.3. Powder

- 2.4. UV-Cured

-

3. Resin Type

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyurethane

- 3.5. Polyester

- 3.6. Other Resin Types

-

4. Layer

- 4.1. Basecoat

- 4.2. Clearcoat

- 4.3. Electrocoat

- 4.4. Primer

Germany Automotive OEM Coatings Market Segmentation By Geography

- 1. Germany

Germany Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobility Preference for Personal Transport; Growing Demand for Better Interiors in Vehicles

- 3.3. Market Restrains

- 3.3.1. Fluctuating Automotive Industry; Harmful Environmental Impact of Conventional Coatings

- 3.4. Market Trends

- 3.4.1. The Acrylic Resins Segment to Register Higher Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.1.3. ACE

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solventborne

- 5.2.3. Powder

- 5.2.4. UV-Cured

- 5.3. Market Analysis, Insights and Forecast - by Resin Type

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyurethane

- 5.3.5. Polyester

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Layer

- 5.4.1. Basecoat

- 5.4.2. Clearcoat

- 5.4.3. Electrocoat

- 5.4.4. Primer

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North Rhine-Westphalia Germany Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jotun

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RPM International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mankiewicz Gebr & Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beckers Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Axalta Coating Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Akzo Nobel N V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PPG Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Sherwin Williams Company*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MIPA SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jotun

List of Figures

- Figure 1: Germany Automotive OEM Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Automotive OEM Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Region 2019 & 2032

- Table 3: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2019 & 2032

- Table 5: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2019 & 2032

- Table 7: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 8: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin Type 2019 & 2032

- Table 9: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Layer 2019 & 2032

- Table 10: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2019 & 2032

- Table 11: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Region 2019 & 2032

- Table 13: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Country 2019 & 2032

- Table 15: North Rhine-Westphalia Germany Automotive OEM Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North Rhine-Westphalia Germany Automotive OEM Coatings Market Volume (Kilo Tons) Forecast, by Application 2019 & 2032

- Table 17: Bavaria Germany Automotive OEM Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Bavaria Germany Automotive OEM Coatings Market Volume (Kilo Tons) Forecast, by Application 2019 & 2032

- Table 19: Baden-Württemberg Germany Automotive OEM Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Baden-Württemberg Germany Automotive OEM Coatings Market Volume (Kilo Tons) Forecast, by Application 2019 & 2032

- Table 21: Lower Saxony Germany Automotive OEM Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Lower Saxony Germany Automotive OEM Coatings Market Volume (Kilo Tons) Forecast, by Application 2019 & 2032

- Table 23: Hesse Germany Automotive OEM Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Hesse Germany Automotive OEM Coatings Market Volume (Kilo Tons) Forecast, by Application 2019 & 2032

- Table 25: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2019 & 2032

- Table 27: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2019 & 2032

- Table 29: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 30: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin Type 2019 & 2032

- Table 31: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Layer 2019 & 2032

- Table 32: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2019 & 2032

- Table 33: Germany Automotive OEM Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive OEM Coatings Market?

The projected CAGR is approximately > 4.10%.

2. Which companies are prominent players in the Germany Automotive OEM Coatings Market?

Key companies in the market include Jotun, RPM International Inc, Mankiewicz Gebr & Co, Beckers Group, BASF SE, Axalta Coating Systems, Akzo Nobel N V, PPG Industries, The Sherwin Williams Company*List Not Exhaustive, MIPA SE.

3. What are the main segments of the Germany Automotive OEM Coatings Market?

The market segments include Application, Technology, Resin Type, Layer.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Mobility Preference for Personal Transport; Growing Demand for Better Interiors in Vehicles.

6. What are the notable trends driving market growth?

The Acrylic Resins Segment to Register Higher Growth Rate.

7. Are there any restraints impacting market growth?

Fluctuating Automotive Industry; Harmful Environmental Impact of Conventional Coatings.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kilo Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the Germany Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence