Key Insights

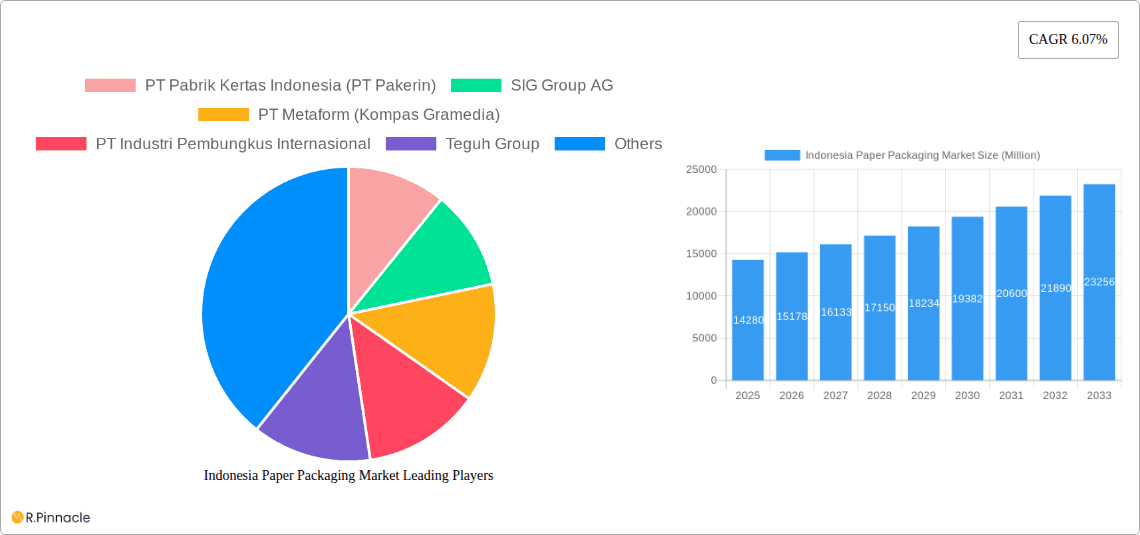

The Indonesia paper packaging market, valued at $14.28 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.07% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, coupled with increasing demand for convenient and safe packaging solutions in healthcare and personal care, significantly contributes to market growth. Furthermore, the rising e-commerce sector necessitates efficient and protective packaging, further bolstering market demand. The increasing adoption of sustainable and eco-friendly packaging materials is also shaping market trends, pushing manufacturers to innovate and offer environmentally responsible options. While challenges exist, such as fluctuating raw material prices and potential supply chain disruptions, the overall market outlook remains positive. Key players like PT Pabrik Kertas Indonesia (PT Pakerin), SIG Group AG, and APP (Asia Pulp & Paper) are strategically positioned to capitalize on these opportunities. The market is segmented by type (folding cartons, corrugated boxes) and end-user industry (food & beverage, healthcare, personal care & household care, industrial), offering diverse avenues for growth. The dominance of corrugated boxes within the packaging type segment is expected to continue, driven by their versatility and cost-effectiveness. The forecast period (2025-2033) presents a promising landscape for investors and businesses operating within this dynamic market. Growth will likely be spurred by government initiatives promoting sustainable practices and an expanding middle class with increased disposable income.

Indonesia Paper Packaging Market Market Size (In Billion)

The Indonesian paper packaging market's growth trajectory reflects the nation's economic development and changing consumer preferences. Strong domestic demand, coupled with potential for export, makes Indonesia a strategically important market for paper packaging companies. While competition among established players is fierce, opportunities exist for new entrants who can differentiate themselves through innovation, sustainability initiatives, and specialized packaging solutions catering to niche market segments. This includes focusing on packaging solutions that meet evolving consumer needs for convenience, product protection, and eco-friendliness. Continuous monitoring of government regulations and environmental concerns will be vital for sustained success within the Indonesian paper packaging market. The consistent growth is expected to continue throughout the forecast period, presenting significant investment opportunities.

Indonesia Paper Packaging Market Company Market Share

Indonesia Paper Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesia paper packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Indonesia Paper Packaging Market Structure & Innovation Trends

The Indonesian paper packaging market exhibits a moderately concentrated structure, with key players like PT Pabrik Kertas Indonesia (PT Pakerin), SIG Group AG, and APP (Asia Pulp & Paper) holding significant market share. However, the market also features numerous smaller players, creating a dynamic competitive landscape. Market share fluctuations are influenced by factors such as pricing strategies, product innovation, and M&A activities. In recent years, several mergers and acquisitions have reshaped the market, with deal values ranging from xx Million to xx Million. The regulatory framework, while generally supportive of industry growth, faces ongoing evolution concerning environmental sustainability. Innovation drivers include increasing demand for eco-friendly packaging solutions and advancements in printing and coating technologies. The primary substitutes are plastic packaging materials, but growing environmental concerns are driving a shift towards paper-based alternatives.

- Market Concentration: Moderately concentrated, with several major players and numerous smaller companies.

- Innovation Drivers: Sustainability concerns, technological advancements in printing and coating.

- Regulatory Framework: Evolving, focusing on environmental sustainability.

- Product Substitutes: Plastic packaging.

- M&A Activity: Significant activity in recent years, with deal values varying widely.

Indonesia Paper Packaging Market Dynamics & Trends

The Indonesian paper packaging market is experiencing robust growth, driven by several key factors. The expanding food and beverage sector, coupled with rising consumer disposable incomes, fuels the demand for attractive and functional packaging. Technological disruptions, including advancements in digital printing and automated packaging solutions, are enhancing efficiency and creating new market opportunities. Consumer preferences are shifting towards eco-friendly and sustainable packaging options, pushing manufacturers to adopt innovative materials and processes. Competitive dynamics are shaped by price competition, product differentiation, and brand loyalty. The market penetration of sustainable packaging is increasing steadily, currently at xx%, and is expected to reach xx% by 2033.

Dominant Regions & Segments in Indonesia Paper Packaging Market

The Java island dominates the Indonesian paper packaging market due to its high population density, robust industrial base, and well-established infrastructure. Within the segments, corrugated boxes hold the largest market share due to their versatility and cost-effectiveness, followed by folding cartons. In the end-user industry, the food and beverage sector accounts for the largest segment, driven by the nation's large and growing population. The healthcare and personal care segments are also exhibiting significant growth.

Key Drivers for Java's Dominance:

- High population density

- Strong industrial infrastructure

- Centralized distribution networks

Dominant Segments:

- By Type: Corrugated Boxes > Folding Cartons

- By End-User: Food & Beverage > Healthcare > Personal Care & Household Care

Indonesia Paper Packaging Market Product Innovations

Recent innovations focus on sustainable materials, improved printability, and enhanced barrier properties. Companies are investing in lightweighting technologies to reduce material usage and improve transportation efficiency. The market is witnessing increasing adoption of bio-based coatings and recycled fiber content to meet growing environmental regulations and consumer demands. These innovations are designed to improve the overall performance and sustainability of paper packaging while maintaining cost-effectiveness.

Report Scope & Segmentation Analysis

This report segments the Indonesian paper packaging market by type (folding cartons and corrugated boxes) and end-user industry (food & beverage, healthcare, personal care & household care, and industrial). Each segment is analyzed based on its market size, growth projections, and competitive dynamics. The forecast period (2025-2033) provides insights into future market potential and growth trajectories for each segment. The report explores the competitive landscape within each segment, highlighting key players and their market strategies.

Key Drivers of Indonesia Paper Packaging Market Growth

Several factors drive the growth of the Indonesian paper packaging market: a rising population leading to increased consumption, expanding e-commerce sector requiring efficient packaging, government initiatives promoting sustainable packaging solutions, and growing investments in the food and beverage sector. These factors collectively create a positive environment for sustained growth in the coming years.

Challenges in the Indonesia Paper Packaging Market Sector

Challenges include the fluctuating prices of raw materials (pulp and paper), increasing competition from alternative packaging materials (especially plastics), and the need for continuous innovation to meet evolving consumer demands and environmental concerns. These factors can impact profitability and market share for individual companies.

Emerging Opportunities in Indonesia Paper Packaging Market

Opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions, the potential for innovation in packaging design and functionality, and the expansion into new end-user markets. Moreover, focusing on the increasing e-commerce sector's packaging needs offers lucrative potential.

Leading Players in the Indonesia Paper Packaging Market Market

- PT Pabrik Kertas Indonesia (PT Pakerin)

- SIG Group AG (SIG Group AG)

- PT Metaform (Kompas Gramedia)

- PT Industri Pembungkus Internasional

- Teguh Group

- Rengo Co Ltd (Rengo Co Ltd)

- International Paper Company (International Paper Company)

- APP (Asia Pulp & Paper) (APP (Asia Pulp & Paper))

- PT Fajar Surya Wisesa Tbk

- PT Pura Barutama

- AR Packaging Group AB (AR Packaging Group AB)

Key Developments in Indonesia Paper Packaging Market Industry

- June 2023: JJGP and Sintesa form a joint venture to produce JANUS, an eco-friendly paper packaging coating. This development significantly impacts the market by offering a sustainable alternative to polyethylene (PE) coatings.

- May 2023: Kraft Heinz invests USD 84 Million in an Indonesian plant, focusing on shifting to paper-based bottles. This highlights the growing trend towards sustainable packaging within the food and beverage sector.

Future Outlook for Indonesia Paper Packaging Market Market

The future of the Indonesian paper packaging market appears promising, with strong growth potential driven by ongoing economic development, increasing consumer spending, and the growing adoption of sustainable packaging practices. Strategic opportunities exist for companies that can effectively innovate, adapt to changing consumer preferences, and efficiently manage their supply chains. The market is expected to witness significant expansion in the coming years, presenting lucrative opportunities for both established players and new entrants.

Indonesia Paper Packaging Market Segmentation

-

1. Type

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Other Types

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Healthcare

- 2.3. Personal Care and Household Care

- 2.4. Industrial

- 2.5. Others End-user Industries

Indonesia Paper Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Paper Packaging Market Regional Market Share

Geographic Coverage of Indonesia Paper Packaging Market

Indonesia Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco-friendly Packaging; Increase in Adoption of Folding Carton by Different Industries

- 3.3. Market Restrains

- 3.3.1. ; Recycling Concerns and Dependence on End-user Uptake

- 3.4. Market Trends

- 3.4.1. Corrugated Boxes Expected to Show Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Household Care

- 5.2.4. Industrial

- 5.2.5. Others End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Pabrik Kertas Indonesia (PT Pakerin)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SIG Group AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Metaform (Kompas Gramedia)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Industri Pembungkus Internasional

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teguh Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rengo Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Paper Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 APP (Asia Pulp & Paper)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Fajar Surya Wisesa Tbk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Pura Barutama*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AR Packaging Group AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 PT Pabrik Kertas Indonesia (PT Pakerin)

List of Figures

- Figure 1: Indonesia Paper Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Paper Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia Paper Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Indonesia Paper Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Paper Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Indonesia Paper Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Indonesia Paper Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Paper Packaging Market?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Indonesia Paper Packaging Market?

Key companies in the market include PT Pabrik Kertas Indonesia (PT Pakerin), SIG Group AG, PT Metaform (Kompas Gramedia), PT Industri Pembungkus Internasional, Teguh Group, Rengo Co Ltd, International Paper Company, APP (Asia Pulp & Paper), PT Fajar Surya Wisesa Tbk, PT Pura Barutama*List Not Exhaustive, AR Packaging Group AB.

3. What are the main segments of the Indonesia Paper Packaging Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco-friendly Packaging; Increase in Adoption of Folding Carton by Different Industries.

6. What are the notable trends driving market growth?

Corrugated Boxes Expected to Show Significant Adoption.

7. Are there any restraints impacting market growth?

; Recycling Concerns and Dependence on End-user Uptake.

8. Can you provide examples of recent developments in the market?

June 2023: JJGP, a Delaware United States corporation, entered into a strategic global joint venture with the Indonesian strategic investment holding company Sintesa, a century-old company dedicated to sustainable development through impact investing. The joint venture will capitalize on patented technology from J&J and the world-class leadership of Sintesa to build the global production capacity of JANUS, an eco-friendly coating for paper packaging, an environmentally friendly coating developed by J&J to replace polyethylene (PE) and its associated environmental risks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence