Key Insights

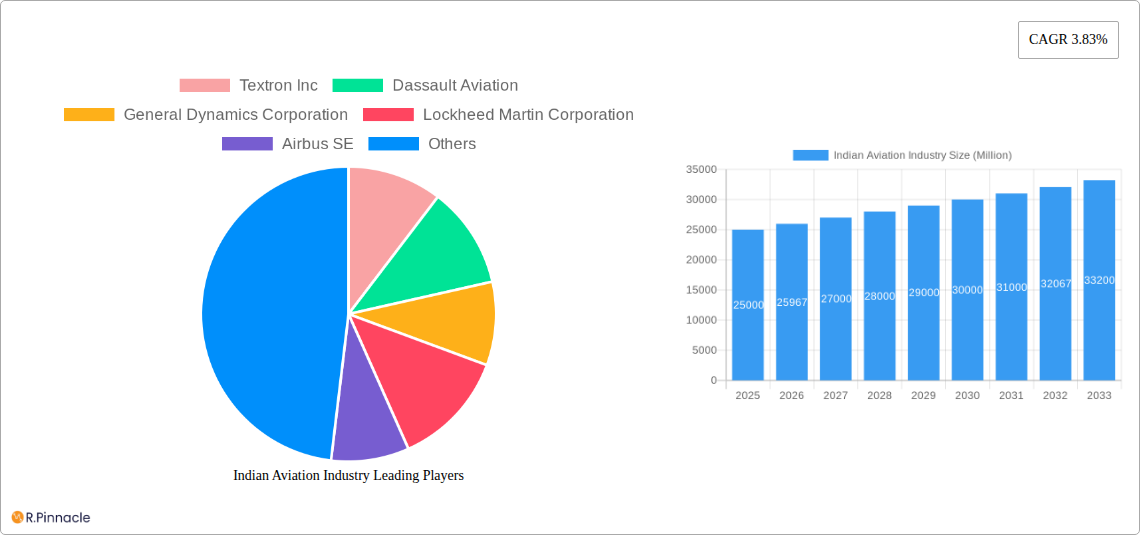

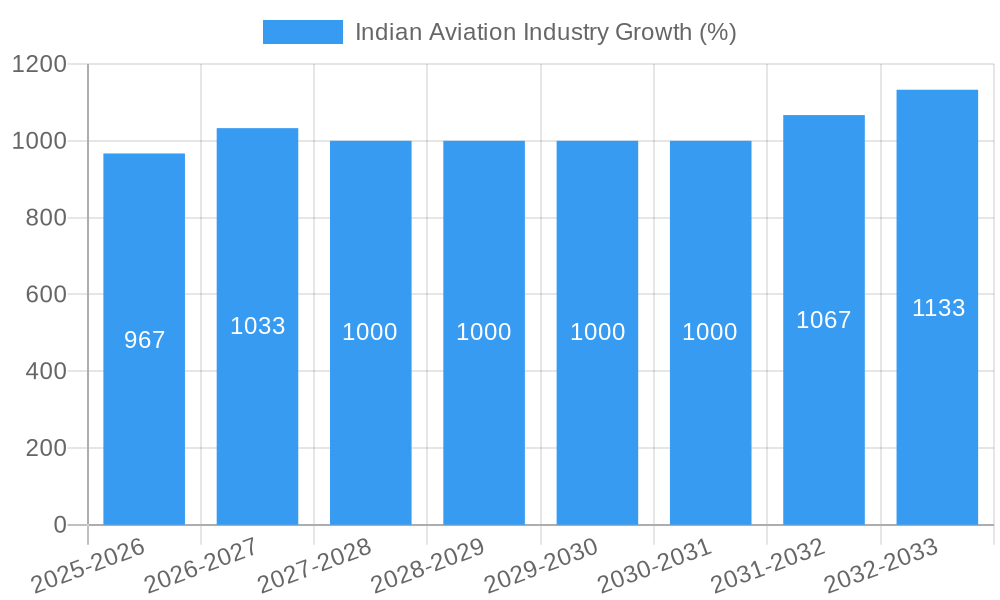

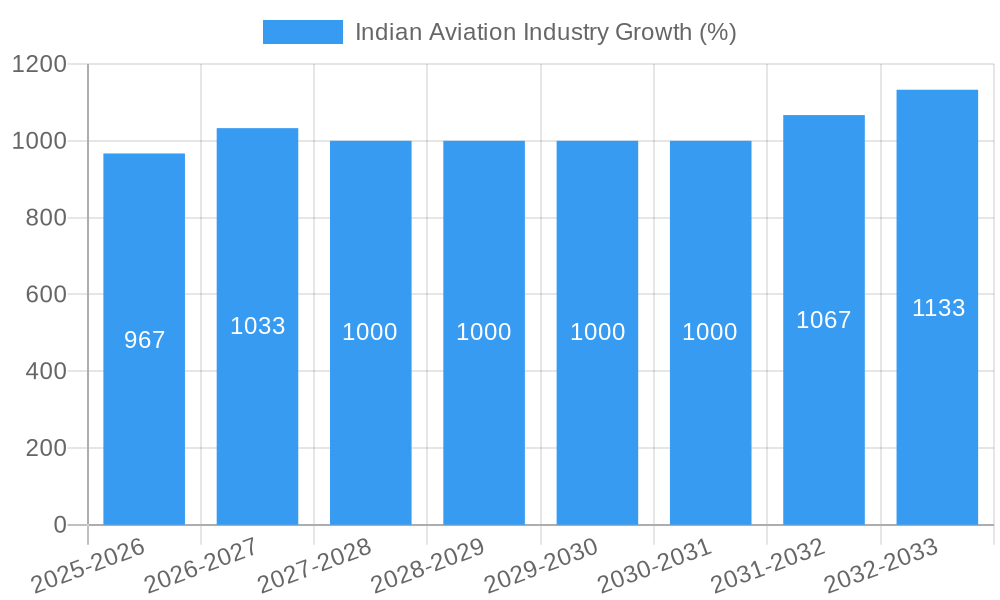

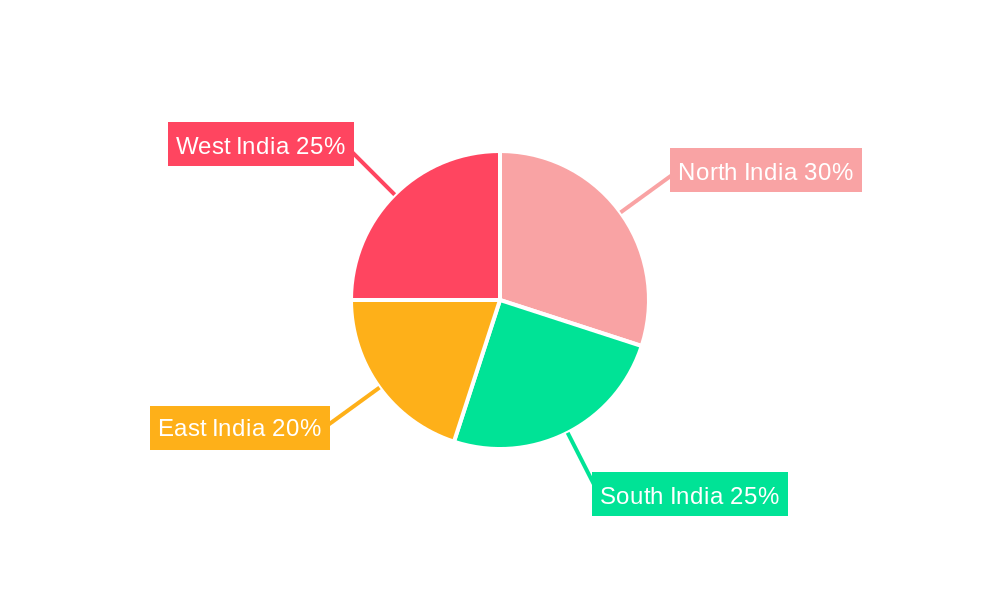

The Indian aviation industry, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) of 3.83% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increased disposable income is driving demand for air travel, particularly domestic flights. Government initiatives aimed at improving infrastructure, such as airport expansions and modernization, are further facilitating growth. The rise of low-cost carriers (LCCs) has made air travel more accessible to a wider segment of the population, contributing significantly to the sector's expansion. However, challenges remain. Fuel price volatility presents a significant headwind, impacting profitability. Concerns around airspace management and regulatory hurdles also pose potential constraints on growth. The industry is segmented by aircraft type (commercial and others), with the commercial aviation segment holding a dominant market share. Major players such as IndiGo, Air India, SpiceJet, and Vistara are competing intensely within this space. Regional variations exist, with certain states exhibiting higher growth than others, driven by factors such as economic activity and tourism. Analyzing regional data (North, South, East, and West India) reveals diverse growth trajectories. While the North and West might show faster growth due to major economic hubs and industrial activity, the South and East show significant growth potential due to tourism and infrastructural investments. This dynamic landscape requires a nuanced approach from stakeholders to navigate the opportunities and challenges.

The forecast period (2025-2033) anticipates a continued expansion of the Indian aviation market, with significant growth opportunities in both domestic and international routes. The market size in 2025 is estimated to be substantial, and predicting future values requires considering factors such as economic growth, fuel prices, and government policies. While estimating precise figures without complete data is difficult, given the existing CAGR and positive industry outlook, continued growth in the sector's value is expected. The strategic implications for airlines, manufacturers, and infrastructure providers are profound, requiring proactive adaptation to the evolving industry dynamics. Focusing on operational efficiency, sustainable practices, and catering to the evolving preferences of the traveling public will be crucial for sustained success in this competitive market.

Indian Aviation Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indian aviation industry, covering market structure, dynamics, key players, and future outlook. With a focus on actionable insights and leveraging data from 2019-2024 (Historical Period), the report projects market trends through 2033 (Forecast Period), using 2025 as the base and estimated year. This report is essential for industry professionals, investors, and policymakers seeking to understand and capitalize on the growth opportunities within this dynamic sector. The report uses Million (M) for all values.

Indian Aviation Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Indian aviation industry. The market is characterized by a mix of established global players and domestic companies. Market concentration is moderate, with a few major players holding significant market share, but numerous smaller players contributing to the overall market size. Innovation is driven by the need for fuel efficiency, enhanced safety features, and improved passenger experience. Stringent regulatory frameworks from the Directorate General of Civil Aviation (DGCA) impact operations and technological advancements. Key product substitutes include rail and road transport, although air travel's speed advantage remains a significant factor. The end-user demographics span a wide range, from budget-conscious travelers to high-spending business class passengers. M&A activities have been moderate in recent years, with deal values reaching xx M in the past five years.

- Market Share: Airbus and Boeing hold the largest market share in the commercial segment, with xx% and xx%, respectively. Hindustan Aeronautics Limited (HAL) holds a significant share in the defense segment.

- M&A Activity: Recent deals, while not reaching the billion-dollar mark, show a pattern of strategic consolidation, primarily focused on streamlining operations and expansion into new markets.

Indian Aviation Industry Market Dynamics & Trends

The Indian aviation industry is experiencing robust growth, fueled by rising disposable incomes, increasing tourism, and government initiatives to improve infrastructure. The CAGR for the forecast period (2025-2033) is estimated at xx%. Technological disruptions, such as the adoption of advanced aircraft technologies and digitalization of airline operations, are reshaping the industry. Consumer preferences are shifting towards low-cost carriers, although there is also a growing demand for premium services. Competitive dynamics are intense, with airlines focusing on network expansion, fleet modernization, and ancillary revenue streams. Market penetration of air travel continues to grow, driven by factors such as increased affordability and accessibility.

Dominant Regions & Segments in Indian Aviation Industry

The Indian aviation market is geographically diverse, with significant growth potential across various regions. While the report identifies the Commercial Aviation segment as dominant, providing detailed analysis of its key drivers and dominance, the Others segment is also explored.

Commercial Aviation:

- Key Drivers:

- Rapid economic growth and rising disposable incomes

- Expanding tourism sector and increasing air travel demand

- Government initiatives to improve airport infrastructure and air connectivity

- Low-cost carrier expansion

- Growing demand for international and domestic travel

Others (e.g., General Aviation, Cargo):

- Key Drivers:

- Growing e-commerce sector (Cargo)

- Increased use of private jets and helicopters (General Aviation)

- Government support for regional connectivity schemes (General Aviation)

The detailed analysis of regional dominance will be provided in the full report. However, major metropolitan areas and high-growth regions will be highlighted as key drivers for both Commercial and Other segments.

Indian Aviation Industry Product Innovations

Recent innovations in the Indian aviation industry focus on fuel-efficient aircraft, advanced avionics, and enhanced passenger experience features. Airlines are adopting new technologies to improve operational efficiency and reduce costs. The market is witnessing a trend toward lighter, more fuel-efficient aircraft designs, catering to the growing demand for sustainable air travel. This includes the integration of improved aircraft maintenance solutions.

Report Scope & Segmentation Analysis

This report segments the Indian aviation industry by aircraft type (Commercial Aviation, Others). The Commercial Aviation segment is further divided by aircraft size (narrow-body, wide-body) and airline type (full-service, low-cost). The "Others" segment includes general aviation, cargo, and military aviation. Growth projections vary significantly across segments, with Commercial Aviation showing the most robust growth. Market sizes for each segment are detailed in the full report, along with a competitive landscape analysis.

Key Drivers of Indian Aviation Industry Growth

Several factors drive the growth of the Indian aviation industry. These include rapid economic growth leading to increased disposable income and travel demand; supportive government policies promoting infrastructure development and air connectivity; increasing tourism; and technological advancements, such as fuel-efficient aircraft and advanced aviation technology, improving operational efficiency and reducing costs.

Challenges in the Indian Aviation Industry Sector

The Indian aviation industry faces several challenges including high fuel costs, intense competition, infrastructural constraints at some airports, fluctuating currency exchange rates, and regulatory hurdles that can impact operations. These factors can lead to decreased profitability and operational efficiency. The impact of these challenges on the industry is quantified through financial analysis in the full report.

Emerging Opportunities in Indian Aviation Industry

The Indian aviation industry presents numerous opportunities including the growing demand for air travel, particularly in Tier 2 and Tier 3 cities; the potential for expansion of low-cost carriers; and the increasing adoption of new technologies to enhance operational efficiency and passenger experience; and a rise in cargo transportation.

Leading Players in the Indian Aviation Industry Market

- Textron Inc

- Dassault Aviation

- General Dynamics Corporation

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Leonardo S p A

- Bombardier Inc

- ATR

- Hindustan Aeronautics Limited

Key Developments in Indian Aviation Industry

- June 2023: Delta Air Lines Inc. in talks with Airbus SE for a wide-body aircraft order (A350 and A330neo). This signals continued demand for larger aircraft in the international market.

- March 2023: Boeing secures a massive contract from Air India for 220 aircraft (190 737 Max, 20 787, and 10 777X), boosting Boeing's market presence significantly.

- December 2022: Textron Inc.'s Bell unit awarded a contract by the US Army for next-generation helicopters, showcasing technological advancements in the defense segment.

Future Outlook for Indian Aviation Industry Market

The Indian aviation industry is poised for continued strong growth, driven by the factors mentioned above. The market's potential remains substantial, with ample opportunities for both established players and new entrants. Strategic investments in infrastructure, technological advancements, and sustainable practices will be crucial for realizing the industry's full potential. The long-term outlook is extremely positive, with projections indicating consistent growth over the next decade.

Indian Aviation Industry Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Indian Aviation Industry Segmentation By Geography

- 1. India

Indian Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North India Indian Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India Indian Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India Indian Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India Indian Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Textron Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dassault Aviation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Dynamics Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lockheed Martin Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Boeing Compan

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leonardo S p A

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bombardier Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ATR

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hindustan Aeronautics Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Textron Inc

List of Figures

- Figure 1: Indian Aviation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indian Aviation Industry Share (%) by Company 2024

List of Tables

- Table 1: Indian Aviation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indian Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Indian Aviation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Indian Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India Indian Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India Indian Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India Indian Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India Indian Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Indian Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 10: Indian Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Aviation Industry?

The projected CAGR is approximately 3.83%.

2. Which companies are prominent players in the Indian Aviation Industry?

Key companies in the market include Textron Inc, Dassault Aviation, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Leonardo S p A, Bombardier Inc, ATR, Hindustan Aeronautics Limited.

3. What are the main segments of the Indian Aviation Industry?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Delta Air Lines Inc. is in talks with Airbus SE to order wide-body aircraft, Bloomberg News reported Monday, citing people familiar with the matter. The discussion focuses on A350 and A330neo hai twin-aisle aircraft.March 2023: Boeing was awarded a contract by Air India for 220 Boeing aircraft, including 190 737 Max, 20 787, and 10 777X.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Aviation Industry?

To stay informed about further developments, trends, and reports in the Indian Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence