Key Insights

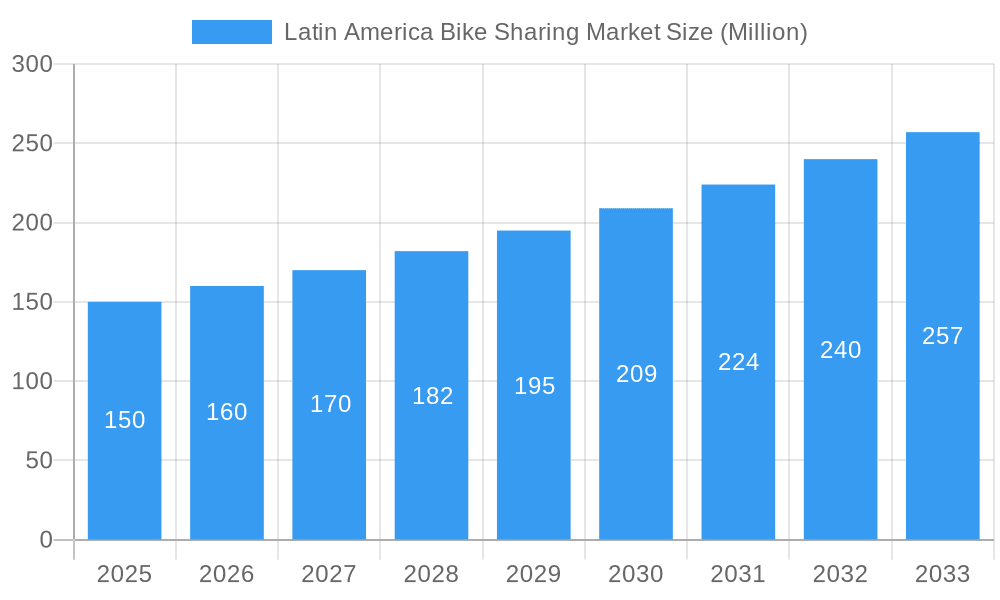

The Latin American bike-sharing market is poised for substantial expansion, driven by accelerating urbanization, heightened environmental consciousness, and supportive government policies promoting sustainable transit. With a projected market size of $5.2 billion and a Compound Annual Growth Rate (CAGR) of 7.4% from a base year of 2025, the sector demonstrates significant growth potential. Key growth factors include the cost-effectiveness and convenience of bike-sharing solutions over private vehicle ownership, particularly in high-density urban environments. The increasing adoption of e-bikes is a significant accelerator, offering users greater accessibility and extended range. Dockless systems are increasingly favored for their enhanced flexibility and accessibility compared to traditional docked models. While Brazil, Argentina, and Mexico currently lead the market, emerging opportunities exist across other Latin American nations as infrastructure development and consumer awareness advance.

Latin America Bike Sharing Market Market Size (In Billion)

Market segmentation highlights a dynamic sector. E-bikes are rapidly capturing market share from traditional bicycles, enhancing user experience. Dockless systems are outperforming docked systems due to their superior convenience and flexibility. Beyond the leading markets of Brazil, Argentina, and Mexico, countries such as Peru, Chile, and Colombia present considerable untapped potential, especially as they prioritize urban development and sustainable transportation initiatives. The competitive landscape is intense, featuring global operators and prominent regional players. The outlook for the Latin American bike-sharing market remains strong, indicating sustained growth and innovation. Strategic adaptation to local market conditions, effective navigation of infrastructural challenges, and the delivery of innovative, user-centric solutions will be critical for success.

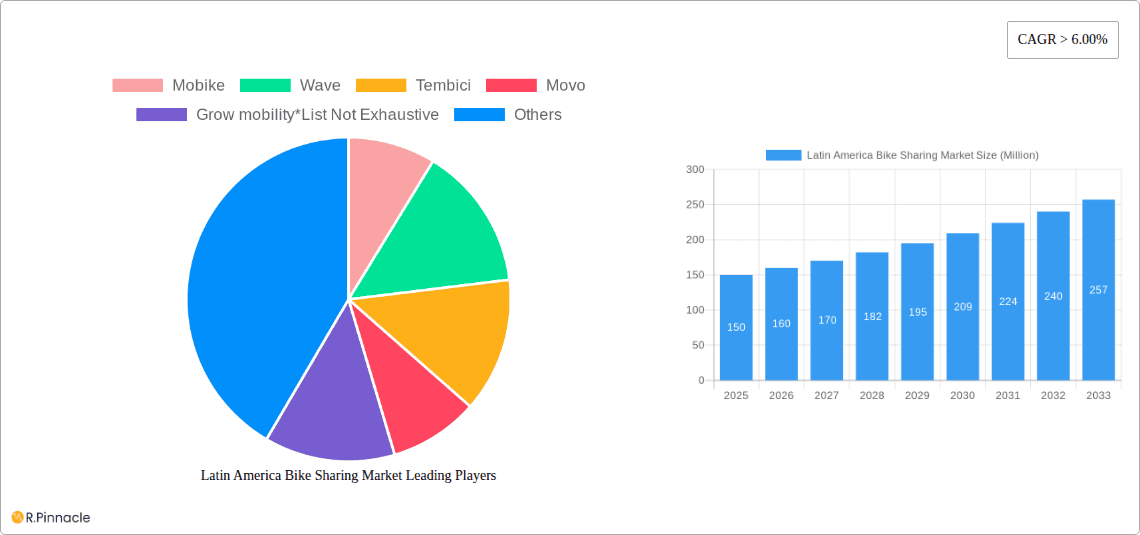

Latin America Bike Sharing Market Company Market Share

Latin America Bike Sharing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America bike-sharing market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The study utilizes rigorous data analysis and expert projections to deliver actionable intelligence.

Latin America Bike Sharing Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players and their market shares. We examine the driving forces behind innovation, including technological advancements and evolving regulatory frameworks. The impact of product substitutes and end-user demographics on market growth is also discussed. Mergers and acquisitions (M&A) within the sector, including deal values, are explored, painting a complete picture of market concentration and strategic maneuvers.

- Market Concentration: The Latin American bike-sharing market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The xx% market share held by the top three companies illustrates this.

- Innovation Drivers: Technological advancements, such as improved battery technology for e-bikes and smarter docking systems, are key innovation drivers. Government initiatives promoting sustainable transportation also play a crucial role.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American countries influence market expansion and operational strategies.

- Product Substitutes: Competition from other forms of micro-mobility, such as e-scooters and ride-hailing services, impacts market growth.

- End-User Demographics: The report details the demographic profile of bike-sharing users, including age, income, and location, highlighting key market segments.

- M&A Activity: The report analyzes recent M&A activity, including deal values and the strategic rationale behind such transactions. For example, the xx Million acquisition of Company X by Company Y significantly altered the market dynamics in 2024.

Latin America Bike Sharing Market Dynamics & Trends

This in-depth analysis explores the key factors shaping the Latin American bike-sharing market's trajectory. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the intricate competitive dynamics influencing market share and profitability. Quantifiable data, including Compound Annual Growth Rate (CAGR) and market penetration rates, are provided to illustrate market evolution. The report covers the period 2019-2033, focusing on the base year 2025 and projected growth until 2033.

- Market Growth Drivers: Increased urbanization, growing environmental concerns, and the rising popularity of micro-mobility solutions are driving market expansion. Government support for sustainable transportation also plays a significant role.

- Technological Disruptions: Advancements in electric bike technology, GPS tracking, and mobile payment systems are transforming the industry.

- Consumer Preferences: The report analyzes evolving user preferences, focusing on factors such as convenience, affordability, and safety.

- Competitive Dynamics: The section details the competitive landscape, including pricing strategies, marketing efforts, and service differentiation among key players. The projected CAGR for the period 2025-2033 is estimated at xx%. Market penetration is forecast to reach xx% by 2033.

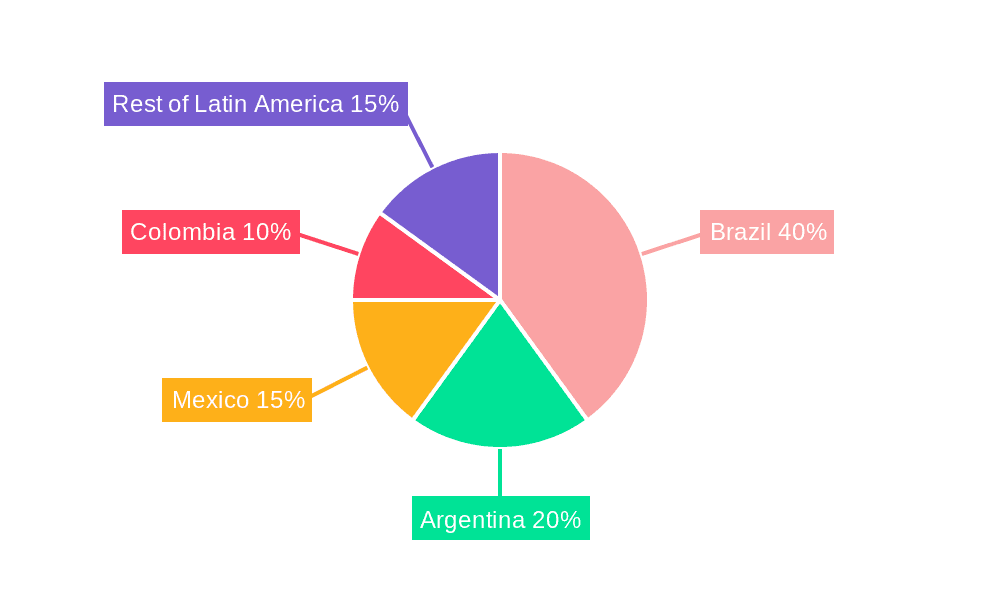

Dominant Regions & Segments in Latin America Bike Sharing Market

This section pinpoints the leading regions, countries, and segments within the Latin American bike-sharing market. We analyze the factors driving their dominance, such as favorable economic policies, robust infrastructure, and consumer preferences.

- By Bike Type:

- E-bikes: The e-bike segment is experiencing rapid growth due to increased convenience and range.

- Traditional/Regular Bikes: Traditional bikes continue to hold a significant market share, particularly in cost-sensitive segments.

- By Sharing System Type:

- Dockless: Dockless systems are gaining popularity due to their flexibility and convenience, accounting for xx% of the market in 2025.

- Docked: Docked systems retain market presence, particularly in areas with dedicated infrastructure.

- By Country:

- Brazil: Brazil is the leading market due to its large population, growing urban areas, and government support. Key drivers include increasing infrastructure investment and supportive government policies.

- Mexico: Mexico shows strong potential due to the high level of adoption of micro-mobility solutions in its major cities.

- Argentina: Argentina's market is developing steadily, driven by the increasing preference for environmentally friendly transportation alternatives.

- Colombia: Colombia's market is growing, driven by increasing urbanization and government initiatives promoting sustainable transport.

- Rest of Latin America: This segment demonstrates promising growth potential, with expansion driven by increasing urbanization and improved infrastructure.

Latin America Bike Sharing Market Product Innovations

This section summarizes recent product developments, emphasizing technological advancements and their impact on market competitiveness. Innovations such as improved battery technology, enhanced security features, and integrated payment systems are discussed in terms of their market appeal and potential to disrupt existing dynamics. The adoption of advanced materials and designs to increase bike durability and lifespan is also highlighted.

Report Scope & Segmentation Analysis

This report segments the Latin American bike-sharing market by bike type (traditional/regular bike, e-bike), sharing system type (docked, dockless), and country (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a comprehensive overview of the market's structure and evolution.

Key Drivers of Latin America Bike Sharing Market Growth

Several factors are driving growth in the Latin American bike-sharing market, including rapid urbanization, rising environmental awareness, and government support for sustainable transportation initiatives. Technological advancements, such as the development of more efficient e-bikes and improved GPS tracking systems, also contribute to this growth. Furthermore, the increasing affordability of bike-sharing services makes them accessible to a wider range of consumers.

Challenges in the Latin America Bike Sharing Market Sector

The Latin American bike-sharing market faces several challenges, including inadequate infrastructure in some areas, regulatory hurdles varying across different countries, and the risk of vandalism or theft. Supply chain disruptions and intense competition from other micro-mobility solutions also pose significant challenges.

Emerging Opportunities in Latin America Bike Sharing Market

The Latin American bike-sharing market presents numerous emerging opportunities. Expanding into underserved markets, developing innovative business models, and integrating with public transportation systems can unlock significant growth potential. Technological advancements, such as the use of AI for better route planning and predictive maintenance, also offer promising avenues for growth.

Leading Players in the Latin America Bike Sharing Market Market

- Mobike

- Wave

- Tembici

- Movo

- Grow mobility

- Bird

- Loop

- Bim Bim Bikes

Key Developments in Latin America Bike Sharing Market Industry

- January 2023: Wave launched a new e-bike model with improved battery technology in Brazil.

- March 2024: Tembici partnered with a local government to expand its bike-sharing program to a new city.

- June 2024: A significant merger between two major bike-sharing companies reshaped the competitive landscape.

Future Outlook for Latin America Bike Sharing Market Market

The future of the Latin American bike-sharing market looks bright, fueled by sustained urbanization, growing environmental consciousness, and ongoing technological advancements. Strategic partnerships, investments in infrastructure, and expanding into new markets will further propel market growth. The increasing adoption of e-bikes and the integration of bike-sharing with other forms of public transportation will also contribute to significant expansion.

Latin America Bike Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System Type

- 2.1. Docked

- 2.2. Dockless

Latin America Bike Sharing Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Bike Sharing Market Regional Market Share

Geographic Coverage of Latin America Bike Sharing Market

Latin America Bike Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. E-Bike Rental is providing the growth in Bike Sharing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Bike Sharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System Type

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mobike

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wave

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tembici

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grow mobility*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bird

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Loop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bim Bim Bikes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mobike

List of Figures

- Figure 1: Latin America Bike Sharing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Bike Sharing Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Bike Sharing Market Revenue billion Forecast, by Bike Type 2020 & 2033

- Table 2: Latin America Bike Sharing Market Revenue billion Forecast, by Sharing System Type 2020 & 2033

- Table 3: Latin America Bike Sharing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Bike Sharing Market Revenue billion Forecast, by Bike Type 2020 & 2033

- Table 5: Latin America Bike Sharing Market Revenue billion Forecast, by Sharing System Type 2020 & 2033

- Table 6: Latin America Bike Sharing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Bike Sharing Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Latin America Bike Sharing Market?

Key companies in the market include Mobike, Wave, Tembici, Movo, Grow mobility*List Not Exhaustive, Bird, Loop, Bim Bim Bikes.

3. What are the main segments of the Latin America Bike Sharing Market?

The market segments include Bike Type, Sharing System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

E-Bike Rental is providing the growth in Bike Sharing Market.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Bike Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Bike Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Bike Sharing Market?

To stay informed about further developments, trends, and reports in the Latin America Bike Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence