Key Insights

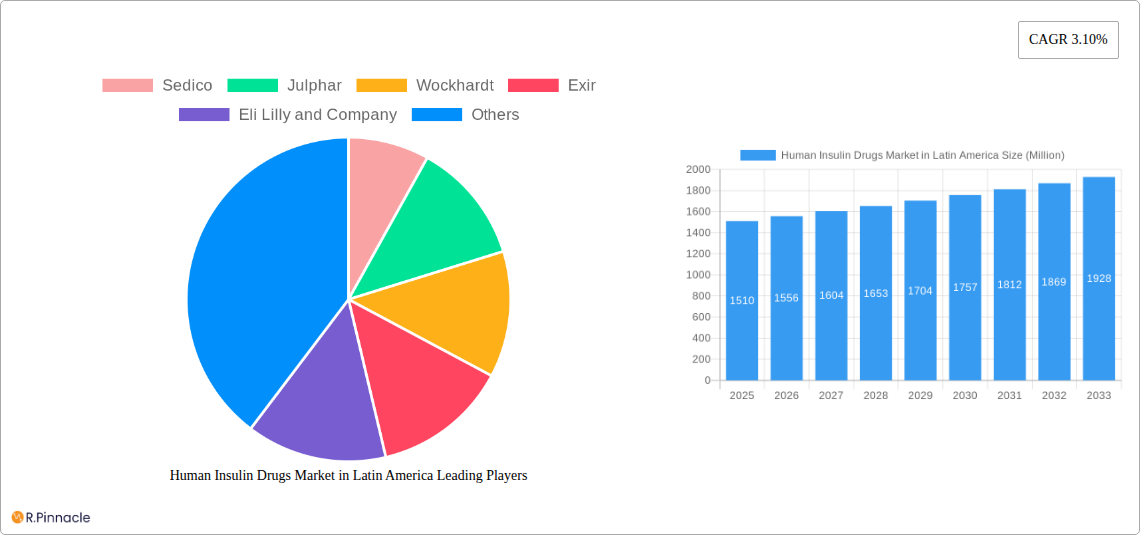

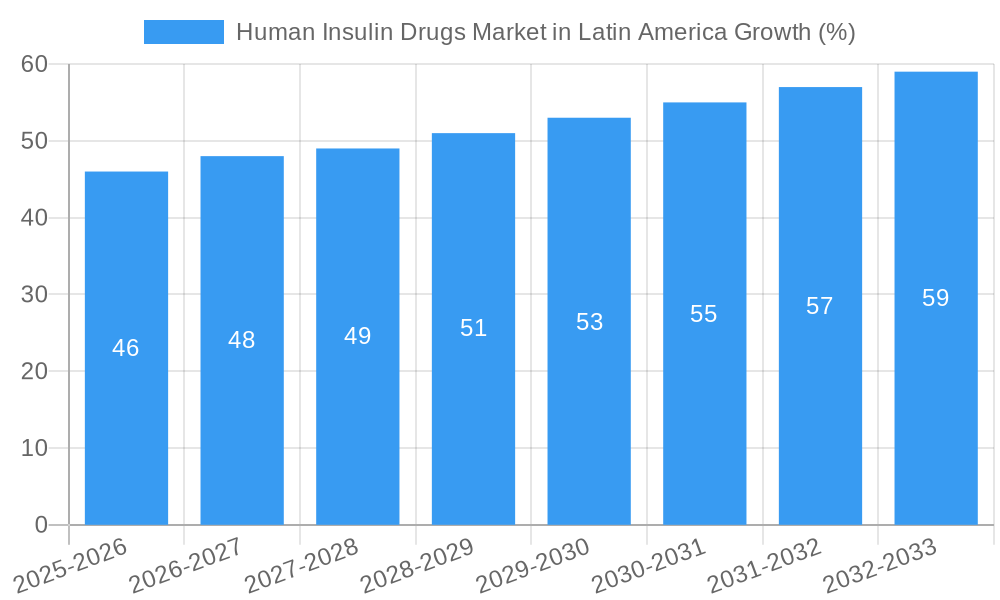

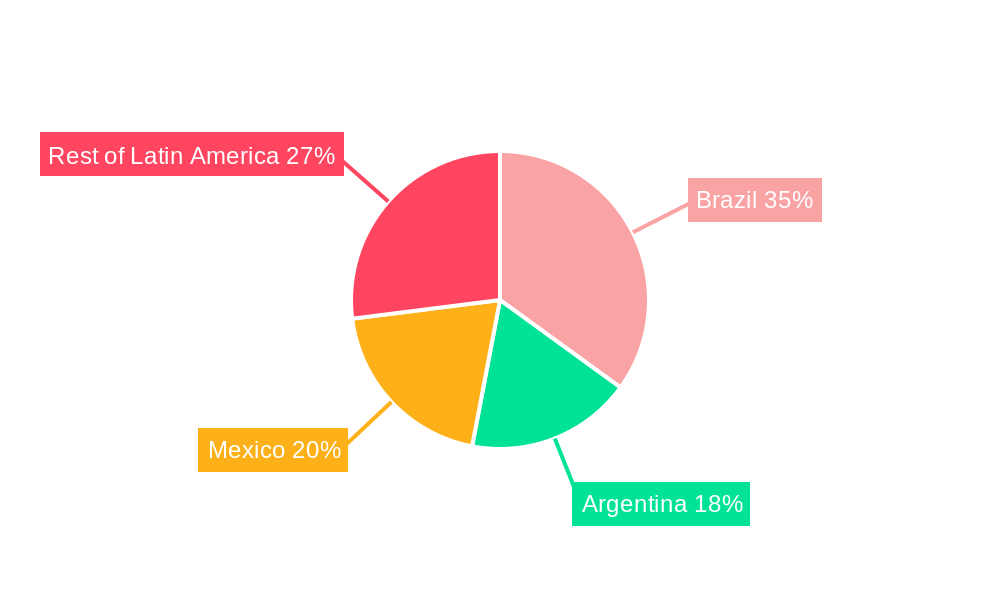

The Latin American human insulin drugs market, valued at $1.51 billion in 2025, is projected to experience steady growth, driven by rising prevalence of diabetes, an aging population, and increasing healthcare expenditure in the region. The market's Compound Annual Growth Rate (CAGR) of 3.10% from 2019 to 2024 suggests a continued, albeit moderate, expansion. Key market segments include basal/long-acting insulins (like Basaglar and Soliqua/Suliqua, encompassing biosimilars), bolus/fast-acting insulins (such as Admelog), traditional human insulins (like Insuman), and combination insulins. Competition among major players like Eli Lilly and Company, Novo Nordisk A/S, Sanofi S.A., Biocon Limited, and regional manufacturers (Sedico, Julphar, Wockhardt, Exir) fuels innovation and influences pricing strategies, impacting market accessibility and affordability. Growth is tempered by factors such as variable healthcare infrastructure across the region, inconsistent diabetes management practices, and affordability concerns for insulin therapies, particularly in less developed economies within Latin America. Brazil, Argentina, and Mexico constitute the largest market segments due to their significant populations and relatively better healthcare access compared to other Latin American countries. The market is expected to witness increased demand for biosimilars as they offer more affordable alternatives to brand-name insulins, thereby promoting greater accessibility. Continued research and development in insulin delivery systems and novel insulin analogs will also contribute to market growth over the forecast period (2025-2033).

The forecast period (2025-2033) anticipates further market expansion, propelled by ongoing efforts to improve diabetes awareness and management programs, increased government initiatives to improve healthcare access, and the gradual introduction of advanced insulin therapies. However, challenges remain. Ensuring consistent access to quality insulin, particularly in remote areas, is paramount. Addressing affordability issues through targeted policies and pricing strategies will be crucial to maximize market potential and improve patient outcomes. Furthermore, the regulatory landscape in different Latin American countries needs consideration, as it influences the speed and ease of drug approvals and market entry for both established and new entrants. The continued focus on preventative measures and improved diabetes management will be key to shaping the trajectory of the Latin American human insulin drugs market in the coming years.

This in-depth report provides a comprehensive analysis of the Human Insulin Drugs market in Latin America, covering market structure, dynamics, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking actionable insights into this rapidly evolving market.

Human Insulin Drugs Market in Latin America Market Structure & Innovation Trends

The Latin American Human Insulin Drugs market exhibits a moderately concentrated structure, with key players such as Eli Lilly and Company, Novo Nordisk A/S, Sanofi S.A, Pfizer Inc, Biocon Limited, and several regional players like Sedico, Julphar, Wockhardt, and Exir competing for market share. The market share distribution is dynamic, with larger multinational corporations holding significant portions while local companies cater to specific regional needs. Innovation is driven by the development of biosimilars, long-acting insulins, and advanced delivery systems aiming to improve patient compliance and reduce hypoglycemic events. Regulatory frameworks vary across Latin American countries, influencing pricing and market access. Substitutes, such as oral antidiabetic drugs, exist but are not as effective for all patients. The end-user demographic comprises a growing diabetic population, particularly in urban areas, with increasing awareness of diabetes management. M&A activities in the region have been limited in recent years, with deal values averaging xx Million, primarily focused on expanding distribution networks and securing local partnerships.

Human Insulin Drugs Market in Latin America Market Dynamics & Trends

The Latin American Human Insulin Drugs market is witnessing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by factors like the rising prevalence of diabetes, increasing healthcare expenditure, and growing awareness about diabetes management. Technological advancements, such as the introduction of once-weekly insulin analogs, are transforming the treatment landscape. Shifting consumer preferences toward improved efficacy and convenience are impacting the demand for newer formulations. Competitive dynamics are intense, with both global and regional players vying for market share through product innovation, pricing strategies, and strategic partnerships. Market penetration of advanced insulin delivery systems remains relatively low, presenting significant opportunities for growth. The increasing accessibility of healthcare insurance schemes and government initiatives for diabetes management further contribute to market expansion.

Dominant Regions & Segments in Human Insulin Drugs Market in Latin America

Leading Region: Brazil accounts for the largest market share due to its large population, high diabetes prevalence, and developing healthcare infrastructure. Mexico follows closely as another significant market.

Dominant Segments:

- Basal or Long-acting Insulins: This segment dominates due to its improved efficacy in managing blood glucose levels throughout the day, leading to enhanced patient compliance.

- Biosimilar Insulins: This segment is experiencing rapid growth driven by the lower cost and increased accessibility these products offer to patients.

Key Drivers:

- Economic growth in certain countries has increased healthcare spending, making insulin treatments more accessible.

- Expanding healthcare infrastructure has improved access to diabetes diagnosis and treatment in many regions.

- Government initiatives for disease management and awareness campaigns are raising diabetes awareness and driving market demand.

Brazil's dominance is attributed to its large population affected by diabetes, coupled with its burgeoning healthcare system. Mexico's large population, a substantial healthcare budget and the increased accessibility of affordable insulin therapies contributes to its position as a key market.

Human Insulin Drugs Market in Latin America Product Innovations

Recent product innovations in the Latin American market focus on enhanced insulin delivery systems such as pre-filled pens and insulin pumps, improving patient adherence and reducing injection-related pain. Biosimilar insulins are gaining traction due to their cost-effectiveness. The market is witnessing a transition toward once-weekly and long-acting insulin analogs, offering improved glycemic control and convenience compared to traditional human insulins. These innovations directly address significant unmet needs by improving treatment outcomes and accessibility, thereby enhancing their market fit.

Report Scope & Segmentation Analysis

The report segments the Latin American Human Insulin Drugs market based on product type:

Soliqua/Suliqua (Insulin glargine/Lixisenatide): This segment showcases a moderate growth rate, driven by its dual action mechanism but faces competition from newer formulations.

Insulin Drugs: Basal or Long-acting Insulins: This segment exhibits the highest growth rate, driven by its superior glycemic control compared to traditional insulins. Market size is expected to reach xx Million by 2033.

Basaglar (Insulin glargine): This segment shows steady growth, driven by brand recognition and established market presence.

Admelog (Insulin lispro): This traditional human insulin segment displays moderate growth, driven by its cost-effectiveness but competition is expected from newer analogs.

Insuman: Combination Insulins: This segment experiences moderate growth; however, its adoption is impacted by potential adverse effects.

Key Drivers of Human Insulin Drugs Market in Latin America Growth

The Latin American Human Insulin Drugs market is fuelled by several key factors. The rising prevalence of diabetes, particularly type 2 diabetes, is the primary driver. Improvements in healthcare infrastructure and increased access to diagnosis are contributing significantly. Government initiatives to improve diabetes awareness and patient education along with rising disposable incomes and increased healthcare spending are also driving market growth. The introduction of biosimilars has increased affordability and accessibility, thereby expanding the market further.

Challenges in the Human Insulin Drugs Market in Latin America Sector

Despite the growth potential, challenges persist. Regulatory hurdles and varying healthcare policies across different countries create inconsistencies in market access and pricing. Supply chain issues and the cost of advanced insulin delivery systems contribute to affordability challenges in certain regions. Furthermore, intense competition among established players and the entry of new biosimilars create price pressure and impact profitability for some companies.

Emerging Opportunities in Human Insulin Drugs Market in Latin America

The market presents several promising opportunities. The increasing prevalence of diabetes creates considerable unmet need, particularly in rural areas. Focus on digital health solutions for improved patient management and remote monitoring shows tremendous potential. Expansion into underserved regions through partnerships with local healthcare providers and investment in patient education programs offers significant potential for expansion and improved patient outcomes.

Leading Players in the Human Insulin Drugs Market in Latin America Market

- Sedico

- Julphar

- Wockhardt

- Exir

- Eli Lilly and Company

- Novo Nordisk A/S

- Biocon Limited

- Pfizer Inc

- Sanofi S.A

Key Developments in Human Insulin Drugs Market in Latin America Industry

- January 2022: The US Food and Drug Administration (FDA) approved the adalimumab biosimilar Yusimry and the insulin glargine biosimilar Rezvoglar. This signifies increased availability of biosimilar options, potentially impacting pricing dynamics in Latin America.

- October 2022: Novo Nordisk announced headline results from the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in people with type 2 diabetes. This development could lead to the introduction of a new, convenient insulin therapy, potentially shaping future market trends.

Future Outlook for Human Insulin Drugs Market in Latin America Market

The Human Insulin Drugs market in Latin America is poised for continued growth, driven by the increasing prevalence of diabetes, advancements in insulin delivery systems, and the growing availability of biosimilars. Strategic investments in improving healthcare infrastructure and enhancing patient education programs will be crucial in realizing the market's full potential. The focus on patient-centric solutions and innovative delivery mechanisms will remain key drivers for future growth, with increased emphasis on accessibility and affordability.

Human Insulin Drugs Market in Latin America Segmentation

-

1. Insulin Drugs

- 1.1. Basal or Long-acting Insulins

- 1.2. Bolus or Fast-acting Insulins

- 1.3. Traditional Human Insulins

- 1.4. Combination Insulins

- 1.5. Biosimilar Insulins

-

2. Geography

-

2.1. Latin America

- 2.1.1. Mexico

- 2.1.2. Brazil

- 2.1.3. Rest of Latin America

-

2.1. Latin America

Human Insulin Drugs Market in Latin America Segmentation By Geography

-

1. Latin America

- 1.1. Mexico

- 1.2. Brazil

- 1.3. Rest of Latin America

Human Insulin Drugs Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Humalog Insulin Drug is Dominating the Latin America Human Insulin Drug Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulin Drugs

- 5.1.1. Basal or Long-acting Insulins

- 5.1.2. Bolus or Fast-acting Insulins

- 5.1.3. Traditional Human Insulins

- 5.1.4. Combination Insulins

- 5.1.5. Biosimilar Insulins

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Latin America

- 5.2.1.1. Mexico

- 5.2.1.2. Brazil

- 5.2.1.3. Rest of Latin America

- 5.2.1. Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Insulin Drugs

- 6. Brazil Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 9. Peru Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 10. Chile Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Human Insulin Drugs Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Sedico

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Julphar

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Wockhardt

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Exir

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Eli Lilly and Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Novo Nordisk A/S

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Biocon Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Pfizer Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sanofi S A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Sedico

List of Figures

- Figure 1: Human Insulin Drugs Market in Latin America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Human Insulin Drugs Market in Latin America Share (%) by Company 2024

List of Tables

- Table 1: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Insulin Drugs 2019 & 2032

- Table 4: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Insulin Drugs 2019 & 2032

- Table 5: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Brazil Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Argentina Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Peru Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Chile Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Chile Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Insulin Drugs 2019 & 2032

- Table 24: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Insulin Drugs 2019 & 2032

- Table 25: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: Human Insulin Drugs Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Human Insulin Drugs Market in Latin America Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Mexico Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Brazil Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Brazil Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Rest of Latin America Human Insulin Drugs Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Latin America Human Insulin Drugs Market in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Insulin Drugs Market in Latin America?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Human Insulin Drugs Market in Latin America?

Key companies in the market include Sedico, Julphar, Wockhardt, Exir, Eli Lilly and Company, Novo Nordisk A/S, Biocon Limited, Pfizer Inc, Sanofi S A.

3. What are the main segments of the Human Insulin Drugs Market in Latin America?

The market segments include Insulin Drugs, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Humalog Insulin Drug is Dominating the Latin America Human Insulin Drug Market in the current year.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

October 2022: Novo Nordisk announced headline results from the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in people with type 2 diabetes. The ONWARDS 5 trial was a 52-week, open-label efficacy and safety treat-to-target trial investigating once-weekly insulin versus once-daily basal insulin (insulin degludec or insulin glargine U100/U300).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Insulin Drugs Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Insulin Drugs Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Insulin Drugs Market in Latin America?

To stay informed about further developments, trends, and reports in the Human Insulin Drugs Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence