Key Insights

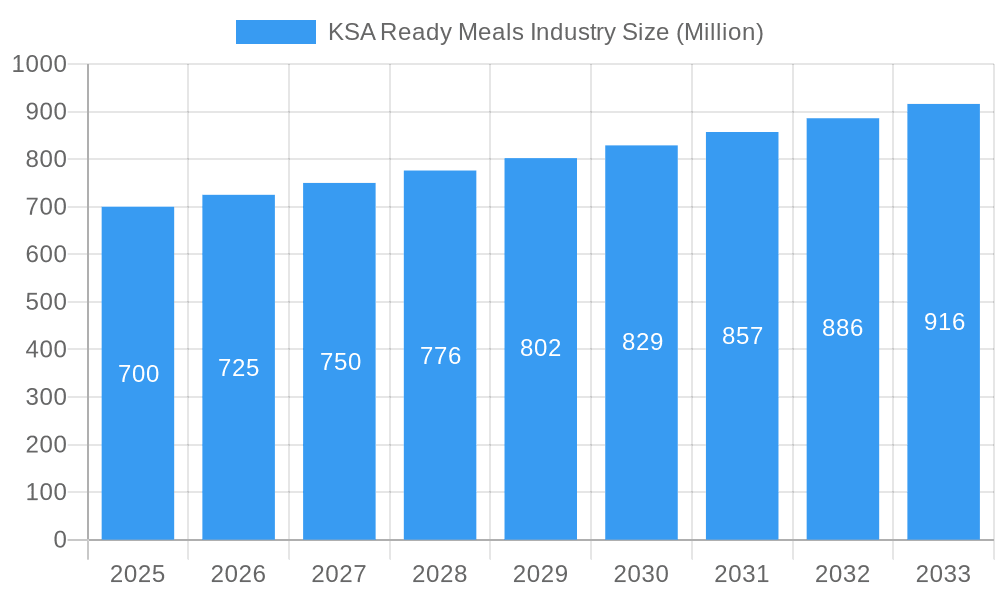

The Kingdom of Saudi Arabia (KSA) ready meals market is projected for significant expansion, anticipated to reach a market size of $1.7 billion by 2029, with a Compound Annual Growth Rate (CAGR) of 6.9%. This growth is fueled by evolving consumer lifestyles, including increasing urbanization, a rising female workforce, and enhanced disposable income driving demand for convenient food solutions. Growing youth demographics and exposure to global culinary trends through digital platforms and tourism are also stimulating interest in diverse ready-to-eat options. Key players are investing in product innovation, offering wider flavor varieties, healthier choices, and catering to specific dietary needs. The frozen ready meal segment is expected to lead due to extended shelf life, followed by chilled ready meals for immediate consumption. Modern retail formats and the surge in online grocery platforms are reshaping distribution, boosting accessibility.

KSA Ready Meals Industry Market Size (In Billion)

Despite strong market drivers, potential restraints include consumer health consciousness, concerns about nutritional content, and a preference for freshly prepared meals. Supply chain complexities, particularly for temperature-sensitive products, and raw material cost fluctuations can also impact profitability. However, trends in convenience, health-focused innovation, and e-commerce expansion are expected to outweigh these challenges. The competitive landscape features prominent local and international brands, including Almunajem Foods, JBS Foods SA (Seara Foods), and Almarai Company, highlighting a dynamic market where innovation and consumer-centric strategies are vital for sustained success.

KSA Ready Meals Industry Company Market Share

Unlock comprehensive insights into the KSA Ready Meals Industry. This report details market structures, dynamics, innovations, and future outlook from 2019 to 2033, with a base year of 2024. It is essential for industry professionals aiming to leverage growth opportunities within Saudi Arabia's convenience food sector, driven by evolving lifestyles, technological advancements, and strategic government initiatives.

KSA Ready Meals Industry Market Structure & Innovation Trends

The KSA Ready Meals Industry exhibits a moderately concentrated market structure, with key players like Almarai Company, Americana Group, and JBS Foods SA (Seara Foods) holding significant market shares. Innovation is primarily driven by the demand for healthier, diverse, and convenient meal options, alongside advancements in packaging technology that extend shelf life and maintain product quality. Regulatory frameworks are evolving to support food safety and product standards, fostering a more robust market environment. Product substitutes, such as home-cooked meals and food service options, present ongoing competition. End-user demographics show a growing preference among busy professionals, millennials, and families seeking quick and easy meal solutions. Merger and acquisition (M&A) activities are anticipated to increase as larger players look to consolidate market presence and acquire innovative startups. M&A deal values are projected to range between USD 50 Million to USD 150 Million over the forecast period, indicating strategic consolidation efforts.

KSA Ready Meals Industry Market Dynamics & Trends

The KSA Ready Meals Industry is poised for substantial growth, driven by a confluence of dynamic market forces. The increasing disposable income and a burgeoning young population are key market growth drivers, leading to a higher adoption rate of convenient food solutions. Technological disruptions are playing a pivotal role, with advancements in food processing, preservation techniques, and smart packaging enhancing product quality, safety, and consumer appeal. The penetration of online retail stores for ready meals is rapidly expanding, offering greater accessibility and convenience. Consumer preferences are rapidly shifting towards healthier ingredients, diverse ethnic cuisines, and personalized meal options. This includes a growing demand for plant-based and low-calorie ready meals. The competitive landscape is intensifying, with both established food giants and emerging startups vying for market share. The overall market penetration is projected to reach over 30% by 2030. The Compound Annual Growth Rate (CAGR) for the KSA Ready Meals Industry is estimated to be approximately 7.5% during the forecast period. The industry is witnessing significant investment in modernizing production facilities to meet escalating demand and stringent quality standards. The focus on sustainability in sourcing and packaging is also gaining traction, aligning with global environmental concerns and consumer expectations.

Dominant Regions & Segments in KSA Ready Meals Industry

The Western Region of Saudi Arabia, particularly cities like Jeddah and Mecca, currently dominates the KSA Ready Meals Industry, owing to its high population density, significant tourist influx, and strong presence of retail infrastructure. Within product types, Frozen Ready Meals hold the largest market share, driven by their longer shelf life and widespread availability in hypermarkets and supermarkets.

Frozen Ready Meal Dominance: The preference for frozen ready meals is attributed to their extended shelf life, which allows for bulk purchasing and reduced food waste. Major players are investing in cold chain logistics to ensure product integrity from production to consumption. The segment is expected to grow at a CAGR of 6.8% during the forecast period, reaching an estimated USD 1,500 Million in market value.

Distribution Channel Dominance – Hypermarkets/Supermarkets: Hypermarkets and supermarkets are the primary distribution channels, offering a wide variety of ready meal options and attracting a broad customer base. Their strategic locations and promotional activities contribute significantly to sales volume. This channel is projected to account for over 50% of total ready meal sales.

Emerging Trends in Chilled and Ambient Ready Meals: While frozen meals lead, Chilled Ready Meals are gaining traction due to consumer demand for fresher options with shorter preparation times. Ambient Ready Meals are also seeing steady growth, catering to specific convenience needs and longer-term storage requirements. The Chilled Ready Meal segment is anticipated to grow at a CAGR of 8.2%, and Ambient Ready Meals at 6.5%.

The growth in these segments is further bolstered by supportive economic policies, ongoing investments in the food processing sector, and the continuous expansion of modern retail infrastructure across the Kingdom.

KSA Ready Meals Industry Product Innovations

Product innovation in the KSA Ready Meals Industry is characterized by a focus on health-conscious options, diverse global cuisines, and convenient meal kits. Companies are introducing meals with reduced sodium, sugar, and unhealthy fats, catering to a growing health-aware consumer base. The development of ready meals featuring authentic Saudi Arabian flavors and popular international cuisines provides significant competitive advantages. Technological trends in food science are enabling the creation of ready meals that mimic the taste and texture of freshly prepared dishes, enhancing consumer satisfaction. Market fit is being achieved through tailored product offerings that align with specific dietary needs, such as gluten-free and vegetarian options, and by leveraging smart packaging solutions for extended shelf life and improved presentation.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the KSA Ready Meals Industry, segmented across key product types and distribution channels.

Product Types:

- Frozen Ready Meal: This segment is projected to maintain its dominant position, driven by convenience and affordability. Market size is estimated to reach USD 1,500 Million by 2033, with a CAGR of 6.8%.

- Chilled Ready Meal: This segment is expected to witness robust growth due to increasing consumer preference for fresher, ready-to-eat options. Its market size is forecast to reach USD 900 Million by 2033, with a CAGR of 8.2%.

- Ambient Ready Meal: While smaller, this segment offers long shelf-life solutions and is projected to grow steadily, reaching USD 400 Million by 2033, with a CAGR of 6.5%.

Distribution Channels:

- Hypermarkets/Supermarkets: This remains the largest distribution channel, offering wide product selection and promotional opportunities. Projected to hold over 50% of market share.

- Convenience Stores: Catering to impulse purchases and quick consumption needs, this channel is expected to grow at a CAGR of 7.0%.

- Online Retail Stores: Experiencing rapid expansion due to growing e-commerce penetration and demand for doorstep delivery. This segment is projected for significant growth, with a CAGR of 9.5%.

- Other Distribution Channels: Includes food service providers and specialized retailers, contributing a niche market share and growing at an estimated 6.0% CAGR.

Key Drivers of KSA Ready Meals Industry Growth

The KSA Ready Meals Industry is propelled by several key drivers. Urbanization and changing lifestyles, with increased female workforce participation and a faster pace of life, are significantly boosting the demand for convenient meal solutions. Government initiatives promoting the domestic food industry and attracting foreign investment, such as those being explored by Almarai Company with the Ministry of Investment, are creating a favorable business environment. Technological advancements in food processing and packaging are enhancing product quality and safety, thereby increasing consumer trust. Furthermore, the growing health and wellness trend, with consumers seeking healthier and more balanced meal options, is also a significant growth catalyst. The increasing adoption of online food delivery platforms has further expanded accessibility and convenience.

Challenges in the KSA Ready Meals Industry Sector

Despite strong growth prospects, the KSA Ready Meals Industry faces several challenges. Maintaining product freshness and quality during distribution, especially in a hot climate, requires robust cold chain logistics, which can be costly. Intense competition from both local and international players necessitates continuous innovation and competitive pricing strategies. Evolving consumer preferences for healthier and more natural ingredients can pose challenges for manufacturers accustomed to traditional formulations. Regulatory hurdles and compliance with food safety standards require significant investment and adherence. Consumer perception regarding the healthiness and taste of ready-to-eat meals compared to freshly prepared food remains a barrier for some segments. Supply chain disruptions and the volatility of raw material prices can impact profitability.

Emerging Opportunities in KSA Ready Meals Industry

The KSA Ready Meals Industry presents numerous emerging opportunities. The growing demand for Halal-certified and culturally relevant meals offers a significant niche for specialized products, as exemplified by BRF Sadia's export markets. The expansion of online retail and food delivery platforms creates direct access to consumers across the Kingdom. There is a substantial opportunity in developing premium and gourmet ready meals catering to affluent consumers seeking convenience without compromising on quality or taste. The increasing focus on plant-based and vegan ready meals aligns with global health trends and growing dietary consciousness. Furthermore, exploring export markets within the GCC and beyond, leveraging Saudi Arabia's strategic location and established trade relationships, presents a significant avenue for growth. The introduction of innovative vending machine solutions, like Siwar Food's "Chef in a Box," opens new distribution channels in high-traffic areas.

Leading Players in the KSA Ready Meals Industry Market

- Almunajem Foods

- JBS Foods SA (Seara Foods)

- Almarai Company

- Sunbulah Group

- Bolton Group SRL

- Americana Group

- Al Karamah Dough Production Co Ltd

- Zen Frozen Foods

- Al Kabeer Group

- The Oetker Group

Key Developments in KSA Ready Meals Industry Industry

- June 2023: Almarai Company signed a memorandum of understanding with the Ministry of Investment to explore new investment opportunities in the food industry, including ready meals, aiming to boost production and exports.

- July 2022: BRF Sadia (a subsidiary of BRF SA) invested USD 18 Million to expand its food production capacity by 1,200 tons in Dammam, Saudi Arabia, reinforcing its commitment to Halal production and international exports.

- June 2022: Siwar Food launched a line of frozen meals and desserts, available through online retail and innovative "Chef in a Box" vending machines strategically placed across Riyadh, offering convenience at SAR 20 per meal.

Future Outlook for KSA Ready Meals Industry Market

The future outlook for the KSA Ready Meals Industry is exceptionally bright, characterized by sustained growth and evolving market dynamics. The continued increase in disposable incomes, coupled with a growing preference for convenient and time-saving food solutions, will remain the primary growth accelerators. Strategic partnerships between food manufacturers and technology providers are expected to drive innovation in product development and distribution. The expansion of e-commerce and the increasing sophistication of online retail platforms will further enhance market reach and consumer accessibility. Government support for the food processing sector, combined with a focus on localization and export promotion, will solidify Saudi Arabia's position as a regional hub for ready meals. Embracing sustainability and health-conscious product development will be crucial for long-term success and market leadership. The industry is projected to witness further consolidation and diversification of product portfolios to cater to an increasingly sophisticated consumer base.

KSA Ready Meals Industry Segmentation

-

1. Product Type

- 1.1. Frozen Ready Meal

- 1.2. Chilled Ready Meal

- 1.3. Ambient Ready Meal

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

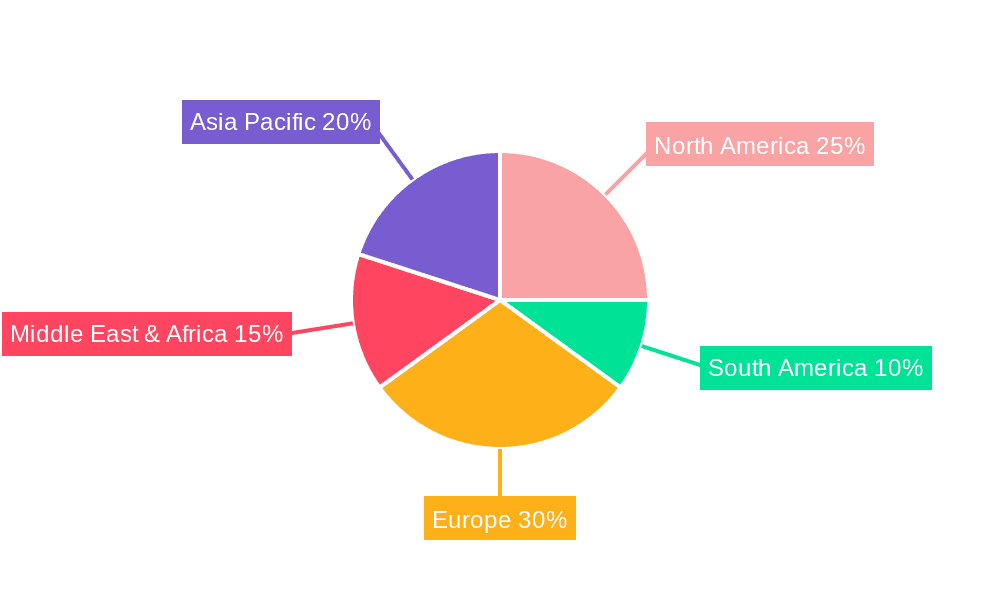

KSA Ready Meals Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

KSA Ready Meals Industry Regional Market Share

Geographic Coverage of KSA Ready Meals Industry

KSA Ready Meals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient Food Products

- 3.3. Market Restrains

- 3.3.1. High Import Dependency for Food Ingredients

- 3.4. Market Trends

- 3.4.1. Increased Demand for Convenience Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global KSA Ready Meals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Ready Meal

- 5.1.2. Chilled Ready Meal

- 5.1.3. Ambient Ready Meal

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America KSA Ready Meals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Frozen Ready Meal

- 6.1.2. Chilled Ready Meal

- 6.1.3. Ambient Ready Meal

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America KSA Ready Meals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Frozen Ready Meal

- 7.1.2. Chilled Ready Meal

- 7.1.3. Ambient Ready Meal

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe KSA Ready Meals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Frozen Ready Meal

- 8.1.2. Chilled Ready Meal

- 8.1.3. Ambient Ready Meal

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa KSA Ready Meals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Frozen Ready Meal

- 9.1.2. Chilled Ready Meal

- 9.1.3. Ambient Ready Meal

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific KSA Ready Meals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Frozen Ready Meal

- 10.1.2. Chilled Ready Meal

- 10.1.3. Ambient Ready Meal

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Almunajem Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JBS Foods SA (Seara Foods)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Almarai Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sunbulah Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bolton Group SRL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Americana Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Karamah Dough Production Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zen Frozen Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Kabeer Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Oetker Group *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Almunajem Foods

List of Figures

- Figure 1: Global KSA Ready Meals Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America KSA Ready Meals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America KSA Ready Meals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America KSA Ready Meals Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America KSA Ready Meals Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America KSA Ready Meals Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America KSA Ready Meals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America KSA Ready Meals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: South America KSA Ready Meals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America KSA Ready Meals Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America KSA Ready Meals Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America KSA Ready Meals Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America KSA Ready Meals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe KSA Ready Meals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe KSA Ready Meals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe KSA Ready Meals Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe KSA Ready Meals Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe KSA Ready Meals Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe KSA Ready Meals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa KSA Ready Meals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa KSA Ready Meals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa KSA Ready Meals Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa KSA Ready Meals Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa KSA Ready Meals Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa KSA Ready Meals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific KSA Ready Meals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Asia Pacific KSA Ready Meals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific KSA Ready Meals Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific KSA Ready Meals Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific KSA Ready Meals Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific KSA Ready Meals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global KSA Ready Meals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global KSA Ready Meals Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global KSA Ready Meals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global KSA Ready Meals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global KSA Ready Meals Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global KSA Ready Meals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global KSA Ready Meals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global KSA Ready Meals Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global KSA Ready Meals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global KSA Ready Meals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global KSA Ready Meals Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global KSA Ready Meals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global KSA Ready Meals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global KSA Ready Meals Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global KSA Ready Meals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global KSA Ready Meals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global KSA Ready Meals Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global KSA Ready Meals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific KSA Ready Meals Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the KSA Ready Meals Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the KSA Ready Meals Industry?

Key companies in the market include Almunajem Foods, JBS Foods SA (Seara Foods), Almarai Company, Sunbulah Group, Bolton Group SRL, Americana Group, Al Karamah Dough Production Co Ltd, Zen Frozen Foods, Al Kabeer Group, The Oetker Group *List Not Exhaustive.

3. What are the main segments of the KSA Ready Meals Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient Food Products.

6. What are the notable trends driving market growth?

Increased Demand for Convenience Food Products.

7. Are there any restraints impacting market growth?

High Import Dependency for Food Ingredients.

8. Can you provide examples of recent developments in the market?

In June 2023, Almarai Company signed a memorandum of understanding with the Ministry of Investment on June 6, 2023, to discuss ways to develop the food industry (including ready meals) in the country through new investment opportunities in the food sector, which has great potential that has contributed significantly to the arrival of these products to various regions of the country and contributing to increasing exports, regionally and internationally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "KSA Ready Meals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the KSA Ready Meals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the KSA Ready Meals Industry?

To stay informed about further developments, trends, and reports in the KSA Ready Meals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence