Key Insights

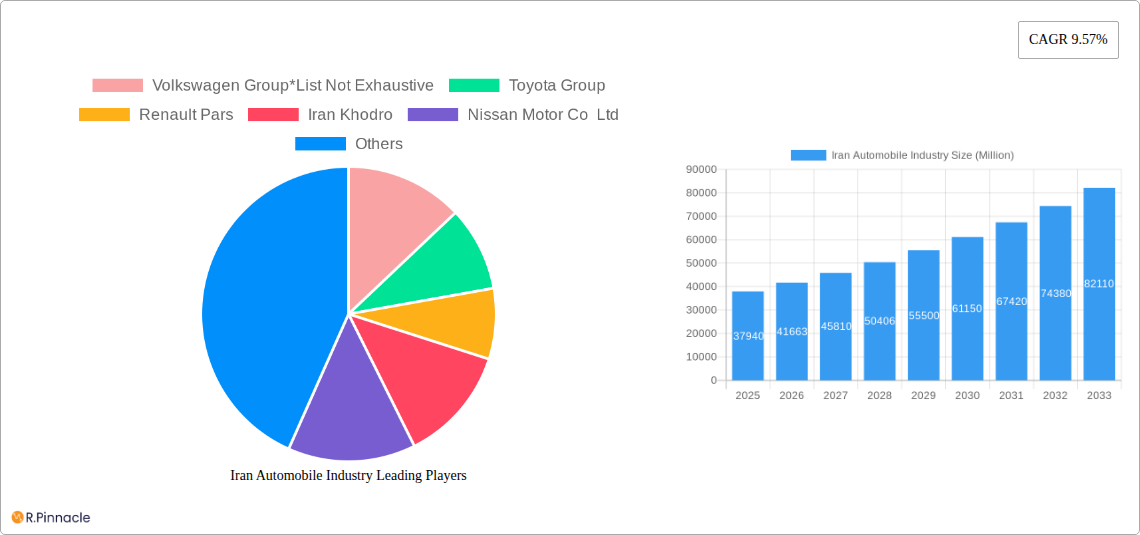

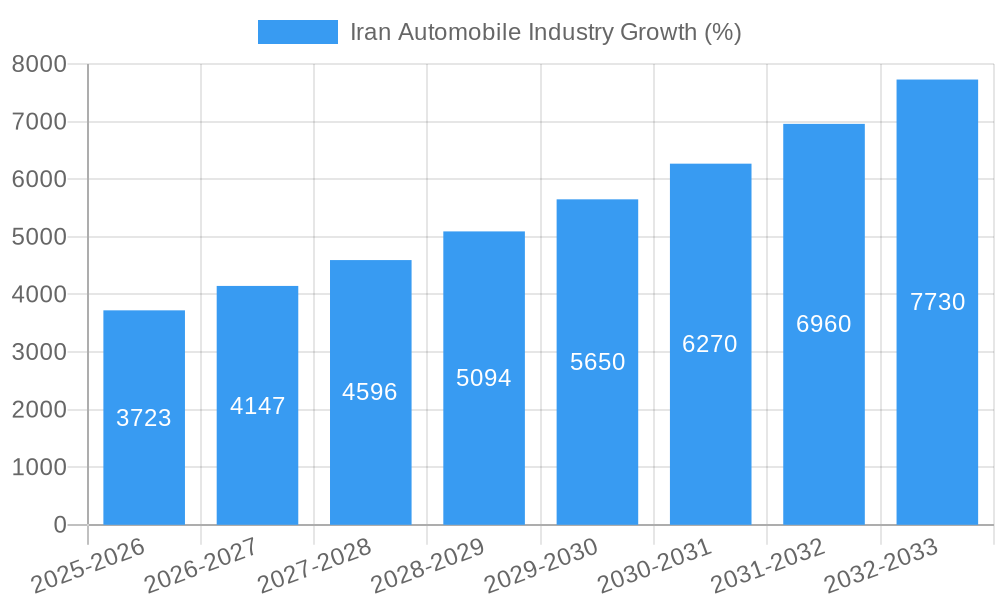

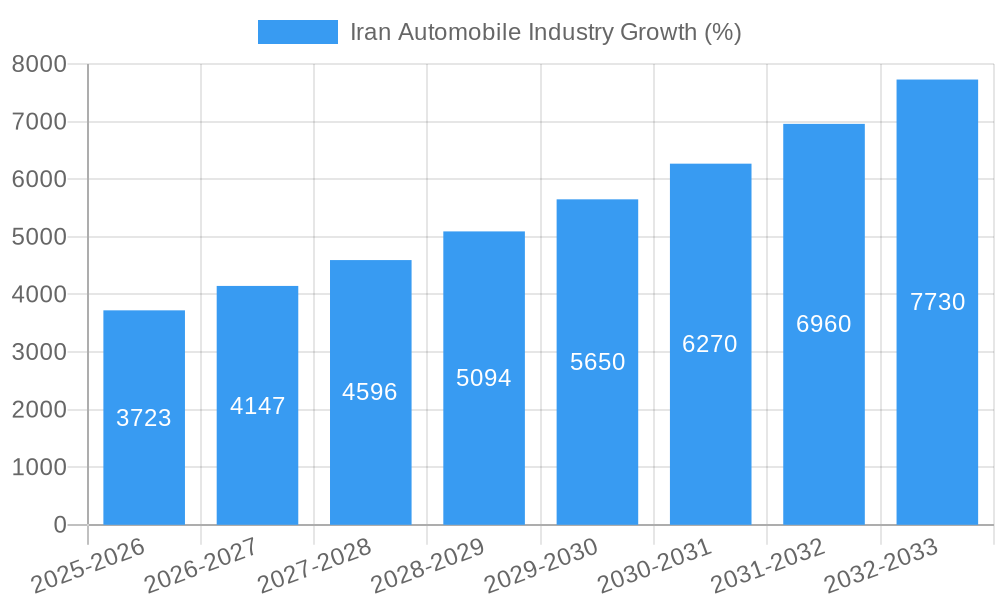

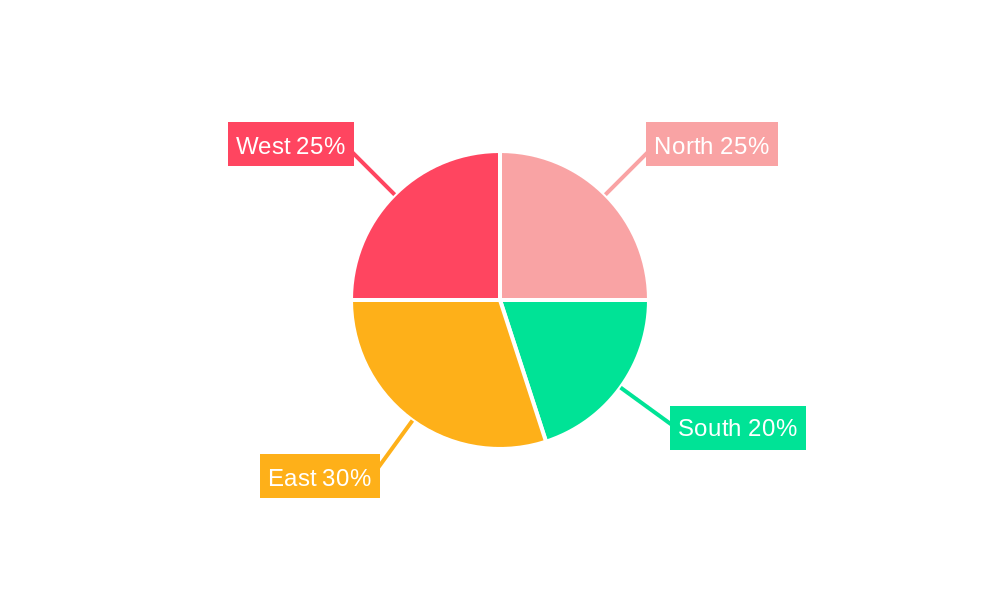

The Iranian automobile industry, valued at $37.94 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 9.57% from 2025 to 2033. This expansion is driven by several factors. Increasing disposable incomes and a growing young population are fueling demand for personal vehicles, particularly passenger cars. Government initiatives aimed at infrastructure development and improving road networks further stimulate market growth. Furthermore, a shift towards domestically produced vehicles, spurred by import restrictions and a focus on self-reliance, is bolstering the industry's performance. However, challenges persist. Sanctions imposed on Iran have impacted access to crucial components and technology, hindering production capacity and limiting innovation. Economic volatility and fluctuations in the national currency also create uncertainty and potentially constrain investment. The industry's future hinges on overcoming these obstacles and adapting to evolving global trends, including a growing preference for electric vehicles and sustainable mobility solutions. Competition among major players like Volkswagen Group, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, and SAIPA Group is fierce, necessitating continuous product innovation and strategic partnerships to maintain market share. Segmentation by vehicle type (passenger and commercial) and fuel type (internal combustion engine and electric) reveals distinct market dynamics, with the electric vehicle segment poised for significant growth as government regulations and technological advancements promote their adoption. Regional variations within Iran (North, South, East, West) also influence market demand, requiring targeted strategies from industry players.

The forecast period (2025-2033) presents both opportunities and risks for the Iranian automobile industry. Successfully navigating sanctions and economic uncertainty is critical for sustaining growth. Investing in research and development to enhance technological capabilities and focusing on producing fuel-efficient and environmentally friendly vehicles will be essential for long-term success in a global market increasingly focused on sustainability. The industry's strategic response to these challenges will shape its future trajectory and determine its ability to meet the growing demand for personal and commercial vehicles within Iran. Diversification of production, exploring partnerships with international firms, and focusing on cost-effective manufacturing solutions are key to maximizing growth potential.

Iran Automobile Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Iranian automobile industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. Expect detailed analysis on market structure, dynamics, leading players, and future growth potential, all supported by robust data and projections. This report is essential for understanding the complexities and opportunities within this dynamic market.

Iran Automobile Industry Market Structure & Innovation Trends

This section analyzes the Iranian automobile market's competitive landscape, innovation drivers, and regulatory environment. We delve into market concentration, examining the market share held by key players such as Iran Khodro and SAIPA Group, alongside international players like the Volkswagen Group, Toyota Group, and Renault Pars. The report also quantifies M&A activity within the sector, estimating deal values in Millions for the period 2019-2024 at xx Million.

- Market Concentration: The Iranian automobile market exhibits a concentrated structure with xx% market share controlled by the top three players in 2024. This concentration is expected to [increase/decrease] slightly by 2033, with [quantifiable prediction].

- Innovation Drivers: Government initiatives promoting technological advancement and domestic production, along with increasing consumer demand for advanced features, drive innovation.

- Regulatory Framework: Government regulations, including emission standards and safety regulations, significantly influence industry developments. The impact of sanctions and their potential relaxation on market dynamics will be meticulously assessed.

- Product Substitutes: The availability of used imported vehicles and the emergence of ride-hailing services represent potential substitutes.

- End-User Demographics: The report analyzes consumer preferences across different age groups and income levels, focusing on vehicle type and fuel type preferences.

- M&A Activity: The report analyzes significant M&A deals, including deal values and their strategic implications for market consolidation and technological advancement.

Iran Automobile Industry Market Dynamics & Trends

This section explores the key dynamics shaping the Iranian automobile industry. We examine market growth drivers, focusing on factors like population growth, increasing urbanization, and government initiatives supporting infrastructure development. Technological disruptions, such as the adoption of electric vehicles (EVs) and connected car technologies, are analyzed in detail. Furthermore, we examine consumer preferences and shifting demand trends for passenger cars versus commercial vehicles and the penetration of IC engine versus electric vehicles. We project a CAGR of xx% for the overall market between 2025 and 2033, with the passenger vehicle segment exhibiting a CAGR of xx% and the commercial vehicle segment a CAGR of xx%. Market penetration of electric vehicles is projected to reach xx% by 2033.

Dominant Regions & Segments in Iran Automobile Industry

This section identifies the leading regions and segments within the Iranian automobile market. Dominance is analyzed based on sales volume, market share, and future growth potential.

By Vehicle Type:

- Passenger Vehicles: The passenger vehicle segment dominates the market, driven by rising disposable incomes and an increasing preference for private transportation. Key factors contributing to dominance include expanding road networks and evolving consumer preferences.

- Commercial Vehicles: The commercial vehicle segment is also significant, with growth driven by increasing industrial activity and infrastructure development. Specific factors driving growth, including government projects and construction, will be included.

By Fuel Type:

- IC Engine: While IC Engine vehicles currently represent the bulk of the market, their dominance is expected to gradually decrease due to increasing environmental concerns and government initiatives to promote electric vehicles.

- Electric Vehicles: The electric vehicle segment is still nascent but is expected to experience significant growth over the forecast period, driven by government subsidies and increasing consumer awareness of environmental sustainability.

Iran Automobile Industry Product Innovations

This section summarizes recent product developments, including advancements in engine technology, safety features, and connected car technologies. We analyze how these innovations are shaping the competitive landscape and meeting changing consumer demands, considering the impact of sanctions and their influence on technological adoption.

Report Scope & Segmentation Analysis

This report segments the Iranian automobile market by vehicle type (passenger and commercial) and fuel type (IC engine and electric). Growth projections, market sizes (in Millions), and competitive dynamics are provided for each segment. Detailed analysis of market sizes will be presented for each segment for 2025 and 2033, including the effect of potential sanctions easing on foreign investment.

Key Drivers of Iran Automobile Industry Growth

Key drivers of growth in the Iranian automobile industry include government support for domestic production, expanding road infrastructure, increasing urbanization, and a growing middle class with rising disposable incomes. Government policies promoting technological advancement, such as incentives for electric vehicle adoption, also play a crucial role.

Challenges in the Iran Automobile Industry Sector

Challenges facing the Iranian automobile industry include the impact of international sanctions on access to technology and components, intense competition, and supply chain disruptions. The regulatory environment, with its potential for instability and the influence of political shifts, presents additional challenges. Quantifiable impacts of these challenges on production and sales will be evaluated.

Emerging Opportunities in Iran Automobile Industry

Emerging opportunities include the growth potential in the electric vehicle segment, the expansion of the automotive parts manufacturing industry, and the possibility of increased foreign investment following potential sanctions relief. The development of connected car technologies and associated services also represents significant opportunities.

Leading Players in the Iran Automobile Industry Market

- Volkswagen Group

- Toyota Group

- Renault Pars

- Iran Khodro

- Nissan Motor Co Ltd

- Brilliance Automobile Group

- Hyundai Kia Automotive Group

- SAIPA Group

Key Developments in Iran Automobile Industry Industry

- [Date]: Launch of a new electric vehicle model by Iran Khodro. Impact: Increased competition in the EV segment.

- [Date]: Joint venture between a foreign automaker and an Iranian company. Impact: Enhanced technological capabilities and increased production capacity.

- [Date]: Government policy changes affecting import tariffs. Impact: Alterations in market competitiveness.

- Further key developments with dates and impacts will be added.

Future Outlook for Iran Automobile Industry Market

The future of the Iranian automobile industry is poised for growth, driven by government initiatives, infrastructure improvements, and increasing consumer demand. However, continued success hinges on the successful navigation of challenges related to sanctions, competition, and technological advancements. The potential easing of sanctions could significantly impact foreign investment and boost market growth considerably.

Iran Automobile Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. IC Engines

- 2.2. Electric

Iran Automobile Industry Segmentation By Geography

- 1. Iran

Iran Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. IC Engines

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volkswagen Group*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toyota Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Renault Pars

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Iran Khodro

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nissan Motor Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Brilliance Automobile Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hyundai Kia Automotive Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAIPA Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Volkswagen Group*List Not Exhaustive

List of Figures

- Figure 1: Iran Automobile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Automobile Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Iran Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Iran Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Automobile Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Automobile Industry?

Key companies in the market include Volkswagen Group*List Not Exhaustive, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, SAIPA Group.

3. What are the main segments of the Iran Automobile Industry?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passenger Car Segment to Witness Highest Growth.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Automobile Industry?

To stay informed about further developments, trends, and reports in the Iran Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence