Key Insights

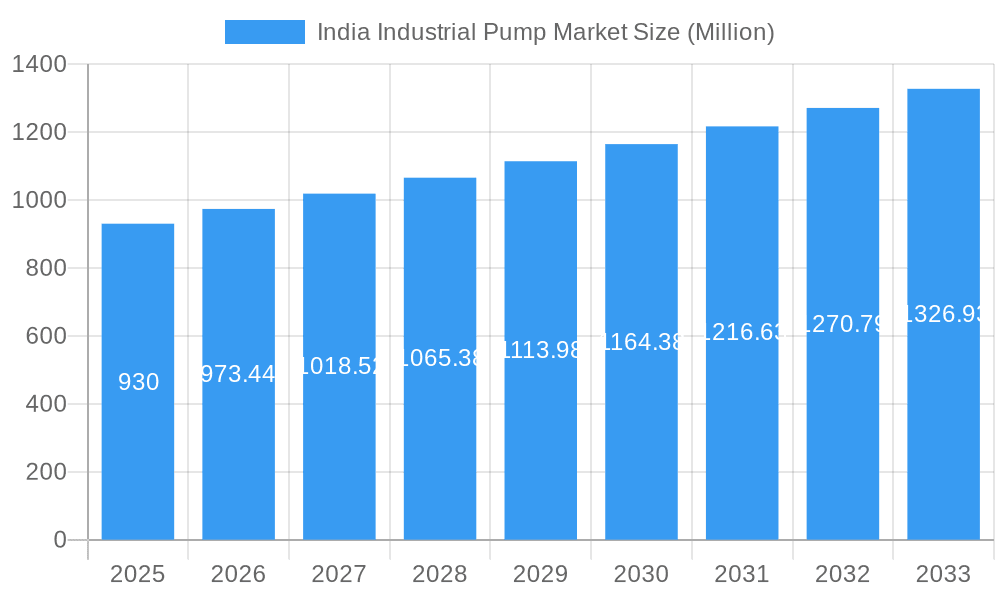

The India industrial pump market, valued at approximately $930 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning industrial sector, particularly in oil & gas, water & wastewater treatment, and the chemicals & petrochemicals industries, fuels significant demand for reliable and efficient pumping solutions. Secondly, increasing government initiatives focusing on infrastructure development and modernization across various sectors contribute to market growth. Furthermore, the adoption of technologically advanced pumps, such as those incorporating energy-efficient designs and smart monitoring capabilities, is gaining traction, further bolstering market expansion. The market is segmented by pump type (centrifugal and positive displacement) and end-user industry, with oil & gas, water & wastewater, and chemicals & petrochemicals representing major segments. Regional variations exist, with potential for growth across all regions (North, South, East, and West India) influenced by localized infrastructure projects and industrial activity. While challenges such as initial investment costs for advanced pumps and potential supply chain disruptions could act as restraints, the overall market outlook remains positive due to the long-term growth prospects of the Indian industrial sector.

India Industrial Pump Market Market Size (In Million)

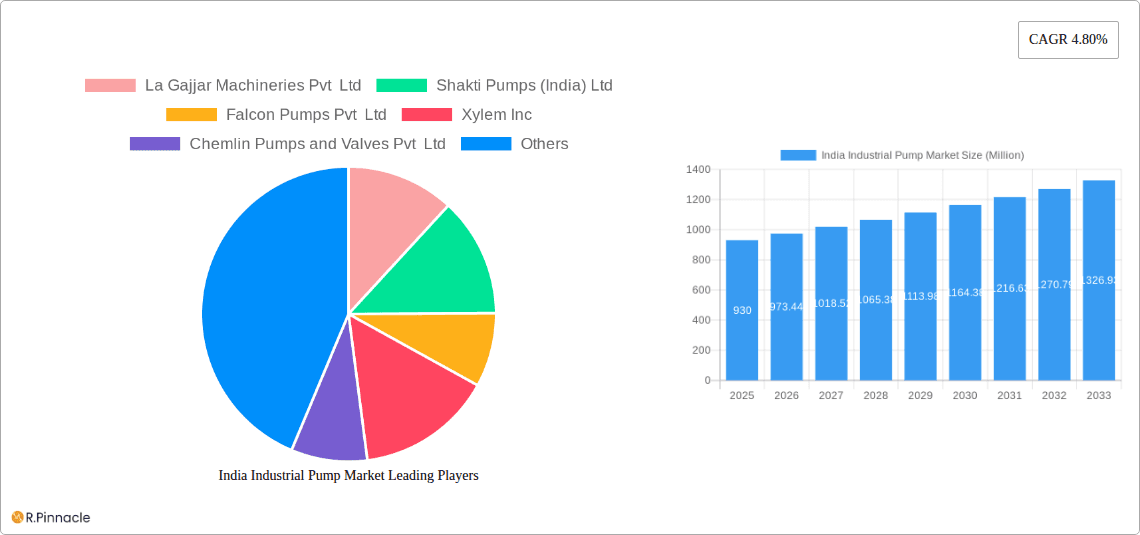

The competitive landscape features a mix of established multinational corporations (e.g., Xylem Inc., Grundfos AS, KSB SE & Co KGA) and domestic players (e.g., Kirloskar Brothers Limited, Shakti Pumps (India) Ltd, CRI Pumps Pvt Ltd). The presence of both international and domestic companies fosters innovation and competition, leading to a diverse range of products and services catering to the varied needs of different end-users. The market is witnessing a shift towards customized solutions, with manufacturers focusing on providing pumps tailored to specific industrial applications and operational requirements. This trend, along with ongoing technological advancements in pump design and manufacturing, will shape the future trajectory of the India industrial pump market. The forecast period (2025-2033) anticipates continued growth, driven by the sustained expansion of the industrial sector and increasing investments in infrastructure development.

India Industrial Pump Market Company Market Share

India Industrial Pump Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Industrial Pump Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook. The study period spans 2019-2024 (Historical Period), with 2025 serving as the Base and Estimated Year. The forecast period extends from 2025 to 2033.

India Industrial Pump Market Market Structure & Innovation Trends

The Indian industrial pump market is characterized by a moderately concentrated structure, featuring robust competition between established domestic manufacturers and dynamic multinational corporations vying for market dominance. A significant catalyst for innovation is the escalating demand for energy-efficient pump solutions, driven by a growing environmental consciousness and the implementation of stringent environmental regulations across various industries. Furthermore, the burgeoning adoption of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) is revolutionizing the sector, enabling sophisticated predictive maintenance capabilities and optimizing operational efficiency. The regulatory framework, particularly concerning water resource management and pollution control standards, exerts a considerable influence on market trajectories. While alternative fluid handling technologies pose a competitive challenge, strategic mergers and acquisitions (M&A) continue to reshape the market landscape, fostering consolidation and expanding capabilities.

- Market Concentration: In 2025, the top 5 market participants are projected to collectively hold approximately 65-70% of the overall market share.

- M&A Activity: The past five years have witnessed a series of impactful M&A transactions, with total deal values estimated to exceed INR 500 Crore. These strategic consolidations have predominantly aimed at broadening product portfolios, enhancing technological competencies, and expanding geographical market reach.

- Innovation Drivers: Key drivers fueling innovation include the relentless pursuit of enhanced energy efficiency, the imperative for improved pump reliability and longevity, and the development of advanced functionalities such as intelligent monitoring and control systems.

India Industrial Pump Market Market Dynamics & Trends

The Indian industrial pump market is experiencing robust growth, driven by the expansion of various end-user industries, particularly water and wastewater treatment, oil and gas, and chemicals and petrochemicals. Technological advancements, such as the integration of smart sensors and remote monitoring capabilities, are transforming the industry. Consumer preferences are shifting towards energy-efficient, durable, and reliable pumps. The competitive landscape is marked by intense competition, with both domestic and international players vying for market share. The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Market penetration of advanced pumps, such as those incorporating IoT, is expected to reach xx% by 2033.

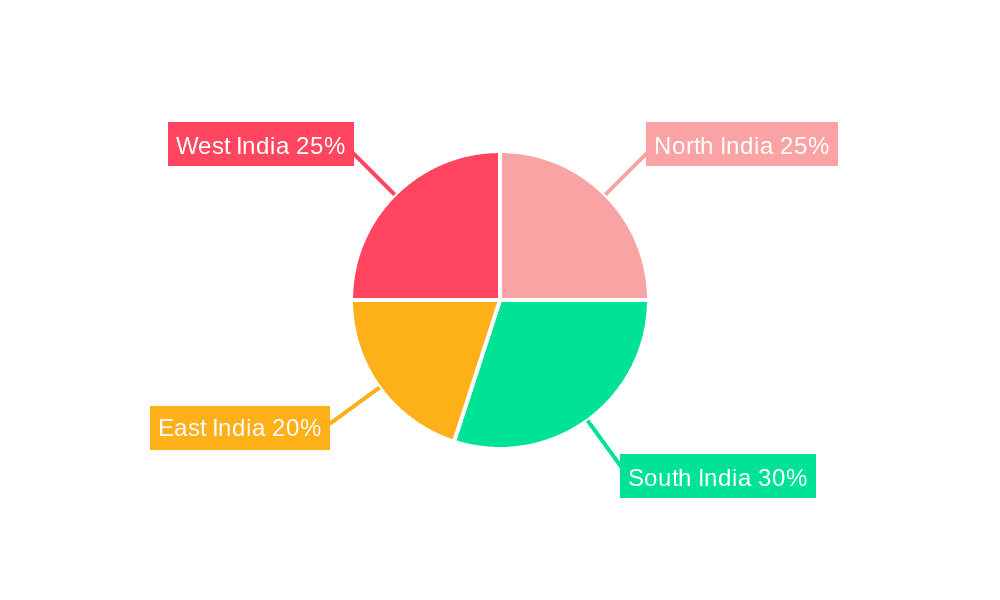

Dominant Regions & Segments in India Industrial Pump Market

The industrial pump market in India shows strong regional variations, with [Leading Region - e.g., Western India] currently dominating due to robust industrial activity. The water and wastewater treatment sector is the largest end-user industry, followed by the oil and gas sector. Centrifugal pumps hold the largest market share among pump types.

Key Drivers for Dominant Regions:

- [Leading Region]: High concentration of industrial clusters, favorable government policies, and robust infrastructure development.

- [Other Significant Regions]: [List key factors for other prominent regions – e.g., Southern India: Growing chemical industry; Northern India: Infrastructure projects]

Dominant Segments:

- Type: Centrifugal pumps dominate due to their versatility and cost-effectiveness.

- End-User Industry: Water and wastewater treatment is the largest segment due to increasing urbanization and water management initiatives.

India Industrial Pump Market Product Innovations

Recent product innovations focus on energy efficiency, improved durability, and smart functionalities. Manufacturers are incorporating advanced materials, designs, and technologies to enhance pump performance and reduce operational costs. The market is witnessing a growing adoption of IoT-enabled pumps for predictive maintenance and remote monitoring. These advancements cater to the increasing demand for reliable and efficient pumping solutions across various industrial applications.

Report Scope & Segmentation Analysis

This report segments the Indian industrial pump market by pump type (Centrifugal Pump, Positive Displacement Pump) and end-user industry (Oil and Gas, Water and Wastewater, Chemicals and Petrochemicals, Mining, Power Generation, Other End-user Industries). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. For instance, the Centrifugal Pump segment is projected to witness a xx Million growth by 2033, while the Water and Wastewater treatment segment within end-user industries is expected to grow at a CAGR of xx% during the forecast period.

Key Drivers of India Industrial Pump Market Growth

The Indian industrial pump market is experiencing robust growth, propelled by a confluence of powerful factors. The continuous expansion of India's industrial sector, with a particular surge in manufacturing and infrastructure development, is creating an ever-increasing demand for high-performance and reliable pumping solutions. Complementing this industrial growth are strategic government initiatives aimed at optimizing water management systems and bolstering infrastructure development across the nation, which directly stimulates market expansion. Moreover, ongoing technological advancements are leading to the development of increasingly sophisticated, energy-efficient, and "smart" pumps, further contributing to the overall market growth and adoption of advanced pumping technologies.

Challenges in the India Industrial Pump Market Sector

The Indian industrial pump market, despite its growth trajectory, navigates several significant challenges. Volatility in raw material prices can impact manufacturing costs and profit margins. The market is also characterized by intense competition, demanding continuous efforts in product development and cost optimization. A critical challenge lies in the availability of skilled labor required for the manufacturing, installation, and maintenance of advanced pumping systems. Furthermore, evolving and often stringent environmental regulations necessitate continuous adaptation and investment in compliant technologies. Supply chain disruptions, whether global or domestic, can adversely affect production schedules and delivery timelines, potentially leading to project delays and increased operational expenses. These multifaceted challenges require strategic planning and agile operational strategies to mitigate their impact on market growth and profitability.

Emerging Opportunities in India Industrial Pump Market

The Indian industrial pump market is poised for significant growth, driven by several promising emerging opportunities. The widespread adoption of smart pumps, integrated with digital technologies for advanced predictive maintenance and real-time remote monitoring, presents a substantial growth avenue. The expanding renewable energy sector, particularly in solar and wind power, often requires specialized pumping solutions for auxiliary systems, creating new demand. Moreover, the increasing national emphasis on water conservation and efficient water management practices is driving the demand for advanced water treatment and distribution pumps. The government's continued focus on large-scale infrastructure development projects, from smart cities to water transport networks, further solidifies a favorable environment for market expansion and innovation in pumping technologies.

Leading Players in the India Industrial Pump Market Market

- La Gajjar Machineries Pvt Ltd

- Shakti Pumps (India) Ltd

- Falcon Pumps Pvt Ltd

- Xylem Inc

- Chemlin Pumps and Valves Pvt Ltd

- KSB SE & Co KGA

- Unnati Pumps Pvt Ltd

- Crompton Greaves Consumer Electricals Limited

- CNP Pumps India Pvt Ltd

- Kishor Pumps Pvt Ltd

- Usha International Limited

- CRI Pumps Pvt Ltd

- V-Guard Industries Limited

- Grundfos AS

- Kirloskar Brother Limited

Key Developments in India Industrial Pump Market Industry

- April 2023: Kirloskar Brothers Limited launched the DBxe Pump, showcasing commitment to global pumping requirements.

- November 2022: Roto Pumps Limited secured a purchase order for 25 Screw Pumps from Suez India Pvt. Ltd.

Future Outlook for India Industrial Pump Market Market

The Indian industrial pump market is poised for significant growth, driven by continued industrial expansion, infrastructure development, and technological advancements. Strategic partnerships, product innovation, and expansion into new markets will be crucial for success in this dynamic sector. The market’s future potential is substantial, presenting attractive opportunities for both established players and new entrants.

India Industrial Pump Market Segmentation

-

1. Type

- 1.1. Centrifugal Pump

- 1.2. Positive Displacement Pump

-

2. End-User Industry

- 2.1. Oil and Gas

- 2.2. Water and Wastewater

- 2.3. Chemicals and Petrochemicals

- 2.4. Mining

- 2.5. Power Generation

- 2.6. Other End-user Industries

India Industrial Pump Market Segmentation By Geography

- 1. India

India Industrial Pump Market Regional Market Share

Geographic Coverage of India Industrial Pump Market

India Industrial Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Industrialization4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment

- 3.4. Market Trends

- 3.4.1. Centrifugal Pump Expected to Dominate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Centrifugal Pump

- 5.1.2. Positive Displacement Pump

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water and Wastewater

- 5.2.3. Chemicals and Petrochemicals

- 5.2.4. Mining

- 5.2.5. Power Generation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 La Gajjar Machineries Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shakti Pumps (India) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Falcon Pumps Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xylem Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chemlin Pumps and Valves Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KSB SE & Co KGA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unnati Pumps Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crompton Greaves Consumer Electricals Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNP Pumps India Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kishor Pumps Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Usha International Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CRI Pumps Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 V-Guard Industries Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Grundfos AS

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kirloskar Brother Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 La Gajjar Machineries Pvt Ltd

List of Figures

- Figure 1: India Industrial Pump Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Industrial Pump Market Share (%) by Company 2025

List of Tables

- Table 1: India Industrial Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Industrial Pump Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: India Industrial Pump Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: India Industrial Pump Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: India Industrial Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Industrial Pump Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Industrial Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: India Industrial Pump Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: India Industrial Pump Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: India Industrial Pump Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: India Industrial Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Industrial Pump Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Pump Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the India Industrial Pump Market?

Key companies in the market include La Gajjar Machineries Pvt Ltd, Shakti Pumps (India) Ltd, Falcon Pumps Pvt Ltd, Xylem Inc, Chemlin Pumps and Valves Pvt Ltd, KSB SE & Co KGA, Unnati Pumps Pvt Ltd, Crompton Greaves Consumer Electricals Limited, CNP Pumps India Pvt Ltd, Kishor Pumps Pvt Ltd, Usha International Limited, CRI Pumps Pvt Ltd, V-Guard Industries Limited, Grundfos AS, Kirloskar Brother Limited.

3. What are the main segments of the India Industrial Pump Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.93 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Industrialization4.; Government Initiatives.

6. What are the notable trends driving market growth?

Centrifugal Pump Expected to Dominate the Market Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment.

8. Can you provide examples of recent developments in the market?

April 2023: Kirloskar Brothers Limited, a prominent pump manufacturing company in India, has recently unveiled its latest offering, the DBxe Pump. Boasting unique design parameters and a wide range of features, the introduction of the DBxe Pump marks a significant milestone for Kirloskar Brothers Limited. This launch showcases the company's commitment to meeting global pumping requirements by leveraging the finest aspects of Indian innovation and expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Pump Market?

To stay informed about further developments, trends, and reports in the India Industrial Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence