Key Insights

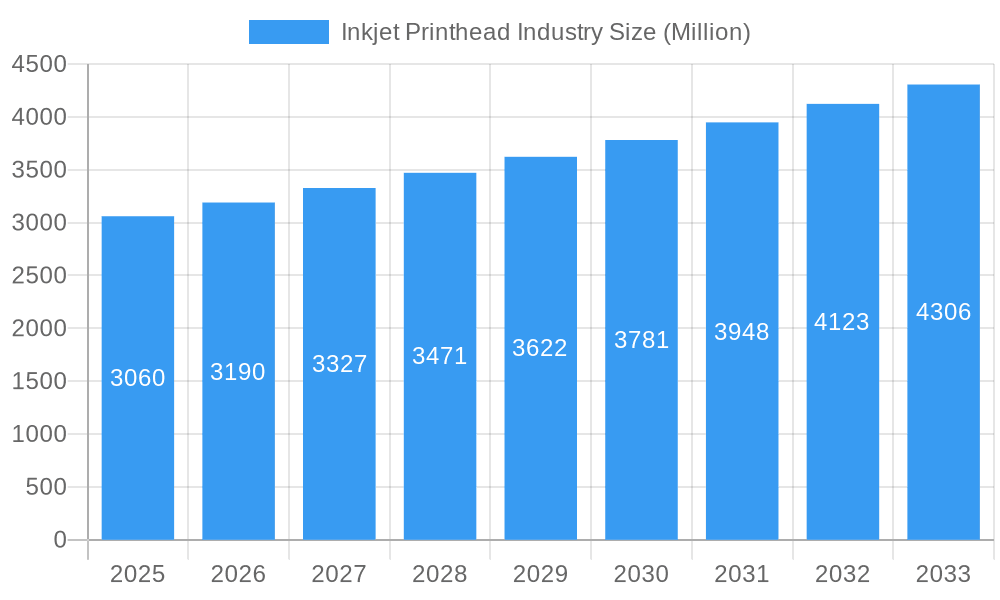

The inkjet printhead market, valued at $3.06 billion in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. A Compound Annual Growth Rate (CAGR) of 4.28% from 2025 to 2033 indicates a significant expansion of this market. Key drivers include the rising adoption of inkjet technology in high-volume industrial printing applications, particularly in packaging and textile printing, where its versatility and high-speed capabilities offer significant advantages over traditional methods. The ongoing miniaturization of printheads through advancements in MEMS-based technology is also fueling market growth, enabling higher print resolutions and improved efficiency. Growth is further supported by the increasing demand for high-quality, personalized printing solutions in the office and consumer segments. However, the market faces certain restraints, including the relatively high initial investment costs for advanced inkjet systems and the potential for technological disruptions from emerging print technologies. Nevertheless, the continuous innovation in inkjet technology and the expanding applications across various end-user segments ensure a positive outlook for the market's future.

Inkjet Printhead Industry Market Size (In Billion)

The segmentation of the inkjet printhead market reveals diverse opportunities. The piezoelectric technology, offering continuous inkjet capabilities, holds a significant market share due to its precision and versatility in various applications. The MEMS-based segment is experiencing rapid growth, driven by its ability to produce smaller, more energy-efficient printheads. The industrial printing sector accounts for a substantial portion of the market share, surpassing office and consumer applications in terms of revenue generation. This is attributable to the increasing demand for high-throughput, high-quality printing in packaging, textile, and other industrial segments. Leading players like Konica Minolta, Ricoh, Canon, and Epson, along with specialized firms like Xaar and Memjet, are actively engaged in research and development, contributing to technological innovation and driving market competition. Regional growth is expected to be fairly balanced, though Asia-Pacific, driven by China and India's expanding manufacturing sectors, may witness accelerated growth compared to other regions.

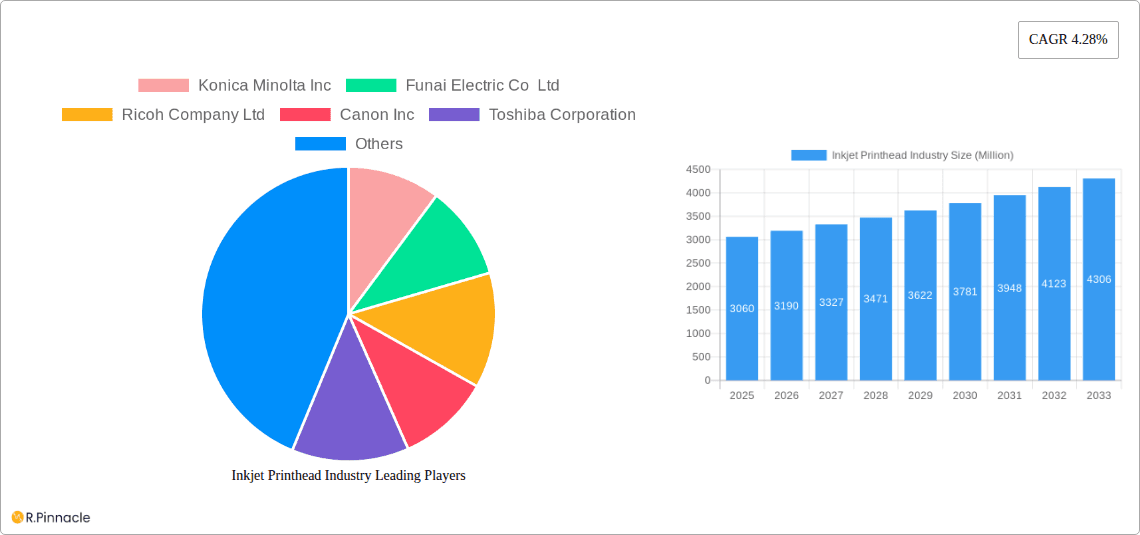

Inkjet Printhead Industry Company Market Share

Inkjet Printhead Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the inkjet printhead industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, technological advancements, and competitive landscapes. The report projects a market valued at $XX Million by 2033.

Inkjet Printhead Industry Market Structure & Innovation Trends

The global inkjet printhead market is characterized by a moderately concentrated structure, with a few dominant players shaping its landscape. Leading entities such as Konica Minolta Inc., Ricoh Company Ltd., Canon Inc., Seiko Epson Corporation, and Hewlett-Packard Development Company LP command a significant portion of the market share. While precise figures for 2024 are still emerging, industry estimates suggest these key players collectively hold a substantial majority, exceeding 60% of the market. The relentless pursuit of innovation within this sector is primarily driven by the escalating demand for higher printing resolutions, faster print speeds, enhanced compatibility with a wider range of inks (including UV-curable and aqueous inks), and a consistent push towards cost reduction. Furthermore, evolving regulatory frameworks, with a strong emphasis on environmental impact and material safety, are actively influencing product development cycles and material choices. Although the market experiences some degree of substitution from alternative printing technologies, inkjet technology continues to maintain its stronghold across numerous critical segments. Mergers and acquisitions (M&A) activity has been observed as moderate, with an estimated aggregate deal value of approximately $XX Million over the past five years. A significant trend is the noticeable shift in end-user demographics, with a pronounced and growing demand emanating from the industrial and graphic printing sectors, signaling a move beyond traditional office and consumer applications.

- Market Concentration: The market exhibits moderate concentration, with a select group of major players collectively dominating, estimated to hold over 60% of the global market share.

- Key Innovation Drivers: The primary catalysts for innovation include the pursuit of higher printing resolutions, accelerated print speeds, broader ink compatibility, significant cost reductions, and compliance with stringent environmental and material safety regulations.

- M&A Landscape: M&A activity remains moderate, with an estimated total deal value of $XX Million recorded between 2019 and 2024.

- End-User Dynamics: A clear demographic shift is underway, with an increasing demand originating from the industrial and graphic printing segments.

Inkjet Printhead Industry Market Dynamics & Trends

The inkjet printhead market is experiencing robust growth, driven by increasing demand from various end-user segments, particularly industrial and graphic printing. Technological advancements such as the development of MEMS-based printheads are enabling higher resolutions and improved print quality. Consumer preferences are shifting towards high-quality, cost-effective printing solutions, fueling the demand for innovative printheads. Competitive dynamics are intense, with major players investing heavily in R&D to maintain their market positions. The market's Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033), with significant market penetration in emerging economies expected.

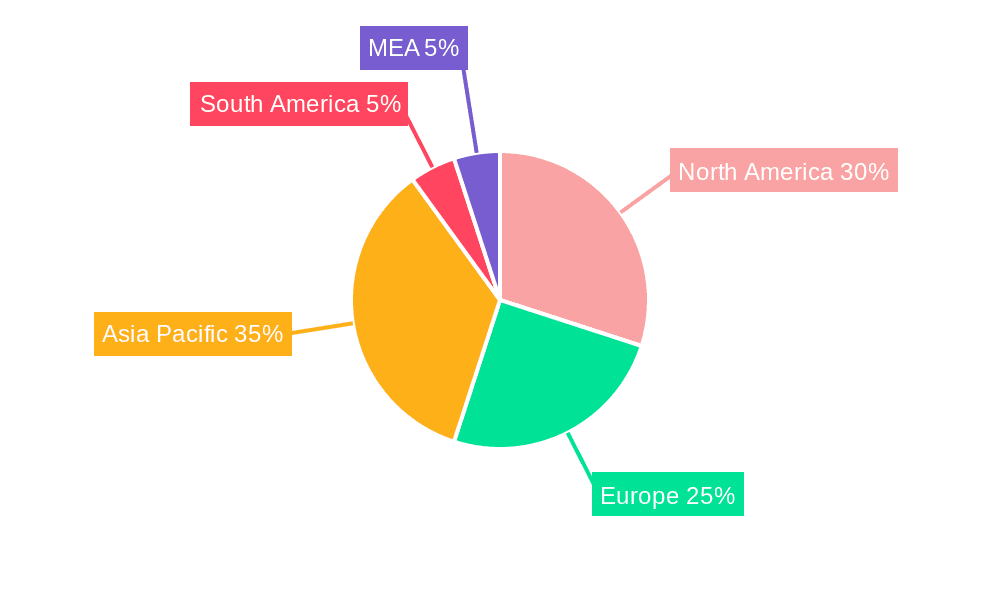

Dominant Regions & Segments in Inkjet Printhead Industry

North America currently holds the largest market share in the inkjet printhead industry due to strong demand from various sectors, including industrial, graphic, and office/consumer-based printing. However, Asia-Pacific is anticipated to showcase the highest growth rate in the forecast period.

- By Type: MEMS-based printheads are experiencing the fastest growth rate due to their advanced features.

- By End-user Type: Industrial printing is witnessing substantial growth, driven by the increasing demand for high-quality printing in packaging, textiles, and other applications.

- By Technology Type: Drop-on-demand technology dominates the market due to its versatility and ease of use.

- Key Drivers:

- North America: Strong demand across various sectors, well-established infrastructure.

- Asia-Pacific: Rapid economic growth, increasing industrialization, and rising disposable incomes.

- Europe: High adoption of advanced printing technologies, stringent environmental regulations.

Inkjet Printhead Industry Product Innovations

Recent innovations in inkjet printheads include increased circulation technology (Kyocera's KJ4B-EX1200-RC) offering superior jetting performance and Epson's I1600-A1 MEMS head featuring high-density resolution and exceptional durability. These advancements are improving print quality, speed, and cost-effectiveness, enhancing market penetration across diverse printing applications including packaging, commercial printing, and high-resolution imaging.

Report Scope & Segmentation Analysis

This comprehensive report meticulously dissects the inkjet printhead market, offering detailed segmentation across various dimensions. The analysis categorizes the market by core technology type, focusing on advancements in "drop-on-demand" (DOD) systems. Further segmentation is provided by the specific type of printhead, encompassing MEMS-based technologies, conventional printheads, and piezo-based approaches (including continuous inkjet systems). Crucially, the report also segments the market by end-user type, differentiating between office & consumer-based applications, industrial printing solutions, and the vibrant graphic printing sector. Within each of these defined segments, the report delivers in-depth analyses of projected growth trajectories, precise market size estimations, and a thorough evaluation of the competitive dynamics at play.

Key Drivers of Inkjet Printhead Industry Growth

The robust growth trajectory of the inkjet printhead industry is propelled by a confluence of powerful factors. A primary driver is the escalating demand for high-quality, visually compelling printing solutions across an expansive array of industries, including but not limited to packaging, textiles, and large-format signage. This demand is further amplified by continuous advancements in printhead technology itself, which are consistently delivering higher resolutions and remarkable increases in print speeds. The ever-expanding scope of digital printing applications, from personalized marketing materials to on-demand manufacturing, also plays a pivotal role. Moreover, governmental policies and regulations that actively promote and incentivize the adoption of sustainable and eco-friendly printing solutions are proving to be significant contributors to the market's sustained expansion.

Challenges in the Inkjet Printhead Industry Sector

Challenges include the intense competition among established players, price pressures from cheaper alternatives, supply chain disruptions impacting the availability of components, and stringent environmental regulations necessitating material innovation and cost management. These factors can impact profitability and market growth.

Emerging Opportunities in Inkjet Printhead Industry

The landscape of the inkjet printhead industry is replete with promising emerging opportunities. A key area of growth lies in the burgeoning demand for specialized printing applications, such as the additive manufacturing of 3D objects, the precise deposition of functional materials for flexible electronics, and the development of printed circuit boards. The ongoing research and development into eco-friendly inks and sustainable printhead materials presents another significant avenue for innovation and market penetration. Furthermore, the strategic expansion into new and developing geographic markets, where the adoption of digital printing is still in its nascent stages, offers substantial growth potential. Innovations stemming from breakthroughs in materials science and advanced manufacturing processes are poised to unlock entirely new product categories and market segments for inkjet printhead manufacturers.

Leading Players in the Inkjet Printhead Industry Market

- Konica Minolta Inc

- Funai Electric Co Ltd

- Ricoh Company Ltd

- Canon Inc

- Toshiba Corporation

- Kyocera Corporation

- Seiko Epson Corporation

- Hewlett-Packard Development Company LP

- FUJIFILM Holdings Corporation

- Xaar PLC

- Memjet Holdings Limited

Key Developments in Inkjet Printhead Industry

- June 2023: Epson has introduced the I1600-A1 printhead, a cost-effective solution designed with MEMS technology. It boasts a high resolution of 600 DPI and exceptional durability, catering to a wide range of printing needs.

- February 2024: Kyocera Corporation has unveiled its advanced KJ4B-EX1200-RC printhead. This innovative product features enhanced circulation technology, significantly improving jetting performance and adaptability for diverse printing applications across various industrial sectors.

Future Outlook for Inkjet Printhead Industry Market

The inkjet printhead market is poised for continued growth, driven by technological innovations, expanding applications across various industries, and increasing demand in emerging economies. Strategic partnerships, mergers and acquisitions, and investments in R&D will shape the future competitive landscape, presenting significant growth opportunities for key players.

Inkjet Printhead Industry Segmentation

-

1. Technology Type

-

1.1. Drop-on-demand

- 1.1.1. Thermal

- 1.1.2. Piezo-based

- 1.2. Continuous

-

1.1. Drop-on-demand

-

2. Type

- 2.1. MEMS-based

- 2.2. Conventional

-

3. End-user Type

- 3.1. Office and Consumer-Based

- 3.2. Industrial Printing

- 3.3. Graphic Printing

Inkjet Printhead Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Inkjet Printhead Industry Regional Market Share

Geographic Coverage of Inkjet Printhead Industry

Inkjet Printhead Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Piezo-Based Printheads Witnessing Higher Adoption in Industrial and Commercial Segments; Ongoing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Cost Remains a Key Prohibitive Factor Compared to Other Technologies

- 3.4. Market Trends

- 3.4.1. Industrial Printing to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Drop-on-demand

- 5.1.1.1. Thermal

- 5.1.1.2. Piezo-based

- 5.1.2. Continuous

- 5.1.1. Drop-on-demand

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. MEMS-based

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by End-user Type

- 5.3.1. Office and Consumer-Based

- 5.3.2. Industrial Printing

- 5.3.3. Graphic Printing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. North America Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Drop-on-demand

- 6.1.1.1. Thermal

- 6.1.1.2. Piezo-based

- 6.1.2. Continuous

- 6.1.1. Drop-on-demand

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. MEMS-based

- 6.2.2. Conventional

- 6.3. Market Analysis, Insights and Forecast - by End-user Type

- 6.3.1. Office and Consumer-Based

- 6.3.2. Industrial Printing

- 6.3.3. Graphic Printing

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Europe Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Drop-on-demand

- 7.1.1.1. Thermal

- 7.1.1.2. Piezo-based

- 7.1.2. Continuous

- 7.1.1. Drop-on-demand

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. MEMS-based

- 7.2.2. Conventional

- 7.3. Market Analysis, Insights and Forecast - by End-user Type

- 7.3.1. Office and Consumer-Based

- 7.3.2. Industrial Printing

- 7.3.3. Graphic Printing

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Asia Pacific Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Drop-on-demand

- 8.1.1.1. Thermal

- 8.1.1.2. Piezo-based

- 8.1.2. Continuous

- 8.1.1. Drop-on-demand

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. MEMS-based

- 8.2.2. Conventional

- 8.3. Market Analysis, Insights and Forecast - by End-user Type

- 8.3.1. Office and Consumer-Based

- 8.3.2. Industrial Printing

- 8.3.3. Graphic Printing

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Latin America Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Drop-on-demand

- 9.1.1.1. Thermal

- 9.1.1.2. Piezo-based

- 9.1.2. Continuous

- 9.1.1. Drop-on-demand

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. MEMS-based

- 9.2.2. Conventional

- 9.3. Market Analysis, Insights and Forecast - by End-user Type

- 9.3.1. Office and Consumer-Based

- 9.3.2. Industrial Printing

- 9.3.3. Graphic Printing

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Middle East and Africa Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology Type

- 10.1.1. Drop-on-demand

- 10.1.1.1. Thermal

- 10.1.1.2. Piezo-based

- 10.1.2. Continuous

- 10.1.1. Drop-on-demand

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. MEMS-based

- 10.2.2. Conventional

- 10.3. Market Analysis, Insights and Forecast - by End-user Type

- 10.3.1. Office and Consumer-Based

- 10.3.2. Industrial Printing

- 10.3.3. Graphic Printing

- 10.1. Market Analysis, Insights and Forecast - by Technology Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Konica Minolta Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Funai Electric Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ricoh Company Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canon Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toshiba Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kyocera Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Seiko Epson Corporatio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hewlett-Packard Development Company LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FUJIFILM Holdings Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 XAAR PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Memjet Holdings Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global Inkjet Printhead Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 3: North America Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 4: North America Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 7: North America Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 8: North America Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 11: Europe Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 12: Europe Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 15: Europe Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 16: Europe Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 19: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 20: Asia Pacific Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 27: Latin America Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 28: Latin America Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 31: Latin America Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 32: Latin America Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 35: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 36: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 39: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 40: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 2: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 4: Global Inkjet Printhead Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 6: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 8: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 10: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 16: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 18: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 20: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 22: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 24: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inkjet Printhead Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Inkjet Printhead Industry?

Key companies in the market include Konica Minolta Inc, Funai Electric Co Ltd, Ricoh Company Ltd, Canon Inc, Toshiba Corporation, Kyocera Corporation, Seiko Epson Corporatio, Hewlett-Packard Development Company LP, FUJIFILM Holdings Corporation, XAAR PLC, Memjet Holdings Limited.

3. What are the main segments of the Inkjet Printhead Industry?

The market segments include Technology Type, Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Piezo-Based Printheads Witnessing Higher Adoption in Industrial and Commercial Segments; Ongoing Technological Advancements.

6. What are the notable trends driving market growth?

Industrial Printing to Witness Major Growth.

7. Are there any restraints impacting market growth?

Cost Remains a Key Prohibitive Factor Compared to Other Technologies.

8. Can you provide examples of recent developments in the market?

February 2024: A new inkjet printhead featuring increased circulation technology was developed by Kyocera Corporation. With compatibility with a wide range of inks, the new KJ4B-EX1200-RC offers industry-leading jetting performance across a wide range of printing applications, including package and commercial printing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inkjet Printhead Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inkjet Printhead Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inkjet Printhead Industry?

To stay informed about further developments, trends, and reports in the Inkjet Printhead Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence