Key Insights

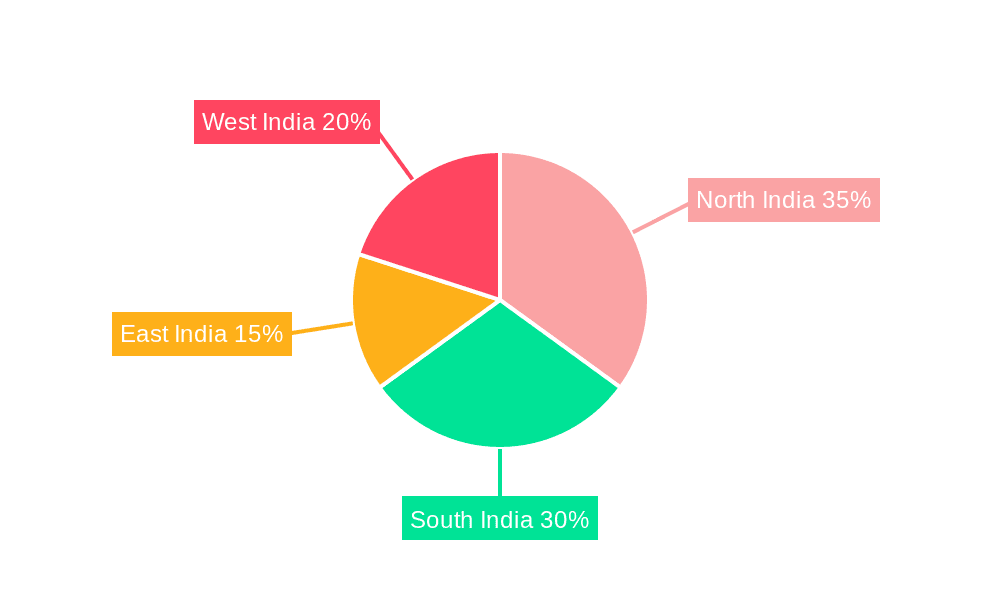

The India Reusable Transport Packaging (RTP) market is poised for significant expansion, driven by the escalating demand for efficient and sustainable supply chain solutions across key industries. Projected to reach $52.4 billion by 2033, the market is experiencing a compound annual growth rate (CAGR) of 8.9%, from a base year of 2025. This robust growth is underpinned by the increasing adoption of RTP in sectors such as automotive, food and beverage, and consumer goods, where waste reduction and supply chain optimization are critical. The burgeoning e-commerce sector and a heightened emphasis on environmental sustainability are further accelerating the adoption of reusable packaging. While plastics continue to dominate due to their cost-effectiveness and durability, growing environmental concerns are fostering interest in sustainable alternatives like wood and metal, particularly in eco-conscious segments. Regional growth is anticipated to be led by North and South India, benefiting from established manufacturing and distribution infrastructure. Opportunities for expansion also exist in the East and West regions. Leading players are strategically investing in innovation and expanding their service portfolios to meet evolving customer requirements.

India Reusable Transport Packaging Industry Market Size (In Billion)

Challenges within the industry include the substantial initial investment required for RTP adoption, which can present a hurdle for small and medium-sized enterprises. Effective management of reverse logistics, alongside the efficient cleaning and maintenance of reusable packaging, necessitates robust operational systems. However, these challenges are being addressed through innovative approaches such as pooling models and advanced tracking technologies, which enhance inventory management and supply chain transparency. The market's growth trajectory signals a promising future for the India RTP industry, marked by ongoing innovation, the integration of sustainable practices, and broader adoption across diverse sectors. Success will depend on collaborative efforts between packaging providers, logistics firms, and end-users to establish efficient and environmentally responsible supply chain ecosystems.

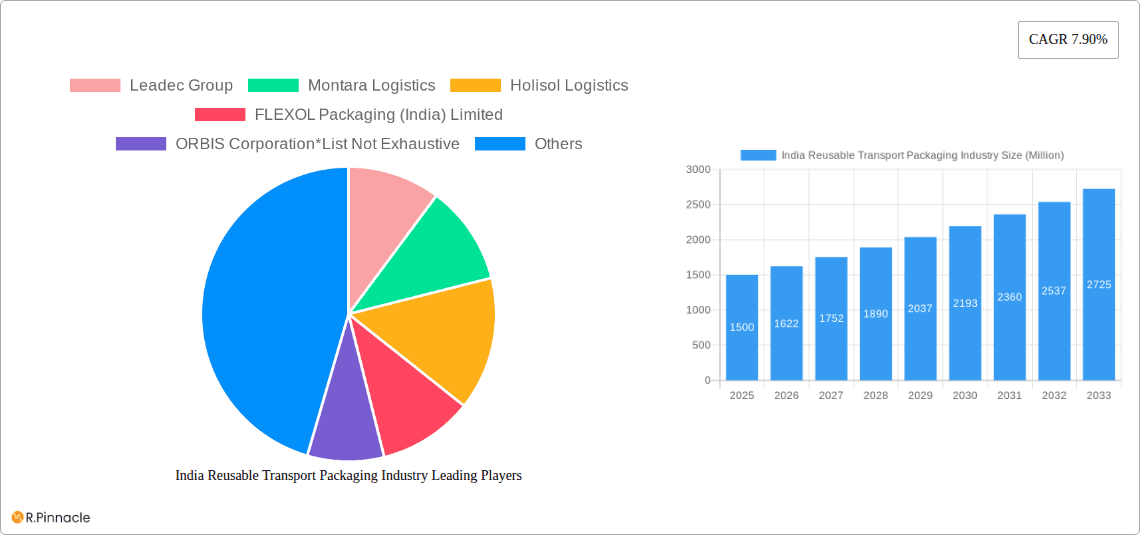

India Reusable Transport Packaging Industry Company Market Share

India Reusable Transport Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Reusable Transport Packaging (RTP) industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The study leverages extensive primary and secondary research to deliver actionable intelligence.

India Reusable Transport Packaging Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian RTP market, examining market concentration, innovation drivers, regulatory influences, and key industry trends. We delve into the impact of product substitutes and explore the evolving end-user demographics influencing demand. Furthermore, the report assesses mergers and acquisitions (M&A) activities within the sector, including estimated deal values and their influence on market share. Key players such as Leadec Group, Montara Logistics, Holisol Logistics, FLEXOL Packaging (India) Limited, ORBIS Corporation, Signode Limited, Leap India, CHEP Logistics, Nefab AB, and GEFCO India Private Limited are analyzed for their market positioning and strategic moves. The analysis incorporates data on market share distribution and M&A activity, revealing the current dynamics and future potential for consolidation. The report estimates that the market concentration ratio (CR4) for 2025 is approximately xx%, indicating a [describe the level of concentration: e.g., moderately concentrated] market. The average M&A deal value during the historical period (2019-2024) was approximately xx Million, showcasing [describe the trend: e.g., an increasing trend in consolidation].

India Reusable Transport Packaging Industry Market Dynamics & Trends

This section provides a detailed examination of the market's growth trajectory, exploring key drivers, technological advancements, consumer preferences, and competitive pressures. We analyze the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033), which is estimated at xx%, indicating a [describe the growth rate: e.g., robust] expansion of the market. Further analysis includes a deep dive into market penetration rates across various end-user industries. The increasing adoption of sustainable packaging solutions, coupled with the burgeoning e-commerce sector, are identified as significant drivers. Technological disruptions, such as the introduction of advanced materials and smart packaging solutions, are also analyzed for their impact on market dynamics and consumer behavior. Competitive dynamics are assessed through an examination of pricing strategies, product differentiation, and marketing efforts employed by key players. The report projects a market size of xx Million by 2033.

Dominant Regions & Segments in India Reusable Transport Packaging Industry

This section pinpoints the leading regions and segments within the Indian RTP market. The analysis considers material type (Plastic, Metal, Wood) and end-user industry (Automotive, Food and Beverage, Consumer Goods, Electronics and Appliances, Other End-user Industries).

- Leading Region: [State the leading region, e.g., Maharashtra] dominates the market due to [Reasons, e.g., strong automotive and manufacturing sectors, established infrastructure].

- Dominant Material: Plastic accounts for the largest market share due to its [Reasons, e.g., cost-effectiveness, versatility, and lightweight nature].

- Primary End-user Industry: The Automotive sector is a major driver, accounting for xx% of market demand, owing to [Reasons, e.g., increasing vehicle production and stringent supply chain optimization initiatives].

The report provides a granular analysis of each segment's growth drivers, exploring the influence of economic policies, infrastructural development, and regulatory frameworks. The detailed analysis includes market size projections and competitive landscapes for each segment. The dominance analysis considers factors such as market penetration, growth rates, and the concentration of key players within each segment.

India Reusable Transport Packaging Industry Product Innovations

This section summarizes recent product developments, focusing on technological advancements that enhance product applications and provide competitive advantages. Innovation in material science, such as the development of lighter, stronger, and more sustainable materials, is highlighted. The integration of smart technologies, such as RFID tracking, enhances supply chain visibility and efficiency. These innovations are analyzed for their impact on market adoption and their ability to meet the evolving needs of end-users.

Report Scope & Segmentation Analysis

This report segments the Indian Reusable Transport Packaging market based on material type (Plastic, Metal, Wood) and end-user industry (Automotive, Food and Beverage, Consumer Goods, Electronics and Appliances, Other End-user Industries). Each segment is analyzed individually, providing insights into growth projections, market sizes, and competitive dynamics. For example, the plastic segment is projected to exhibit a CAGR of xx% during the forecast period, driven by [reasons]. Similarly, the automotive end-user industry segment is expected to witness strong growth due to [reasons]. The report provides a detailed overview of the market size and competitive dynamics for each of these segments.

Key Drivers of India Reusable Transport Packaging Industry Growth

The growth of the Indian RTP industry is fueled by several key factors. Stringent regulations promoting sustainable packaging practices are driving demand for reusable solutions. The expansion of the e-commerce sector necessitates efficient and reliable packaging for faster delivery and reduced damage. Furthermore, advancements in material science and technology are leading to the development of lighter, stronger, and more sustainable RTP solutions. The increasing focus on supply chain optimization and cost reduction also plays a significant role, with companies seeking to reduce transportation and packaging costs.

Challenges in the India Reusable Transport Packaging Industry Sector

The Indian RTP industry faces several challenges, including high initial investment costs for reusable packaging solutions, potential issues related to hygiene and sanitation, and the need for efficient reverse logistics systems for collection and cleaning. Furthermore, competition from single-use packaging options and fluctuating raw material prices pose challenges to profitability. Regulatory hurdles and infrastructure limitations in some regions further contribute to the challenges faced by industry participants.

Emerging Opportunities in India Reusable Transport Packaging Industry

The Indian RTP industry presents promising opportunities. The growing demand for sustainable and eco-friendly packaging creates a significant market for reusable solutions. The increasing adoption of advanced technologies such as RFID tracking and IoT sensors provides opportunities for improved supply chain management and increased efficiency. Furthermore, expanding into new end-user industries and geographical regions presents potential for market growth and diversification.

Leading Players in the India Reusable Transport Packaging Industry Market

- Leadec Group

- Montara Logistics

- Holisol Logistics

- FLEXOL Packaging (India) Limited

- ORBIS Corporation

- Signode Limited

- Leap India

- CHEP Logistics

- Nefab AB

- GEFCO India Private Limited

Key Developments in India Reusable Transport Packaging Industry Industry

- January 2023: [Insert a significant development, e.g., FLEXOL Packaging launched a new line of reusable plastic containers.]

- June 2022: [Insert a significant development, e.g., CHEP Logistics expanded its distribution network in Southern India.]

- [Add more bullet points as needed]: Include dates, brief descriptions, and impact on market dynamics.

Future Outlook for India Reusable Transport Packaging Industry Market

The Indian RTP market is poised for significant growth, driven by the increasing adoption of sustainable packaging practices, technological advancements, and the expansion of key end-user industries. Strategic investments in research and development, focusing on innovative and sustainable materials, will further drive market expansion. Companies adopting a proactive approach to addressing regulatory requirements and supply chain efficiencies will be well-positioned to capitalize on the emerging opportunities in this dynamic market. The market is expected to see a continued increase in consolidation and expansion of leading players.

India Reusable Transport Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Wood

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Food and Beverage

- 2.3. Consumer Goods

- 2.4. Electronics and Appliances

- 2.5. Other End-user Industries

India Reusable Transport Packaging Industry Segmentation By Geography

- 1. India

India Reusable Transport Packaging Industry Regional Market Share

Geographic Coverage of India Reusable Transport Packaging Industry

India Reusable Transport Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing awareness on the effectiveness of RTP; Growing adoption from key end-user segments such as F&B and Electronics

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Automotive Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Reusable Transport Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Wood

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Food and Beverage

- 5.2.3. Consumer Goods

- 5.2.4. Electronics and Appliances

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Leadec Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Montara Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Holisol Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FLEXOL Packaging (India) Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ORBIS Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Signode Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leap India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CHEP Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nefab AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEFCO India Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Leadec Group

List of Figures

- Figure 1: India Reusable Transport Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Reusable Transport Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: India Reusable Transport Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: India Reusable Transport Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Reusable Transport Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Reusable Transport Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 5: India Reusable Transport Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Reusable Transport Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Reusable Transport Packaging Industry?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the India Reusable Transport Packaging Industry?

Key companies in the market include Leadec Group, Montara Logistics, Holisol Logistics, FLEXOL Packaging (India) Limited, ORBIS Corporation*List Not Exhaustive, Signode Limited, Leap India, CHEP Logistics, Nefab AB, GEFCO India Private Limited.

3. What are the main segments of the India Reusable Transport Packaging Industry?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.4 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing awareness on the effectiveness of RTP; Growing adoption from key end-user segments such as F&B and Electronics.

6. What are the notable trends driving market growth?

Automotive Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Reusable Transport Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Reusable Transport Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Reusable Transport Packaging Industry?

To stay informed about further developments, trends, and reports in the India Reusable Transport Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence