Key Insights

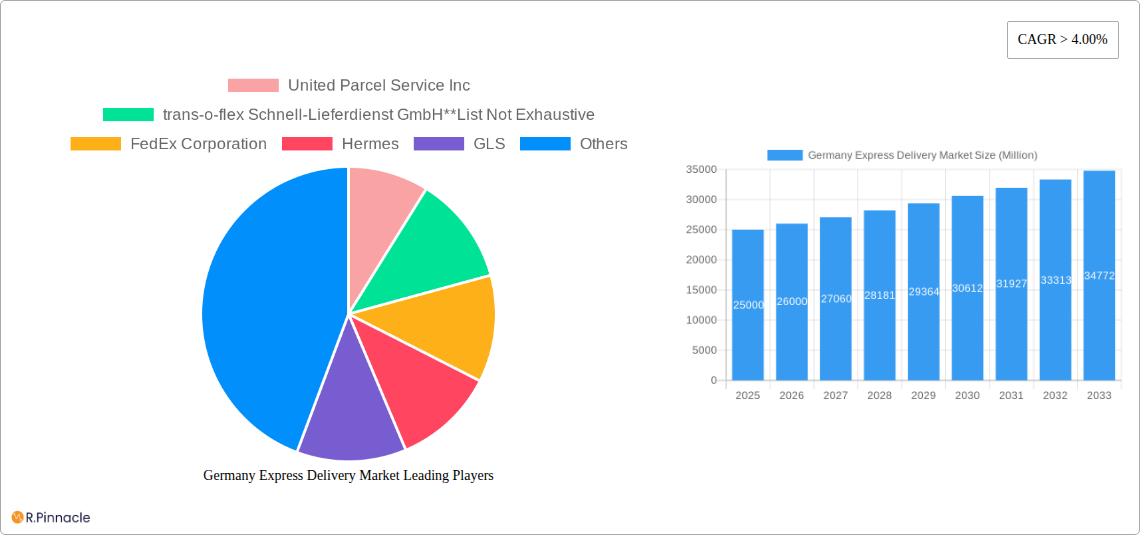

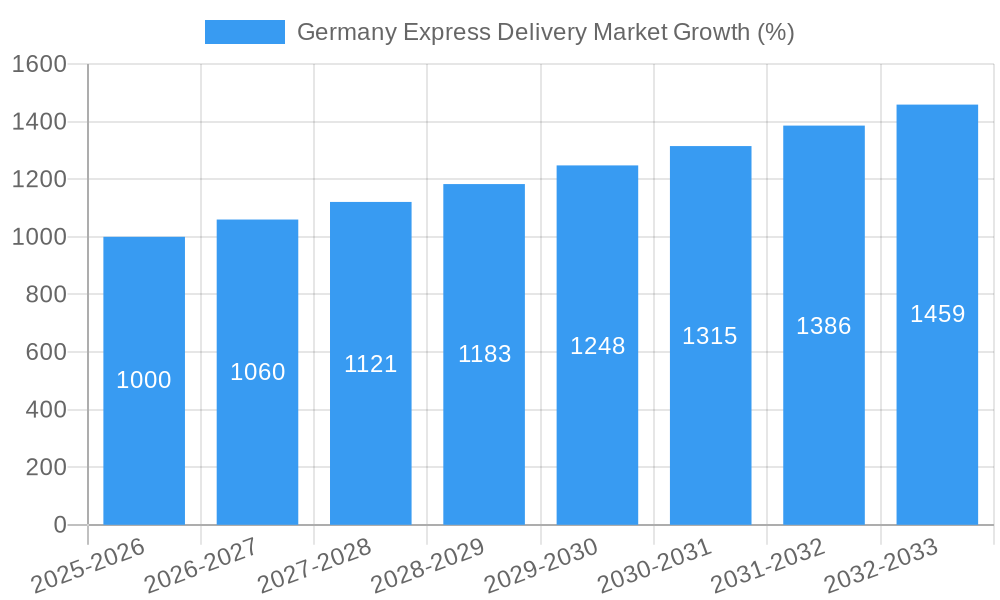

The German express delivery market, a significant contributor to the nation's robust logistics sector, is experiencing robust growth, fueled by the expansion of e-commerce, the increasing reliance on just-in-time manufacturing, and the growing demand for faster delivery services across various sectors. With a market size exceeding €X billion in 2025 (the exact figure requires further research but is estimated based on similar mature markets and the provided CAGR), the market is projected to maintain a Compound Annual Growth Rate (CAGR) of over 4% through 2033. This growth is driven by several key factors: the thriving e-commerce industry within Germany, particularly the rise of online retail giants and smaller businesses utilizing online sales channels; the increasing need for efficient supply chain management across manufacturing, construction, and utilities; and the consistent demand from the BFSI sector for secure and timely document and package delivery. The B2C segment is expected to dominate, driven by consumer expectations for rapid delivery, while the B2B sector will also see substantial growth due to optimized logistics and supply chain management within businesses. Regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, being significant economic hubs, will continue to be major contributors to market revenue.

However, the market faces certain challenges. Rising fuel costs and labor shortages are significant restraints, potentially impacting profitability and delivery times. Increasing competition from smaller, regional players and the need for continuous investment in technology, particularly in automation and delivery optimization software, will also influence market dynamics. Despite these headwinds, the long-term outlook for the German express delivery market remains positive, driven by consistent growth in e-commerce, industrial activity, and a sustained need for reliable and efficient delivery services across numerous sectors. The market's segmentation by destination (domestic vs. international), end-user industry, and business type (B2B vs. B2C) allows for a nuanced understanding of the diverse forces shaping its evolution and offers opportunities for targeted market penetration. Major players like DHL, UPS, FedEx, and Hermes will continue to hold significant market share, but competition and innovation are likely to shape the market landscape throughout the forecast period.

Germany Express Delivery Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Germany express delivery market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, and future growth prospects. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence on this dynamic market. Market values are expressed in Millions.

Germany Express Delivery Market Market Structure & Innovation Trends

The German express delivery market exhibits a moderately concentrated structure, with key players like Deutsche Post DHL Group, DPD Group, and FedEx Corporation holding significant market share. However, smaller, specialized players like trans-o-flex Schnell-Lieferdienst GmbH also contribute significantly, particularly in niche segments. Market share fluctuates depending on the segment (B2B vs B2C, domestic vs international), with estimations for 2025 placing DHL at approximately xx Million and DPD at approximately xx Million in revenue. Innovation is driven by technological advancements, including automation, AI-powered route optimization, and last-mile delivery solutions. Stringent regulatory frameworks, particularly concerning data privacy and environmental regulations, shape market practices. Product substitutes, such as same-day delivery services offered by retailers, pose a competitive challenge. The market experiences considerable M&A activity, with recent notable deals including GEODIS' acquisition of trans-o-flex in December 2022. This deal, valued at xx Million, underscores the ongoing consolidation within the sector. Other significant M&A activities have contributed xx Million to the market in the past 5 years.

- Market Concentration: Moderately concentrated, with a few dominant players and several niche players.

- Innovation Drivers: Technological advancements, automation, AI, and last-mile delivery solutions.

- Regulatory Frameworks: Stringent data privacy and environmental regulations.

- M&A Activity: Significant activity, exemplified by GEODIS’ acquisition of trans-o-flex. Total M&A value (2019-2024): xx Million.

Germany Express Delivery Market Market Dynamics & Trends

The German express delivery market is experiencing robust growth, driven by the expansion of e-commerce, increasing demand for faster delivery options, and the growth of B2C deliveries. The rise of online marketplaces and omnichannel retail strategies fuels this demand. Technological disruptions, such as the adoption of autonomous vehicles and drone technology for last-mile delivery, are reshaping the market landscape. Consumer preferences are shifting towards greater transparency, traceability, and sustainable delivery options. Competitive dynamics are characterized by intense competition among major players, with a focus on price competitiveness, service differentiation, and technological innovation. The market's Compound Annual Growth Rate (CAGR) for 2025-2033 is projected at xx%, driven by the factors listed above. Market penetration for express delivery services within the B2C segment reached an estimated xx% in 2024, illustrating the increasing reliance on these services.

Dominant Regions & Segments in Germany Express Delivery Market

The domestic segment of the Germany express delivery market dominates in terms of revenue and volume, driven by the strong growth of e-commerce within Germany itself. The B2C segment is also a key driver of market growth, fueled by increasing consumer demand for convenient and fast delivery options. Within end-users, the Wholesale and Retail Trade (E-commerce) sector is the most significant contributor, followed by the Manufacturing sector.

- Key Drivers for Domestic Segment: Robust e-commerce growth, dense population centers, and well-developed infrastructure.

- Key Drivers for B2C Segment: Rising consumer expectations for faster and more convenient deliveries.

- Key Drivers for Wholesale and Retail Trade: The booming e-commerce sector in Germany.

The dominance of the domestic segment stems from several factors:

- Strong Domestic E-commerce: Germany boasts a highly developed and rapidly expanding e-commerce market.

- Extensive Logistics Infrastructure: Germany possesses a well-established road, rail, and air network, facilitating efficient deliveries.

- High Population Density: The densely populated areas in Germany lead to higher demand and operational efficiency.

Germany Express Delivery Market Product Innovations

Recent innovations in the German express delivery market include the integration of advanced tracking technologies, the adoption of sustainable delivery practices (e.g., electric vehicles), and the development of specialized solutions for temperature-sensitive goods. These innovations enhance efficiency, improve customer experience, and address growing environmental concerns. The market fit for these innovations is strong, given the increasing demand for speed, transparency, and sustainability in express delivery services.

Report Scope & Segmentation Analysis

This report segments the Germany express delivery market based on destination (domestic, international), end-user (services, wholesale & retail trade, manufacturing, construction & utilities, primary industries), and business type (B2B, B2C). Each segment exhibits unique growth dynamics and competitive landscapes. For example, the international segment is experiencing moderate growth driven by global trade, while the B2B segment is characterized by higher average order values and specialized service requirements. Growth projections vary across segments, reflecting the specific market drivers and challenges in each area. Market sizes for 2025 and projected market sizes for 2033 are provided for each segment in the full report.

Key Drivers of Germany Express Delivery Market Growth

The growth of the German express delivery market is driven by several key factors: the rapid expansion of e-commerce, the rising demand for faster and more reliable delivery options among consumers, and ongoing technological advancements in logistics and transportation. Government initiatives promoting digitalization and infrastructure development further contribute to market expansion. The increasing adoption of omnichannel retail strategies by businesses also fuels growth, creating a need for flexible and efficient delivery solutions.

Challenges in the Germany Express Delivery Market Sector

The German express delivery market faces challenges including increasing fuel costs, labor shortages, and the rising complexity of last-mile delivery in urban areas. Regulatory changes impacting emissions and delivery schedules also pose difficulties. Furthermore, intense competition and price pressures affect profit margins. These challenges necessitate innovative solutions and strategic adaptations to maintain profitability and competitiveness.

Emerging Opportunities in Germany Express Delivery Market

Emerging opportunities include the expansion of specialized services (e.g., same-day delivery, temperature-controlled transport), the adoption of drone technology for last-mile delivery, and the growth of sustainable delivery options. The increasing demand for transparency and traceability in the delivery process also presents opportunities for service providers to differentiate themselves. Furthermore, expansion into underserved rural areas holds potential for growth.

Leading Players in the Germany Express Delivery Market Market

- United Parcel Service Inc (UPS)

- trans-o-flex Schnell-Lieferdienst GmbH

- FedEx Corporation (FedEx)

- Hermes

- GLS

- Deutsche Post DHL Group (DHL)

- DPD Group (DPD)

- Go! Express

- Atlantic International Express

Key Developments in Germany Express Delivery Market Industry

- December 2022: GEODIS acquired trans-o-flex, significantly impacting the premium express sector, especially temperature-controlled logistics.

- May 2023: NCAB Group's acquisition of DB Electronic strengthens its quick-turnaround PCB delivery capabilities, potentially affecting the high-tech and electronics segments.

Future Outlook for Germany Express Delivery Market Market

The German express delivery market is poised for continued growth, driven by sustained e-commerce expansion and ongoing technological advancements. Strategic investments in infrastructure, innovative logistics solutions, and sustainable practices will be crucial for success. Market players that effectively adapt to evolving consumer preferences and regulatory changes are expected to thrive in the years to come. The market is expected to reach xx Million by 2033.

Germany Express Delivery Market Segmentation

-

1. Business

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Manufacturing, Construction, and Utilities

- 3.4. Primary

Germany Express Delivery Market Segmentation By Geography

- 1. Germany

Germany Express Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace

- 3.2.2 automotive

- 3.2.3 and pharmaceuticals.

- 3.3. Market Restrains

- 3.3.1 4.; The geopolitical situation in the Middle East can create security concerns for logistics operations

- 3.3.2 4.; Regulations and customs procedures can be complex and subject to change.

- 3.4. Market Trends

- 3.4.1. Increased E-commerce Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Manufacturing, Construction, and Utilities

- 5.3.4. Primary

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. North Rhine-Westphalia Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 United Parcel Service Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 trans-o-flex Schnell-Lieferdienst GmbH**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FedEx Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hermes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GLS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deutsche Post DHL Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DPD Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Go! Express

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlantic International Express

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 United Parcel Service Inc

List of Figures

- Figure 1: Germany Express Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Express Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Express Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 3: Germany Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Germany Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Germany Express Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North Rhine-Westphalia Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Bavaria Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Baden-Württemberg Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Lower Saxony Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Hesse Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 13: Germany Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 14: Germany Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Germany Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Express Delivery Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Germany Express Delivery Market?

Key companies in the market include United Parcel Service Inc, trans-o-flex Schnell-Lieferdienst GmbH**List Not Exhaustive, FedEx Corporation, Hermes, GLS, Deutsche Post DHL Group, DPD Group, Go! Express, Atlantic International Express.

3. What are the main segments of the Germany Express Delivery Market?

The market segments include Business, Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace. automotive. and pharmaceuticals..

6. What are the notable trends driving market growth?

Increased E-commerce Sales Driving the Market.

7. Are there any restraints impacting market growth?

4.; The geopolitical situation in the Middle East can create security concerns for logistics operations. 4.; Regulations and customs procedures can be complex and subject to change..

8. Can you provide examples of recent developments in the market?

May 2023: NCAB Group, a PCB provider, has expanded further with the acquisition of DB Electronic, situated in Waldshut-Tiengen in southern Germany, DB Electronic AG in Switzerland, and DB Electronic SAS in France. As of today, the three companies have been merged into NCAB Group. db electronic focuses mostly on so-called Quick turnarounds, or smaller series with quick delivery times, which complement NCAB's offering in Europe. Their primary source of PCBs is South Korean factories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Express Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Express Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Express Delivery Market?

To stay informed about further developments, trends, and reports in the Germany Express Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence