Key Insights

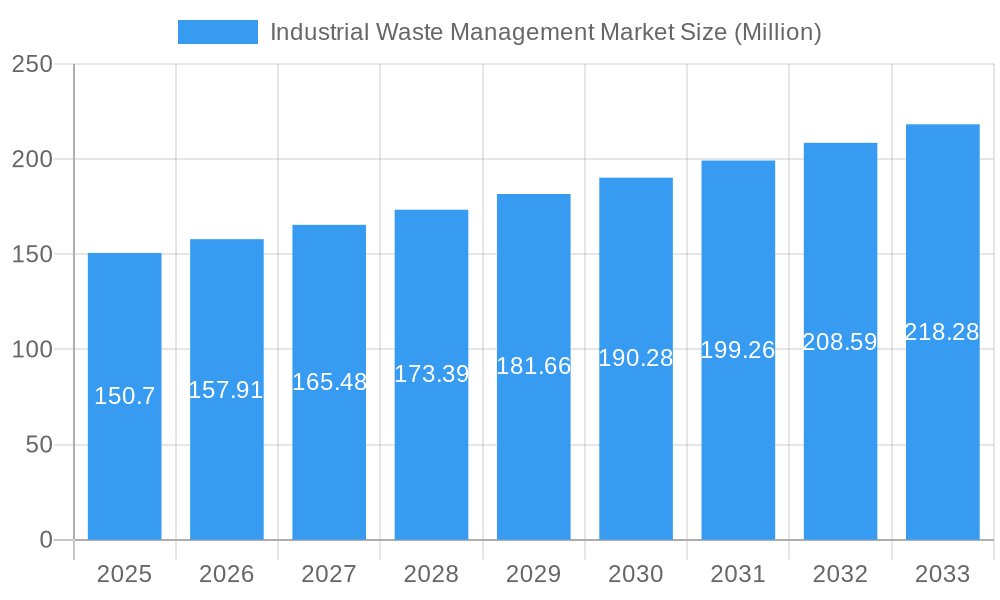

The global industrial waste management market, valued at $150.70 million in 2025, is projected to experience robust growth, driven by stringent environmental regulations, increasing industrialization, and a rising focus on sustainable waste disposal practices. The 4.79% CAGR from 2019-2033 indicates a steadily expanding market, with significant opportunities for established players like Veolia Environnement SA, Suez Environment SA, and Waste Management Inc., as well as emerging companies focusing on innovative technologies. Growth drivers include the increasing generation of hazardous waste from manufacturing and industrial processes, necessitating specialized and safe disposal solutions. Furthermore, the rising adoption of circular economy principles is fueling demand for waste recycling and resource recovery, creating lucrative avenues for companies offering comprehensive waste management services. Challenges, however, include fluctuating raw material prices, stringent permitting processes, and the need for substantial capital investments in advanced waste treatment technologies.

Industrial Waste Management Market Market Size (In Million)

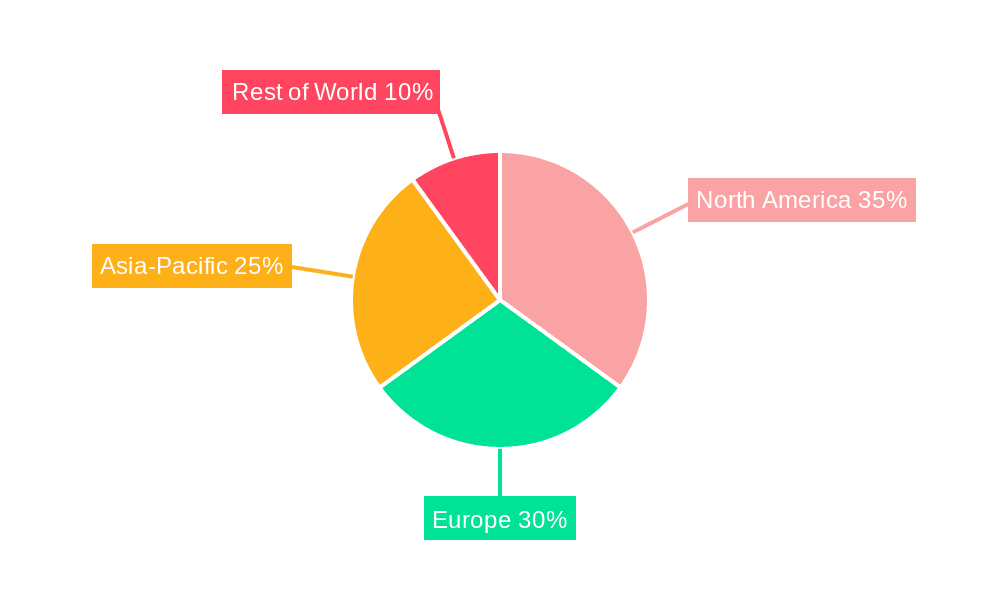

The market's segmentation, although not explicitly provided, can be reasonably inferred. It likely includes categories based on waste type (hazardous, non-hazardous), treatment method (landfill, incineration, recycling, biological treatment), and industry served (manufacturing, energy, construction). Geographic variations are also expected, with developed regions like North America and Europe demonstrating greater market maturity and higher adoption of advanced waste management solutions, while developing economies in Asia-Pacific and Latin America exhibit high growth potential fueled by rapid industrial expansion. The competitive landscape is characterized by both large multinational corporations and smaller specialized companies, indicating a diverse range of service offerings and technological approaches. Future growth will likely depend on continued technological advancements, improved regulatory frameworks, and increasing consumer awareness regarding environmental responsibility.

Industrial Waste Management Market Company Market Share

Industrial Waste Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Industrial Waste Management Market, offering actionable insights for industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report examines market dynamics, key players, and future trends. The market is projected to reach xx Million by 2033, experiencing a CAGR of xx%.

Industrial Waste Management Market Market Structure & Innovation Trends

The Industrial Waste Management Market is characterized by a moderately consolidated structure, with a significant presence of large multinational corporations that collectively hold a substantial market share. Key industry leaders such as Veolia Environnement SA, Suez Environment SA, Republic Services Inc., Waste Connections, Waste Management Inc., Remondis AG & Co Kg, Biffa Group, Clean Harbors Inc., Covanta Holding Corporation, and Daiseki Co Ltd. (this list is representative and not exhaustive) actively compete, fostering a dynamic environment for innovation and shaping market trends. Market share is subject to continuous evolution, influenced by strategic mergers and acquisitions (M&A) and the adoption of cutting-edge technological advancements. Recent M&A activities within the sector have collectively represented an investment of approximately [Insert Specific Value] Million, with a primary strategic focus on broadening geographical reach and enhancing the breadth of service offerings.

- Market Concentration: The top five key players are projected to command an estimated [Insert Percentage]% of the global market share by 2025.

- Innovation Drivers: A primary impetus for innovation stems from increasingly stringent environmental regulations, a growing societal awareness of the critical importance of sustainable waste management practices, and significant technological breakthroughs in waste processing, treatment, and recycling methodologies.

- Regulatory Frameworks: Government policies, directives, and regulations pertaining to waste disposal, recycling, and environmental protection exert a profound influence on market expansion and investment strategies. The inherent variability in regulatory approaches across different regions contributes to a diverse array of market strategies and operational models.

- Product Substitutes: While the availability of direct substitutes is limited, alternative waste management solutions, such as advanced incineration technologies that incorporate energy recovery, are gaining traction. These alternatives can present a competitive challenge to the traditional reliance on landfill services, influencing market dynamics.

- End-User Demographics: The primary clientele for industrial waste management services encompasses a broad spectrum of industrial sectors, including manufacturing, construction, and the energy industry. These sectors exhibit distinct waste generation patterns and consequently possess diverse waste management requirements.

- M&A Activities: Consolidation through mergers and acquisitions remains a prominent and significant trend. These strategic moves are instrumental in achieving enhanced operational efficiencies, expanding market presence, and solidifying market share for leading entities within the industry.

Industrial Waste Management Market Market Dynamics & Trends

The Industrial Waste Management Market is currently experiencing a phase of robust and sustained growth, propelled by a confluence of impactful drivers. The escalating trends of global industrialization and rapid urbanization are directly contributing to increased waste generation volumes, thereby escalating the demand for sophisticated and efficient waste management solutions. Concurrently, significant advancements in technology, including the integration of AI-powered waste sorting systems and the development of highly advanced recycling technologies, are demonstrably enhancing operational efficiencies and concurrently broadening the horizon of market opportunities. Furthermore, a discernible shift in consumer preferences towards environmentally conscious products and services is playing a pivotal role, compelling industries to adopt and prioritize sustainable waste management practices. The competitive landscape is characterized by intense rivalry, where companies are strategically prioritizing innovation, aggressive expansion, and the formation of strategic partnerships to not only maintain but also enhance their competitive standing in the market.

Dominant Regions & Segments in Industrial Waste Management Market

The [Dominant Region, e.g., North America] region currently dominates the Industrial Waste Management Market, driven by factors such as stringent environmental regulations, robust infrastructure, and high levels of industrial activity.

- Key Drivers in [Dominant Region]:

- Stringent environmental regulations promoting recycling and waste reduction.

- Well-developed waste management infrastructure, including collection, processing, and disposal facilities.

- High levels of industrial activity generating substantial volumes of industrial waste.

- Significant government investment in research and development of advanced waste management technologies.

[Detailed dominance analysis of the dominant region, including market size and growth projections for the forecast period (2025-2033). Include a comparative analysis with other significant regions.]

Industrial Waste Management Market Product Innovations

Recent product innovations include advanced sorting technologies using AI and machine learning for improved recycling rates, development of new materials from recycled industrial waste, and implementation of real-time monitoring systems for better waste tracking and management. These innovations offer competitive advantages by improving efficiency, reducing environmental impact, and enhancing compliance with stringent regulations. Technological trends are focused on automation, data analytics, and sustainable material recovery. Market fit is strong due to increasing regulatory pressures and growing demand for environmentally responsible waste management.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Industrial Waste Management Market based on critical parameters including waste type (categorized as hazardous and non-hazardous), treatment methodology (encompassing landfilling, incineration, recycling, and other advanced methods), and the diverse range of end-user industries (including manufacturing, construction, energy, and others). Each of these distinct segments exhibits unique growth trajectories and presents specific competitive dynamics. For instance, the hazardous waste segment is anticipated to experience a comparatively higher Compound Annual Growth Rate (CAGR) than the non-hazardous waste segment, largely attributable to escalating regulatory scrutiny and the implementation of more stringent disposal standards. The recycling segment, in particular, is witnessing substantial growth, a trend strongly supported by the widespread adoption of circular economy initiatives and a burgeoning demand for recycled materials. The projected market size for each individual segment is estimated to reach [Insert Specific Value] Million by the year 2033.

Key Drivers of Industrial Waste Management Market Growth

The sustained and accelerated growth of the Industrial Waste Management Market is being propelled by a number of pivotal factors. Foremost among these are the increasingly stringent environmental regulations being enacted globally, which are actively driving the widespread adoption of more sustainable and responsible waste management practices. The continuing trajectory of industrialization and urbanization, particularly in developing economies, is leading to a substantial increase in waste generation, thereby creating significant opportunities for market expansion. Furthermore, technological advancements in waste processing and recycling, such as the implementation of intelligent AI-powered sorting systems, are instrumental in boosting operational efficiency and effectively minimizing the environmental footprint of waste management operations. Complementing these advancements, government initiatives that actively promote circular economy models and substantial investments in waste management infrastructure are further contributing to the robust growth of the market.

Challenges in the Industrial Waste Management Market Sector

Several challenges hinder market growth. High capital expenditure for setting up advanced waste management facilities presents a major barrier, especially for small and medium-sized enterprises (SMEs). Fluctuating raw material prices and energy costs impact operational profitability. Stringent regulations and compliance requirements can increase operational complexities and costs. Competition among large players can lead to price wars and reduced profit margins. Addressing these challenges is crucial for sustainable market development.

Emerging Opportunities in Industrial Waste Management Market

The Industrial Waste Management Market is ripe with emerging opportunities. These include the pioneering development of innovative technologies geared towards waste-to-energy conversion, which offers a sustainable method for energy generation from waste materials. There is also significant potential in the expansion of recycling facilities specifically designed for the recovery of valuable materials, thereby promoting resource efficiency. The strategic utilization of data analytics presents a promising avenue for optimizing waste management operations, leading to increased efficiency and cost savings. The burgeoning demand for sustainable solutions in developing economies offers substantial untapped market potential, aligning with global sustainability goals. The overarching concept of the circular economy is actively fostering the creation of novel business models that prioritize resource recovery and waste minimization. Moreover, the intensifying global focus on reducing carbon footprints is creating significant opportunities for the development and implementation of technologies designed to effectively mitigate emissions.

Leading Players in the Industrial Waste Management Market Market

- Veolia Environnement SA

- Suez Environment SA

- Republic Services Inc

- Waste Connections

- Waste Management Inc

- Remondis AG & Co Kg

- Biffa Group

- Clean Harbors Inc

- Covanta Holding Corporation

- Daiseki Co Ltd

Key Developments in Industrial Waste Management Market Industry

- November 2023: NEC Corporation Ltd. launched a real-time industrial waste monitoring system in Thailand, improving waste tracking and reducing illegal disposal.

- November 2023: P&G initiated a digital watermarking test in France for enhanced recycling through the Holy Grail 2.0 program.

- May 2023: Waste Management Inc. announced plans to build a new construction and demolition recycling plant with a capacity of 1,200 tonnes per day.

Future Outlook for Industrial Waste Management Market Market

The Industrial Waste Management Market is poised for continued growth, driven by increasing environmental awareness, stringent regulations, and technological advancements. Strategic investments in research and development, expansion into new markets, and adoption of sustainable business practices will be key to success. The focus on circular economy principles and resource recovery will shape the future of the industry. Growing demand for sustainable waste management solutions in emerging economies presents significant growth opportunities for market players.

Industrial Waste Management Market Segmentation

-

1. Disposal Methods

- 1.1. Landfill

- 1.2. Incineration

- 1.3. Recycling

-

2. Type

- 2.1. Hazardous

- 2.2. Non-hazardous

Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Industrial Waste Management Market Regional Market Share

Geographic Coverage of Industrial Waste Management Market

Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Environmental Regulations; Growing Awareness of Sustainability

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Growing Awareness of Sustainability

- 3.4. Market Trends

- 3.4.1. A Growing Demand for Industrial Waste Management is Anticipated in Asia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.1.1. Landfill

- 5.1.2. Incineration

- 5.1.3. Recycling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hazardous

- 5.2.2. Non-hazardous

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 6. North America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 6.1.1. Landfill

- 6.1.2. Incineration

- 6.1.3. Recycling

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Hazardous

- 6.2.2. Non-hazardous

- 6.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 7. Europe Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 7.1.1. Landfill

- 7.1.2. Incineration

- 7.1.3. Recycling

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Hazardous

- 7.2.2. Non-hazardous

- 7.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 8. Asia Pacific Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 8.1.1. Landfill

- 8.1.2. Incineration

- 8.1.3. Recycling

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Hazardous

- 8.2.2. Non-hazardous

- 8.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 9. Middle East and Africa Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 9.1.1. Landfill

- 9.1.2. Incineration

- 9.1.3. Recycling

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Hazardous

- 9.2.2. Non-hazardous

- 9.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 10. Latin America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 10.1.1. Landfill

- 10.1.2. Incineration

- 10.1.3. Recycling

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Hazardous

- 10.2.2. Non-hazardous

- 10.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Veolia Environnement SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Suez Environment SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Republic Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Waste Connections

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Management Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Remondis AG & Co Kg

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Biffa Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clean Harbors Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Covanta Holding Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Daiseki Co Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Veolia Environnement SA

List of Figures

- Figure 1: Global Industrial Waste Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Waste Management Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 4: North America Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 5: North America Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 6: North America Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 7: North America Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 9: North America Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 16: Europe Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 17: Europe Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 18: Europe Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 19: Europe Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 28: Asia Pacific Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 29: Asia Pacific Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 30: Asia Pacific Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 31: Asia Pacific Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 32: Asia Pacific Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 33: Asia Pacific Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 40: Middle East and Africa Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 41: Middle East and Africa Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 42: Middle East and Africa Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 43: Middle East and Africa Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Middle East and Africa Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Middle East and Africa Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East and Africa Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 52: Latin America Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 53: Latin America Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 54: Latin America Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 55: Latin America Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Latin America Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 57: Latin America Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Latin America Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Latin America Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Latin America Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 2: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 3: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Global Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 8: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 9: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 18: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 19: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Germany Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 34: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 35: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 37: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Japan Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: India Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: South Korea Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 50: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 51: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 56: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 57: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 59: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Waste Management Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Industrial Waste Management Market?

Key companies in the market include Veolia Environnement SA, Suez Environment SA, Republic Services Inc, Waste Connections, Waste Management Inc, Remondis AG & Co Kg, Biffa Group, Clean Harbors Inc, Covanta Holding Corporation, Daiseki Co Ltd**List Not Exhaustive.

3. What are the main segments of the Industrial Waste Management Market?

The market segments include Disposal Methods, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Environmental Regulations; Growing Awareness of Sustainability.

6. What are the notable trends driving market growth?

A Growing Demand for Industrial Waste Management is Anticipated in Asia.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Growing Awareness of Sustainability.

8. Can you provide examples of recent developments in the market?

November 2023: NEC Corporation Ltd announced the successful installation and delivery of a real-time industrial waste monitoring system to promote effective waste management in Thailand's industry estates. The system, designed in collaboration with the Industrial Estate Authority of Thailand, gives the ability to track, observe, and manage the movement of industrial waste from source to disposal. This system helps reduce the risk of illegal waste disposal and ensures the safety of the environment and the public.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence