Key Insights

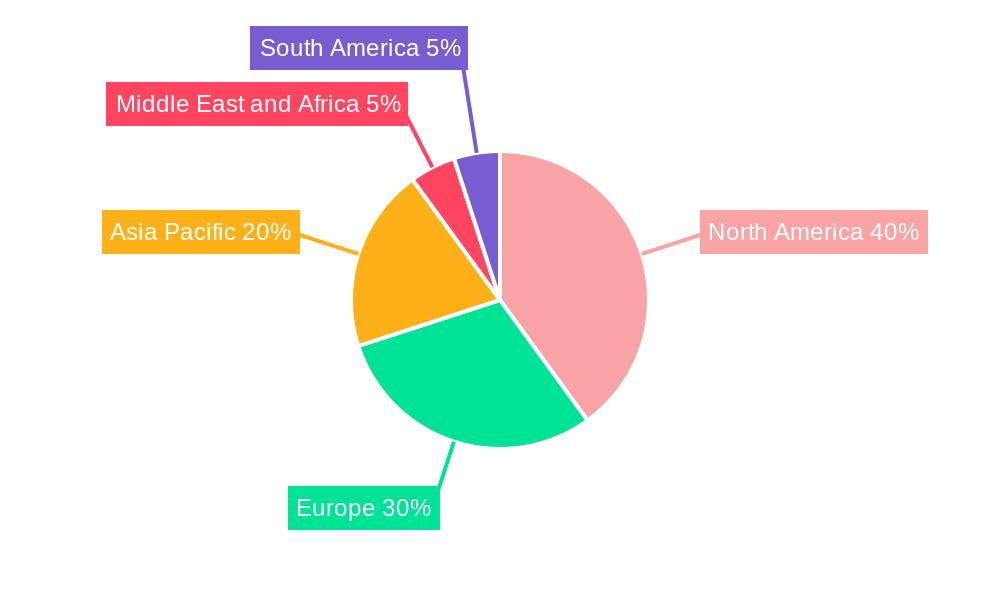

The Gram-positive bacterial infection treatment market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by rising prevalence of drug-resistant strains like Methicillin-resistant Staphylococcus aureus (MRSA), increasing geriatric population (more susceptible to infections), and advancements in diagnostic technologies enabling quicker and more accurate identification of infections. The market's expansion is fueled by the development of novel antibiotics and innovative treatment approaches. However, the emergence of multi-drug resistant organisms presents a significant challenge, impacting treatment efficacy and necessitating the development of new therapeutic strategies. The market is segmented by drug type (including Beta-lactam antimicrobials, fluoroquinolones, and others), disease type (covering pneumonia, sepsis, MRSA infections, and others), and distribution channel (hospital, retail, and online pharmacies). North America and Europe currently hold significant market shares due to advanced healthcare infrastructure and higher per capita healthcare spending, but the Asia-Pacific region is poised for substantial growth owing to its expanding population and increasing healthcare expenditure.

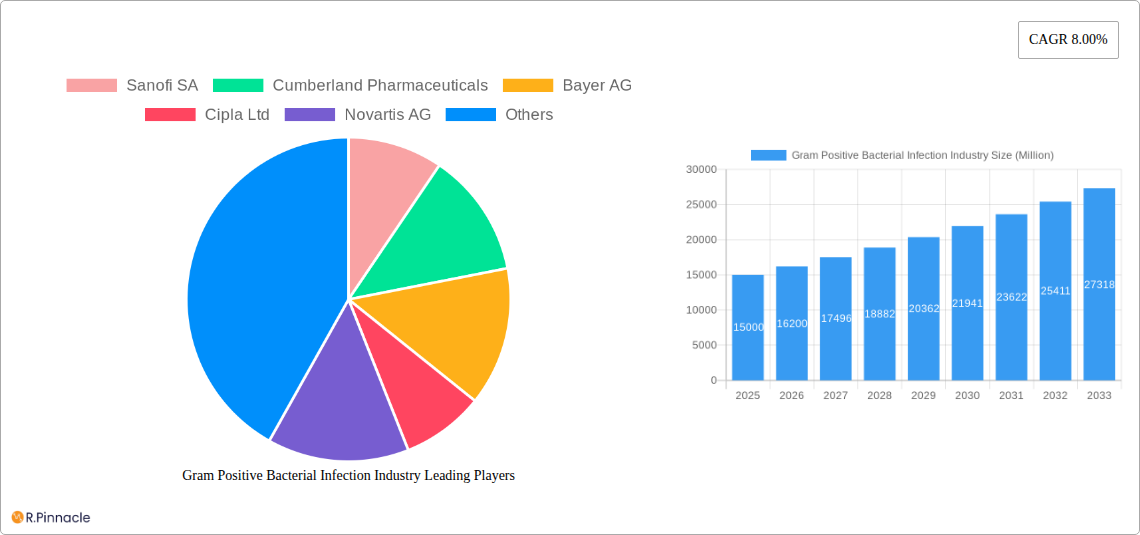

The competitive landscape is characterized by the presence of major pharmaceutical companies like Sanofi, Bayer, Novartis, Merck, and Pfizer, actively engaged in research and development of new antibiotics and therapies. The market is witnessing increasing collaborations and partnerships between pharmaceutical companies and research institutions to accelerate the development of effective treatments for drug-resistant gram-positive bacterial infections. Future growth will be significantly influenced by the success of ongoing research initiatives, regulatory approvals for new drugs, and the adoption of innovative treatment strategies. The continued development of effective and affordable antibiotics is critical to mitigating the threat of drug-resistant gram-positive infections globally, ensuring long-term market sustainability and improved patient outcomes.

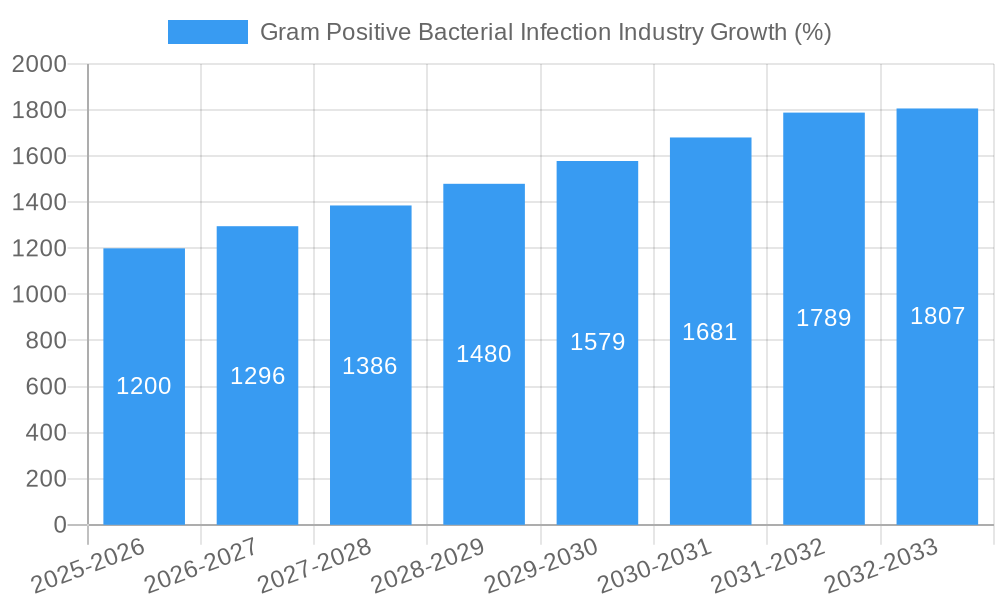

This comprehensive report provides a detailed analysis of the Gram Positive Bacterial Infection industry, offering invaluable insights for industry professionals, investors, and researchers. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. We analyze market size (in Millions), growth drivers, challenges, and emerging opportunities, providing actionable intelligence to navigate this dynamic sector.

Gram Positive Bacterial Infection Industry Market Structure & Innovation Trends

This section delves into the competitive landscape of the Gram Positive Bacterial Infection industry, examining market concentration, innovation drivers, and regulatory influences. The analysis includes an assessment of market share held by key players, including Sanofi SA, Cumberland Pharmaceuticals, Bayer AG, Cipla Ltd, Novartis AG, Merck & Co Inc, GlaxoSmithKline Plc, AstraZeneca, Johnson & Johnson Inc, Sun Pharmaceutical Industries Ltd, Bristol-Myers Squibb Company, Pfizer Inc, and others.

The report will quantify market share for major players, revealing the level of market concentration. For example, the top 5 players might collectively hold xx% of the market in 2025, while the remaining market share is fragmented amongst numerous smaller players. The impact of mergers and acquisitions (M&A) on market dynamics will be evaluated, including details on notable deals and their corresponding values (in Millions). For instance, an analysis of M&A activity between 2019 and 2024 will reveal an estimated total deal value of xx Million, highlighting the consolidation trends within the industry. Innovation drivers, such as the development of new antibiotics and advancements in diagnostic technologies, will also be discussed, alongside regulatory frameworks governing drug development and approval. Analysis will also include an assessment of the impact of substitute products and end-user demographics on overall market growth.

Gram Positive Bacterial Infection Industry Market Dynamics & Trends

This section examines the key market dynamics influencing the growth of the Gram Positive Bacterial Infection industry. The report will analyze the Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033), projecting a growth rate of xx%. This will be further supported by an assessment of market penetration of different drug types and treatment methods across various regions. We will explore how technological disruptions, such as the development of novel drug delivery systems and diagnostic tools, are changing the treatment landscape. Furthermore, we will examine how consumer preferences, such as the increasing demand for personalized medicine and effective treatment strategies are shaping the industry. The competitive dynamics, including the strategies employed by major players, such as pricing strategies and market expansions, will also be scrutinized. This analysis will utilize various sources to arrive at data-driven insights, leading to predictions about future market trends and opportunities.

Dominant Regions & Segments in Gram Positive Bacterial Infection Industry

This section identifies the leading regions, countries, and segments within the Gram Positive Bacterial Infection industry based on drug type, disease, and distribution channel.

- By Drug Type: The report will analyze market dominance across Beta-Lactam Antimicrobials, Fluoroquinolones, Penicillin, Cephalosporins, RNA Immunoprecipitation (RIP), Vaccines, and Other Drugs. For example, Beta-Lactam Antimicrobials are predicted to hold the largest market share in 2025 at xx Million, owing to its widespread use and established efficacy. This dominance is attributable to factors such as proven efficacy and existing infrastructure within healthcare settings.

- By Disease: Dominance analysis for Pneumonia, Sepsis, Pharyngitis, MRSA infections, Endocarditis, Meningitis, and Other Diseases will be undertaken. For example, MRSA infections may exhibit the fastest growth rate due to the rise in antibiotic-resistant strains and the need for specialized treatments. This segment's substantial market value stems from the high prevalence of the disease and the associated need for expensive treatment options.

- By Distribution Channel: The report analyzes market dominance across Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. The shift towards online pharmacies is analyzed to explain the gradual market growth of this segment, while hospital pharmacies continue to dominate due to their direct link to treatment centers.

Key regional drivers, including economic policies, healthcare infrastructure, and disease prevalence, will be highlighted for each segment.

Gram Positive Bacterial Infection Industry Product Innovations

This section will discuss recent product developments and their competitive advantages. We will highlight technological advancements driving innovation, such as the development of novel antibiotic formulations to combat antibiotic resistance, and improved diagnostic tools that allow for earlier and more accurate detection of infections. The report will discuss how these innovations translate into better patient outcomes and market fit.

Report Scope & Segmentation Analysis

This report comprehensively segments the Gram Positive Bacterial Infection industry.

- By Drug Type: Growth projections, market sizes (in Millions), and competitive dynamics will be presented for each drug type.

- By Disease: A similar analysis will be conducted for each disease category.

- By Distribution Channel: The market share, growth projections, and competitive dynamics for each distribution channel will also be detailed.

Key Drivers of Gram Positive Bacterial Infection Industry Growth

The growth of the Gram Positive Bacterial Infection industry is driven by several key factors. The rising prevalence of Gram-positive bacterial infections, fueled by factors like aging populations and increased antibiotic resistance, is a major contributor. Technological advancements in diagnostics and treatment options, coupled with favorable regulatory environments in certain regions, further accelerate market growth. Increased healthcare spending and rising awareness of infection control also play significant roles.

Challenges in the Gram Positive Bacterial Infection Industry Sector

The industry faces significant challenges, including the increasing prevalence of antibiotic resistance, stringent regulatory hurdles for new drug approvals, and high research and development costs. Supply chain disruptions and intense competition among existing players also pose considerable difficulties. These factors significantly impact market growth and profitability, potentially limiting expansion in certain areas.

Emerging Opportunities in Gram Positive Bacterial Infection Industry

Despite the challenges, several opportunities exist. The development of novel antibiotics and innovative treatment strategies to combat antibiotic resistance presents a major avenue for growth. Expanding into emerging markets with high disease prevalence and untapped potential offers significant opportunities. Furthermore, the growing focus on personalized medicine and preventative care creates additional market opportunities for specialized therapies and diagnostic solutions.

Leading Players in the Gram Positive Bacterial Infection Industry Market

- Sanofi SA

- Cumberland Pharmaceuticals

- Bayer AG

- Cipla Ltd

- Novartis AG

- Merck & Co Inc

- GlaxoSmithKline Plc

- AstraZeneca

- Johnson & Johnson Inc

- Sun Pharmaceutical Industries Ltd

- Bristol-Myers Squibb Company

- Pfizer Inc

Key Developments in Gram Positive Bacterial Infection Industry Industry

- September 2022: GSK plc and Spero Therapeutics, Inc. announced an exclusive license agreement for tebipenem pivoxil hydrobromide (tebipenem HBr), a potential oral carbapenem antibiotic for complicated urinary tract infections. This development signifies a potential advancement in treating antibiotic-resistant infections.

- September 2022: ImprimisRx launched Fortisite, a compounded combination of Tobramycin 1.5% and Vancomycin 5%, offering a new treatment option for specific ophthalmic infections. This represents a response to the growing demand for effective treatments.

Future Outlook for Gram Positive Bacterial Infection Industry Market

The Gram Positive Bacterial Infection industry is poised for continued growth, driven by the rising prevalence of drug-resistant infections, ongoing research and development efforts focusing on novel antibiotics, and the expanding availability of advanced diagnostic tools. Strategic collaborations and acquisitions will further shape the market landscape, leading to the introduction of innovative therapies and the expansion of market access in underserved regions. The long-term outlook remains positive, albeit contingent on continued efforts to address the challenges of antibiotic resistance.

Gram Positive Bacterial Infection Industry Segmentation

-

1. Drug Type

- 1.1. Beta-Lactam Antimicrobials

- 1.2. Fluoroquinolones

- 1.3. Penicillin

- 1.4. Cephalosporins

- 1.5. RNA Immunoprecipitation (RIP)

- 1.6. Vaccine

- 1.7. Others Drugs

-

2. Disease

- 2.1. Pneumonia

- 2.2. Sepsis

- 2.3. Pharyngitis

- 2.4. Methicil

- 2.5. Endocarditis

- 2.6. Meningitis

- 2.7. Other Diseases

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Online Pharmacies

Gram Positive Bacterial Infection Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Gram Positive Bacterial Infection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Gram-positive Bacterial Infections; Increasing Number of Drug Approvals

- 3.3. Market Restrains

- 3.3.1. Antibiotic Resistance

- 3.4. Market Trends

- 3.4.1. Cephalosporins Segment is Expected to Witness Significant Growth over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Beta-Lactam Antimicrobials

- 5.1.2. Fluoroquinolones

- 5.1.3. Penicillin

- 5.1.4. Cephalosporins

- 5.1.5. RNA Immunoprecipitation (RIP)

- 5.1.6. Vaccine

- 5.1.7. Others Drugs

- 5.2. Market Analysis, Insights and Forecast - by Disease

- 5.2.1. Pneumonia

- 5.2.2. Sepsis

- 5.2.3. Pharyngitis

- 5.2.4. Methicil

- 5.2.5. Endocarditis

- 5.2.6. Meningitis

- 5.2.7. Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Online Pharmacies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. North America Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. Beta-Lactam Antimicrobials

- 6.1.2. Fluoroquinolones

- 6.1.3. Penicillin

- 6.1.4. Cephalosporins

- 6.1.5. RNA Immunoprecipitation (RIP)

- 6.1.6. Vaccine

- 6.1.7. Others Drugs

- 6.2. Market Analysis, Insights and Forecast - by Disease

- 6.2.1. Pneumonia

- 6.2.2. Sepsis

- 6.2.3. Pharyngitis

- 6.2.4. Methicil

- 6.2.5. Endocarditis

- 6.2.6. Meningitis

- 6.2.7. Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Retail Pharmacies

- 6.3.3. Online Pharmacies

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Europe Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. Beta-Lactam Antimicrobials

- 7.1.2. Fluoroquinolones

- 7.1.3. Penicillin

- 7.1.4. Cephalosporins

- 7.1.5. RNA Immunoprecipitation (RIP)

- 7.1.6. Vaccine

- 7.1.7. Others Drugs

- 7.2. Market Analysis, Insights and Forecast - by Disease

- 7.2.1. Pneumonia

- 7.2.2. Sepsis

- 7.2.3. Pharyngitis

- 7.2.4. Methicil

- 7.2.5. Endocarditis

- 7.2.6. Meningitis

- 7.2.7. Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Retail Pharmacies

- 7.3.3. Online Pharmacies

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Asia Pacific Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. Beta-Lactam Antimicrobials

- 8.1.2. Fluoroquinolones

- 8.1.3. Penicillin

- 8.1.4. Cephalosporins

- 8.1.5. RNA Immunoprecipitation (RIP)

- 8.1.6. Vaccine

- 8.1.7. Others Drugs

- 8.2. Market Analysis, Insights and Forecast - by Disease

- 8.2.1. Pneumonia

- 8.2.2. Sepsis

- 8.2.3. Pharyngitis

- 8.2.4. Methicil

- 8.2.5. Endocarditis

- 8.2.6. Meningitis

- 8.2.7. Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Retail Pharmacies

- 8.3.3. Online Pharmacies

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. Middle East and Africa Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 9.1.1. Beta-Lactam Antimicrobials

- 9.1.2. Fluoroquinolones

- 9.1.3. Penicillin

- 9.1.4. Cephalosporins

- 9.1.5. RNA Immunoprecipitation (RIP)

- 9.1.6. Vaccine

- 9.1.7. Others Drugs

- 9.2. Market Analysis, Insights and Forecast - by Disease

- 9.2.1. Pneumonia

- 9.2.2. Sepsis

- 9.2.3. Pharyngitis

- 9.2.4. Methicil

- 9.2.5. Endocarditis

- 9.2.6. Meningitis

- 9.2.7. Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Retail Pharmacies

- 9.3.3. Online Pharmacies

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 10. South America Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 10.1.1. Beta-Lactam Antimicrobials

- 10.1.2. Fluoroquinolones

- 10.1.3. Penicillin

- 10.1.4. Cephalosporins

- 10.1.5. RNA Immunoprecipitation (RIP)

- 10.1.6. Vaccine

- 10.1.7. Others Drugs

- 10.2. Market Analysis, Insights and Forecast - by Disease

- 10.2.1. Pneumonia

- 10.2.2. Sepsis

- 10.2.3. Pharyngitis

- 10.2.4. Methicil

- 10.2.5. Endocarditis

- 10.2.6. Meningitis

- 10.2.7. Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospital Pharmacies

- 10.3.2. Retail Pharmacies

- 10.3.3. Online Pharmacies

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 11. North America Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Gram Positive Bacterial Infection Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Sanofi SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cumberland Pharmaceuticals

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bayer AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Cipla Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Novartis AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Merck & Co Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 GlaxoSmithKline Plc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AstraZeneca

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Johnson & Johnson Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Sun Pharmaceutical Industries Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Bristol-Myers Squibb Company*List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Pfizer Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Sanofi SA

List of Figures

- Figure 1: Global Gram Positive Bacterial Infection Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Gram Positive Bacterial Infection Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 13: North America Gram Positive Bacterial Infection Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 14: North America Gram Positive Bacterial Infection Industry Revenue (Million), by Disease 2024 & 2032

- Figure 15: North America Gram Positive Bacterial Infection Industry Revenue Share (%), by Disease 2024 & 2032

- Figure 16: North America Gram Positive Bacterial Infection Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: North America Gram Positive Bacterial Infection Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: North America Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Gram Positive Bacterial Infection Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 21: Europe Gram Positive Bacterial Infection Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 22: Europe Gram Positive Bacterial Infection Industry Revenue (Million), by Disease 2024 & 2032

- Figure 23: Europe Gram Positive Bacterial Infection Industry Revenue Share (%), by Disease 2024 & 2032

- Figure 24: Europe Gram Positive Bacterial Infection Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe Gram Positive Bacterial Infection Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 29: Asia Pacific Gram Positive Bacterial Infection Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 30: Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million), by Disease 2024 & 2032

- Figure 31: Asia Pacific Gram Positive Bacterial Infection Industry Revenue Share (%), by Disease 2024 & 2032

- Figure 32: Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Asia Pacific Gram Positive Bacterial Infection Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 37: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 38: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million), by Disease 2024 & 2032

- Figure 39: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue Share (%), by Disease 2024 & 2032

- Figure 40: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Gram Positive Bacterial Infection Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 45: South America Gram Positive Bacterial Infection Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 46: South America Gram Positive Bacterial Infection Industry Revenue (Million), by Disease 2024 & 2032

- Figure 47: South America Gram Positive Bacterial Infection Industry Revenue Share (%), by Disease 2024 & 2032

- Figure 48: South America Gram Positive Bacterial Infection Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 49: South America Gram Positive Bacterial Infection Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: South America Gram Positive Bacterial Infection Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Gram Positive Bacterial Infection Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 3: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 4: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 33: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 34: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 40: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 41: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 50: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 51: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 60: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 61: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 62: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 67: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 68: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 69: Global Gram Positive Bacterial Infection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Gram Positive Bacterial Infection Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gram Positive Bacterial Infection Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Gram Positive Bacterial Infection Industry?

Key companies in the market include Sanofi SA, Cumberland Pharmaceuticals, Bayer AG, Cipla Ltd, Novartis AG, Merck & Co Inc, GlaxoSmithKline Plc, AstraZeneca, Johnson & Johnson Inc, Sun Pharmaceutical Industries Ltd, Bristol-Myers Squibb Company*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the Gram Positive Bacterial Infection Industry?

The market segments include Drug Type, Disease, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Gram-positive Bacterial Infections; Increasing Number of Drug Approvals.

6. What are the notable trends driving market growth?

Cephalosporins Segment is Expected to Witness Significant Growth over the Forecast Period..

7. Are there any restraints impacting market growth?

Antibiotic Resistance.

8. Can you provide examples of recent developments in the market?

September 2022: GSK plc and Spero Therapeutics, Inc. received an exclusive license agreement for tebipenem pivoxil hydrobromide (tebipenem HBr), a late-stage antibiotic being developed by Spero, as the oral carbapenem antibiotic to potentially treat complicated urinary tract infections (cUTI), including pyelonephritis, caused by certain bacteria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gram Positive Bacterial Infection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gram Positive Bacterial Infection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gram Positive Bacterial Infection Industry?

To stay informed about further developments, trends, and reports in the Gram Positive Bacterial Infection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence