Key Insights

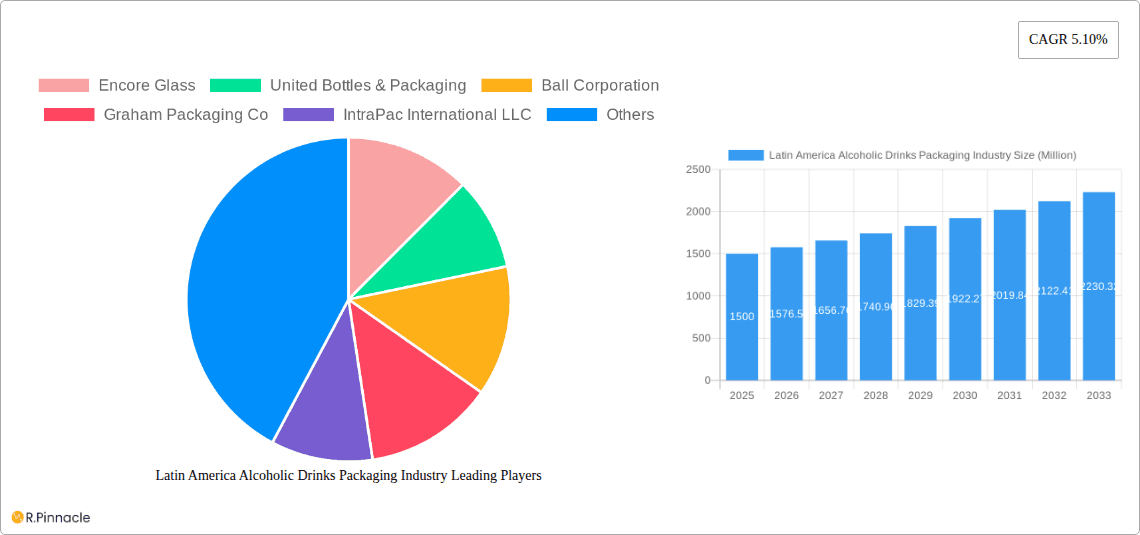

The Latin American alcoholic drinks packaging market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising popularity of craft beers and premium spirits fuels demand for sophisticated and aesthetically pleasing packaging. Secondly, increasing disposable incomes across several Latin American countries, coupled with a growing young adult population, are bolstering alcohol consumption and, consequently, packaging needs. Furthermore, the ongoing shift towards convenient ready-to-drink (RTD) beverages necessitates innovative packaging solutions, such as lightweight and portable cans and bottles. While glass remains a dominant material, the growing environmental consciousness is prompting a gradual shift towards sustainable alternatives like recyclable aluminum cans and plant-based plastics. However, challenges remain, including fluctuating raw material prices and the need to comply with increasingly stringent regulations regarding material safety and recyclability. The market is segmented by primary material (glass, metal, plastic, paper), alcoholic product (wine, spirits, beer, RTDs, other), product type (bottles, cans, etc.), and country (Brazil, Argentina, Mexico, and the Rest of Latin America). Brazil and Mexico are expected to dominate the market given their larger populations and significant alcoholic beverage consumption. Competitive landscape includes major players like Amcor Plc, Ball Corporation, and Crown Holdings Inc., alongside regional players catering to specific market needs.

Latin America Alcoholic Drinks Packaging Industry Market Size (In Billion)

The market's growth trajectory hinges on several strategic factors. Companies are investing in advanced technologies like lightweighting and improved barrier properties to enhance packaging efficiency and reduce environmental impact. Furthermore, partnerships with beverage producers are proving crucial for developing customized packaging solutions that align with brand identities and marketing strategies. Successful players will need to adapt to changing consumer preferences and address sustainability concerns, while optimizing their supply chains to mitigate cost fluctuations and maintain competitiveness. Market segmentation analysis highlights opportunities for specialized packaging solutions catering to niche alcoholic beverage segments and specific regional preferences. This presents an attractive investment opportunity for those specializing in eco-friendly and high-quality packaging materials and production methodologies.

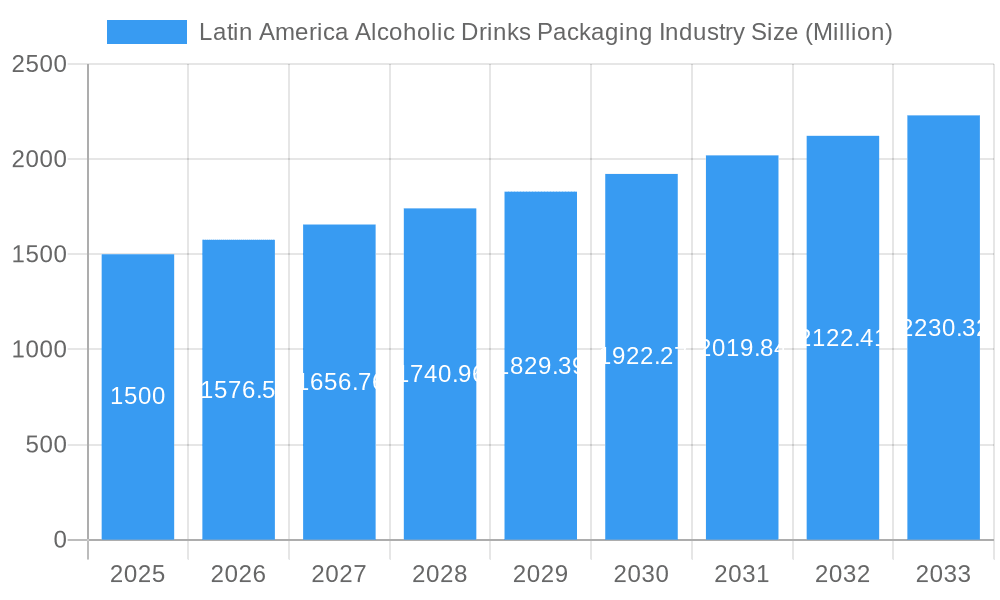

Latin America Alcoholic Drinks Packaging Industry Company Market Share

Latin America Alcoholic Drinks Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America alcoholic drinks packaging industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, trends, and opportunities across various segments, including primary materials, alcoholic products, product types, and key countries within Latin America. The report's meticulous data analysis and forward-looking projections are essential for navigating this dynamic market. Expect detailed analysis of major players like Amcor Plc, Ball Corporation, and Berry Global Inc., among others. The total market value in 2025 is estimated at xx Million.

Latin America Alcoholic Drinks Packaging Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Latin American alcoholic drinks packaging market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities (M&A). The report delves into the market share held by leading players such as Amcor Plc, Ball Corporation, and Berry Global Inc., providing a clear picture of market dominance. Further, the report assesses the impact of mergers and acquisitions (M&A) on market consolidation and innovation, analyzing deal values and their strategic implications for the industry. The influence of regulatory frameworks on material usage and sustainability practices is also scrutinized. Innovation drivers, including consumer demand for sustainable packaging and technological advancements in materials science, are thoroughly explored. Estimated M&A deal values in the analyzed period are approximately xx Million.

Latin America Alcoholic Drinks Packaging Industry Market Dynamics & Trends

This section provides a detailed analysis of the key growth drivers and challenges impacting the Latin American alcoholic drinks packaging market. We examine the compound annual growth rate (CAGR) and market penetration across different segments, offering granular insights into market dynamics. Technological advancements, shifting consumer preferences toward sustainable packaging options, and the competitive landscape are analyzed to understand the evolving market forces. Factors like rising disposable incomes, increasing consumption of alcoholic beverages, and evolving consumer preferences for convenience and premiumization are evaluated for their contribution to market growth. The impact of technological disruptions such as automation and lightweighting are also examined. This detailed analysis of the market’s trajectory provides a clear picture of its future direction. The estimated CAGR for the forecast period (2025-2033) is xx%.

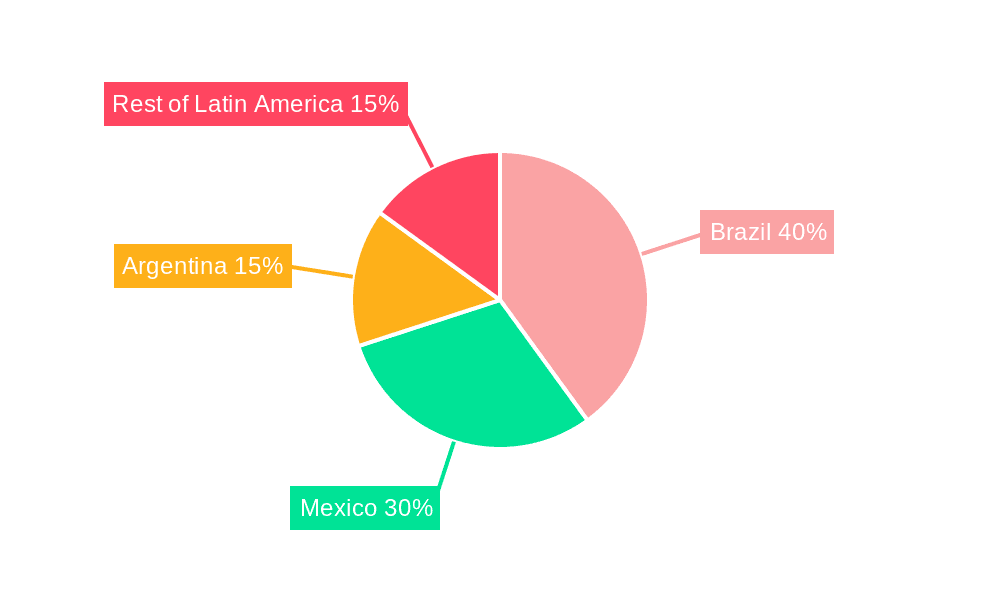

Dominant Regions & Segments in Latin America Alcoholic Drinks Packaging Industry

This section identifies the leading regions, countries, and segments within the Latin American alcoholic drinks packaging market. A detailed breakdown is provided across:

- By Primary Material: Glass, Metal, Plastic, Paper

- By Alcoholic Products: Wine, Spirits, Beer, Ready-to-Drink, Other Types of Alcoholic Beverages

- By Product Type: Glass Bottles, Metal Cans, Plastic Bottles, Other Product Types

- By Country: Brazil, Argentina, Mexico, Rest of Latin America

We analyze the key drivers behind the dominance of specific segments and regions, including economic policies, infrastructure development, and consumer behavior. The analysis focuses on the factors contributing to the market share of each region and segment. For instance, Brazil's significant alcoholic beverage production and consumption contribute to its strong position in the market. The report explores each segment's characteristics and performance to clarify the market dynamics. Mexico’s strong beer market contributes to a large metal can segment.

Latin America Alcoholic Drinks Packaging Industry Product Innovations

This section examines the latest product innovations in the Latin American alcoholic drinks packaging industry. The report discusses new product developments, their applications, and their competitive advantages, highlighting the impact of technological advancements on packaging design, sustainability, and consumer appeal. The focus is on the integration of sustainable materials, the adoption of lightweighting techniques, and the enhancement of product protection and shelf life.

Report Scope & Segmentation Analysis

This report segments the Latin American alcoholic drinks packaging market across multiple dimensions:

- By Primary Material: This segment analyzes the market size and growth projections for glass, metal, plastic, and paper packaging, examining the competitive landscape within each category.

- By Alcoholic Products: This segment assesses market dynamics for wine, spirits, beer, ready-to-drink beverages, and other alcoholic products, considering the unique packaging requirements of each category.

- By Product Type: This segment focuses on the market size and growth for glass bottles, metal cans, plastic bottles, and other packaging types, including their respective competitive dynamics.

- By Country: This segment analyzes market sizes and growth projections for Brazil, Argentina, Mexico, and the Rest of Latin America, considering the specific market conditions and regulatory environments in each country.

Key Drivers of Latin America Alcoholic Drinks Packaging Industry Growth

The growth of the Latin American alcoholic drinks packaging industry is driven by several factors. The increasing consumption of alcoholic beverages across the region is a key driver, fueled by rising disposable incomes and changing lifestyles. The adoption of sustainable packaging practices, driven by consumer demand and environmental regulations, also contributes significantly to market growth. Technological advancements in packaging materials and production processes are creating opportunities for innovation and efficiency gains.

Challenges in the Latin America Alcoholic Drinks Packaging Industry Sector

The Latin American alcoholic drinks packaging industry faces several challenges. Fluctuations in raw material prices can impact profitability, while supply chain disruptions can cause production delays and shortages. Stringent environmental regulations regarding packaging waste management pose a significant challenge, requiring companies to adopt sustainable practices. Intense competition from both domestic and international players also contributes to the pressure on profit margins.

Emerging Opportunities in Latin America Alcoholic Drinks Packaging Industry

Several emerging opportunities exist for the Latin American alcoholic drinks packaging industry. Growing demand for eco-friendly and sustainable packaging presents a significant opportunity for companies to develop and market innovative solutions. The expansion of the e-commerce sector requires adaptable packaging designs for efficient shipping and handling. There are also prospects for growth in premiumization, with consumers seeking higher quality and more innovative packaging.

Leading Players in the Latin America Alcoholic Drinks Packaging Industry Market

- Encore Glass

- United Bottles & Packaging

- Ball Corporation

- Graham Packaging Co

- IntraPac International LLC

- Amcor Plc

- O I Glass Inc

- Crown Holdings Inc

- Ardagh Group S

- Berry Global Inc

Key Developments in Latin America Alcoholic Drinks Packaging Industry

- January 2022: Ambev, a Brazilian glass packaging maker and brewer, plans to build a new factory in Parana to manufacture recycled glass bottles, investing BRL 870 Million (approximately xx Million USD). Operations are expected to begin in 2025.

- March 2021: Anheuser-Busch InBev (AB InBev) launched a sustainable Corona beer packaging design using straw leftover from harvests, combined with recycled wood fiber. Currently tested in Colombia and available in 10,000 Corona 6-packs, with plans for Argentina in mid-2022.

Future Outlook for Latin America Alcoholic Drinks Packaging Industry Market

The future outlook for the Latin American alcoholic drinks packaging industry is positive, driven by factors such as continuous growth in the alcoholic beverage market, increased adoption of sustainable packaging solutions, and ongoing technological advancements. Strategic opportunities lie in focusing on sustainability, innovating in packaging design and materials, and expanding into e-commerce-driven distribution channels. The market is poised for significant growth in the coming years.

Latin America Alcoholic Drinks Packaging Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Metal

- 1.3. Plastic

- 1.4. Paper

-

2. Alcoholic Products

- 2.1. Wine

- 2.2. Spirits

- 2.3. Beer

- 2.4. Ready To Drink

- 2.5. Other Types of Alcoholic Beverages

-

3. Product Type

- 3.1. Glass Bottles

- 3.2. Metal Cans

- 3.3. Plastic Bottles

- 3.4. Other Product Types

Latin America Alcoholic Drinks Packaging Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Alcoholic Drinks Packaging Industry Regional Market Share

Geographic Coverage of Latin America Alcoholic Drinks Packaging Industry

Latin America Alcoholic Drinks Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Purchasing Power of Consumers; Growing Awareness Amongst the Alcoholic Beverage Manufacturers to Differentiate their Products Over Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Against Non-biodegradable Products

- 3.4. Market Trends

- 3.4.1. Beer Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Alcoholic Drinks Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Paper

- 5.2. Market Analysis, Insights and Forecast - by Alcoholic Products

- 5.2.1. Wine

- 5.2.2. Spirits

- 5.2.3. Beer

- 5.2.4. Ready To Drink

- 5.2.5. Other Types of Alcoholic Beverages

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Glass Bottles

- 5.3.2. Metal Cans

- 5.3.3. Plastic Bottles

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Encore Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Bottles & Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ball Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IntraPac International LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 O I Glass Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crown Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ardagh Group S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berry Global Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Encore Glass

List of Figures

- Figure 1: Latin America Alcoholic Drinks Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Alcoholic Drinks Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Primary Material 2020 & 2033

- Table 2: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Alcoholic Products 2020 & 2033

- Table 3: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Primary Material 2020 & 2033

- Table 6: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Alcoholic Products 2020 & 2033

- Table 7: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Latin America Alcoholic Drinks Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Alcoholic Drinks Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Alcoholic Drinks Packaging Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Latin America Alcoholic Drinks Packaging Industry?

Key companies in the market include Encore Glass, United Bottles & Packaging, Ball Corporation, Graham Packaging Co, IntraPac International LLC, Amcor Plc, O I Glass Inc, Crown Holdings Inc, Ardagh Group S, Berry Global Inc.

3. What are the main segments of the Latin America Alcoholic Drinks Packaging Industry?

The market segments include Primary Material, Alcoholic Products, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Purchasing Power of Consumers; Growing Awareness Amongst the Alcoholic Beverage Manufacturers to Differentiate their Products Over Packaging.

6. What are the notable trends driving market growth?

Beer Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Against Non-biodegradable Products.

8. Can you provide examples of recent developments in the market?

January 2022 - Ambev, a Brazilian glass packaging maker and brewer, plans to build a new factory in Parana to manufacture recycled glass bottles. The company plans to invest BRL 870 million in the plant. Ambev, a subsidiary of Belgium's Anheuser-Busch InBev, stated that the plant will start operations in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Alcoholic Drinks Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Alcoholic Drinks Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Alcoholic Drinks Packaging Industry?

To stay informed about further developments, trends, and reports in the Latin America Alcoholic Drinks Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence