Key Insights

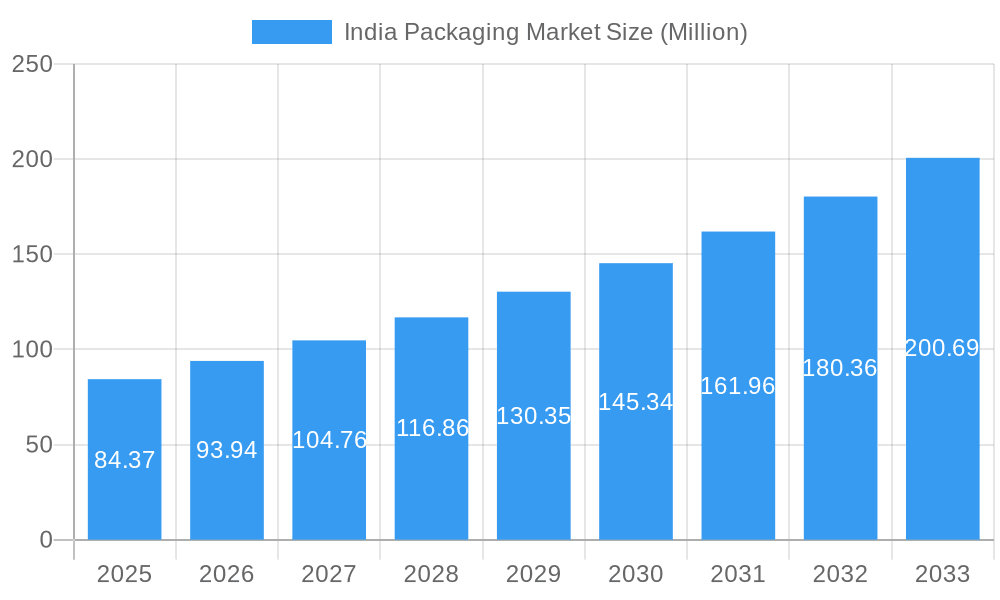

The India packaging market, valued at $84.37 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.06% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning food and beverage sector, coupled with a rising consumer base and increased disposable incomes, significantly contributes to the demand for diverse packaging solutions. E-commerce's rapid growth further accelerates this demand, requiring innovative and efficient packaging for safe and timely delivery. The pharmaceutical and healthcare sectors also contribute substantially, driven by stringent regulatory requirements and the need for protective packaging for sensitive medications. Furthermore, the cosmetics and personal care industry's expansion necessitates aesthetically pleasing and functional packaging, boosting market growth. Growth is also being driven by advancements in packaging materials and technologies, focusing on sustainability and eco-friendly options. While challenges remain, such as fluctuating raw material prices and stringent environmental regulations, the overall market outlook remains positive.

India Packaging Market Market Size (In Million)

Market segmentation reveals a significant contribution from flexible and rigid plastic packaging, followed by paper-based solutions like corrugated boxes and folding cartons. The regional distribution indicates varying levels of market penetration across North, South, East, and West India, with potential for growth in less developed regions. Competitive dynamics are characterized by a mix of established multinational corporations and domestic players, leading to innovation and price competitiveness. The forecast period suggests sustained growth, driven by continued economic expansion and evolving consumer preferences, with opportunities for players focused on sustainable and innovative packaging solutions. Successful players will likely need to focus on delivering efficient, cost-effective, and environmentally responsible packaging that caters to the diverse needs of India’s expanding market.

India Packaging Market Company Market Share

India Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, segmentation, key players, and future trends, this report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The report uses Million (M) for all values.

India Packaging Market Market Structure & Innovation Trends

The Indian packaging market exhibits a moderately fragmented structure, with several large multinational corporations and a multitude of smaller domestic players competing for market share. Major players like Uflex Limited and ITC Limited hold significant positions, but the market demonstrates considerable dynamism through mergers and acquisitions (M&A). Innovation drivers are fueled by increasing demand for sustainable packaging solutions, evolving consumer preferences, and technological advancements in materials science and printing technologies. Regulatory frameworks, including those focused on waste management and environmental protection, significantly influence market practices. Product substitutes, such as biodegradable and compostable packaging materials, are gaining traction, driving competition and innovation. End-user demographics, characterized by a growing middle class and rising disposable incomes, further drive market growth. M&A activity in the sector has seen a significant uptick in recent years, with deal values exceeding xx Million in the last five years. Examples include strategic acquisitions aimed at expanding product portfolios and geographic reach.

- Market Concentration: Moderately Fragmented

- Key Innovation Drivers: Sustainability, Consumer Preferences, Technological Advancements

- M&A Activity: xx Million in deal value over the last 5 years.

India Packaging Market Market Dynamics & Trends

The Indian packaging market is experiencing robust growth, driven primarily by the expansion of various end-use sectors such as food & beverage, pharmaceuticals, and e-commerce. The market is witnessing a CAGR of xx% during the forecast period (2025-2033), with a market penetration rate of xx% in 2025. Technological disruptions, including the adoption of automation in manufacturing and the increasing use of smart packaging solutions, are reshaping the industry landscape. Consumer preferences for convenient, sustainable, and aesthetically appealing packaging are driving demand for innovative packaging materials and designs. The competitive dynamics are intense, with companies focusing on product differentiation, cost optimization, and strategic partnerships to gain a competitive edge. The increasing focus on sustainability is influencing the choice of materials, driving the adoption of eco-friendly packaging options.

Dominant Regions & Segments in India Packaging Market

The Indian packaging market is a dynamic landscape characterized by significant regional disparities in growth and consumer preferences. While precise regional market share data remains elusive, urban centers and rapidly developing states consistently exhibit higher growth trajectories. Within the market's diverse segmentation, the food and beverage sector reigns supreme, followed closely by the pharmaceutical and healthcare, and personal care and cosmetics sectors. This dominance stems from a confluence of factors: surging consumption, stringent regulatory oversight (particularly concerning safety and preservation), and the pivotal role packaging plays in product preservation and brand identity.

- Key Growth Drivers (Food & Beverage): The sector's expansion is fueled by a potent combination of rising disposable incomes, evolving lifestyles mirroring Western trends, and the robust growth of organized retail, which demands sophisticated packaging solutions.

- Key Growth Drivers (Pharmaceutical & Healthcare): Stringent regulatory compliance regarding product safety and efficacy, coupled with escalating healthcare expenditure, drive the demand for specialized and tamper-evident packaging in this sector.

- Key Growth Drivers (Personal Care & Cosmetics): A burgeoning middle class and increasing awareness of personal hygiene and grooming, especially amongst younger demographics, fuel the demand for attractive and functional packaging in this competitive market.

- Dominant Material Type: Plastic continues its dominance, primarily due to its affordability and versatile nature, catering to a broad range of packaging needs across various segments.

- Dominant Packaging Type: Flexible plastic packaging maintains its leading position because of its cost-effectiveness and ease of use, especially for transporting and storing goods across India's diverse geographical landscape.

India Packaging Market Product Innovations

The Indian packaging market is experiencing a wave of innovation, driven by the imperative for sustainable, user-friendly, and secure packaging solutions. Key trends include the accelerated adoption of eco-friendly materials such as biodegradable and compostable alternatives to traditional plastics. The integration of smart packaging technologies is also gaining traction, enhancing product traceability, security, and brand interaction. Furthermore, innovative packaging designs are being developed to enhance shelf appeal and elevate the overall consumer experience. These advancements empower packaging companies to gain a competitive edge by meeting the ever-evolving demands of consumers and aligning with increasingly stringent regulatory frameworks.

Report Scope & Segmentation Analysis

This report segments the India packaging market by End-user (Food, Beverage, Cosmetics and Personal Care, Industrial, Pharmaceutical and Healthcare, Other End-users), Paper Type (Folding Carton, Corrugated Boxes, Paper Bags and Liquid Paperboard), Non-alcoholic Beverages (Personal Care and Cosmetics, Healthcare), Material Type (Plastic, Paper, Glass, Metal), and Plastic Type (Rigid Plastic Packaging, Flexible Plastic Packaging). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The market is expected to witness significant growth across all segments, driven by factors such as rising consumer spending, economic growth, and urbanization. Competitive dynamics are intense, with established players and new entrants constantly vying for market share.

Key Drivers of India Packaging Market Growth

The robust growth of the Indian packaging market is propelled by several interconnected factors. The expanding food and beverage sector, with its rising demand for effective packaging solutions, is a key contributor. The rapid growth of e-commerce has significantly amplified the demand for protective and durable packaging to safeguard goods during transit. Simultaneously, rising disposable incomes are fueling higher consumer spending on packaged goods, driving market expansion. The flourishing pharmaceutical and healthcare industry presents a significant demand for specialized packaging solutions. Finally, governmental regulations focused on improving packaging quality and promoting sustainability are playing a crucial role in shaping the market's trajectory. Technological advancements in materials science and printing technologies are further accelerating growth by providing innovative and cost-effective solutions to industry players.

Challenges in the India Packaging Market Sector

Despite the significant growth potential, the India packaging market faces several challenges. These include managing plastic waste and meeting evolving sustainability standards, fluctuations in raw material prices, and the need for improved infrastructure to support the efficient movement of goods. Stringent regulatory requirements related to food safety and environmental protection add to the complexity of operating in this market. Competitive pressure from both domestic and international players also poses a challenge. The lack of skilled manpower in certain areas also limits the sector's growth potential.

Emerging Opportunities in India Packaging Market

The India packaging market presents many opportunities. The increasing demand for sustainable packaging solutions, including biodegradable and compostable alternatives, represents a significant growth area. The expanding e-commerce sector creates an opportunity for specialized packaging solutions that ensure the safe and efficient delivery of goods. The growing focus on personalized and customized packaging further creates niche opportunities for companies that offer tailored solutions. Finally, the increasing use of smart packaging technologies for product tracking and authentication creates lucrative market opportunities.

Leading Players in the India Packaging Market Market

- Polyplex Corporation Limited

- Aptar Group Inc

- Hitech Plast (Hitech Group)

- Ball India (Ball Corporation)

- Emami Paper Mills Limited (Emami Group)

- Schott Poonawalla Private Limited

- KCL Limited

- The Bag Smith

- Uflex Limited

- Trident Paper Box Industries

- Hindustan Tin Works Ltd

- OJI India Packaging Pvt Ltd

- Canpac SA

- TCPL Packaging Limited

- Tetra-pak India Private Limited

- JK Paper Ltd

- PGP Glass Private Limited (Piramal Glass)

- Agi Glaspac (HSIL Limited)

- Zenith Tins Pvt Ltd

- AI Packaging Limited

- Bag Master

- Jindal Poly Films Limited

- Megaplast India Pvt Ltd

- Asepto (Uflex Limited)

- Schoeller Allibert

- Berry Global Inc

- Westrock India

- ITC Limited

- Gerresheimer AG

Key Developments in India Packaging Market Industry

- May 2022: Huhtamaki's establishment of its first recycling plant in Maharashtra, representing a USD 1.18 Million investment with a capacity to process approximately 1,600 kg of flexible plastic waste daily, highlights the burgeoning focus on sustainable packaging practices within the industry.

- February 2023: Revlon's launch of a new package for its 'Top Speed' hair color range exclusively in India showcases the strategic importance of localized product adaptations and packaging innovation to cater to specific market demands.

- [Add more recent developments here with dates and brief descriptions]

Future Outlook for India Packaging Market Market

The future of the India packaging market looks promising, driven by continued economic growth, increasing consumer spending, and the growing adoption of sustainable packaging solutions. The market is expected to experience robust growth, with significant opportunities for companies that can offer innovative, sustainable, and cost-effective packaging solutions. The increasing focus on e-commerce and the rising demand for personalized packaging will further drive market expansion. Companies that can adapt to changing consumer preferences and regulatory requirements will be best positioned for success.

India Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastic

-

1.1.1. Plastic Type - Summary

- 1.1.1.1. Rigid Plastic Packaging

- 1.1.1.2. Flexible Plastic Packaging

-

1.1.2. End-user

- 1.1.2.1. Food

- 1.1.2.2. Beverage

- 1.1.2.3. Cosmetics and Personal Care

- 1.1.2.4. Industrial

- 1.1.2.5. Pharmaceutical and Healthcare

- 1.1.2.6. Other End-users

-

1.1.1. Plastic Type - Summary

-

1.2. Paper

-

1.2.1. Paper Type - Summary

- 1.2.1.1. Folding Carton

- 1.2.1.2. Corrugated Boxes

- 1.2.1.3. Paper Bags and Liquid Paperboard

- 1.2.2. Food and Beverage

- 1.2.3. Retail and E-commerce

- 1.2.4. Personal Care & Cosmetics

-

1.2.1. Paper Type - Summary

-

1.3. Container Glass

- 1.3.1. Container Glass - Summary

- 1.3.2. Alcoholic

- 1.3.3. Non-alcoholic

- 1.3.4. Personal Care and Cosmetics

-

1.4. Metal Cans and Containers

- 1.4.1. Metal Cans and Containers - Summary

- 1.4.2. Paints and Chemicals

-

1.1. Plastic

India Packaging Market Segmentation By Geography

- 1. India

India Packaging Market Regional Market Share

Geographic Coverage of India Packaging Market

India Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of the Organized Retail and E-commerce Sector; Increasing Demand for Sustainable and Recyclable Packaging

- 3.3. Market Restrains

- 3.3.1. Alternative Packaging Options such as Aluminum and Plastic

- 3.4. Market Trends

- 3.4.1. Food Industry is Expected to Hold the Largest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Plastic Type - Summary

- 5.1.1.1.1. Rigid Plastic Packaging

- 5.1.1.1.2. Flexible Plastic Packaging

- 5.1.1.2. End-user

- 5.1.1.2.1. Food

- 5.1.1.2.2. Beverage

- 5.1.1.2.3. Cosmetics and Personal Care

- 5.1.1.2.4. Industrial

- 5.1.1.2.5. Pharmaceutical and Healthcare

- 5.1.1.2.6. Other End-users

- 5.1.1.1. Plastic Type - Summary

- 5.1.2. Paper

- 5.1.2.1. Paper Type - Summary

- 5.1.2.1.1. Folding Carton

- 5.1.2.1.2. Corrugated Boxes

- 5.1.2.1.3. Paper Bags and Liquid Paperboard

- 5.1.2.2. Food and Beverage

- 5.1.2.3. Retail and E-commerce

- 5.1.2.4. Personal Care & Cosmetics

- 5.1.2.1. Paper Type - Summary

- 5.1.3. Container Glass

- 5.1.3.1. Container Glass - Summary

- 5.1.3.2. Alcoholic

- 5.1.3.3. Non-alcoholic

- 5.1.3.4. Personal Care and Cosmetics

- 5.1.4. Metal Cans and Containers

- 5.1.4.1. Metal Cans and Containers - Summary

- 5.1.4.2. Paints and Chemicals

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Polyplex Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aptar Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitech Plast (Hitech Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ball India (Ball Corporation)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emami Paper Mills Limited (Emami Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schott Poonawalla Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KCL Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Bag Smith

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Uflex Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trident Paper Box Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hindustan Tin Works Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 OJI India Packaging Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Canpac SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TCPL Packaging Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra-pak India Private Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 JK Paper Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 PGP Glass Private Limited (Piramal Glass)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Agi Glaspac (HSIL Limited)

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Zenith Tins Pvt Ltd

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 AI Packaging Limited

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Bag Master

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Jindal Poly Films Limited

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Megaplast India Pvt Ltd

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Asepto (Uflex Limited)

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Schoeller Allibert

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Berry Global Inc

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 Westrock India

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 ITC Limited

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.29 Gerresheimer AG

- 6.2.29.1. Overview

- 6.2.29.2. Products

- 6.2.29.3. SWOT Analysis

- 6.2.29.4. Recent Developments

- 6.2.29.5. Financials (Based on Availability)

- 6.2.1 Polyplex Corporation Limited

List of Figures

- Figure 1: India Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: India Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: India Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: India Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: India Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Packaging Market?

The projected CAGR is approximately 11.06%.

2. Which companies are prominent players in the India Packaging Market?

Key companies in the market include Polyplex Corporation Limited, Aptar Group Inc, Hitech Plast (Hitech Group), Ball India (Ball Corporation), Emami Paper Mills Limited (Emami Group), Schott Poonawalla Private Limited, KCL Limited, The Bag Smith, Uflex Limited, Trident Paper Box Industries, Hindustan Tin Works Ltd, OJI India Packaging Pvt Ltd, Canpac SA, TCPL Packaging Limited, Tetra-pak India Private Limited, JK Paper Ltd, PGP Glass Private Limited (Piramal Glass), Agi Glaspac (HSIL Limited), Zenith Tins Pvt Ltd, AI Packaging Limited, Bag Master, Jindal Poly Films Limited, Megaplast India Pvt Ltd, Asepto (Uflex Limited), Schoeller Allibert, Berry Global Inc, Westrock India, ITC Limited, Gerresheimer AG.

3. What are the main segments of the India Packaging Market?

The market segments include Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of the Organized Retail and E-commerce Sector; Increasing Demand for Sustainable and Recyclable Packaging.

6. What are the notable trends driving market growth?

Food Industry is Expected to Hold the Largest Share in the Market.

7. Are there any restraints impacting market growth?

Alternative Packaging Options such as Aluminum and Plastic.

8. Can you provide examples of recent developments in the market?

February 2023: Cosmetics and hair care brand Revlon developed a new package for its 'Top Speed' hair color range exclusively for the Indian market. The brand unveiled a new visual identity for products across India in the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Packaging Market?

To stay informed about further developments, trends, and reports in the India Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence