Key Insights

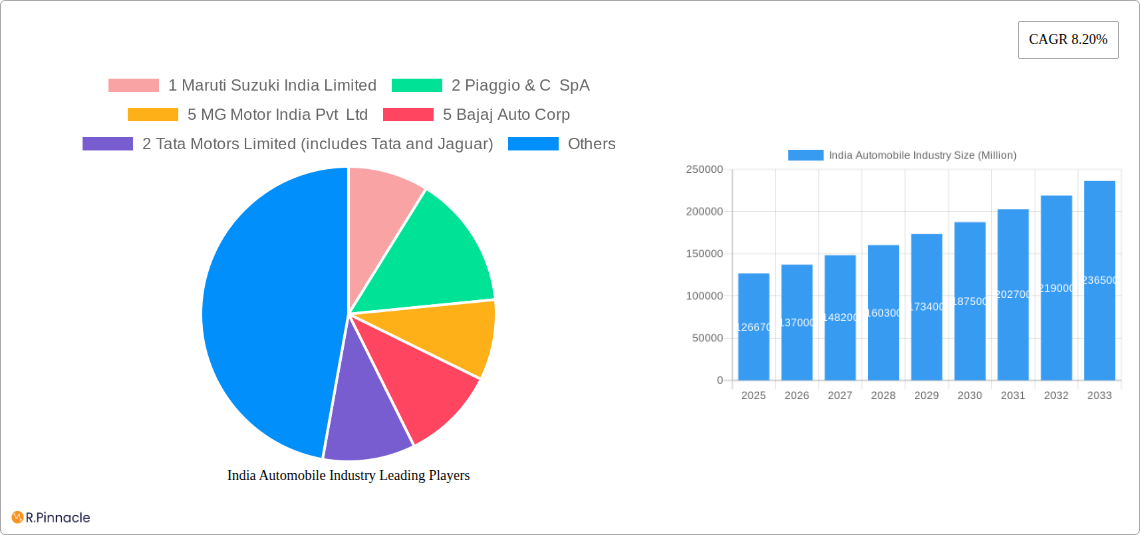

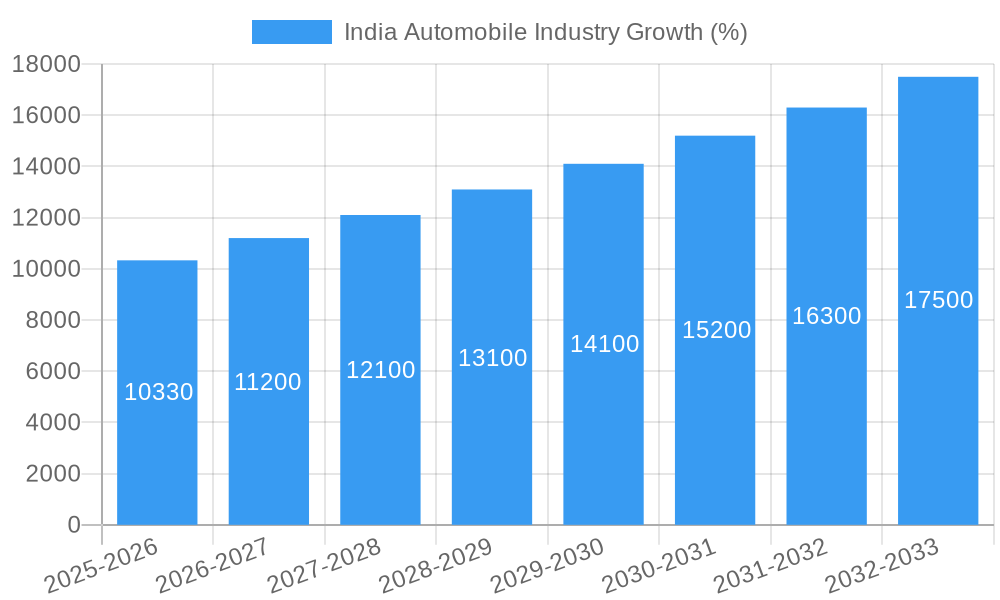

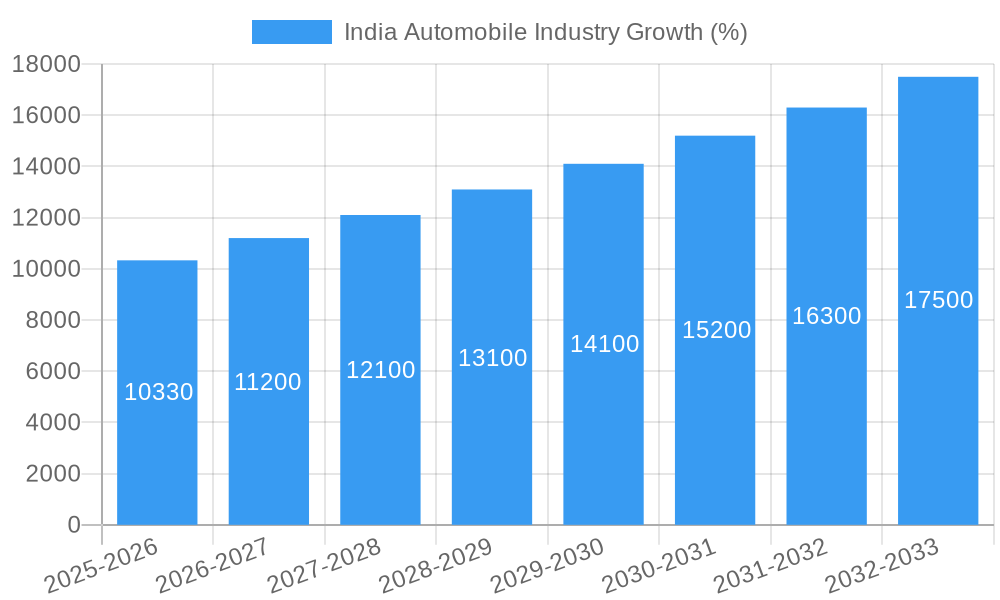

The Indian automobile industry, valued at $126.67 billion in 2025, is projected to experience robust growth, fueled by a compound annual growth rate (CAGR) of 8.20% from 2025 to 2033. This expansion is driven by several factors. Rising disposable incomes and a burgeoning middle class are stimulating demand for personal vehicles, particularly two-wheelers and passenger cars. Government initiatives promoting infrastructure development and electric vehicle (EV) adoption are further accelerating market growth. The increasing urbanization and the need for efficient last-mile connectivity are boosting the demand for three-wheelers and commercial vehicles. However, challenges remain. Fluctuations in fuel prices, stringent emission norms, and the ongoing semiconductor shortage pose potential restraints on the industry's growth trajectory. The market is segmented by vehicle type (two-wheelers, passenger cars, commercial vehicles, three-wheelers), fuel type (diesel, petrol/gasoline, CNG and LPG, electric, others), and region (North, South, East, and West India). The competitive landscape is dominated by a mix of established global and domestic players, each vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. The electric vehicle segment is expected to witness significant growth in the coming years, driven by government incentives and increasing consumer awareness of environmental sustainability.

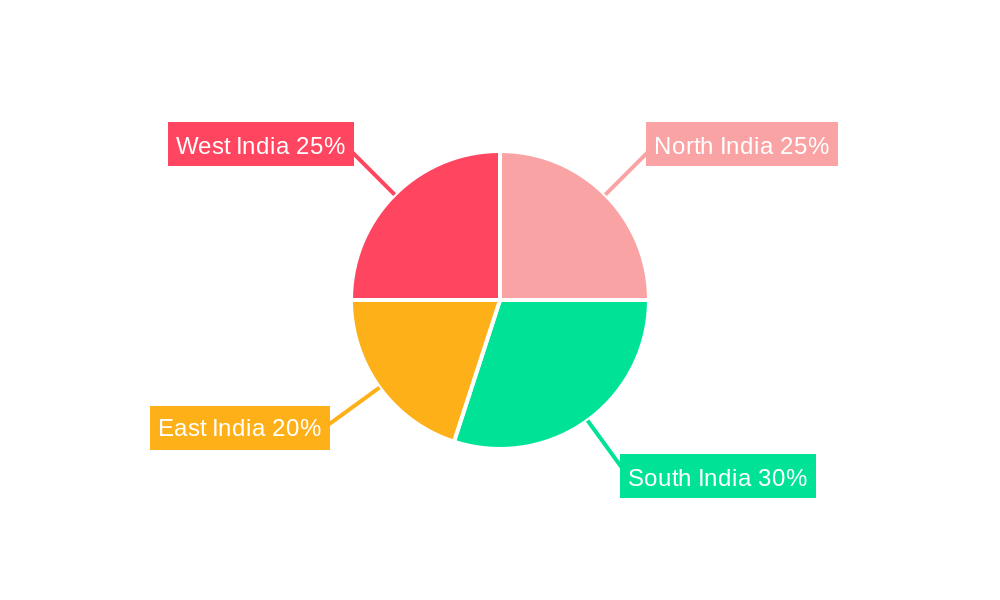

The regional distribution of market share reflects the varying levels of economic development and infrastructure across India. While the South and West regions currently hold larger shares due to higher per capita income and infrastructure development, the North and East regions are expected to witness considerable growth, fueled by rising incomes and improving infrastructure. The industry is characterized by intense competition, with key players constantly innovating to capture market share. The success of individual companies will depend on their ability to adapt to evolving consumer preferences, navigate regulatory changes, and manage supply chain disruptions effectively. The forecast period, 2025-2033, promises significant opportunities, particularly for companies focusing on technological advancements in electric vehicles and connected car technologies. The industry's sustained growth will significantly contribute to India's overall economic development.

India Automobile Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indian automobile industry, covering market dynamics, key players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategists.

India Automobile Industry Market Structure & Innovation Trends

The Indian automobile market is characterized by a diverse range of players, spanning from global giants to domestic manufacturers. Market concentration varies significantly across segments, with two-wheelers exhibiting higher competition compared to the passenger car segment. Innovation is driven by factors such as stringent emission norms (BS-VI), increasing consumer demand for advanced safety features, and the rising popularity of electric vehicles. The regulatory framework, including import duties and localization policies, plays a crucial role in shaping market dynamics. Product substitutes, such as public transportation and ride-sharing services, exert a degree of influence, particularly in urban areas. End-user demographics, with a growing young and aspirational population, significantly impact demand. The industry has witnessed considerable M&A activity in recent years, with deal values reaching xx Million USD in the past five years.

- Market Share: Maruti Suzuki holds a significant market share in the passenger car segment, while Hero MotoCorp dominates the two-wheeler market.

- M&A Activity: Recent mergers and acquisitions have focused on technology integration, expansion into new segments, and access to new markets. For instance, the partnership between TVS and Mitsubishi illustrates strategic collaborations aimed at electric vehicle technology and expansion.

India Automobile Industry Market Dynamics & Trends

The Indian automobile industry demonstrates robust growth, driven primarily by rising disposable incomes, increasing urbanization, and expanding infrastructure. Technological advancements, including the adoption of electric and hybrid vehicles, are reshaping the landscape. Consumer preferences are shifting toward safer, more fuel-efficient, and technologically advanced vehicles. Competitive dynamics are intense, with players constantly vying for market share through product innovation, aggressive pricing strategies, and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the overall market is projected at xx% during the forecast period, with significant variations across segments. Market penetration of electric vehicles is steadily increasing, though from a relatively low base.

Dominant Regions & Segments in India Automobile Industry

- By Vehicle Type: Two-wheelers constitute the largest segment, driven by affordability and widespread usage across various demographics. Passenger cars are the second largest, followed by commercial vehicles and three-wheelers.

- By Fuel Type: Petrol/Gasoline remains the dominant fuel type, although the market share of electric vehicles is experiencing robust growth. Diesel fuel continues to hold a significant presence in commercial vehicles. CNG and LPG have niche markets.

- By Region: North and West India currently hold the largest market share due to higher population density and economic activity. However, South and East India show promising growth potential, spurred by infrastructure development and rising disposable incomes.

The dominance of specific regions and segments is influenced by several factors:

- Economic policies: Government initiatives promoting vehicle electrification and infrastructure development contribute significantly to regional growth.

- Infrastructure: Well-developed road networks and charging infrastructure play a crucial role in facilitating vehicle adoption.

India Automobile Industry Product Innovations

The Indian automobile industry showcases a dynamic product landscape with advancements in vehicle electrification, connectivity, and safety features. Manufacturers are focusing on developing cost-effective and fuel-efficient vehicles to cater to the price-sensitive Indian market. Technological integration of advanced driver-assistance systems (ADAS) and infotainment systems are gaining traction, enhancing the overall user experience. The market is witnessing a growing number of electric two-wheelers and three-wheelers, driven by government incentives and environmental concerns.

Report Scope & Segmentation Analysis

This report segments the Indian automobile market by vehicle type (two-wheelers, passenger cars, commercial vehicles, three-wheelers), fuel type (diesel, petrol/gasoline, CNG and LPG, electric, others), and region (North, South, East, West India). Each segment is analyzed in detail, including growth projections, market size estimates, and competitive dynamics. Growth is expected to be substantial across all segments, driven by a combination of macroeconomic trends and technological innovations. The competitive landscape is highly fragmented, with a mix of domestic and international players.

Key Drivers of India Automobile Industry Growth

Several factors drive the growth of the Indian automobile industry. These include a burgeoning middle class with increased disposable income, supportive government policies aimed at infrastructure development and boosting domestic manufacturing, and ongoing technological advancements leading to fuel efficiency and enhanced vehicle features. The government's push towards electric vehicles also significantly contributes to the industry's growth trajectory.

Challenges in the India Automobile Industry Sector

The Indian automobile industry faces several challenges, including supply chain disruptions, stringent emission norms requiring significant technological upgrades, and fluctuating raw material prices. Competition is fierce, and the market's susceptibility to macroeconomic factors presents further challenges. Regulatory changes and infrastructure limitations in certain regions also hinder the industry's progress. For example, the cost of transitioning to electric vehicles and the lack of widespread charging infrastructure pose significant hurdles.

Emerging Opportunities in India Automobile Industry

The Indian automobile industry presents numerous opportunities. The rising adoption of electric vehicles and connected car technologies offers significant growth potential. Expanding into rural markets and focusing on affordable and fuel-efficient vehicles presents substantial opportunities. The government's focus on infrastructure development creates further avenues for growth.

Leading Players in the India Automobile Industry Market

- Maruti Suzuki India Limited

- Piaggio & C SpA

- MG Motor India Pvt Ltd

- Bajaj Auto Corp

- Tata Motors Limited

- Hero Moto Corp

- Atul Auto Limited

- Mercedes-Benz India Pvt Ltd

- Honda Motorcycle & Scooter India Pvt Ltd

- Terra Motors India Corp

- Renault Group

- TVS Motor Company

- Volkswagen India

- Kinetic Green Energy & Power Solutions Lt

- Mahindra & Mahindra Limited

- Suzuki Motorcycle India Private Limited

- Royal Enfield

- Scooters India Ltd

- Honda Cars India Ltd

- Lohia Auto Industries

- Hyundai Motor India Ltd

- BMW AG

- BYD Company Ltd

Key Developments in India Automobile Industry Industry

- January 2024: Maruti Suzuki announced plans to build a new car manufacturing facility in Gujarat with an annual capacity of 1 Million vehicles, representing a significant investment of INR 35,000 crore (USD 4.2 Billion).

- February 2024: TVS Mobility secured a 32% stake from Mitsubishi Corporation, a Japanese conglomerate, in TVS Vehicles Mobility Solutions (TVS VMS) through an investment of INR 300 crore (USD 40 Million), signifying growing interest in the Indian electric vehicle sector.

Future Outlook for India Automobile Industry Market

The future of the Indian automobile industry is bright, fueled by continued economic growth, technological advancements, and government support for the electric vehicle sector. The market is poised for sustained expansion, with significant opportunities for players who can adapt to changing consumer preferences and technological disruptions. Strategic partnerships, product innovation, and a focus on sustainable practices will be key factors in determining future success.

India Automobile Industry Segmentation

-

1. Vehicle Type

- 1.1. Two-wheelers

- 1.2. Passenger Cars

- 1.3. Commercial Vehicles

- 1.4. Three-wheelers

-

2. Fuel Type

- 2.1. Diesel

- 2.2. Petrol/Gasoline

- 2.3. CNG and LPG

- 2.4. Electric

- 2.5. Others

India Automobile Industry Segmentation By Geography

- 1. India

India Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. The Two-Wheelers Segment to Register Fastest Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-wheelers

- 5.1.2. Passenger Cars

- 5.1.3. Commercial Vehicles

- 5.1.4. Three-wheelers

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Diesel

- 5.2.2. Petrol/Gasoline

- 5.2.3. CNG and LPG

- 5.2.4. Electric

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 1 Maruti Suzuki India Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 2 Piaggio & C SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 5 MG Motor India Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 5 Bajaj Auto Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 2 Tata Motors Limited (includes Tata and Jaguar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 2 Hero Moto Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 4 Atul Auto Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 11 Mercedes-Benz India Pvt Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 3 Honda Motorcycle & Scooter India Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 5 Terra Motors India Corp

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 7 Renault Group (Includes Nissan and Renault)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Two-wheelers

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 1 TVS Motor Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Three-wheelers

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 6 Volkswagen India

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 6 Kinetic Green Energy & Power Solutions Lt

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Passenger Cars and Commercial Vehicles

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 4 Mahindra & Mahindra Limited

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 6 Suzuki Motorcycle India Private Limited

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 4 Royal Enfield

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 3 Scooters India Ltd

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 8 Honda Cars India Ltd

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 1 Lohia Auto Industries

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 3 Hyundai Motor India Ltd

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 10 BMW AG (includes BMW and MINI)

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 9 BYD Company Ltd

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.1 1 Maruti Suzuki India Limited

List of Figures

- Figure 1: India Automobile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automobile Industry Share (%) by Company 2024

List of Tables

- Table 1: India Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: India Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: India Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: India Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automobile Industry?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the India Automobile Industry?

Key companies in the market include 1 Maruti Suzuki India Limited, 2 Piaggio & C SpA, 5 MG Motor India Pvt Ltd, 5 Bajaj Auto Corp, 2 Tata Motors Limited (includes Tata and Jaguar), 2 Hero Moto Corp, 4 Atul Auto Limited, 11 Mercedes-Benz India Pvt Ltd, 3 Honda Motorcycle & Scooter India Pvt Ltd, 5 Terra Motors India Corp, 7 Renault Group (Includes Nissan and Renault), Two-wheelers, 1 TVS Motor Company, Three-wheelers, 6 Volkswagen India, 6 Kinetic Green Energy & Power Solutions Lt, Passenger Cars and Commercial Vehicles, 4 Mahindra & Mahindra Limited, 6 Suzuki Motorcycle India Private Limited, 4 Royal Enfield, 3 Scooters India Ltd, 8 Honda Cars India Ltd, 1 Lohia Auto Industries, 3 Hyundai Motor India Ltd, 10 BMW AG (includes BMW and MINI), 9 BYD Company Ltd.

3. What are the main segments of the India Automobile Industry?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

The Two-Wheelers Segment to Register Fastest Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

January 2024: Maruti Suzuki India intended to build a car production facility in Gujarat, India, capable of manufacturing 1 million vehicles annually, with an estimated investment of around INR 35,000 crore (USD 4.2 billion). This move is expected to bolster the Indian automobile industry significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automobile Industry?

To stay informed about further developments, trends, and reports in the India Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence