Key Insights

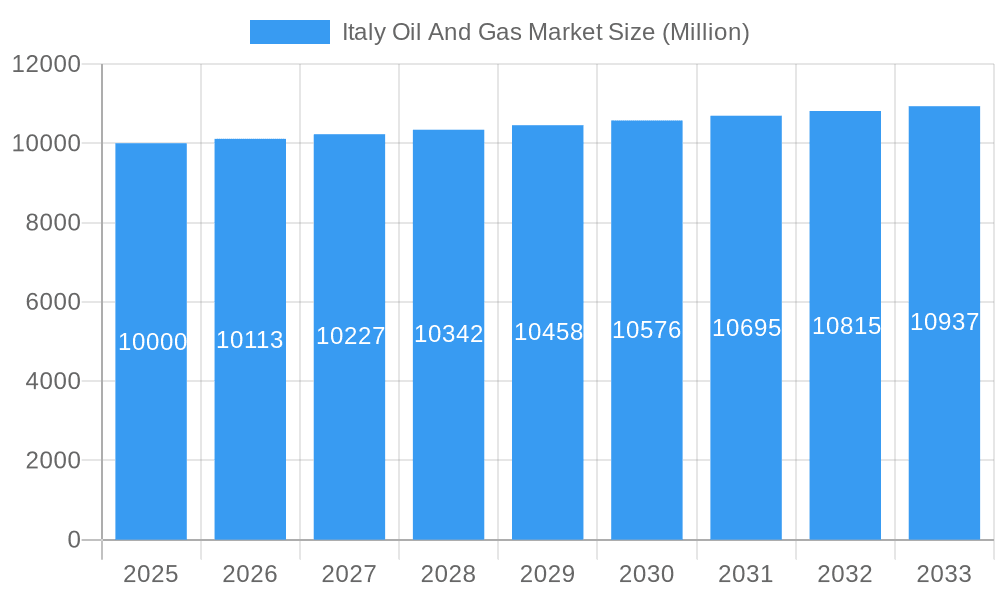

The Italy Oil and Gas market is projected to reach €42.5 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This growth trajectory is influenced by a dynamic interplay of upstream, midstream, and downstream activities. Upstream operations, characterized by mature reserves and a global transition to renewables, face inherent challenges. Conversely, Italy's continued dependence on natural gas for power generation and heating supports sustained downstream demand. Midstream infrastructure is expected to see moderate expansion to facilitate both domestic needs and imports, compensating for limited domestic production. Key industry players, including Eni SpA, TotalEnergies SE, and Shell PLC, alongside numerous smaller entities, actively shape market dynamics through competitive strategies. Government regulations focused on energy security and environmental sustainability will be pivotal in guiding future investments and market development.

Italy Oil And Gas Market Market Size (In Billion)

Market segmentation into upstream, midstream, and downstream sectors offers a detailed view of operational trends. Declining domestic reserves and increasing extraction costs present challenges for upstream operations, potentially increasing import reliance. Midstream sector expansion hinges on both domestic production volumes and import levels, while downstream performance is driven by domestic energy consumption and competition from alternative energy sources. Geographic concentration within Italy will foster regional market variations. Future forecasts must account for evolving European Union energy policies aimed at reducing fossil fuel dependency, which may impact market growth and the long-term sustainability of specific segments. Strategic adaptation through diversification and investment in low-carbon energy solutions will be crucial for established players navigating this evolving energy landscape.

Italy Oil And Gas Market Company Market Share

Italy Oil and Gas Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Italy Oil and Gas Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future trends. It leverages extensive data analysis and expert insights to illuminate growth opportunities and potential challenges within this dynamic sector.

Italy Oil And Gas Market Market Structure & Innovation Trends

The Italian oil and gas market exhibits a moderately concentrated structure, with major players like Eni SpA, BP PLC, and Shell PLC holding significant market share. However, a diverse range of smaller companies and specialized service providers also contribute to the overall market activity. Market concentration analysis reveals a xx% market share for the top 5 players in 2025 (based on revenue).

Market Concentration:

- Top 5 Players: xx% Market Share (2025)

- Average Deal Size for M&A: USD xx Million (2019-2024)

- Number of M&A Deals: xx (2019-2024)

Innovation in the Italian oil and gas sector is driven by the need for increased efficiency, reduced environmental impact, and enhanced energy security. Stringent environmental regulations are pushing adoption of cleaner technologies, while the pursuit of cost optimization and enhanced resource recovery fuels innovation in exploration and production techniques. The regulatory framework, while supportive of energy independence, also presents challenges for rapid technological adoption, necessitating strategic partnerships and government incentives. Product substitutes, such as renewable energy sources, pose a growing competitive threat, prompting continuous innovation to maintain market share. The end-user demographic is increasingly sophisticated and demands transparent and sustainable energy solutions.

Italy Oil And Gas Market Market Dynamics & Trends

The Italian oil and gas market is characterized by a complex interplay of factors impacting its growth trajectory. A CAGR of xx% is projected for the forecast period (2025-2033), driven by factors such as increasing energy demand, government support for energy infrastructure development, and strategic investments in exploration and production activities. Technological advancements in exploration and extraction techniques, alongside the adoption of smart technologies in upstream, midstream, and downstream operations, are further boosting market growth. However, fluctuating global oil and gas prices, along with the rise of renewable energy sources, present significant challenges to market expansion. Consumer preferences are increasingly shifting towards sustainable and environmentally friendly energy solutions, compelling industry players to adopt cleaner technologies and practices. The market dynamics are further shaped by competitive pressures, with both domestic and international companies vying for market share and investment opportunities. Market penetration of LNG is estimated at xx% in 2025, projected to increase to xx% by 2033.

Dominant Regions & Segments in Italy Oil And Gas Market

While specific regional data may require more detailed analysis, the Po Valley region is likely to remain a dominant area due to established infrastructure and resource concentration. This dominance is attributable to factors such as:

- Existing Infrastructure: Mature pipeline networks and processing facilities.

- Resource Availability: Significant reserves of oil and natural gas within the region.

- Government Incentives: Targeted policy support for energy development in the region.

Segment Dominance:

The Upstream segment will likely maintain its leading position in the Italian oil and gas market through 2033. This is primarily driven by the ongoing investment in exploration and production activities, both onshore and offshore. While all segments will experience growth, the Upstream segment's dominance is expected to persist due to the strategic importance of domestic resource extraction for energy independence. Further research into specific sub-segments could reveal more nuanced dynamics and potential shifts within each sector. However, the integration of different segments — Upstream, Midstream, and Downstream — is a critical factor to consider in achieving energy independence.

Italy Oil And Gas Market Product Innovations

Recent product innovations focus on enhanced oil recovery techniques, advanced drilling technologies, and the utilization of digital technologies to improve efficiency and reduce environmental impact. Companies are increasingly investing in LNG infrastructure and adopting carbon capture and storage (CCS) technologies to meet growing environmental concerns. Furthermore, there’s a significant push towards developing hydrogen infrastructure to diversify energy sources and meet climate change targets. These innovations offer competitive advantages by improving resource extraction efficiency, reducing operational costs, and enhancing environmental performance.

Report Scope & Segmentation Analysis

This report segments the Italian oil and gas market into three key sectors: Upstream, Midstream, and Downstream.

Upstream: This segment encompasses exploration, extraction, and processing of crude oil and natural gas. The market size is projected to reach USD xx Million by 2033, driven by ongoing investment in exploration and production.

Midstream: This segment includes the transportation, storage, and processing of oil and gas. Growth will be fueled by increased investments in pipeline infrastructure and LNG terminals, reaching a market size of USD xx Million by 2033.

Downstream: This segment comprises refining, marketing, and distribution of petroleum products. This sector’s growth will be influenced by changes in consumer demand and product diversification, expecting a market size of USD xx Million by 2033.

Key Drivers of Italy Oil And Gas Market Growth

Several factors contribute to the growth of the Italian oil and gas market. Firstly, increasing energy demand driven by population growth and economic expansion fuels market expansion. Secondly, the Italian government's commitment to energy independence and security through strategic investment in domestic energy sources stimulates growth. Thirdly, technological advancements improving efficiency and reducing costs in exploration, extraction, and processing of oil and gas resources positively impact the market. Finally, strategic alliances and collaborations amongst key players promote innovation and market expansion.

Challenges in the Italy Oil And Gas Market Sector

The Italian oil and gas market faces various challenges. The fluctuating global oil and gas prices pose volatility risks impacting profitability. Environmental regulations and the increasing demand for cleaner energy sources impose restrictions and necessitate significant investments in emission reduction technologies. Competition from renewable energy sources and the availability of cheaper energy imports present significant competitive pressures. These factors collectively hinder market growth and demand robust adaptation strategies.

Emerging Opportunities in Italy Oil And Gas Market

The Italian oil and gas market presents several promising opportunities. The increasing demand for LNG, coupled with planned investments in LNG infrastructure, presents a significant growth opportunity. The development of hydrogen infrastructure, aimed at diversifying energy sources, represents a substantial future market. Finally, leveraging digital technologies to improve efficiency and optimize resource management presents lucrative opportunities for market players.

Leading Players in the Italy Oil And Gas Market Market

- Zenith Energy Ltd (CA)

- Shell PLC

- Engie SA

- Edison SpA

- Schlumberger NV

- Saipem SpA

- SGS Italia SpA

- TotalEnergies SE

- Eni SpA

- BP PLC

Key Developments in Italy Oil And Gas Market Industry

January 2024: Snam's USD 12.51 Billion investment in gas and LNG infrastructure signifies a significant commitment to expanding Italy's energy capacity and reducing reliance on foreign sources. This 15% increase from the 2022-26 plan underscores a proactive approach to energy security.

June 2023: The agreement between Italy and Germany to develop a 3,300-kilometer gas pipeline, enabling future hydrogen transportation, represents a crucial step towards regional energy cooperation and diversification.

January 2023: Eni's USD 8 Billion deal with Libya's National Oil Corporation to develop two offshore gas fields demonstrates a strategic move to enhance Italy's energy independence by securing alternative gas supplies and reducing reliance on Russia. The projected 7.5 billion cubic meters of annual gas production significantly surpasses Italy's previous reliance on Russian imports.

Future Outlook for Italy Oil And Gas Market Market

The future of the Italian oil and gas market appears positive, driven by continued investment in infrastructure, exploration activities, and a push towards energy diversification. The development of LNG infrastructure and exploration for domestic resources will be central to growth. Furthermore, the strategic shift towards hydrogen and the ongoing adoption of innovative technologies offer substantial opportunities for market expansion and enhanced efficiency. The market is poised for sustained growth, albeit with ongoing challenges in navigating fluctuating global energy prices and environmental concerns.

Italy Oil And Gas Market Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Downstream

- 1.3. Midstream

Italy Oil And Gas Market Segmentation By Geography

- 1. Italy

Italy Oil And Gas Market Regional Market Share

Geographic Coverage of Italy Oil And Gas Market

Italy Oil And Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Competition from Renewable Energy

- 3.4. Market Trends

- 3.4.1. The Midstream Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Oil And Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Downstream

- 5.1.3. Midstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zenith Energy Ltd (CA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shell PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Engie SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Edison SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schlumberger NV*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saipem SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SGS Italia SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eni SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BP PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zenith Energy Ltd (CA)

List of Figures

- Figure 1: Italy Oil And Gas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Oil And Gas Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Oil And Gas Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Italy Oil And Gas Market Volume Thousand Forecast, by Sector 2020 & 2033

- Table 3: Italy Oil And Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Oil And Gas Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 5: Italy Oil And Gas Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 6: Italy Oil And Gas Market Volume Thousand Forecast, by Sector 2020 & 2033

- Table 7: Italy Oil And Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Italy Oil And Gas Market Volume Thousand Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Oil And Gas Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Italy Oil And Gas Market?

Key companies in the market include Zenith Energy Ltd (CA), Shell PLC, Engie SA, Edison SpA, Schlumberger NV*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi, Saipem SpA, SGS Italia SpA, TotalEnergies SE, Eni SpA, BP PLC.

3. What are the main segments of the Italy Oil And Gas Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development.

6. What are the notable trends driving market growth?

The Midstream Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Competition from Renewable Energy.

8. Can you provide examples of recent developments in the market?

January 2024: Snam, an Italian gas company, announced plans to invest USD 12.51 billion in gas and liquefied natural gas (LNG) infrastructure in Italy by 2027. Compared to the 2022-26 plan, the company's investment increased by 15%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Oil And Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Oil And Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Oil And Gas Market?

To stay informed about further developments, trends, and reports in the Italy Oil And Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence