Key Insights

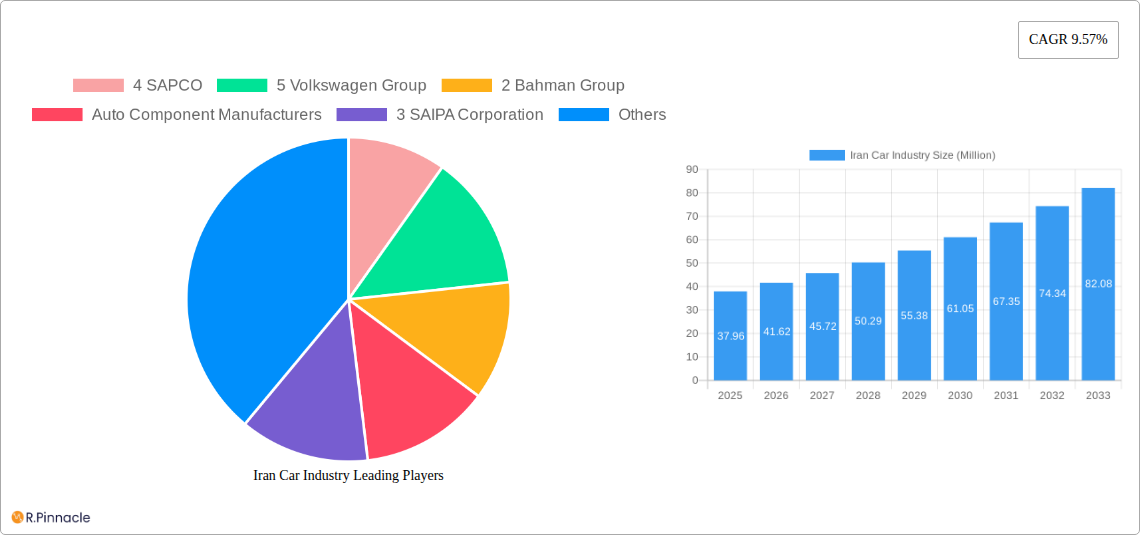

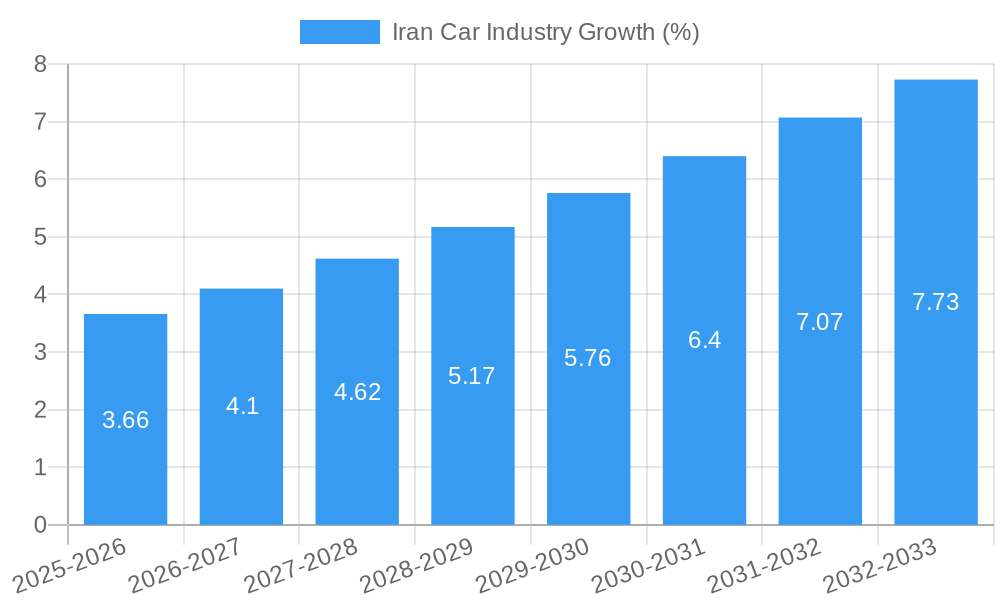

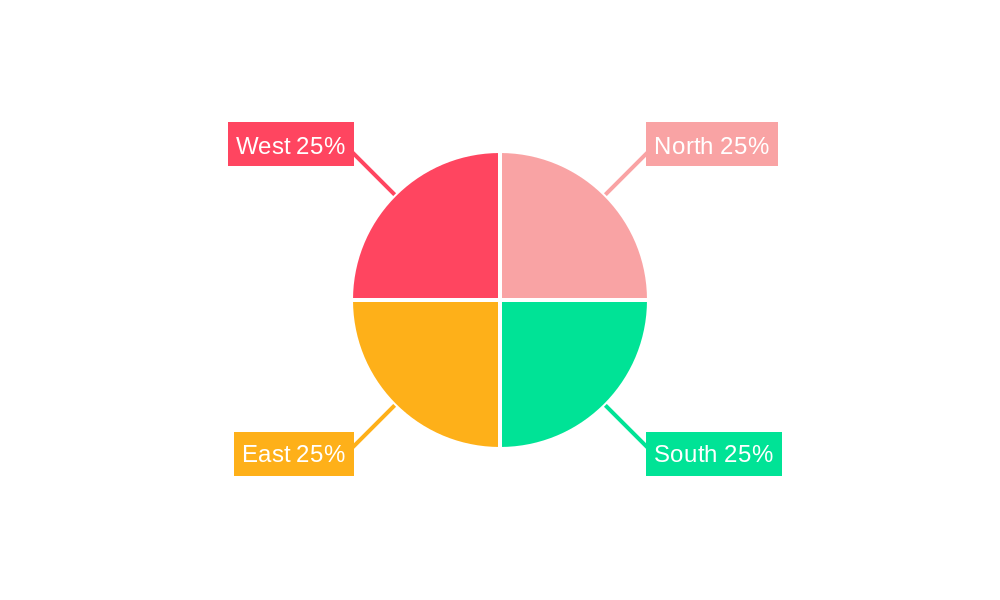

The Iranian car industry, valued at $37.96 million in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 9.57% from 2025 to 2033. This expansion is driven by several factors. Rising disposable incomes and a growing middle class are fueling increased demand for personal vehicles, particularly passenger cars and motorcycles. Government initiatives aimed at infrastructure development and improving transportation networks further stimulate market growth. The presence of both domestic manufacturers like Iran Khodro (IKCO), SAIPA Corporation, and Bahman Group, alongside international players such as Hyundai, Kia, and Volkswagen, fosters competition and innovation. However, the market faces challenges. Economic sanctions and fluctuations in the national currency can impact the cost of imported components and affect overall production. Furthermore, stringent emission regulations and a push towards electric vehicles present both opportunities and obstacles for manufacturers needing to adapt their production lines and product portfolios. The segmentation of the market into passenger cars, commercial vehicles, and motorcycles reflects diverse consumer needs and preferences, while the manufacturer segmentation highlights the involvement of auto ancillaries, engine manufacturers, and other key players in the supply chain. The geographical distribution across the North, South, East, and West regions of Iran indicates varying levels of demand and market penetration based on regional economic conditions and infrastructure. Growth in the coming years will heavily depend on successful navigation of economic challenges, government policies, and successful adaptation to global trends in automotive technology.

The forecast period (2025-2033) anticipates significant expansion, with the market size likely exceeding $100 million by 2033. This growth is predicated on continued economic recovery, sustained consumer confidence, and the industry’s ability to leverage technological advancements and cater to the evolving needs of Iranian consumers. Competitive pressures from both domestic and international manufacturers will be a defining characteristic of this period, shaping pricing strategies and product innovation. Strategic partnerships and investments in research and development will be key for companies seeking to maintain market share and capitalize on the potential for growth in the Iranian automotive sector. Monitoring government regulations and global technological advancements will be crucial for sustained success.

This comprehensive report provides a detailed analysis of the Iranian car industry, encompassing market structure, dynamics, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic market. The report leverages extensive data analysis and insights to offer actionable strategies for navigating the Iranian automotive landscape. Expected market value of xx Million is projected by 2033.

Iran Car Industry Market Structure & Innovation Trends

This section analyzes the Iranian car industry's market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The Iranian car market is characterized by a mix of domestic and international players, with Iran Khodro (IKCO) holding a significant market share. The market is fragmented with several key players such as SAIPA Corporation, Bahman Group, and Pars Khodro competing intensely.

- Market Concentration: Iran Khodro (IKCO) holds approximately xx% market share, followed by SAIPA Corporation with xx%. The remaining market share is divided amongst other manufacturers and importers.

- Innovation Drivers: Government initiatives promoting domestic manufacturing and technological advancements are key drivers of innovation. The focus is on improving fuel efficiency and incorporating advanced safety features.

- Regulatory Framework: Recent revisions to car import regulations have opened the market to more international brands, impacting both domestic manufacturers and consumers.

- Product Substitutes: The availability of used imported vehicles acts as a substitute for new domestically manufactured cars, influencing consumer choices.

- End-User Demographics: The growing middle class and rising disposable incomes are boosting demand for passenger cars, particularly in urban areas.

- M&A Activities: The M&A landscape is characterized by xx Million in deal values over the past five years. Most activity focuses on strategic partnerships and technological collaborations.

Iran Car Industry Market Dynamics & Trends

This section explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the Iranian car industry. The market exhibits a complex interplay of factors influencing its trajectory.

The Iranian car market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors including rising disposable incomes, increasing urbanization, and government support for the automotive sector. However, challenges such as sanctions and fluctuations in currency exchange rates pose significant risks. Market penetration of new technologies, such as electric vehicles, is currently low but is expected to increase gradually as the market evolves. Consumer preferences are shifting towards higher fuel efficiency and advanced safety features. Intense competition among domestic manufacturers and the re-entry of international brands is shaping the market landscape.

Dominant Regions & Segments in Iran Car Industry

This section identifies the leading regions and segments within the Iranian car industry.

By Vehicle Type: Passenger cars constitute the largest segment, followed by commercial vehicles and motorcycles.

- Key Drivers for Passenger Cars: Rising disposable incomes and urbanization are driving demand.

- Key Drivers for Commercial Vehicles: Growth in the logistics and transportation sectors fuels this segment.

- Key Drivers for Motorcycles: Affordable transportation is a key driver, particularly in rural areas.

By Manufacturer Type: Automobile manufacturers dominate the market, followed by auto ancillaries and engine manufacturers.

- Key Drivers for Automobile Manufacturers: Government support and technological advancements are shaping this sector.

- Key Drivers for Auto Ancillaries: Growing domestic manufacturing is boosting this supporting industry.

- Key Drivers for Engine Manufacturers: Technological advancements and government regulations are driving innovation.

The Tehran region holds the largest market share due to its concentration of population and economic activity.

Iran Car Industry Product Innovations

The Iranian car industry is witnessing gradual product innovation, focusing primarily on improving fuel efficiency and incorporating basic safety features. While the adoption of advanced technologies like electric vehicles is still nascent, domestic manufacturers are increasingly incorporating modern design elements and improving overall vehicle quality. This aligns with evolving consumer preferences for more fuel-efficient and safer vehicles.

Report Scope & Segmentation Analysis

This report segments the Iranian car market by vehicle type (passenger cars, commercial vehicles, motorcycles) and manufacturer type (automobile manufacturers, auto ancillaries, engine manufacturers, other manufacturing types). Each segment's growth projections, market size, and competitive dynamics are analyzed. Passenger cars are expected to dominate, while commercial vehicles are projected to show steady growth. Within manufacturing types, automobile manufacturers hold a significant share, with ancillaries and engine manufacturers contributing to the overall automotive ecosystem.

Key Drivers of Iran Car Industry Growth

Growth in the Iranian car industry is propelled by factors such as rising disposable incomes driving increased vehicle demand, government initiatives supporting domestic production and technological advancements, and the gradual easing of international sanctions, leading to increased foreign investment and market accessibility. Infrastructure development and expansion of the road network also contribute to market expansion.

Challenges in the Iran Car Industry Sector

The Iranian car industry faces significant challenges, including international sanctions impacting access to advanced technologies and components, supply chain disruptions impacting production and delivery timelines, and intense competition from both domestic and international brands. Currency fluctuations and economic instability add further complexity. These challenges can significantly impact production capacity and market growth.

Emerging Opportunities in Iran Car Industry

Emerging opportunities include the potential for increased foreign investment following the easing of sanctions, the growth of electric vehicle and hybrid technology markets, and a focus on the development of export markets to neighboring countries. The increasing demand for more fuel-efficient and technologically advanced vehicles presents opportunities for manufacturers who can respond to these evolving consumer preferences.

Leading Players in the Iran Car Industry Market

- Iran Khodro (IKCO)

- SAIPA Corporation

- Bahman Group

- Pars Khodro

- Renault Pars

- SAPCO

- Monavari Brothers Industrial Group

- IPM

- Hyundai Motor Company

- Kia Motors Corporation

- Volkswagen Group

- Sazeh Gostar

- Auto Component Manufacturers

- Automobile Manufacturers

Key Developments in Iran Car Industry Industry

- October 2022: Iran Khodro Company (IKCO) launched the TF21 model, diversifying its product offerings.

- July 2023: Skoda's re-entry into the Iranian market signifies a shift in import regulations and increased competition.

Future Outlook for Iran Car Industry Market

The Iranian car industry's future hinges on navigating the complexities of sanctions, economic fluctuations, and evolving consumer preferences. Strategic partnerships, technological innovation, and a focus on export markets will be crucial for long-term growth. The market is expected to experience moderate growth, driven by domestic demand and gradual market liberalization.

Iran Car Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Motorcycles

-

2. Manufacturer Type

- 2.1. Auto Ancillaries

- 2.2. Engine

- 2.3. Other Manufacturing Types

Iran Car Industry Segmentation By Geography

- 1. Iran

Iran Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in The Passenger Car Sales Across the Region

- 3.3. Market Restrains

- 3.3.1. Transportation Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Growing Passenger Car Sales to Have Positive Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Motorcycles

- 5.2. Market Analysis, Insights and Forecast - by Manufacturer Type

- 5.2.1. Auto Ancillaries

- 5.2.2. Engine

- 5.2.3. Other Manufacturing Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 4 SAPCO

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 5 Volkswagen Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Bahman Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Auto Component Manufacturers

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 3 SAIPA Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Automobile Manufacturers

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 4 Renault Pars

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 5 IPM

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 6 Hyundai Motor Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3 Monavari Brothers Industrial Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 1 Iran Khodro (IKCO)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 Kia Motors Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 1 Sazeh Gostar

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 2 Pars Khodro

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 4 SAPCO

List of Figures

- Figure 1: Iran Car Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Car Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Car Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Iran Car Industry Revenue Million Forecast, by Manufacturer Type 2019 & 2032

- Table 4: Iran Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Car Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Car Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Iran Car Industry Revenue Million Forecast, by Manufacturer Type 2019 & 2032

- Table 12: Iran Car Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Car Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Car Industry?

Key companies in the market include 4 SAPCO, 5 Volkswagen Group, 2 Bahman Group, Auto Component Manufacturers, 3 SAIPA Corporation, Automobile Manufacturers, 4 Renault Pars, 5 IPM, 6 Hyundai Motor Company, 3 Monavari Brothers Industrial Group, 1 Iran Khodro (IKCO), 7 Kia Motors Corporation, 1 Sazeh Gostar, 2 Pars Khodro.

3. What are the main segments of the Iran Car Industry?

The market segments include Vehicle Type, Manufacturer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in The Passenger Car Sales Across the Region.

6. What are the notable trends driving market growth?

Growing Passenger Car Sales to Have Positive Impact on the Market.

7. Are there any restraints impacting market growth?

Transportation Infrastructure Development.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen's wholly-owned Czech subsidiary, Skoda, was poised to make a comeback in Iran's auto market after an absence of four decades. The reintroduction of five Skoda models to Iranian showrooms follows a revision of the country's car import regulations, which now permit the importation of new and used cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Car Industry?

To stay informed about further developments, trends, and reports in the Iran Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence