Key Insights

The India D2C logistics solutions market is poised for significant expansion, driven by the rapid growth of e-commerce and increasing consumer preference for direct-to-consumer brands. Projecting a Compound Annual Growth Rate (CAGR) of 25% and a market size of 14 billion by 2025, this sector presents substantial opportunities for investment and strategic development. Key growth catalysts include widespread online shopping adoption, the proliferation of social commerce, and the escalating demand for expedited and reliable delivery services. Emerging trends such as hyper-personalization, omnichannel fulfillment strategies, and the integration of advanced technologies like AI-driven route optimization and drone delivery are fundamentally transforming the logistics landscape.

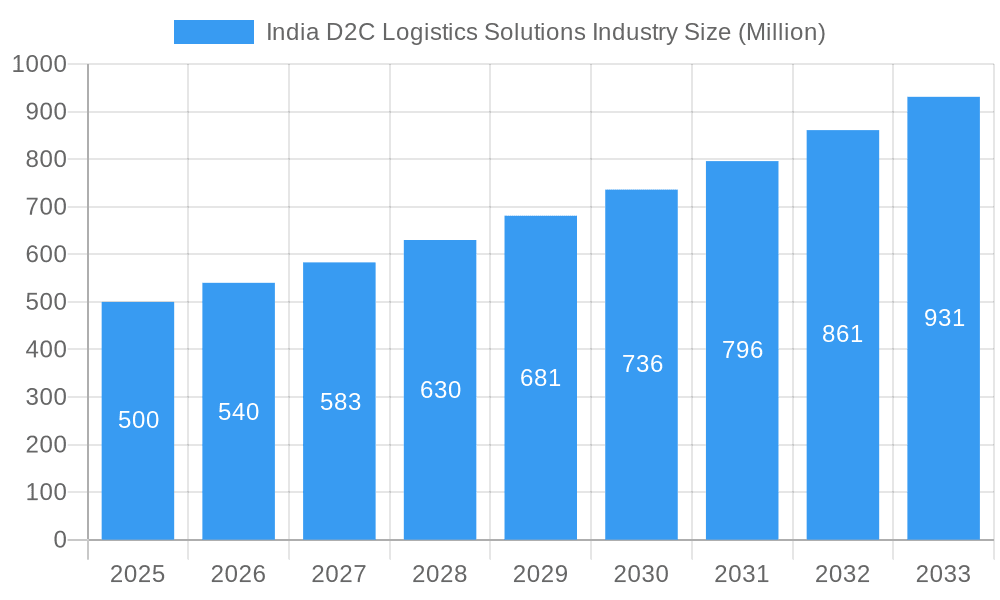

India D2C Logistics Solutions Industry Market Size (In Billion)

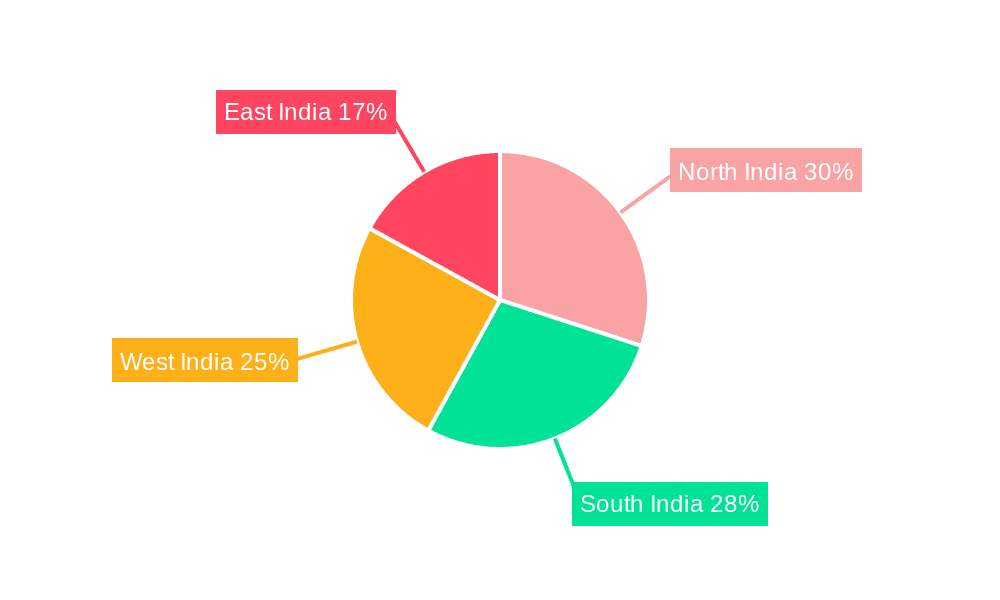

Despite these advancements, the market faces challenges including infrastructure limitations, particularly in rural areas, volatile fuel prices, and the imperative for highly efficient last-mile delivery solutions. The market is segmented across key end-user industries, with fashion, consumer electronics, beauty and personal care, and home décor emerging as dominant segments. Leading industry participants, including Delhivery, Ecom Express, and Unicommerce, are actively vying for market leadership through scalability, technological innovation, and strategic alliances to augment their service portfolios. Regional dynamics suggest that North and South India may experience accelerated growth due to higher e-commerce penetration. The market is anticipated to maintain its upward trajectory through the forecast period (2025-2033), propelled by increasing digital literacy and an expanding consumer base.

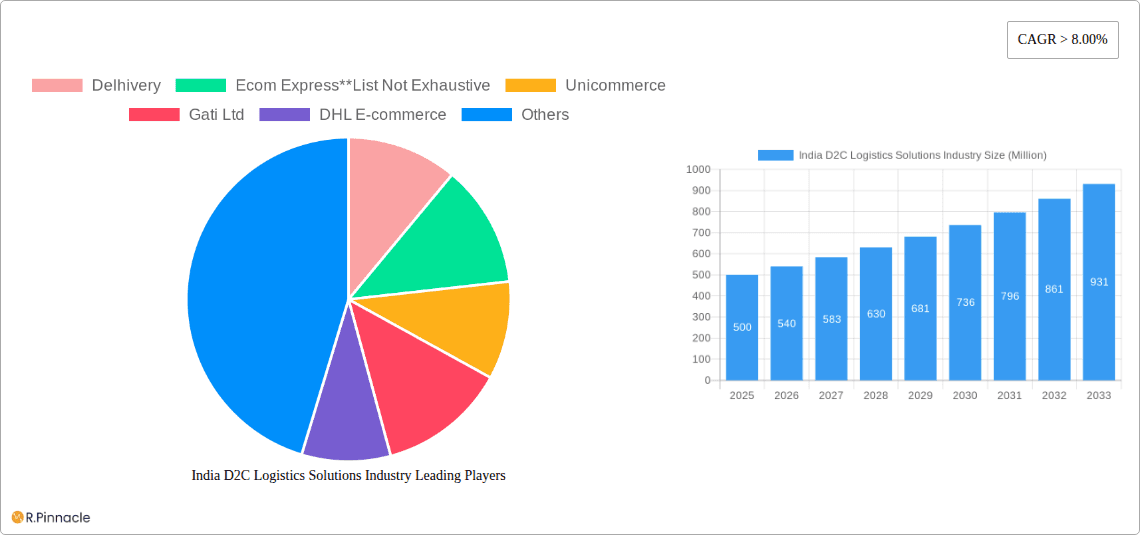

India D2C Logistics Solutions Industry Company Market Share

The competitive environment is characterized by a blend of established enterprises and agile startups. These entities are consistently investing in cutting-edge technology and robust infrastructure to optimize operational efficiency and deliver value-added services, such as same-day/next-day delivery, flexible delivery options, and enhanced tracking functionalities. Growth within specific market segments will be contingent upon evolving consumer preferences, technological breakthroughs, and supportive government policies aimed at fostering e-commerce and logistics development. Furthermore, a growing emphasis on sustainability and ethical supply chain practices will significantly shape market dynamics in the foreseeable future. The considerable growth potential within the Indian D2C logistics solutions market firmly establishes it as a dynamic and highly attractive sector for businesses aiming for expansion and investment within India's rapidly evolving e-commerce ecosystem.

India D2C Logistics Solutions Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning India D2C Logistics Solutions industry, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report utilizes historical data (2019-2024) to project future market trends and growth opportunities. The report covers market size, segmentation, key players, and significant industry developments, equipping readers with the knowledge to navigate this dynamic landscape. The total market value is projected to reach xx Million by 2033.

India D2C Logistics Solutions Industry Market Structure & Innovation Trends

The Indian D2C logistics solutions market exhibits a moderately concentrated structure, with key players like Delhivery, Ecom Express, Unicommerce, Gati Ltd, DHL E-commerce, Shipyaari, Shiprocket, Shipway, Shadowfax, and Pickrr commanding significant market share. However, the market also accommodates numerous smaller players, fostering competition. Innovation is driven by the need for faster delivery, improved last-mile solutions, and technological integration (AI, IoT, automation). The regulatory framework, while evolving, presents both opportunities and challenges. Product substitutes, like in-house logistics solutions, exist but are limited for many D2C businesses. End-user demographics are shifting towards younger, tech-savvy consumers who demand seamless and efficient delivery. M&A activity is significant, with recent deals like Delhivery's investment in Vinculum (Rs 25 crore in May 2023) and CEVA Logistics' acquisition of Stellar Value Chain Solutions (August 2023) reshaping the competitive landscape. The total value of M&A deals in the past five years is estimated at xx Million. Market share distribution is approximately as follows (estimated): Delhivery (25%), Ecom Express (15%), Unicommerce (10%), Others (50%).

India D2C Logistics Solutions Industry Market Dynamics & Trends

The Indian D2C logistics solutions market is experiencing robust growth, driven by the booming e-commerce sector, increasing consumer demand for faster delivery options, and the rise of D2C brands. Technological advancements, such as AI-powered route optimization and automated warehousing, are transforming the industry. Consumer preferences are shifting towards personalized delivery experiences and increased transparency. The competitive landscape is intensely dynamic, with both established players and new entrants vying for market share. The market's CAGR during the forecast period is estimated to be xx%, with a market penetration rate reaching xx% by 2033. Significant growth drivers include increasing smartphone penetration, rising disposable incomes, and improved infrastructure in certain regions. Challenges include infrastructure gaps in remote areas, regulatory complexities, and fluctuating fuel prices.

Dominant Regions & Segments in India D2C Logistics Solutions Industry

While the market is spread across India, metropolitan areas like Mumbai, Delhi, Bangalore, and Hyderabad are the dominant regions due to high e-commerce penetration and better infrastructure. The Fashion segment is currently the leading end-user segment, driven by the high demand for online apparel and accessories.

- Key Drivers for Fashion Segment Dominance:

- High online fashion adoption.

- Diverse range of brands and products.

- Increasing consumer preference for online shopping.

- Efficient supply chains enabling quick delivery.

Other segments, such as Consumer Electronics, Beauty and Personal Care, and Home Decor are showing strong growth potential. The dominance of the Fashion segment is expected to continue through the forecast period, although the other segments are expected to see faster CAGR. The growth is fueled by a combination of factors including increased internet and smartphone penetration, rising disposable incomes, improving logistics infrastructure, and government initiatives promoting e-commerce.

India D2C Logistics Solutions Industry Product Innovations

The industry is witnessing significant product innovations, focusing on technology-driven solutions. These include AI-powered route optimization, real-time tracking, automated warehousing, and drone delivery for enhanced efficiency and speed. Companies are also investing in developing customized logistics solutions tailored to specific D2C brand needs. These innovations improve delivery speed, reduce costs, and enhance customer experience, leading to a competitive advantage.

Report Scope & Segmentation Analysis

This report segments the market by end-user:

Fashion: This segment is characterized by high volume, diverse product types, and a strong emphasis on fast delivery. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033. Competitive intensity is high.

Consumer Electronics: This segment involves higher-value items with stringent delivery requirements, demanding robust packaging and secure handling. The 2025 market size is estimated at xx Million, with a projection of xx Million by 2033.

Beauty and Personal Care: This segment demands efficient temperature-controlled logistics, especially for perishable products. The market size is projected at xx Million in 2025, and xx Million by 2033.

Home Decor: This segment comprises bulky items, requiring specialized handling and transportation. The 2025 market size is estimated at xx Million, projected to reach xx Million by 2033.

Other End Users: This segment encompasses diverse products and services, presenting unique logistical challenges.

Key Drivers of India D2C Logistics Solutions Industry Growth

Several factors drive the growth of the India D2C logistics solutions industry: the rapid expansion of e-commerce, increasing consumer demand for faster and more convenient delivery options, advancements in technology, government initiatives promoting digitalization and infrastructure development, and favorable economic conditions.

Challenges in the India D2C Logistics Solutions Industry Sector

The industry faces challenges like infrastructure gaps in rural areas, high fuel costs, regulatory hurdles, the need for skilled labor, intense competition, and last-mile delivery complexities. These factors contribute to increased operational costs and potential delivery delays.

Emerging Opportunities in India D2C Logistics Solutions Industry

Emerging opportunities lie in leveraging technology, expanding into underserved markets, offering specialized logistics solutions, partnering with D2C brands for customized services, focusing on sustainability, and exploring innovative delivery methods such as drone delivery.

Leading Players in the India D2C Logistics Solutions Industry Market

- Delhivery

- Ecom Express

- Unicommerce

- Gati Ltd

- DHL E-commerce

- Shipyaari

- Shiprocket

- Shipway

- Shadowfax

- Pickrr

Key Developments in India D2C Logistics Solutions Industry Industry

May 2023: Delhivery invests Rs 25 crore in Vinculum to strengthen its D2C offerings. This signifies a strategic move towards enhancing technological capabilities and expanding its reach in the D2C market.

July 2023: Myntra's D2C program accelerates growth for 200 Indian fashion and lifestyle brands. This boosts the demand for D2C logistics solutions within the fashion segment.

August 2023: CEVA Logistics acquires a 96% stake in Stellar Value Chain Solutions. This M&A activity signifies consolidation within the industry and indicates an increased focus on market expansion and enhanced service offerings.

Future Outlook for India D2C Logistics Solutions Industry Market

The future outlook for the India D2C logistics solutions market is highly positive. Continued growth in e-commerce, technological advancements, and favorable government policies will fuel expansion. Strategic partnerships, investments in infrastructure, and innovation in delivery methods will be crucial for companies to maintain a competitive edge and capture market share in this rapidly evolving industry. The market is expected to witness significant growth in the coming years, with substantial opportunities for both established players and new entrants.

India D2C Logistics Solutions Industry Segmentation

-

1. End user

- 1.1. Fashion

- 1.2. Consumer electronic

- 1.3. Beauty and Personal Care

- 1.4. Home decor

- 1.5. Other end users

India D2C Logistics Solutions Industry Segmentation By Geography

- 1. India

India D2C Logistics Solutions Industry Regional Market Share

Geographic Coverage of India D2C Logistics Solutions Industry

India D2C Logistics Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Competition from established brands

- 3.4. Market Trends

- 3.4.1. Festive Season and Mega Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India D2C Logistics Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End user

- 5.1.1. Fashion

- 5.1.2. Consumer electronic

- 5.1.3. Beauty and Personal Care

- 5.1.4. Home decor

- 5.1.5. Other end users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delhivery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecom Express**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unicommerce

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gati Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL E-commerce

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shipyaari

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shiprocket

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shipway

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shadowfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pickrr

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delhivery

List of Figures

- Figure 1: India D2C Logistics Solutions Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India D2C Logistics Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: India D2C Logistics Solutions Industry Revenue billion Forecast, by End user 2020 & 2033

- Table 2: India D2C Logistics Solutions Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India D2C Logistics Solutions Industry Revenue billion Forecast, by End user 2020 & 2033

- Table 4: India D2C Logistics Solutions Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India D2C Logistics Solutions Industry?

The projected CAGR is approximately 25%.

2. Which companies are prominent players in the India D2C Logistics Solutions Industry?

Key companies in the market include Delhivery, Ecom Express**List Not Exhaustive, Unicommerce, Gati Ltd, DHL E-commerce, Shipyaari, Shiprocket, Shipway, Shadowfax, Pickrr.

3. What are the main segments of the India D2C Logistics Solutions Industry?

The market segments include End user.

4. Can you provide details about the market size?

The market size is estimated to be USD 14 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration.

6. What are the notable trends driving market growth?

Festive Season and Mega Sales Driving the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Competition from established brands.

8. Can you provide examples of recent developments in the market?

May 2023: Delhivery India's largest fully integrated logistics services provider, will invest around Rs 25 crore in Vinculum, a global software leader enabling omnichannel retailing for D2C enterprises, brands, brand distributors, and quick commerce companies, to strengthen its D2C offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India D2C Logistics Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India D2C Logistics Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India D2C Logistics Solutions Industry?

To stay informed about further developments, trends, and reports in the India D2C Logistics Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence