Key Insights

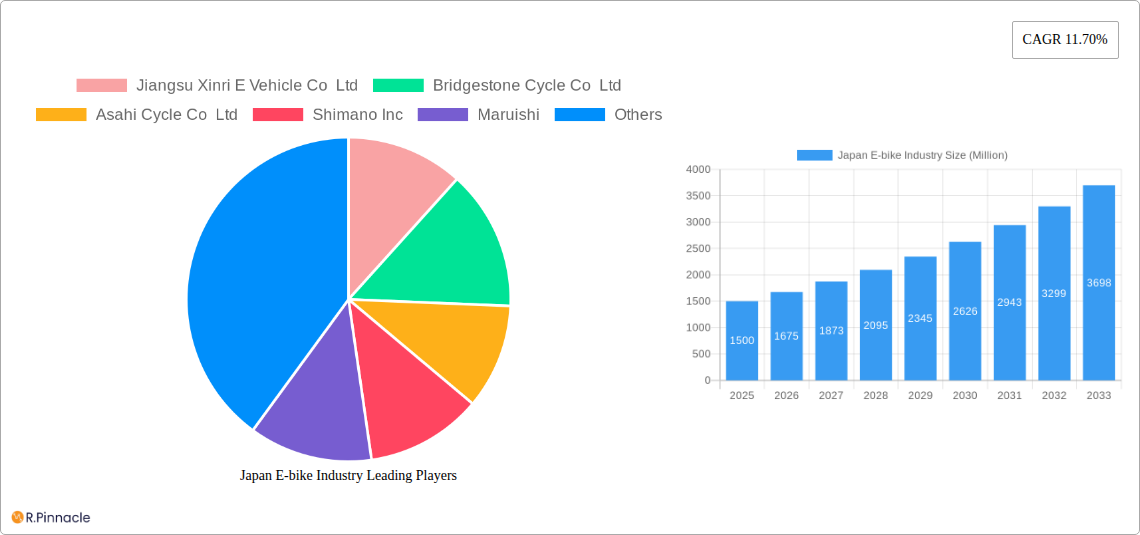

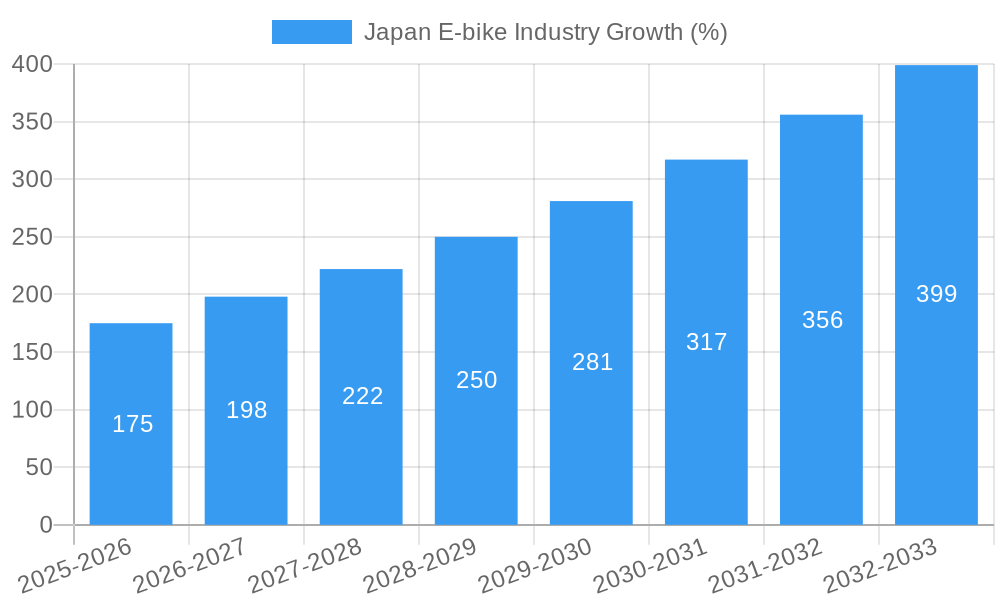

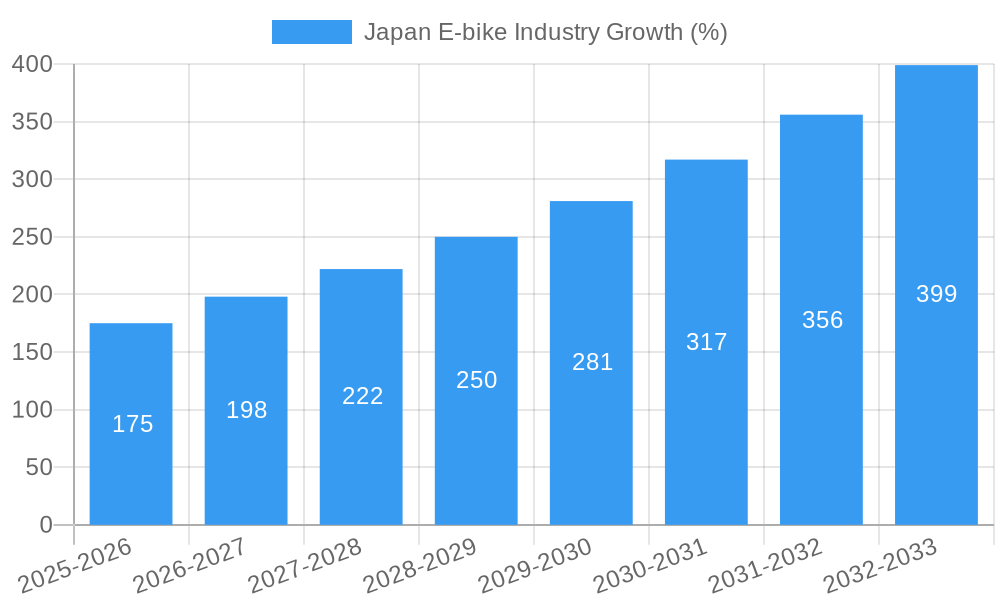

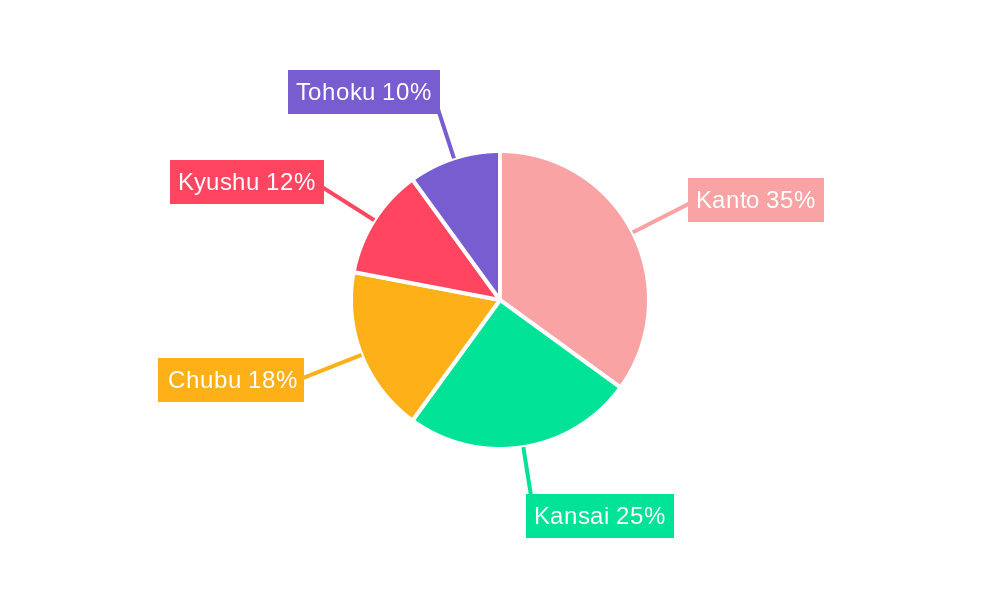

The Japan e-bike market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) of 11.70% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing environmental awareness and government initiatives promoting sustainable transportation are fueling demand for eco-friendly alternatives to gasoline-powered vehicles. Secondly, advancements in battery technology, particularly in lithium-ion batteries offering increased range and longer lifespans, are making e-bikes a more practical and appealing choice for commuters and leisure riders. Furthermore, the diverse range of e-bike models available, catering to various needs and preferences (from city commuting to trekking adventures), is expanding market penetration across different demographics. Specific segments like pedal-assisted and lithium-ion battery powered e-bikes are expected to witness particularly strong growth due to their superior performance and user experience. The established presence of major bicycle manufacturers like Bridgestone Cycle and Shimano, alongside emerging players, contributes to a competitive yet dynamic market. Regional variations are expected, with densely populated areas like Kanto and Kansai likely exhibiting higher adoption rates.

However, challenges remain. The relatively high initial cost of e-bikes compared to traditional bicycles could hinder wider market access. Furthermore, inadequate charging infrastructure in some regions may pose a barrier to widespread adoption, especially for longer-range e-bike models. Addressing these challenges through targeted government subsidies and investment in charging infrastructure will be crucial in unlocking the full potential of the Japan e-bike market. The market's continued growth trajectory is firmly anchored in its appeal as a practical, environmentally conscious, and increasingly affordable mode of personal transportation. The increasing popularity of e-bikes as a last-mile solution within urban areas and their versatility across diverse applications will undoubtedly drive expansion throughout the forecast period.

Japan E-bike Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Japan e-bike industry, covering market size, segmentation, growth drivers, challenges, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking to understand the dynamics of this rapidly evolving sector. Expect in-depth insights into market structure, innovation trends, competitive dynamics, and future growth opportunities within the Japanese e-bike market. The report forecasts a market value exceeding XX Million by 2033.

Japan E-bike Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Japanese e-bike market, encompassing market concentration, innovation drivers, regulatory influences, and key industry activities. We delve into the impact of mergers and acquisitions (M&A), examining deal values and their effect on market share. The analysis covers the period 2019-2024, providing a historical perspective for future projections.

- Market Concentration: The Japanese e-bike market exhibits a [Describe level of concentration - e.g., moderately concentrated] structure, with key players holding significant market share. [Insert estimated market share data for top 3 players]. Smaller players contribute to the remaining market share.

- Innovation Drivers: Technological advancements in battery technology (Lithium-ion batteries gaining prominence), motor efficiency, and smart features are driving innovation. Government incentives and rising environmental awareness also contribute significantly.

- Regulatory Framework: Japanese regulations regarding e-bike classifications, safety standards, and import/export policies influence market dynamics. [Briefly describe relevant regulations and their impact].

- Product Substitutes: Traditional bicycles and other forms of personal transportation (e.g., scooters, motorcycles) compete with e-bikes. [Discuss market share impact of substitutes].

- End-User Demographics: The primary users are [Describe primary demographic: age, income, lifestyle]. The market is witnessing increased adoption among various demographics, driven by factors like [mention specific driving factors, e.g., commuting needs, leisure activities].

- M&A Activities: The period 2019-2024 witnessed [Number] significant M&A deals in the Japanese e-bike industry, with a total estimated value of XX Million. These activities have [Describe the impact of M&A, e.g., reshaped the market landscape, increased market concentration]. Further mergers and acquisitions in the forecast period (2025-2033) are anticipated.

Japan E-bike Industry Market Dynamics & Trends

This section provides a comprehensive overview of the market dynamics and trends influencing the growth of the Japanese e-bike industry. The analysis covers market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape, providing a detailed account of the factors shaping the industry's trajectory from 2019 to 2033. The Compound Annual Growth Rate (CAGR) during the forecast period is projected to be XX%. Market penetration is expected to reach XX% by 2033.

[Insert a comprehensive paragraph (600 words) addressing market growth drivers (e.g., government initiatives, rising fuel prices, increasing urbanization), technological disruptions (e.g., advancements in battery technology, smart bike features), consumer preferences (e.g., demand for eco-friendly transport, convenience, health benefits), and competitive dynamics (e.g., pricing strategies, product differentiation, brand loyalty). Include specific data and examples to support your analysis.]

Dominant Regions & Segments in Japan E-bike Industry

This section identifies the leading regions and segments within the Japanese e-bike market. We analyze the factors driving dominance in each segment, such as propulsion type, application type, and battery type.

Dominant Regions: [Identify dominant region(s) within Japan, providing rationale for dominance, e.g., higher population density, favorable government policies, better infrastructure].

Dominant Segments:

- Propulsion Type: Lithium-ion battery powered pedal-assisted e-bikes dominate due to [reasons, e.g., longer range, lighter weight, better performance].

- Application Type: The City/Urban segment holds the largest market share due to [reasons, e.g., increasing urbanization, suitability for short commutes].

- Battery Type: Lithium-ion batteries dominate owing to their [advantages, e.g., higher energy density, longer lifespan].

[Insert a detailed paragraph (600 words) for each segment, providing a comprehensive dominance analysis. Include bullet points outlining key drivers (e.g., economic policies, infrastructure development, consumer preferences) for each dominant segment.]

Japan E-bike Industry Product Innovations

Recent years have witnessed significant advancements in e-bike technology, leading to the development of innovative products that cater to diverse consumer needs. These innovations are focused on enhancing performance, improving user experience, and increasing the overall appeal of e-bikes. Key trends include the integration of smart features, lightweight designs, and improved battery technology. Manufacturers are also focusing on specialized e-bike models for specific applications, such as cargo e-bikes for delivery services and trekking e-bikes for outdoor enthusiasts. This focus on innovation ensures the e-bike market's continued growth and adaptation to evolving consumer demands.

Report Scope & Segmentation Analysis

This report comprehensively segments the Japanese e-bike market based on propulsion type (Pedal Assisted, Speed Pedelec, Throttle Assisted), application type (Cargo/Utility, City/Urban, Trekking), and battery type (Lead Acid Battery, Lithium-ion Battery, Others). Each segment's growth projections, market sizes, and competitive dynamics are detailed. [Insert paragraphs (approximately 100-150 words per segment) providing detailed analysis of each segment].

Key Drivers of Japan E-bike Industry Growth

Several factors contribute to the growth of the Japanese e-bike industry. Government initiatives promoting sustainable transportation, coupled with rising fuel prices and increasing urbanization, fuel demand for eco-friendly commuting solutions. Technological advancements in battery technology and motor efficiency, leading to longer ranges and improved performance, also contribute significantly. Furthermore, the increasing awareness of health and fitness benefits associated with cycling further boosts the market.

Challenges in the Japan E-bike Industry Sector

Despite the significant growth potential, the Japanese e-bike industry faces several challenges. High initial costs for e-bikes can limit accessibility for some consumers. Supply chain disruptions and the availability of raw materials needed for battery production pose challenges. Furthermore, existing infrastructure limitations and a lack of dedicated e-bike lanes in some areas hinder widespread adoption. These factors necessitate strategic planning and innovative solutions to ensure sustainable growth.

Emerging Opportunities in Japan E-bike Industry

The Japanese e-bike market presents various opportunities. The rising popularity of e-bikes for leisure activities and tourism opens new market segments. Advancements in battery technology and the development of lighter, more efficient e-bikes will further enhance adoption. The integration of smart features and connectivity options enhances the user experience, further boosting demand. The government's focus on sustainable transportation will also create further opportunities.

Leading Players in the Japan E-bike Industry Market

- Jiangsu Xinri E Vehicle Co Ltd

- Bridgestone Cycle Co Ltd

- Asahi Cycle Co Ltd

- Shimano Inc

- Maruishi

- Fujikom Co Ltd

- Panasonic Cycle Technology Co Ltd

- Trek Bicycle Corporation

- Yamaha Bicycle

- Kawasaki Motors Corporation Japan

Key Developments in Japan E-bike Industry

- June 2022: Yamaha introduced a new mid-drive electric bike motor with increased power in a smaller package.

- July 2022: Kawasaki debuted the Elektrode bicycle, featuring three adjustable speed modes, a disc brake, an integrated battery, and a wheel-mounted motor. The listed cost was $1,099.

- November 2022: Jiangsu Lvneng Electrical Bicycle Technology Co., Ltd. introduced the 20F02 folding electric bicycle.

Future Outlook for Japan E-bike Industry Market

The future of the Japanese e-bike market appears promising. Continued technological advancements, supportive government policies, and growing environmental awareness will drive market expansion. The increasing demand for sustainable transportation solutions and the evolving consumer preferences towards convenient and eco-friendly modes of transport will further fuel the industry's growth. Strategic partnerships and investments in research and development will also play a crucial role in shaping the future of the Japanese e-bike industry.

Japan E-bike Industry Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Japan E-bike Industry Segmentation By Geography

- 1. Japan

Japan E-bike Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan E-bike Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Kanto Japan E-bike Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan E-bike Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan E-bike Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan E-bike Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan E-bike Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jiangsu Xinri E Vehicle Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bridgestone Cycle Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asahi Cycle Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shimano Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Maruishi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujikom Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panasonic Cycle Technology Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trek Bicycle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yamaha Bicycle

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kawasaki Motors Corporation Japan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jiangsu Xinri E Vehicle Co Ltd

List of Figures

- Figure 1: Japan E-bike Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan E-bike Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan E-bike Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan E-bike Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Japan E-bike Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Japan E-bike Industry Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 5: Japan E-bike Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Japan E-bike Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kanto Japan E-bike Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kansai Japan E-bike Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chubu Japan E-bike Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kyushu Japan E-bike Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tohoku Japan E-bike Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan E-bike Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 13: Japan E-bike Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 14: Japan E-bike Industry Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 15: Japan E-bike Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan E-bike Industry?

The projected CAGR is approximately 11.70%.

2. Which companies are prominent players in the Japan E-bike Industry?

Key companies in the market include Jiangsu Xinri E Vehicle Co Ltd, Bridgestone Cycle Co Ltd, Asahi Cycle Co Ltd, Shimano Inc, Maruishi, Fujikom Co Ltd, Panasonic Cycle Technology Co Ltd, Trek Bicycle Corporation, Yamaha Bicycle, Kawasaki Motors Corporation Japan.

3. What are the main segments of the Japan E-bike Industry?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

November 2022: Jiangsu Lvneng Electrical Bicycle Technology Co., Ltd. has introduced the 20F02 folding electric bicycle.July 2022: Kawasaki debuted the Elektrode bicycle in the market. It has three adjustable speed modes, a disc brake, an integrated battery, and a motor located on the wheel. The list cost is $1,099.June 2022: Yamaha has introduced a new mid-drive electric bike motor with increased power in a smaller package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan E-bike Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan E-bike Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan E-bike Industry?

To stay informed about further developments, trends, and reports in the Japan E-bike Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence